[Analysis] UAE Free Zone Entities – Recent Developments and Key Tax Implications

- Blog|International Tax|

- 12 Min Read

- By Taxmann

- |

- Last Updated on 7 March, 2024

By Nirav Shah – Founder & Managing Director | Fame Advisory | DMCC

Table of Contents

- Overview of Recent Developments on Free Zones

- Conditions for Free Zone Persons

- Meaning of Adequate Substance

- Core Income Generating Activity and its outsourcing

- Determination of Qualifying Income for Free Zone Persons

- Income derived from Immovable Property

1. Overview of Recent Developments on Free Zones

- 09 December 2022: Corporate Tax Law issued

- 01 June 2023:

-

- Ministerial Decision No.139 of 2023 – Qualifying Activities and Excluded Activities

- Cabinet Decision no. 55 of 2023 – Determination of Qualifying Income

- 19 July 2023: Public Consultation Paper on Free Zones

- 03 November 2023:

-

- Ministerial Decision No. 265 of 2023 – Qualifying Activities and Excluded Activities

- Cabinet Decision no. 100 of 2023

2. Conditions for Free Zone Persons

- Article No. 18 of Corporate Tax (CT) Law

- Public Consultation on Free Zone

- Cabinet Decision No. 100 of 2023

- Ministerial Decision No. 265 of 2023

2.1 Definition as per CT law

- Free Zone: Free Zone is a designated and defined geographic area within the UAE that is specified in a decision issued by the Cabinet at the suggestion of the Minister.

- Free Zone Person (FZP): The definition of a Free Zone Person under the UAE CT Law refers to juridical person incorporated, established or otherwise registered in a Free zone including branch of a NonResident Person registered in a Free Zone and branch of mainland entity in a free zone.

2.2 CT Rate for Qualifying Free Zone Person

Corporate Tax shall be imposed on a Qualifying Free Zone Person at the following rates:

- 0% on Qualifying Income

- 9% on Taxable Income that is not Qualifying Income

2.3 Conditions as specified in Article 18 of CT Law for Free Zone Persons

- Maintain adequate substance in UAE

- Deriving Qualifying Income

- Has not elected to be subject to Corporate Tax

- Complies with Arm length principle and transfer pricing documentation

- Meets any other conditions as may be prescribed by the Minister.

2.4 Tax Impact if a FZP is not a Qualifying Free Zone Person (QFZP)

A FZP will NOT be considered as a QFZP for 5 years

- If any one of the 4 conditions are NOT met in any particular year – Entire Profit Taxable @9%

- If ELECTS to be subject to general rate of Corporate Tax in any particular year – Profit Taxable @9%

2.5 Additional Condition for Free Zone Persons

Ministerial Decision No. 265 of 2023 specified two additional conditions that Free Zone has to complied:

- Non–qualifying revenues do not exceed the de-minimis requirements.

- Prepares Audited Financial Statements in accordance with the Law.

Failure to meet any of the above requirements shall cease taxpayer’s status of a Qualifying Free Zone Person from the beginning of the relevant Tax Period and for the subsequent four Tax Periods.

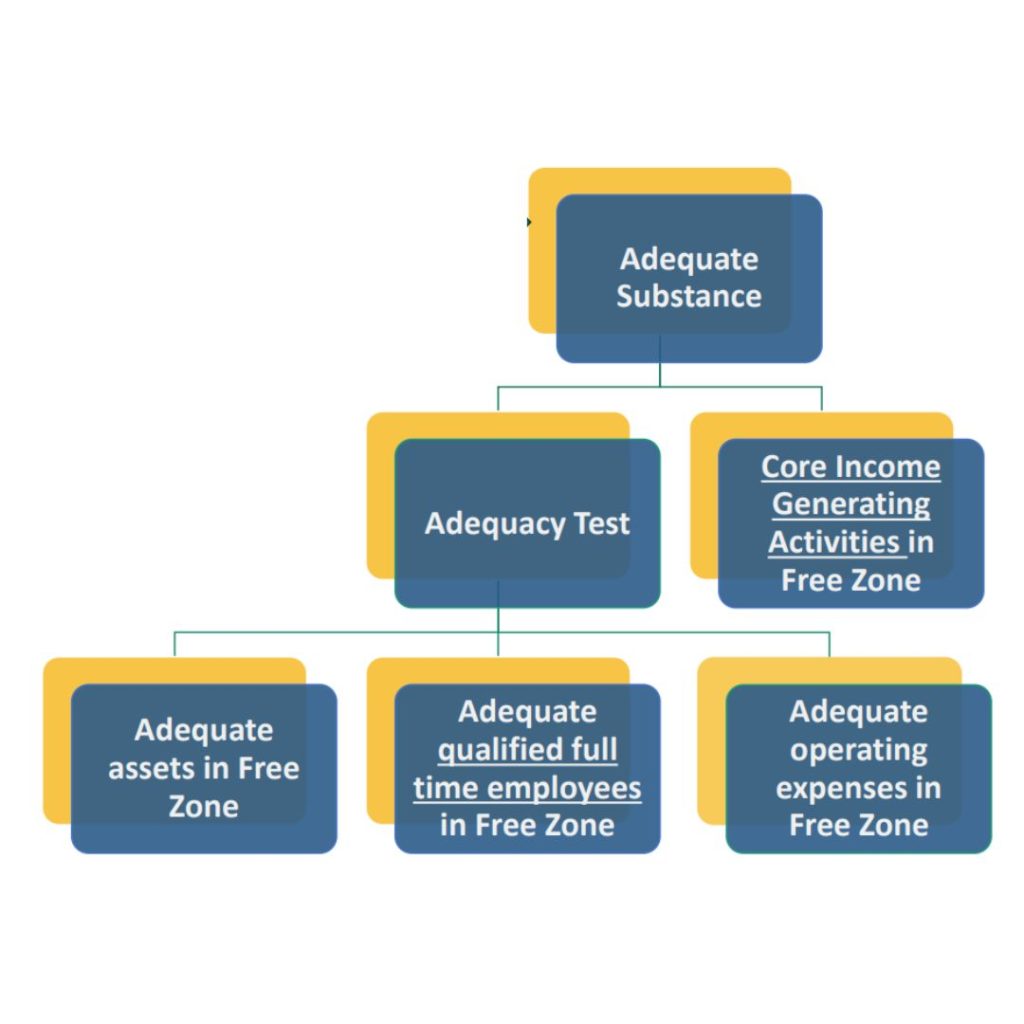

3. Meaning of Adequate Substance

- Maintain adequate substance in UAE

- Deriving Qualifying Income

- Has not elected to be subject to Corporate Tax

- Complies with Arm length principle and transfer pricing documentation

- Meets any other conditions as may be prescribed by the Minister

Illustration-1 Free Zone Person

- X Ltd is a free zone person in UAE having Flexi Desk in Free Zone

- X ltd may not be considered a Qualifying Free Zone Person because of absence of proper office premises in Free Zone.

Illustration-2 Free Zone Person

- X Ltd is a free zone person in UAE with no employees

- X ltd would not be considered a Qualifying Free Zone Person because of absence of employees in Free Zone.

Illustration-3 Offshore Free Zone Person

- Z Ltd is JAFZA offshore entity of UAE

- Z ltd an offshore entity would not be considered a Qualifying Free Zone Person because of absence of physical premises and employees in offshore.

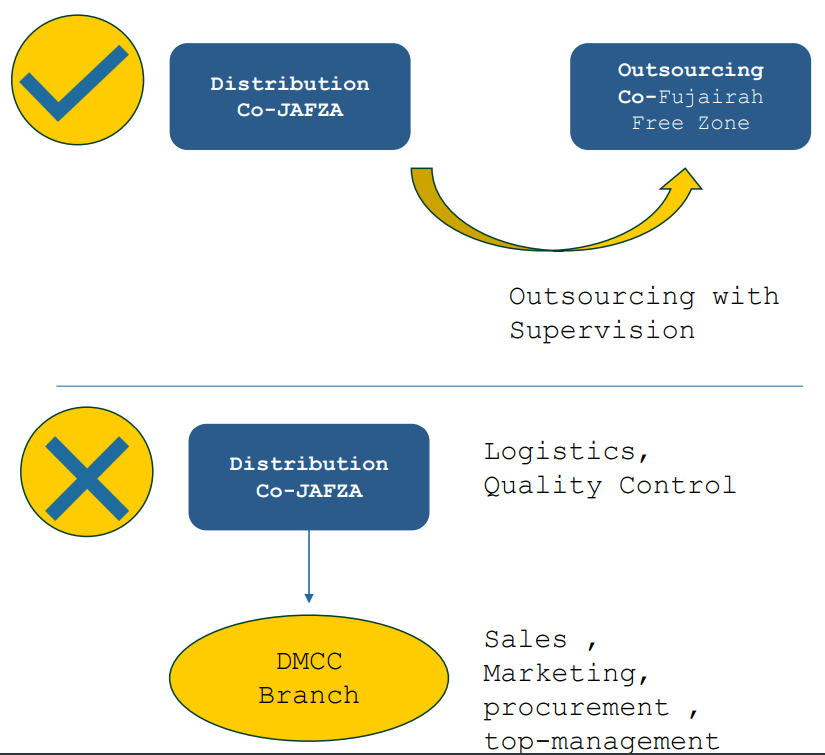

4. Core Income Generating Activity and its outsourcing

As per Cabinet Decision No. 100

- A Qualifying Free Zone Person shall undertake its core income-generating activities in a Free Zone or a Designated Zone, depending on where such activities are required to be conducted, and having regard to the level of the activities carried out, have adequate assets, an adequate number of qualified full-time employees in a Free Zone or a Designated Zone depending on where such activities are required to be conducted, and incur an adequate amount of operating expenditures, in relation to each activity.

- Core income-generating activities can be outsourced to another Person in a Free Zone or a Designated Zone depending on where such activities are required to be conducted, provided the Qualifying Free Zone Person has adequate supervision of the outsourced activity.

- Core income-generating activities in respect of Qualifying Intellectual Property can be outsourced to any other Person in the UAE and to any other Person who is not a Related Party outside the UAE, provided the Qualifying Free Zone Person has adequate supervision of the outsourced activity.

- Core income-generating activities may vary according to the specific activity but mainly consist of those significant functions that drive the business value for each activity carried out by a Qualifying Free Zone Person and are not exclusively or mostly support activities.

Illustration – CIGA

- CIGA undertaken in a Free Zone or in a Designated Zone (e.g., for Distribution Activity)

- Full -time employment

- Outsourcing with an adequate supervision to a person in a Free Zone or in a Designated Zone (e.g., for Distribution Activity)

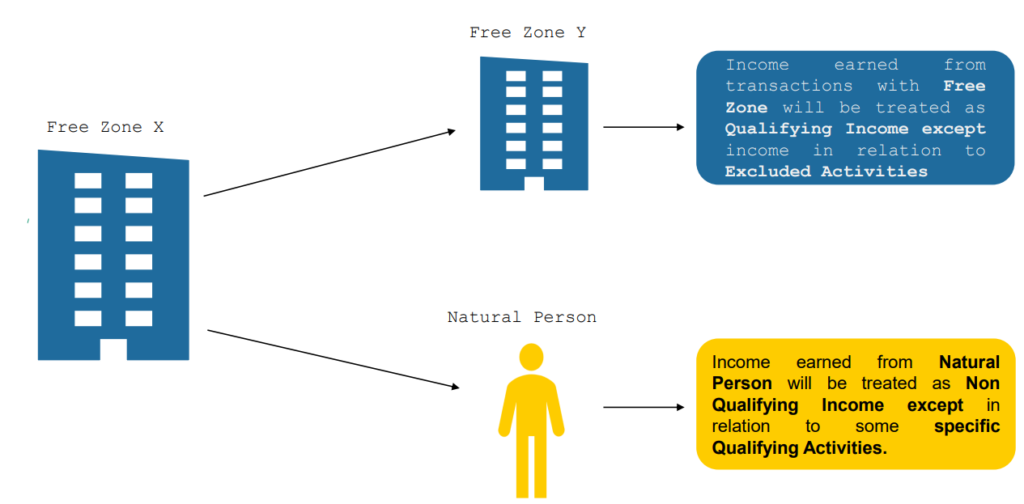

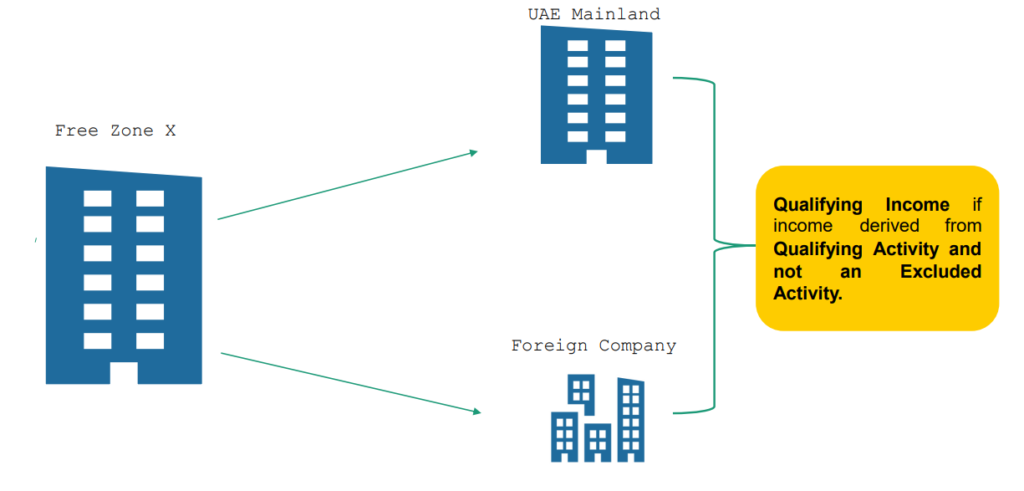

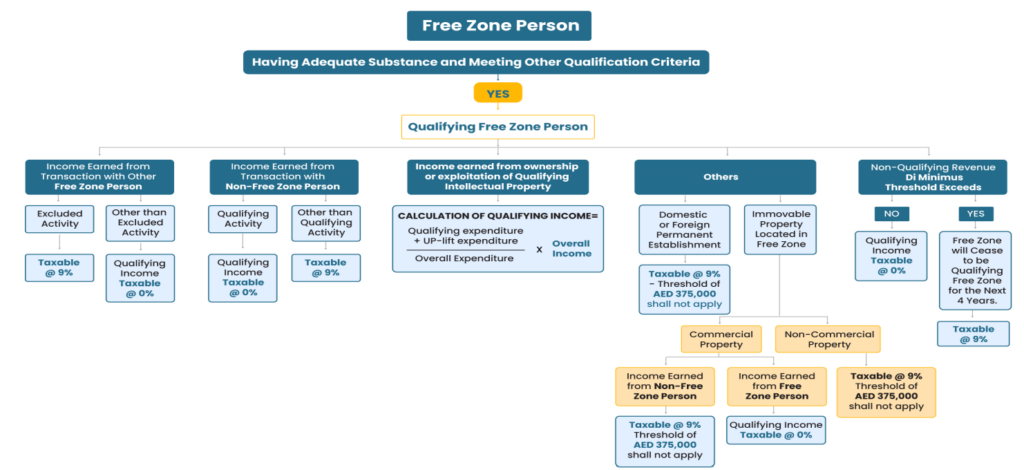

5. Determination of Qualifying Income for Free Zone Persons

As per Cabinet Decision 100, Qualifying Income of the Qualifying Free Zone Person shall include the below categories of income:

- Income derived from transactions with a Free Zone Person, except for income derived from Excluded Activities

- Income derived from transactions with a Non-Free Zone Person, but only in respect of Qualifying Activities that are not Excluded Activities

- Income derived from the ownership or exploitation of Qualifying Intellectual Property

- Any other income provided that the Qualifying Free Zone Person satisfies the de minimis

requirements

5.1 List of Qualifying Activities

In respect of Goods are follows:

- Manufacturing of goods or materials

- Processing of goods or materials

- Trading of Qualifying Commodities

- Distribution of goods or material in or from a Designated Zones (Designated Zones is as defined in VAT law) to a customer that resells such goods or materials, or parts thereof or processes or alters such goods or materials or parts thereof for the purposes of sale or resale

Others: Holding of shares and other securities for investment.

In respect of Services are as follows:

- Ownership, management & operation of Ships

- Reinsurance services, if subject to regulatory oversight

- Fund management services, if subject to regulatory oversight

- Wealth and investment management services, if subject to regulatory oversight

- Headquarter services to Related Parties

- Treasury and financing services to Related Parties

- Financing and leasing of Aircraft, including engines and rotable

- Logistics services

* Any activity that are ancillary to the above activities

5.2 List of Excluded Activities

- Income from certain regulated financial service activities:

- Banking activities

- Insurance activities except

-

-

- Reinsurance services

- Headquarter services to Related Parties

-

-

- Finance and leasing activities except:

-

-

- Treasury and financing services to Related Parties

- Ownership, management and operation of Ships

- Financing and leasing of Aircraft

-

- Ownership or exploitation of Immovable property except transaction in respect of Commercial property located in Free Zone with other Free Zone Person.

- Any activities that are ancillary to the Excluded Activities

- Any transaction with natural persons, except transactions in relation to:

-

- Ownership, managements and operation of Ships

- Fund Management services

- Wealth and investment management services

- Financing and leasing of Aircraft

Determination of Qualifying Income from Free-Zones Person

Determination of Qualifying Income from Free-Zones Person

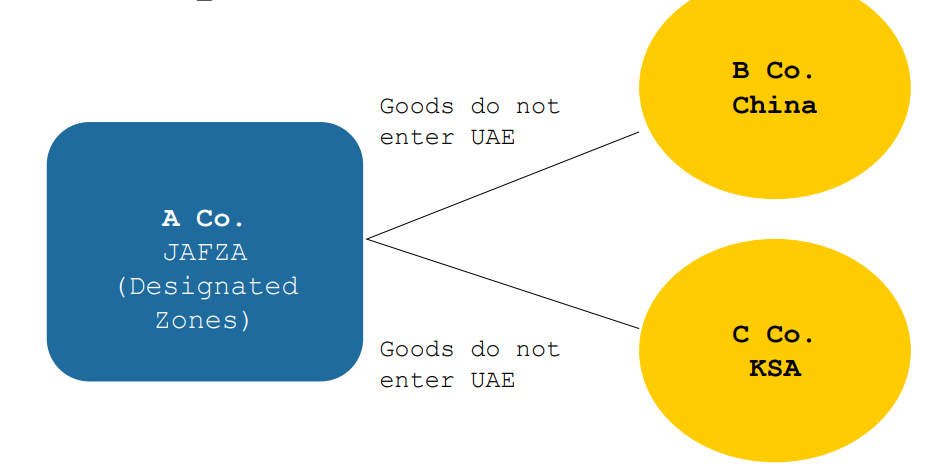

Illustration

Distribution Activity in a Free Zone will be Qualifying Activity if the said activities of distributing of goods or material is in or from a Designated Zones to customers that resells or processes or alters and sells such goods or material and the said goods/materials entering the State must be imported through Designated Zones.

Distribution Activity undertaken in and from a Designated Free Zone Person:

- Free Zone Person: Qualifying Income irrespective whether distribution activity is from designated zone or not.

- Mainland Person: Qualifying Income subject to the above condition.

- Natural Person: Non Qualifying Income as it is covered under “Excluded Activity”.

- Foreign Entity: Qualifying Income subject to the above condition.

Illustration

Service Activity undertaken by Free Zone Person

- Free Zone Person: Qualifying Income (i.e. consultancy, logistics etc.) except if it is from “Excluded Activity”

- Mainland Person & Foreign Entity: Non Qualifying Income except if it is from Qualifying Activity other than “Excluded Activities”

- Natural Person: Non-Qualifying Income except in respect of following Qualifying Activities:-

-

- Fund management services

- Wealth and investment management services

- Aircraft, including engines and rotable components

- Ownership, management and operation of Ships

5.3 De Minimis Requirements

Non Qualifying Revenue derived by the Qualifying Free Zone Person in a Tax Period does not exceed the below limit:

DE MINIMIS THRESHOLD = NON QUALIFYING REVENUE

- 5% OF TOTAL REVENUE or

- AED 5 MILLION

WHICHEVER IS LOWER

5.4 Non-Qualifying Revenue

Non Qualifying Revenue is revenue derived in a Tax Period from any of the followings:

- Excluded Activities

- Activities other than “Qualifying activities”, where other party to the transaction is Non Free Zones person.

- Transaction with a Free Zone Person where such Free Zone Person is not the beneficial Recipient of the relevant Services or Goods.

5.5 Additional Condition for Free Zone Persons

Ministerial Decision No. 265 of 2023 specified two additional conditions that Free Zone has to complied:

- Non–qualifying revenues do not exceed the de-minimis requirements.

- Prepares Audited Financial Statements in accordance with the Law.

Failure to meet any of the above requirements shall cease taxpayer’s status of a Qualifying Free Zone Person from the beginning of the relevant Tax Period and for the subsequent four Tax Periods.

Illustration

|

Particulars |

Example 1 |

Example 2 |

| Revenue | 100,000,000 | 80,000,000 |

| Non – Qualifying Revenue | 4,000,000 | 6,000,000 |

| Total Revenue | 104,000,000 | 86,000,000 |

| (a) 5% of Total Revenue | 5,200,000 | 4,300,000 |

| (b) Fixed amount | 5,000,000 | 5,000,000 |

| De minimis (Lower of (a) & (b) | 5,000,000 | 4,300,000 |

| Qualifying Income (0%) | 104,000,000 | –– |

| Taxable Income (9%) | –– | 86,000,000 |

5.6 Calculation for De Minimis

Revenue attributable to immovable property located in Free Zone derived from:

- Transaction with Non–Free Persons in respect of Commercial Property

- Transaction with any person in respect of immovable property that is not commercial property

Not to consider for Non – Qualifying Revenue and Total Revenue:

- Revenue attributable to Domestic or a Foreign Permanent Establishment of the Qualifying Free Zone Person.

- Revenue Derived from the ownership or exploitation of intellectual property, except for the Qualifying Income calculated in accordance with the decision issued by the Minister

5.7 Domestic or Foreign Permanent Establishment

Domestic Permanent Establishment (PE): A place of business or other form of presence of a Qualifying Free Zone Person outside the Free Zone in the UAE.

- Free Zone person deriving income from Domestic or Foreign PE would be “Non Qualifying Income”.

- Free Zone Person has to pay Corporate Tax @9% on such income.

- Free Zone person will not be allowed to avail basic exemption threshold limit of AED 375,000.

Free Zone:

- Domestic PE (i.e. Mainland Branch)

- Foreign PE

6. Income derived from Immovable Property

Income attributable to immovable property located in a Free Zone that is derived from the below transactions shall be considered as Taxable Income and taxed @ 9% without availing the benefit of basic threshold limit of AED 375,000:

- In respect of Commercial Property, income derived from Non Free Zone Persons.

- In respect of Non-Commercial Property, income derived from any Persons.

6.1 Commercial Property

As per Article 1 of Cabinet Decision No. 55 of 2023, Immovable Property or part thereof:

- Used exclusively for a Business or Business Activity.

- Not used as a place of residence or accommodation including hotels, motels, bed and breakfast establishments, serviced apartments and the like

Illustration

Qualifying Income Tax @ 0%

Business Center/Warehouse/office

- Commercial Property

- Situated in Free Zone

- Income from transaction with other Free Zone Persons

Non Qualifying Income Tax @ 9 %

Hotel/residence, etc

- Non Commercial Property

- Situated in Free Zone

- Income from transaction with any Persons

6.2 Amendments in new Free Zone Decisions

- Updated list of Qualifying Activities and Excluded Activities – Description of Qualifying Activities and Excluded Activities – Additions

- Clarifications on Free Zone substance requirements – De minimis threshold calculations – Clarifications

- Incidental income is removed from Qualifying Income list, but ancillary activities definition is changed – Competent authorities are defined – Others

6.3 Introduction of new decision on Free Zone Persons

On 3rd November, 2023, UAE Ministry of Finance has issued new Cabinet Decision (CD) No. 100 of 2023 on Determining Qualifying Income, as well as Ministerial Decision (MD) No. 265 of 2023 on Qualifying Activities and Excluded Activities. These decisions are applicable retrospectively from 1st June, 2023 and has replaced previous Cabinet Decision No. 55 of 2023 and Ministerial Decision No. 139 of 2023 decisions.

2 new activities are included in the list of Qualifying activities:

- Trading of Qualified Commodities

- Ownership or exploitation of Qualifying Intellectual Property

6.4 Trading of Qualified Commodities

Trading of Qualified Commodities – Qualifying Activity:

Income earned from physical trading of metals, minerals, energy and agricultural commodities in raw form that are traded on a recognized stock exchange, as well as the

associated derivative trading income used to hedge against, the risk of such trading activities, shall be considered as Qualifying Income.

6.5 Qualifying Commodities

Qualified Commodities: As per Ministerial decision no-265 of 2023 – Metals, minerals, energy and agriculture commodities that are traded on a Recognized Commodities Market in Raw Form shall be considered as Qualified Commodities.

Examples of Qualifying Commodities:

- Gold Bars

- Silver Bars

- Platinum Bars

- Natural Gas

- Coal

- Crude Oil

6.6 Ownership or exploitation of Qualifying Intellectual Property

Ownership or exploitation of Qualifying Intellectual Property – Qualifying Activity:

Qualifying Intellectual Property has been defined in Cabinet Decision No. 100 of 2023, as patents, copyrighted software and any right functionally equivalent to a patent but does not include marketing related intellectual property assets, such as trademarks.

6.7 Calculation of Qualifying Income derived from Qualifying Intellectual Property

Qualifying Income shall be determined by using the below formulae:

Qualifying Income = Qualifying Expenditure + Up-lift Expenditure/Overall Expenditure x Overall Income

‘Uplift Expenditures” means the Qualifying Expenditure increased by 30% (thirty percent),

6.8 Change in definition of Ancillary Income

- Ancillary Activities-as per new Cabinet Decision no-265 of 2023: An activity shall be considered ancillary where it is necessary for the performance of the main activity or where it makes a minor contribution to it and is so closely related to the main activity that it should not be regarded as a separate activity.

- Ancillary Activities-as per old Cabinet Decision no-139 of 2023: An activity shall be considered ancillary where it serves no independent function but is necessary for the performance of the main Qualifying Activity.

6.9 Holding of shares and other securities

- Ministerial Decision 265 has renamed the Qualifying activity “Holding of shares and other securities” to “Holding of shares and other securities for investment purpose”.

- One critical condition has been included in new Ministerial Decision No.265 of 2023, which states that the shares and other securities shall be deemed to be held for investment purposes if it is held for uninterrupted 12 months period.

- Hence, solely active trading of shares and other securities cannot not be regarded as a Qualifying activity.

- There is no other condition that needs to be satisfied in case of holding of other securities (which was earlier mentioned in the PCD).

6.10 Distribution of Goods or Material in or from Designated Zone

Distribution of goods or materials in or from a Designated Zone, includes the buying and selling of goods, materials, component parts or any other items that are tangible or movable and may include the importation, storage, inventory management, handling, transportation and exportation of those goods or materials to a customer that resells such goods or materials, or parts thereof or processes or alters such goods or materials or parts thereof for the purposes of sale or resale, provided such activities are conducted in or from a Designated Zone and the goods or materials entering the State are imported through the Designated Zone.

6.11 List of Designated Zones

Dubai

Jebel Ali FZ (North-South)

- Dubai Cars and Automotive Zone.

- DAFZA Industrial Park FZ – Al Qusais

- Dubai Aviation City

- Dubai Airport FZ

- International Humanitarian City – Jebel Ali

- Dubai CommerCity

Abu Dhabi

- Free Trade Zone of Khalifa Port

- Abu Dhabi Airport FZ

- Khalifa Industrial Zone

- Al Ain International Airport FZ

- Al Butain International Airport FZ

Ras Al Khaimah

- RAK Port FZ

- RAK Maritime City FZ

- Al Hamra Industrial Zone – FZ

- Al Ghail Industrial Zone – FZ

- Al Hulaila Industrial Zone – FZ

Others

Sharjah

- Hamriyah FZ

- Sharjah Airport International FZ

Fujairah

- Fujairah FZ

- Fujairah Oil Industry Zone

Umm Al Quwain

- Umm Al Quwain Free Trade Zone in Ahmed Bin Rashid Port

- Umm Al Quwain Free Trade Zone on Sheikh Mohammed Bin Zayed Road

Ajman

- Ajman FZ

6.12 High Sea Sales/Third Port Shipment – Case Study

Will High Sea Sales (Third port shipment) be considered as a Qualifying Activity?

The new decision has not clarified the tax position with respect to High-sea sales (Third Port Shipment). In various awareness sessions, it was mentioned by FTA that High Seas Sales (Third Port Shipment) if undertaken from Designated Zones shall be covered

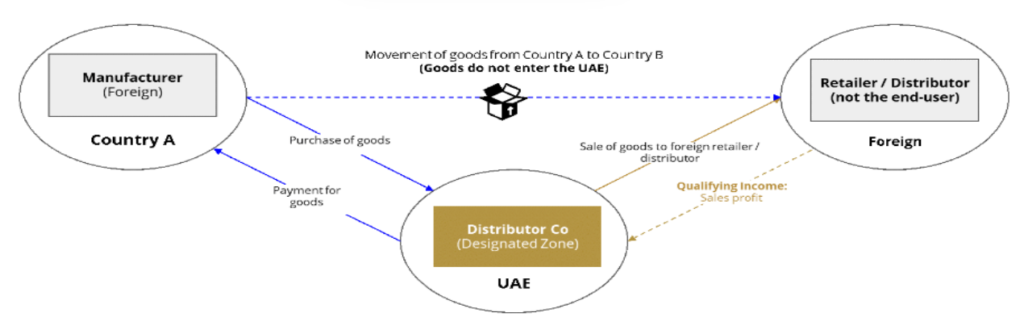

6.13 Distribution activity as per Public Consultation Paper on Free Zones

Article 2(1)(k) – Distribution of goods or materials

Illustrations

Distribution of goods or materials outside of the UAE – Designated Free Zone Person (Distributor Co) buys goods from a manufacturer in Country A, and sells these goods to a retailer in Country B. Distributor Co earns a profit/margin on the goods sold to the retailer in Country B. The goods are shipped directly from the Manufacturer in Country A to the Retailer in Country B.

6.14 Manufacturing of Goods or Materials – Case Study

PCD on Free Zone

- As per Public Consultation document on freezone persons, income derived from the manufacturing of goods or material by manufacturing company would be considered as Qualifying Income, irrespective of whether the manufactured products or material are manufactured for sale to mainland or foreign juridical person.

- The income that is attributable to the distribution (sale) of the manufactured products or material would not be considered Qualifying Income from manufacturing, unless the distribution meets the conditions to be treated to be treated as a Qualifying distribution activity.

Cabinet Decision No. 100 of 2023

- Manufacturing of goods or materials includes the production, improvement or assembly of products and materials from raw materials or components.

6.15 Flowchart for Determination of Qualifying Income

6.16 Steps in Determining Taxability for Free Zone Persons

Step 1: Are you a free zone Peron?

Step 2: Are you a qualifying Free zone person?

Step 3: Do you derive income from Qualifying Activity or from a free zone person?

Step 4: Does your Non-Qualifying Revenue exceed de-minimis threshold?

Step 5: Whether you are subject to 0% CT or taxable @9% CT?

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA