[Opinion] Budget 2023: Changes in Income Tax & Payments to Micro and Small Suppliers

- Blog|Budget|Finance Act|

- 3 Min Read

- By Taxmann

- |

- Last Updated on 21 March, 2023

Authored by AR Raghunathan | CA

Table of Contents

1. As per section 15 of MSME Act 2006

3. Conclusion

Deduction for payments to Micro and small suppliers will now be on actual payment basis and not on payable basis as per amendment to Section 43B of the Income Tax Act,1961 in this Budget.

A new clause has been added effective from 1.4.2024 the following clause has been inserted in section 43B of the Income Tax Act.

“(h) any sum payable by the assessee to a micro or small enterprise beyond the time limit specified in section 15 of the Micro, Small and Medium Enterprises Development Act, 2006,”;

Further the proviso in the section has been amended as follows:

in the proviso, after the words “nothing contained in this section”, the brackets, words and letter “[except the provisions of clause (h)]” shall be inserted;

Thus a combined reading of the above amendments means that any over due amount to Micro and Small enterprises, by any assessee as on 31st March of a year should have been paid on or before 31st March. Ie the amount outstanding as payable should not be beyond the due date as in Section 15 of MSME Act.

1. As per section 15 of MSME Act 2006

15. Liability of buyer to make payment (applicable in case of Micro and small enterprises only) —Where any supplier supplies any goods or renders any services to any buyer, the buyer shall make payment therefor on or before the date agreed upon between him and the supplier in writing or, where there is no agreement in this behalf, before the appointed day:

Provided that in no case the period agreed upon between the supplier and the buyer in writing shall exceed forty-five days from the day of acceptance or the day of deemed acceptance

Appointed day means :

2 (b) “appointed day” means the day following immediately after the expiry of the period of fifteen days from the day of acceptance or the day of deemed acceptance of any goods or any services by a buyer from a supplier.

Explanation: For the purposes of this clause,—

(i) “the day of acceptance” means,—

(a) the day of the actual delivery of goods or the rendering of services; or

(b) where any objection is made in writing by the buyer regarding acceptance of goods or services within fifteen days from the day of the delivery of goods or the rendering of services, the day on which such objection is removed by the supplier;

(ii) “the day of deemed acceptance” means, where no objection is made in writing by the buyer regarding acceptance of goods or services within fifteen days from the day of the delivery of goods or the rendering of services, the day of the actual delivery of goods or the rendering of

Section 2 (n) “supplier” means a micro or small enterprise, which has filed a memorandum with the authority referred to in sub-section (1) of section 8, and includes,—

(i) the National Small Industries Corporation, being a company, registered under the Companies Act, 1956 (1 of 1956);

(ii) the Small Industries Development Corporation of a State or a Union territory, by whatever name called, being a company registered under the Companies Act, 1956 (1 of 1956);

(iii) any company, co-operative society, trust or a body, by whatever name called, registered or constituted under any law for the time being in force and engaged in selling goods produced by micro or small enterprises and rendering services which are provided by such enterprises

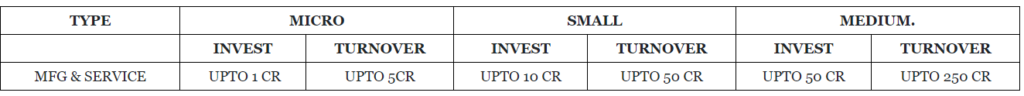

2. Classification

3. Conclusion

The amendment to proviso will not allow as deduction even if the overdue amount is paid on or before due date for filing the returns.

The amendment will be applicable only to those micro and small units which are registered under MSME Act and provides proof of same to its customers.

Dive Deeper

[Download PDF] Copy of Finance Bill 2023

Highlights of the Finance Bill 2023

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA