Guide to Family Succession Planning and Tax Implications

- Blog|Income Tax|

- 3 Min Read

- By Taxmann

- |

- Last Updated on 5 February, 2024

Darshak Shah – Partner | S N & Co.

Table of Contents

1. Case Study on Family Business

1. Case Study on Family Business

- Family Business go for unrelated diversification to cope up рооr communication, structure

- Family Business with several member go for majority poll or if not then delay decision or take low risk

- Trusteeship role builds Perpetuate business, In process younger generation may not get opportunity to cultivate fresh ideas

- Yongsters are ambitious, look modern in short time and existing busines manage by outside professional, so greater possibility of entrepreneurship among young generation

1.1 Solutions

- Family businesses with greater level of professionalisation practiced both in business and family are likely to perform and perpetuate better over a long period of time.

- Large business families are likely to approve new investments in diversified areas in small amounts to test the idea first before considering significant investments.

- Shirt sleeve to shirt sleeve in three generations’ is a myth in growing economies

- Entrepreneurship reflected in terms of starting green field ventures is likely to below in families where family members get groomed into managerial roles in existing firms soon after their studies.

- New ventures are likely to be encouraged in business families when existing businesses are managed by outside professionals, leaving limited openings at senior levels for the family members.

- In family businesses where family members are competent managers, professionals find the environment very conducive to work, and draw synergies.

- Higher the level of mutual respect between family members and outside professionals, greater is likely to be the performance.

1.2 Case Study

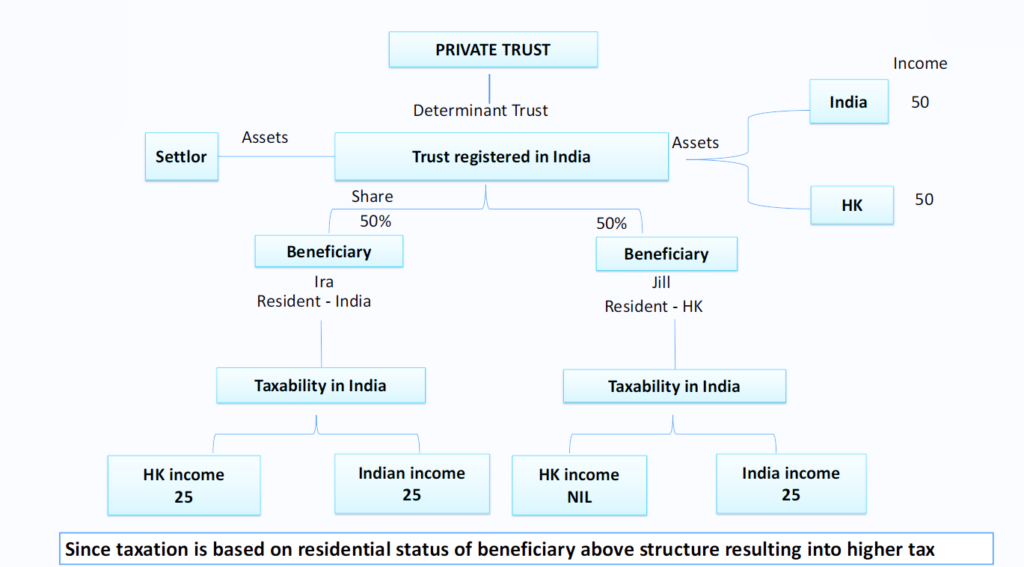

2. Taxability of Trust

|

Determinate |

Discretionary |

Foreign |

|

| Status of trust | Beneficiary to extent of share | Beneficiary to extent of share | Beneficiary to extent of share |

| If different then status of trustee | |||

| Residential Status | Beneficiary to extent of share | Beneficiary to extent of share If different then status of trustee |

Beneficiary to extent of share |

| Taxability in hands of | Trustee or beneficiary | Income distributed – Beneficial/trustee

Income not distributed – Trustee |

Refer – Table B |

| Rate of Tax | Normal rate of beneficiary [B&P @ MMR] Or AOP rate | MMR or AOP [exception cases] |

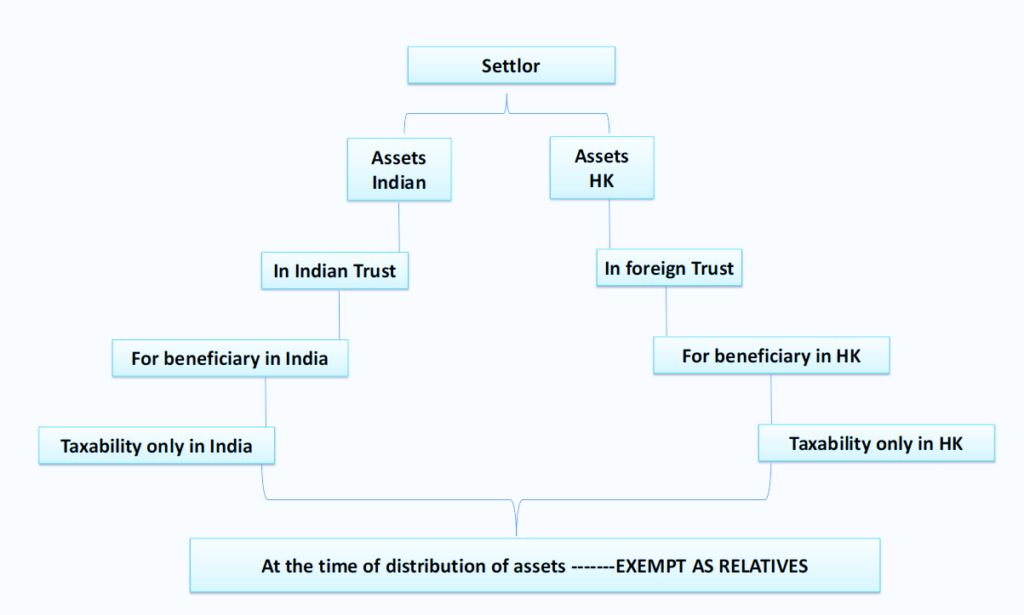

2.1 Table B

| Revocable | Indian settlor | Taxable in his hand |

| Revocable | Foreign settlor | Based on status of beneficiary |

| Irrevocable | POEM | World income is taxable |

| Irrevocable | Foreign & Indian beneficiaries | Indian beneficiary taxed on distribution |

2.2 Case Study

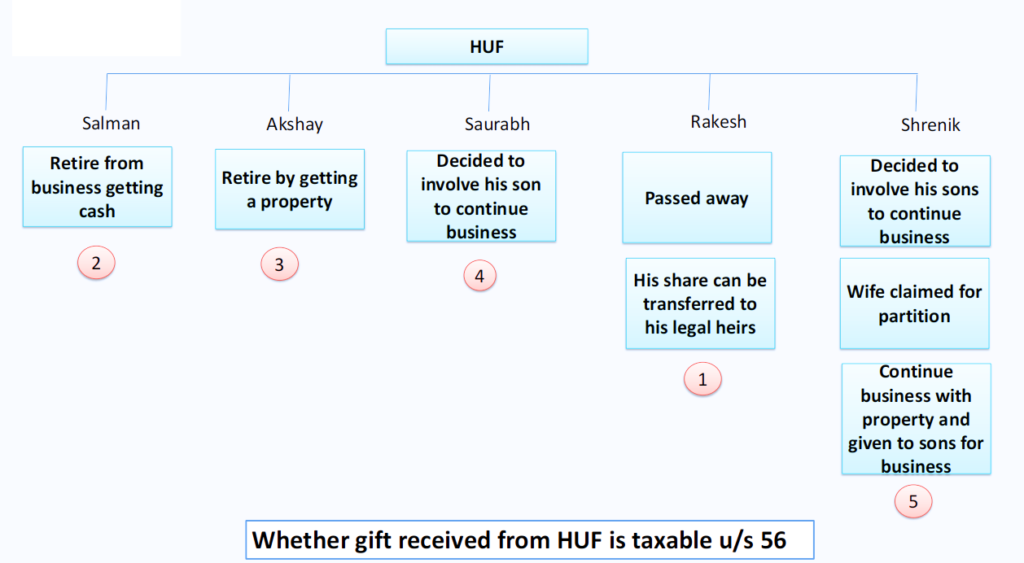

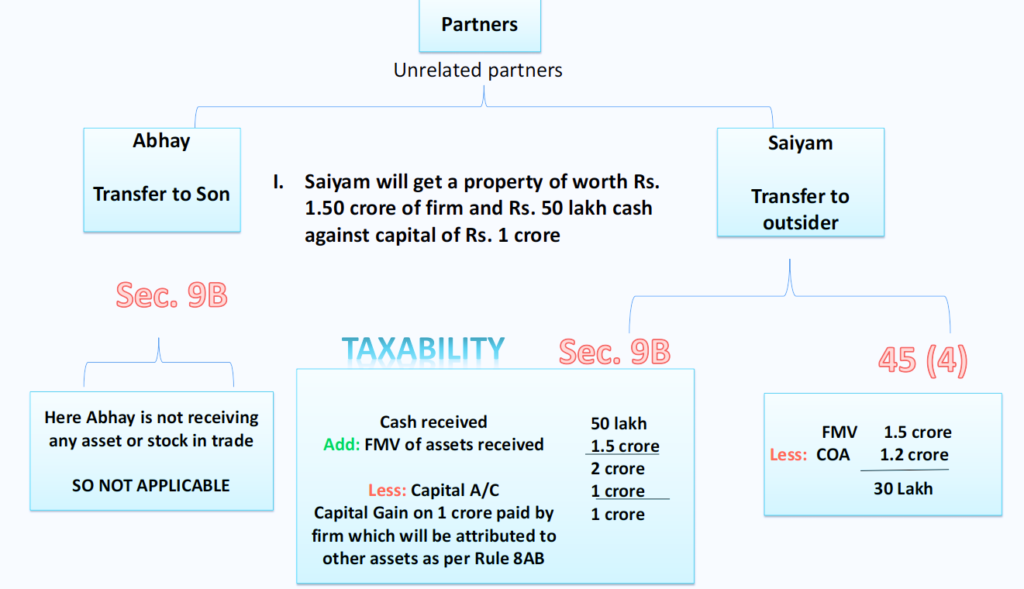

2.3 Case Study – Reconstitution of Firms

2.4 Case Study for Wills & FA

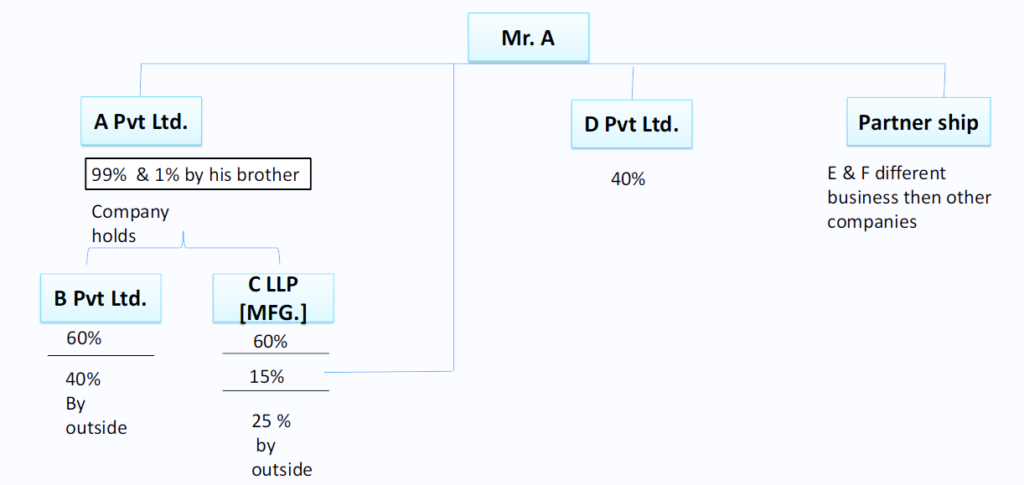

2.5 Objective – What Mr A Wants?

- To distribute assets in ratio of 40:40:20 between wife, brother & mother and to give control of business

- No emotional disputes within family

- Initially shares of A Pvt Ltd. to be distributed equally between brother & wife

- Condition transfer at the time of execution of will

3. Effects of Will

|

Wife |

Brother |

|

A Pvt Ltd. 99 % |

C LLP 75% |

| B Pvt ltd. 60% [ Effective] |

E & F |

| D Pvt Ltd. 40% |

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA