Alternative Tax Regime & TDS/TCS Amendments by the Finance Act 2023

- Blog|Income Tax|

- 6 Min Read

- By Taxmann

- |

- Last Updated on 29 May, 2023

Table of Contents

- An Overview of Alternative Tax Regime Under Section 115BAC

- Amendments by the Finance Act 2023 Pertaining to TCS on Foreign Remittance

- Amendments by the Finance Act 2023 Pertaining to TCS in the Case of Non-Pan/Non-filer

1. An Overview of Alternative Tax Regime Under Section 115BAC

1.1 Who is covered under the alternative tax regime

- Any Individual

- Any HUF

- Any AOP/BOI/AJP

1.2 Tax rates

| Total income | Rate of tax |

| Up to Rs. 3,00,000 | Nil |

| From Rs. 3,00,001 to Rs. 6,00,000 | 5 per cent |

| From Rs. 6,00,001 to Rs. 9,00,000 | 10 per cent |

| From Rs. 9,00,001 to Rs. 12,00,000 | 15 per cent |

| From Rs. 12,00,001 to Rs. 15,00,000 | 20 per cent |

| Above Rs. 15,00,000 | 30 per cent |

| Any other | Slab rate

Regular tax regime |

| 0 – Rs. 2.5 lakh | Nil |

| Rs. 2.5 lakh – Rs. 5 lakh | 5% |

| Rs. 5 lakh – Rs. 10 lakh | 20% |

| Above Rs. 10 lakh | 30% |

1.3 Exemption limit

| Total income | Rate of tax |

| Up to Rs. 3,00,000 | Nil |

| From Rs. 3,00,001 to Rs. 6,00,000 | 5 per cent |

| From Rs. 6,00,001 to Rs. 9,00,000 | 10 per cent |

| From Rs. 9,00,001 to Rs. 12,00,000 | 15 per cent |

| From Rs. 12,00,001 to Rs. 15,00,000 | 20 per cent |

1.4 Rebate under section 87A

- Resident individual

- Total income not to exceed Rs. 7,00,000

- Amount of rebate is 100% of income-tax or Rs. 25,000, whichever is lower

- Marginal relief: Between Rs. 7,00,000 and Rs. 7,27,770

- Resident individual

- Total income not to exceed Rs. 5,00,000

- Amount of rebate is 100% of income-tax or Rs. 12,500, whichever is lower

| X Rs. | Y Rs. | |

| Income Income Tax Less: Rebate u/s 87A Balance Add: HEC @ 4% Tax liability |

7,00,000 | 7,10,000 |

| 25,000 25,000 |

26000 16000 |

|

| Nil | 10,000 400 |

|

| 10,400 |

1.5 Tax on other incomes chargeable at special rates

- Special rates under Chapter XII

- Special rates are applicable under alternative tax regime

1.6 Surcharge and education cess

- Surcharge – 10%, 15%, 25%

- HEC – 4%

| House 1 Self-occupied Rs. |

House 2 Let out Rs. |

|

| Gross annual value Less: Municipal Tax Net annual value Less: Deduction Standard deduction u/s 24(a) Interest u/s 24(b) Income |

0 0 |

6,25,000 25,000 |

| Nil | 6,00,000

1,80,000 |

|

| Nil | 1,40,000 |

| Regular tax regime Rs. |

Alternate tax regime Rs. |

|

| House 1 (let out) House 2 (let out) Income from house property Other income Net income |

17,00,000 (-) 25,00,000 |

17,00,000 (-) 25,00,000 |

| (-) 8,00,000 35,00,000 |

Nil 35,00,000 |

|

| 33,00,000 | 35,00,000 |

| Regular tax regime Rs. |

Alternate tax regime Rs. |

|

| House 1 (let out) House 2 (let out) Income from house property Other income Net income |

47,00,000 (-) 25,00,000 |

47,00,000 (-) 25,00,000 |

| 22,00,000 35,00,000 |

22,00,000 35,00,000 |

|

| 57,00,000 | 57,00,000 |

1.7 Tax incentives which are not available (blocked incentives)

- Leave travel concession [Sec. 10(5)]

- House rent allowance [Sec. 10(13A)]

- Special allowance(s) (other than those as may be prescribed) [Sec. 10(14)]

- Allowance to MPs/MLAs [Sec. 10(17)]

- Exemption up to Rs. 1500 available in the case of clubbed income of a minor child [Sec. 10(32)]

- Special economic zone [Sec. 10(32)]

- Entertainment allowance deduction [Sec. 16(ii)]

- Professional tax deduction [Sec. 16(iii)]

- Interest on housing loan in the case of one or two self-occupied properties [Sec. 24(b)]

- House property loss cannot be adjusted against other incomes

- Additional depreciation [Sec. 32(1)(iia)]

- Investment allowance in the case of backward area [Sec. 32AD]

- Tea/coffee/rubber development account [Sec. 33AB]

- Site restoration fund [Sec. 33ABA]

- Deduction for scientific research [Sec. 35(1)(ii)(iia)(iii), 35(2AA)]

- Capital expenditure pertaining to specified business [Sec. 35AD]

- Agriculture extension project [Sec. 35CCC]

- Deduction under section 80C to 80U [except employer’s contribution towards NPS under section 80CCD(2), deduction under section 80JJAA and deduction under section 80LA(1A)]

1.8 Tax incentives which are available (Incentives not blocked)

- Intrest on PPF

- Final payment of PPF

- Intrest on Sukanya Samriddhi Account

- Final payment of Sukanya Samriddhi Account

- Exemption pertaining to

-

- Gratuity [Sec. 10(10)]

- Commutation of pension [Sec. 10(10A)]

- Leave encashment [Sec. 10(10AA)]

- Retrenchment compensation [Sec. 10(10B)]

- Compensation on voluntary retirement or separation [Sec. 10(10C)]

- Tax on non-monetary perquisites paid by employer [Sec. 10(10CC)]

- Sum received under a life insurance policy [Sec. 10(10D)]

- Interest and withdrawal from recognised provident fund [Sec, 10(12)]

- Payment (including withdrawal) from NPS [Sec. 10(12A)/(12B)]

- Payment from approved superannuation fund [Sec. 10(13)]

1.9 AMT – Whether applicable

Alternate Minimum Tax (AMT) under section 115JC, not applicable

1.10 How to exercise option

- Alternate tax regime is Default tax regime from the AY 2024-25

- For regular tax regime – Option to be exercised along with the return of income every year (pertaining to AY 2024-25 or subsequent year) [Form No – 10IE]

- Form No – 10IE – Persons having income from business or profession – One time option for regular tax regime to be exercised for AY 2024-25 (or any subsequent year). Once exercised, it cannot be withdrawn.

1.11 How to exercise TDS option under section 192

- For TDS purposes, option can be given to employer

- Once exercised, it cannot be withdrawn for that financial year

- However, at the time of submission of return of income, the employee will have to opt again (the same option or different)

1.12 When it is beneficial

- Find out quantum of blocked incentives

- Find out income before blocked incentives

| Income (before deducting blocked incentives) | Alternative tax regime | Rate of tax |

| More than Rs. 5 crore | ✓ | |

| Rs. 15 lakh – Rs. 5 crore | ✓ (blocked incentives < Rs. 3,75,000) |

✓ (blocked incentives > Rs. 3,75,000) |

| Rs. 7,27,770 – Rs. 15 lakh | ✓ (blocked incentives > Rs. 3,75,000) |

|

| Rs. 7 lakh – Rs. 7,27,770 | ✓ (blocked incentives > Rs. 1,51,500) |

|

| 0 – Rs. 7 lakh | ✓ | x |

Note: Senior citizen: Rs. 3,66,667

1.13 When it is beneficial to exercise option

|

Regular tax regime |

Alternative tax regime |

|

| Basic salary |

34,00,000 |

34,00,000 |

| House rent allowance [HRA received: Rs. 3,15,000 — exemption under section I0 (13A): Rs. 3,l5,000] |

Nil |

3,15,000 |

| Standard deduction | (—) 50,000 | — 50,000 |

| Income from other sources (interest on saving bank account) | 21,000 | 21,000 |

| Gross total income | 33,71,000 | 36,86,000 |

| Less: Deductions | ||

| Under section 80C (PPF contribution) | 1,50,000 | Blocked |

| Under section 80TTA (interest on saving bank account) | 10,000 | Blocked |

| Net income | 32,11,000 | 36,86,000 |

| Tax on net income | ||

| Income-tax | 7,75,800 | 8,05,800 |

| Add: Health and education cess | 31,032 | 32,232 |

| Tax liability | ||

| 8,06,830 | 8,38,030 |

| Regular tax regime | Alternative tax regime | |

| Basic salary |

34,00,000 |

34,00,000 |

| House rent allowance [HRA received: Rs. 3,l5,000 – exemption under section l0(13A): Rs. 1,60,000] |

1,55,000 |

3,l5,000 |

| Standard deduction | (—) 50,000 | — 50,000 |

| Income from other sources (interest on saving bank account) | 21,000 | 21,000 |

| Gross total income | 35,26,000 | 36,86,000 |

| Less: ’ Deductions | ||

| Under section 80C (PPF contribution) | 1,50,000 | Blocked |

| Under section 80TTA (interest on saving bank account) | 10,000 | Blocked |

| Net income | 33,66,000 | 36,86,000 |

| Tax on net income | ||

| Income-tax | 8,22,300 | 8,05,800 |

| Add: Health and education cess | 32,892 | 32,232 |

| Tax liability | 8,55,190 | 8,38,030 |

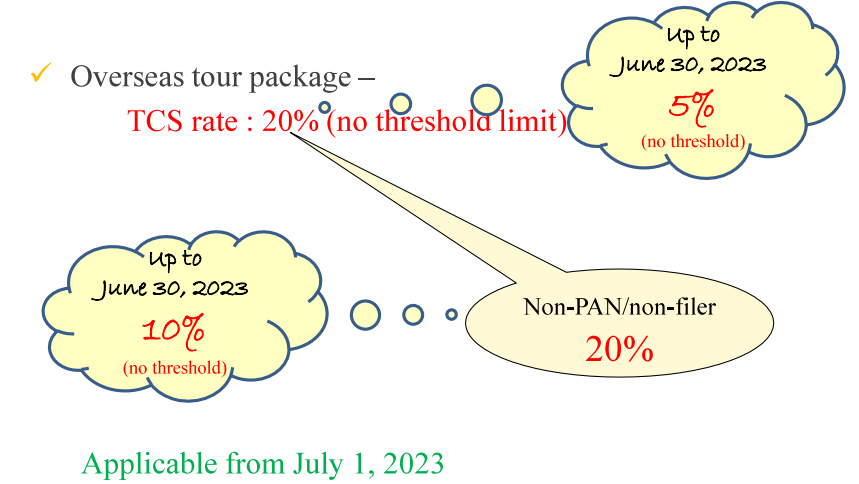

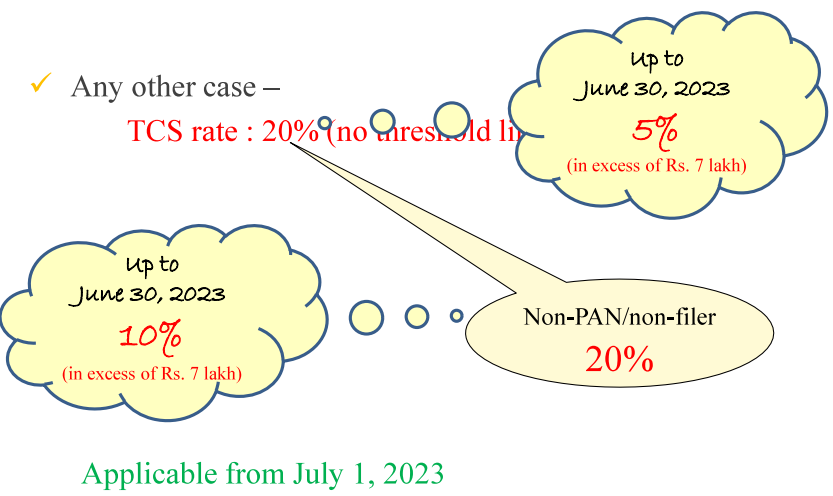

2. Amendments by the Finance Act 2023 Pertaining to TCS on Foreign Remittance

2.1 TCS under section 206C(IG)

- Remittance for education —

- If the amount being remitted out is a loan obtained from any financial institution as defined in section 80E

TCS rate: 0.5% (in excess of Rs. 7 lakh)

Non-Pan/Non-filer: 5% - Remittance for education (but not covered by above) TCS rate: 5% (in excess of Rs. 7 lakh)

Non-Pan/Non-filer: 10%

- If the amount being remitted out is a loan obtained from any financial institution as defined in section 80E

No change by Finance Act, 2023

- Remittance for medical treatment —

TCS rate: 5% (in excess of Rs. 7 lakh)

Non-Pan/Non-filer: 10%

No change by Finance Act, 2023

3. Amendments by the Finance Act 2023 Pertaining to TCS in the Case of Non-Pan/Non-filer

3.1 Modifications in the provisions of section 206CC/206CCA

- TCS rate in the case of non-PAN/non-filer:

-

- Twice the regular rate, or

- 5%

whichever is higher (But not more than 20% w.e.f. July 1, 2023)

3.2 Other amendments pertaining to TDS/TCS

- In the case of section 192A, TDS rate in non-PAN case: 20%.

- New section 194BA – TDS on winnings from online games.

-

- TDS rate: 30% (no threshold).

- Tax to be deducted at the end of financial year (subject to an exception)

- Tax to be deducted whether winnings are in cash or kind or both.

- Higher threshold under section l94N if recipient is a co-operative society.

- Tax treaty relief for TDS under section 196A.

- Threshold limit to be applied on cumulative basis under sections 194B and 194BB.

- “Specified person” amended under sections 206AB/206CCA to exclude those who are otherwise not required to submit return of income and who are notified.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA