Revised MSME Classification – Investment and Turnover Limits

- Blog|Income Tax|

- 9 Min Read

- By Taxmann

- |

- Last Updated on 29 April, 2025

The Revised MSME Classification refers to the updated criteria for categorizing Micro, Small, and Medium Enterprises (MSMEs) based on enhanced investment and turnover limits, effective from April 1, 2025. Under the new framework, the thresholds for investment in plant and machinery or equipment and annual turnover have been increased by 2.5 times and 2 times, respectively. This revision aims to broaden the coverage of MSMEs, encourage growth, and provide expanded benefits under government schemes. The classification continues to apply a composite criterion (both investment and turnover) and is aligned with the Udyam Registration system.

Check out Taxmann's FAQs on Timely Payments to MSME – An Interplay between Sec. 43B(h) of the Income-tax Act & MSMED Act which explains how Section 43B(h) of the Income-tax Act converges with the MSMED Act to ensure timely payments to Micro and Small Enterprises (MSEs). It highlights the implications for buyers regarding disallowances, interest liabilities, and reporting requirements when payments exceed statutory deadlines. It incorporates FAQs, flowcharts, case studies, and checklists; the book offers straightforward guidance on complex practical scenarios. Aimed at professionals, businesses, and academics, it covers updated definitions, Udyam Registration norms, and best compliance and risk mitigation practices.

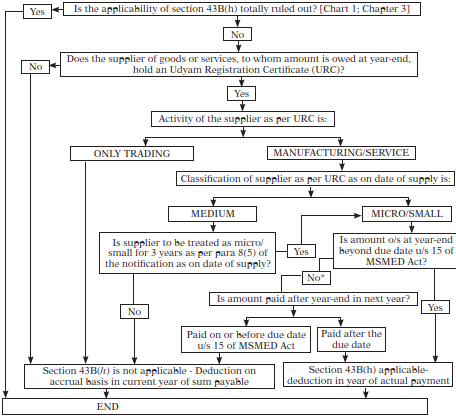

Deduction/Disallowance u/s 43B(h)

*Means amount o/s at year-end and due date falls in next year

FAQ 1. What are the definitions of the terms “micro enterprise” and “small enterprise”?

In Explanation 4 below section 43B, clauses (e) and (g) have been substituted to define the expression “micro enterprise” and “small enterprise” respectively as under –

‘(e) “micro enterprise” shall have the meaning assigned to it in clause (h) of section 2 of the Micro, Small and Medium Enterprises Development Act, 2006 (‘MSMED Act’);

(g) “small enterprise” shall have the meaning assigned to it in clause (m) of section 2 of the Micro, Small and Medium Enterprises Development Act, 2006.’

As clauses (e) and (g) of Explanation 4 to section 43B make applicable the definitions of “micro” and “small” enterprises in the MSMED Act to section 43B(h), it is necessary to examine the definitions in MSMED Act.

Section 2(h) of MSMED Act defines “micro enterprise” to mean an enterprise classified as such under sub-section (1) of section 7.

Section 2(m) of MSMED Act defines “small enterprise” to mean an enterprise classified as such under sub-section (1) of section 7.

Sub-section (1) of section 7 of MSMED Act provides that the Central Government may, for the purposes of this Act, by notification (in the Official Gazette), classify any class or classes of manufacturing or service enterprises, whether proprietorship, Hindu undivided family, association of persons, co-operative society, partnership firm, company or undertaking, by whatever name called, into –

(a) Micro Enterprises

(b) Small Enterprises

(c) Medium Enterprises

Sub-section (9) of section 7 of MSMED Act provides that the Central Government may, while classifying any class or classes of enterprises under sub-section (1), vary, from time to time, the criterion of investment and also consider criteria or standards in respect of employment or turnover of the enterprises and include in such classification the micro or tiny enterprises or the village enterprises, as part of small enterprises.

Classification of enterprises based on composite criteria of investment and turnover.

The Central Government has issued Notification No. SO 2119(E), dated 26-6-2020 (hereinafter referred to ‘the Notification’), under section 7(1) read section 7(9) of the MSMED Act. Para 3(1) of the said Notification provides that a composite criterion of investment and turnover shall apply for classification of an enterprise as micro, small or medium. Para 1 of the Notification provides for classification of enterprises based on the composite criteria. Para 1 provides that an enterprise shall be classified as a micro, small or medium enterprise on the basis of the following criteria, namely —

- a micro enterprise, where the investment in plant and machinery or equipment does not exceed one crore rupees and the turnover does not exceed five crore rupees;

- a small enterprise, where the investment in plant and machinery or equipment does not exceed ten crore rupees and the turnover does not exceed fifty crore rupees; and

- a medium enterprise, where the investment in plant and machinery or equipment does not exceed fifty crore rupees and the turnover does not exceed two hundred and fifty crore rupees.

Revised Classification of MSMEs applicable with effect from 01.04.2025

In the Union Budget Speech, 2025, the Finance Minister announced that the investment and turnover limits for classification of all MSMEs will be enhanced to 2.5 and 2 times respectively. [See Para 28 of the Union Budget Speech, 2025]

The revision of limits announced in Union Budget Speech is as follows –

| Rs. in Crore | Investment Limits | Turnover Limits | ||

| Current | Revised (applicable from 01.04.2025) | Current | Revised (applicable from 01.04.2025) | |

| Micro Enterprises | 1 | 2.5 | 5 | 10 |

| Small Enterprises | 10 | 25 | 50 | 100 |

| Medium Enterprises | 50 | 125 | 250 | 500 |

The above revised investment and turnover limits have been made applicable with effect from 01.04.2025 [Notification No. S.O. 1364(E), dated 21.03.2025]

Analysis of the impact of revision of investment and turnover limits

It appears that revised investment and turnover limits will be considered for classification of MSMEs from classification year 2025-26 (Financial year 2025-26).

It appears that classification of MSMEs for Financial Year 2024-25 (Assessment year 2025-26) will not be affected by the revision of limits and pre-revised limits will apply for Assessment Year 2025-26. This is based on the past practices followed by MSME Ministry and the Udyam Portal.

For detailed analysis of revision of investment and turnover limits, see also Taxmann’s MSME Ready Reckoner (2025 Edition).

Analysis of classification of MSMEs based on composite criteria

Para 3 of the Notification clarifies as under –

- A composite criterion of investment and turnover shall apply for classification of an enterprise as micro, small or medium.

- If an enterprise crosses the ceiling limits specified for its present category in either of the two criteria of investment or turnover, it will cease to exist in that category and be placed in the next higher category but no enterprise shall be placed in the lower category unless it goes below the ceiling limits specified for its present category in both the criteria of investment as well as turnover.

- All units with Goods and Services Tax Identification Number (GSTIN) listed against the same Permanent Account Number (PAN) shall be collectively treated as one enterprise and the turnover and investment figures for all of such entities shall be seen together and only the aggregate values will be considered for deciding the category as micro, small or medium enterprise.

Para 8(5) and 8(6) of the Notification provide as under –

- In case of an upward change in terms of investment in plant and machinery or equipment or turnover or both, and consequent re-classification, an enterprise shall continue to avail of all non-tax benefits of the category (micro or small or medium) it was in before the re-classification, for a period of three years from the date of such upward change. [Para 8(5)]

- In case of reverse-graduation of an enterprise, whether as a result of re-classification or due to actual changes in investment in plant and machinery or equipment or turnover or both, and whether the enterprise is registered under the Act or not, the enterprise will continue in its present category till the closure of the financial year and it will be given the benefit of the changed status only with effect from 1st April of the financial year following the year in which such change took place. [Para 8(6)]

FAQ 2. How is turnover calculated for the classification of enterprises into micro, small and medium?

Turnover is reckoned on net turnover basis i.e. turnover of goods and services less exports of goods and services.

Para 5 of the Notification deals with Calculation of turnover as under –

(1) Exports of goods or services or both, shall be excluded while calculating the turnover of any enterprise whether micro, small or medium, for the purposes of classification.

(2) Information as regards turnover and exports turnover for an enterprise shall be linked to the Income-tax Act or the Central Goods and Services Act (CGST Act) and the GSTIN.

(3) The turnover related figures of such enterprise which do not have PAN will be considered on self-declaration basis for a period up to 31st March, 2021 and thereafter, PAN and GSTIN shall be mandatory.

(4) The exemption from the requirement of having GSTIN shall be as per the provisions of the Central Goods and Services Tax Act, 2017 (12 of 2017).

On MSME Registration & Classification, Udyam Portal has clarified that as follows –

- The Udyam Registration portal fetches data from the portals of Income Tax Department and GSTN and classifies registered MSMEs on the basis of frozen data on investment and turnover. For example, for F.Y. 2021-22 the data used is for 2019-20.

FAQ 3. How is investment in plant and machinery or equipment calculated for classification of enterprises into micro, small and medium?

Investment in plant and machinery or equipment is reckoned on net investment basis i.e. depreciated cost as per the Income-tax return of plant and machinery or equipment less cost of pollution control, R&D and industrial safety devices.

Para 4 of the NMN deals with calculation of investment in plant and machinery or equipment and provides as follows –

- The calculation of investment in plant and machinery or equipment will be linked to the Income Tax Return (ITR) of the previous years filed under the Income Tax Act, 1961. On MSME Registration & Classification, Udyam Portal has clarified that as follows:

The Udyam Registration portal fetches data from the portals of Income Tax Department and GSTN and classifies registered MSMEs on the basis of frozen data on investment and turnover. For example, for F.Y. 2021-22 the data used is for 2019-20.

- In case of a new enterprise, where no prior ITR is available, the investment will be based on self-declaration of the promoter of the enterprise and such relaxation shall end after the 31st March of the financial year in which it files its first ITR.

- The terms “plant and machinery” and “equipment” shall have the meaning as assigned to the plant and machinery in the Income-tax Rules, 1962 framed under the Income-tax Act, 1961 and shall include all tangible assets (other than land and building, furniture and fittings).

- The purchase (invoice) value of a plant and machinery or equipment, whether purchased first hand or second hand, shall be taken into account excluding Goods and Services Tax (GST), on the self-disclosure basis, if the enterprise is a new one without any ITR.

- The cost of certain items specified in Explanation I to sub-section (1) of section 7 of the MSMED Act shall be excluded from the calculation of the amount of investment in plant and machinery.

According to the said Explanation 1, the following items shall be excluded in calculating investment in plant and machinery or equipment –

(a) Cost of pollution control equipment,

(b) Cost of Research & Development equipment,

(c) Cost of Industrial safety devices, and

(d) Such other items as may be notified.

As regards (a) to (c) above, item 20 of the online registration form on Udyam portal also provides for their exclusion.

No items have been notified under (d) above for exclusion from investment in plant and machinery or equipment. The earlier notification providing for exclusion of certain items (Notification No. SO 1722(E), dated 5-10-2006) has been rescinded vide Notification No. SO 2119(E), dated 26-6-2020.

FAQ 4. So will each buyer-entity have to call for the financials, ITRs and GSTs of every trade creditor/supplier and determine their classification as micro enterprise or small enterprise?

No. Fortunately, there is the mechanism of Udyam Registration of micro, small and medium enterprise to validate the classification of enterprises into micro, small and medium and their activity as manufacturing, service or trading and provide evidence of their classification and activity. Para 2 of the Notification deals with “Becoming micro, small or medium enterprise” and provides as under –

- Any person who intends to establish a micro, small or medium enterprise may file Udyam Registration online in the Udyam Registration Portal, based on self-declaration with no require-ment to upload documents, papers, certificates or proof.

- On registration, an enterprise (referred to as “Udyam” in the Udyam Registration Portal) will be assigned a permanent identity number to be known as “Udyam Registration Number”.

- An e-certificate, namely, “Udyam Registration Certificate” shall be issued on completion of the registration process.

The e-certificate of Udyam Registration provides the classification of registered enterprises as micro, small and medium Financial Year-wise since its incorporation. Para 8(3) of the Notification provides that “Based on the information furnished or gathered from Government’s sources including ITR or GST return, the classification of the enterprise will be updated.”

The buyer-entities need to obtain the Udyam Registration Numbers of their suppliers and use the Udyam Registration Number printed on it to run a search on Udyam Portal to access Udyam Certificate. This search based on Udyam Number can be carried out every now and then (say once in 3 months or once in 6 months) to see if there is any change in classification or certificate has been suspended or cancelled. Two examples of Udyam Registration e-Certificate with details redacted are given hereunder for reference:

Example 1 –

Udyam Registration Number – UDYAM-DL-00-0000000

| Name of Enterprise | XXXXX | ||

| Organisation Type | Proprietary | Major Activity | Services |

| Gender | Female | Social Category | General |

| Date of Incorporation | 01/04/2019 | Date of Commencement of Production/Business | 01/04/2019 |

Enterprise Type

| S. No. | Classification Year | Enterprise Type | Classification Date |

| 1. | 2024-25 | Small | 27/04/2024 |

| 2. | 2023-24 | Micro | 09/05/2023 |

| 3. | 2022-23 | Micro | 26/06/2022 |

| 4. | 2021-22 | Micro | 22/06/2021 |

Unit(s)/Plant Locations Details

| S. No. | Unit Name | Flat | Building | Village/Town | Block | Road | City | Pin | State | District |

| 1. | XXX | XXX | XXX | XXX | XXX | XXX | XXX | XXX | XXX | XXX |

Official Address of Enterprise

| Flat/Door/Block No. | XXX | Name of Premises/Building | |

| Village/Town | XXX | Block | |

| Road/Street/Lane | XXX | City | XXX |

| State | XXX | District | XXX |

| Mobile |

National Industry Classification Code(S)

| S. No. | Nic 2 Digit | Nic 4 Digit | Nic 5 Digit | Activity | Date |

| 1. | 90 – Creative, arts and entertainment activities | 9000 – Dramatic arts, music and other arts activities | 90009 – Other Creative Arts and entertainment activities | Services | 20/06/2021 |

| DIC | XXX |

| MSME-DFO | XXX |

| Date of Udyam Registration | 20/06/2021 |

Example 2 –

Udyam Registration Number – UDYAM-DL-00-0000000

| Name of Enterprise | XXXXXX | ||

| Organisation Type | Proprietary | Major Activity | Manufacturing |

| Gender | Male | Social Category | General |

| Date of Incorporation | 00/00/0000 | Date of Commencement of Production/Business | 00/00/0000 |

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA