Weekly Round-up on Tax and Corporate Laws | 13th to 18th December

- Blog|Weekly Round-up|

- 11 Min Read

- By Taxmann

- |

- Last Updated on 21 December, 2021

This weekly newsletter analytically summarises the key stories reported at taxmann.com during the previous week from 13th to 18th December 2021, namely:

(b) Delhi High Court quashes all re-assessment notices issued under the old provision

(e) Uber challenged GST applicability on Auto Rickshaws service

(f) Measurement of Interim Income Tax Expense under Ind AS 34 (Interim Financial Reporting)

1. CCI slaps Rs. 202 crore penalty on Amazon for suppressing actual scope and intent of Amazon-Future deal

The Competition Commission of India (CCI) imposed a penalty of Rs. 200 crores on Amazon for failing to notify the details of its combination (acquisition of 49% stake in Future Coupons Private Limited (FCPL)) as required under Section 6(2) of the Competition Act, 2002. It also imposed a separate penalty of Rs. 2 crores for suppressing the actual scope and purpose of the combination (a term used in competition law for acquisition, merger or amalgamation of two or more enterprises). The CCI also revoked the approval granted for Amazon’s deal with Future Group. The CCI, in its order, stated that Amazon suppressed the actual purpose and particulars of the 2019 deal and sought to establish false representation and suppression of material fact.

In 2019, Amazon had entered into a deal worth Rs. 2,000 crores with Future Group. As part of the deal, Amazon had acquired 49% stake in Future Coupons – the promoter firm of Future Retail. Amazon notified the said transaction to the CCI in Combination Registration No. C-2019/09/688 notice. The combination notified by Amazon comprised the following 3 transactions:

Transaction I: The issue of 9.1 million Class A voting equity shares of FCPL to Future Coupons Resources Private Limited (FCRPL). Prior to, and immediately post-issuance of such equity shares, FCPL will be a wholly-owned subsidiary of FCRPL;

Transaction II: The transfer of 13.67 million shares of FRL held by FCRPL (representing 2.52% of the issued, subscribed and paid-up equity share capital of Future Retail Limited (FRL)), on a Fully Diluted Basis to FCPL; and

Transaction III: The acquisition of the Subscription Shares representing 49% of the total issued, subscribed and paid-up equity share capital of FCPL (on a Fully Diluted Basis) by Amazon, by way of a preferential allotment.

It was also stated in the notice that in relation to the combination notified to the CCI, Amazon and the relevant entities and persons belonging to the Future Group had entered into

(a) a share subscription agreement dated 22nd August 2019 (FCPL SSA) to set out the terms and conditions of subscription by Amazon and the issuance by FCPL of its shares to Amazon, and

(b) a shareholders agreement dated 22nd August 2019 to determine their respective rights and obligations as shareholders of FCPL (FCPL SHA) Amazon stated in the notice that the parties have only executed FCPL SSA and FCPL SHA in relation to the combination.

The notice also mentioned that Amazon would acquire certain rights in terms of FCPL Shareholders Agreement (FCPL SHA) to protect its investment in FCPL. These, inter-alia, included the requirement of prior written consent of Amazon for FCPL to decide on or implement any matter under the shareholders’ agreement dated 12th August 2019 relating to FRL (FRL SHA), which requires the consent of FCPL.

Amazon had also stated that it does not have any direct or indirect shareholding in FRL, and it would not acquire directly any rights in FRL. Amazon has only limited investor protection rights in FCPL to protect the value of its investment in FCPL. These rights can be exercised only through FCPL and not directly by Amazon. The said rights have been derived from the rights granted to FCPL in terms of FRL SHA, which was negotiated by the promoters, FRL and FCPL, independent of the investment by Amazon in FCPL and to unlock value for FCPL.

FCPL filed the application dated March 25, 2021, stating that Amazon has initiated arbitration proceedings in relation to the transfer of assets of FRL, a company in which FCPL holds 9.82% of the shareholding, and there are related litigations pending before the constitutional courts. It was alleged in the application that Amazon took completely contradictory stands in the arbitration proceedings and constitutional courts with respect to its investments in FCPL as compared to the representations and submissions made before the Commission. Such contradictions were said to establish false representation and suppression of material facts before the Commission.

CCI held that Amazon ought to have notified the combination, among other things, consisting of the inter-connected steps:

(a) Transaction I;

(b) Transaction II;

(c) Transaction III;

(d) FRL SHA for the acquisition of strategic rights over FRL through FCPL SHA; and

(e) commercial agreements between Amazon and Future groups, to establish strategic alignment and partnership between Amazon Group and FRL as well as have a ‘foot-in-the-door’ in the India retail sector.

Amazon failed to notify FRL SHA and the commercial arrangements as parts of the combination between the parties. CCI said that Amazon has suppressed the actual purpose and particulars of the combination, as discussed above, in contravention of the obligation contained in sub-section (2) of Section 6 of the Act read with Regulation 5 and sub-regulations (4) and (5) of Regulation 9 of the Combination Regulations.

Read the Ruling

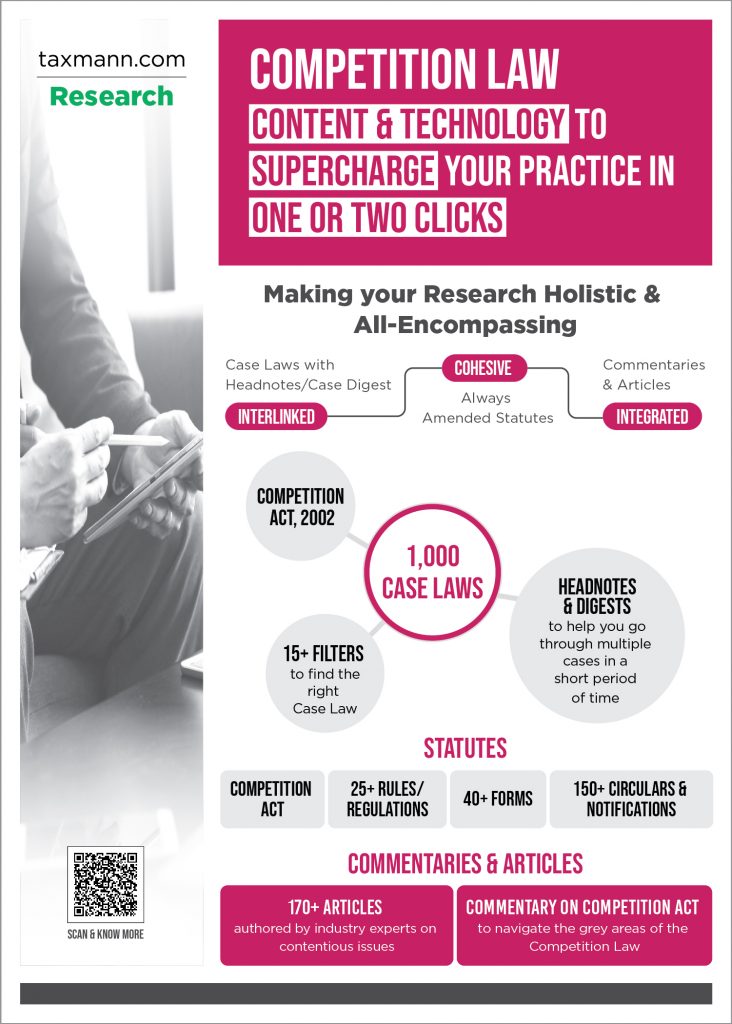

Taxmann.com’s | Research Module for Competition Laws has the largest database of Case Laws from all Courts/Tribunals, always updated Statutory Contents (like Acts, Rules, Circulars, Notifications, etc.), commentaries & articles on various topics from renowned authors. All the contents are integrated/interlinked with each other to make your tax and corporate law-related research holistic and all-encompassing.

Supercharge your Competition Law Practice with Taxmann.com Now!

2. The Delhi High Court quashes all re-assessment notices issued under the old provision

The Delhi High Court has quashed more than 1,300 writ petitions challenging re-assessment notice issued by the Income-tax Dept. after 31-03-2021, under the old regime. The Court hed that the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020 doesn’t empower the Government to extend the applicability of erstwhile provisions of re-assessment.

Facts

1,346 writ petitions were filed before the Delhi High Court to decide whether the Government can change the law of the land by a Notification without specific authorisation from the legislature.

Assessees sought quashing of the re-assessment notices issued under Section 148 post 31-03-2021. Assessees also seek to declare Explanations A(a)(ii)/A(b) to the Notification No. 20 dated 31-03-2021 and Notification No. 38 dated 27-04-2021 ultra vires.

Ruling

The legislature has introduced the new provisions of Sections 147 to 151 by the Finance Act, 2021 with effect from 01-04-2021.

The Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020 (TLA 2020) empowers the Government to extend only the time limits. It does not delegate the power to legislate on provisions to be followed for initiation of re-assessment proceedings. The TLA 2020 does not give power to Government to extend the erstwhile Sections 147 to 151 beyond 31-03-2021 or defer the operation of substituted provisions enacted by the Finance Act, 2021.

Consequently, the impugned Explanations in the Notifications dated 31-03-2021 and 27-04-2021 are not conditional legislation and are beyond the power delegated to the Government and ultra vires the TLA 2020.

Revenue cannot rely on Covid-19 for contending that the new provisions Sections 147 to 151 should not operate between 01-04-2020 to 30-06-2021 as Parliament was fully aware of Covid-19 Pandemic when it passed the Finance Act, 2021.

Thus, Explanations A(a)(ii)/A(b) to the Notifications dated 31-03-2021 & 27-04-2021 are declared to be ultra vires the TLA 2020 and are therefore bad in law, null and void. Thus, all re-assessment notices issued under old provisions of Section 148 are quashed.

Read the Ruling

Taxmann's New Law Relating To Reassessment is a comprehensive commentary on the Reassessment provision under the Income-tax Act, as introduced by the Finance Act, 2021. It features an exhaustive discussion on both fundamental concepts and issues arising under the new law of reassessment combined with essential commentary on statutory provisions and the jurisprudence. It also includes cross-references to other chapters wherever implications need to be understood entirely to assist the reader.

3. Borrowers cannot pray to Court to grant One Time Settlement Scheme as a matter of right, rules SC

In this significant ruling in Bijnor Urban Cooperative Bank Ltd. v. Meenal Agarwal – [2021] 133 taxmann.com 167 (SC), the Supreme Court ruled that Borrowers cannot pray to Court to grant a one-time settlement scheme as a matter of right.

Facts

The borrower had obtained a credit facility from a bank that was categorised as “Non-Performing Asset (NPA)”. The bank initiated proceedings under the provisions of the SARFAESI Act, 2002. The borrower applied to the bank to consider her case under the One Time Settlement (OTS) Scheme. The bank rejected the application saying that she was not eligible for settlement under the OTS Scheme as her loan account had been declared as NPA. The loan could be recovered by auction of the mortgaged property.

The borrower filed a writ petition before the High Court to challenge the order passed by the bank rejecting her application for giving the benefit of the OTS scheme. The High Court issued a writ of mandamus and directed the bank to positively consider her application for grant of benefit under the OTS Scheme.

Supreme Court

On appeal, the Supreme Court held that no borrower could, as a matter of right, pray for a grant of benefit of the One Time Settlement Scheme. The Apex Court observed that it might happen that a person would borrow a considerable amount, for example, Rs. 100 crores. After availing of the loan, he may deliberately not pay any amount towards instalments, though able to make the payment. He would wait for the OTS Scheme and then pray for a grant of benefit under the OTS Scheme, under which always a lesser amount will be paid than the amount due and payable under the loan account. This, despite all possible recovery of the entire loan amount, can be realised by selling the mortgaged/secured properties.

The Court further stated that if it were held that the borrower can still, as a matter of right, pray for benefit under the OTS Scheme, in that case, it would be giving a premium to a dishonest borrower, who, despite the fact that can make the payment and the fact that the bank can recover the entire loan amount even by selling the mortgaged/secured properties, either from the borrower and guarantor. Under the OTS Scheme, a debtor has to pay a lesser amount than the actual amount due and payable under the loan account. Such cannot be the intention of the bank while offering OTS Scheme, and that cannot be the purpose of the Scheme, which may encourage such dishonesty.

If prayer is entertained on the part of the defaulting unit/person to compel or direct the financial corporation/bank to enter into a one-time settlement on the terms proposed by it/him, then every defaulting unit/person which/who is capable of paying its/his dues as per the terms of the agreement entered into by it/him would like to get a one-time settlement in its/his favour. Who would not like to get his liability reduced and pay a lesser amount than the amount they are liable to pay under the loan account? Asked Court

The Apex Court ruled that no writ of mandamus can be issued by the High Court in the exercise of powers under Article 226 of the Constitution of India, directing a financial institution/bank to grant the benefit of OTS to a borrower positively.

Given the above, the High Court, in the present case, has materially erred and has exceeded in its jurisdiction in issuing a writ of mandamus in the exercise of its powers under Article 226 of the Constitution of India by directing the appellant Bank to positively consider/grant the benefit of OTS to the original writ petitioner.

The Apex Court quashed and set aside the order passed by the High Court, holding it to be unsustainable.

Read the Ruling

Check out Taxmann's Guide to SARFAESI Act 2002 & Recovery of Debts and Bankruptcy Act 1993. It contains 'chapter-wise commentary on provisions of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI Act), and Recovery of Debt and Bankruptcy Act, 1993 (RDB Act)

4. CBIC issued a clarification on various issues relating to the shift in GST liability from restaurant to food aggregators

With effect from 01-01-2022, the GST liability on restaurant services availed through food aggregators has been shifted from the restaurants to food aggregators. In this regard, the GST law provides that for the supply of such ‘restaurant services’, the E-Commerce operator (i.e. food aggregator) would be liable to pay GST.

In view of the above paradigm shift, the CBIC has issued a circular clarifying various points for both restaurants and food aggregators.

Amongst various points, one of the points is that food aggregator cannot utilise the input tax credit (ITC) available in its credit pool for discharging the GST liability on restaurant services. Therefore, such liability would be required to be paid in cash. Further, the circular also provides that restaurants would be required to include the impugned supply value in their aggregate turnover for various purposes under the GST law (such as for registration threshold, etc.).

Read the Circular

Register Now for Taxmann’s Live Webinar | Demystifying GST Applicability on Food Aggregators & Restaurants 📅 27th December 2021 (Monday) | 🕒 5:00 PM – 6:00 PM (IST) 💻 Register Now For FREE! (Limited Slots Available) 📋 Coverage of the Webinar: ✔️ General Provisions relating to GST on E-commerce Operators ✔️ Implications of the Amendment on Food Aggregators ✔️ Implications of the Amendment on Restaurants ✔️ Open house Q&A session with Taxmann Team

5. Uber challenged GST applicability on Auto Rickshaws services

The Government has issued amendment notification to provide that the services of autos, e-rickshaws, etc. availed using aggregator would be subject to GST (Notification No. 16/2021-CT (Rate) & 17/2021-CT (Rate), Dated 18-11-2021, effective from 01-01-2022. The aggregator would be liable to pay GST in such cases. However, such services provided through offline mode continue to be exempted.

In the above backdrop, Uber India Systems (P.) Ltd. has filed a writ petition challenging the levy of GST on supply of passenger transportation service through an electronic commerce operator when such service is provided by auto-rickshaw with effect from 01-01-2022 before the Hon’ble Delhi High Court on the grounds of discrimination and absence of reasonable classification. The Delhi High Court has ordered the issue of notice.

Read the Ruling

Known as the Pharmacy of the world, India is amongst the global leaders in manufacturing drugs. The FMCG sector is also growing tremendously, with the e-commerce sector booming. In the above background, Taxmann and TMSL are organizing a webinar to discuss the sectors and implications of GST thereon. The webinar will include a discussion on: ✔️ Overview of the Sectors ✔️ Business Models ✔️ Common Issues under GST ✔️ Key Litigation Area Register Here

6. Measurement of Interim Income Tax Expense under Ind AS 34 (Interim Financial Reporting)

As per Ind AS 34, an Interim financial report means a financial report containing either a complete set of financial statements or a set of condensed financial statements for an interim period which is a financial reporting period shorter than a full financial year.

Income tax expense for an interim period is accrued using the tax rate that would apply to the expected total annual earnings of the entity. Further, income taxes are assessed on an annual basis. Therefore, interim period income tax expense is also calculated using the tax rate applicable to expected total annual earnings.

That estimated average annual income tax rate would reflect the blend of progressive tax rate structure expected to apply to the full year’s earnings. The estimated average annual income tax rate would be re-estimated on a year-to-date basis. So, to the extent practicable, a separate estimated average annual effective income tax rate is determined for each governing taxation law and applied individually to the interim period pre-tax income under such laws. Similarly, if different income tax rates apply to different categories of income, to the extent practicable, a separate rate is applied to each individual category of interim period pre-tax income.

Tax statutes provide certain deductions/exemptions in the computation of income for determining tax payable. Adjustments with respect to these deductions/exemptions are to be done while computing the estimated annual effective income tax rate as these are considered in calculating the tax rate on an annual basis under the usual provisions of tax statutes.

Whereas the tax benefits related to a one-time event are recognised in computing income tax expense in that interim period only, in the same way, special tax rates are applicable to particular income categories.

Effective tax rate in case of deferred tax and carried forward losses

Ind AS 12 provides that ’a deferred tax asset shall be recognised for the carry forward of unused tax losses and unused tax credits to the extent that it is probable that future taxable profit will be available against which the unused tax losses and unused tax credits can be utilised’. It also provides criteria for assessing the probability of taxable profit against which the unused tax losses and credits can be utilised. Those criteria are applied at the end of each interim period. If they are met, the effect of the tax loss carried forward is reflected in the computation of the estimated average annual effective income tax rate.

Read the Story

Ind AS Ready Reckoner is a simple & practical workbook on Ind AS [as amended by the Companies (Indian Accounting Standards) (Amendment) Rules 2021] to guide the members in practice/employment in their day-to-day works. This book will help the professionals to cope-up with various developments in the accounting standards’ area.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA