Form 26Q- TDS Return Filing for Non Salary Deductions, Deposit, Certificate

- Blog|Income Tax|

- 4 Min Read

- By Taxmann

- |

- Last Updated on 9 January, 2025

TDS on Payment other than Salary: Deduction, Deposit, Returns & Acknowledgment Certificate:

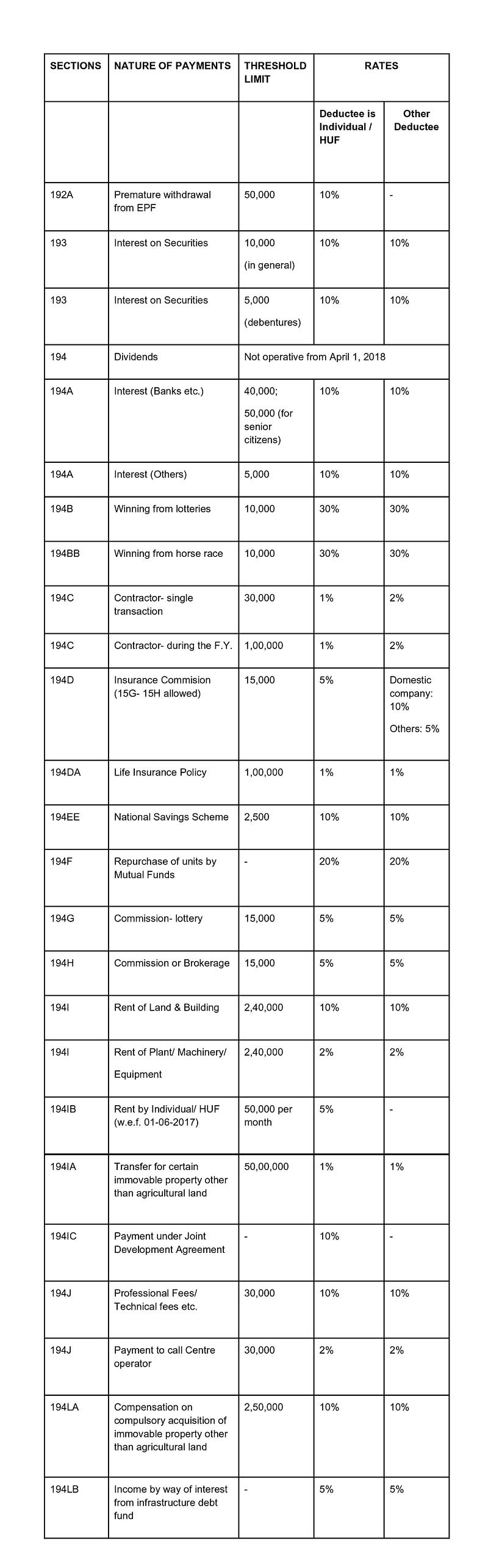

Taxpayers registered under the scheme of tax deduction are liable to deduct tax on the payments made at the prescribed rate on crossing the threshold limit defined by the particular sections of the Income Tax Act, 1961 (Refer table given below). When such deductions are made other than on the salary payments, a statement of return is required to be filed in FORM NO. 26Q. For TDS on salary, return is filed in FORM NO. 24Q.

Rate Chart for Non-salary deductions for which TDS return is filed in FORM NO. 26Q for the AY 2020-21:

Deduction of Tax at lower rate:

If the deductee has obtained the certificate of lower deduction under section 197 of the Income Tax Act, 1961, then while making payments to such person, TDS shall be deducted at the rate specified in the certificate and the same shall be reflected while filing return of TDS for non- salary payments in form no. 26Q.

How to deposit tax deducted while making non-salary payments?

Once the deductions have been made while making the payments, it is necessary to deposit the amount so deducted to the credit of government exchequer. TDS shall be deposited by way of challan ITNS 281. It can be filled online on the website of TIN.

When is the due date for deposit of TDS for non-salary payments?

The due dates for deposit of TDS by non-government deductors on non-salary payments for the AY 2020-21 are tabulated below:

|

S.NO |

PARTICULARS |

DUE DATE |

|

1 |

For the month of April- Feb |

7th of next month |

|

2 |

For the month of March |

April 30, 2020 |

The due dates for deposit of TDS by government deductors on non-salary payments for the AY 2020-21 are tabulated below:

|

S.NO |

PARTICULARS |

DUE DATE |

|

1 |

Without challan |

Same day |

|

2 |

With challan |

7th of next month |

Filing of return of TDS on non-salary payments:

A statement of return in Form No. 26Q reflecting the details of payments made for all the sections covered in the above table and the TDS deducted on such payments has to be filed for every quarter as per the TDS return filing procedure, the due dates for which are tabulated below.

TDS Return Due Date for AY 2020-21:

|

QUARTER |

QUARTER PERIOD |

DUE DATE |

|

1st Quarter |

1st April to 30th June |

31st July 2019 |

|

2nd Quarter |

1st July to 30th September |

31st October 2019 |

|

3rd Quarter |

1st October to 31st December |

31st January 2020 |

|

4th Quarter |

1st January to 31st March |

31st May 2020 |

Preparation of Return FORM NO. 26Q:

Return can be prepared online by using NSDL e-Gov e-TDS/TCS Return Preparation Utility (RPU) that can be downloaded free of cost from the website of TIN. Prepared return has to be submitted to any of the TIN-FCs established by NSDL e-Gov.

Status of TDS return Filed:

Status of statement of TDS return filed by the taxpayer can be checked online using the TAN and the Provisional receipt number/ Token number on the website of NSDL.

Interest attached with non-salary TDS:

|

Particulars |

Interest Rate |

|

If not DEDUCTED |

1% per month or part of the month from due date of deduction to actual date of deduction |

|

If not DEPOSITED |

1.5% per month or part of the month from the actual date of deduction to the actual date of payment |

Penalty attached with Form 26Q/non-salary TDS return:

|

Section |

Minimum penalty |

Maximum Penalty |

|

Late filing of 26Q (Penalty u/s 234E) |

@200 per day until filing of return |

Maximum penalty can be equal to the amount of TDS deducted |

|

Non- filing of 26Q Penalty u/s 271H* |

10,000/- |

1,00,000/- |

* No penalty will be charged under 271H if following conditions are fulfilled –

-

- TDS is deposited to the government

- Late filing fees and interest (if any) is also deposited

- Return is filed before expiry of 1 year from due date

Other Related Forms:

1. FORM NO. 16A – Quarterly TDS certificate:

For the purpose of deduction of tax on the income other than salary income, TDS certificate Form- 16A is issued by person making the payment (i.e. deductor) to the deductee as an acknowledgement of the fact that the tax has been deducted at the source and has been deposited to the credit of government treasury. Content of Form no. 16A includes:

-

- Name, PAN & TAN of Deductor of Tax

- Name, PAN of Deductee of Tax

- Payment date and amount

- Nature of payment

- Receipt number of TDS statement

The above details as mentioned in Form 16A are required to be furnished at the time of filing of returns. Form 16A should be issued within 15 days from the due date for furnishing the statement of TDS.

Due dates for issue of Form No. 16A for the AY 2020-21:

|

QUARTER |

QUARTER PERIOD |

DUE DATE |

|

1st Quarter |

1st April to 30th June |

15th August 2019 |

|

2nd Quarter |

1st July to 30th September |

15th November 2019 |

|

3rd Quarter |

1st October to 31st December |

15th February 2020 |

|

4th Quarter |

1st January to 31st March |

15th June 2020 |

FORM No. 27A – Control Chart:

Along with the TDS return in Form 26Q, a separate statement is required to be filed by the tax deductor/ collector in form no 27A for each quarter. It is a summary of TDS/TCS returns which requires the control totals of:

-

- No. of deductee/ Party record

- Amount paid

- Income tax deducted/ collected at source

- Tax deposited as per the challan

Dive Deeper:

All You Need To Know About Income Tax Form 16

Form 27Q: TDS Return in Case of Payments to NRI

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA

Comments are closed.