Banking Products and Services – Types | Terms | CIBIL Score

- Blog|FEMA & Banking|

- 13 Min Read

- By Taxmann

- |

- Last Updated on 2 June, 2025

Banking Products and Services refer to the wide range of financial tools, facilities, and solutions that banks offer to meet the varied needs of individuals, businesses, and institutions. These products and services help users manage money, access credit, build wealth, and perform secure transactions, while supporting broader financial inclusion and economic development.

Table of Contents

- Introduction

- Banking Products and Services

- Types of Bank Deposit Accounts

- Various Types of Loans

- Terms Related to the Loan Process

- CIBIL

Check out Taxmann's Finance For Everyone by Prof. (Dr) Amit Kumar Singh and Dr Rohit Kumar Shrivastav, simplifies essential finance principles for undergraduates in all fields, fully aligning with NEP guidelines. It uses clear language, real-life examples, and hands-on exercises to nurture financial literacy and independence. Structured in five units—from budgeting and banking to insurance and the stock market—each chapter includes concise learning outcomes, practical case studies, and practice questions. This highly accessible guide suits students, educators, self-learners, and professionals eager to strengthen their personal finance knowledge.

1. Introduction

We are all aware the with time banks have evolved to a great extent in terms of the products and services they offer. Based upon the expectations of their customers, banking, itself, leads to the development of new products and services. These expectations are dependent on their experience with their banks, which interestingly sets the standards for new experiences as well (Popescu & Rizescu, 2008). Consequently, there is enormous scope for innovation in the development of new products and services. But such innovation is restricted due to two reasons:

- The regulations in place attempt to limit the use of riskier products and services to protect the interests of the general public.

- Product development needs an intersection between ‘technical possibilities’ and ‘commercial feasibility’.

These two factors should take place simultaneously for the introduction of any product or service. With all the deliberations held up to date, the following are the products and services that are offered to various customers depending upon their needs.

2. Banking Products and Services

The following are the products and services offered by banks to the general public.

2.1 Account Management

- Savings account – The most basic product of any bank is the savings account. The money is deposited in a savings account earning a nominal rate of interest. Different banks use different features, such as ease of banking, security, and rewards to attract clients to their banks. For instance, ICICI Bank offers no minimum balance requirement, a complete waiver of charges on demand drafts, pay orders and anywhere banking facilities, complimentary and personalised international debit cards, internet banking, mobile banking, and a nomination facility to attract customers.

- Current Account – Current account in retail banking is for small business owners who wish to transact daily for their business needs. They are provided with special services such as limitless deposits and withdrawals, pay-orders, cheques, and overdraft facilities to enable the smooth functioning of their businesses.

2.2 Cards Facility

ATM-cum-Debit cards are issued by the bank to their clients to shop online, pay bills, and even withdraw money from ATMs.

Moreover, Credit Cards, a post-paid money instrument that lets you pay bills or shop for utilities up to a maximum specified limit, are also issued by some banks. Borrowers, then, pay back the money to the bank along with interest charged to clear their debt.

2.3 Deposits

Every bank offers different types of term deposits of different duration as per the client’s objective. For instance, if somebody wants to save taxes, then they can choose tax-saver fixed deposits. Similarly, if somebody wishes to deposit Rs. 5000 every month for three years, then they can choose Recurring Deposits. These types of deposits are the most conventional and relatively safer type of investment wherein you get a fixed rate of interest income. The interest income is relatively higher than what you get in a savings account because the money is locked in for the period specified in the term deposit.

2.4 Loan

Banks provide a variety of loans for different purposes such as home loans to buy a house, car loans to buy a car, education loans for paying educational institutes’ fees, personal loans for personal needs, and business loans to finance a startup or business. Banks also provide loans against any asset deposited as a security. For example, gold loans, loans against property, loans against fixed deposits, and loans against any property. In return, banks charge interest from the client depending on the credit score of the client, the type of loan taken, and the tenure of the loan.

2.5 Foreign Exchange Services

Some banks provide foreign exchange services such as Foreign Currency, Traveler’s Cheques, and Travel Cards for foreign business and holiday trips.

2.6 Demat Account Service

A Demat account is an account which helps investors in holding securities in electronic form. Demat account service enables clients access to their Demat Accounts. Information about the holdings, transactions, bills, and ISIN details can be attained by opting for the SMS service at a reasonable charge.

2.7 Investment Products

In recent times, banks have also introduced various investment opportunities for their clients. Mutual funds (SIPs especially), bonds, Public Provident Funds (PPF), Atal Pension Yojana (APY), IPO-related investments, Kisan Vikas Patra (KVP), National Pension Scheme (NPS) are some of the investment schemes that can be directly availed from the bank itself. Some banks have also introduced their investment schemes. E.g., Axis Direct and Axis MidCap Fund by Axis Bank.

2.8 Insurance Products and Services

Banks give their customers a wide range of insurance schemes to choose from. Life insurance, home insurance, travel insurance, health insurance, business insurance, and social security schemes such as Pradhan Mantri Suraksha Bima Yojana, Pradhan Mantri Jeevan Jyoti Bima Yojana, and Bima Uphaar Yojana can be availed very easily by applying for the scheme in the respective bank.

2.9 Safe Deposit Locker

Upon payment of nominal charges, banks provide their customers with the facility of keeping their valuables safe in a locker. The client, depending on her requirements, can choose the size of the lockers.

2.10 Investment Banking and Underwriting

A separate branch of banks can also act as investment bankers and underwriters for companies planning to raise funds in the capital market. Banks, as investment banker, has a very crucial role in advising, assisting, and facilitating funds efficiently from the market.

2.11 Smart Banking or Digital Banking

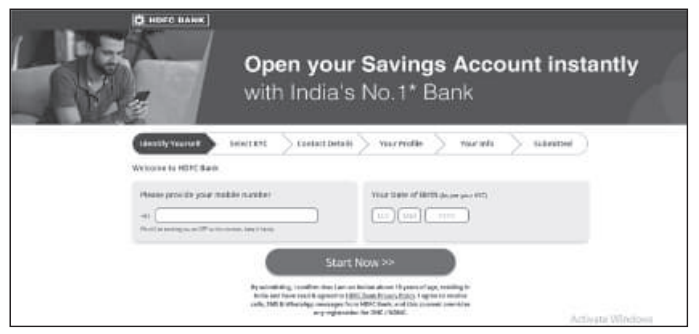

- Opening an Account Online – Most of the leading banks of India give an option of opening a savings account online without actually going to a bank. A bank representative, upon filling out the application form online, contacts you for video and Aadhaar-based KYC (Know Your Customer). Video KYC entails verification of identity and documents with the help of a PAN card, Live Signature, Live photography, and geo-tagging. An example of HDFC’s digital application is depicted in the figure.

- Online Banking – Every bank offers NEFT, IMPS, and foreign transfer services to its client base. Recently, with the announcement of the digital rupee, certain banks have also started providing the facility to transfer and receive money through the digital rupee wallet.

- Mobile Banking – Banks offer smart services such as SMS banking, UPI auto-pay, and Biometric net banking payment with the help of mobile banking. Daily utilities and money transfers can now be initiated through a click on your mobile banking application. Be it GST, electricity, water, broadband, mobile recharges, or gas bills; you can pay all through your bank’s mobile application. Mini statements and payment statuses can be updated in real-time with mobile banking. Some banks also provide the facility of Fastag services, wherein the toll charges are automatically deducted from the linked bank account. Interestingly, chatbots are also deployed on websites and applications to help customers with their banking queries. E.g., HDFC’s chatbot EVA.

- Branchless Banking – Due to financial illiteracy and a lack of financial institutions in remote areas, India is not able to attain financial inclusion. Branchless Banking offers its banking services without any branches or borders. The most basic form of branchless banking is the launch of ATMs (Automated Teller Machines), Mobile Banking, and Net banking. Moreover, many initiatives are taken by India’s major banks to reach the underbanked or unbanked areas of India with their Business Correspondent (BC) model. Under this model, banks employ an intermediary, which uses a Micro ATM/Laptop, web camera, and fingerprint-capturing machine to enrol the customer with the simplified e-KYC norms. These facilitators also provide other services such as preliminary processing of loan applications, creating financial awareness, money and debt counselling, the disbursal and collection of small-value credit, etc. RBI’s Annual Report (2021-2022) states that the total number of outlets serviced by the BCs increased by 114 per cent (from more than 15 lacs in 2021 to more than 32 lacs in 2022).

- E-lockers – E-lockers are introduced to enable customers to keep their documents handy, online, and safe.

2.12 Modern Banking Products and Services

- Cash Recyclers or Cash Deposit Machine – Unlike ATMs, which traditionally could only dispense cash, the Cash Recycling Machine (CRM) helps customers to deposit and withdraw cash at self-service terminals without any bank or any manual intervention in real-time. An acknowledgement slip is generated by CRM and funds credited or debited are reflected almost immediately in your accounts with the help of CRMs. The cash deposit machine (commonly known as Automated Deposit cum Withdrawal Machine ADWM) provides the facility of depositing funds in your PP, RD, and loan accounts as well. The per transaction limit is Rs. 49,900 for a cardless deposit (by entering the account number) and is Rs. 2 lacs for Debit Card transactions.

- Neo-Banking – The major buzzword in the fintech industry these days is ‘Neo Banking’. It is a truly digitalised bank with no branch whatsoever. Typically, in India, they exist either as a collaboration with a traditional bank partner or as a separate ‘only-digital initiative’ of a traditional bank. Thus, they are not regulated by RBI individually. As of 2022, India has more than 35 neo-banks. Some of them are Akudo, Paytm Bank, Chqbook, Jupiter, Digibank, Mahila Money, RazorpayX, etc.

- Whatsapp Banking – Launched in 2020 in partnership with the National Payment Corporation of India (NPCL), WhatsApp Banking is a recent initiative to promote digital banking. Customers can open an account, get their account details, and get answers to banking queries by sending a simple ‘Hi’ from their registered mobile number to their bank’s Whatsapp banking number. A virtual banking chat box assists customers through simple tasks, thus providing them with a customised and contextual customer experience.

- Green Deposit Account – A very innovative product, recently launched by McKinsey is a green deposit account. This account is maintained by clients who wish the banks to invest their funds in sustainable initiatives only.

- Impact Account – Another innovation in the field of banking is the impact account. It is a special type of current account that traces the account holder’s carbon footprint, provides advice on budgeting and saving, and keeps the customer updated about community-building initiatives.

- Smart Vault – Designed with state-of-the-art robotic technology and high-end security, the automated locker, smart vault by ICICI, help customers access their lockers any time of any day.

As discussed, inherently, a bank is a place that accepts deposits and lends loans to its customers. It offers different types of services and financial products depending on the customer’s needs. There are different types of bank deposit accounts and loans which caters to different purpose and are discussed below:

3. Types of Bank Deposit Accounts

- Savings Bank Account – Savings bank account is the most basic form of bank account. As the name suggests, this account is meant for people with definite income and who wish to save a part of it. A minimum initial deposit and KYC are required to open a savings bank account. An amount greater than 50,000 rupees can be deposited only after attaching a copy of the PAN Card along with it. The account holder can withdraw their money without any withdrawal limit with the help of a cheque or an ATM card. A nominal interest is also earned on the balance of the savings bank account.

- Term Deposit – Also called as fixed deposit account (FD), these bank accounts accept deposit for a specified term and also offers a higher rate of interest than a savings bank account. The term of the deposit ranges from 15 days to five years or more during which no withdrawals can be made. The funds are locked in for the specified period and encashment before that specified period attracts some penalty in the form of lower interest rates. The FDs can be mortgaged as a security for a loan and can also be renewed at the ongoing rates at the end of maturity.

- Current Account – Corporates, businesses, and large institutions have to make large numbers of payments on a daily basis. Since savings account has a limited number of withdrawals, current accounts are availed by the firms. These types of accounts earn no interest on the amount deposited, rather they provide other facilities like bank overdraft (a short-term loan allowing account holders to withdraw more amount than what their actual balance is). A certain amount of minimum balance is to be maintained by the accountholder (called the Average Quarterly Balance AQB) and is required to pay some operational charges annually.

- Recurring Deposit – As the name suggests, deposits are made at recurring intervals for a specified period. The principal amount as well as interest is credited to the savings account at the end of the maturity. The rate of interest offered is higher than that of savings accounts and lower than that of FDs. Recurring deposits are introduced to facilitate regular saving habits among customers.

| Scheme | Axis Bank | HDFC Bank | SBI | PNB | Union Bank of India |

| Savings Account Interest Rate (%) | 3.00 | 3.00 | 2.70 | 2.70 | 2.75 |

| 3-Year Term Deposit Interest Rate (%) |

7.26 | 7.00 | 6.50 | 6.50 | 6.70 |

| Current Account Minimum Balance Requirement (Rs.) | 15,000 | 10,000 | 5,000 | 1,00,000 for silver current account | 10,000 |

Source – Compiled from official websites of respective banks. Figures as on March, 2023.

4. Various Types of Loans

- Personal Loans – On the basis of purpose, personal loans can be classified as —

-

- Education Loan – An education loan is availed to finance education fees and education-related expenses. The loan can be availed by the parents for their child or by the person for his education as well. It covers loans for studies in India or abroad as well, for regular or vocational courses as well, and graduation and post-graduation courses as well. The most interesting feature of an education loan is the moratorium period, wherein the students have the option to start repaying their instalments only after they get employed or one year post-completion of the course, whichever is earlier.

- Consumer Durable Loan – Electronic gadgets and household appliances can be purchased and paid for in instalments with the help of a consumer durable loan. It is usually a short-term loan with a low interest rate. Instant approvals and no security deposit is required while applying for these types of loans.

- Vehicle Loan – Buying a car or a scooter is very easy these days. A vehicle loan helps you buy your dream vehicle with instalment payments in 5-10 years. The instalment consists of some part of the principal and interest on the outstanding balance.

- Housing Loan – Housing Loans help customers finance their purchase of a house. These types of loans, generally, are long term ranging from 10 years to 30 years. Home loans also cover loans for construction, renovation, and extension. Interest rate and approval depend on the credit score of the applicant.

- Term Loans – Term loans are loans that have to be repaid during a specified period with a fixed rate of interest. On the basis of duration, term loans can be bifurcated into—

-

- Short Term – The repayment period is less than one year.

- Medium Term – The repayment period is less than three years and more than one year.

- Long Term – The repayment period is of more than three years.

- On the Basis of Security

-

- Secured Loan – Secured loans are loans, which necessitate depositing an asset as a security against the loan. For eg. Gold, House property papers, and Fixed Deposits can be pledged or mortgaged as a security to avail the loan. The security provides a guarantee to the lender because if the borrower defaults in the repayment of either interest or principal amount, then the lender can sell the security to recover his dues. For e.g. a Home loan is a type of secured loan.

- Unsecured Loan – Unsecured loans are loans that require no security to avail the loan. For e.g. Credit cards and consumer durable loans are examples of unsecured loans. Interest rate is relatively high in these types of loans because lack of guarantee.

- Some Other Types of Loan

-

- Credit Card – Credit card is the most famous type of loan. A short-term credit facility that can be availed by applying for a plastic card and can be used for online or POS transactions. The rate of interest charged is very high and smart use of credit cards can help you improve your CIBIL score.

- Bank Overdraft – As discussed, the bank provides the current account holders with an additional facility of overdraft. It means that account holders can withdraw more than the balance amount in their current account. It is a short-term facility with a low interest rate and the amount of overdraft depends on the type of current account.

- Cash Credit – A contract between the customer and the financial institution that enables the customer to withdraw more than their limit for one year is called cash credit.

- Microfinance – Low-income groups, sometimes, are not able to avail loans due to a variety of reasons like lack of proper documentation or lack of accessibility to financial institutions. To cater for borrowing needs, micro-credit is advanced to low-income group people or small business owners to help them sustain and develop. Microfinance facilitates financial inclusion in the economy and facilitates reaching out to people who have little or no access to the conventional banking system. For example, Equitas Small Finance is a microfinance institution that provides loans of upto Rs. 25000 at 24% per annum.

5. Terms Related to the Loan Process

- Mortgage– Mortgage refers to the contract between the lender and borrower, wherein the borrower provides some asset, usually immovable, as collateral or security in exchange for a loan. The mortgaged asset serves as a guarantee to the lender. If the borrower defaults in the repayment of interest or the principal amount, the lender can take over the mortgaged asset to recover his dues.

- Reverse Mortgage – To help senior citizens fight inflation, rising interest rates, and rising medical expenses; banks have come up with reverse mortgage loans. They can use their self-owned house property to supplement their monthly payment by borrowing against ownership in the house without selling the house or without mortgaging it for a loan. The interest charged is deducted from their monthly payment by the bank and is usually higher than the interest on a loan against property.

- Hypothecation – A hypothecation deed is an agreement between the lender and the borrower to keep the asset as collateral while retaining the ownership rights, possession, and title of the asset with himself. In case of default in the repayment, the lender has the right to seize the asset. For example – While buying a car, if the car is used as a security against the car loan, then it is called hypothecation.

- Pledge – Pledge refers to an act of creating a charge over an asset against a bank loan. The pledged asset is kept with the lender till the loan along with the interest is repaid. For e.g. a Gold loan is sanctioned against gold pledged with the lender. The borrower has to transfer the possession of gold to the lender till the repayment of his dues.

Difference Between Mortgage, Pledge, and Hypothecation

| Basis | Pledge | Hypothecation | Mortgage |

| Meaning | Bailment of or creation of charge on the goods against the loan | Creation of charge on the goods against the loan without actual delivery or without transferring the possession of goods. | Charge on the immovable property to serve as a security for a personal or commercial loan. |

| Type of collateral | Movable | Movable | Usually immovable |

| Possession | With the lender | With the borrower | With the borrower |

| Examples | Gold Loan | Car Loan | Housing Loan |

6. CIBIL

The Credit Information Bureau (India) Limited (CIBIL) is the first and one of the most popular credit information companies licensed by the Reserve Bank of India. TransUnion CIBIL (a partnership between U.S.-based TransUnion since 2000) collects and maintains monthly reports, called Credit Information Report (C.I.R.), from the financial institutions, collection agencies, and government regarding individuals loan and credit payment history over the last 18 to 36 months. Based on the report generated, a Credit Score is generated to help lenders during the loan evaluation process. A credit score reflects the creditworthiness of an individual, which act as the first impression to a lender. It is the result of a mathematical algorithm applied to credit information to predict how credit-worthy an individual is.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA