Venture Capital in India – Meaning | Features | Stages | Types

- Blog|FEMA & Banking|

- 12 Min Read

- By Taxmann

- |

- Last Updated on 10 February, 2026

Venture Capital in India refers to equity-based risk financing provided to early-stage, innovative, and high-growth Indian companies that lack access to traditional bank finance or public capital markets, with the objective of fostering entrepreneurship, technological innovation, and scalable business growth while generating long-term capital appreciation for investors.

Table of Contents

- Venture Capital – Catalysing Innovation in India’s Investment Banking Landscape

- Meaning and Concept of Venture Capital

- Features of Venture Capital

- Evolution of Venture Capital in India

- Venture Capital Investment (Financing) Process

- Stages of Venture Capital Financing

- Types of Venture Capital

Check out Taxmann's Investment Banking & Financial Services which is a comprehensive, NEP-aligned textbook that offers a clear, contemporary, and practice-oriented understanding of the investment banking and financial services ecosystem. It blends core principles with emerging areas such as fintech, ESG and sustainable finance, digital assets, algorithmic trading, and AI-driven analytics. With integrated coverage of regulatory frameworks, Indian and global market practices, and realistic case studies, the book strengthens analytical capability and application skills. Designed for undergraduate learners, faculty, and early-career professionals, it effectively bridges academic learning with industry relevance and career readiness.

1. Venture Capital – Catalysing Innovation in India’s Investment Banking Landscape

In the Indian investment banking scenario, venture capital plays a pivotal role in bridging the financing gap for high-potential start-ups and early-stage enterprises that lack access to traditional capital markets or bank credit. With India’s rapidly growing entrepreneurial ecosystem, fuelled by digital transformation, demographic advantage, and government initiatives such as Startup India and Digital India, venture capital provides both risk capital and strategic support to businesses in sectors like fintech, e-commerce, healthtech, and clean energy. Investment banks often act as intermediaries by facilitating fundraising, structuring deals, and connecting entrepreneurs with venture capital funds, thereby strengthening innovation-driven growth. The rationale lies in fostering economic dynamism, promoting job creation, and positioning India as a global hub for innovation, while simultaneously generating high returns for investors willing to bear the risks of early-stage financing.

Venture Capital (VC) is one of the most dynamic forms of financing within the investment banking and financial ecosystem. It refers to equity financing provided to early-stage, high-potential, and growth-oriented businesses that often lack access to conventional sources of capital such as bank loans or public markets. By taking significant risks, venture capitalists fuel innovation, job creation, and technological advancement. For students of investment banking, understanding the role of venture capital is critical, as it bridges the gap between entrepreneurship and institutional finance.

2. Meaning and Concept of Venture Capital

Venture Capital (VC) refers to a form of private equity financing that is provided to early-stage, innovative, and high-growth companies that have strong potential but may not yet have access to traditional sources of finance such as banks or capital markets. Unlike loans, venture capital is usually invested in exchange for an equity stake (ownership) in the company, making the venture capitalist a part-owner who shares in both the risks and rewards of the enterprise.

The key feature of venture capital is that it involves risk-bearing capital. Start-ups and new ventures often operate in untested markets, with unproven technologies or business models. Traditional lenders shy away from funding such businesses because of the high possibility of failure. Venture capitalists, however, are willing to provide funds because they are motivated by the possibility of generating very high returns if the business succeeds.

In addition to money, venture capitalists often provide strategic guidance, mentorship, networking access, and professional expertise to entrepreneurs. This active involvement helps start-ups grow faster and enhances their chances of success. Some of the prominent examples of Venture Capital include:

- Flipkart – One of India’s biggest e-commerce companies started as a small online bookstore. It received early-stage venture capital funding from Accel India and later Tiger Global. This funding helped Flipkart expand its operations and eventually attract billions of dollars in further investment, culminating in Walmart acquiring a majority stake.

- Ola Cabs – The ride-hailing company was able to scale up its operations after receiving early venture capital support from firms like Matrix Partners India and Sequoia Capital India. This allowed Ola to compete with global players like Uber.

- Byju’s – The edtech giant received significant venture capital from investors such as Sequoia Capital and Tencent. These funds enabled Byju’s to develop its learning app, expand internationally, and acquire other education companies.

- Naukri.com (Info Edge) – In its early years, Info Edge benefited from venture capital support which enabled it to become India’s leading online job portal, later successfully listing on the stock exchange.

- Zomato – Initially backed by Info Edge India Ltd. and later by Sequoia Capital, Zomato used venture capital to grow from a restaurant listing site into a global food delivery and dining platform.

2.1 Role of Venture Capital in the Economy

Venture Capital plays a critical role in a modern, innovation-driven economy by:

- Fuelling Innovation – Providing the necessary risk capital to transform novel, untested ideas into commercially viable products and services.

- Economic Growth and Job Creation – Start-ups, particularly those backed by VC, are significant drivers of job creation and often disrupt established industries, enhancing productivity.

- Bridging the Financing Gap – VC addresses the “funding gap” for start-ups, which are often too risky for traditional banks to finance and require significant capital before generating revenue.

- Value Addition (The “Smart Money” Concept) – Beyond capital, VC firms provide strategic guidance, operational expertise, and access to vast professional networks to help founders scale their businesses effectively.

3. Features of Venture Capital

Following are the key characteristics of Venture Capital (VC):

3.1 Equity-Based Financing

Venture capital typically involves investing in the equity of start-ups and early-stage companies rather than lending them debt. This gives investors’ partial ownership and a share in future profits. For example – Sequoia Capital invested in Byju’s and OYO Rooms in exchange for equity, becoming part-owners of these ventures.

3.2 High Risk, High Return

VC funds target innovative businesses with uncertain outcomes. The failure rate is high, but successful ventures can deliver extraordinary returns. For example – Flipkart received early VC backing from Accel Partners in 2009. Though risky at the time, the investment paid off when Walmart acquired Flipkart in 2018, giving huge returns to investors.

3.3 Focus on Innovation and Growth

VCs primarily fund companies in sectors with high growth potential and innovation such as technology, biotechnology, fintech, and clean energy. For example – Tiger Global has invested in Indian fintech start-ups like Razorpay and Cred, betting on the digital payments boom.

3.4 Active Participation and Mentorship

Unlike traditional financiers, venture capitalists actively engage in the strategic direction of the business. They provide managerial expertise, industry connections, and guidance in scaling operations. For example – Nexus Venture Partners not only invested in Zomato but also helped it expand globally through strategic advice and networks.

3.5 Staged Financing

VC funding usually comes in multiple “rounds” (Seed, Series A, B, C, etc.), with each round tied to performance milestones. This reduces risk for investors and provides gradual capital infusion as the company proves its model. For example – Swiggy raised multiple rounds from SAIF Partners, Naspers, and others, starting from seed capital to mega-rounds as it expanded nationwide.

3.6 Exit-Oriented Investment

VCs invest with the intention of exiting profitably within 5-10 years through Initial Public Offerings (IPOs), mergers, or acquisitions. For example – Early investors in Paytm gained profitable exits when the company launched its IPO in 2021. Similarly, Accel Partners exited Flipkart during the Walmart acquisition.

3.7 Targeting Unlisted and High-Growth Firms

Venture capital is generally directed towards private companies that are not listed on stock exchanges and are in their growth phase. For example – Early-stage investments in Ola happened before it became a market leader in ride-hailing and before considering IPO plans.

4. Evolution of Venture Capital in India

The evolution of Venture Capital (VC) in India has been gradual and policy-driven, shaped by the country’s economic reforms, technological progress, and entrepreneurial culture. While venture capital originated in the United States during the 1940s, it emerged in India only in the mid-to-late 1980s, primarily as a government initiative to promote innovation and technology-based enterprises. Over time, India transitioned from state-supported venture capital to a diversified and globally integrated VC ecosystem, with active participation from domestic and foreign investors.

4.1 Early Development Phase (1985–1991) – The Foundation Stage

The concept of venture capital in India was formally recognised in the Seventh Five-Year Plan (1985–1990), which emphasised the need for risk capital to promote technological entrepreneurship. During this period, venture capital was largely public sector–driven, focusing on technology-intensive and small-scale industries.

Key Milestones

- 1988 – Establishment of Technology Development and Information Company of India (TDICI) by ICICI in collaboration with UTI—the first formal VC institution in India.

- 1988 – Formation of Risk Capital Foundation (RCF) by IFCI to support innovative ventures.

- 1989 – Setting up of Risk Capital and Technology Finance Corporation (RCTFC) by IDBI to provide equity support for technology-oriented enterprises.

These institutions provided the initial framework for venture financing in

India, though their approach was more developmental than commercial,

focusing on technology diffusion rather than returns.

4.2 Expansion and Liberalisation Phase (1991–2000) – Entry of Private Players

The economic liberalisation of 1991 marked a major turning point for venture capital in India. Market reforms, deregulation, and the opening of foreign investment channels encouraged private and foreign participation in the VC industry.

Key Developments:

- 1993 – The Government of India and World Bank jointly launched the Technology Development and Information Program (TDIP) to strengthen venture capital institutions.

- 1996 – The Securities and Exchange Board of India (SEBI) introduced the Venture Capital Funds Regulations, 1996, to bring uniformity and investor protection in VC operations.

- Entry of Private VC Funds – Global firms such as Kleiner Perkins, Walden International, and Draper International entered India, primarily investing in IT and software companies.

The 1990s witnessed the rise of technology-based enterprises such as Infosys, Wipro, and NIIT, which attracted early-stage risk capital and proved the potential of the Indian innovation landscape.

4.3 Consolidation Phase (2001–2010) – Growth of Technology and Institutional Depth

The dot-com boom (and subsequent bust) of the early 2000s reshaped venture capital practices in India. While early internet ventures faced setbacks, the period led to professionalisation and deeper institutional presence of VC firms.

Highlights

- Rise of IT and IT-enabled services (ITES) and business process outsourcing (BPO) industries created new investment opportunities.

- Establishment of domestic VC arms by financial institutions such as ICICI Venture, SIDBI Venture Capital Ltd., and IL&FS Venture Corporation.

- 2005 – Launch of SME Growth Fund by SIDBI to focus on small and medium enterprises.

- 2006 onwards – Entry of global players such as Sequoia Capital India, Accel Partners, and Helion Ventures, who invested in early technology ventures.

During this decade, the VC industry transitioned from a policy-driven to a market-oriented framework.

4.4 Maturity and Globalisation Phase (2011–Present) – The Start-up Revolution

Post-2010, India witnessed an unprecedented start-up boom, driven by technology, innovation, and digital transformation. This period marked the global recognition of India as a major start-up hub, with exponential growth in venture capital activity.

Key Drivers

- Digital Infrastructure – Growth of internet and smartphone penetration.

- Government Support – Initiatives such as Startup India (2016), Digital India, Atal Innovation Mission, and the Fund of Funds for Start-ups (FFS) under SIDBI.

- Emergence of Unicorns – Companies like Flipkart, Paytm, Zomato, Byju’s, OYO, and Swiggy demonstrated successful VC-backed growth and global scalability.

- Foreign Investment – Major participation from global funds such as SoftBank Vision Fund, Tiger Global, and Naspers.

- Regulatory Reform – Introduction of SEBI (Alternative Investment Funds) Regulations, 2012, replacing the 1996 VC regulations, to expand the scope and structure of private investment funds.

Impact – India emerged as the third-largest start-up ecosystem in the world, with thousands of active start-ups and a dynamic venture capital environment that integrates domestic innovation with global capital.

5. Venture Capital Investment (Financing) Process

The venture capital investment process is a structured sequence of steps through which venture capital funds identify, evaluate, finance, and monitor entrepreneurial ventures with high growth potential. The venture capital investment process is not only about injecting capital but also about actively nurturing businesses to achieve scalability and sustainability. Each step is interlinked, requiring a balance of financial expertise, strategic foresight, and risk management. It reflects how venture capital and investment banking together create a pipeline of innovation-driven enterprises that contribute significantly to economic growth. Figure 6.1 gives the flowchart of the various steps involved in VC Financing.

Following are the key steps involved in VC financing process.

5.1 Idea Generation

The first step involves the generation of deal flow, which refers to the process of sourcing potential investment opportunities. This is achieved through networks, industry contacts, referrals, and direct applications from entrepreneurs. Investment banks also play a supporting role here by connecting start-ups with venture capital firms, thereby improving the visibility of viable projects.

5.2 Initial Screening

The second step is initial screening, where venture capitalists conduct a preliminary evaluation of business proposals. At this stage, the focus is on broad alignment with the fund’s investment strategy in terms of industry sector, stage of growth, geographic location, and scalability. Only a small percentage of proposals pass this stage, as most are filtered out based on lack of fit or weak fundamentals.

5.3 Evaluation and Due Diligence

The third step is detailed evaluation and due diligence. This involves a thorough analysis of the business model, financial statements, technology, intellectual property, competitive landscape, and management team. Both qualitative and quantitative assessments are carried out. For instance, venture capitalists examine revenue models, cash flow projections, and scalability potential while simultaneously assessing the credibility and vision of the founding team. Investment banks may assist in structuring valuations, benchmarking against industry peers, and conducting financial due diligence.

5.4 Investment Appraisal and Structuring

The next step is investment appraisal and structuring of the deal. Once a venture passes due diligence, the venture capital firm negotiates the terms of investment with the entrepreneur. This includes deciding on the amount of financing, the form of instruments (such as equity, convertible debt, or preference shares), ownership stake, valuation, governance rights, and exit preferences. A term sheet is prepared to outline these conditions, followed by legally binding agreements. The structure is often designed to balance the high risks of early-stage financing with adequate safeguards for the investor.

5.5 Disbursement

Once the investment agreement is finalised, funds are disbursed, usually in tranches linked to milestones rather than as a lump sum. This phased financing ensures that the entrepreneur remains accountable for progress and allows the venture capital firm to monitor performance closely. At this stage, the relationship evolves from financing to partnership, as venture capitalists actively participate in mentoring, strategic guidance, and network support. They may take board positions to influence key decisions and add value to the firm’s operations.

5.6 Monitoring and Value Addition

The next step is monitoring and value addition. Venture capitalists continuously track the company’s financial performance, market expansion, and operational challenges. They may facilitate recruitment of senior management, introductions to strategic partners, or entry into new markets. Investment banks may step in during this phase to assist with follow-on fundraising rounds, mergers and acquisitions, or strategic alliances.

5.7 Exit

The final step in the process is exit, which is the realisation of returns for the venture capitalists. Exits can take multiple forms such as initial public offerings (IPOs), trade sales to larger corporations, secondary sales to other investors, or buybacks by the original promoters. Investment banks play a critical role in structuring and executing these exits, especially in IPOs where they underwrite and manage the listing process. A successful exit not only provides high returns to investors but also validates the business model and strengthens the ecosystem for future funding.

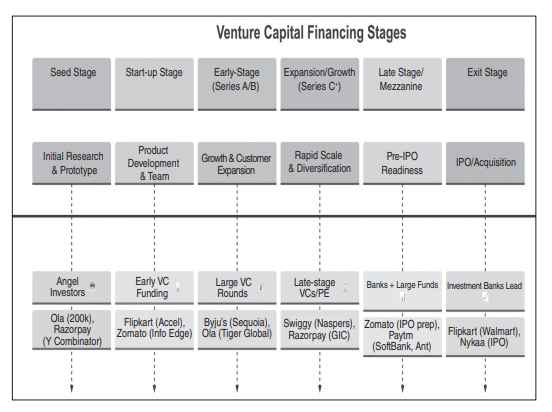

6. Stages of Venture Capital Financing

Venture capital financing typically progresses through sequential stages; each aligned with the growth and funding requirements of a start-up. Investment banks often engage at later stages to structure deals, raise larger funding rounds, or prepare companies for IPOs and strategic exits. Figure 6.2 explains the various stages of VC financing.

6.1 Seed Stage Financing

This stage supports the initial research, concept development, and prototype creation of a start-up idea. Funding is generally small and used for product feasibility studies, business model validation, and early operations wherein investor’s role includes high-risk capital providers such as angel investors, seed funds, or early-stage VCs. For example – Ola Cabs received its first seed funding of around USD 200,000 from angel investor Rehan Yar Khan to test its aggregator model; Razorpay was backed in its seed stage by Y Combinator to build its digital payments platform.

Stages of Venture Capital Financing

6.2 Start-up Stage Financing

This stage funds product development, hiring of the initial management team, marketing efforts, and scaling from prototype to market-ready product wherein investor’s role includes early institutional funding by VCs to start-ups with some proof of concept but no significant revenue. For example – Flipkart, after initial seed capital, raised early-stage VC funding from Accel India in 2009 to expand its online retail operations; Zomato secured early funding from Info Edge to strengthen its platform and marketing activities.

6.3 Early-Stage Financing (Series A and Series B)

This stage accelerates growth, expands the customer base, and optimises operations once the product has gained initial traction. Funds are used for scaling, technology upgrades, and geographic expansion. Larger VC funds and institutional investors come in at this stage with bigger cheques. For example – Byju’s raised a USD 25 million Series B round from Sequoia Capital to expand its edtech platform; Ola received USD 5 million in Series A from Tiger Global to grow its ride-hailing services beyond Bangalore.

6.4 Expansion/Growth Stage Financing (Series C and Beyond)

This stage supports rapid business expansion, diversification of product lines, entry into international markets, and large-scale marketing. Companies at this stage demonstrate strong revenue growth though profitability may still be limited. Late-stage VC funds, private equity firms, and corporate venture arms typically participate here. Investment banks often act as advisors for structuring these larger rounds. For example – Swiggy raised USD 210 million in a Series G round led by Naspers and DST Global to strengthen its food delivery network across India; Razorpay received late-stage funding from GIC and Sequoia to expand into new fintech solutions.

6.5 Late Stage/Mezzanine Financing (Pre-IPO Stage)

This stage prepares the company for IPO, merger, or acquisition by enhancing balance sheets, achieving profitability, and expanding further. Funds may be used for restructuring, acquisitions, or large-scale infrastructure. Investment banks play a critical role in syndicating private placements, arranging mezzanine debt, and advising on IPO readiness. For example – Zomato, before its IPO, raised late-stage funding from Tiger Global and Ant Financial. Investment banks like Morgan Stanley and Kotak Mahindra Capital helped structure its IPO in 2021; Paytm raised billions in pre-IPO rounds from investors such as Ant Group and SoftBank, with banks advising on its USD 2.5 billion IPO.

6.6 Exit Stage (IPO/Acquisition/Buyouts)

This stage provides returns to venture capitalists and investors, while enabling the company to access public markets or strategic buyers. Investment banks lead IPOs, mergers, and acquisitions, ensuring compliance, valuation, and capital raising. For example – Flipkart’s exit came in 2018 when Walmart acquired a 77% stake for USD 16 billion, one of the largest exits in India’s VC history. Investment banks advised both parties in structuring the deal; Nykaa launched a successful IPO in 2021, backed by investors like TPG and Fidelity, with the issue managed by ICICI Securities, Kotak Mahindra Capital, and Morgan Stanley.

7. Types of Venture Capital

While the stages of venture capital financing describe the chronological progression of a start-up’s funding journey, the types of venture capital categorise funding based on purpose, nature, and risk profile. Investment banks and venture capital funds often categorise these stages to structure deals effectively.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA