Classification of Goods under Customs and GST Law

- Blog|GST & Customs|

- 7 Min Read

- By Taxmann

- |

- Last Updated on 30 August, 2023

Table of Contents

- Need for Classification of Goods and Services

- Role of WTO/WCO in Classification

- Key Laws Governing Classification

- Application of Rules for Classification of Goods

- Classification under GST Law

- Consequences of Incorrect Classification

1. Need for Classification of Goods/Services

- Millions of goods and services

- Continuous advent/evolution of new goods and services

- Statistical tracking of goods and services for trade, policy matters, social welfare etc

- HSN a system of grouping/coding of goods of same kind

- Basis for charging duties/taxes/fees

- Basis for trade negotiations and concessions

- Classification may not reflect the correct nature of goods

2. Role of WTO/WCO in Classification

- Harmonized System (HS) nomenclature was developed by the WCO and entered into force on 1 January 1988

- 160 contracting countries/parties to HSN and 42 other countries using HSN

- HS Committee of the WCO undertakes a periodic review to take account of changes in technology and patterns in international trade, and recommends amendments to the HS

- Changes made on 1 January of 1992, 1996, 2002, 2007, 2012, 2017 and 2022…..2027 under discussion

- Publishes Explanatory Notes to HSN which aid in drafting local laws/rules (Explanatory notes to Harmonized System – Have strong persuasive value – General trend of taking assistance of Explanatory Notes to resolve entry related dispute not to be departed from- CCE v. UNI Products India Ltd. 2020 (372) E.L.T. 465 (S.C.)

- WTO facilitates discussions and agreements

3. Key Laws Governing Classification

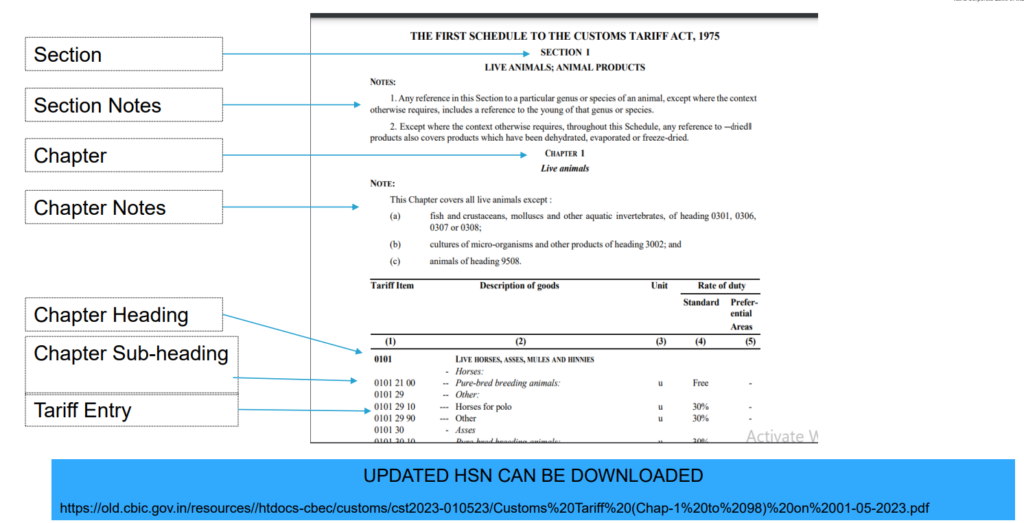

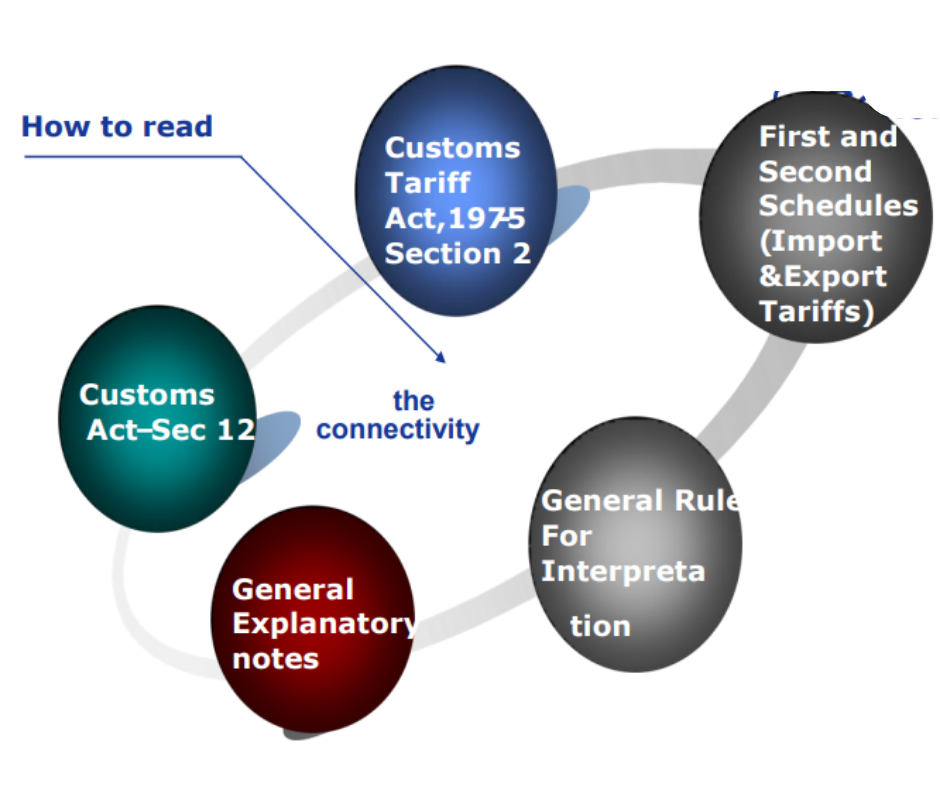

- Customs Tariff Act, 1962 master code for classification of goods

- Schedule I of Customs Tariff Act (Import Tariff) contains list of goods with basic customs duty rates

- Schedule II of Customs Tariff Act (Export Tariff) contains select list of goods with export duty rates

- Under GST law, Schedule of product wise duty rates based on HSN provided (total Sch I-5%, Sch II-12%, Sch III-18%, Sch IV- 28%, Sch V-3%, Sch VI- 0.25%, SCH VII-1.5%)

- GST law refers to Customs Tariff Act for classification of goods

- Central Excise Act contains rules similar to Customs Tariff Act for classification

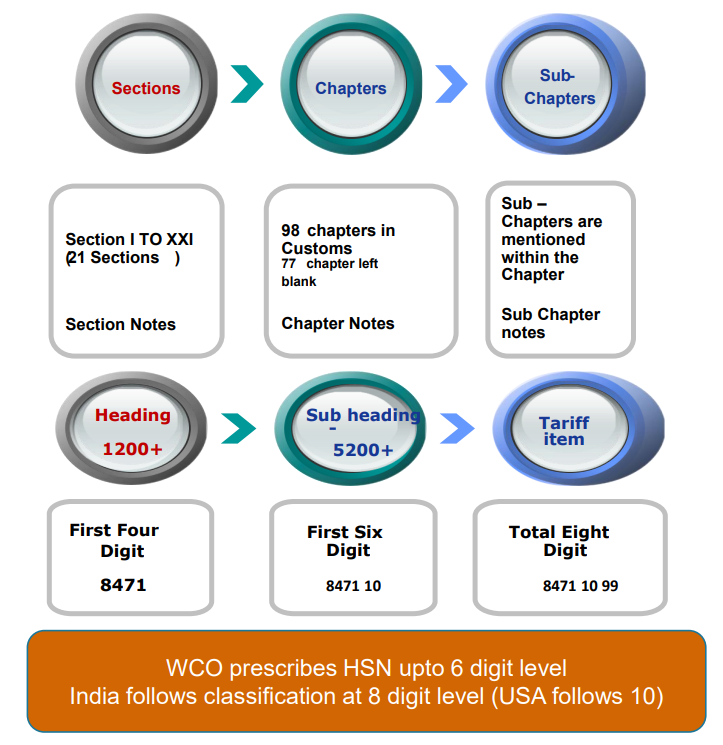

3.1 Arrangement of HSN

- Dash in sub-headings and Tariff Entry

- (-) A single dash denotes that goods belongs to a group covered under a heading

- (–) A double dash denotes that the article is a sub-classification of the preceding article that has a single dash

- (—) or (—-) a triple dash or quadruple dash indicates the article is a sub-classification of the preceding article that has a double dash or triple dash

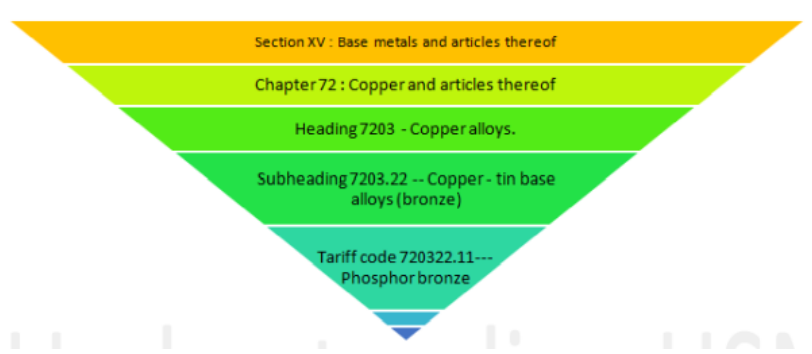

3.2 HSN/Tariff Illustration

Arrangement of HSN

- Raw materials/natural goods

- Un-worked products

- Semi-finished products

- Finished products

Principles of Classification

A commodity can be classified either by:

- Terms of heading

- Notes to sections, chapters or subheadings

- General interpretative rules

3.3 General Rules of Interpretation

Overarching provisions – Apply to all Chapters of HSN

Rule 1: The titles of Sections, Chapters and sub-Chapters are provided for ease of reference only; for legal purposes, classification shall be determined according to the terms of the headings and any relative Section or Chapter Notes and, provided such headings or Notes do not otherwise require.

Rules 2-5 can only be used when Rule 1 has failed. The rules must be used in hierarchical order.

Rule 2: Prescribes how to classify both incomplete and unassembled goods, and mixtures and combinations of goods.

2(a) the incomplete/unfinished goods having essential characteristics of the finished/complete product to be classified as that of the finished product

2(b) Reference of any material in a heading will include mixture/combination of that material. Classification of goods consisting of more than one material shall be done Rule 3

Rule 3: Prescribes how to classify products that are, prima facie, classifiable under two or more different HS headings.

3(a) Specific heading to be preferred over general headings

3(b) Mixtures/composite goods consisting of different materials/components should be classified according to the material/component that gives them their essential character.

3(c) If two headings are equally suited to the item, then the heading that appears last in numerical order to be chosen.

Rule 4: Prescribes that goods cannot be classified under above rules, to be classified under the heading appropriate to the goods to which they are most akin.

Rule 5: In respect of packing material& containers following rules shall be applicable.

5(a) specifies containers specifically designed for the article and suitable for long-term use shall be classified along with that article, if such articles are normally sold along with such cases. For example, a camera case would be classifiable as cameras.

5(b) Packing materials and containers are to be classified with the related goods except when the packing is for repetitive use.

Rule 6: Prescribes how to classify products at subheading level, based on the wording of the subheadings and the relative HS Section and Chapter Notes. Only subheadings at the same level within the same heading are comparable.

3.4 Classification of parts

A ‘part’ is an essential component of the whole without which the whole cannot function – ‘Accessory’ is supplementary or subordinate in nature and need not be essential for actual functioning of the product.

Parts of General Use – Note 2 to Section XV

Throughout this Schedule, the expression “parts of general use” means:

a) articles of headings 7307, 7312, 7315, 7317 or 7318 and similar articles of other base metal;

b) springs and leaves for springs, of base metal, other than clock or watch springs (heading 9114); and

c) articles of headings 8301, 8302, 8308, 8310 and frames and mirrors, of base metal, of heading 8306

Each Section/Chapter note provides that parts of general use will be classified in their respective chapters like nuts and bolts of all kinds of machines will be classified under chapter heading 7318

Parts of specific machines classified according to Section/Chapter notes. Classification of parts under Section XVI illustrated:

Subject to Note 1 to this Section, Note 1 to Chapter 84 and to Note 1 to Chapter 85, parts of machines (not being parts of the articles of heading 8484, 8544, 8545, 8546 or 8547) are to be classified according to the following rules:

(a) parts which are goods included in any of the headings of Chapter 84 or 85 (other than headings 8409, 8431, 8448, 8466, 8473, 8487, 8503, 8522, 8529, 8538 and 8548) are in all cases to be classified in their respective headings;

(b) other parts, if suitable for use solely or principally with a particular kind of machine, or with a number of machines of the same heading (including a machine of heading 8479 or 8543) are to be classified with the machines of that kind or in heading 8409, 8431, 8448, 8466, 8473, 8503, 8522, 8529 or 8538 as appropriate. However, parts which are equally suitable for use principally with the goods of headings 8517 and 8525 to 8528 are to be classified in heading 8517;

(c) all other parts are to be classified in heading 8409, 8431, 8448, 8466, 8473,8503, 8522, 8529 or 8538 as appropriate or, failing that, in heading 8487 or 8548.

3.5 Classification of Accessories

Accessories (Condition) Rules, 1963

Accessories of, and spare parts and maintenance or repairing implements for, any article, when imported along with that article shall be chargeable at the same rate of duty as that article, if the proper officer is satisfied that in the ordinary course of trade:

I. such accessories, parts and implements are compulsorily supplied along with that article; and

II. no separate charge is made for such supply, their price being included in the price of the article.

4. Application of Rules of Classification

- Customs Tariff categorists goods under 98 chapters (chapter 98 – Project Imports unique to India)

- Understanding nature, composition, and use of the goods critical for classification

- Identify the Section(s) where goods can potentially be classified

- Plastic Toys

Section VII: Plastics and Articles thereof

OR

Section XX: Misc. manufactured articles

Chapter 95 Toys, games and sports requisites

- Machinery and Mechanical appliances classified under Chapter 84

- Chapter Heading 8423 covers Weighing Machinery (excluding Balances of a Sensitivity of 5 Centi Grams or Better), Including Weight Operat ED Counti NG or Checking Machines; Weighing Machine Weights of all Kinds

- Personal Weighing machine covered tariff entry under 8423 10 00

- No sub-heading; direct tariff entry

- Balances of sensitivity of 5CGM or better covered under chapter heading 9018

- Balances of advanced feature cover under 9031 since 8423 covers only Personal Weighing Machines

4.1 Test for classification laid down by Courts

- Common parlance test or Popular meaning test

- Goods should be classified according to their popular meaning or as they are understood in their commercial sense and not as per the scientific or technical meaning

- Main raw material which goes into manufacture of injection moulded VIP suitcases is plastic. Even in common parlance suitcases are understood to be plastic goods. In the circumstances, the presence of other fitments in the suitcases, i.e., steel bands, locks and ancillaries made of other materials and whose value may be even more than the value of plastic, is not material. Suitcases are undoubtedly plastic goods. A. Nagaraju Bros. v. State of Andhra Pradesh – 1994 (72) E.L.T. 801 (S.C.)

5. Classification under GST Law

- Explanation appended to notification 1/2017 and 2/2017-central tax (rate) dated 28.06.2017

“(iii) “Tariff item”, “sub-heading” “heading” and “Chapter” shall mean respectively a tariff item, sub-heading, heading and chapter as specified in the First Schedule to the Customs Tariff Act, 1975 (51 of 1975).”

“(iv) The rules for the interpretation of the First Schedule to the Customs Tariff Act, 1975 (51 of 1975), including the Section and Chapter Notes and the General Explanatory Notes of the First Schedule shall, so far as may be, apply to the interpretation of this notification.”

- Limit for declaring HSN on invoices under GST laws:

1. Upto to NR 5 Crores- Four Digit (Chapter Heading)

2. More than 5 Cr. – Six Digit Digits (Chapter sub-heading)

- Notification 11/2017-Central Tax dated 28.06.17 covers use of Service Code

- Classification under GST is based on UNCPC (United Nations Central Product Classification)

6. Consequences of incorrect classification

- Leads to incorrect duty/tax payments, claim of incorrect export incentives etc.

- Authorities invoke Section 111 (m), Section 112, Section 114A and Section 114AA of the Customs Act

- Incorrect classification does not attract penalties until mala fide intention is proved Commissioner v. Lewek Altair Shipping Pvt. Ltd. – 2019 (367) E.L.T. A328 (S.C.) Commissioner v. Man Industries India Ltd. – 2016 (331) E.L.T. A90 (S.C.)]

- Seek provisional assessment or clear goods on payment of duty under protest in classification is challenged by the department

- Seek clarification from CBIC through business chambers

- Conduct periodic classification reviews to avoid errors

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA