India’s Foreign Direct Investment (FDI) Regulations – Case Studies | Tips | Practical Strategies

- Blog|FEMA & Banking|

- 11 Min Read

- By Taxmann

- |

- Last Updated on 22 April, 2024

Foreign Direct Investment (FDI) refers to an investment made by a firm or individual in one country into business interests located in another country. Typically, FDI takes the form of a parent company starting a subsidiary abroad, acquiring a controlling interest in an existing foreign company, or through a merger or joint venture with a foreign company. FDI is crucial because it allows the direct investor to gain a foothold in foreign markets, and it often involves not just the transfer of funds but also the exchange of expertise, technology, and human resources. There are two main types of FDI: – Horizontal FDI: This occurs when a business expands its domestic operations to a foreign country, creating the same kind of products or services in a different country. This might be done to bypass tariffs, reduce transport costs, or access new markets. – Vertical FDI: This takes place when a company invests in a foreign business that is not a direct competitor but a supplier or distributor. It often involves different aspects of related businesses to control the supply chain or distribution network. FDI is considered a critical driver of economic growth in developing countries, as it can lead to job creation, improved productivity, and technology transfer. It can also have a significant impact on global trade patterns.

By CA. Niki Shah – Partner | SN & Co.

Table of Contents

- Statistics & Trends

- Basics: FDI

- Rights Issue and ESOP

- Pricing Guidelines

- Reporting Requirements

- Case Studies

- FDI vs FPI

- Downstream Investment

- Sector Specific

1. Statistics & Trends

1.1 Statistics

FDI Sectors (April 2023 – December 2023)

|

Sector |

Amount ($ Millions) |

| Services | 5,187 |

| Construction | 3,841 |

| Software | 3,417 |

| Trading | 2,661 |

| Power | 1,583 |

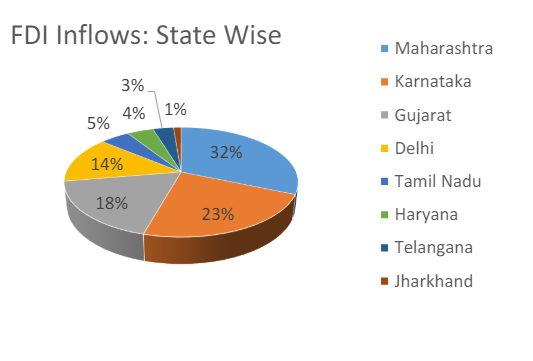

States Attracting Highest Inflow (April 2023 – December 2023)

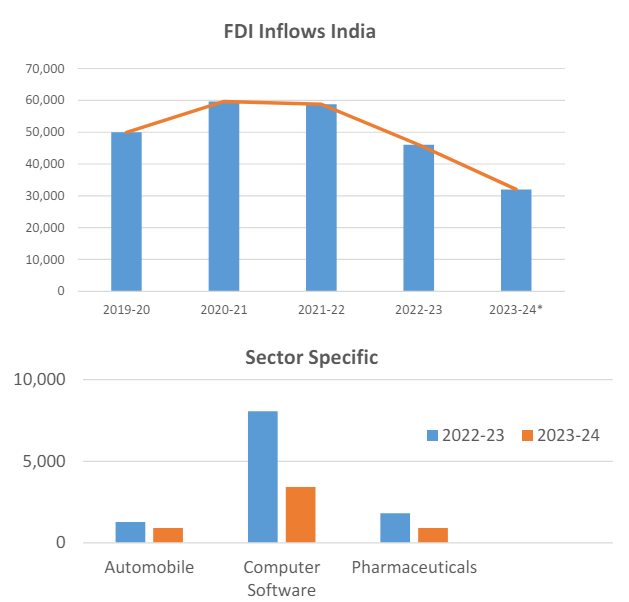

1.2 Recent Trends in FDI

Macro Reasons

- Repatriation of Capital/Disinvestment by existing investors

- Global FDI down y/y 12% for 2022

- Steep decline in transactions in developed economy

- Pre Election Nervousness

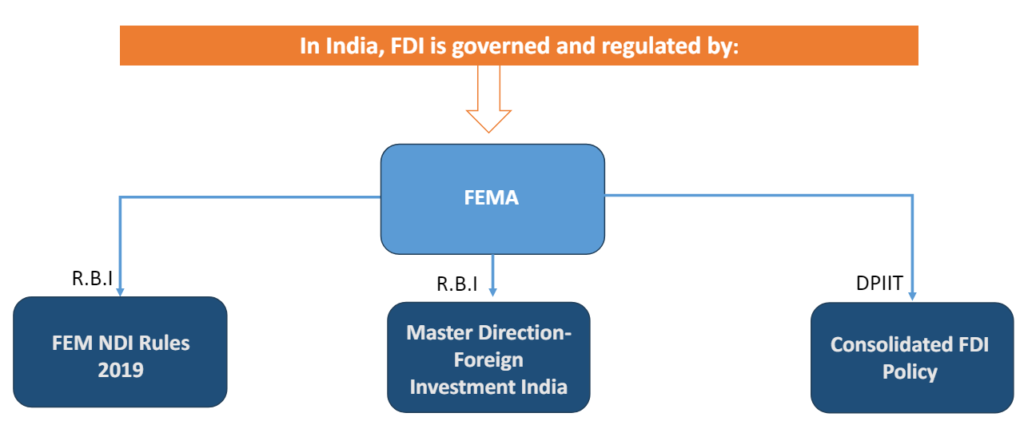

2. Basics: FDI

2.1 Entry Routes

FDI Guidelines for Investing in India

Automatic Route: No prior approval from the Government of India is required.

- Available for most sectors, except those specifically restricted.

- Limits: Sectoral caps/ stipulated sector specific guidelines.

- Investors only need to inform the Reserve Bank of India (RBI) within 30 days of investment.

- Faster process since it bypasses government scrutiny.

Government Route: Prior approval from the Government of India is mandatory

- Only for cases other than Automatic Route and those mentioned in sectoral policy.

- Investors must obtain permission from the concerned ministry or department before investing.

- An entity of a country, sharing land border with India or where the beneficial owner of an investment into India is situated in or is a citizen of any such country (Pakistan)

2.2 Sectoral Caps

Automatic Route

- Mining

- IT

- Financial services(a)

- Insurance (a)

- Construction Development

- Infrastructure

- Manufacturing sector

Government Route

- Titanium (Mining) – 100%

- Broadcasting (Content) – 46%

- Banking for Public – 20%

- Print – 26%

Negative List

- Agriculture (b)

- Atomic energy

- Lottery, betting and gambling

- Chit fund, Nidhi company

- Trading in Transferable Development Rights

- Cigars & Cigarettes

Note: (a) Sector specific guidelines

(b) Subject to certain exceptions

2.3 Eligible Entities

- Limited Liability Partnership

- Company

- Partnership/Proprietary Concern*

- Investment Vehicles**

*A NRI or an OCI may invest on a non-repatriation basis

**I.V like REITS, AIFs, etc.

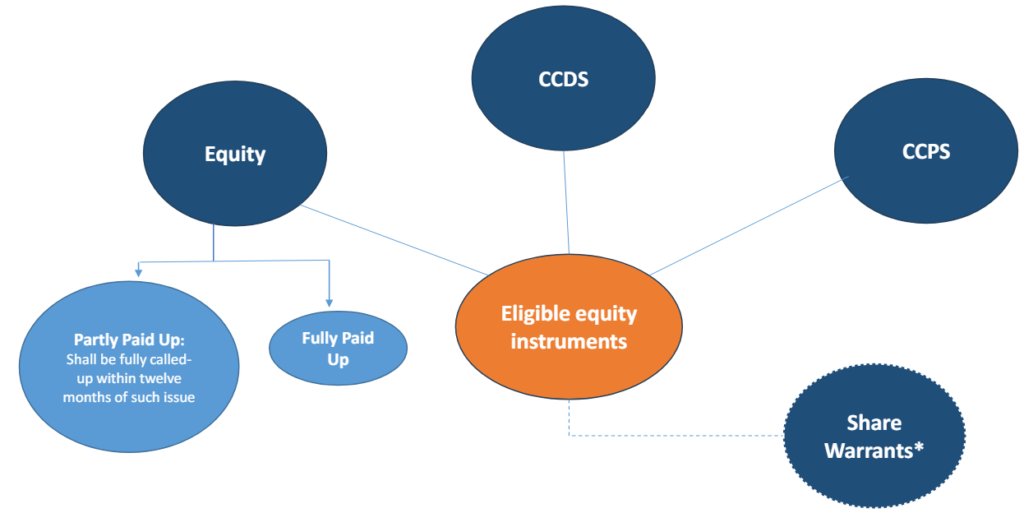

2.4 FDI Compliant Securities

*Share Warrants are those issued by an Indian company in accordance with the regulations by the SEBI

3. Rights Issue and ESOP

3.1 Rights and Bonus Issue

Investment via Rights and Bonus Issue

- Offer made must be in compliance with Companies Act, 2013

- Such issue shall not breach the sectoral cap applicable

- Listed Company: Rights Issue to PROI shall be at a price determined by the company

- Unlisted Company: Rights issue to PROI shall not be at a price less than the one offered to Resident

- The mode of payment and attendant conditions are specified by the RBI

3.2 Issue of Employees Stock Options

Eligible Issuers

- Indian companies can issue ESOs/sweat equity shares to their employees or directors abroad

- Applies to employees/directors of the company’s holding, JV or WOS

Regulatory Framework

- Scheme must comply with SEBI Act, 1992 regulations

- Alternatively, adherence to the Companies (Share Capital and Debentures) Rules, 2014 is required

Government Approval

- Prior approval needed if the investment is under the government approval route

- Mandatory government approval for issues to citizens of Bangladesh or Pakistan

Special Case

- Shares acquired via ESOs while being a resident in India must be held on a non-repatriation basis by overseas residents

Compliance

- Issued shares must adhere to the applicable sectoral investment caps

4. Pricing Guidelines

| Particulars | Guidelines | Listed Company | Unlisted Company |

| Issue by company to person resident outside India | Price not less than | The rule prescribes that the price must be worked out in accordance with SEBI guidelines | The fair value worked out as per any internationally accepted pricing methodology for valuation on an arm’s length basis, duly certified by A Chartered Accountant

or A SEBI registered Merchant Banker or A practicing Cost Accountant. |

| Transferred from a person resident in India to a person resident outside India | |||

| Transferred by a person resident outside India to a person resident in India |

Price not more than |

| Particulars |

Methodology |

| Swap of Equity Instruments | Irrespective of the amount, valuation involved in the swap arrangement shall have to be made by a Merchant Banker registered with the SEBI or an investment banker outside India registered with the appropriate regulatory authority in the host country |

| Subscription to MOA | Such investments shall be made at Face Value subject to entry route and sectoral caps |

| Share Warrants | Their pricing and the price or conversion formula shall be determined upfront. |

*Note that these pricing guidelines shall not be applicable for investment in equity instruments by a person resident outside India on a non-repatriation basis.

5. Reporting Requirements

| FORM | When to File | Due Date |

| FC-GPR | Indian company issuing capital instruments to a PROI.

Also in case of conversion of ECB into equity along with Form ECB-2 (Part V: Annex III). |

30 days from the date of issue of capital instruments. |

| FLA Return | Indian company which has received FDI or an LLP which has received investment by way of capital contribution | By 15 July of the corresponding year |

| FC-TRS | For transfer of capital instruments | 60 days of transfer or receipt/remittance of funds (which is earlier) |

| ESOP | Indian company issuing employees’ stock option to PROI | 30 days from the date of issue of ESOPs. |

| LLP (I) | LLP receiving amount of consideration for capital contribution and acquisition of profit shares | 30 days from the date of consideration |

| LLP (II) | Disinvestment/transfer of capital contribution or profit share of LLP between a resident and a non-resident | 60 days from the date of receipt of funds |

| LEC (FII) | Purchase/transfer of capital instruments by FPIs on the stock exchanges in India | N.A |

| DI | Indian entity or an investment Vehicle making downstream investment in another Indian entity | 30 days from the date of allotment of capital instruments |

| CN | Indian startup company issuing Convertible Notes to a person resident outside India | 30 days of such issue |

6. Case Studies

Case 1: Shares Allotted Before Inward Remittance

Facts of the case

- An Indian Company was incorporated as a Private Limited on 28.12.2018.

- The company allotted 400 and 6000 equity shares of Face Value Rs. 10 each to the foreign investors ABC Ltd (UK) and XYZ (individual) respectively on 14th August 2019 against subscription to Memorandum of Association against which the company received Inward remittances from them as FDI on 8th September 2019 amounting to Rs. 67,000.

- However, the company had surplus share application money after the shares were allocated. Also, No FEMA compliances were done for FDI received and shares allotted.

Question

- What will be the course of action and Compliance required to be done?

Case 2: KYC Missing for FCGPR Filing

Facts of the case

- Company A, based in India, received an investment from foreign Investors X, Y, and Z against which Equity Shares were allotted.

- Fresh Issue of shares necessitated the filing of Form FC-GPR, for FDI received from foreign Investors.

- However, later on, while filing the Form FC-GPR, a necessary document i.e. 6-pointer KYC of the Foreign Investors could not be obtained as their local bank accounts were dormant.

Question

- What would be the appropriate way forward for Company A to ensure compliance with the FEMA regulations while facilitating the fresh issue of shares to foreign investors?

Case 3: Compliance on Bonus Issue of Shares

Facts of the case

- A Listed company X issued ESOPs to its Resident and Non-Resident Employees under different ESOP Schemes.

- Subsequently, twice the Bonus Shares were also issued to their employees in 2000 and 2006.

- Form FC-GPR was duly filled by the company under the regulatory compliances for the issuance of ESOPs to non-resident employees on a timely basis.

- However, Company X was unaware of the compliance while issuing Bonus Shares to its Non-Resident employees.

Question

- What are the immediate regulatory steps the company must take to rectify the non-compliance?

Case 4: Delay in Filing of FC-TRS

Facts of the case

- Mr. A, a Person of Indian origin held shares of M/S XYZ Limited on Non-Repatriable basis.

- He was granted permission by RBI Foreign Exchange department to convert his investment into repatriable basis for transfer to M/S AD Limited (Non-Resident Company).

- However, the FC-TRS forms for these transfers were filed belatedly.

Question

- What are corrective measures for compliance with Regulation 10A(b)(i)

Case 5: Non-refund of Excess Share Application Money

Facts of the case

- M/S VX Limited incorporated on 31.12.2022, allotted 2,000 equity shares to M/S Dataex (NonResident).

- However, a part of the consideration was received after the allotment by the company.

- The company failed to refund the excess application money beyond the prescribed time limit of 75 days from the date of inward remittance.

Question

- What regulations should the company have followed and the way forward?

Case 6: Fund Transfer to NRO/NRE Account

Facts of the case

- Mr. X who is Non-Resident transferred equity shares of an Unlisted Company to M/s AB Private Limited (Resident Indian).

- M/s AB Private Limited transferred the Sales consideration to Mr. X’s (Non-Resident) NRO A/c.

Questions

- Is M/s AB Private Limited is liable for any compliance to be done?

- What are the compliances if the Sales consideration is transferred to NRE A/c?

Case 7: Money Exchanger

Facts of the case

- M/s XYZ Private Limited incorporated in India received Foreign Investment from Mr. A (NonResident)

- Mr. A who is Non-Resident transferred the Share Application money via the Money Exchanger platform. The company received the Share Application money in INR as a result.

- Since the transaction was not processed under the traditional banking channels, FIRC copy could not be raised.

- Hence, M/s XYZ Private Limited was unable to file Form FC-GPR.

- XE International Money Transfer, Payoneer, PayPal

7. FDI vs FPI

7.1 Foreign Direct Investment

Definition

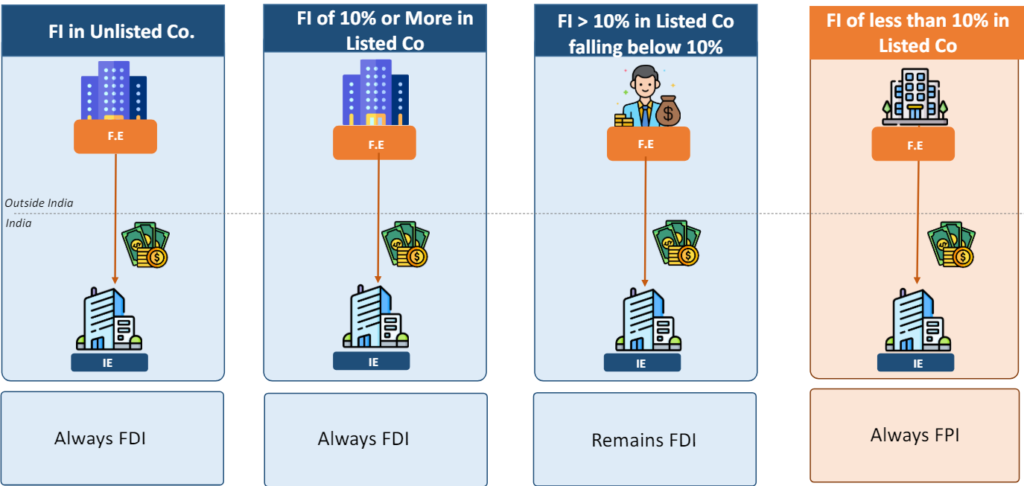

Investment through equity instruments by a PROI in an unlisted Indian company; or in ten per cent or more of the post issue paid-up equity capital on a fully diluted basis of a listed Indian company.

Control & Ownership

Implies acquiring a substantial degree of control and ownership in the foreign business entity. The investor often holds a significant stake, usually 10% or more, in the company.

Purpose

Often aimed at establishing production facilities, expanding operations, accessing new markets, or obtaining strategic assets in a foreign country.

Economic Impact

Generally viewed as more beneficial for the host country’s economy in the long run due to technology transfer, employment generation, and infrastructure development.

Investment Vehicles

FDI is allowed in entities like companies, partnerships, and trusts*, subject to certain conditions and guidelines outlined under FEMA.

Pricing Guidelines

Pricing guidelines for issuing and transferring shares are specified under FEMA regulations.

Registration Requirements

There is no such requirement here. However, there are compliance and reporting requirements under FEMA for entities receiving FDI.

7.2 Foreign Portfolio Investment

Definition

Investments by non-residents in Indian company equity instruments, where the investment is below 10% of the paid-up capital or equity series of a listed company.

Control & Ownership

Generally does not result in ownership or significant control over the invested entity.

Purpose

Brings in capital from foreign investors, which can be used for the development and growth of the country’s financial markets. It allows for a wider investor base.

Economic Impact

Provides short-term capital for the country’s financial markets, which can help in improving liquidity. However, it can lead to volatility.

Investment Vehicles

FPI is allowed mainly in marketable securities like Listed Companies , Government Bonds, Corporate Bonds, Mutual Funds, ETFs.

Pricing Guidelines

The purchase and sale of shares must comply with the market price for listed companies. For unlisted companies, investment by FPIs is subject to guidelines similar to FDI but mainly focused on debt instruments.

Registration Requirements

FPIs need to obtain a certificate of registration from SEBI and comply with the conditions prescribed in the SEBI (FPI) Regulations, 2014. The process involves due diligence requirements, adherence to KYC norms, and other regulatory compliances.

7.3 FDI vs FPI: Cases

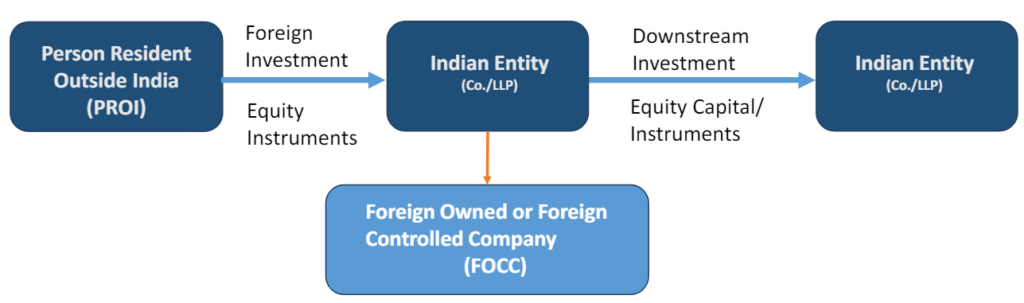

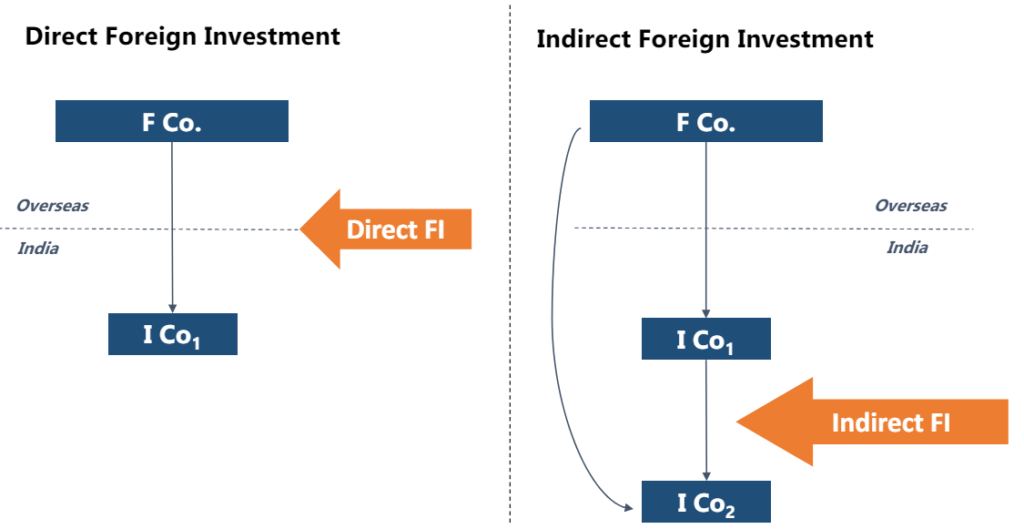

8. Downstream Investment

- Downstream Investment refers to the investment made by an Indian entity that has received foreign direct investment (FDI) into another Indian company

- Reporting requirements within 30 days of investment with DIPP/FIPB introduced

- Indian company making downstream investment not permitted to leverage funds from domestic market

- FI to include all types of foreign investments

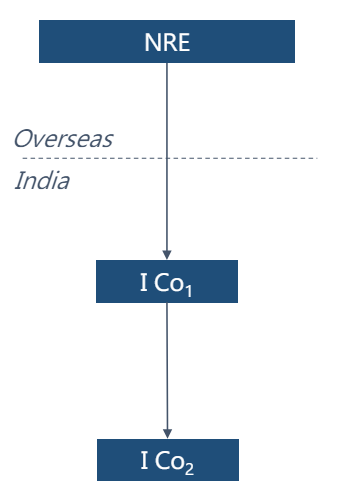

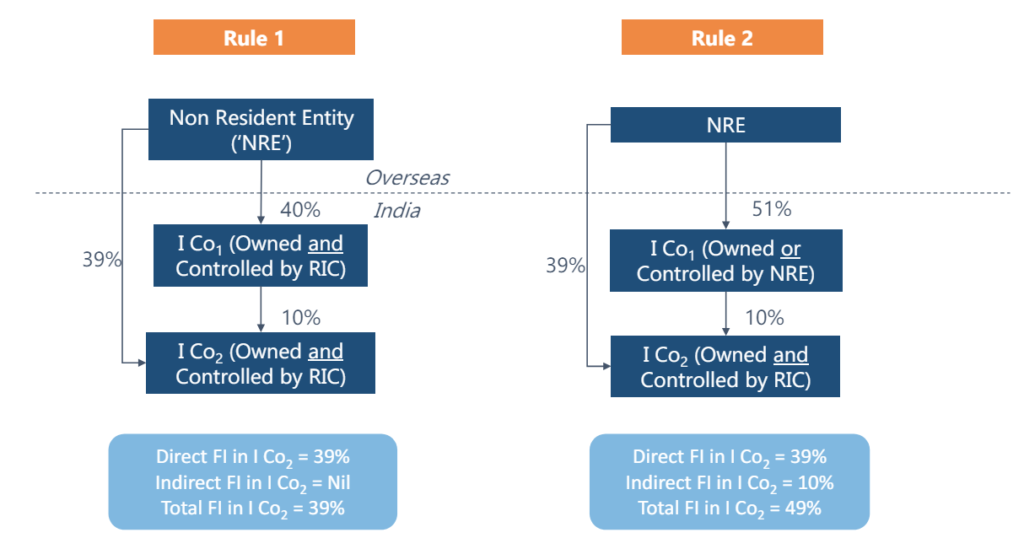

- For RIC own and control are cumulative conditions; for NRE these are non-cumulative

- The methodology to apply to every stage of investment at Indian company

- If ICO2 & ICO1 owned and controlled by RIC, investment by ICO1 in ICO2 is not indirect FDI 1

- If ICO1 is owned or controlled by NRE, investment by ICO1 in ICO2 is considered indirect FDI

- If ICO1 holds 100% in ICO2, NRE investment in ICO1 is considered indirect FDI in ICO2

Total FI is sum of Direct FI and Indirect FI

9. Sector Specific

9.1 Sectoral Caps

|

Sectoral/Activity |

% of FDI Cap/Equity |

Route |

| Real estate i.e. (Development of Townships, Housing, Built-up infrastructure and Construction- development projects) |

100% |

Automatic |

Pharmaceutical:

|

100% |

Automatic up to 74% Govt. Route beyond 74% |

9.2 Pharmaceutical Sector

Two Major Types:

- Greenfield Investment: The parent company creates a new operation in a foreign country from the ground up.

- Brownfield Investment: The parent company creates a new operation in a foreign country from the ground up.

General Rule: ‘Non-compete’ clause shall not be allowed except in special circumstances with the Government approval.

Brownfield Specific Rules

- Maintain the production level of essential medicines at the highest of the past three years for the next five years.

- Keep R&D spending at the highest level of the past three years for the next five years.

- Report any technology transfers to the Ministry of Health and Family Welfare or Department of Pharmaceuticals.

- The Ministry of Health and Family Welfare and other relevant authorities will monitor compliance with these conditions.

9.3 Real Estate Sector

Construction Development: Townships, Housing, Built-up infrastructure

Permissible Activities

- Development of Townships

- . Construction of Residential/Commercial Premises

- Roads and Bridges

- Hotels, Resorts, Hospitals , Educational Institutes

Exit and Repatriation Conditions

- Exit permitted upon project completion or after developing basic infrastructure (e.g., roads, water supply).

- Foreign investors can exit before project completion after a 3-year lock-in period for each investment tranche, under automatic route.

Transfer of Stake

- Transfer of stake from one non-resident to another is unrestricted by lock-in periods or government approval, without requiring repatriation of investment.

Project Standards Compliance

- Projects must meet all applicable norms, standards, and regulatory requirements, including land use and community amenities.

Developed Plots Sales

- Only plots with completed trunk infrastructure are to be sold as “developed plots.“

Responsibilities of the Indian Investee Company

- Must secure all necessary approvals and comply with local regulations, including development charges and infrastructure development.

Monitoring of Compliance

- Local or state government bodies to monitor developer compliance with the conditions.

Prohibited FDI Activities

- FDI not permitted in real estate business, construction of farmhouses, and trading in transferable development rights (TDRs).

- Real estate business is defined as dealing in land and immovable property for profit, excluding specified development projects.

Lock-in Period Exemptions

- Lock-in period does not apply to investments in hotels, tourist resorts, hospitals, SEZs, educational institutions, old age homes, and investments by NRIs.

FDI in Completed Projects

- 100% FDI allowed under automatic route in completed projects for townships, malls, business centres, etc., with a 3-year lock-in period per FDI tranche.

- Transfer of ownership/control to non-residents permitted, but immovable property transfers are restricted during the lock-in.

Notes:

The term “real estate business” does not include the development of townships, construction projects, or earning rent/income from property leasing.

Completion of the project is determined according to local regulations.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA