Nuances of Anti-money Laundering Laws & Interplay with Other Economic Offences

- Blog|FEMA & Banking|

- 23 Min Read

- By Taxmann

- |

- Last Updated on 1 May, 2023

Table of Contents

- Practical Aspects of the Money Laundering Law in the Country

- The Legislation and Authorities Governing the Anti-money Laundering Law in India

- Important Definitions and Process of Money Laundering

- Law in Books and Law in Practice

- Role of Chartered Accountants and Tax Lawyers in Handling Notices and Attachment Orders Issued by the ED

1. Practical Aspects of the Money Laundering Law in the Country

1.1 Definition – Money Laundering

1.1 Definition – Money Laundering

Offences of Money Laundering

- Whosoever directly or indirectly attempts to indulge or knowingly assists or knowingly is a party or is actually involved in any process or activity connected with the (proceeds of crime including concealment, possession, acquisition or use and projecting or claiming ) it as untainted property shall be guilty of offence of money laundering.

- In easier terms, any action which leads to conversion of Illegal money/assests into legitimate funds/assets shall be considered as an “Offence of Money Laundering”.

2. The Legislation and Authorities Governing the Anti-money Laundering Law in India

2.1 Legislation Governs Money Laundering

The Prevention of Money Laundering Act, 2002 (know in short as PMLA), prohibits and penalizes Money Laundering activities in India.

2.2 Agencies and Judicial Authorities under the Act

1. The Enforcement Directorate (E.D.)

The Executive functions under the Actlike Search, Seizure, Provisional Attachment, Arrests, Initiate Prosecution etc. are performed by the Authorised Officers under the Act.

2. Adjudicating Authority (AA)

- This is the quasi-judicial authority established under the Act, which exclusively adjudicates matters connected with and incidental to the Attachment and Retention of property/records. The AA has the power to lay down its own procedure and is governed by the Principles of Natural Justice. Although the AA has the powers of a Civil Court regarding issuance of summons, production of documents and evidence.

- The AA consists of a Chairman and two other members. The Chairman and members are persons having expertise in field of law, administration, finance and Accounting.

- The bench of AA constitutes of a single member, however at the discretion of the Chairman, proceedings can be heard by a bench of 2 members.

3. Appellate Tribunal under PMLA

- The Appellate Tribunal has been established under section 25 of the Act which hears the appeals from the final orders of the AA.

- The appeal is to be filed within a period of 45 days from the date of the receipt of the order of the AA.

- The Appeal from the decision/order of the Appellate Tribunal lie to the jurisdictional High Court where the aggrieved party resides/carries on business.

4. Special Court (Court of Sessions)

- This is the Designated Court of Sessions established under the Act for conducting the trial for the offence of Money Laundering. The Special Court while trying the offence of Money Laundering shall be governed by the procedure laid down in the Cr.P.C. for conducting the trial before the Court of Sessions.

- The Trial for the Schedule Offence along with offence of Money Laundering shall be conducted in the Special Court if an application is made by the Enforcement Officer to club the trial of the schedule offence with the offence under the PMLA.

2.3 Web of Actions

3. Important Definitions and Process of Money Laundering

3.1 Proceeds of Crime 2 (1)(u)

It is defined as “proceeds of crime” means any property derived or obtained, directly or indirectly, by any person as a result of criminal activity relating to a scheduled offence or the value of any such property or where such property is taken or held outside the country, then the property equivalent in the value held within the country or abroad.

3.2 New Amendment wef 1.8.2019

Explanation.—For the removal of doubts, it is hereby clarified that “proceeds of crime” include property not only derived or obtained from the scheduled offence but also any property which may directly or indirectly be derived or obtained as a result of any criminal activity relatable to the scheduled offence.

3.3 Scheduled Offence

- The Scheduled Offences are the offences as prescribed in the schedule to the PMLA, whichis divided in 3 parts e. Part ‘A’ ‘B’ ‘C’.

- The Schedule Offence is the genesis of the offence of Money laundering, as there cannot be any offence of Money Laundering unless and until an Offence provided in the Schedule of the PMLA has been first committed.

3.4 Money Laundering

The PMLA defines the offence of Money Laundering u/s 3 as

“Whosoever directly or indirectly attempts to indulge or knowingly assists or knowingly is a party or is actually involved in any process or activity connected with the proceeds of crime including its concealment, possession, acquisition or use and projecting or claiming as untainted property shall be guilty of offence of Money Laundering”.

New Amendment wef 1.8.2019

Explanation.—For the removal of doubts, it is hereby clarified that:

(i) a person shall be guilty of offence of money-laundering if suchperson is found to have directly or indirectly attempted to indulge or knowingly assisted or knowingly is a party or is actually involved in one or more of the following processes or activities connected with proceeds of crime, namely:

(a) concealment; or

(b) possession; or

(c) acquisition; or

(d) use; or

(e) projecting as untainted property; or

(f) claiming as untainted property, in any manner whatsoever,

(ii) the process or activity connected with proceeds of crime is a continuing activity and continues till such time a person is directly or indirectly enjoying the proceeds of crime by its concealment or possession or acquisition or use or projecting it as untainted property or claiming it as untainted property in any manner whatsoever.

3.5 Process of Money Laundering

Stage –I Commission of the Scheduled Offence

Stage –II Generation of Proceeds of Crime

Stage –III Commission of Money Laundering By: Placement, Layering, Integration

Money Laundering Involves 3 Stages

I Placement: Assimilating of proceeds of crime into financial system

II Layering: Routing of assimilated proceeds of crime to hide its source

III Integration: Re-introduction of the proceeds of crime subsequent to above two stages to project such proceeds of crime as white money

3.6 Commencement of Proceedings under PMLA

- Enquiry and Investigation: The Enforcement Officer conducts enquiry and investigation upon the Accused/Suspected and any other person on the basis of the information received from other agencies like CBI, FIU, EOW, Income Tax Authorities and other authorities.

- Summons u/s 50 PMLA: The Enforcement Officer issues Summons to the persons for recording their statement and for the production of any document. Any statement recorded u/s 50 of the Act is admissible as evidence in the Courts.

- Survey, Search and Seizure u/s 16, 17 PMLA: The Enforcement Officer on the basis of information gathered through enquiry and investigation and qua the result of summons issued, may after being duly satisfied of commission of the offence of Money Laundering, may conduct Search and Seizure operations.

- Proceeding for Retention of Records and Properties: Original Application (OA) filed u/s 17(4) of PMLA before the AA.

- Proceeding for Confirmation of Provisional Attachment of Properties: Original Complaint (OC) filed U/S 5(5) PMLA before the AA.

- Proceeding for Criminal Prosecution: Prosecution Complaint filed u/s 45 of PMLA before the special court.

3.7 OA (OriginalApplication)

- Search u/s 17 is conducted by the Enforcement Officer on the basis of information in his possession that any person has either committed the offence of money laundering, or is in possession of proceeds of crime or is in possession of any records relating to Money Laundering.

- However, no search can be conducted unless a report u/s 157 of P.C. has been forwarded to the Magistrate in relation to the scheduled offence.

- While the search is being conducted, u/s 17(1), if the Enforcement Officer finds any property or record, he may seize/retain it and prepare a memo of the items seized/retained. Such seizure/retention is valid for 180 days.

- Once search and seizure procedure is completed, the Enforcement Officer will draw up the OA and forward it to the AA within 3o days from such seizure, requesting the continuation of the seizure beyond the period of 180 days.

3.8 OC (Original Complaint)

- Where the Authorised Officer has reason to believe that any person is in possession of Proceeds of Crime and such person is likely to alienate such proceeds of crime to frustrate the proceedings under the Act, then the Authorised Officer has power u/s 5 (1) to make an order for provisional attachment of such proceeds of crime and such attachment is valid for a period of 180 days.

- However no such attachment can be done unless a charge sheet (report u/s 173 Cr.P.C.) in relation to the scheduled offence has been forwarded to the Magistrate for taking cognizance.

- Although, the Authorised Officer may proceed directly with the attachment of the Proceeds of Crime before a report u/s Section 173 Cr.P.C has been forwarded to the magistrate, if he has strong reasons to believe on the basis of cogent material in his possession that if such property is not attached immediately, the proceedings under the Act would be frustrated.

- The Authorised Officer, as per the provisions of Section 5(5) of PMLA after attaching the property shall forward a complaint (OC) to the AA within 30 days of the Provisional Attachment, for authorizing the attachment beyond the period of 180 days.

3.9 Validity (Shelf Life) of the Order of the AA

- The AA has to decide upon the OA/OC as the case may be within the time when the Provisional Attachment/Retention is alive i.e. within period of 180 days from the date of passing of such Provisional Attachment/Retention order.

- The AA if it finds that the property/record is involved in Money laundering may confirm the Provisional Attachment/Retention order, otherwise it may set-aside such order and release the property/record from encumbrance placed upon by the ED.

- The order of the AA confirming the OA/OC is valid for a period of 365 days or till the pendency of criminal prosecution under this Act.

3.10 Criminal Prosecution

- The offence of Money laundering as per Section 3 of the PMLA is punishable with Rigorous Imprisonment for a term not less than 3 years but which may exceed to 7 years and shall also be liable to fine.

- Where the scheduled offence has been committed under paragraph 2 of Part A (offences under NDPS Act) of the Schedule to the PMLA, then the maximum imprisonment is 10 years and fine.

- The Prosecution under PMLA unlike other criminal prosecutions is initiated qua filing of Prosecution Complaint as prescribed u/s 45 of the Act. The trial under PMLA is a sessions trial and is governed by the provisions of Cr.P.C.

4. Law in Books and Law in Practice

4.1 Inter-ministerial Co-ordination Committee (Section 72A)

The Central Government may, by notification, constitute an Inter-ministerial Co- ordination Committee for inter-departmental and inter-agency co-ordination for the following purposes, namely:—

- operational cooperation between the Government, law enforcement agencies, the Financial Intelligence Unit, India and the regulators or supervisors;

- policy cooperation and co-ordination across all relevant or competent authorities;

- such consultation among the concerned authorities, the financial sector and other sectors, as are appropriate, and are related to anti money-laundering or countering the financing of terrorism laws, regulations and guidelines;

- development and implementing policies on anti money-laundering or countering the financing of terrorism; and

- any other matter as the Central Government may, by notification, specify in this behalf.

4.2 Controversies Relating to Certain Provisions In PMLA

4.2.1 Proceeds of Crime 2(1)(u)

It is defined as “proceeds of crime” means any property derived or obtained, directly or indirectly, by any person as a result of criminal activity relating to a scheduled offence or the value of any such property or where such property is taken or held outside the country, then the property equivalent in the value held within the country or abroad.

Explanation.—For the removal of doubts, it is hereby clarified that “proceeds of crime” include property not only derived or obtained from the scheduled offence but also any property which may directly or indirectly be derived or obtained as a result of any criminal activity relatable to the scheduled offence.

4.2.2 Situations envisaged under the law

1. First Situation: when property is held in India:

“Proceeds of crime” means any property derived or obtained, directly indirectly, by any person as result of criminal activity relating to the scheduled offence or the value of any such property.

2. Second Situation: when property is taken or held abroad:

- “Proceeds of crime” means any property derived or obtained, directly indirectly, by any person as result of criminal activity relating to the scheduled offence or the property equivalent in value held within the country or abroad.

- Thus, from the above, it is clear from the bare reading that the legislature has made distinction while using two expressions differently in two different situations.

- The property equivalent in value’ is used only for the second situation and thus it can be read and interpreted as such in that situation alone.

- For the first situation, the expression used is ‘value of any such property’. The expression ‘such’ denotes property derived or obtained result of criminal activity relating to the scheduled Thus, it can be read and interpreted in that manner only.

- If the legislature would have intended to cover any property equivalent in value in first situation also, then there was no need for the legislature to incorporate two different situations and use two different expressions therein.

- It is well accepted position that the legislature uses any particular expression that too in contradistinction to the other very consciously and for an intended reason.

- Here, it may be noted that the expression ‘equivalent’ has been used for the second situation Thus, it can be used for second situation only.

- Thus, for first situation, any other property ‘equivalent’ in value cannot be treated as ‘proceeds of crime’ unless that property falls in the category of ‘any such property derived or obtained result of criminal activity relating to the scheduled offence’.

- Thus, from the perusal of the above, it is clear that the Enforcement Directorate cannot attach any property other than the property derived or obtained as a result of criminal activity related to a scheduled crime, when all of the properties are undisputedly held in India.

4.3 Judgments of the Courts

- Seema Garg vs. Directorate of Enforcement, [2020] 116 taxmann.com 202 (Punj. & ) Dt. 6thMarch, 2020(P & H High Court)(No. PMLA 1-3 of 2019)

- Satyam Computer Services Ltd DOE 2019 (3) AndhLD 472 ( Andhra Pradesh HC)

- Abdullah Ali Balsharaf vs. Directorate of Enforcement, [2019] 101 taxmann.com 466 (Delhi)/2019 (3) RCR(Criminal) 798 (DHC)

- DOE vs. Axis Bank in Appeal No. 143/2018 (DHC), [2019] 104 taxmann.com 49 (Delhi)

4.4 Section 3 vis-à-vis Section 24 PMLA

- While Section 3 defines the offence of Money Laundering, whereas Section 24 lays down the burden of proof to be discharged.

- Section 3:

“Whosoever directly or indirectly attempts to indulge or knowingly assists or knowingly is a party or is actually involved in any process or activity connected with the proceeds of crime including its concealment, possession, acquisition or use and projecting or claiming as untainted property shall be guilty of offence of Money Laundering”.

Explanation.—For the removal of doubts, it is hereby clarified that,

(i) a person shall be guilty of offence of money laundering if such person is found to have directly or indirectly attempted to indulge or knowingly assisted or knowingly is a party or is actually involved in one or more of the following processes or activities connected with proceeds of crime, namely:—

(a) concealment; or

(b) possession; or

(c) acquisition; or

(d) use; or

(e) projecting as untainted property; or

(f) claiming as untainted property, in any manner whatsoever,

(ii) the process or activity connected with proceeds of crime is a continuing activity and continues till such time a person is directly or indirectly enjoying the proceeds of crime by its concealment or possession or acquisition or use or projecting it as untainted property or claiming it as untainted property in any manner whatsoever.

- Section 24:

“In any proceedings relating to proceeds of crime under this act-

(a) incase of person charged with offence of Money Laundering, the authority or the court shall unless the contrary is proved, presume that such proceeds of crime are involved in Money laundering

(b) in case of any other person the authority or court may presume that such proceeds of crime are involved in Money laundering”

- Although the Act provides exception to general rule of evidence for burden of proof, however the authorities have occasionally misinterpreted Section 24 by making presumptions of the following facts:-

(a) that he has committed the Scheduled Offence

(b) that the proceeds of crime are generated from the commission of scheduled offence

- Whereas the Law, u/s 24 or anywhere else in the Act, has not contemplated the presumption of commission of the scheduled offence or for generation of The law clearly provides for a singular presumption i.e. for proceeds of crime being involved in Money Laundering.

- Since the offence of Money Laundering initiates essentially from the commission of the scheduled offence and generation of proceeds of crime thereof, hence there cannot be any presumption with regards to Proceeds of Crime being involved in Money Laundering unless it is proved beyond reasonable doubt that a scheduled offence has been committed.

- The unfortunate scenario currently going on before the AA is that the order confirming the Provisional Attachment is passed by taking such presumption, even when no charges of Money Laundering are framed before the Special court.

4.5 Section 5 of PMLA/Controversy Pertaining to Twin Reasons to Believe

- The section prescribes for attachment of property, for which a prerequisite is that “Reasons to Believe” have to be recorded in writing that:

(a) Any person is in possession of any proceeds of Crime; and

(b) Such proceeds of crime are likely to be concealed, transferred or dealt with in any manner which may result in frustrating any proceedings relating to confiscation of such POC.

Another pre-requisite is that such an attachment order can be passed only subsequent to forwarding of a report u/s 173 Cr.P.C., to the Magistrate.

- Proviso has been carved out for emergent situations when without the report u/s 173, attachment order can be passed, but for the exercise of such power, the Authorised officer has to again record “Reasons to Believe” in writing for immediate attachment of property without report u/s 173being forwarded to the Therefore the legislature clearly provided for separate reasons to be recorded for such immediate and emergent action.

- However, it is seen that the Authorities have generally neglected to adhere to this twin requirement of recording of “reasons to believe” and utilize the power as given in proviso without recording any separate reason to believe.

4.6 Power of ED of Search and Seizure (Section 17)

As per Section 17 (1): Where the Director [or any other officer not below the rank of Deputy Director authorised by him for the purposes of this section], on the basis of information in his possession, has reason to believe (the reason for such belief to be recorded in writing) that any person:

(i) has committed any act which constitutes money laundering, or

(ii) is in possession of any proceeds of crime involved in money laundering, or

(iii) is in possession of any records relating to money laundering, [or]

(iv) is in possession of any property related to crime,

(iv) then, subject to the rules made in this behalf, he may authorise any officer subordinate to him to—

-

-

- enter and search any building, place, vessel, vehicle or aircraft where he has reason to suspect that such records or proceeds of crime are kept;

- break open the lock of any door, box, locker, safe, almirah or other receptacle for exercising the powers conferred by clause (a) where the keys thereof are not available;

- seize any record or property found as a result of such search;

- place marks of identification on such record or [property, if required or] make or cause to be made extracts or copies therefrom;

- make a note or an inventory of such record or property;

- examine on oath any person, who is found to be in possession or control of any record or property, in respect of all matters relevant for the purposes of any investigation under this Act.

-

Proviso of Section 17(1) has been omitted by the Finance (No. 2) Act, 2019, it read as follows:

Provided that no search shall be conducted unless, in relation to the scheduled offence, a report has been forwarded to a Magistrate under section 157 of the Code of Criminal Procedure, 1973, (2 of 1974) or a complaint has been filed by a person, authorised to investigate the offence mentioned in the Schedule, before a Magistrate or court for taking cognizance of the scheduled offence, as the case may be, or in cases where such report is not required to be forwarded, a similar report of information received or otherwise has been submitted by an officer authorised to investigate a scheduled offence to an officer not below the rank of Additional Secretary to the Government of India or equivalent being head of the office or Ministry or Department or Unit, as the case may be, or any other officer who may be authorised by the Central Government, by notification, for this purpose.

4.7 Search of Persons (Section 18)

As per Section 18(1): If an authority, authorised in this behalf by the Central Government by general or special order, has reason to believe (the reason for such belief to be recorded in writing) that any person has secreted about his person or in anything under his possession, ownership or control, any record or proceeds of crime which may be useful for or relevant to any proceedings under this Act, he may search that person and seize such record or property which may be useful for or relevant to any proceedings under this Act.

Proviso of Section 18(1) has been omitted by the Finance (No. 2) Act, 2019, it read as follows:

Provided that no search of any person shall be made unless, in relation to the scheduled offence, a report has been forwarded to a Magistrate under section 157 of the Code of Criminal Procedure, 1973, (2 of 1974), or a complaint has been filed by a person, authorised to investigate the offence mentioned in the Schedule, before a Magistrate or court for taking cognizance of the scheduled offence, as the case may be, or in cases where such

report is not required to be forwarded, a similar report of information received or otherwise has been submitted by an officer authorised to investigate a scheduled offence to an officer

not below the rank of Additional Secretary to the Government of India or equivalent being head of the office or Ministry or Department or Unit, as the case may be, or any other officer who may be authorised by the Central Government, by notification, for

this purpose.

4.8 Inter-play between Section 17, 20 & 21 PMLA

- When the Enforcement Officer conducts search and subsequently seizes any property u/s 17(1), then he has to record reasons in writing as per section 20(1) & 21(1) that such property needs to be retained for the purpose of adjudication u/s 8 and subsequent to procedure as prescribed u/s 20 and 21, then only can the Enforcement Officer forward an application for extension of the retention/seizure order.

- Section 20 (1) Retention of property: (1) Where any property has been seized under section 17or section 18 or frozen under sub-section (IA) of section 17 and the officer authorised by the Director in this behalf has, on the basis of material in his possession, reason to believe (the reason for such belief to be recorded by him in writing) that such property is required to be retained for the purposes of adjudication under section 8, such property may, if seized, be retained or if frozen, may continue to remain frozen, for a period not exceeding one hundred and eighty days from the day on which such property was seized or frozen, as the case may be.

- Section 20 (4): The Adjudicating Authority, before authorising the retention or continuation of freezing of such property beyond the period specified in subsection (1), shall satisfy himself that the property is prima facie involved in money-laundering and the property is required for the purposes of adjudication under section 8.

- In addition to the recording of reasons, the Enforcement Officer also has to pass an order u/s 20(2) for the provisional retention of the property/record for a period of 180 days and has to forward the copy of the order, along- with the material in his possession to the AA.

- The AA will also scrutinize the same and record its separate satisfaction as per section 20(4) that such property/record is required for the purpose of adjudication before issuing the SCN u/s 8(1).

- However, the Enforcement Officer would generally without complying with the provisions of Section 20 and 21, straight away forward the application for confirmation of retention/seizure to the AA u/s17(4).

4.9 Section 8 (1) PMLA/Controversy regarding Non-recording of Reasons to Believe by Adjudicating Authority

- Section 8(1) of PMLA, clearly lays down that after the receipt of OA/OC, the AA has to form independent “Reason to Believe” that any person has committed the offence of Money Laundering or is in possession of POC, and only after forming of such Reason to Believe can the AA issue SCN to a person.

- However it is generally observed that no Reason to Believe are provided to the defendants neither there is any mechanism for the inspection of the same.

4.10 Section 8(4) PMLA/Controversy Regarding Constructive Possession of Attached Property

- Section 8(4) provides that the Enforcement Officer can forthwith take possession of the property of whose attachment has been confirmed by the AA.

- Further Rule 5(2) of the PMLA (Taking possession of attached or frozen properties confirmed by the Adjudicating Authority) Rules, 2013, prescribes that if the property confirmed for attachment is immovable property then, the Enforcement Officer may serve an eviction notice of 10days to the occupants of such immovable property.

- However this power of taking possession of the property by Enforcement Officer is draconian, harsh and a case of giving unfettered power to the agency as without proving the guilt of the person in trial, not only he is barred from alienating his property but he is evicted from such property.

4.11 Other Problems/Controversies

- No- judicial members in the adjudicating authority

- Summary procedure before AA makes the adjudication based only on incomplete facts and prima-facie evidences

- Non-compliance of Section 21(2) by the department by not giving the copies of the records seized

- The order of confirmation of the attachment passed by the aa is without any findings to the effect whether any scheduled offence is committed or proceeds of crime have been generated

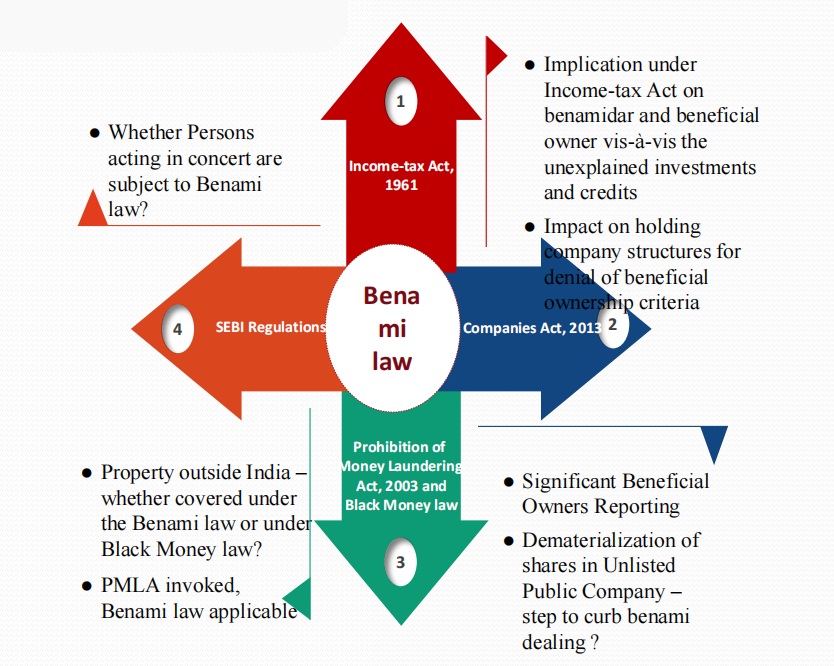

4.12 Interplay of various Laws Dealing with Economic Offences

4.13 Case Studies

- Factory purchased in the year 2005

- Alleged violation of enviornment protection act and water pollution act in the year 2009

- POC illegally calculated from the year 2007-08 till 2012-13

- Factory acquired in 2005 having no nexus with POC attached

- Bitcoin scheme floated in the year 2015 which ended in the year 2017

- FDR created in the bank in the year 2018 out of funds having no nexus with the scheme

- FDR attached by ED without identifying any transaction linking POC with the attached property

5. Role of Chartered Accountants and Tax Lawyers in Handling Notices and Attachment Orders Issued by the ED

- Identifying the source of the attached properties and differentiating it with the alleged POC.

- Identifying Loan utilization in the attached property.

- Calculation of the correct value of any alleged POC.

- Valuation of the property attached and comparison with the alleged POC.

- Proper Financial Accounting and Analysis.

- Preparation of Money Trail for the attached properties to demarcate the source of fund.

5.1 Financial Action Task Force (FATF)

- The Financial Action Task Force (FATF) is the global money laundering and terrorist financing It sets international standards that aim to prevent these illegal activities and the harm they cause to society.

- India is a member of FATF since June 2010.

- The FATF Recommendations provide a comprehensive framework of measures to help countries tackle illicit financial flows.

- The International Standards on combating money laundering and the financing of terrorism and proliferation, known as the FATF Recommendations, recommends “Customer due diligence” and “record-keeping”.

- The Financial Institutions are prohibited from keeping anonymous accounts or accounts in fictitious names the measures should be undertaken when:

(a) Establishing business relations;

(b) Carrying out occasional transaction:

(i) above the applicable designated threshold (USD/EUR 15,000); or

(ii) that are wire transfers in the circumstances covered by the recommendation 16 (Wire Transfers)

(c) There is a suspicion of money laundering or terrorist financing; or

(d) The financial institution has doubt about the veracity or adequacy of previously obtained customer identification data

The Customer Due Diligence measures to be taken are as follows:

- Identifying the customer and verifying that customer’s identity using reliable, independent source documents, data or information.

- Identifying the beneficial owner, and taking reasonable measures to verify the identity of the beneficial owner, such that the financial institution is satisfied that it knows who the beneficial owner For legal persons and arrangements this should include financial institutions understanding the ownership and control structure of the customer.

- Understanding and, as appropriate, obtaining information on the purpose and intended nature of the business relationship.

- Conducting ongoing due diligence on the business relationship and scrutiny of transactions undertaken throughout the course of that relationship to ensure that the transactions being conducted are consistent with the institution’s knowledge of the customer, their business and risk profile, including, where necessary, the source of funds.

The record keeping entails as such:-

- Maintain record of all transaction for at least five years.

- Maintain all records obtained through Customer Due Diligence measure (such as copies or records of official identification documents like passports, identity cards, driving licences or similar documents), account files and business correspondence, including the results of any analysis undertaken (e.g., inquires to establish the background and purpose of complex, unusual large transaction) for at least five years after the business relationship is ended, or after the date of the occasional transaction.

- The information and transaction records should be available to domestic competent authorities upon appropriate authority.

5.2 PMLA in consonance with the recommendation of FATF

- Chapter IV states obligations of Banking Companies, Financial Institutions And Intermediaries

- Section 12AA- Enhanced Due Diligence

- Section12 AA was added by virtue of the Finance Act 2019

- It casts a duty upon the reporting entity, prior to commencement of each specified transaction to:

(a) Verify the identity of client by authentication under the Aadhaar (Targeted Delivery of Financial and Other Subsidies, Benefits And Services) Act, 2016.

(b) Take additional steps to examine the ownership and financial position, including sources of funds of the client.

(c) Take additional steps to record the purpose behind conducting the specified transaction and intended nature of the relationship between transaction parties.

- When client fails to fulfil the condition, the Reporting Entity shall not allow the specified transaction

5.3 What is Reporting Entity?

- Section 2(1)(wa) was added in year 2013

- Reporting Entity means

-

- A banking company,

- Financial institution,

- Intermediary, or

- A person carrying on a designated business or profession

5.4 Who is person carrying on designated business or profession?

- Section 2(1)(sa) was added in year 2013

- Person carrying on designated business or Profession means:

(a) a person carrying on activities for playing games of chance for cash or kind, and includes such activities associated with casino,

(b) Inspector-General of Registration appointed under section 3 of the Registration Act, 1908, as may be notified by the Central Government

(c) Real estate agent, as may be notified by the Central Government

(d) Dealers in precious metals, precious stones and other high value goods, as may be notified by the Central Government

(e) Person engaged in safekeeping and administration of cash and liquid securities on behalf of other person, as may be notified by the Central Government

(f) Person carrying on such other activities as the Central Government may by notification, so designate, from time to time

5.5 New Notification u/s 2(1)(sa) (vi)

- The Ministry of Finance on 07.03.2023, issued the notification, notifying following activities when carried out for or on behalf of another natural or legal person in the course of business as an activity for the purposes of said sub-clause, namely:-

-

- exchange between virtual digital assets and fiat currencies;

- exchange between one or more forms of virtual digital assets;

- transfer of virtual digital assets;

- safekeeping or administration of virtual digital assets or instruments enabling control over virtual digital assets; and

- participation in and provision of financial services related to an issuer’s offer and sale of a virtual digital asset.

Explanation: For the purposes of this notification “virtual digital asset” shall have the same meaning assigned to it in clause (47A) of section 2 of the Income-tax Act, 1961 (43 of 1961).

5.6 The Prevention of Money-laundering (Maintenance of Records) Rules, 2005

Rule 3- Maintenance of records of transactions (nature and value)

Every reporting entity shall maintain the record of all transaction including, the record of-

(a) All cash transactions of the value of more than 10 Lakhs rupees or its equivalent in foreign currency

(b) All series of cash transactions integrally connected to each other which have been individually valued below rupees ten lakh or its equivalent in foreign currency where such series of transactions have taken place within a month and the monthly aggregate exceeds an amount of ten lakh rupees or its equivalent in foreign currency;

(ba) All transactions involving receipts by non-profit organisations of value more than rupees ten lakh, or its equivalent in foreign currency;

(c) All cash transactions where forged or counterfeit currency notes or bank notes have been used as genuine or where any forgery of a valuable security or a document has taken place facilitating the transactions;

(d) All suspicious transactions whether or not made in cash and by way of from list (i) to (v)

(e) All cross border wire transfers of the value of more than five lakh rupees or its equivalent in foreign currency where either the origin or destination of fund is in India;

(f) All purchase and sale by any person of immovable property valued at fifty lakh rupees or more that is registered by the reporting entity, as the case may be

Rule 9 Client Due Diligence

Every reporting entity shall-

(a) at the time of commencement of an account-based relationship

(i) identify its clients, verify their identity, obtain information on the purpose and intended nature of the business relationship; and

(ii) determine whether a client is acting on behalf of a beneficial owner, and the identify the beneficial owner and take all steps to verify the identity of the beneficial owner

(b) in any other cases verify identity while carrying out transaction of an amount equal to or exceeding 50 Thousand, whether as single transaction or several transaction which appears as to be connected

5.7 KYC as per Rule 9

- 1A- Every reporting entity shall within 10 days after the commencement of an account-based relationship with a client, file the electronic copy of the client’s KYC records with Central KYC Records Registry.

- 1B- The Central KYC Records Registry shall process the KYC records received from a reporting entity for de-duplicating and issue a KYC Identifier for each client to the reporting entity, which shall communicate the KYC Identifier in writing to their client.

- 1C- Where a client, for the purposes of clause (a) and clause (b), submits a KYC Identifier to a reporting entity, then such reporting entity shall retrieve the KYC records online from the Central KYC Records Registry by using the KYC Identifier and shall not require a client to submit the same KYC records or information or any other additional identification documents or details.

- 1D- A reporting entity after obtaining additional or updated information from a client under sub-rule (1C), shall as soon as possible furnish the updated information to the Central KYC Records Registry which shall update the existing KYC records of the client and the Central KYC Records Registry shall thereafter inform electronically all reporting entities who have dealt with the concerned client regarding updation of KYC record of the said client.

- 1E- The reporting entity which performed the last KYC verification or sent updated information in respect of a client shall be responsible for verifying the authenticity of the identity or address of the client.

- 1F- A reporting entity shall not use the KYC records of a client obtained from the Central KYC Records Registry for purposes other than verifying the identity or address of the client and shall not transfer KYC records or any information contained therein to any third party unless authorised to do so by the client or by the Regulator or by the Director.

- 1G- The regulator shall issue guidelines to ensure that the CentralKYC records are accessible to the reporting entities in real time.

5.8 Section 13: Powers of Director to Impose Fine

- As per Section 13, failure to comply with Chapter IV, the Director of ED may impose monetary penalty from Rs. 10,000 to One Lakh for each failure

- Rule 8. Furnishing of information to the Director.

-

- Information in respect of transactions referred to in clauses (A), (B), (BA), (C), and (E) of sub-rule (1) of Rule 3 every month by the 15th of the succeeding month.

- Information promptly in writing or by fax or by electronic mail in respect of transaction referred to in clause (D) of sub-rule (1) of Rule 3 not later than seven working days on being satisfied that the transaction is suspicious.

- Information in respect of transaction referred to in clause (F) of sub-rule (1) of Rule 3 every quarter to the Director by the 15th day of the month succeeding the quarter.

- For the purpose of this rule, delay of each day in not reporting a transaction or delay of each day in rectifying a misreported transaction beyond the time limit as specified in this rule shall constitute a separate violation.

5.9 Section 11A Verification of Identity by Reporting Entity

Every reporting entity shall verify the identity of its clients and the beneficial owner, by

- Authentication under the Aadhaar (targeted Delivery of Financial and Other Subsidies, Benefits and Services) Act, 2016 if reporting entity is a banking company

- Offline verification under the Aadhaar (targeted Delivery of Financial and Other Subsidies, Benefits and Services) Act, 2016

- Use of passport issue under Section 4 of the Passports Act, 1967

- Use of any other officially valid documents or modes of identification

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA