Cost of Capital – Different Types and How to Calculate it?

- Blog|Company Law|

- 34 Min Read

- By Taxmann

- |

- Last Updated on 12 October, 2022

Table of Contents

2. Factors Affecting Cost of Capital

4. Measurement of Cost of Capital

5. Cost of Long-term Debts and Bonds

6. Cost of Preference Share Capital

7. Cost of Equity Share Capital

9. Weighted Average Cost of Capital

Check out Fundamentals of Financial Management | CBCS which discuss the fundamental concepts, procedures, and practices of Financial Management. The subject matter is presented simply, systematically, and comprehensively. The student-oriented book features MCQs, graded illustrations & theoretical questions as well.

“Every profit seeking corporation has its own risk-return characteristics. Each group of investors in the corporation—bond holders, preferred stock holders, and common stock holders—requires a minimum rate of return commensurate with the risks it accepts by investing in the firm. From the standpoint of the corporation, these groups provide the capital needed to finance the firm’s investments. The minimum rate of return that the corporation must earn in order to satisfy the overall rate of return required by its investors is called the corporation’s cost of capital1.”1

The concept of cost of capital is an important and fundamental concept of theory of financial management. In particular, the concept of cost of capital has two applications. First, in capital budgeting it is used to discount the future cash flows to obtain their present values, and second, it is also used in optimization of the financial plan or capital structure of a firm. The second aspect of the concept of cost of capital will be taken up in Chapter 8. In the present chapter, an attempt has been made towards the determination and measurement of this discount rate i.e., the cost of capital besides analyzing other related aspects.

1. Concept of Cost of Capital

A firm needs funds for various capital budgeting proposals. These funds can be procured from different types of investors i.e., equity shareholders, preference shareholders, debt holders, depositors etc. These investors while providing the funds to the firm will have an expectation of receiving a minimum return from the firm. The minimum return expected by the investors depends upon the risk perception of the investor as well as on the risk-return characteristics of the firm. Therefore, in order to procure funds, the firm must pay this return to the investors. Obviously, this return payable to investors would be earned out of the revenues generated by the proposal wherein the funds are being used. So, the proposal must earn at least that much, which is sufficient to pay to the investors of the firm. This return payable to investor is therefore, the minimum return the proposal must earn otherwise, the firm need not take up the proposal.

The minimum rate of return that a firm must earn in order to satisfy the expectations of its investor is the cost of capital of the firm.

1.1 Importance and Significance of Cost of Capital

The importance and significance of the concept of cost of capital can be stated in terms of the contribution it makes towards the achievement of the objective of maximization of the wealth of the shareholders. If a firm’s actual rate of return exceeds its cost of capital and if this return is earned without of course, increasing the risk characteristics of the firm, then the wealth maximization goal will be achieved. The reason for this is obvious. If the firm’s return is more than its cost of capital, then the investor will no doubt be receiving their expected rate of return from the firm. The excess portion of the return will however be available to the firm and can be used in several ways e.g.,

(i) for distribution among the shareholders in the form of higher than expected dividends, and

(ii) for reinvestment within the firm for increasing further the subsequent returns.

In both the cases, the market price of the share of the firm will tend to increase and consequently will result in increase in the shareholders wealth.

Moreover, the cost of capital when used as a discount rate in capital budgeting, helps accepting only those proposals whose rate of return is more than the cost of capital of the firm and hence results in increasing the value of the firm. Further, the cost of capital has a useful role to play in deciding the financial plan or capital structure of the firm. It may be noted that in order to maximize the value of the firm, the cost of all the different sources of funds must be minimized. The cost of capital of different sources usually varied and the firm will like to have a combination of these sources in such a way so as to minimize the overall cost of capital of the firm. This aspect has been discussed in detail in Chapter 8.

2. Factors Affecting the Cost of Capital

The cost of capital is the minimum expected rate of return of the investors or suppliers of funds to the firm. The expected rate of return depends upon the risk characteristics of the firm, risk perception of the investors and a host of other factors. Following are some of the factors which are relevant for the determination of cost of capital of the firm.

1. Risk-free Interest Rate: The risk free interest rate, If, is the interest rate on the risk free and default-free securities. For example, the securities issued by the Government of India are taken as risk free and default free in respect of payment of periodic interest as well as principal repayment on maturity. Theoretically speaking, the risk free interest rate, If, depends upon the supply and demand consideration in financial market for long term funds. The market sources of demand and supply determines the If, which is consisting of two components :

(a) Real Interest Rate: The real interest rate is the interest rate payable to the lender for supplying the funds or in other words, for surrendering the funds for a particular period.

(b) Purchasing Power Risk Premium: When a lender lends money, he in fact lends his present purchasing power in favour of the other party i.e., borrower. After sometimes, when the lender gets the repayment, he recovers the same face value money. But if the prices have increased during the same period, then he is not getting back the same purchasing power which he lent. Investors, in general, like to maintain their purchasing power and therefore, like to be compensated for the loss in purchasing power over the period of lending or supply of funds. So, over and above the real interest rate, the purchasing power risk premium is added to find out the risk-free interest rate. Higher the expected rate of inflation, greater would be the purchasing power risk premium and consequently higher would be the risk free interest rate, IRF.

2. Business Risk: Another factor affecting the cost of capital is the risk associated with the firm’s promise to pay interest and dividends to its investors. The business risk is related to the response of the firm’s Earnings Before Interest and Taxes, EBIT, to change in sales revenue. Every project has its effect on the business risk of the firm. If a firm accepts a proposal which is more risky than average present risk, the investor will probably raise the cost of funds so as to be compensated for the increased risk. This premium added for the business risk compensation is also known as business risk premium. There would obviously be a point at which the investor will not like to supply the funds regardless of the return, the firm would be ready to pay.

3. Financial Risk: The financial risk is an other type of risk which can affect the cost of capital of the firm. The particular composition and mixing of different sources of finance, known as the financial plan or the capital structure, can affect the return available to the investors. The financial risk is often defined as the likelihood that the firm would not be able to meet its fixed financial charges. It is related to the response of the firm’s earning per share to a variation in EBIT. The financial risk is affected by the capital structure or the financial plan of the firm. Higher the proportion of fixed cost securities in the overall capital structure, greater would be the financial risk. The investor in such a case require to be compensated for this increased risk. They add financial risk premium over and above the business risk premium.

4. Other Considerations: The investors may also like to add a premium with reference to other factors. One such factor may be the liquidity or marketability of the investment. Higher the liquidity available with an investment, lower would be the premium demanded by the investor. If the investment is not easily marketable, then the investors may add a premium for this also and consequently demand a higher rate of return.

In view of the above, the cost of capital may be defined as

![]() (5.1)

(5.1)

where, k = Cost of capital of different sources.

IRF = Risk free interest rate.

b = Business risk premium, and

f = Financial risk premium.

Equation 5.1 indicates that the cost of capital of a particular source of finance depends upon the risk free cost of capital of that type of funds, the business risk premium and the financial risk premium.

If a firm wants to raise funds by the issue of security then it must offer a return in the form of interest or redemption premium or expected dividends to the investors. Now, the investor before making a decision to invest the funds in the firm will compare the returns offered by the firm with the returns he can get elsewhere. In other words, the investor will be ready to supply the funds only if the firm offers a return which is at least equal to the opportunity cost of the investor. The opportunity cost of the investor may be defined as the return foregone by the investor on the alternative investment opportunity of the same or comparable risk. So, the cost of capital of the firm may be defined as the opportunity cost of the suppliers of funds i.e., the investors.

The opportunity cost of the investors depends upon the nature and type of security being offered by the firm. Every investor has a risk perception regarding the risk inherent in different types of investment. As the risk increases, an investor may be ready to supply the funds only if sufficiently compensated for the risk. That is why the opportunity cost of the investor is not the same for different types of securities. Therefore, the cost of capital of the firm is not same for different types of securities. The firm has to offer different returns to the investors depending upon the risk of the security.

3. Types of cost of capital

3.1 Specific and Overall Cost of Capital

At a particular point of time, the firm might have raised funds from various sources i.e., short term as well as long term. Conceptually, the cost of capital as a measure represents the combined cost of total funds being used by the firms. However, the short term sources of funds are kept outside the calculation of cost of capital as these short term sources e.g. bank credit, trade credit, bill etc., are generally considered to be temporary in nature and are subject to repayment in the short run. Therefore, the cost of capital of a firm is calculated as the combined cost of long term sources of funds.

Moreover, all these long term sources have their own specific costs. The combined cost of capital depends upon these specific costs. The combined cost of capital is in fact, known as the overall cost of capital of the firm, while the specific costs are known as the specific cost of capital of a particular source. The long term sources of funds can be broadly categorized into

(i) long term debt and loans,

(ii) preference share capital

(iii) equity share capital, and

(iv) the retained earnings.

The firm has a specific cost of capital for each of these sources and on the basis of these specific cost of capital, the overall cost of capital of the firm can be determined.

Normally, the capital funds come from a pool of different sources, none of the elements of which can or should be specifically identified with the particular proposals under review. Instead, any use of capital funds should reflect a firm’s overall cost of capital. The capital expenditures are backed by the long term capital structure of a company, which may include different degrees of leverage. Thus, an overall cost of capital is an important criterion in the capital budgeting evaluation procedure. In the following discussion, an attempt has been made first, to measure the specific cost of capital of each source and second, how these specific costs of capital can be combined to produce a measure of overall cost of capital of the firm.

3.2 Explicit and Implicit Cost of Capital

The cost of capital of a firm can be analyzed as explicit cost and implicit cost of capital. The explicit cost of capital of a particular source may be defined in terms of the interest or dividend that the firm has to pay to the suppliers of funds. There is an explicit flow of return payable by the firm to the supplier of fund. For example, the firm has to pay interest on capital, dividend at fixed rate on preference share capital and also some expected dividend on equity shares. These payments refer to the explicit cost of capital.

However, there is one source of funds which does not involve any payment or flow i.e., the retained earnings of the firm. The profits earned by the firm but not distributed among the equity shareholders are ploughed back and reinvested within the firm. These profits gradually result in a substantial source of funds to the firm. Had these profits been distributed to equity shareholders, they could have invested these funds (return for them) elsewhere and would have earned some return. This return is foregone by the investors when the profits are ploughed back. Therefore, the firm has an implicit cost of these retained earnings and this implicit cost is the opportunity cost of investors. Thus, the implicit cost of retained earnings is the return which could have been earned by the investor, had the profit been distributed to them.

Except the retained earnings, all other sources of funds have explicit cost of capital. How to determine or measure the cost of capital ? This is discussed in the following section.

4. Measurement of Cost of Capital

The measurement of cost of capital refers to the process of determining the cost of funds to the firm. Once the cost has been determined, it is in the light of this cost that the capital budgeting proposal will be evaluated.

Just as the firm should carefully estimate the relevant cash flows associated with a proposal, it should also carefully estimate the cost of capital. If there is a mistake in the determination of the cost of capital, then the investment decision as well as other decisions may be taken wrongly and thus ultimately affecting the profitability and survival of the firm.

Thus, utmost care must be taken in the measurement of cost of capital, otherwise, unacceptable proposals might be selected and acceptable proposals might get rejection. Further, although the cost of capital is measured at a given point of time, it must reflect the cost of funds over the long run because the cost of capital is used in capital budgeting involving expenditures providing benefits in the long run.

4.1 Underlying Assumptions

The measurement of cost of capital is based on the following assumptions :

(a) The basic assumption of the cost of capital concept is that the business risk of the firm is unaffected by the proposal being evaluated at the cost of capital. The implication of this assumption is that every firm has a particular level of business risk as determined by the present composition of its fixed and variable costs.

(b) Another assumption required to be made is that the financial risk of the firm remains unchanged, whether a proposal is accepted or not. The financial risk of the firm depends upon the degree of debt financing in the overall capital structure of the firm and this assumption implies that the same degree of debt financing will be maintained.

4.2 Taxes and Cost of Capital

It is already discussed in Chapter 3 that the cash flows relevant for capital budgeting decisions are taken on an after-tax basis. These cash flows are then discounted at the cost of capital to find out their present value. It should be noted that this cost of capital which is used to discount the cash flows (after-tax) should also be after-tax only. If the firm is using IRR technique, then the cut-off rate should also be taken on an after-tax basis. This ensures consistency in the evaluation procedure. As discussed in the following sections, it is only the debt financing for which the tax adjustment to cost of capital is required. The reason being that interest on bonds and debentures is tax deductible. The other sources i.e., the preference share capital and the equity share capital do not require such tax adjustment.

In the following discussion, the calculation of specific cost of capital for different sources has been taken up first, followed by calculation of Weighted Average Cost of Capital, WACC.

5. Cost of Long-term debt and Bonds

The cost of debts, bonds and debenture measures the current cost to the firm of borrowing funds to finance the projects. In general, it is determined by the following variables :

(a) The current level of interest rates. As the level of interest rates increases, the cost of debt for the firm will also increase,

(b) The default risk of the firm. As the default risk of the firm increases the cost of bonds and debentures will also increase.

(c) The tax advantages associated with the debt. Since, the interest is tax deductible, the after-tax cost of debt is a function of tax rate. The tax benefit that accrues from paying interest makes the after tax cost of debt lower than the pre-tax cost.

The cost of capital for debt may be defined as the returns expected by the potential investors of debt securities of the firm. In order to find out the cost of capital of debts, the following information is required :

(i) Net Proceeds from the Issue: This refers to the net cash inflow at the time of issue of debt. This can be calculated as :

![]()

where, B₀ = Net Proceeds

FV = Face Value of Debt

Pₘ = Premium charged on the issue of debt.

D = Discount allowed at the time of issue of debt, and

F = Flotation cost i.e., the cost of raising funds including underwriting, brokerage and issue expenses.

For example, a debenture having a face value of ` 100 is issued at a discount of 5% and total issue of expenses are estimated at 5%, the net proceed i.e., B0 = ` 100 – ` 5 – ` 5 = ` 90. In case, the debenture is issued at a premium of 10%, then B0 = ` 110 – ` 5.50 = ` 104.50 (note that the flotation cost has been calculated at face value or the issue price whichever is higher).

(ii) Periodic Payments of Interest: In most of the cases, (except in case of issue of Zero Interest Fully Convertible Debentures), the firm has to pay interest on debt instruments. To simplify the calculation of cost of debt, the interest amount is assumed to be payable annually. It may be noted that interest on debt is always payable on the face value irrespective of the issue price. For example, if the company issues 15% debentures, then the annual interest charge will be ` 15, irrespective of the fact whether the net proceeds, B0, was ` 100 or more or even less.

(iii) Maturity Payment: The principal amount of the debt instrument or loan (i.e., the balancing figure after amortization, if any) will be payable by the firm on the maturity date. This may be paid together with the interest for the last year.

On the basis of the above information, the cost of capital for debt can now be ascertained as follows :

(i) Cost of Capital of Perpetual Debt: The cost of capital of perpetual debt (i.e., debt availed by the firm on a regular basis) may be ascertained as follows :

![]() (5.2)

(5.2)

where, kᵢ = Cost of Capital of Debt (before tax)

I = Annual Interest Payable

B₀ = Net Proceeds

t = Rate of Tax

A few points are worth noting in Equation 5.2.

-

-

- Equation 5.2 calculates the cost of capital of debt after tax.

- The repayments (periodic amortization or maturity repayment) have not been considered as the debt is taken as perpetual. It may be noted that the concept of perpetual debt is theoretical in nature, otherwise debt, being a type of a loan is always repayable.

-

Tax Adjustment: An important aspect of cost of debt is the tax effect. As the interest on debt is tax deductible, the firm gets a saving in its tax liability. The interest works as a tax-shield and the tax liability of the firm is reduced. The net cost of interest to the firm (at least for those with sufficient profits that are liable for taxes) is the annual interest multiplied by a factor of (1 – tax rate).

(ii) Cost of Capital of Redeemable Debt: The cost of capital of redeemable debt may be ascertained with the help of Equation 5.3.

![]() (5.3)

(5.3)

where, I = Annual Interest Payment

B₀ = Net Proceeds

COPᵢ = Regular Cash Outflow on account of amortization

COPₙ = Cash Outflow on account of repayment at maturity

kₔ = After tax cost of capital of debt.

In case, the debt is repayable only at the time of maturity and there is no annual amortization then Equation 5.3 will not contain the second element i.e., COPi/(1 + kd)i. Equation 5.3 is to be solved for the value of kd, which will be after tax cost of capital for debt. This equation is to be solved by trial and error procedure (as the IRR equation was solved in Chapter 4).

Example 1

ABC Ltd. issues 12.5% debentures of face value of ` 100 each, redeemable at the end of 7 years. The debentures are issued at a discount of 5% and the flotation cost is estimated to be 1%. Find out the cost of capital of debentures given that the firm has 40% tax rate.

Solution :

For the given situation :

B₀ = ` 100 – ` 5 – ` l = ` 94.

I = ` 12.5 (1 – .4) = 7.50

Putting these values in Equation 5.3

94 = 9.50 (PVAF(r,n)) + 100(PVF(r,n))

The value of right hand side of the equation is to be made equal to the amount of ` 94 and can be derived by trial and error procedure as follows :

at kₔ = 9% = 7.50(5.033) + 100(.547)

= 37.75 + 54.70 = 92.45

Since the amount is less than ` 94, the rate of discount may be reduced to 8%, and

at kₔ = 8% = 7.5(5.206) + 100(.583)

= 39.05 + 58.30 = 97.35

By interpolating between 8% and 9%, the value of kd comes to 8.68%. So, the cost of capital (after tax) of debenture is 8.68%.

In order to avoid the cumbersome procedure of trial and error to find out the value of kd in Equation 5.3, Equation 5.4 may be used to give an approximation to after tax cost of capital of debt.

![]() (5.4)

(5.4)

where, RV = Redemption Value of debenture

kₔ = After Tax Cost of Debt

t = Tax rate

N = Life of debenture

Now, applying Equation 5.4 for Example 1,

![]()

= .861 or 8.61%.

So, the value of kd as given by Equation 5.4 provides an approximation to kd. The exact value of kd can however, be calculated only with the help of Equation 5.3. Moreover, Equation 5.4 can be used only when the debenture is to be redeemed at maturity.

| Note: Under the provisions of the Income-tax Act, 1961, the discount on issue of debentures or premium payable on redemption of debentures is deducted out of the taxable income of the company on proportionate basis over the life of the debentures. Hence, this tax deductibility provides a tax shield to the company. In the strict sense, this tax shield should be treated as a cash inflow for different years and be incorporated in the process of calculation of cost of capital of debentures. However, the present value of the annual tax shield of discount on issue and premium on redemption has been ignored for the sake of simplicity. |

Example 2

ABC Ltd. issues 15% debentures of face value of ` 1000 each at a flotation cost of ` 50 per debenture. Find out the cost of capital of the debenture which is to be redeemed in 5 annual instalments of ` 200 each starting from the end of year 1. The tax rate is 30%.

Solution :

For the given situation the net proceeds i.e., B0 is ` 1000 – 50 = ` 950. As the debenture is to be amortized in 5 instalments of ` 200 per year, the interest @ 15% will be payable only on the reduced balances as follows :

| Year-end | Interest | Repayment | After tax Cash Flow |

| 1 | ` 150 | ` 200 | ` 200 + 105 = ` 305 |

| 2 | 120 | 200 | 200 + 84 = 284 |

| 3 | 90 | 200 | 200 + 63 = 263 |

| 4 | 60 | 200 | 200 + 42 = 242 |

| 5 | 30 | 200 | 200 + 21 = 221 |

These after tax cash flows may be discounted at an appropriate rate, say, 12% and 13%, to be made equal to ` 900

i.e.

![]()

at kₔ = 12%, the right hand side of the equation gives a value of ` 965.18.

at kₔ = 13%, the right hand side of the equation gives a value of ` 943.91.

By interpolation between 12% and 13%, value of kd comes to 12.71%.

The above discussion shows that the cost of capital of debt, kd, increases as the net proceeds from the debt issue decreases because the investors have paid less to get the interest payment and the principal repayment. In Example 2, by paying ` 950 only and getting that ` 1,000, the investors have a capital gain which accrues to them proportionately every year. The rate of interest on the debenture is 15% and therefore, the after tax cost of debt should be 10.5% only. However, due to net proceeds of ` 950, the cost of debt (after tax) comes to about 12.71%. It is important to note that the adjustment in kd occurs through the change in issue price. As the investors demand a higher return for the debt security, they will be willing to pay a lessor price for the security for any given set of interest and repayment terms.

6. Cost of Preference Share Capital

Companies can raise funds by the issue of preference share capital also. The preference share capital is differentiated from equity share capital on account of two basic features, namely :

(i) the preference shares are entitled to receive dividends at fixed rate in priority over the equity shares, and

(ii) in case of liquidation of the company, the preference shareholders will get the capital repayment in priority over the distribution among the equity shareholders.

It may be noted that there is no obligation on the firm to compulsorily pay the preference dividend as the preference dividend is payable only when the sufficient profit are there and the company wants to pay dividends to equity shareholders also. The preference dividend is payable as an appropriation of profit unlike interest on debentures which is a charge against profits.

The fixed rate of dividend on preference shares is the starting point for calculation of cost of capital of preference share capital. Conceptually, the preference shares may either be redeemable or irredeemable, the cost of capital may also be ascertained accordingly.

6.1 Cost of Capital of Redeemable Preference Shares

If the preference shares are redeemable at the end of a specific period, then the cost of capital of preference shares can be calculated by Equation 5.5 (which is very similar to Equation 5.3).

![]() (5.5)

(5.5)

where, P₀ = Net proceeds on issue of preference shares

Pₔ = Annual preference dividend at fixed rate of dividend

RV = Amount payable at the time of redemption

kₚ = Cost of preference share capital, and

n = Redemption period of preference shares.

Equation 5.5 is to be solved by the trial and error procedure to find out the value of kp. In Equation 5.5, neither the kp nor PD require any tax adjustment as the preference dividend is payable out of profit after tax and consequently there is no tax shield to the company.

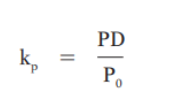

6.2 Cost of Capital of Irredeemable Preference Shares

In case of irredeemable preference shares, the dividend at the fixed rate will be payable to the preference shareholder perpetually. The cost of capital of the irredeemable preference shares can be calculated with the help of Equation 5.6.

(5.6)

(5.6)

where, PD = Annual preference dividend

P₀ = Net proceeds on issue of preference shares

kₚ = Cost of capital of preference shares.

| It may be noted that in India, no company can issue irredeemable preference shares after 1988 (Section 55 of the Companies Act, 2013). |

Example 3

ABC Ltd. issues 15% Preference shares of the face value of ` 100 each at a flotation cost of 4%. Find out the cost of capital of preference share if (i) the preference shares are irredeemable, and (ii) if the preference shares are redeemable after 10 years at a premium of 10%.

Solution :

If the preference shares are irredeemable then the cost of capital is :

![]()

If the preference shares are redeemable then the cost of capital, kp, may be calculated by solving the following equation :

![]()

At kₚ = 16%, the right hand side of the equation may be written as :

= 15(PVAF(16%,10)) + 110(PVF(16%,10))

= 15(4.833) + 110(.227)

= ` 97.46

As the value is more than ` 96, the rate of discount may be increased to 17%.

At kₚ = 17%, the right hand side of the equation may be written as :

= 15(PVAF(17%,10)) + 110(PVF(17%,10))

= 15(4.659) + 110(.208)

= ` 92.76.

By interpolating between 16% and 17% the value of kₚ comes to 16.31% as follows :

![]()

It may be noted that the cost of capital of preference share, kp, is higher i.e., 16.31% when it is redeemable after 10 years at 10% premium. The reason for this is the premium payable at the time of redemption. In the same case, if the premium is not payable at the time of redemption and the preference share is redeemable, instead, at ` 96 only, then the cost of capital will be as follows :

At kₚ = 16%, the right hand side of the equation may be written as :

= 15(PVAF(16%,10)) + 96(PVF(16%,10))

= 15(4.833) + 96(.227) = ` 94.27

As the value is less than ` 96, the rate of discount may be decreased to 15%.

At kₚ = 15%, the right hand side of the equation may be written as :

= 15(PVAF(15%,10)) + 96(PVF(15%,10))

= 15(5.019) + 96(.247) = ` 98.99

By interpolating between 15% and 16% the value of kₚ comes to 15.63%.

So, the cost of capital is same at 15.63% as it was when the preference shares were treated as irredeemable. However, if the preference shares are redeemable at par i.e., ` 100, then kₚ comes to 15.83%. This increase in cost of capital from 15.63% to 15.83% arises because of premium of ` 4 payable at the time of redemption. This premium is a gain to shareholders but reflect a cost to the company as indicated by the increase in cost of capital.

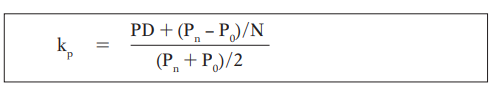

Approximation to kₚ: An approximation to kₚ can be quickly obtained by using the following formulation :

In case the preference share is issued at a net proceed of ` 96 and is redeemable at par at the end of year 10, then

![]()

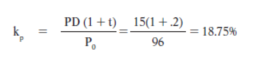

| Note: The calculation of kp as presented in Equation 5.5 is a standard model in financial management. This, however, may be adjusted in the light of the relevant tax provisions. In India, till 2020-21, the company paying preference dividend, had to pay a Dividend Distribution Tax. Say, a company declares preference dividend of ` 2 per share and the rate of Dividend Distribution Tax is 20%, then the company has to pay 40 paise tax to the government, and therefore the total cash outflow of the company would be ` 2.40. So, in Equations 5.5 and 5.6, the term PD may be accordingly adjusted to incorporate the effect of Dividend Distribution Tax. |

In Example 3, Preference Dividend (PD) has been taken as ` 15. If the Corporate Dividend tax is taken @ 20%, then the value of PD would be taken as 15 (1+.2) = ` 18, and kp would be:

It may be noted that due to the payment of Dividend Distribution Tax, the kp has increased from 15.63% to 18.75%. Similarly, if the preference shares are redeemable, then the value of PD will be increased from ` 15 to ` 18, and the kp can be calculated accordingly.

Also Read: Guide to Capital Structure

7. Cost of Equity Share Capital

The measurement of cost of capital of equity share capital is the most typical and conceptually a difficult exercise. The reason being that there is no fixed rate of dividend in case of equity shares. Further, there is no commitment to pay equity dividend and it is the sole discretion of the Board of Directors to pay or not to pay dividend or to decide at what rate the dividend be paid to the equity shareholders.

Calculation of cost of equity share capital can be taken up in two different ways:

(a) Based on Expected dividends, and

(b) Based on Risk Perception of investors.

7.1 Cost of Equity Share Capital based on Expected dividends:

The potential investors of equity share capital must estimate the expected stream of dividend from the firm. This stream of dividends may then be discounted to get the present value of such stream. The rate of discount at which the expected dividends are discounted to determine their present value is known as the cost of equity share capital.

Theoretically speaking, the present market value of a share is a function of the returns expected by the shareholders and the risk associated with the share. This is based on the premise that the market price of a share is equal to the present value of all expected future dividends on the share plus the sale proceeds realized when the share is sold. This is represented in Equation 5.7.

where, P₀ = Current Market Price of Equity Share Pₙ = Share market price after year n Dᵢ = Dividends receivable over different years kₑ = Required rate of return of the shareholder or cost of equity share capital. |

In Equation 5.7 and the subsequent discussion, it has been assumed that equity dividends are payable only annually. Equation 5.7 does not seem to be practical one as it requires to ascertain the market price at the end of year n, when the share is eventually sold. However, the share price at year ‘n’ is itself the present value of all the future expected dividends plus the subsequent sale proceeds. The sale of a share and the selling price thereof can be seen as merely transferring the right of future dividends for a price. The share price, therefore at any time can be taken as the present value of all the future expected dividends infinitely. Thus, Equation 5.7 may be modified to write as Equation 5.8.

![]() (5.8)

(5.8)

In Equation 5.8, the value of ke is the cost of equity share capital i.e., the discount rate which will equate the discounted value of all future expected dividends with the present market value of the share. Now, the estimation of future expected dividends is the most important input required for calculation of ke. The other variable i.e., the current market price, P0, can be easily known from the stock market data. There can be different assumptions regarding the expected behaviour of future dividends and under each of such assumption, the value of ke, can be ascertained. These assumptions and the calculation of ke have been taken up as follows :

(i) Zero-Growth Dividends: It may be assumed that dividends will remain constant and pegged at the current level for the assumed perpetual life of the firm. In such a case, the dividend stream is treated as a perpetuity of dividends and the cost of equity share capital, ke can be ascertained with the help of Equation 5.9.

![]() (5.9)

(5.9)

where, ke = Cost of equity share capital

D₁ = Expected dividend at the end of year 1

P₀= Current market price of the share.

Impliedly, zero growth dividend means that the firm is following policy of 100% dividend pay out ratio and no profits are retained by the firm. Under such a situation, the D1 will be equal to EPS1 of the firm. In other words, when earnings are constant and the dividend pay out ratio is 100%, then

E1 = E2 = E3 ———- E, and

D1 = D2 = D3 ———- D and therefore, E = D.

On the basis of Equation 5.9, and E = D,

![]()

It may be noted on the basis of this equation that ke = 1(P0/E1) and therefore, ke may also be defined as inverse of the PE ratio.

(ii) Constant Growth Rate in Dividends perpetually: Dividends may be assumed to grow at a constant rate, say, ‘g’ per cent per annum. In such a case, the dividend payment in year n can be expressed as :

![]()

and the present market price of the share can be shown as in Equation 5.10

![]() (5.10)

(5.10)

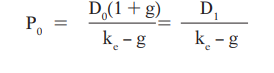

The only condition before applying Equation 5.10 is that ke > g. Note that in Equation 5.10, the dividend amount will get larger and larger as the time passes because of the growth factor, g. This is clearly different from the debts, preference share capital and the zero growth dividend streams. Mathematically, Equation 5.10 can be further simplified and written as Equation 5.11.

(5.11)

(5.11)

or, ![]() (5.12)

(5.12)

Equation 5.12 can be interpreted as that the cost of equity share capital ke is the present dividend yield plus the growth rate, g.

Equation 5.12 tells that ke has two components. The first, D1/P0 is called the dividend yield. This is calculated as the expected cash dividend divided by the current price, so, it is similar to current yield on a bond. The second part is the growth rate, g, which refers to capital gains yield.

Example 4

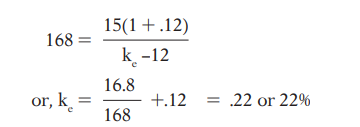

ABC Ltd. has just declared and paid a dividend at the rate 15% on the equity share of ` 100 each. The expected future growth rate in dividends is 12%. Find out the cost of capital of equity shares given that the present market value of the share is ` 168.

Solution :

The cost of equity capital in the case may be ascertained by using the Equation 5.11.

![]()

The formulations given in Equations 5.11 and 5.12 are subject to the following assumptions:

-

- That the current market price of the share is a function of future expected dividends.

- D0is > 0, i.e., the present dividend is positive.

- The dividend pay out ratio is constant.

(iii) Varying Growth Rate in Dividends: Dividends may also be assumed to grow at different rates for different years. For example, for first 5 years the growth rate may be 10% per annum, then for the next 5 years the growth rate may be 15% per annum and thereafter the dividends may grow at 20% per annum infinitely. This means that the dividend will grow at 10% per annum, for years 1 to 5, and at 15% for years 6 to 10 and at 20% for the year 11 and thereafter. Equation 5.10 can be modified to take care of such situations of dividend stream and the cost of capital may therefore be calculated with the help of Equation 5.13.

![]() (5.13)

(5.13)

where, P₀ = Current market price of the equity share

D₀ = Dividend just paid by the company

D₅ = Dividend payable at the end of year 5

D₁₀ = Dividend payable at the end of year 10

g1, g2 and g3 = Different growth rates, and

ke = Cost of equity share capital.

Equation 5.13 can be solved by trial and error procedure to find out the value of kₑ.

| Note: Calculation of ke as per Equations 5.7 to 5.13, is a standard formulation in financial management. This however, may be adjusted in the light of relevant tax laws. In India, till 2020-21, Equity Dividend was subject to Dividend Distribution Tax. For example, a company declares a dividend of ` 5 on equity shares, then it has to pay Dividend Distribution tax to the government. In the above equations, the term D1 may be replaced by D1 (1 + t) where ‘t’ is the Dividend Distribution Tax Rate. |

In Example 4, the value of ke may be calculated with Dividend Distribution Tax as follows :

![]()

It may be observed that the ke has increased from 22% to 24% as a result of inclusion of Dividend Distribution Tax.

Zero Dividends: It may also be assumed that the firm may not pay any dividend and instead reinvests its entire earnings. In such a case, where there is no current dividend or expected dividend for year 1, Equations 5.9, 5.10, 5.11 and 5.13 cannot be used to find out the value of ke. The investors, even if no dividend is expected, will not change their required rate of return. Instead, the investor must be expecting a capital gain in the form of increase in market price. Thus, the required rate of return accrues to the investors in the form of capital gain which they receive when they sell their shares at a later date at a price say, Pn, against the current price, P0. In such a case, the cost of capital, ke, may be calculated with the help of Equation 5.14.

![]() (5.14)

(5.14)

An important assumption in Equation 5.14 is that Pn > P0. The value of ke in Equation 5.14 can be derived as :

![]()

The main problem in applying this equation and Equation 5.14 is that it is difficult, if not impossible to estimate value of Pn i.e., the expected market price at the end of year n.

Cost of Capital of Newly Issued Capital or External Equity: A firm may face a situation where it needs to raise funds by issue of fresh equity capital in order to finance the new projects. If so, then what return must be earned on these funds raised by fresh issue to make the project worthwhile. The existing equity share capital expect the firm to pay a stream of dividends and this stream of dividends is earned from the existing assets. The new equity capital will also likewise expect to receive the same quantum of returns. Obviously, for new shares to obtain the same stream as that on existing shares, the new funds obtained from the issue of fresh capital must be utilized to produce a return high enough to provide a dividend stream whose present value is just equal to the net proceeds of fresh issue. In other words, the minimum rate of return which the new shares expect in order to prevent a decline in the market price of existing shares, is the cost of fresh equity.

Theoretically speaking, the firm should therefore, sell the new shares at the current market price of existing equity shares. However, in practice, the net proceeds to the firm will be reduced as the firm will be required to bear additional expenses of flotation including underwriting expenses, brokerage, issue expenses, advertisement and above all a discount off the current price to the potential investor to induce them to subscribe all the shares offered. Thus, the net proceeds will be reduced below the current market price for (i) the flotation cost and (ii) offer price being below the current market price.

The cost of new equity shares can be estimated on the basis of Equation 5.12 by determining the net proceeds after flotation cost etc., and taking the assumption of constant growth rate as follows :

![]()

where, NP = Net proceeds from fresh issue, and

kₙ = Cost of new equity.

It may be noted that this equation is almost the same as Equation 5.12 except that P0 is replaced by NP and NP is < P0 because of flotation cost. The kn will always be higher than ke because the net proceeds from fresh capital, NP, will always be lower than the current market price, P0.

Example 5

The share of ABC Ltd. is presently traded at ` 50 and the company is expected to pay dividends of ` 4 per share with a growth rate expected at 8% per annum. It plans to raise fresh equity share capital. The merchant banker has suggested that an under pricing of Rupee 1 is necessary in pricing the new issue besides involving a cost of 50 paise per share on miscellaneous expenses. Find out the cost of existing equity shares as well as the new equity given that the dividend rate and growth rate are not expected to change.

Solution :

In the given case, the following information is available.

Market price, P0 = ` 50 per share

Under pricing = ` 1 per share

Flotation cost = Paise 50 per share

Net proceed, NP = ` 50–1–.50 = ` 48.50

Growth rate, g = 8%

D₁, = ` 4

Cost of capital of existing capital :

![]()

Cost of capital for fresh equity :

![]()

7.2 Cost of Equity Share Capital based on Risk Perception of investors:

Any rate of return, including the cost of equity capital is affected by the risk. If an investment is more risky, the investor will demand higher compensation in the form of higher expected return. The equity shareholders receive dividends after interest have been paid to the debt holders and preference dividends have been paid to preference shareholders. This means that their return will be volatile with reference to the change in company’s performance. The cost of equity capital will be higher than that of other sources to reflect this risk. The risk factor is incorporated in the calculation of cost of equity capital above as it will be reflected in the market price of the share. A risky company will have a relatively lower share price and hence a higher cost of equity capital. A less risky company will be more valuable and commands a higher share price and hence a lower cost of equity capital.

It is possible to find out the cost of equity capital by using the mechanism of risk-return trade off as given by the Capital Assets Pricing Model (CAPM).

The CAPM classifies the total risk associated with a security/asset into two classes i.e., (i) the diversifiable or unsystematic risk, and (ii) non-diversifiable or systematic risk. The diversifiable risk refers to that risk which can be eliminated by more and more diversification. On the other hand, non-diversifiable risk is that risk which affect all the firms at a particular point of time and hence cannot be eliminated e.g., risk of political uncertainties, risk of Government policies, etc.

An investor can eliminate the diversifiable risk by diversifying into more and more securities, however, the non-diversifiable risk is the point where the investor’s attention is required. This non-diversifiable risk of a security is measured in relation to the market portfolio and is denoted by the beta coefficient, b. In order to estimate the required rate of return of the equity investors, the risk associated with the shares (as represented by the beta factor) need to be estimated. The CAPM as applied to find out the cost of capital of equity shares can be presented as follows :

![]()

where, ke = Cost of capital of equity shares

IRF = Risk free interest rate

β = The beta factor i.e., the measure of non-diversifiable risk,

kₘ = The expected rate of return of the market portfolio or average rate of return on all assets.

For example, a firm having beta coefficient of 1.8 finds the risk free rate to be 8% and the market cost of capital at 14%. The cost of capital of equity shares of the firm will be :

![]()

= .08 + 1.8(.14 –.08)

= .188 or 18.8%.

In order to apply the CAPM, the firm has to estimate (i) the risk free rate, (ii) the rate of return on market portfolio and (iii) the beta factor. Moreover, it is based upon the crucial assumption that the investors can easily eliminate the diversifiable risk and hence require compensation for the non-diversifiable risk only, and this risk is reflected in the beta factor.

The dividend basis of cost of capital and the CAPM based cost of capital are different in more than one ways. First, the former does not consider any risk explicitly while the latter considers the risk associated with a security through the beta factor, b. Secondly, the CAPM ignores and is not capable of adjusting itself to any external variable such as flotation cost or growth in dividends etc., whereas the dividend based cost of capital can easily accommodate these variables.

8. Cost of Retained Earnings

Earnings generated by a firm are distributed among the equity shareholders. However, if the entire earnings are not distributed and a part is retained by the firm, then these retained earnings are available for reinvestment within the firm. As the retained earnings increase the shareholders equity in the same way as the new issue of equity share capital would do, the retained earnings are often considered as subscription to additional share capital by existing equity shareholders. However, the firm is not required to pay dividend on this part of shareholders funds (i.e., the retained earnings portion), so it may be argued that the retained earnings have no cost as such. But this is not true.

The cost of retained earnings must be considered as the opportunity cost of the foregone dividends. From the point of view of equity shareholders, any earning retained by the firm could have been profitably invested by the equity shareholders themselves, had these been distributed to them. Thus, there is an opportunity cost involved in the firms retaining the earnings and an estimation of this cost can be taken up as a measure of cost of capital of retained earnings, kᵣ.

The cost of retained earnings, kᵣ, is often taken as equal to the cost of equity share capital, kₑ, since the retained earnings are viewed as the fresh subscription to the equity share capital. If a firm has to decide whether to raise funds by issuing new equity shares or by retaining the earnings, it will have to find out the rate of return at which the investors will be indifferent between whether the firm distributes the earnings or reinvests these earnings for future growth. This is reflected in market price of the share which is used to determine the cost of equity. If the investors are not getting the expected returns from the firm’s reinvestment, they will tend to sell their holding, forcing down the price until they get the expected return. By lowering the share price, the investors maintain the required rate of returns. Therefore, the share price fully reflect the cost of capital of the retained earnings. So, kᵣ = kₑ. It may be noted that the cost of retained earnings is not to be adjusted for tax and for flotation cost.

9. Weighted Average Cost of Capital

Once the specific cost of capital of each of the long term sources i.e., the debt, the preference share capital, the equity share capital and the retained earnings have been ascertained, then the next step is to calculate the overall cost of capital of the firm. This overall cost of capital of the firm is relevant as this rate is used as the discount rate or the cut-off rate in evaluating the capital budgeting proposals. The overall cost of capital may be defined as the rate of return that must be earned by the firm in order to satisfy the requirements of different investors. The overall cost of capital is thus, the minimum required rate of return on the assets of the firm. This overall cost of capital should take care of the relative proportion of different sources in the capital structure of the firm. Therefore, this overall cost of capital should be calculated as the weighted average rather than simple average of different specific cost of capital. The weighted average cost of capital (WACC) is defined as the weighted average of the cost of different sources and may be described as follows :

![]()

where, WACC = Weighted Average Cost of Capital

kₑ = Cost of Equity capital

kₔ = After tax cost of Debt

kₚ = Cost of Preference shares

kᵣ = Cost of Retained earnings

w1 = Proportion of Equity capital in capital structure

w2 = Proportion of Debt in capital structure

w3 = Proportion of Preference capital in capital structure.

w4 = Proportion of Retained earnings

The WACC is often denoted by ko, i.e., overall cost of capital.

So, ko = ke.we + kd.wd + kp.wp + kr.wr

As most of the firms use more than one source of capital fund in financing the capital budgeting proposals and because over time, the mix of these sources may change, it is necessary to examine the cost of the firm’s capital structure as a whole. The firm must have a cost of capital that is weighted to reflect the differences in various sources used. It encompasses the cost of compensating the debt investors, preference shareholders and the equity shareholders. So, in order to calculate the WACC, there must be a system of assigning weights to different specific cost of capital. The following considerations are worth noting while assigning weights to specific cost of capital to find out the WACC.

_____________________

- Neveu Raymond R., Fundamentals of Managerial Finance, Southern Western Publishing Co., Ohio, 1981, p. 334.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA