Basic Skill Requirements for Business Correspondent

- Blog|FEMA & Banking|

- 10 Min Read

- By Taxmann

- |

- Last Updated on 19 April, 2024

A Business Correspondent typically refers to an individual or entity that acts as a representative of a bank or financial institution, especially in areas where it is not feasible or cost-effective to establish a branch. They are mainly appointed to provide banking services to the underserved or unbanked population, helping extend financial inclusion.

Table of Contents

- Introduction

- Soft Skills and Hard Skills

- Soft Skills to Build Relationships

- Negotiation Skill

- Let Us Sum Up

- Keywords

Check out IIBF X Taxmann's Inclusive Banking Through Business Correspondents (Advanced Course) which is a vital tool for those aspiring to be Business Correspondents or Facilitators in India, offering knowledge and skills to link banks with unbanked or underbanked populations, thereby aiding India's economic growth. It addresses operational and reputational risks in banking and emphasizes skill development. The content includes general banking, financial inclusion, technical skills, and soft skills, making it invaluable for bankers and financial institutions.

1. Introduction

In furthering financial inclusion, customer service to the ‘financially excluded’, is more vital and arduous than to the ‘financially included’. Banks will have to depend upon, to a very great extent, on the local people, who understand the rural economy, rural psychology, rural dialect and the rural people. The Business Correspondent is an intermediary or a bridge, between the bank and the financially excluded people. He/She is the face of the bank, in the areas, where there is no branch. He/She has to directly assist the people in various banking and finance related matters. It is expected that he/she has to perform the role of a friend, philosopher and guide to the people residing in the area, with reference to financial inclusion. In his role, he/she has to communicate with the bankers as well as with the targeted people in the area. Hence, success of a Business Correspondent, depends on the effectiveness with which he/she was able to communicate with these people.

2. Soft Skills and Hard Skills

Hard skills are academic skills, experience and level of expertise, while the soft skills are self-developed, interactive, communicative, human and transferable skills. Skills relating to management, operation, production and logistic can be grouped under the Hard Skills. Machine learning, financial analysis, typing skill, computer proficiency, programming etc., are some of the examples of hard skills.

Soft skills are the skills of learning, how to be nice, how to play together, when and where to use our manners, the development of social grace, how to resolve conflict, how to express appreciation and how to use language in a way that persuades others. Communication, self-motivation, leadership, responsibility, team work, problem-solving, decision-making ability, time management, flexibility and negotiation and conflict resolution are considered as soft skills. The difference between hard skills and soft skills are presented in the following table:

| Hard Skills vs. Soft Skills | |

| Management Skills | Communication |

| Operations Skills | Self-Motivation |

| Production Skills | Leadership |

| Logistic Skills | Responsibility |

| (Machine learning, financial analysis, typing skills, computer knowledge, Programming, Tools techniques, Technological knowledge, etc., are some of the examples) | Team Work Problem-Solving Decisiveness Time Management Flexibility Negotiation and Conflict Resolution |

3. Soft Skills to Build Relationships

Soft skills are nothing but the relationship building towards the customers. Here are some common soft skills that help to deliver the best customer service and build relationships.

Good Communication: Both written and verbal communication is important. BC should be able to understand the customer’s requirement and do the needful for them. Speaking loudly with an upbeat tone will help the Business Correspondent to communicate confidently and clearly to the customers. Clear communication is essential in customer service – one needs to know what the customer wants and be able to articulate what can be done for the customer.

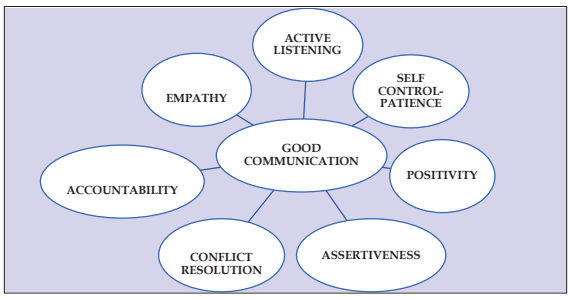

The features of good communication and their advantages are explained in the following table:

| Active Listening | Listening is as important, as good communication. Business Correspondent should carefully listen to the customers and understand their needs. The active listening can be demonstrated, through responses/asking questions for clarifications and body language. The body language refers to the conscious and unconscious gestures and movements that express or convey information. It can include facial expressions, good posture, hand gestures, and eye contact or movement. Nodding head, making eye contact, or smiling (when appropriate) are excellent cues to show that one is paying attention. |

| Self-Control-Patience | Remaining calm and cool, while handling customers is an important soft skill. With patience, one can deal negative issues, in a positive manner. Self-control and patience will help in resolving conflicts efficiently. |

| Positivity | Positive attitude will always help in handling customers. Having a good knowledge about the product or service and their benefits can help the Business Correspondent convey and convince customer. Being optimistic and proactive is a perfect way to stay positive. |

| Assertiveness or

Confidence |

With confidence, one can create a background of trust amongst the customers. The display of professionalism will make customers to feel confident who are keen for settlement of their problems/issues. |

| Conflict Resolution/ Problem Solving skills | It is very important for the Business Correspondent to understand the problem carefully and find the best solution. He/She should develop problem solving skills which is highly essential. |

| Accountability | This is a must-have skill and fundamental to customer service. Accountability guarantees customer confidence. |

| Empathy | Business Correspondent should know to apologize to a customer if he/she provides them with poor quality of service. Apologizing to customers on behalf of bank can help to solve the problem to a certain level. |

In order to improve effectiveness, Business Correspondent has to imbibe the following qualities:

- Business Correspondent should work with commitment towards social objectives and goals. He/She should be sensitivity to the customers with whom, he/she is working

- He/she should develop and understand knowledge on finance and financial products, including banking and banking products

- He/She should develop his confidence and skills

- He/She should avoid misselling of financial products, by making a false or misleading statement, concealing or omitting material facts of the product, concealing the associated risk factors of the products, etc.

4. Negotiation Skill

Negotiation skills are inherent qualities that help two or more parties agree to a common logical solution. In the workplace, one has to display his/her negotiating skills, in various situations. Lack of negotiation skills, affects the business bottom line and could ruin customer relationship. Negotiation skills are soft skills and essential to become a negotiator and resolve workplace conflicts. However, this skill set, depends on the work environment, the parties involved and outcome desired. Often, when one party is ready for reaching a compromise, the other party may be resistant. This makes the negotiation difficult and that is why, one need to master the negotiation skills.

Negotiation is a coveted leadership skill, which helps businesses reach their business objective. Here are a few necessities for possessing the negotiation skills in the workplace:

- Builds relationship: Despite the difference in opinion, negotiation skills help strike a solution and focus more on creating goodwill and value. This builds a long-term relationship.

- Delivers excellent solutions: Good negotiation skills ensure that the solutions to the conflicts are not short-term. It focuses on creating long-lasting solutions, because both the parties make a concession only when the solution is satisfactory.

- Avoids future conflicts: As both the parties agree to a common solution, the chances of future conflicts reduce to a great extent.

- Create an environment of business success: Good negotiation skills ensure the accomplishment of business goals, which creates an environment for the business to be successful. This also increases the chances of future business transaction.

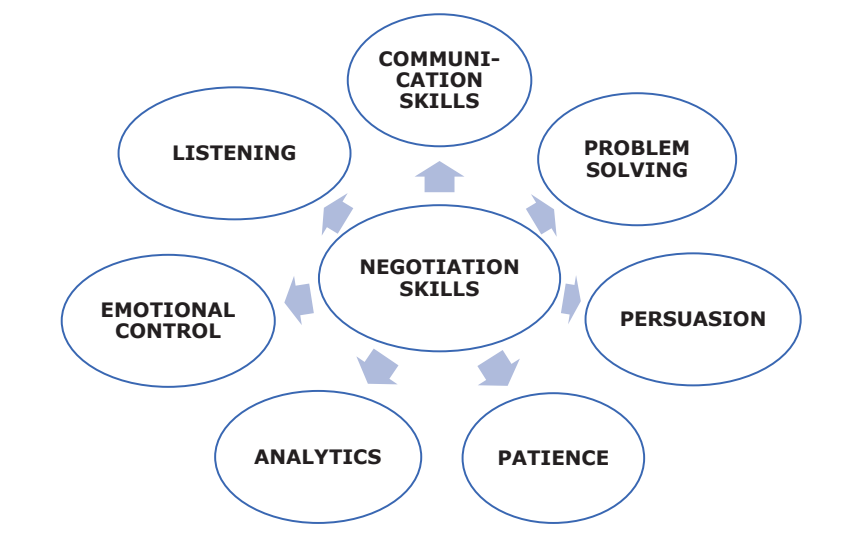

One should possess various traits as indicated in the diagram to be a good negotiator.

Communication Skills

Communication is the process of exchanging information, ideas, thought etc. between at least two persons, in order to create a common understanding. There are different types of communication viz. oral or written, formal or informal etc. Communication may work in both the ways i.e., it can either break or build relationships. In communication, body language is also important and there should be harmony between body language and words spoken. The ten points to be remembered in good communication are

- Listening

- Politeness

- Clarity

- Empathy

- Remove Obstruction

- Patience

- Eye Contact

- Do not argue

- Responding

- Interpersonal Contact.

While engaged in recovery of loans, communication takes place, between the debtor and the agent by words, in writing, eye contact or by body language (during personal meetings).

Communication is of two types viz., Verbal communication by spoken words, Non-verbal communication (facial expressions, eye contact), voice language (voice tone, voice pitch), and body language (body position, body movement): All or any of these elements of non-verbal language, communicate some message (whether intended or unintended, by the communicator) to the receiver.

Following are the main principles of effective communication, which could be followed by an agent (communicator), in communications, with the debtor (receiver):

- The agent’s language (verbal as well as body language) should be civil and courteous, as per the bank-specific requirement.

- The objective of the communication should be clear.

- The language used should be clear, simple and courteous.

- The language used should be easily understood by the receiver.

- The agent should be watchful and sensitive to the receiver’s responses (including his/her body language, as mentioned above).

- Make sure that the non-verbal communication (or body language) is not averse to the debtor, though unintentional.

- Make sure that the receiver has understood the message intended to be conveyed; otherwise reiterate and clarify the missing points.

Problem Solving

Problem solving refers to the ability to handle difficult or unexpected situations in the workplace, as well as complex business challenges. Organizations bank on people, who can assess both kinds of situations and calmly identify solutions. Problem-solving skills are traits that enable one to do that. While problem solving skills are valued by the employers, they are also highly useful in other areas like relationship building and day-to-day decision making. Problem solving skill help determining the source of a problem and find an effective solution. Although problem-solving is often identified as its own separate skill, there are other related skills that contribute to this ability. Active listening, analysis, research, creativity, communication, decision making, team building are the requisite skills for problem solving.

Persuasive skills

After having established good rapport with the debtor, the next skill required in a good recovery agent is, to be able to persuade the debtor, to repay the dues. This may be termed as persuasive skill. The persuasive skill is built on establishing a good rapport and winning the trust of the debtor. Some of the elements of persuasion in debt recovery are as under:

- Explain that the bank (principal) lends money out of the deposits collected from the public and the repayments of the loans by the particular debtor and others, as per the terms of the loan would enable the bank to pay the deposit liabilities, when demanded by the depositors.

- Explain your task/duty of collection of dues, on behalf of the principal and that you have no authority to waive/reduce or unduly postpone the recovery.

- Show interest/concern for the debtor by understanding his/her problems and say that you would try to give assistance to the extent possible, within the authority given to you, as an agent by the principal.

- Explain that non-payment may adversely impact the debtor’s credit history, which may make his/her future borrowing with any bank costlier and difficult. This should induce the debtor to pay.

- Also explain that non-repayment of the loan dues would amount to breach of the loan agreement and would result in the bank charging higher interest rate. Agents may also state the other consequences that may result from the non-payment of the dues in terms of the loan agreement signed by the debtor, e.g., repossession of the charged asset by the bank, filing of a suit by the bank to recover the dues etc. However, in explaining so, the agent should not appear to be giving any kind of threats to the debtor. The efforts should appear as persuasive and not threatening, to the debtor.

Patience

In negotiations, be patient and level-headed. It is very important that one takes negotiations point-by-point, without rushing the process. Also, one cannot negotiate on emotion. Staying level-headed and keeping emotions out of negotiation is key to successful negotiation. One has to be patient and grounded, and really make an impact in negotiations. Advantage always goes to the patient negotiator, who persistently pursues creative win-win solutions. Negotiation is a complex process that takes time. Progress usually comes in small increments. Impatient negotiators who lack persistence, often leave potential results on the table and make costly mistakes. The most successful and effective negotiators are the most creative. Good solutions eventually come to those with the patience to wait for them, the persistence work for them and the desire to produce innovative win-win results. One should not forget that some of the more difficult negotiations will likely call for quite a bit of stamina.

Analytical Skill

Analytical skills involve reviewing the research, facts and other information on a problem and identifying trends and conclusions that lead to usable solutions. Analysis can include studying relevant data and rules and regulations and think critically about research information as to how the information relates to the problem.

Emotional Control

Strong emotions make us blind towards reason during negotiation. Though it is normal to become emotional during negotiation but as we get more emotional, we will not be able to channel our negotiating behavior in a constructive manner. Therefore, it is important to maintain control.

Listening skills

Listening is another skill which is essential in recovery process. A good agent should be a good communicator and also a good listener. Listening refers to all the ways in which communication is being received from the other party and includes not only hearing but also facial and body expressions, attentiveness or lack of it. Following are the requisites of good listening, which help improve communication and make it effective:

- Hear attentively to what the debtor is saying. One may hear, but not listen, if he/she is distracted or inattentive.

- Lack of listening, conveys lack of regard/respect for the communicator; hence it should be avoided.

- Do not show impatience or haste, while listening to the debtor. You may lose some important information the debtor wishes to say.

- Do not show anger or disapproval, or other such facial/body expressions, while listening to the debtor’s point of view.

Normally, commence speaking only after the other party has finished speaking or making a point. Normally do not interrupt. In other words, interrupt only when absolutely necessary, e.g., when the points being spoken are irrelevant or becoming unduly lengthy or controversial and time is limited or is being exceeded. Also interrupt softly by saying words like “excuse me”. The importance of good listening may be explained as follows:

- Listening improves flow of communication, by removing the psychological distances between two parties. Listening with attention helps the agent to know more about the debtor and the information so received, may facilitate smooth recovery process.

- Better relations are built between the agent and the debtor, through good communication and also good listening, than without these two essential skills or lack of them.

5. Let Us Sum Up

The Business Correspondent is an intermediary or a bridge between the bank and the financial excluded people. In this role, the BCs have to communicate with the bankers as well as with the targeted people in the area. The BCs should have necessary soft skills to build relationship with the customers. Clear communication with the clients shall help the BC in discharge of their responsibilities very effectively. Preparation and planning, knowledge of the subject matter being negotiated, ability to think clearly and rapidly under pressure and uncertainty, ability to express thoughts verbally, listening attentively, integrity, ability to persuade others, patience, decisiveness, open to options, being flexible, thinking and talking of possible areas of agreement, etc., are the most important traits of a good negotiator and the BCs should practice to acquire the negotiation skills, in order to be successful.

6. Keywords

Hard skills: refer to the essential knowledge that one needs to acquire for the profession pursued by him/her.

Soft skills: are personal qualities that influence one’s approach to problems, creativity, and ability to work with others.

Active listening: ability to listen actively to a partner going through a difficult time; this is very important when a relationship partner is distressed.

Positivity: the practice of being or tendency to be positive or optimistic in attitude.

Problem solving: is the act of defining a problem; determining the cause of the problem; identifying, prioritizing, and selecting alternatives for a solution; and implementing a solution.

Empathy: the ability to understand and share the feelings of another person.

Negotiator: a person who conducts negotiations.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA