Guide to Faceless Assessment and New e-Proceedings Utility

- Blog|Income Tax|

- 6 Min Read

- By Taxmann

- |

- Last Updated on 29 April, 2025

Faceless Assessment is a system introduced by the Income Tax Department of India to conduct assessments electronically without any physical interface between the taxpayer and the tax authorities. Under this regime, assessments are carried out in a completely digital manner through the Income Tax e-Filing portal, ensuring greater transparency, efficiency, and accountability.

Table of Contents

- Launch of New Income Tax ‘e-Filing Portal’ & New ‘e-Proceedings’ Utility

- Step by Step Guide to ‘Faceless Assessment Proceedings’ Under Sections 143(3), 144 and 147/143(1)

Check out Taxmann's Faceless Assessment Appeals & Penalty Ready Reckoner with Practical Guide to Handling Income Tax Notices which is a definitive guide to India's new Faceless Taxation Regime under the Income-tax Act, offering in-depth coverage of Faceless Assessments, Appeals, and Penalties. It illustrates step-by-step e-proceedings, AI-driven compliance, and strategies to respond effectively to notices. Case studies on issues like penny stock LTCG and disallowances, combined with ready-to-use templates, foster practical learning. Amended by the Finance Act 2025, it explores principles of natural justice, the substituted reassessment regime, and international best practices. Authored by CA Mayank Mohanka, it is indispensable for tax practitioners, corporates, legal experts, and academicians seeking clear, hands-on guidance.

1. Launch of New Income Tax ‘e-Filing Portal’ & New ‘e-Proceedings’ Utility

The Central Board of Direct Taxes (CBDT) has launched the new income tax e-filing portal on 7th June, 2021. The new portal ‘www.incometax.gov.in’ has replaced the existing e-filing portal ‘www.incometaxindiaefiling.gov.in’. The portal is being redesigned for the convenience of the taxpayers that will provide the facility of income tax return filing and other tax-related services in a modern and seamless manner.

As a part of e-governance initiative, to facilitate conduct of assessment proceedings electronically, Income-tax Department has developed the ‘e-Proceedings’ facility. It is a simple way of communication between the Department and assessee in a hassle-free manner, through electronic means, without the necessity to visit the Income-tax Office for conduct of assessment proceedings. This new facility is also environment friendly as assessment proceedings have now become paperless.

In assessment proceedings through the ‘e-Proceedings’ functionality, there is a seamless flow of letters, notices, questionnaires, orders etc. from Assessing Officer to assessee’s e-Filing account. On receipt of departmental communication, assessee is able to submit his response along with attachments, if any, by uploading the same on the e-Filing portal. The response submitted by the assessee is also viewed by the Assessing Officer electronically. Thus, besides saving precious time of the taxpayer, ‘e-Proceedings’ also provides a 24×7 anytime/anywhere convenient facility to submit response to the departmental queries in course of assessment proceedings.

With the launch of this new e-filing portal, the previous version of e-Proceedings functionality has also been substituted by an altogether new version of e-Proceedings utility. Thus, it has become essential for all the stakeholders including the taxpayers and the tax consultants, to get accustomed and familiar with the new features and working modalities and functionalities of this new e-Proceedings utility in the new e-filing portal, so as to file their responses and submissions to the scrutiny notices and requisitions, in a timely, effective and correct manner.

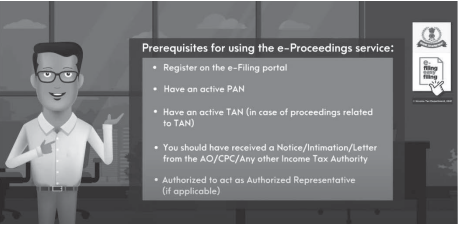

1.1 Prerequisites for Using ‘e-Proceedings Utility’

Source – Income Tax Department

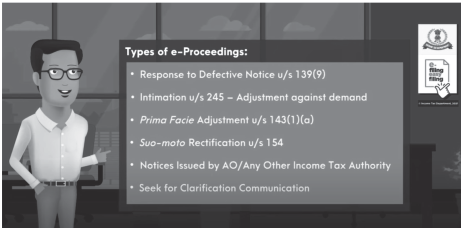

1.2 Types of e-Proceedings

Source – Income Tax Department

All regular assessments in section 143(3), income escaping assessments or reassessments in section 147 and best judgment assessments in section 144 of the Income Tax Act, except those cases, falling under the Central Charges, i.e., search and survey cases, and International Taxation Charges, i.e., international transfer pricing cases, are to be conducted in a faceless manner, as per the procedure and manner, stipulated in section 144B of the Income-tax Act, 1961.

In Chapter Nos. 1, 2 and 3, the theoretical aspects of the new Faceless Assessment Regime as enshrined in the newly inserted section 144B of the Income Tax Act, have been discussed and explained. Human memory is conditioned to understand and remember the things, explained in a practical manner, better and faster, so an honest and sincere effort has been made in this Chapter to explain and demonstrate the practical aspects and nitty-gritties of the manner of conducting of faceless assessments in a ‘Step-by-Step-Manner’.

The complete procedure of ‘Faceless Assessments’ carried out via the new ‘e-Proceeding’ functionality in the registered ‘e-filing’ account of the assessee in the newly launched income tax portal, through ‘practical illustrations encompassing real time scrutiny windows’, is being explained in ensuing paragraphs.

So, let us commence our journey through the practical gateways of the new version of ‘e-Proceedings’ utility, in the new e-Filing portal of Income Tax Department.

2. Step by Step Guide to ‘Faceless Assessment Proceedings’ Under Sections 143(3), 144 and 147/143(1)

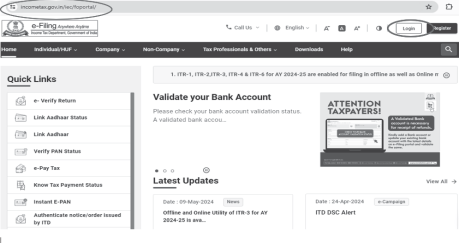

Step 1 – Visiting the ‘e-filing portal’ in Income Tax Website

The assessee is required to visit the ‘e-filing portal’ in the Income Tax Website by visiting the link – https://www.incometax.gov.in/iec/foportal

The assessee is required to click on ‘Login’ tab, located on the top right side of the screen.

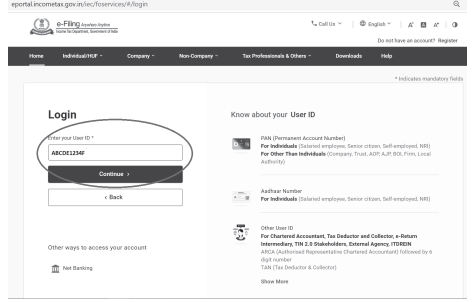

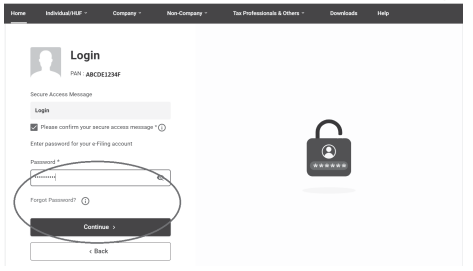

Step 2 – Login to the ‘e-filing portal’ in Income Tax site

The assessee needs to fill in his ‘user id’ which is his ‘PAN’ and click ‘Continue’.

Then the assessee needs to enter the password and click ‘continue’ in order to login to his registered e-filing account.

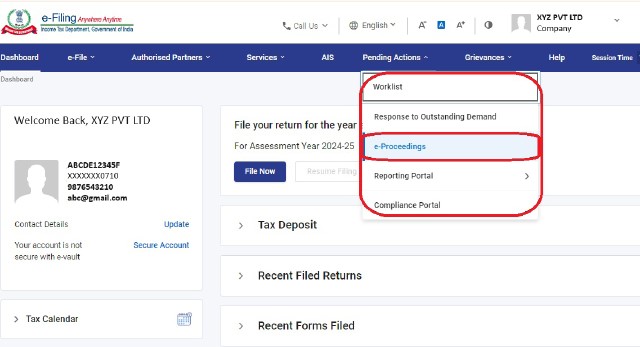

Step 3 – Visiting ‘e-Proceedings’ tab

After logging in, the assessee needs to select ‘e-Proceedings’ tab from under the ‘Pending Actions’ icon.

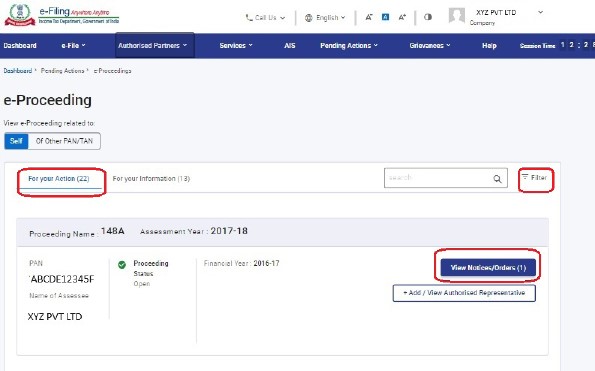

The assessee is redirected to a new page ‘View e-Proceedings related to’ and this new page displays all the ‘assessment notices’ under section 143(1)(a)/143(2)/147/139(9)/270A, for different assessment years, which the assessee might have received. The assessee may use the ‘Filter’ tab to view the pending and closed e-proceedings for any particular assessment year.

The path is Dashboard > Pending Actions > e-Proceedings

2.1 Faceless Assessment Proceedings Under Section 143(3)

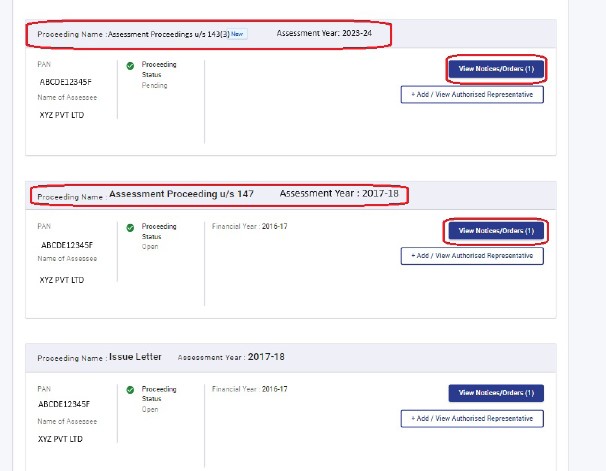

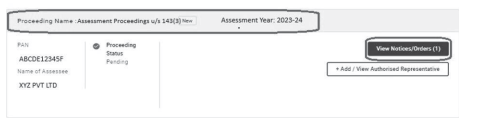

Step 1 – Click ‘View Notices’ under ‘Assessment Proceedings under section 143(3)’ tab

To view the regular assessment proceeding details under section 143(3), the assessee needs to click on the ‘View Notices’ tab under ‘Assessment Proceeding under section 143(3)’, which is available under the tab ‘Proceeding Name’.

Step 2 – Selecting the Notice to Respond

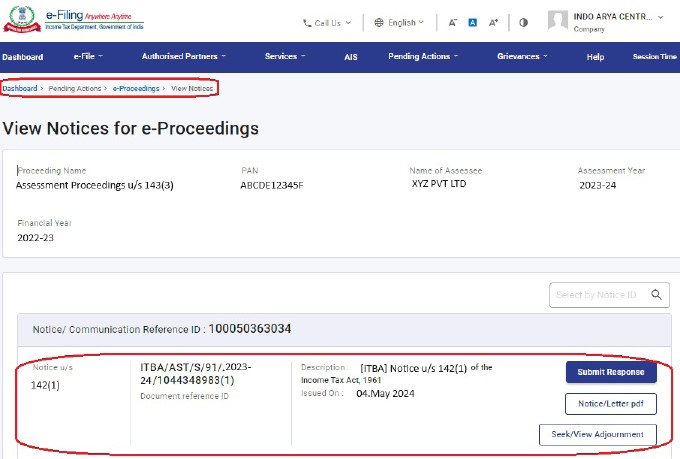

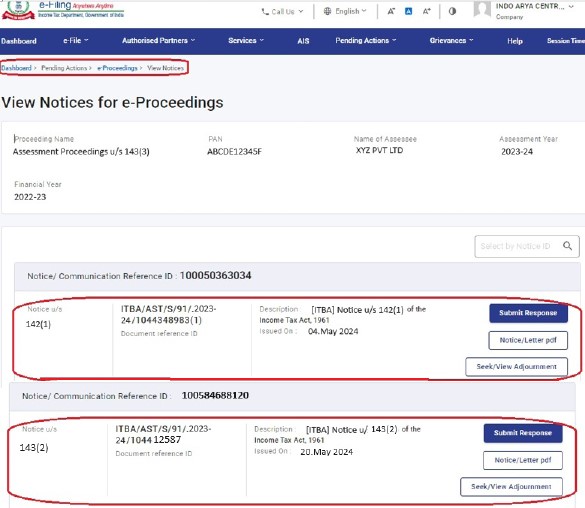

The path is Dashboard > Pending Actions > e-Proceedings > View Notices

In the sub window of “Assessment Proceedings u/s 143(3)”, the assessee is able to see all the Notices, say u/s 143(2) or 142(1), issued for that particular assessment year.

This sub window provides three tabs viz.

(i) View Response;

(ii) Notice/Letter Pdf and

(iii) Seek/View Adjournment.

In order to access the relevant Notice, the assessee needs to Click “Notice/Letter Pdf” tab.

The assessee can also seek adjournment by clicking “Seek Adjournment” tab, after providing the reason for seeking adjournment.

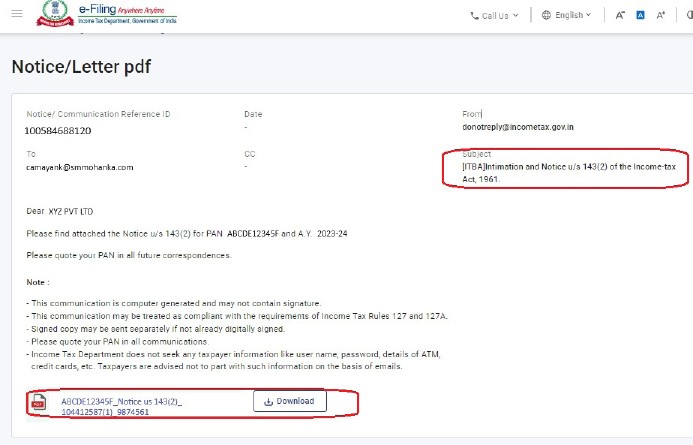

Step 3 – Downloading the Assessment Notice

The path is Dashboard > Pending Actions > e-Proceedings > View Notices > Detailed Notices

The assessee is required to click on the ‘Download’ tab, given at the bottom of the page to download the assessment notice.

After downloading the assessment notice by clicking on the ‘Download’ tab, the assessee can view the scrutiny notice sent by the AO containing the following details –

- PAN of the Assessee

- Address of the Assessee

- Section under which Notice has been issued

- Assessment Year

- Notice No.

- Date of issuing Notice

- Purpose for sending the Notice

- Questionnaire, if the notice is issued under section 142(1).

Under the Faceless Regime u/s 144B, the Notices under section 143(2) of the Act is not issued by the jurisdictional Assessing Officer of the assessee but by the National Faceless Assessment Centre (NaFAC).

The downloaded real time Notice issued under section 143(2) of the Act as per Computer Aided Scrutiny Selection (CASS) looks like as under –

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA