Overview of Investment in Foreign Listed Companies

- Blog|FEMA & Banking|

- 5 Min Read

- By Taxmann

- |

- Last Updated on 29 May, 2023

Table of Contents

- Overview on International Capital Market

- Overseas Direct Investment

- Investments by Indian Entity Foreign

- Investments by Resident Individual in Foreign

- Securities You Can Invest in Under OPI

- How to Invest in Foreign Securities

- Limit for Investment

- Repatriation and Time Limit

- Scope/Benefits of Investing in Foreign Stocks

- Tax Implication

- Comparative Analysis

- How TCS Works

- Reporting Compliance

- Challenges Faced by Investors in Investing Abroad

- Data/Statistics

- Vendors you can Invest with

1. Overview on International Capital Market

International Capital Market deals in instruments and assets which includes:

- Stocks and Indices

- Bond markets

- Currencies, Commodities &

- All other form of tradable instruments

Investing in International markets benefits in:

- Higher returns and cheaper borrowing costs

- Diversifying risk

- Tax Free Returns

- Round the clock operations (24/5 days)

1.1 Investment in Foreign Listed Companies

- Investment in foreign company is regulated under Foreign Exchange Management Act, 1999. It is also known as Overseas Investment.

- There are two types of Overseas Investments-

-

- Overseas Direct Investment

- Overseas Portfolio Investment

1.2 Who Can Invest

Resident Individual

- Can invest in shares of foreign companies listed on overseas stock exchanges

- Less than 10% stake

- No control over the foreign entity in which the investment is being made

Indian Entity

- Indian entity means company, body corporate, LLP and Partnership registered firm

- Invest in OPI of not more than 50% of its net worth as on the date of its last audited balance sheet

- Invest in ODI abroad in Joint Ventures/Wholly Owned Subsidiaries

2. Overseas Direct Investment

Indian entity means company, body corporate, LLP and Partnership registered firm

- Investment made in the JV and WOS by way of

1. Subscription to the Memorandum of a foreign entity

2. Purchase of existing shares of foreign entity either by market purchase or private placement or through stock exchange

- Indian Entity can make ODI – Foreign entity engaged in bonafide business activity

- Debt & non-fund based commitment – Permitted

- Sole proprietors and unregistered firms – Not Permitted

- ODI – upto 400% of net worth of Indian entity

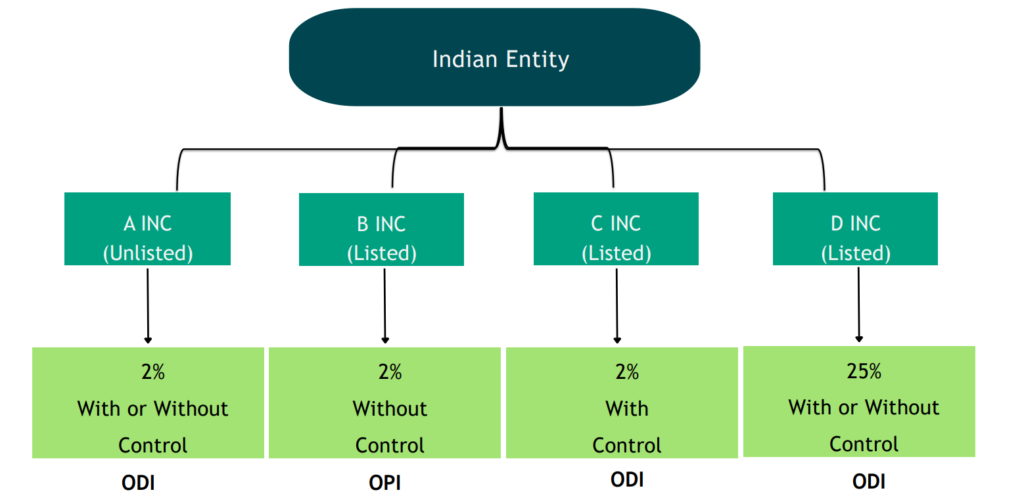

3. Investments by Indian Entity Foreign

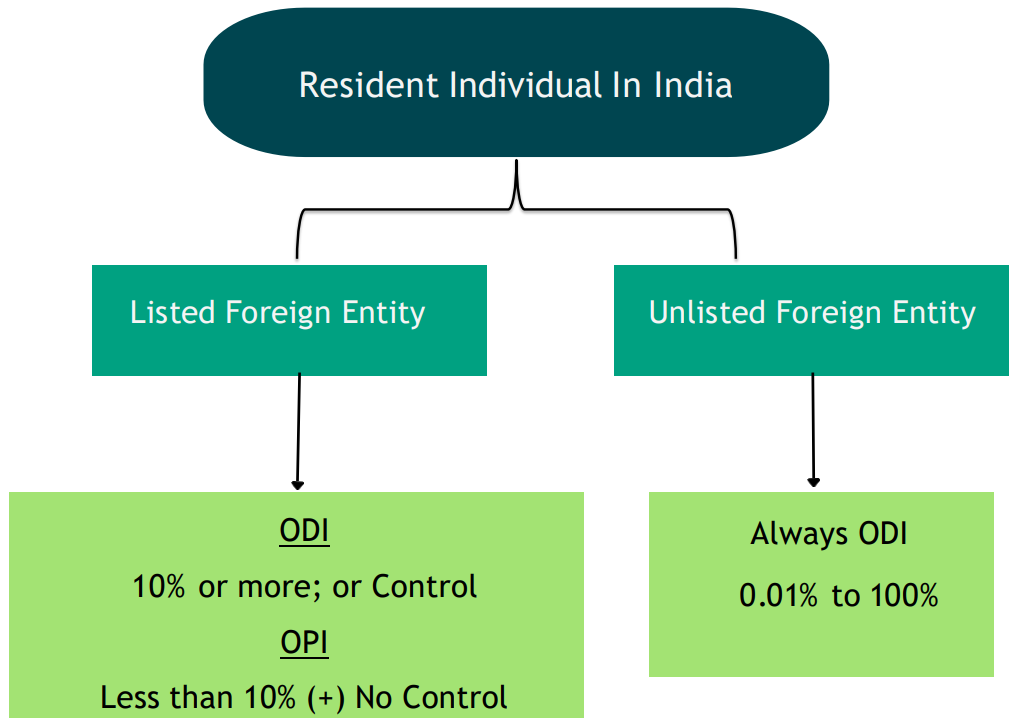

4. Investments by Resident Individual in Foreign

5. Securities You Can Invest in Under OPI

- Foreign Listed Shares

- International Mutual Funds

- Listed debt instruments

- Foreign securities by way of inheritance/Gift

- Entities located in IFS C (GIFT City in Gujarat)

- Acquisition of sweat equity shares/ESOP/minimum qualification shares

6. How to Invest in Foreign Securities

- Drawal of foreign exchange from an AD bank

- Capitalization of exports

- Swap of shares

- Balances held in EEFC account of the Indian Party

- Proceeds of foreign currency funds raised through ADR/GDR issues

-

- From above (iv) and (v) Financial commitment made through such resources prior to the date of notification of the OI Rules/Regulations shall not be reckoned towards the limit.

7. Limit for Investment

Liberalised Remittance Scheme (LRS)

- Resident individuals, including minors can remit up to USD 2,50,000 per financial year

- Can remit in any permissible current or capital account transaction or a combination of both

- Investment made from EEFC/RFC account is also included in prescribed LRS limit

8. Repatriation and Time Limit

- The foreign exchange realised/unspent/unused and not reinvested, is to be repatriated and surrendered to an authorised person.

- Repatriation should be within a period of 180 days from the date of such receipt/realisation/purchase/acquisition or date of return to India.

- Investor, who has remitted funds under LRS can retain, reinvest the income earned on the investments.

9. Scope/Benefits of Investing in Foreign Stocks

- Increase exchange rate leading to high profits

- Overseas investments that earlier needed approval have now been allowed under

Automatic Route - Diversified portfolios

- Investment in Stock such as Tesla, Google, Amazon, Facebook whose net worth continues

to grow at a rapid pace

10. Tax Implication

10.1 Foreign

- Dividend Income – 25% Tax on dividend Income received

- Capital Gains – No Capital gains for Non- Resident

10.2 India

- Dividend Income – As per Slab Rates (Due to double tax,

residents can claim Foreign Tax credit) - Capital Gains – LTCG- 20% + Surcharge and fees on Gains on Sales proceeds

- STCG – Applicable Slab Rates

If Foreign stock are held for more than 24 months it is considered as LTCG or else

STCG and accordingly Tax rates will be applicable in India.

11. Comparative Analysis

11.1 Indian Stock Market

- Investment ₹100

- Return on Investment 15%

- Total Return ₹115

- (Brokerage Charges and Other Fees will be deducted)

11.2 Foreign Stock Market

- Investment $100

- TCS 20%

- Actual Investment $80

- Return on Investment 20%

- Total Return $96 ~ 16% ROI

Merits/Demerits of Investing Abroad

- Currency Volatility but asset appreciation

- TCS of 20% on Remittance (Will be deducted by AD bank at the time of remittance)

- Tax deducted in Abroad as well as in India

- Brokerage Charges and other fees

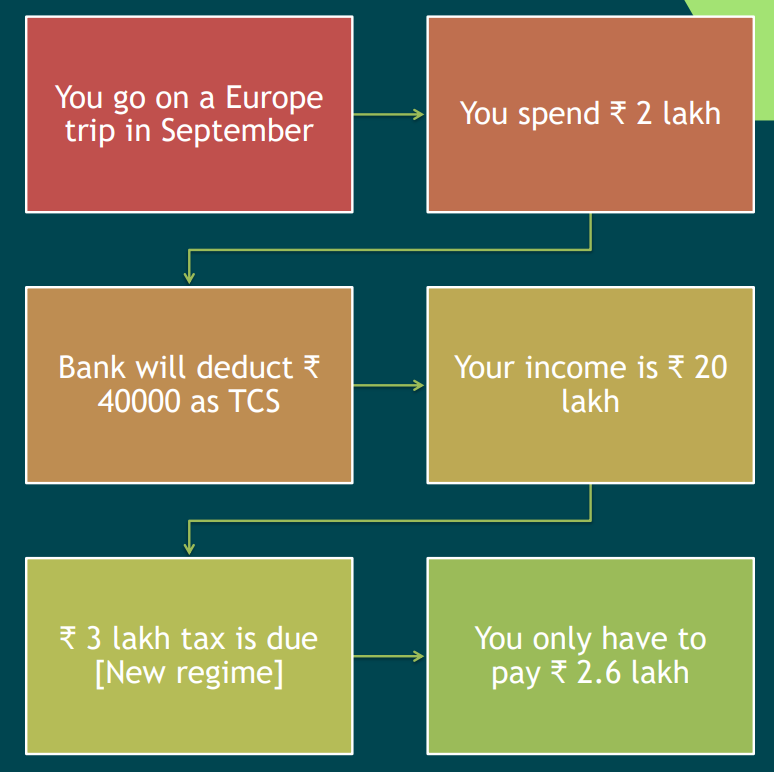

12. How TCS Works

- TCS can be adjusted against advance tax or claimed as refund in your returns

13. Reporting Compliance

- Indian Resident -> Remittance-> Foreign Entities

– submit bank specific documents (pertaining to LRS) at the time of making remittance - No Compliance for Indian Resident making Investment under OPI

- Except in cases where OPI is by way of employee stock ownership plan (ESOP) where the employer is required to report it in Form OPI.

14. Challenges Faced by Investors in Investing Abroad

- Higher Transaction Costs – (Brokerage Commissions, Liquidity problem, Clearing & Exchange fees, higher fund manager fees, etc)

- Currency Volatility – (Change in Currency exchange rate)

- Liquidity & Geo-Political Risks – (risking substantial losses due to Political or economic crisis)

- Repatriation or Remittance without Taxing – (Depending on different countries the profits are taxable and in some regions its as high as 57% on the profits)

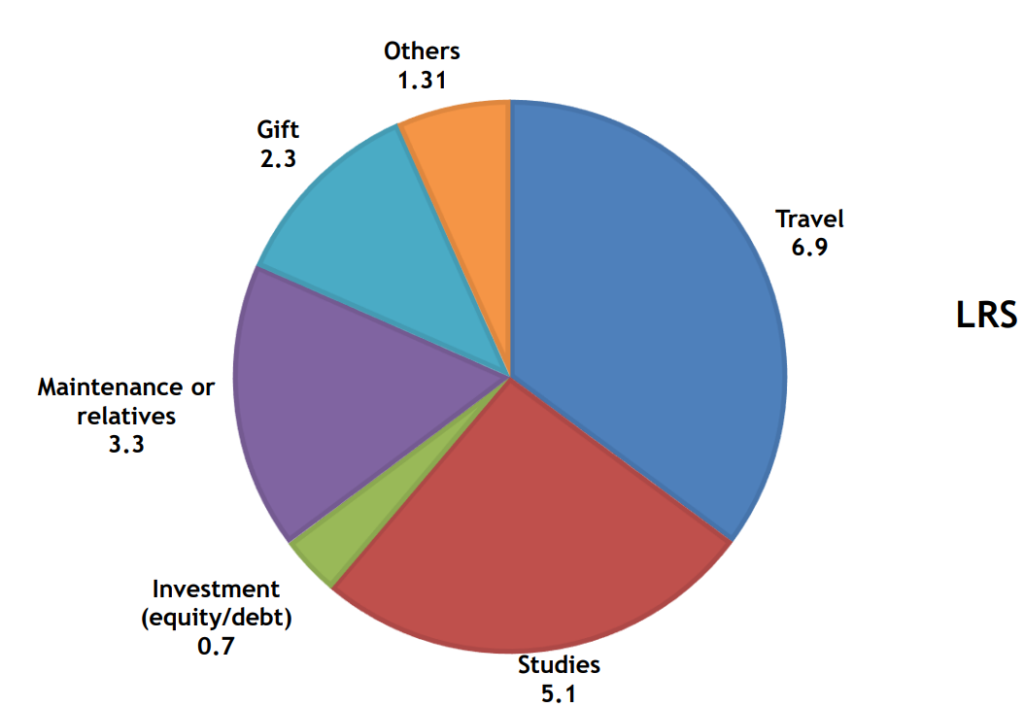

15. Data/Statistics

Outward remittances under LRS in 2021-22 (in $ billion)

16. Vendors you can Invest with

- The Wealth Creators

- Angel One

- ICICI Direct

- Kotak Securities

- Interactive Brokers

- Charles Schwab

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA