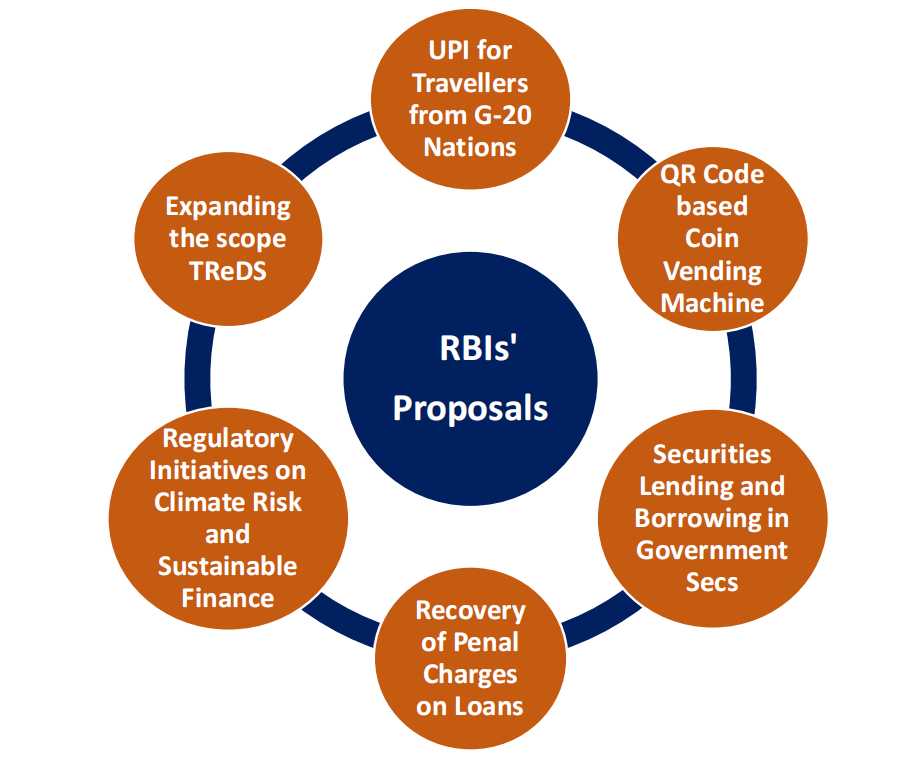

[Highlights] RBIs’ Statement on Developmental and Regulatory Policies

- Blog|FEMA & Banking|

- 5 Min Read

- By Taxmann

- |

- Last Updated on 2 May, 2023

Authored by Taxmann’s Advisory & Research (Corporate Laws)

Table of Contents

1. RBI proposes to extend UPI for Inbound Travellers from G-20 Nations to India

2. RBI aims to bring QR Code based Coin Vending Machine

3. RBI allows Securities Lending and Borrowing in Government Securities

4. RBI propose Recovery of Penal Charges on Loans

5. RBI takes Regulatory Initiatives on Climate Risk and Sustainable Finance

6. Proposal to expand the scope of the Trade Receivables Discounting System (TReDS)

Introduction

RBI vide. Press Release no. dated February 8, 2023, has introduced a Statement on various developmental and regulatory policies relating to (i) Financial Markets; (ii) Regulation; (iii) Payment and Settlement Systems and (iv) Currency Management. The proposal aims to promote stability and sustainability in the financial ecosystem. The key proposals as laid down in the Statement on Developmental and Regulatory Policies are discussed in detail hereunder:

1. RBI proposes to extend UPI for Inbound Travellers from G-20 Nations to India

Unified Payments Interface (UPI) has become a popular payment method for retail electronic payments in India. RBI has extended the scope of UPI to NRIs with international mobile numbers linked to NRE/NRO accounts.

RBI has proposed to allow all inbound travellers from G-20 countries to use UPI for merchant payments at select airports and eventually at all entry points in India.

Countries covered under G-20: Argentina, Australia, Brazil, Canada, China, EU, France, Germany, India, Indonesia, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, Turkey, UK and USA.

Comments:

The proposed implementation can greatly benefit international travellers visiting India. It would provide a convenient payment method without carrying cash or currency. Furthermore, the use of UPI would ensure a secure and smooth payment process, contributing to the growth of India’s digital payments industry.

2. RBI aims to bring QR Code based Coin Vending Machine

The Reserve Bank of India (RBI) is partnering with several lending banks to launch a pilot project on QR Code-based Coin Vending Machines (QCVMs) to improve the distribution of coins among the public. The QCVMs will dispense coins through a debit from the customer’s bank account via the Unified Payments Interface (UPI), making it a cashless coin dispensation solution.

The pilot project for QR Code-based Coin Vending Machines will be launched at 19 locations in 12 cities across India. The aim is to make coin distribution more accessible by installing the machines in public places such as railway stations, shopping malls, and marketplaces. Based on the results of the pilot tests, guidelines will be provided to banks for improved coin distribution using QCVMs.

Comments:

QCVM would eliminate the need for physical tendering of banknotes and their authentication. Customers will also have the option to withdraw coins in the required quantity and denominations in QCVMs. The machines can process payments faster and more efficiently than traditional coin vending machines that rely on cash and coins.

3. RBI allows Securities Lending and Borrowing in Government Securities

The creation of a robust market for securities lending and borrowing will increase the liquidity and depth of the Government securities market, promoting efficient price discovery.

To achieve this, RBI has proposed to allow the lending and borrowing of Government securities, which will supplement the existing special repo market. This is expected to encourage greater participation in the securities lending market, allowing investors to maximize returns on idle securities. It will also enhance the financial market in India.

4. RBI propose Recovery of Penal Charges on Loans

According to current guidelines, Regulated Entities (REs) have the autonomy to establish a fair and transparent policy for charging penal interest on loans through approval from their Board. The purpose of penal interest is to promote responsible borrowing habits, not to serve as a source of revenue beyond the agreed-upon interest rate. However, supervisory evaluations have revealed inconsistent practices among REs regarding the assessment of penal interest, with some instances being excessive and causing customer complaints and disputes.

RBI reviewed the existing guidelines on the assessment of penal interest. It has been decided that any penalties for loan defaults or non-compliance with loan terms should be in the form of “penal charges” in a reasonable and transparent manner, rather than “penal interest” added to the loan’s interest rate.

Furthermore, penal charges should not be capitalized and must be separately recovered. However, if a borrower’s credit risk profile deteriorates, Regulated Entities (REs) have the freedom to adjust the credit risk premium as per existing guidelines on interest rates.

5. RBI takes Regulatory Initiatives on Climate Risk and Sustainable Finance

The Reserve Bank of India, as a Central Bank with the goal of maintaining financial stability, recognizes that climate change translates into climate-related financial risks to Regulated Entities (REs) and potentially affects overall financial stability. To address these risks and develop a strategy based on global best practices, the bank released a Discussion Paper on Climate Risk and Sustainable Finance for public feedback on July 27, 2022. Based on the feedback received, it has been decided to issue the following guidelines:

The guidelines will be rolled out gradually, and the Reserve Bank of India will have a webpage dedicated to climate risk and sustainable finance, which will gather all relevant information, including instructions, press releases, publications, speeches, and communications from the bank.

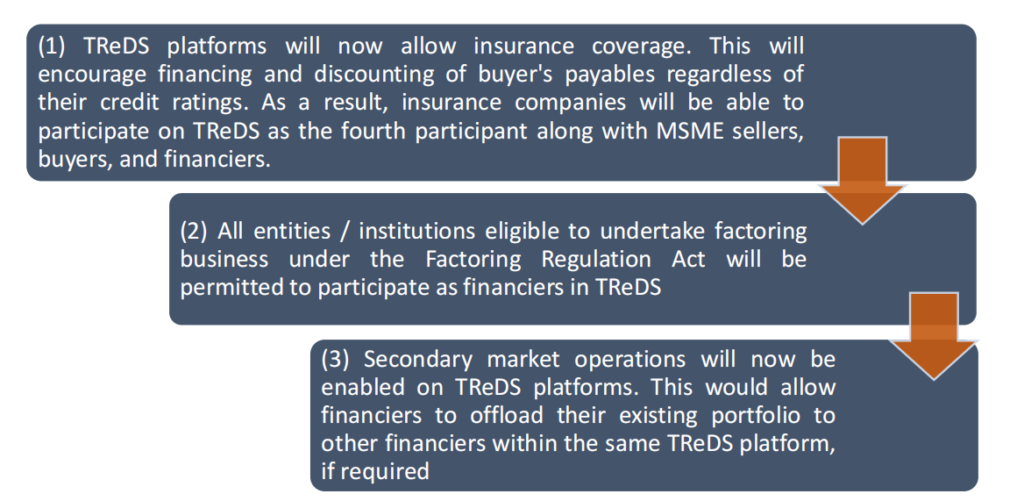

6. Proposal to expand the scope of the Trade Receivables Discounting System (TReDS)

The guidelines on Trade Receivables Discounting System (TReDS) were issued in December 2014 to facilitate the financing of MSMEs’ trade receivables.

Subsequently, three entities started operating TReDS platforms and two more entities have been granted in-principle authorisation. These entities process about ₹60,000 crore worth of transactions annually.

To boost Trade Receivable Discounting System (TReDS) platforms, the scope of their operation will be broadened. These changes are expected to enhance the cash flow of Micro, Small and Medium Enterprises (MSMEs).

The RBI has proposed the following measures:

Comments:

The expansion of the scope of the Trade Receivables Discounting System has the potential to bring a number of benefits to MSMEs. One of the primary advantages is improved access to finance. MSMEs can use TReDS to discount their trade receivables through multiple financiers, giving them access to a wide range of funding options. Further, expanding the scope of TReDS can help to enhance the ease of doing business in India.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA