Tax Audit | Detailed Analysis of Clause 9 to 12 | As per the Guidance Note issued by the ICAI

- Blog|Tax Audit Week|Account & Audit|

- 5 Min Read

- By Taxmann

- |

- Last Updated on 22 September, 2023

An assessee is required to get his books of accounts audited in accordance with Section 44AB of The Income Tax Act, 1961. The Chartered Accountant conducting the tax audit is required to give his findings, observations, etc., in the form of an audit report at the e-filing portal of Income-tax in Form No. 3CA/3CB and 3CD. In this story, we discuss the reporting requirement of clause 9 to 12, that are contained in Part B of Form 3CD.

1. Clause 9

9(a): If firm or association of persons indicate names of partners/members and their profit sharing ratios

Where the assessee is a Partnership firm, Limited liability partnership (LLP), Association of Person (AOP), Body of Individual (BOI), an auditor is required to mention the name of partners or members, as the case may be and their profit-sharing ratios.

An auditor should also verify the details with the certified copies of deed or agreement (in case of LLP), and notice of changes, etc. including certified copies of acknowledgment if any.

9(b): If there is any change in the partners/members or their profit-sharing ratios, the particulars of such change

If there is any change during the previous year as to partners or members and/or profit-sharing ratios since the last date of the preceding year, the particulars of such change should be stated and an auditor should:

- Enquire about changes that have been occurred in the partners or members and/or their profit-sharing ratios.

- Verify details from the latest certified copy of partnership deed or agreement (in case of LLP) and other relevant documents if any.

- Ensure that all changes that have occurred during the entire previous year have been stated.

- Obtain management representation.

- In case of dissolution of the firm, the clause is not applicable as the firm ceases to exist.

2. Clause 10

10(a): Nature of business or profession (if more than one business or profession is carried on during the previous year, nature of every business or profession)

- Auditor should verify the nature of each business or profession carried on by the assessee by verifying incorporation documents (e.g., MOA/Partnership deed/LLP agreement/Trust deed, etc.). In case, an assessee belongs to the service sector, then, the nature of each type of service should be broadly stated.

- Auditor should also ensure that details pertaining to subsector and business code related to the nature of assessee’s business is provided in the manner illustrated below:

| S.No. |

Sector |

Sub Sector |

Code |

| 1 | Construction | Site preparation works | 6001 |

| 2 | Construction | Building of complete constructions or parts-civil contractors | 6002 |

| 3 | Construction | Building installation | 6003 |

10(b): If there is any change in the nature of business or profession, the particulars of such change

- Any material change in the nature of business or profession during the previous year should be precisely set out. If there is any temporary discontinuance of business, the same is not required to be mentioned.

- Auditor may note such changes by reviewing the minutes of the meeting, wherein such changes are approved. A declaration may also be obtained from the assessee regarding such change.

- Temporary suspension of the business should not be reported as it may not amount to change.

- If a new line of business has emerged or any line of activity was hived off because of business reconstruction/reorganization, the same may be stated.

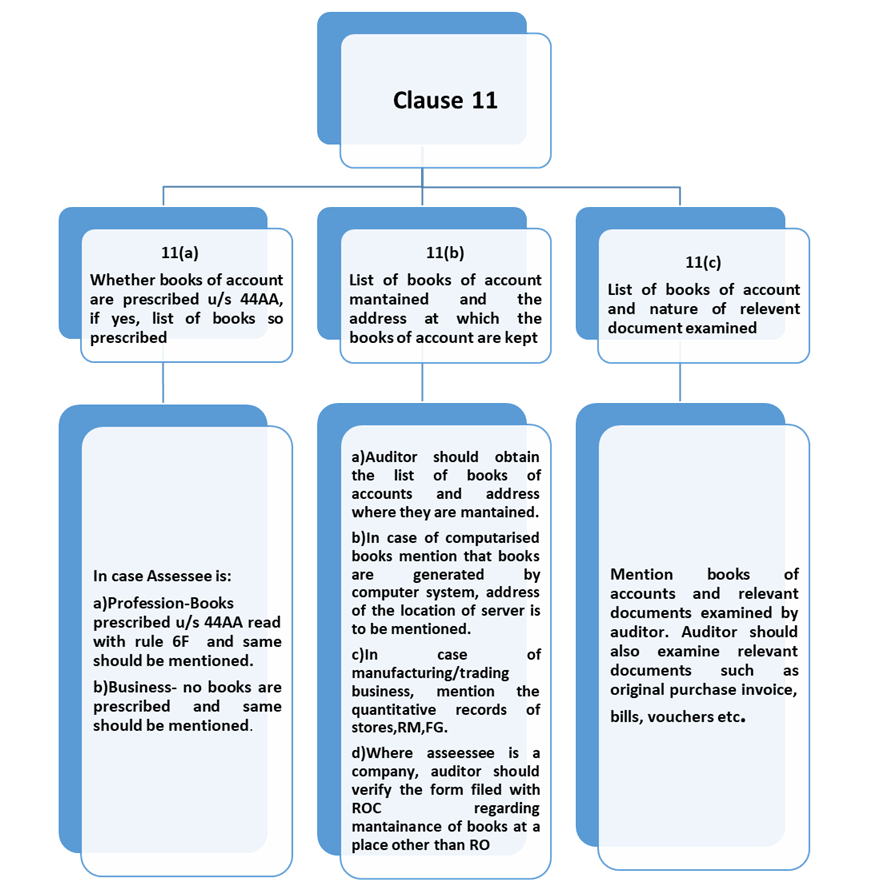

3. Clause 11

4. Clause 12

Whether the profit and loss account includes any profits and gains assessable on a presumptive basis, if yes, indicate the amount and the relevant sections (44AD, 44AE, 44AF, 44B, 44BB, 44BBA, 44BBB, Chapter XII-G, First Schedule or any other relevant section.)

Where the profits and gains are assessed on a presumptive basis under any of the sections mentioned below, the amount of such profits and gains credited/debited in the profit and loss account should be stated:

- 44AD – Business profit on estimated basis.

- 44AE – Business of plying, hiring or leasing goods carriages.

- 44AF – Retail Business

- 44B – Shipping business of non-residents.

- 44BB – Business of exploration of mineral oils.

- 44BBA – Operation of Aircraft by non-resident.

- 44BBB – Foreign companies engaged in civil construction, etc. in turnkey power projects

- Other relevant sections e.g., section 44ADA, section 172

Read More Details About- Income Tax Acts

During the tax audit, an auditor may come across the following different scenarios:

| 1. Assessee maintains regular books of accounts for more than one business. It includes the business of the nature assessable on a presumptive basis, whereas, no separate books of accounts are maintained for such business | An auditor should ascertain the correct profit of the presumptive scheme by making a reasonable apportionment of the common expenditure, by reviewing the basis of evidence provided by the assessee.

However, if the auditor is not satisfied with the reasonableness of such apportionment, then, such fact should be indicated under this clause. |

| 2. Assessee maintains regular books of accounts for more than one business. It includes the business of the nature assessable on a presumptive basis and separate books of accounts are maintained for such business | This situation does not pose any problem in ascertaining the amount of profit to be disclosed. |

| 3. Assessee maintains regular books of accounts for the main business but has an additional business, where, no se books of account are maintained. However, the net income arising from such business is included in the profit and loss account of the main business. | In this situation, the auditor will be unable to find correct income from the presumptive business credited to the profit and loss account.

An auditor should state the amount, as appearing, in the profit and loss account, with a suitable observation showing his inability to verify said figure. In the absence of books of account, an auditor is unable to form his opinion as to true and fair view of profit an loss account of the assesse. Hence, it would be necessary for him to qualify his audit report. |

Dive Deeper:

Detailed Analysis of Clause 13 and Clause 14

Detailed Analysis of Clause 15 and Clause 16

Detailed Analysis of Clause 17 to Clause 19

Detailed Analysis of Clause 20 and Clause 21

Detailed Analysis of Clause 22 to Clause 25

Detailed Analysis of Clause 26 to Clause 29

Detailed Analysis of Clause 30 to Clause 30C

Detailed Analysis of Clause 31

Detailed Analysis of Clause 32 to Clause 34

Detailed analysis of Clause 35 to Clause 38

Detailed Analysis of Clause 39 to Clause 41

Detailed Analysis of Clause 42 and Clause 43

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA