Basic Primer for Investments in India

- Blog|Company Law|

- 16 Min Read

- By Taxmann

- |

- Last Updated on 6 February, 2024

Learning Outcomes of this Article are as follows:

-

- Understand the concept of investment

- Differentiate financial investment from real investment

- Know various features and objectives of investment

- Differentiate between investment and speculation

- Analyse investment environment

- Understand investment decision process

- Differentiate between direct and indirect investing

1. Introduction

Investment is the backbone of any economy. Savings of an economy must be channelized into productive investment to generate income. An individual may keep his savings in a bank account or invest in financial and/or real assets. In India savings bank account does not provide high interest income. Therefore the investors, who wish to earn higher returns, have to explore other avenues for investment such as equity shares, bonds, mutual funds, gold, property, derivatives, etc. Hence, the need for financial literacy on the part of individual investors. This chapter provides an overview of the basic concept of investment, types of investment and approaches of investing.

Investment refers to commitment of funds in expectation of future gains or benefits. Every investment requires that current consumption is foregone so that in future some benefits or returns are generated. Different investment products have different levels of risk and return and hence their estimation and analysis is an important aspect of investment decision making. An investor should make his investment decision depending upon his risk-return preferences and analysis of risk-return features of the investment options.

This article provides a clear understanding of the various investment avenues available, modes of investment and process of taking an investment decision.

2. Investment

The term investment implies employment of current funds to earn commensurate return in future. It implies sacrifice of current consumption for expected income in future because the amount which is not spent on current consumption is saved and invested. An investor foregoes current consumption and invests his savings in investments in anticipation of higher future consumption. It is important to note here that investment does not always guarantee higher future returns. At times losses are also incurred. Hence the environment of investment is quite uncertain. We are in fact facing a VUCA (Volatile, Uncertain, Complex, Ambiguous) environment in the context of investments.

“In 1986, Microsoft Corporation first offered its stocks to public and within 10 years, the stock’s value had increased over 5000%. In the same year, Worlds of Wonder also offered its stock to public but ten years later the company was defunct.”

The word ‘investment’ connotes different meanings to different people. To a layman it may mean purchase of shares, bonds or others financial instruments. To an economist, it implies purchase of fixed productive assets (Capital assets) such as plant and machinery. To a businessman as well investment refers to purchase of fixed assets such as land, building, plant, machinery etc.

Irrespective of its context, the word investment requires commitment of funds in some assets at present so as to be able to generate higher income in future.

2.1 Financial Investment vs. Real Investment

Depending upon the type of asset, all the investments can be classified as financial or real investment.

-

- Financial investment is investment of funds in financial assets. Financial assets are claims over some real/physical assets. The examples of financial assets are shares, bonds, mutual fund units etc. The return of financial investment is in the form of interest, dividend and/or appreciation in value.

- Real Investment (or Economic Investment) is an investment where funds are invested in real or tangible assets. Real assets are those long term (or fixed) assets which are used in the production process. The examples of real assets are plant, machinery, equipments, building etc.

An individual investor invests in financial assets (equity shares, bond, etc) and commodity assets (e.g. gold, silver etc.). Now-a-days real estate investment has also become an important part of individual investor’s portfolio. Real estate is investment in tangible house/commercial properties to get income in the form of rent and/or capital gain due to price appreciation.

The subject matter of this book – “Investing in stock markets” is financial investment. Financial assets are primarily in the form of securities. A security as defined under the Securities Contacts (Regulation) Act, 1956 includes—

(i) shares, scrips, stocks, bonds, debentures, debenture stock or other marketable securities of a like nature in or of any incorporated company or other body corporate;

(ii) derivative;

(iii) units or any other instrument issued by any collective investment scheme to the investors in such schemes;

(iv) security receipt as defined in clause (zg) of section 2 of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (54 of 2002);

(v) units or any other such instrument issued to the investors under any mutual fund scheme;

(vi) any certificate or instrument (by whatever name called), issued to an investor by any issuer being a special purpose distinct entity which possesses any debt or receivable, including mortgage debt, assigned to such entity, and acknowledging beneficial interest of such investor in such debt or receivable including mortgage debt, as the case may be;

(vii) Government securities;

(viii) such other instruments as may be declared by the Central Government to be securities; and

(ix) rights or interests in securities.

This book primarily deals with investment in stocks, mutual funds and derivative instruments.

3. Features (or factors affecting) of Investment

Individual investors make investment keeping in mind certain objectives. After all they forego current consumption in order to avail of higher income and hence consumption in future. The ultimate objective of investment is to minimize risk and maximize return. However due to the fact that risk and return move hand-in-hand, it is not always possible to get very high return at very low risk. So risk-return trade-off becomes the primary factor affecting investment by any individual. Other factors which must be kept into mind while making investment may be tax benefits, safety and capital, liquidity, etc.

The following is the list of factors to be considered while making investment:

-

- Return

Every investment is expected to provide certain rate of return over a period in future. Return is the income generated by investment expressed as a percentage of the cost of investment. For example if a person buys an equity share at a cost of `100 and gets `10 as dividend at the end of the year, his return on share would be 10/100*100 = 10%. Here we assume no change in share price at the end of the year. If the share price also increases to `105 then his return would be ![]()

Different investment instruments have different returns depending on their level of risk. For example Treasury bills (T-bills) and govt. securities carry low return as compared to equity shares and derivatives.

-

- Risk

Risk is defined as variability in expected return. If return from an investment is certain, fixed and 100% sure then there is no risk attached to it. Generally, Government securities are considered to be risk-free. However instances of sovereign debt crisis (in which European Countries government failed to repay the public debt) cast doubt on government securities being risk free. Risk can be calculated as standard deviation of the expected returns from an investment. The objective of any investment is to minimize risk. Different individuals have different risk taking abilities. For example young entrepreneurs may take higher risk than old and retired people. Therefore investment must be done keeping in mind the risk bearing ability of the investors.

-

- Liquidity

It is the “moneyness” of investment i.e. the ease with which investment can be converted into cash with no or little risk of loss of capital. Some assets are highly liquid (e.g. equity shares, mutual fund units etc.) and some are less liquid (e.g. bonds, debentures). It is important to mention here that the development and efficiency of financial markets depends to a great extent on the liquidity of the securities traded in it.

-

- Marketability

A related aspect is marketability i.e. the ease with which an asset can be bought or sold. An asset may be highly marketable but less liquid (e.g. distress sale of property). For being marketable it is important that there is a ready market for the security, where it can be bought or sold.

-

- Tax Benefits

Availing tax advantage is another important objective of investment in financial assets in India. Section 80C of Income Tax Act, 1961 provides certain investment alternatives (e.g. PPF, NSC, Mutual Funds, ELSS-Equity Linked Savings Schemes etc.) which qualify for deduction from taxable income upto `1,50,000. Assessment of tax benefits is important which undertaking investment because it affects the actual effective return from investment.

For example : Rural Electrification Corporation (REC) has come out with tax-free bonds at a coupon rate of 8.12% p.a. for 10 years. It implies that interest income from these bonds will be exempt from tax. If an individual is in 30% tax bracket then the effective pre-tax interest rate would be

-

- Hedge against Inflation

A good investment should provide hedge against the purchasing power risk or inflation. The investor must ensure that the return generated by his investment is higher than the prevailing inflation rate. Then only he is benefited by making investment, otherwise he is worse off. For example, if the prevailing inflation rate is 8%, the investor should look for investment options which provide more than 8% return otherwise his real worth of investment will go down. Inflation erodes purchasing power of money and hence hedge against inflation is an important consideration in investment.

Generally, equity shares are considered to be a good hedge against inflation because of their varying return. It is expected that in times of inflation, equity shares generate higher return. On the other hand fixed income securities like bonds are not a good hedge against inflation due to the fact that their interest rate are fixed and do not increase in times of rising inflation.

-

- Safety of Capital

Safety of capital should come first. The investor must secure his principal amount which he invests. That is he should not be impressed by very high rate of return on an investment if the amount invested is not safe. For this, credit rating agencies play an important role in providing bond-ratings. Generally bonds which have lower than AAA ratings are considered to be not so safe. For example many NBFC come out with fixed deposit schemes at an attractive interest rate but safety of investment is less.

|

Don’ts of Good investing Don’t try to predict market movement Don’t expect quick returns Avoid chasing hot tips Don’t blindly follow the crowd Over or inadequate diversification Use of borrowed money to make more money Don’t fall in love with poor investments |

4. Speculation

Speculation is investment in an asset that offers a potentially large return but is also very risky; a reasonable probability that the investment will produce a loss. It can be defined as the assumption of considerable risk in obtaining commensurate gain. Considerable risk means that the risk is sufficient to affect the decision. Commensurate gain means a higher risk premium. Speculative assets are high risk-high return assets and hence should be invested in with caution. Generally large investors hold speculative assets so as to make quick gains.

Stock market is identified with two types of speculators – bulls and bears. Bull speculators expect increase in stock prices while bear speculators expect decline in prices. It must be noted here that speculation, per se, is not bad. Rather it is essential for smooth functioning of stock market and to maintain price continuity and liquidity. However excessive speculation is bad as it takes the prices away from their true fundamental values. Therefore SEBI keeps a check on excessive speculation in Indian stock market, through various rules and guidelines under SEBI Act, 1992.

It must be noted here that the same asset can be held by an investor for investment and by the other for speculation. For example shares of RIL, if held by a small investor for long term amounts to investment but if it is held by an FII for making quick return over short run then it implies speculation.

4.1 Investment vs. Speculation

Investment and speculation can be distinguished on the following grounds:

|

Basis of Difference |

Investment |

Speculation |

|

| 1. | Time horizon | Long generally exceeding one year | Short may be as short as intra-day |

| 2. | Risk | Low to Moderate | Very high |

| 3. | Return (expected) | Low to moderate and consistent | Very high and inconsistent |

| 4. | Funds | Own funds are used for investment | Speculators also borrow funds and/or do margin trading |

| 5. | Income | Dividend, Interest etc. | Change in price of asset |

| 6. | Source of Information | Fundamental factors of the company are analysed | Subjective analysis, inside information etc. |

4.2 Gambling

Gambling is a game undertaken for someone’s excitement e.g. horse race, card games, lotteries. Here although the winner makes big money but that cannot be classified as return because it is not consistent or regular. Gambling is a zero sum game – someone’s loss is other party’s gain. It is purely by chance that one party wins over the other. Therefore gambling is highly uncertain and may involve complete loss of funds put in it.

5. Investment Environment

The investment environment implies various types of securities which are available for investment and the entire mechanism or process through which these securities can be bought or sold.

The investment environment comprises of three main aspects- securities (also referred as financial assets or financial instruments); securities markets (i.e. financial market) and intermediaries in securities markets. The investment environment now-a-days is characterized as VUCA (Volatile, Uncertain, Complex, Ambiguous).

5.1 Securities

An investor can invest in a variety of securities such as equity shares, bonds, debentures, derivatives, mutual funds, exchange traded funds etc. One may also invest in commodities and bullions (such as gold and other precious metals). Even currency derivatives are also getting popular as an investment avenue these days. These securities may be transferred from one owner to the other without much difficulty.

5.2 Securities Market

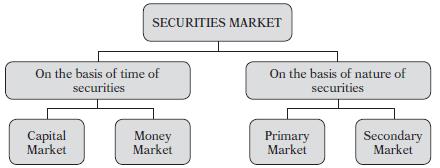

Security market brings together buyer and seller of securities and provides operational mechanism to facilitate the exchange of securities. An efficient and developed security market is a prerequisite for increased investment in securities. There are many types in which securities market can be classified.

On the basis of Time, securities market is classified as:

(a) Capital market is the market for long term financial investment and instruments (more than one year). It primarily deals with equity shares, long term bonds and debentures. In India, it is further classified into the following two segments- Equity Market and Wholesale Debt Market.

(b) Money market deals with short term securities (one year or less). It deals with Treasury bills, short term debts such as commercial paper, certificates of deposits etc.

On the basis of nature of securities, a security market can be further classified as:

(a) Primary market is the market where new securities are issued for the first time. IPO is a tool of primary market.

(b) Secondary market which provides the platform where existing (or second hand) securities are bought or sold. Shares issued in IPO are traded in secondary market.

A well functioning primary market is essential for the growth of investments in an economy. At the same time, a transparent and efficient secondary market that ensures speedy transfer of ownership of securities, is a prerequisite for investment in a particular security. For example in India, secondary market for bonds is not properly developed and hence growth in bond market in India is lagging behind as compared to growth in other countries bond markets.

Every security is characterized by market intermediaries who are positioned between the buyer and seller of securities. Stock exchange, its brokers and sub-brokers act as market intermediaries in secondary market.

5.3 Regulation of securities Market

The investment environment and hence securities market is well regulated. Securities market is not a laissez-faire market but adequately regulated by regulatory bodies such as SEBI (Securities and Exchange Board of India), RBI (Reserve Bank of India), Department of Company Affairs, Ministry of Finance etc. The multiplicity of regulatory agencies sometimes proves detrimental to the growth and efficient regulation of securities market. Hence there is a move towards reducing the number of regulatory bodies in India. On 28th September, 2015, Forwards Markets Commission has been merged with SEBI.

6. Types of Investments (Or Securities)

Various types of securities or Investment option can be classified into the following categories on the basis of their peculiar features as well as risk return relationships:

6.1 Equity shares – “investment in stock markets”

Equity shares are also known as ‘Common stocks’ in western economies. An equity share represents an ownership claim in a company. The owner of the equity share is termed as equity shareholder in the company and enjoys all voting rights in corporate matters. Equity shareholders get future benefits in the form of dividends (i.e. the amount of profit distributed as dividends) and in the form of price appreciation (or capital gains). However it is not obligatory on the part of the company to declare dividends every year and the amount of dividends, if any, may also vary from year to year. Hence equity shares are also referred to as ‘variable income securities’ and do not promise fixed return. Due to variability in returns, equity shares are highly risky securities. They may generate a very high return or very high loss during the investment horizon. Worldwide equity shares are expected to generate higher returns (as they have higher risk) over long term.

Equity shares are offered to general public for the first time through a public offer. There are two types of public offer:

(i) IPO (Initial Public Offering): IPO is the process through which a company goes public. IPO is the sale of equity shares by a company to general public for the first time. It can be a public issue of shares by a new company trying to raise capital or an old private company which wants to be listed on stock exchange and become public company. IPO is a very lucrative opportunity for investment as shares bought through IPO, if held for long term, have potential to yield huge profits. E.g. Burger King has come up with an IPO in the month of December 2020.

An investor can subscribe to an IPO by filling the application form and paying the initial application money for the number of shares he wants to buy. An IPO is open only for a limited number of days. Once the IPO closes and the shares are listed on the stock exchange for trading, buyers can easily buy or sell these shares anytime.

(ii) FPO (Follow-on Public Offering): FPO is the process of issuing additional or new equity shares to public by an already listed company. So, FPO is brought by a company which has already gone through the IPO process. An FPO is available to new as well as existing shareholders of the company. [E.g. Facebook announced its FPO in December 2013 to raise money for its working capital needs.]

An investor can either buy equity shares in the primary market through an IPO/FPO or in the secondary market, i.e., stock exchange where the shares are continuously traded.

Dive Deeper:

Paytm/Zomato IPO Saga: SEBI Proposes Tougher Norms for Pricing of IPOs

6.2 Bonds and debentures

Bonds and debentures are fixed income securities. A bond is an IOU (I Owe You) of the borrower. It arises out of a lending-borrowing contract wherein, the borrower (or the issuer of the bond) promises to pay a fixed amount of interest to the lender (or the bond holder) periodically and repays the loan either periodically or at maturity. Most of the bonds and debentures are redeemed at maturity only and they carry a fixed coupon rate or fixed rate of interest. Bonds may be corporate bonds or government bonds, short term bonds or long term bonds, secured bonds or unsecured bonds, etc. Bonds and debentures may also be convertible or non-convertible. Since bonds and debentures carry a fixed rate of interest, their future benefits are known in advance, therefore they have relatively lower risk than equity shares. At the same time they generate relatively lower return. Some bonds also offer tax exemption up to a certain amount of investment depending upon notification by the government. E.g. NABARD (National Bank for Agricultural and Rural Development), REC (Rural Electrification Corporation) and NHAI (National Highway Authority of India) bonds, RBI tax relief bonds.

6.3 Treasury Bills

Treasury bills are the securities issued by Central Government in the context of a lending- borrowing contract. An investor in Treasury bills actually lends money to the Central Government. This type of security carries minimum (or negligible) risk of non-payment of the amount as promised. Hence the default risk in case of Treasury bills is negligible. These bills are issued at discount and redeemed at par and hence the rate of return is known with certainty in the very beginning of the investment. Because of this feature, Treasury bills are also referred to and used as “Risk free asset” in research studies.

6.4 Deposit related investments

There are various types of deposit options available to investors like fixed deposits, recurring deposits, and special term deposit schemes in banks. These offer a return of 6-8% p.a. interest on the amount invested. This interest income is taxable also except for the tax-saving deposit schemes which provide relief up to ` 1,50,000 under section 80C of Income Tax Act, 1961. The post tax returns on these deposits are usually not adequate to increase the value of investment because inflation is higher than their post tax returns.

6.5 Government schemes

Government launches various types of schemes from time to time with an objective of inculcating saving habit amongst citizens and for this purpose various tax benefits are also attached with these investment schemes. Following are the popular government schemes:

(i) National Savings Certificate (NSC): NSC is an Indian government savings bond certificate issued by post offices. Currently, NSC VIII (8.5%, 5 years) and NSC IX (8.8%, 10 years) are being offered. These are transferable once in their time horizon. One certificate costs ` 100 but there is no upper limit on amount of investment. Investment amount qualifies for rebate under section 80C of Income Tax Act.

(ii) Public Provident Fund(PPF): The Public Provident Fund Scheme, 1968 is one of the most popular long-term, tax-free investment scheme of Ministry of Finance. It acts as a kind of compulsory saving and helps in developing saving discipline. It has a minimum investment limit of ` 500 and a maximum limit of ` 1,50,000 per annum. Investors get an interest rate of around 7% p.a. on a compounding basis. It has a maturity period of 15 years. PPF account can be opened throughout the year with bank or post office. PPF is an Exempt, Exempt, Exempt scheme, i.e., periodic deposits provide tax deduction while no tax is levied on interest income and withdrawals on maturity.

No withdrawals are allowed till first 6 years. From 7th year onwards, a person can withdraw amount (not more than 50% of the balance) every year. PPF also provides a loan facility wherein a person can take a loan of up to 25% of the account balance available at the end of first financial year. This facility is available from third year onwards.

(iii) Post office schemes: Indian Post Offices offer tax saving deposit schemes for different maturity periods and investment periodicity. E.g.: Monthly Deposits, Saving Deposit, Time Deposit, Recurring Deposit, etc.

(iv) Infrastructure bonds: Government allows its undertakings and some approved infrastructure companies to issue tax-free bonds from time to time. Most popular are the infrastructure bonds issued by NABARD, REC, PFC and NHAI. These bonds have a lock-in period and if sold by an investor before the expiry of lock-in period, the tax exemption will not be given. In the union budget 2016, government had declared that only interest income on these bonds is tax free, the capital gains would be taxed and the money invested will not be eligible for tax deduction.

6.6 Alternative investment avenues

Besides above, a number of new securities have been introduced in securities market over the past two decades. These securities include- mutual funds, exchange traded funds (ETFs), derivatives ( financial derivatives and commodity derivatives), warrants, mortgaged backed securities, deep discount bonds, catastrophe bonds, collective investment schemes, REITs (Real Estate Investment Trusts), etc. These securities have enriched the investment environment by providing a variety of choice to the investors.

(i) Mutual funds – Mutual funds collect money from investors and put the pool of money so collected into investment products like equity shares, bonds, debentures, money market instruments or combinations thereof. Most funds are launched with a predetermined investment nature such as debt funds, equity funds, or balanced funds. Mutual funds are professionally managed and provide diversification benefits to retail investors. Systematic Investment Plan (SIP) – a new development in mutual fund investment – is a smart mode for investing money in mutual funds. It provides rupee cost averaging and compounding benefits.

(ii) Equity Linked Savings Scheme (ELSS): ELSS are diversified mutual fund schemes with tax benefits under section 80 C of Income Tax Act. ELSS as the name suggests invest in equity products along with debt investment. These funds invest in equities, thus offer long-term growth opportunities. These come with a lock-in period of three years; however, the dividend income is tax free and long term capital gains are also exempt from tax. So, ELSS is also an EEE (Exempt, Exempt, Exempt) option but it has the shortest lock in period as compared to PPF and NSC.

(iii) ULIP (Unit Linked Insurance Policy) – ULIP is an insurance product which offers a combination of insurance and investment. It provides life cover and investment benefit. Some premium portion goes for the life insurance policy and the rest is invested into an option chosen by investor. The worth of investment is highly linked or dependent on market performance. Different insurance companies offer different types of ULIP schemes with varying investment portfolio, different fees and premiums. ULIPs have not been able to make a mark amongst investors because of not so consistent returns and high market risk involved. ULIP premium is eligible for 80C deduction.

Dive Deeper:

FAQs on Taxation of ULIPs

Taxation of Unit Linked Insurance Plan (ULIPs)

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA