Capital Structure – Definition, Theories and Approach

- Blog|Company Law|

- 8 Min Read

- By Taxmann

- |

- Last Updated on 29 November, 2023

Table of Content

5. Net Operating Income Approach (NOI)

6. Modiglani-Miller Approach (MM)

10. Proforma Statement Showing EBIT, EPS & MPS

11. Selection of plan on the basis of EPS or MPS (New company)

12. Selection of plan on the basis of EPS or MPS (Existing company)

14. Financial Break Even Point

15. Indifference Point in case of Equal Number of Share

Frequently Asked Questions (FAQs)

Checkout Taxmann's Financial Management & Economics for Finance (FM & ECO) | CRACKER which covers all past exam questions (sub-topic-wise) & detailed answers for the CA-Inter exam by ICAI till May 2022, RTPs & MTPs of ICAI. It includes solved model test papers and chapter-wise summary notes with relevant formulae. CA-Inter | New Syllabus | Nov. 2022 Exam

1. What is Capital Structure

Capital structure is the combination of capitals from different sources of finance.

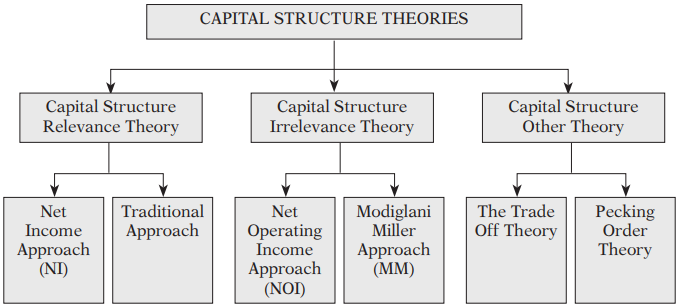

2. Capital Structure Theories

3. Net Income Approach (NI)

According to this approach, capital structure decision is relevant to the value of the firm. An increase in financial leverage (Debt Proportion) will lead to decline in the weighted average cost of capital (WACC), while the value of the firm as well as market price of ordinary share will increase.

As per NI Approach:

-

- Kd and Ke will remain constant.

- Ko will decrease with the help of use of Debt.

- MV of Equity and Firm will increase with the help of use of Debt.

Formulae:

Value of Share (S) = ![]() Or = V – D

Or = V – D

Value of Debt (D) = Face Value of Debt

Value of Firm (V) = S + D Or =

Cost of Capital (Ko) = ![]() Or = KeWe + KdWd

Or = KeWe + KdWd

Cost of Equity (Ke) = ![]()

Note: Ke and Ko of unlevered firm are same.

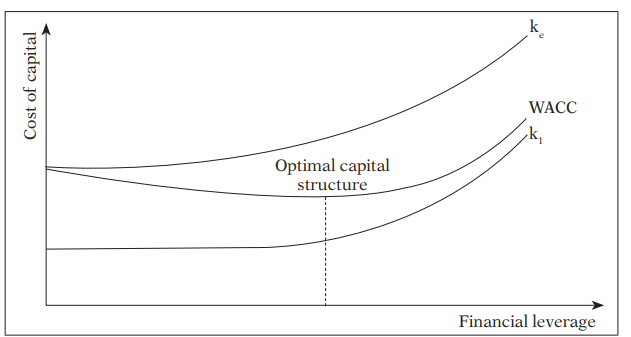

4. Traditional Approach

This approach favours that as a result of financial leverage up to some point, cost of capital comes down and value of firm increases. However, beyond that point, reverse trends emerge.

As per Traditional Approach:

-

- Kd, Ke, Ko and MV of Equity and MV of Firm are variable

- Company has to select capital structure with lowest Ko or highest MV of Firm

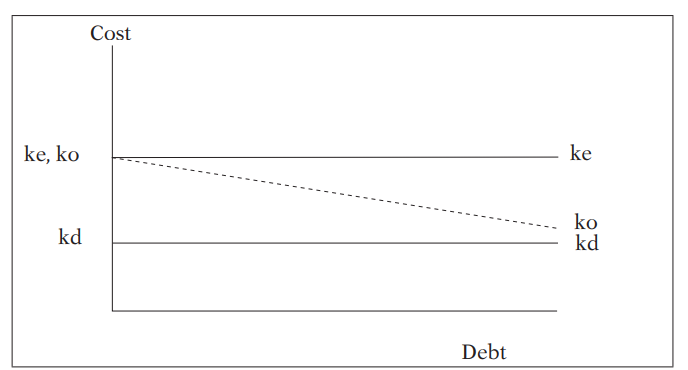

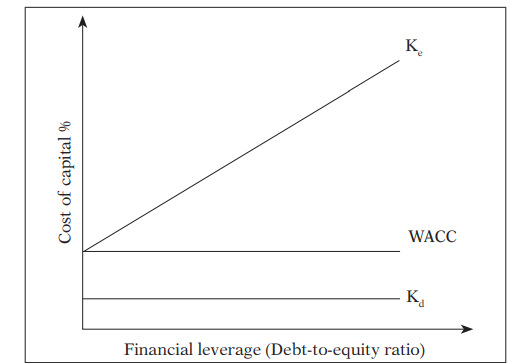

5. Net Operating Income Approach (NOI)

According to this approach, capital structure decisions of the firm are irrelevant. Any change in the leverage will not lead to any change in the total value of the firm and the market price of shares, as the overall cost of capital is independent of the degree of leverage.

As per NOI Approach:

-

- Kd, Ko and MV of Firm will remain constant in case of without tax structure.

- Kd will remain constant in case of with tax structure, with the increase in Debt, MV of firm will increase and Ko will decrease

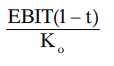

Value of Firms as per NOI Approach:

Step 1: Calculate Value of Unlevered Firm:

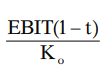

Value of Unlevered Firm (VU) =

Step 2: Calculate Value of Levered Firm:

Value of Levered Firm (VL) = VU + DT

6. Modiglani-Miller Approach (MM)

The NOI approach is definitional or conceptual and lacks behavioral significance. However, Modigliani-Miller approach provides behavioural justification for constant overall cost of capital and therefore, total value of the firm.

Assumptions of MM Approach

-

- Capital markets are perfect

- All information is freely available

- There are no transaction costs

- All investors are rational

- Firms can be grouped into ‘Equivalent risk classes’

- Non-existence of corporate taxes

Note: Solution of practical problems are same under NOI and MM Approaches

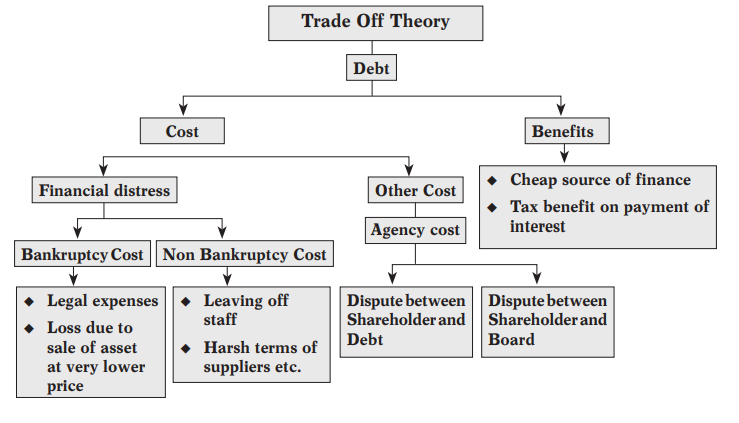

7. The Trade Off Theory

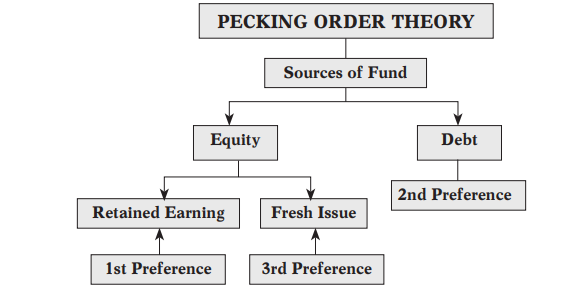

8. Pecking Order Theory

9. Arbitrage Process

Capital structure arbitrage refers to a strategy used by companies and individual where they take advantage of the existing market mispricing across all securities to make profits. In this strategy, there is buying share of undervalued firms and sell shares of overvalued firm. The main objective is to make use of the pricing inefficiency to make a profit. There is anticipation that the pricing difference, will at some point cancel out or reach at equilibrium.

10. Proforma Statement Showing EBIT, EPS & MPS

| Particulars | ` |

| Sales | XXX |

| Less: Variable Cost | (XXX) |

| Contribution | XXX |

| Less: Fixed Cost | (XXX) |

| Operating Profit or EBIT | XXX |

| Less: Interest on long term debt | (XXX) |

| EBT | XXX |

| Less: Tax | (XXX) |

| EAT | XXX |

| Less: Preference Dividend | (XXX) |

| Earnings available for Equity Shareholders | XXX |

| ÷ No. of Equity shares | ÷ XX |

| EPS | XXX |

| × PE Ratio | × XX |

| MPS | XXX |

Note:

-

- MPS = EPS × PE Ratio

- Number of Equity Shares = Existing Shares + New Shares

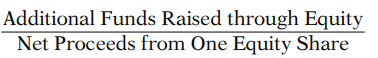

- New Equity Shares =

- Net Proceeds from Share = Issue Price – Issue Expenses

Note: If nothing is specified in the question, MPS is assumed to be Issue Price.

11. Selection of plan on the basis of EPS or MPS (New company)

Statement of EPS & MPS

| Particulars | Alternatives | ||

| Equity | Debt | Preference | |

| EBIT | XXX | XXX | XXX |

| Less: Interest | – | (XXX) | – |

| EBT | XXX | XXX | XXX |

| Less: Tax @ 50% | (XXX) | (XXX) | (XXX) |

| EAT | XXX | XXX | XXX |

| Less: Preference Dividend | – | – | (XXX) |

| Earning For Equity | XXX | XXX | XXX |

| ÷ No. of Equity shares | ÷ XX | ÷ XX | ÷ XX |

| EPS | XXX | XXX | XXX |

| MPS (EPS × PE Ratio) | XXX | XXX | XXX |

12. Selection of plan on the basis of EPS or MPS (Existing company)

Statement of EPS & MPS

| Particulars | Alternatives | ||

| Equity | Debt | Preference | |

| EBIT | XXX | XXX | XXX |

| Less: Interest: | |||

| Existing | (XXX) | (XXX) | (XXX) |

| New | – | (XXX) | – |

| EBT | XXX | XXX | XXX |

| Less: Tax @ 50% | (XXX) | (XXX) | (XXX) |

| EAT | XXX | XXX | XXX |

| Less: Preference Dividend: | |||

| Existing | (XXX) | (XXX) | (XXX) |

| New | – | – | (XXX) |

| Earning For Equity | XXX | XXX | XXX |

| ÷ No. of Equity shares | ÷ XX | ÷ XX | ÷ XX |

| (Existing + New) | (XX + XX) | (XX + NIL) | (XX + NIL) |

| EPS | XXX | XXX | XXX |

| MPS (EPS × PE Ratio) | XXX | XXX | XXX |

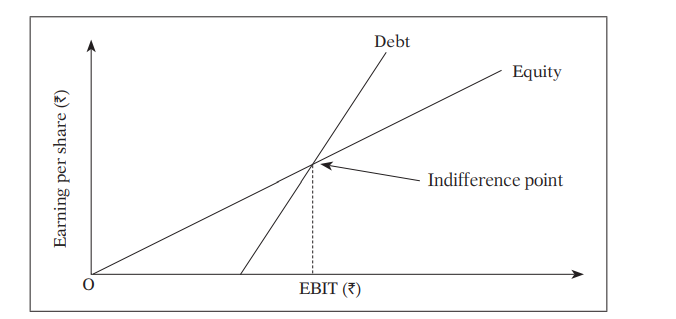

13. Indifference Point

Indifference point refers the level of EBIT at which EPS under two different options are same.

EPS under option 1 = EPS under option 2

![]()

-

- Course of Action:

| Situations | Action |

| If expected EBIT < Indifference Point | Select option having lower Fixed Financial Burden |

| If expected EBIT = Indifference Point | Select any option |

| If expected EBIT > Indifference Point | Select option having higher Fixed Financial Burden |

14. Financial Break Even Point

It is the level of EBIT at which EPS will be zero.

EBIT = Interest + ![]()

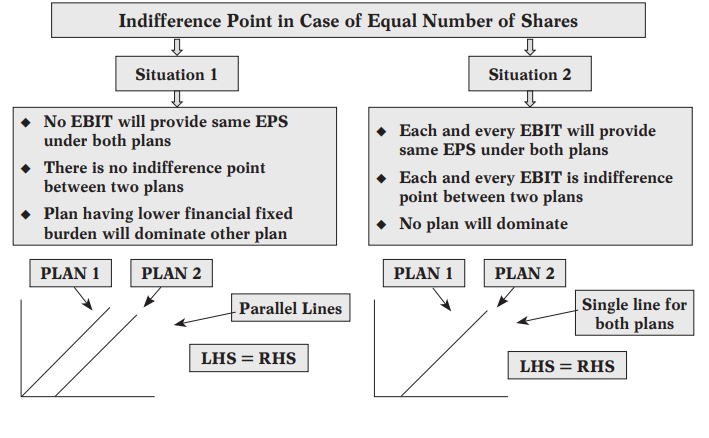

15. Indifference Point in case of Equal Number of Share

Also Read:

Financial Management – Financial & Capital Structure

What is Capital Budgeting? | Financial Management

Frequently Asked Questions (FAQs)

FAQ 1. What is Net Operating income theory of capital structure?

Net Operating Income (NOI) Theory of Capital Structure

According to NOI approach, there is no relationship between the cost of capital and value of the firm i.e. the value of the firm is independent of the capital structure of the firm.

Assumptions:

-

- The corporate income taxes do not exist.

- Debt Equity mix is irrelevant for computation of market value of firm.

- With the increase in debt proportion, financial risk and expectations of shareholders increase.

- The overall cost of capital (Ko) remains constant for all degrees of debt equity mix.

FAQ 2. What are the fundamental principles governing capital structure?

Fundamental Principles Governing Capital Structure are:

1. Financial leverage or Trading on Equity

Debt is cheaper source of finance and interest is also allowed expense as per tax. When a firm raise funds through long-term fixed interest bearing debt and preference share capital along with equity share capital, EPS will increase if cost of fixed funds is lower than rate of return earned by firm. It is called as favourable leverage situation. If cost of fixed fund is higher than rate of return then leverage work adversely. Therefore, it needs caution to plan the capital structure of a firm.

2. Growth and stability of sales

Growth and stability of sales is most important factor to decide capital structure. Firm with stable sale can raise higher amount of debt because with stable revenue we can easily pay debt. Similarly, the rate of the growth in sales also provides confidence to management that they can easily pay interest and principal on time. With greater rate of growth of sales, firm can raise funds through debt. If sales of any firm is fluctuating then firm should not go with debt finance.

3. Cost Principle

As per cost principle, optimum capital structure is that debt equity mix at which cost of capital is lowest and market value of firm is highest.

4. Risk Principle

Due to commitment of fixed payment, debt is a risky source of finance and equity is non-risky source. Higher proportion of debt and accordingly higher risk is not recommended.

5. Control Principle

If we raise additional funds through issue of equity shares then control over company of existing shareholders will be diluted. Existing management control and ownership remains undisturbed with debt finance.

6. Flexibility Principle

Firm should arrange funds in an efficient manner so that we can increase or decrease company’s fund base according to requirement.

7. Other Considerations

Other factors such as nature of business, market situation, existing and future market scenario, government policies, timing of issue and competition in market etc. should also be considered.

FAQ 3. What is Over Capitalisation?

Over capitalization: It is a situation where a firm has excess capital or funds are higher than requirement. In this situation assets are worth less than its issued share capital, and earnings are not sufficient to pay dividend and interest.

Causes of Over Capitalization

-

- Raising higher amount through issue of shares or debentures than company needs.

- Raising higher amount of debt at higher rate than rate at which company can earn.

- Huge payment for the acquisition of fictitious assets like high payment is made to purchase goodwill etc.

- Provision for depreciation is not made properly.

- Payment of dividend with high rate.

- Estimation of earnings and capitalization was wrong.

Consequences of Over-Capitalisation

-

- Decrease in the rate of dividend and interest payments.

- Decrease in the market price of shares.

- Decrease in market value of firm.

- Firm may use window dressing.

- Reorganisation of company.

- Liquidation in worst scenario.

FAQ 4. What do you mean by capital structure in financing decisions?

Capital structure

Capital structure refers to the combination of funds from different sources of finance. Company can arrange funds through equity share capital, retained earnings, preference share capital and long term debts.

Significance

The primary objective of any firm is wealth maximisation. Value of any firm is calculated by capitalisation of it’s after tax earnings. Cost of capital is used as rate of capitalisation. Lower rate of cost of capital leads higher market value of firm and cost of capital is lowest at optimum capital structure. So capital structure is relevant in maximizing value of the firm and minimizing overall cost of capital. To finance any investment or arrange any single rupee, firm has to take capital structure decision.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA