Best Approach to Succession Planning Strategies

- Other Laws|Blog|

- 5 Min Read

- By Taxmann

- |

- Last Updated on 10 April, 2025

Succession Planning is a strategic process organizations use to identify and develop potential future leaders or senior managers to fill key positions within a company when they become vacant. This process ensures that businesses continue to operate efficiently without interruption when important roles are suddenly or eventually left by their current holders. The plan typically involves: – Identifying Critical Positions: Determining which roles are essential for the organization's operations and long-term success. – Assessing and Identifying Talent: Evaluating current employees to identify potential candidates who have the skills, experience, and potential to fill these critical roles. – Development and Training: Providing targeted training, mentorship, and development opportunities to prepare these candidates for future roles. – Monitoring and Adjusting: Regularly reviewing and updating the succession plan to reflect changes in the organization's strategy, employee development, or other factors. The goal of succession planning is to minimize disruptions, maintain continuity, and ensure that the organization remains strong and resilient in the face of changes in leadership or other critical roles.

Table of Contents

- Introduction

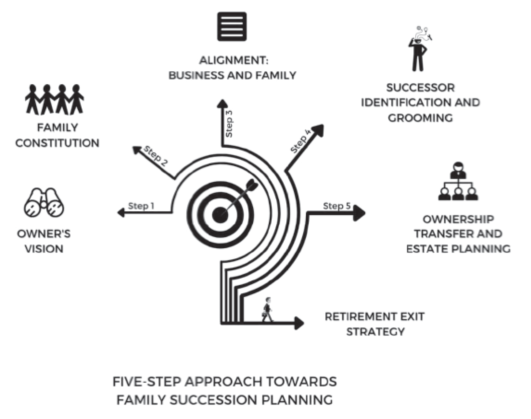

- Five-step Approach Towards Family Succession Planning

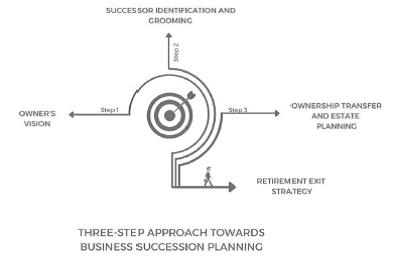

- Three-step Approach Towards Business Succession Planning

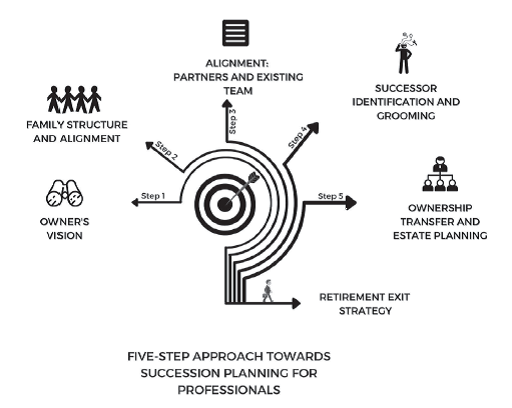

- Five-step Approach Towards Succession Planning for Professionals

Check out Taxmann's Business Succession Planning which is an authoritative roadmap by CA. Ravi Mamodiya for transferring ownership and leadership across generations. Integrating strategic frameworks, legal guidance, and real-world case studies, it covers estate planning, governance models, and taxation intricacies. The 5-Step Approach and 3-P Framework offer both novices and experts practical insights. Ultimately, the book addresses succession's emotional and generational complexities, ensuring a lasting business legacy.

1. Introduction

Typically, business owners consult with a variety of professionals in developing their succession plans — lawyers, accountants, bankers, financial planners, insurance advisors, merger and acquisition consultants and management consultants. Furthermore, quite often, these professionals find it difficult to proceed because the business has yet to make a number of personal decisions that will drive the planning process.

On that note, the diverse strategies involved in achieving efficient succession planning at the individual, family and business levels include:

- Strategic Planning

- Continuity Planning

- Human Resources Planning

- Financial Planning

- Estate Planning

- Exit Planning

The process comprises five and three steps for family and business succession planning respectively. Each step involves an exploration of several key questions. They might be better visualised as points on a circle, each one connected to all of the others.

2. Five-step Approach Towards Family Succession Planning

2.1 Vision

- Do you have clarity over your passion, purpose and why?

- Do you want to keep the business in the family?

- Can you make the shift from “me” to “we”?

- How do you want to spend your “golden” years?

- Do you have the Retirement strategy in place?

2.2 Family Constitution

- Do members of your family have a vision for their own lives?

- Does the next generation wish to own and/or operate the business?

- Do you have a written document describing the responsibilities & roles of family members?

- How will you frame bodies like family board or family council?

- How would these bodies function?

2.3 Aligning the Business & Family Strategies

- Does the company’s strategic plan support the family’s vision and values?

- Have you placed the Alignment of the Ownership with Family and Management?

- Is the business positioned for long-term viability and succession?

- Could the business survive your untimely death or disability?

2.4 Identifying & Preparing Successors and Leadership Transition

- Who will run the business?

- Which family members will enter the business?

- Who will you prepare for succession?

- How will you prepare them?

- How to Groom the Successor?

2.5 Estate Planning

- How will you ease the transition?

- When will the change in ownership take place?

- Who will own the business?

- How can you leave your family and the business in the best possible financial shape?

- What will be the Taxation on the transition?

- What will be the best suitable structure for carrying out your business?

3. Three-step Approach Towards Business Succession Planning

3.1 Vision

- Do you have clarity over your passion, purpose and why?

- Are you clear about the direction you want internally within the organisation and where you want to head externally?

- Can you make the shift from “me” to “we”?

- How do you want to spend your “golden” years?

- Do you have a Retirement strategy in place?

3.2 Identifying & Preparing Successors for Leadership

- Who will run the business?

- Do you want to hand over your business to someone known or sell your business to an outsider?

- Who will you prepare for succession?

- How will you prepare them?

- How to Groom the Successor?

3.3 Estate Planning

- How will you ease the transition?

- When will the change in ownership take place?

- Who will own the business?

- What will be the Taxation on the transition?

- What will be the best suitable structure for carrying out your business?

4. Five-step Approach Towards Succession Planning for Professionals

4.1 Vision

- Do you have clarity over your passion, purpose and why?

- Are you clear about the direction you want internally within the organization and where you want to head externally?

- Can you make the shift from “me” to “we”?

- How do you want to spend your “golden” years?

- Do you have a Retirement strategy in place?

4.2 Family Structure and Alignment

- When do you want your child or the candidate to take over your professional practice?

- How will the succession affect other family members?

- What happens in case the chosen person gets incapacitated?

- How does your succession plan affect individual goals?

4.3 Alignment with the Partners and the Existing Team

- Do you have the processes in place to openly discuss the organisation’s vision, values, and mission with your team?

- Have you planned ways to support your employees’ progress, career development, and well-being?

- Are your team members aware of the significance of their positions in the company?

- Have you specified that the current succession plan is not a permanent resolution but subject to change over time?

4.4 Successor Identification and Grooming

- Who will run the business?

- Do you want to hand over your business to someone known or sell your business to an outsider?

- Who will you prepare for succession?

- How will you prepare them?

4.5 Estate Planning and Exit Strategy

- How will you ease the transition?

- When will the change in ownership take place?

- Who will own the business?

- What will be the taxation on the transition?

- What will be the best suitable structure for carrying out your business?

These questions are like your checklist of things to consider before the transition begins. But, how do you know when you have succeeded in the succession process? The next chapter talks about the wheel of succession, and how you can measure your succession progress.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA