GST Input Tax Credit – Definitions and Conditions for Claiming GST ITC

- Blog|GST & Customs|

- 15 Min Read

- By Taxmann

- |

- Last Updated on 16 February, 2024

Table of Contents

- Introduction

- Input Tax Credit Meaning

- Rationale Behind ITC Under GST

- Legal Framework of ITC

- Eligibility for Availing ITC [Section 16(1)]

- Conditions to be satisfied for Availing ITC [Section 16(2)]

- Reversal of ITC in case of Non-Payment of Consideration

- No ITC if Depreciation is claimed on Tax Component [Section 16(3)]

- Time Limit for availing the Input Tax Credit [Section 16(4)]

- Apportionment of Input Tax Credit

Check out Taxmann's flagship publication for GST & Customs Law | TEXTBOOK for aspiring commerce and management professionals. It simplifies legal concepts using straightforward language and illustrative examples, making it ideal for various university courses. It is meticulously structured to facilitate sequential self-learning and includes recent examination questions from Delhi University. Covering a wide range of topics from the pre-GST era to customs procedures, this book is crafted to minimize reliance on multiple texts and bridge the gap between theoretical knowledge and practical application.

1. Introduction

When a registered person purchases goods or avails services, GST is paid on such inward supplies. These supplies are used for furtherance of business and the outward supplies are made. On such outward taxable supplies, GST is collected from the recipient. The total GST collected on outward supplies will not be payable to the Government in entirety, but it will get reduced on account of adjustment of tax paid on inward supplies, subject to certain conditions. This mechanism in which tax paid on inward supply is adjusted towards tax paid on outward supply is known as Input Tax Credit (ITC). The GST laws provide the benefit of ITC not only on input goods/services but also on capital goods. This ITC available reflects in the electronic credit ledger of the taxpayer maintained at the GST common portal. In this chapter, we will discuss the various aspects of ITC like conditions, circumstances, manner of computation, reversal etc.

2. Input Tax Credit Meaning

As per Section 2 (63) of the CGST Act, 2017 “input tax credit” means the credit of input tax. Input-tax is defined under section 2(62) of the CGST Act as follows:—

It means the Central tax, State tax, Integrated tax or Union territory tax charged on any supply of goods or services or both made to a registered person but does not include the tax paid under the composition levy.

It shall also include:—

(a) The integrated goods and services tax which is charged on import of goods

(b) The tax payable as per section 9(3) and (4) of the CGST Act

(c) The tax payable as per section 5(3) and (4) of the IGST Act

(d) The tax payable as per section 9(3) and (4) of the respective SGST Act

(e) The tax payable as per section 7(3) and (4) of the UTGST Act.

3. Rationale Behind ITC Under GST

The credit mechanism under the indirect tax aims to mitigate the cascading effect of duty on duties. It provides for credit of duties paid on goods or services which are used as inputs in production of output goods or provision of output services. This aim was not achieved to the fullest as various duties, taxes and cess were levied at the central and state levels and all were not adjusted against each other. With the introduction of GST, credit on goods and services is available across the entire supply chain barring a few exceptions. It may be noted that it is an auto populated feature.

| Burden of Proof for claiming ITC |

| As per section 155 of CGST Act, 2017, where any person claims that he is eligible for input tax credit under this Act, the burden of proving such claim shall lie on such person. |

4. Legal Framework of ITC

The various provisions related to INPUT TAX CREDIT (ITC) are given under Chapter V (Section 16-21) of the CGST Act, and CGST Rules. These provisions of ITC under CGST are also applicable to the IGST Act. Section 20 of the IGST Act has made the provisions applicable. The aspects covered under various sections are:—

| Section 16: | Eligibility and Conditions for taking Input tax credit |

| Section 17: | Apportionment of credit and blocked credits |

| Section 18: | Availability of Credits in Special Circumstances |

| Section 19: | Taking input tax credit in respect of inputs and capital goods sent for job work. |

| Section 41: | Utilization of ITC |

| Section 42: | Matching, Reversal and Reclaim of ITC. |

CGST RULES, 2017 RELATING TO ITC

The Chapter V of CGST Rules, 2017 contains the following rules in relation to ITC:

| Rule 36: | Documentary requirements & conditions for claiming ITC |

| Rule 37: | Reversal of ITC in the case of Non-Payment of consideration |

| Rule 38: | Claim of credit by a Banking Company or a Financial Institution |

| Rule 39: | Procedure for distribution of ITC by Input Service Distributer (ISD) |

| Rule 40: | Manner of claiming credit in special circumstances |

| Rule 41: | Transfer of credit on sale, merger, etc. |

| Rule 42: | Manner of determination of ITC in respect of inputs or input services & reversal |

| Rule 43: | Manner of determination of ITC in respect of Capital goods & reversal thereof |

| Rule 44: | Manner of reversal of credit under special circumstances |

| Rule 44A: | Manner of reversal of credit of Additional Duties of Customs |

| Rule 45: | Conditions and restrictions in respect of inputs and Capital Goods to the job worker |

5. Eligibility for Availing ITC [Section 16(1)]

As per section 16(1),

“Every registered person shall, subject to such conditions and restrictions as may be prescribed and in the manner specified in section 49, be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of business and the said amount shall be credited to the electronic credit ledger of such person.”

The analysis of above statutory provision reveals the following:

- Registered Person: As per Section 16(1), Input tax credit is available only to a registered person. When a registered person is supplied with goods or services or both, on which tax has been charged, he is allowed to take credit of the input tax paid. This is subject to the provisions relating to use of ITC under section 49 and the conditions & restrictions in the rules. This means, if a person is unregistered he will not be eligible to claim Input tax credit.

Exception: There is one exception wherein ITC is not available although the person is registered. This exception applies to a person who pays tax under section 10 of the CGST Act, under the compounded levy scheme. Such person cannot claim ITC in respect of inward supplies made by him. In-fact, the tax paid under Composition levy does not fall within the definition of Input tax.

- In the course of or in furtherance of business: The goods/services must be used or intended to be used in the course of or in furtherance of his business. However, no such credit is available in respect of inputs used for outward supply of exempted goods or services.

Explanation: The relation of inputs and input services with business can be direct or indirect. ‘Intention to use’ implies that ITC can be availed as soon as inputs or input services are received, though the same may be utilised later. However, if finally, the input goods or services are not utilised for intended purpose, ITC is disallowed, as provided in section 17(5) of CGST Act. [Provisions of section 17(5) are discussed in the ensuing pages of this Chapter in Para 10.10.] In fact, the tax paid on goods and/or services which are used or intended to be used for non-business purposes cannot be availed as credit.

- Credit Ledger: The amount of ITC shall be credited to the Electronic Credit Ledger of the person entitled.

- Manner of Utilisation: The ITC shall be utilised in the manner specified in section 49.

- Rules under CGST Rules, 2017: The conditions and restrictions have been specified in Chapter V of CGST Rules, 2017 (Rule 36 to Rule 45). These rules have been mentioned under the appropriate heading throughout this chapter.

6. Conditions to be satisfied for Availing ITC [Section 16(2)]

The registered person is entitled to the credit of any input tax credit on a supply only if all the following conditions are fulfilled:

(a) Possession of a Tax Invoice or Debit Note

(b) Furnishing and communication of details

(c) The ITC is not restricted

(d) Receipt of goods and/or services

(e) Payment of tax to the Government

(f) Furnishing the valid return under section 39

NOTE: The above conditions are given in section 16(2), which starts with “Notwithstanding anything contained in this section …..”. It implies that it is an overriding section. Moreover, these conditions are cumulative, therefore, they all must be satisfied in order to be eligible for availing tax credit.

(a) Possession of Invoice

As per section 16(2)(a), no registered person shall be entitled to the credit of any input tax in respect of any supply of goods or services or both to him unless, he is in possession of a tax invoice or debit note issued by a supplier registered under this Act, or documents as prescribed in Rule 36.

| Rule 36: Documentary requirements and conditions for claiming input tax credit | |

| 36(1) | Any of the following documents suffice the condition of possession of invoice.

(a) an invoice issued by the supplier of goods or services or both (as per section 31) (b) an invoice raised by the recipient in case of inward supply from unregistered. (c) a debit note issued by the supplier of goods or services or both (as per section 34) (d) a bill of entry or any similar document prescribed under the Customs Act, 1962 (e) an Input Service Distributor invoice or Input Service Distributor credit note or any document issued by an Input Service Distributor for distribution of credit. (Rule 54). |

| 36(2) | The ITC shall be availed by a registered person only if all the applicable particulars as specified in the provisions of Chapter VI are contained in the document mentioned in Rule 36(1).

Provided that if the said document does not contain all the specified particulars but contains the details of the amount of tax charged, description of goods or services, total value of supply of goods or services or both, GSTIN of the supplier and recipient and place of supply in case of inter-State supply, input tax credit may be availed by such registered person. The section 16(2) does not specify which copy of invoice will be the basis of taking ITC. However, Rule 48 does clarify that original copy should be kept by the recipient for the purposes of record. |

(b) Furnishing and communication of details

As per section 16(2)(aa), the details of the invoice or debit note has been furnished by the supplier in the statement of outward supplies and such details have been communicated to the recipient of such invoice or debit note in the manner specified under section 37.

| 36(4) | No ITC shall be availed by a registered person in respect of invoices or debit notes the details of which are required to be furnished under sub-section (1) of section 37 unless,-

(a) the details of such invoices or debit notes have been furnished by the supplier in the statement of outward supplies in FORM GSTR-1 or using the invoice furnishing facility; and (b) the details of ITC in respect of such invoices or debit notes have been communicated to the registered person in FORM GSTR-2B under rule 60(7). Author’s Comment: After insertion of section 16(2)(aa) and substituted rule 36(4), w.e.f. 1-1-2022, the ITC claims will be allowed only when the details of such invoice/debit note have been furnished by the supplier in his GSTR-1 and subsequently it appears in GSTR-2A. Thus, now the recipient can no longer claim provisional ITC. In other words, the ITC claimed should be reflected in GSTR-2A. |

(c) The ITC is not restricted

The details of input tax credit in respect of the supply communicated to the registered person under section 38 has NOT been restricted.

(d) Receipt of Goods or Services or both

As per section 16(2)(b), the registered person should have received the goods or services or both. This means the ITC will not be available unless the goods are received by the registered person.

When goods/Services are deemed to have been received:

Statutory Provisions:

As amended by the Central GST (Amendment) Act, 2018, the Explanation to section 16(2)(b) clarifies, for the purpose of this clause, it shall be deemed that the registered person has received the goods or, as the case may be, services—

(i) Where the goods are delivered by the supplier to a recipient or any other person on the direction of such registered person, whether acting as an agent or otherwise, before or during movement of goods, either by way of transfer of documents of title to goods or otherwise;

(ii) Where the services are provided by the supplier to any person on the direction of and on account of such registered person.

Analysis of the Provisions:

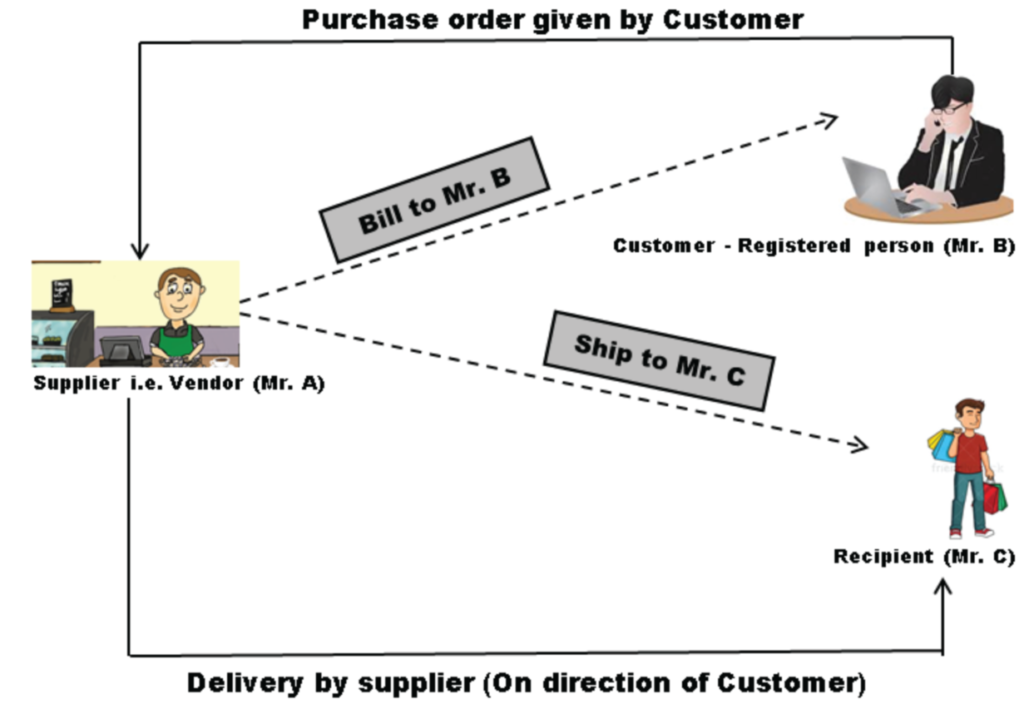

The above provision is related with “Bill to ship to” model.

Bill to Ship to Model: Under this model, the goods are delivered to a third party on the direction of the customer (registered person) who purchases the goods from the supplier.

The ‘Bill to Ship to’ Model supplies include two supplies:

(a) From Supplier to Customer (i.e. from Mr A to Mr B)

(b) From Customer to third party (i.e. From Mr B to Mr C)

It is clear that goods/services may be provided to a third party by the supplier on the direction of the registered person. In this case, though the registered person does not receive the goods or services, but by virtue of Explanation to section 16(2)(b) it is deemed that the registered person has received the goods/services. Accordingly, ITC will be available to the registered person, on whose direction the goods/services are provided to a third party.

(e) Payment of Tax to the Government

As per section 16(2)(c), the third essential condition is that the tax should have actually been paid to the government on the goods or services for which ITC is being taken. This payment can be done by the supplier either by:—

(a) Making the payment through cash or

(b) through utilization of ITC.

However, when the recipient claims ITC, it is provisionally allowed to be utilized for making the payment of self-assessed tax on outward supply, before matching in the common portal. It is later on verified after filing of GSTR 3.

(f) Filing of valid Return

As per Section 16(2)(d), the fourth essential condition is that the registered person should have furnished the return under section 39.

The return has to be filed before 20th of the month succeeding the month in which the supplies were received. This return must be furnished in Form GSTR-3 and must contain all the details of inward supplies.

| When Goods are received in instalments |

| Sometimes, the goods covered under an invoice are not received in a single consignment but are received in lots/instalments. In this case, as per the first Proviso to Section 16(2), the registered person shall be entitled to take credit upon the receipt of the last lot or instalment. |

7. Reversal of ITC in case of Non-Payment of Consideration

The following are the relevant provisions given under CGST Act, 2017 and CGST Rules, 2017:

(1) ITC availed to be paid along with Interest [Second Proviso to Section 16(2)]: Where a recipient fails to pay to the supplier of goods or services or both, the amount towards the value of supply along with tax payable thereon, within 180 days from the date of issue of invoice by the supplier, an amount equal to ITC availed by the recipient shall be added to his output tax liability, along with interest thereon, in the manner as may be prescribed.

| Related provisions as prescribed under Rule 37 of CGST Rules, 2017 |

| As per Rule 37(1), A registered person, who has availed of input tax credit on any inward supply of goods or services or both, other than the supplies on which tax is payable on reverse charge basis, but fails to pay to the supplier thereof, the amount towards the value of such supply, whether wholly or partly, along with the tax payable thereon, within the time limit specified in the second proviso to section 16(2), shall pay or reverse an amount equal to the input tax credit availed in respect of such supply, proportionate to the amount not paid to the supplier, along with interest payable thereon under section 50, while furnishing the return in FORM GSTR-3B for the tax period immediately following the period of 180 days from the date of the issue of the invoice.

When supply is made without consideration: The value of supplies made without consideration as specified in Schedule I of the said Act shall be deemed to have been paid for the purposes of the second proviso to section 16(2). As per Rule 37(2), Where the said registered person subsequently makes the payment of the amount towards the value of such supply along with tax payable thereon to the supplier thereof, he shall be entitled to re-avail the input tax credit referred to in rule 37(1). |

(2) Re-Entitlement when payment is made subsequently: The recipient shall be entitled to avail of the credit of input tax on payment made by him of the amount towards the value of supply of goods or services or both along with tax payable thereon. In case part payment has been made, proportionate credit would be allowed.

| Related provisions as prescribed under Rule 37(4) of CGST Rules, 2017 |

| The time limit of availing credit as specified in section 16(4) shall not apply to a claim for re-availing of any credit, in accordance with the provisions of the Act or the provisions of this Chapter that had been reversed earlier. |

(3) Exceptions to the Limitation Period of 180 days: The condition of payment of value of supply plus tax within 180 days does not apply in the following cases:

(a) The supplies on which tax is payable under Reverse Charge.

(b) Deemed supplies without consideration.

(c) Additions made to the value of supplies on account of suppliers liability, in relation to such supplies, being incurred by the recipient of the supply.

The value of supply is deemed to have been paid, in situations given in (b) and (c) above.

8. No ITC if Depreciation is claimed on Tax Component [Section 16(3)]

Where the registered person has claimed depreciation on the tax component of the cost of capital goods and plant and machinery under the provisions of the Income-tax Act, 1961, the input tax credit on the said tax component shall not be allowed. It is clear that in respect of tax paid on such items, double benefit cannot be claimed under GST laws and Income-tax Act, 1961 simultaneously. Therefore, the assessee has the option to either claim depreciation on tax component of capital goods by capitalizing the capital goods inclusive of tax in the books of account or to claim ITC. A person is not allowed to take the dual benefit under two different laws simultaneously.

9. Time Limit for availing the Input Tax Credit [Section 16(4)]

The Finance Act, 2022 has amended section 16(4), w.e.f. 1-1-2022, to extend the period to take ITC. Pursuant to this amendment, a taxable person shall not be entitled to take ITC in respect of any invoice or debit note or supply of goods or services or both, after the 30th November following the end of the financial year to which such invoice or debit note pertains or furnishing of the relevant annual return, whichever is earlier.

In view of this, it can be concluded that the ITC on invoices which pertains to a particular financial year must be availed as per the following:

| Earlier of | 30th November of the next financial year |

| Date of filing Annual Return in FORM GSTR-9 under section 44 |

Additional points as regards the time limits for claiming ITC

The following additional points may be noted as regards the time limit for claiming ITC:

1. Relevant Date for Debit Note: After the amendment made by Finance Act, 2020 w.e.f. 1-1-2021, the date of issue of invoice relating to debit note is of no relevance for determining time limit to take ITC of GST charged on Debit Note.

2. No time limit for reclaiming ITC reversed due to non-payment within 180 days:

As per rule 37 the time limit specified in sub-section (4) of section 16 shall not apply to a claim for re-availing of any credit, which has been reversed earlier, in accordance with the provisions of the Act. Therefore, the amount so added to the output tax liability can again be re-claimed as ITC, once the payment is made. If part payment is made after the expiry of 180 days and after the ITC availed has been added to output liability, the proportionate ITC can be reclaimed without any limitation of time.

3. One Year from the date of Invoice in special cases:

The Section 18(2) provides that in special circumstances, like new registration or voluntary registration, the registered person shall not be entitled to take input tax credit under sub-section (1) in respect of any supply of goods or services or both to him after the expiry of one year from the date of issue of tax invoice relating to such supply. For Example: Subhash enterprises obtained voluntary registration on 31-8-2018. He had purchased inputs for furtherance of business invoice dated 14-8-2017. The input tax on the same was ` 30,000. Although Section 16(4) allows to claim ITC by 20th October 2018 (assuming annual return for the financial year 2017-18 is not yet filed), but if it is read together with section 18(2), the ITC cannot be claimed beyond 14-8-2018 i.e. one year from the date of invoice.

10. Apportionment of Input Tax Credit

As regards the apportionment of ITC, the provisions are contained in section 17 of CGST Act, 2017, which are as follows:

(1) Where goods or services are used partly for business purposes and partly for other purposes [Section 17(1)]

(2) Where goods or services are used partly for effecting taxable supply including zero rated supply and partly for exempted supply [Section 17(2)]

(3) Items included in exempted supplies [Section 17(3)

(4) Optional method for Banks for taking ITC [Section 17(4)]

(5) Blocked Credits [Section 17(5)]

The following rules under CGST Rules, 2017 prescribe the procedure for claiming ITC.

(1) ITC by a banking company or a financial institution [Rule 38]

(2) Manner of determination of ITC in respect of Inputs or input services and reversal [Rule 42]

(3) Manner of determination of ITC in respect of Capital Goods and Reversal [Rule 43]

The provisions have been discussed as under:—

10.1 Where goods or services are used partly for business purposes and partly for other purposes [Section 17(1)]

The registered person may use the input supplies either for business or non-business purposes. As per Section 17(1),

“Where the goods and/or services are used by the registered person partly for the purposes of any business and partly for other purposes, the amount of credit shall be restricted to so much of the input tax as is attributable to the purposes of his business.”

This means that no ITC will be available in respect of those inputs which are used for non-business purposes. For Example: Suman owns a Business entity and deals in textiles. She has purchased goods for the business, in respect of which ITC admissible is ` 42,500. If 15% of such goods have been used by her for personal purposes, then ITC will not be available in relation to such goods which are used for non-business purposes. Therefore, as per section 17(1), Suman shall be entitled to take credit of ` 36,125 (calculated as 85% of ` 42,500).

10.2 Where goods or services are used partly for effecting taxable supply including zero rated supply and partly for exempted supply [Section 17(2)]

When the goods are used for business purposes, they may either be used in effecting the following supplies:

(1) Taxable supplies, which includes zero-rated supplies or

(2) Exempted supplies (either under this Act or under IGST Act) or

(3) Partly taxable and partly exempted supplies.

As per Section 17(2),

“Where the goods or services or both are used by the registered person partly for effecting taxable supplies including zero-rated supplies under this Act or under the Integrated Goods and Services Tax Act and partly for effecting exempt supplies under the said Acts, the amount of credit shall be restricted to so much of the input tax as is attributable to the said taxable supplies including zero-rated supplies.”

In other words, the ITC shall be available only for that portion of Input tax which is attributable to the purposes of business of providing taxable supplies including zero-rated supplies.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA

I have purchased some goods from ABC and I have availed ITC on that Invoice, Now I will not pay any amount to ABC for that Invoice and I want to Keep invoice as credit, How long can I put this Invoice as credit and is there any effect in ITC,

The GST provisions provide reversal of ITC where the recipient fails to make payment of the value of supply along with tax payable thereon within 180 days from the date of issue of invoice by the supplier. Such amount shall be added to the output tax liability of the supplier along with the interest thereon. Therefore, you can keep this credit maximum up to the above timelines. Post the above period, you would be required to reverse the credit along with interest.