Investment made in Umbrella Organization by Urban Co-operative Banks not to be counted in non-SLR investment limit

- News|Blog|FEMA & Banking|

- 2 Min Read

- By Taxmann

- |

- Last Updated on 17 February, 2026

Circular no. RBI/2021-22/177 DOR.REC.MRG.90/16.20.000/2021-22, Dated: 03.03.2022

The RBI issued the revised guidelines with regard to Investments in Non-SLR securities by primary (urban) cooperative banks on Jan 30, 2009.

The revised guidelines states that the non-SLR investments shall be limited to 10 per cent of a bank’s total deposits as on March 31 of the previous year.

Further the investments in unlisted securities shall not exceed 10 per cent of the total non-SLR investments at any time.

In the year 2019, RBI permitted UCBs to subscribe to capital of the UO on voluntary basis.

The RBI through the current circular provides that the investment made for subscribing to the capital of the UO, for acquiring its membership, shall be exempt from the limits prescribed for non-SLR investments as mentioned hereinabove. This Circular applies to all Primary (Urban) Co-operative Banks.

Click Here To Read The Full News

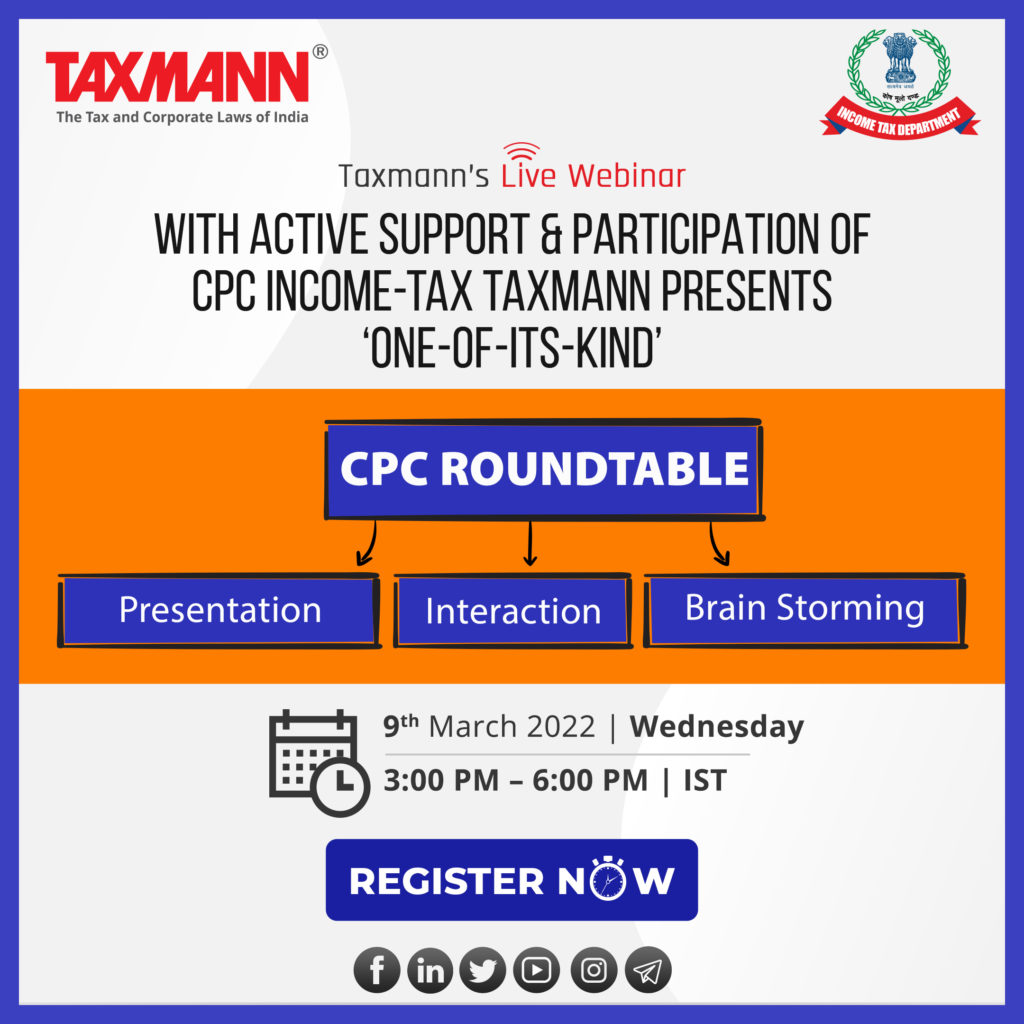

Check out Taxmann's Live Webinar with CPC Income-Tax! The 'One-of-a-Kind' – CPC Roundtable Presentation | Interaction | Brain Storming 🗓️ 9th March 2022 (Wednesday) | 🕒 3:00 PM – 6:00 PM (IST) 👩💻👨💻 Register Now for FREE! (Limited Slots Available): https://taxmann.social/HxkX 💬 ASK from CPC You can also raise your concern(s)/suggestion(s) with CPC regarding Registration, E-filing, Processing, Refund and Rectification related issues. CPC officers will take up the issues during the live event. Coverage of the Webinar & the Speakers: ✔️ Welcome Address & Moderator| Mukesh Patel | International Tax Expert ✔️ Keynote Address | Dr Sibichen Mathew | Director of Income-tax | CPC-ITR

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA