Financial Management – Financial & Capital Structure

- Other Laws|Blog|

- 18 Min Read

- By Taxmann

- |

- Last Updated on 24 December, 2024

After reading this blog you will be able to –

-

- Know the capital structure decision

- Distinguish between Financial Structure and Capital structure

- Explain Net Income Approach

- Explain Net Operating Income Approach

- Understand and explain Modigliani Miller (MM) Hypothesis

- Analyze features of an appropriate capital structure

- Identify various determinants of Capital Structure

Table of Content

1. Capital Structure decision

2. Financial Structure

3. Capital Structure

4. Net Income Approach

5. Net Operating Income Approach

6. Traditional Approach

Stage I: Initial Stage- Low to moderate use of debt capital

Stage II: Further increase in Debt capital

Stage III: Higher use of Debt Capital

1. Capital Structure decision

A company’s financing decision or capital structure decision is concerned with the sources of funds from where long term finance is raised and the proportion in which the total amount is raised using these sources of funds. It involves determining how the selected assets/project will be financed. Broadly, financing decisions involve the following three issues-

i. The amount of total long term capital requirement. This is related with capital budgeting decision of the company.

ii. Sources of funds from where funds are raised.

iii. Composition of total funds i.e. the proportion of each specific source in total capitalization.

2. Financial Structure

Financial structure of a company is concerned with both long term and short term sources of funds. Hence financial structure is the mix of all sources of funds whether long term such as debt and equity or short term such as bank overdraft, short term loans etc.

Taxmann's Basic Financial Management is a comprehensive, authentic & well-illustrated student-oriented book, featuring an elementary understanding of concepts, examples & illustrations, solved previous exam question papers, solved problems, summaries, and financial decision making through Excel

3. Capital Structure

Capital structure decision is concerned with the sources of long term funds such as debt and equity capital. Capital structure is defined as the mix of various long term sources of funds broadly classified as debt and equity. Hence capital structure is also referred to as ‘Debt Equity Mix’ of a company.

In other words, capital structure represents the proportionate relationship between debt and equity in the total capitalisation of the company. Equity capital includes paid up share capital, share premium, reserves and surplus (retained earnings) while debt capital includes bonds, loans, debentures etc. For the purpose of capital structure, preference shares are also classified in the category of debt capital. This is because preference shares also bear a fixed rate of dividend and they are generally redeemable.

Hence capital structure of a company is the composition of debt and equity capital in total capitalisation of the company. Debt and equity capital differ in terms of costs and risks. From the viewpoint of the company raising funds, debt is considered to be a cheaper source than equity capital. However debt also increases the financial risk of the company and may be responsible for increase in cost of equity.

Capital structure decision, in turn, affects overall cost of capital of a company. This overall cost of capital is generally used as discount rate while evaluating capital projects under capital budgeting decision.

There are three issues in capital structure decision of a company

-

- What should be the mix of debt and equity?

- Does capital structure affect value of a firm? Or Is there any relationship between capital structure and firm’s value?

- Is there any optimal capital structure?

The capital structure decision should be examined from the view point of its impact on firm’s value. If capital structure affects a firm’s value then the firm should try to have an optimal capital structure at which overall cost of capital is minimum and value of the firm is maximum.

There exist two schools of thought on the relationship between capital structure and value of firm. One view is that capital structure is relevant i.e. capital structure affects the value of a firm. Capital structure theories which support this view are – Net Income approach and Traditional Approach. The other school of thought (led by Modigliani and Miller) agrees on the irrelevance of capital structure i.e. capital structure is irrelevant in determining the value of firm. Theories which support this view include – Net Operating Income and Modigliani Miller Hypothesis.

It must be noted that Modigliani Miller Hypothesis (MM Hypothesis) as originally developed shows that in the absence of corporate taxes capital structure is irrelevant to the value of a firm. However when corporate taxes are considered then MM hypothesis states that capital structure is relevant for the value of a firm.

We will discuss all these theories in the following sections. Let’s first discuss the valuation concepts in a firm. We know that the total value of a firm is the sum total of its equity and debt values.

Value of Firm = Value of Equity + Value of Debt

V = E + D

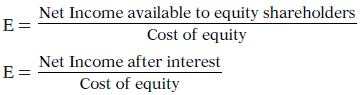

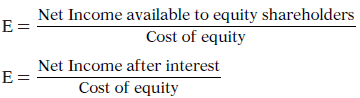

Now value of equity is equal to the discounted value of income available for equity shareholders. The discount rate is cost of equity ( Ke).

Value of Equity = Discounted Value of Net Income available to equity shareholders

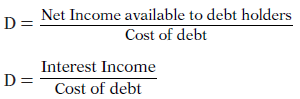

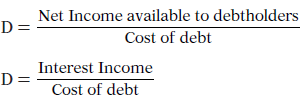

Value of debt is the discounted value of the interest payments made to debenture holders. If we assume perpetual debt capital then we calculate the value of debt capital as below:

Value of Debt = Discounted Value of Interest

Further we can calculate the Weighted average cost of capital (WACC) denoted by Ko . It is also termed as overall cost of capital.

Ko = We × Kd + Wd × Kd

Where:

We = proportion of funds invested in equity or weight of equity capital

Wd = proportion of funds invested in debt or weight of debt capital

When we are given the operating income (or EBIT) of a firm and its cost of capital then the value of a firm can be calculated as the discounted value of its operating income. Since the firm has perpetual life the value of a firm will be

![]()

If we are given value of a firm and its operating income then we can calculate its overall cost of capital as below:

![]()

4. Net Income Approach

As per Net Income Approach, there is a relationship between capital structure and value of the firm and therefore firm can affect its value by increasing or decreasing the debt proportion in the overall financing mix. This approach shows that capital structure has relevance in determining the value of firm. The Net Income Approach makes the following main assumptions:

-

- The total capital requirement of the firm is given and remains constant.

- Perpetual Debt and equity capital.

- Cost of debt (Kd) is less than the cost of equity (Ke) and both these costs are constant irrespective of the amount of debt capital used .

- There are no taxes and no transaction costs.

- Firm has perpetual life.

Given these assumptions a Firm’s value is calculated by adding value of equity and value of debt. As shown below:

Value of Firm = Value of Equity + Value of Debt

V = E + D

Value of debt is the discounted value of the interest payments made to debenture holders. If we assume perpetual debt capital then we calculate the value of debt capital as below:

Value of Debt = Discounted Value of Interest

Further we can calculate the Weighted average cost of capital (WACC) denoted by Ko . It is also termed as overall cost of capital.

Ko = We × Kd + Wd × Kd

Where:

We = proportion of funds invested in equity or weight of equity capital

Wd = proportion of funds invested in debt or weight of debt capital

When we are given the operating income ( or EBIT) of a firm and its cost of capital then the value of a firm can be calculated as the discounted value of its operating income. Since the firm has perpetual life the value of a firm will be

![]()

If we are given value of a firm and its operating income then we can calculate its overall cost of capital as below:

![]()

We can understand the working of Net Income Approach through the hypothetical example given below.

Example 7.1

The expected Earnings before interest and taxes (EBIT) of a firm is ` 4,00,000. It has issued equity share capital and the cost of equity is assumed to be 10%. It has also issued 8% debt of ` 5,00,000. Find out the value of firm and overall cost of capital (WACC) as per Net Income Approach.

Solution:

Here we are given that EBIT = ` 4,00,000. Ke = 10%, Kd = 8% and Value of Debt = ` 5,00,000.

| EBIT | 4,00,000 |

| Less: Interest (8% of ` 5,00,000) | 40,000 |

| Net Profit available for equity shareholders (EBT) | 3,60,000 |

| Cost of Equity (Ke) | 10% |

| Value of Equity (3,60,000/0.10) | 36,00,000 |

| Value of Debt | 5,00,000 |

| Total Value of Firm | 41,00,000 |

![]()

WACC can also be calculated as follows:

WACC = Cost of Equity × Weight of Equity + Cost of Debt × Weight of Debt

![]()

Example 7.2

If in Example 7.1, the firm had issued 8% debt of ` 10,00,000 instead of ` 5,00,000. Then what is the value of the firm and WACC as per Net Income approach?

Solution

In this case, the position would have been as follows:

| EBIT | 4,00,000 |

| Less: Interest (8% of ` 10,00,000) | 80,000 |

| Net Profit available for equity shareholders (EBT) | 3,20,000 |

| Cost of Equity (Ke) | 10% |

| Value of Equity (3,20,000/0.10) | 32,00,000 |

| Value of Debt | 10,00,000 |

| Total Value of Firm | 42,00,000 |

Weighted Average Cost of Capital (WACC) = ![]() = 0.095 or 9.5%

= 0.095 or 9.5%

So, if 8% debt is increased from ` 5,00,000 to ` 10,00,000 the value of firm increases from ` 41,00,000 to ` 42,00,000 and WACC decreases from 9.7% to 9.5%.

Example 7.3

If in Example 7.1, the firm has issued 8% debt of only ` 1,00,000, then what would have been firm’s value and overall cost of capital as per NI approach.

Solution :

In this case the position of the firm would be as follows:

| EBIT | 4,00,000 |

| Less: Interest (8% of ` 1,00,000) | 8,000 |

| Net Profit available for equity shareholders (EBT) | 3,92,000 |

| Cost of Equity (Ke) | 10% |

| Value of Equity (3,92,000/0.10) | 39,20,000 |

| Value of Debt | 1,00,000 |

| Total Value of Firm | 40,20,000 |

Weighted Average Cost of Capital (WACC) = ![]() = 0.0995 or 9.95%

= 0.0995 or 9.95%

So, when the value of 8% debt is reduced to ` 1,00,000 the value of firm reduces to ` 40,20,000 and WACC increases to 9.95%.

Capital Structure and Firm Value as per Net Income Approach

As per Net Income Approach there is a relationship between capital structure and firm’s value. In fact capital structure affects firm’s value and its cost of capital. As per NI approach the higher the proportion of debt capital in capital structure, the lower will be the overall cost of capital and hence the higher will be firm’s value. This is shown in above Examples 7.1, 7.2 and 7.3. It must be noted that as per NI approach as the proportion of debt capital increases, the overall K0 reduces because cheaper debt replaces expensive equity capital. Hence value of firm increases.

Hence there is a positive relationship between the proportion of debt (or financial leverage) and firm’s value. While there is a negative relationship between the proportion of debt (or financial leverage) and firm’s cost of capital.

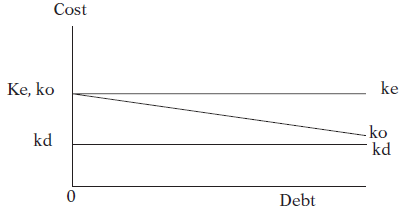

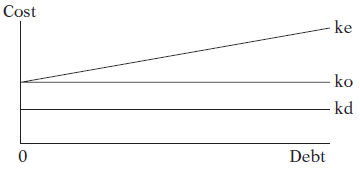

Optimal capital structure as per NI approach is one that has maximum debt capital or 100% debt capital. As shown in Fig. 7.1, Ke and Kd are constant while Kd < Ke. When debt is zero K0 = Ke. However with increase in debt capital K0 decreases proportionately because Ke > Kd. When there is 100% debt, K0 = Kd. At this cost of capital value of firm is maximum.

Fig 7.1 : Net Income Approach

5. Net Operating Income Approach

The Net Operating Income Approach is in complete contrast to the Net Income Approach. According to Net Operating Income Approach, the market value of the firm is not affected by its capital structure. The value of the firm and its overall cost of capital remains same irrespective of the proportion of debt (or financial leverage) in capital structure. The Net Operating Income Approach is based on the following assumptions.

-

- The overall cost of capital, Ko, of the firm is known and constant. It depends upon the business risk, which is assumed to be unchanged.

- The cost of debt, Kd, is known and constant.

- Using more and more debt in the capital structure, increases financial risk to equity shareholders and results in the increase in the cost of equity capital, Ke. The increase in Ke is such that it completely off sets the benefits of employing cheaper debt.

- There are no taxes.

- Firm has perpetual life

- Debt capital is perpetual.

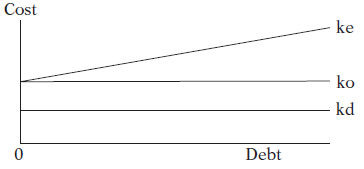

Given these assumptions the relationship between debt capital proportion and cost of capital of a firm is shown in Fig 7.2

Fig 7.2 : Net Operating Income Approach

![]()

Or

![]()

Alternatively, Value of the Firm = Value of Equity + Value of Debt

![]()

Cost of equity can also be calculated as follows:

Ke = K0 + (K0 – Kd) D/E

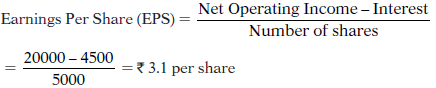

Example 7.4

A firm has an EBIT of ` 4,00,000 and belongs to a risk class of 10% i.e. its overall cost of capital is 10%. What is the value of equity capital if it employees 5% debt to the extent of 30%, 40% or 50% of the total capital of ` 20,00,000? Assume that Net Operating Income approach applies.

Solution:

| 30% Debt | 40% Debt | 50% Debt | |

| EBIT(A) | 4,00,000 | 4,00,000 | 4,00,000 |

| Overall cost of capital (Ko) | 10% | 10% | 10% |

| Value of the firm (V = EBIT/ Ko) | 40,00,000 | 40,00,000 | 40,00,000 |

| Value of debt (D) 30%, 40%, 50% of ` 20 lacs | 6,00,000 | 8,00,000 | 10,00,000 |

| Value of Equity (E = V–D) | 34,00,000 | 32,00,000 | 30,00,000 |

| Interest on debt @5% (B) | 30,000 | 40,000 | 50,000 |

| Net profit available for equity shareholders (A–B) | 3,70,000 | 3,60,000 | 3,50,000 |

| Ke (Net profit for equity shareholders / Value of Equity) | 10.88% | 11.25% | 11.67% |

The cost of equity capital increases with the increase in the proportion of debt capital.

Cost of Equity can also be calculated using the following formula

Ke = K0 + (K0 – Kd) D/E

Ke = 10 + ( 10–5) 6,00,000/34,00,000 = 10.88%

Ke = 10 + ( 10–5) 8,00,000/32,00,000 = 11.25%

Ke = 10 + ( 10–5) 10,00,000/30,00,000 = 11.67%

Capital Structure and Firm Value as per Net Operating Income Approach

As per Net Operating Income (NOI) Approach there is no relationship between capital structure and firm’s value and the two are independent. Hence capital structure does not affect firm’s value and its cost of capital. As per NOI approach the proportion of debt capital in capital structure doest not affect its overall cost of capital. The higher proportion of debt capital results in higher cost of equity such that the overall cost of capital remains constant.

Hence capital structure and value of a firm are independent.

6. Traditional Approach

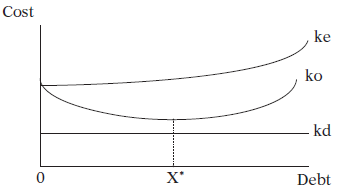

As per the traditional approach, there exists an optimal capital structure at which firms cost of capital is minimum and firm’s value is maximum. Traditional approach suggests that a firm should make judicious use of both the debt and the equity so as to achieve a capital structure which may be called the optimum capital structure. The traditional view point states that there are three stages in which one can view the relationship between capital structure ( or proportion of debt) and firm’s overall cost of capital ( Ko). These stages are shown in Fig. 7.3 and explained below.

Fig 7.3 : Traditional Theory

Stage I: Initial Stage- Low to moderate use of debt capital

Initially when debt capital is used in low to moderate amounts then the cost of debt as well as cost of equity remains constant. Since cost of debt is lower than the cost of equity, the overall cost of capital in this stage declines. It means that the value of the firm increases when moderate amount of debt capital is used. This is region before X* in Fig. 7.3.

Stage II: Further increase in Debt capital:

In this stage debt capital is increased further. Although cost of debt remains same in this stage but as a result of higher risk, cost of equity increases in such a manner that the overall cost of capital attains its minimum value over a range of debt capital or at a particular point. This point (or range) at which overall cost of capital is minimum is termed as optimal capital structure. At this capital structure, the value of the firm is maximum. This is point X* in Fig. 7.3.

Stage III: Higher use of Debt Capital

If debt capital is increased further then the financial risk of the firm increases substantially and it has adverse impact on its cost of capital. When higher proportion of debt capital is used, then cost of debt may remain constant or even increase gradually. Cost of equity increases sharply because equity shareholders would be exposed to very high financial risk. This results in increase in overall cost of capital and hence decline in firm’s value. In Fig. 7.3 this stage is the region after X* point.

Example 7.5

A firm has an EBIT of ` 4,00,000. The company is planning to employ debt to the extent of 30%, 40% or 80% of the total capital of ` 20,00,000. Cost of debt is 5%. Cost of equity at 30% debt capital is 10%, at 40% debt it is 12% and at 80% debt cost of equity is 20%. What is the value of the firm and its overall cost of capital as per Traditional approach?

Solution:

| 30% Debt | 40% Debt | 50% Debt | |

| EBIT (A) | 4,00,000 | 4,00,000 | 4,00,000 |

| Kd | 5% | 5% | 5% |

| Value of Debt capital (D) | 6,00,000 | 8,00,000 | 16,00,000 |

| Interest on Debt capital @5% (B) | 30,000 | 40,000 | 80,000 |

| Net profit for Equity shareholders (C=A-B) | 3,70,000 | 3,60,000 | 3,20,000 |

| Cost of Equity (P) | 10% | 12% | 20% |

| Value of Equity (E= C/P) | 37,00,000 | 30,00,000 | 16,00.000 |

| Value of firm (V= D+E) | 43,00,000 | 38,00,000 | 32,00,000 |

| Overall Cost Capital (A/V) | 0.093 or 9.3% | 0.105 or 10.5% | 0.125 or 12.5% |

6A. Modigliani and Millar Hypothesis with No Taxes : Irrelevance of Capital Structure

Modigliani and Millar (MM) hypothesis states that capital structure is irrelevant for the valuation of a firm. It implies that by changing the proportion of debt and equity, the value of a firm does not change. Firm’s value depends on its earnings and risk of its assets rather than financial leverage (debt-equity ratio).

There are two main propositions under MM Hypothesis-

Proposition 1: Cost of capital is independent of the capital structure of a firm. Hence capital structure is irrelevant for firm’s valuation.

Proposition II : Cost of equity increases proportionately with increase in the proportion of debt so as to nullify the benefit of cheaper debt. Cost of equity is calculated as follows

Ke = K0 + (K0 – Kd) D/E

MM Hypothesis is based on the following assumptions:

(1) Perfect Capital Markets: Capital markets are perfect. All investors are rational. Investors can freely buy or sell securities. There are no transaction costs and securities are infinitely divisible.

(2) Homemade Leverage ( or personal leverage) is a perfect substitute for corporate leverage: It implies that investors can borrow unlimited amount at the same interest rate as the companies can.

(3) No Taxes: There are no corporate taxes. Thus, there is no tax saving for firms on interest payment of debt.

(4) Full Payout: Firms distribute all their earnings after interest as dividends. Thus, the dividend payout ratio is 100%.

Given the above assumptions two firms belonging to same risk class ( i.e. having same operating risk), must have same value irrespective of their capital structure.

This happens due to ARBITRAGE PROCESS.

Let’s say there are two firms A & B. Both the firms belong to the same industry and have same operating risk class. Thus, the operating income and operating risk faced by the two firms is exactly same. Because of same risk and return, investors expect same rate of return or cost of capital on assets. Suppose both the firms are totally equity financed, net operating income before and after interest will be same, as no interest is paid. Moreover, income before and after taxes will also be same, as taxes are absent. We know that,

![]()

Thus, value of both the firms will be same.

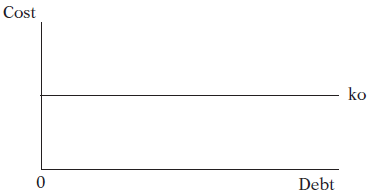

Now, let’s assume that the capital structure of firms A & B are different. Firm A is 100% equity financed and Firm B is 50% equity and 50% debt financed. On the basis of our assumptions, we can state that the operating earnings (EBIT) will still be the same for both the firms as it depends on investment in assets and not on financing decision. Operating Risk will also be the same as it depends on business conditions and not on debt. As risk and return are same, expected rate of return (i.e. cost of capital or Ko) must also be same. Thus, as the net operating income and cost of capital remains intact, the value of both the firms will be same i.e. no effect of financial leverage on Ko. This is shown in Fig. 7.4

Value of Firm A = Value of Firm B

i.e. Value of Unlevered Firm = Value of Levered Firm

Fig 7.4 : MM Hypothesis (Proposition I)

Fig 7.5 : MM Hypothesis Proposition II

6A.1 Arbitrage Process:

MM hypothesis provides a behavioural justification of Proposition I in the form of Arbitrage Process. As per proposition I, the value of unlevered firm and levered firm must be same if they have same operating income and belong to same risk class. However if they are not same, say the value of levered firm is higher than the value of unlevered firm then arbitrage process will set in as we have assumed that investors are rational. Arbitrage is an activity in which an investor sells at high price and buys at a low price keeping his net return intact. This is explained with the help of following example:

Explanation: Suppose there are two firms U and L. Firm U is an unlevered firm with equity capital of ` 1,00,000 and Firm L is a levered firm with a book value of equity capital of ` 50,000 and debt of ` 50,000. However the value of firm U is ` 1,00,000 while that of Firm L is ` 1,10,000. The net operating income (EBIT) of both the firms is same ` 10,000. Firm L has to pay interest on debt at the rate of 5% p.a. The cost of equity for Firm U is 10% . Explain arbitrage process that will ensure that the values of the two firms U and L will be same.

Here we are given that the firms are identical except capital structure. Due to debt capital the value of levered firm is higher by ` 10,000. The value of firm U is ` 1,00,000 which is all equity capital. The value of firm L is ` 1,10,000 which comprises of ` 50,000 as value of debt capital and ` 60,000 (i.e. ` 1,10,000 – ` 50,000) as value of equity capital. The book value of equity capital in firm L is ` 50,000. Therefore an investor’s value of equity capital is higher in firm L. Therefore rational investors will start arbitrage until the values of both the firms become equal.

Let’s say an investor Mr. X holds 10% equity stake in Firm L i.e. he holds 10% equity at a value (10% of ` 60,000) of ` 6,000 .

Present Status of Mr. X in firm L

Book value of equity investment i.e. 10% of ` 50,000 = ` 5,000

Market Value of equity investment i.e. 10% of ` 60,000 = ` 6,000

Income from equity investment i.e. 10% of Earnings available for equity shareholders i.e. 10% of ` 7500 or ` 750.

Earnings available for equity shareholders is calculated below:

| EBIT | = ` 10,000 |

| Less: Interest @5% of ` 50,000 | = ` 2,500 |

| Earnings available for equity shareholders | = ` 7,500 |

Arbitrage Process

We can see that the market value of equity capital of firm L is higher than its book value so Mr. X will take advantage of this and sell his equity shares in firm L which is overvalued and rather buy the shares of firm U which is undervalued. By doing this he would be better off. Let us assume that Mr. X sells his equity shares in firm L at ` 6000. By doing this he makes a capital gain of ` 1000 (i.e. 6000–5000). He further borrows ` 5000 (i.e. 10% of ` 50000) at 5% rate of interest. This is termed as personal leverage because Mr. X is borrowing on personal account. Total funds with Mr. X now is ` 11,000 ( ` 6000 own and ` 5000 borrowed). To buy 10% equity stake in firm U he needs only ` 10,000 (i.e. 10% of `1,00,000). Therefore after investing ` 10,000 in firm U he still has ` 1000 as gain.

Status of Mr.X in firm U

Total Earnings from investment in firm U = 10% of ` 10000 = ` 1000

Less: Interest on borrowed funds @5% of ` 5000 = ` 250

Net earnings of Mr. X = ` 750.

It can be seen that Mr. X enjoys the same amount of earnings from firm U. He has also made a gain of ` 1000 in this arbitrage process. Therefore he is better off.

Other rational investors will also engage in this type of arbitrage and make gain without losing out on net earnings. As a result there will be selling pressure on the shares of firm L (which will reduce its market price) and buying pressure on the shares of firm U (which will increase its share price).

This arbitrage process will come to an end when the two firms have same market value. This is known as equilibrium value.

Example 7.6

There are two firms, U and L. Firm U is the Unlevered Firm and Firm L is the Levered Firm. Firm U has 10000 shares @ ` 15 per share. Firm L has 5000 shares @ ` 15 per share and 6% debentures worth ` 75,000. Operating income of both the firms is ` 20,000. Compute cost of equity of both the firms as per MM Hypothesis. Also calculate EPS of both the firms.

Solution:

Cost of equity of Firm U:-

![]()

= 0.1333 or 13.33%

In case of Firm U, the cost of equity will be same as cost of capital because of zero debts.

![]()

(1) Cost of equity of Firm L:-

Based on proposition 1, the average cost of capital does not depend on capital structure. Thus, WACC will be 13.33%. We know that,

Ke = ko + (ko – kd) D/E = 0.1333 + (0.1333–0.06) 75000/75000 = 0.2066 or 20.66%

Thus, cost of equity will be higher than WACC i.e. 13.33%. The extra 7.33% becomes the financial risk premium.

6A.2 Criticism of MM Approach

MM Hypothesis, although sounds theoretically correct but has many practical limitations. The propositions given by MM mainly holds true because of the arbitrage process of investors. But this arbitrage process may take place only when the underlying assumptions hold true. However in reality these assumptions are hardly valid. Therefore MM Hypothesis is severely criticised due to its unrealistic assumptions. In reality-

-

- Capital markets are not perfect. Investors are not fully rational.

- Securities are not infinitely divisible.

- There are transactions costs for buying and selling shares

- Personal leverage is not a perfect substitute for corporate leverage. Individual investors cannot borrow at the same rate of interest as companies.

- There exist corporate and personal taxes.

Hence due to its unrealistic assumptions MM hypothesis is severely criticised.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA