[Analysis] Taxation in Mergers & Acquisition – Definitions | Objectives | Tax Landscape

- Blog|Company Law|

- 12 Min Read

- By Taxmann

- |

- Last Updated on 28 February, 2024

Table of Contents

- Key Objectives of M&A

- M&A Landscape

- Tax and Regulatory

- Merger – Tax Landscape

- Demerger – Tax Landscape

- Few Other Restructuring

1. Key Objectives of M&A

Internal Drivers

- Cash trap/balancing

- Value Unlocking

- Simplification of Group Structure

- Tax Optimization

External Drivers

- Growth

- Eliminate competition

- Deploy capital

- Enter new markets

1.1 Why M&A

Funding and repatriation

- Pre-IPO Structuring

- Attracting Overseas Investments

- Ease of repatriation of Funds

Structure Rationalization

- Overall efficiency through Business Consolidation

- Segregation of different sets of business

- Value Unlocking

- To create optimum holding structures

Other reasons

- Exit non-core business

- Part of global restructuring

- Achieve growth

- Competitive position

- Market leader

- Economies of scale

Diversification

- Growth-new technology

- Competence capability or marketspace Entering into new segment

- Acquisition of new business

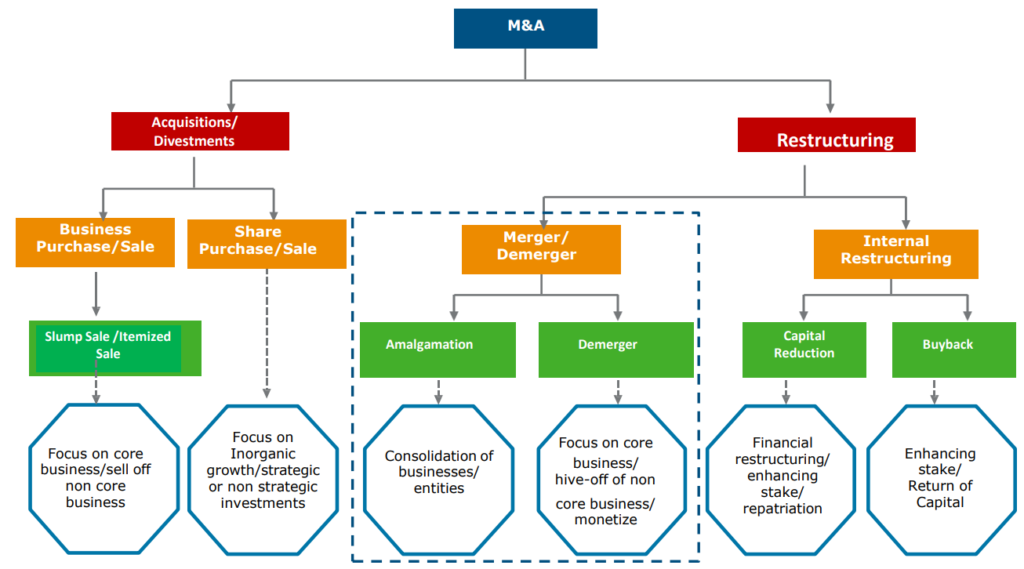

2. M&A Landscape

3. Tax and Regulatory

SEBI

- Schemes involving listed entities

- Other regulations such as takeover

- Prescribed disclosures

FEMA

- Inbound Investment

- Outbound Investment

- Cross Border M&A

- LRS

- Share Swap

Companies Act

- Scheme of arrangements u/s 230 – 234

- Shareholder/creditor approval

- Related party transactions

- Approvals from regulatory authorities such as RD, RoC

- Prescribed compliances

Tax

- Income tax

- Tax attributes

- Tax neutrality

- GST

Other Aspects

- Valuation

- CompetitionAct

- NBFC/CIC guidelines

- Sectoral regulators

Stamp Duty

- State specific entry

- Planning avenues

- Adjudication process

3.1 M&A Tax Landscape – Income tax act

- Merger/Amalgamation – Sec 2 (1B), Expl 7 to 43 (1),Expl 2 to 43(6), 47 (vi),(vii), 72A,

35DD - Demerger – 2 (19AA), 2(22) (v) 47 (vib),(vic),(vid)

- Takeover of shares – Normal capital gains

- Reduction of capital – 2 (22) (d)

- Buyback of shares – Sec 46A, Sec 115QA

- Slump Sale – Sec 2(42C); 50B

- Others – Conversion of firm into company, company into LLP, etc

4. Merger – Tax Landscape

4.1 Type of Merger

- Horizontal: Between cos. dealing in similar products or competing directly with each other. Eg. Vodafone-Idea

- Vertical: Between cos. operating in the same industry but at a different stage of production or distribution system. Eg. Uptron Colour with BPL

- Conglomerate: Between cos. in unrelated business, no competition. Eg ITC Hotels with ITC Ltd

- Reverse: Between profit and loss making, listed and unlisted. Eg. KB Mall with Future Networks

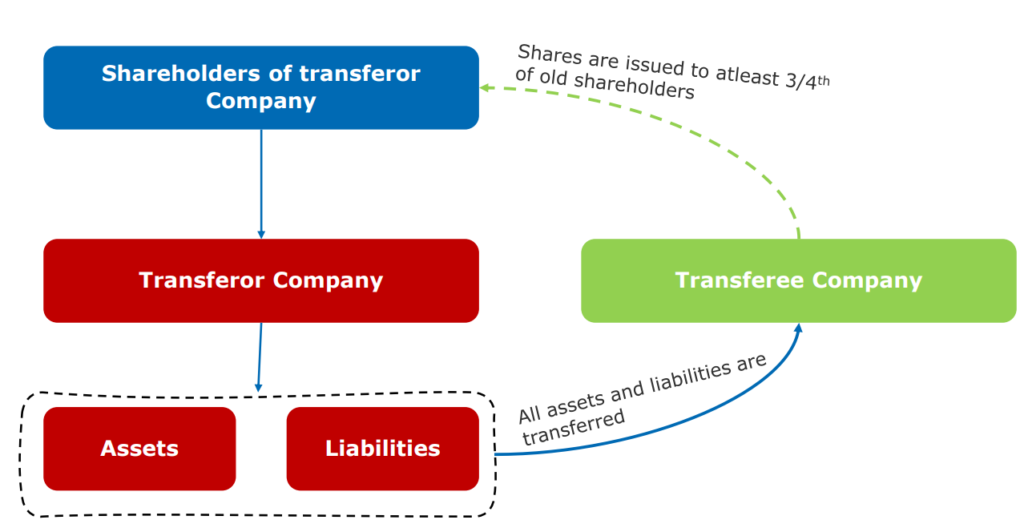

4.2 Merger – Definition

- Merger as a result of acquisition of property by one company shall not tentamount to merger u/s 2 (1B)

- Merger as a result of distribution of property of one company to the other company after the winding up of the first mentioned company shall not tantamount to merger u/s 2 (1B)

- W.r.t. the shareholding condition- Shares already held by the TRee co. or its nominees, in the TRoR shall not be included;

- The definition is only applicable in case of merger of companies;

- The shares allotted to shareholders of TRoR Co. is not subject to any lock-in;

- A share-swap agreement either pursuant to the Scheme, or otherwise is a common transaction;

- It is not mandatory that the shareholders of TRoR constitute the same % of holding in the TRee- For eg: if shareholders holding 80% in TRoR become shareholders of TRee- it is not mandatory that they constitute 80% in TRee also.

4.3 Taxation in Amalgamation – Key Aspects

- Tax Neutrality for company – No capital gain implications [sec 47(vi)]; depreciation shifts to amalgamated company

- Tax Neutrality for shareholders – No transfer a/c of amalgamation [sec 47(vii)] holding period is also inclusive

- Carry forward of losses and accumulated depreciation [sec 72A; Rule 9C]

- Amalgamation Expenses and Bad Debts – sec. 35DD

- Apportionment of Depreciation [sec 32(I), 43 (I), 43(6)]

- Other Aspects

- Important Case Laws

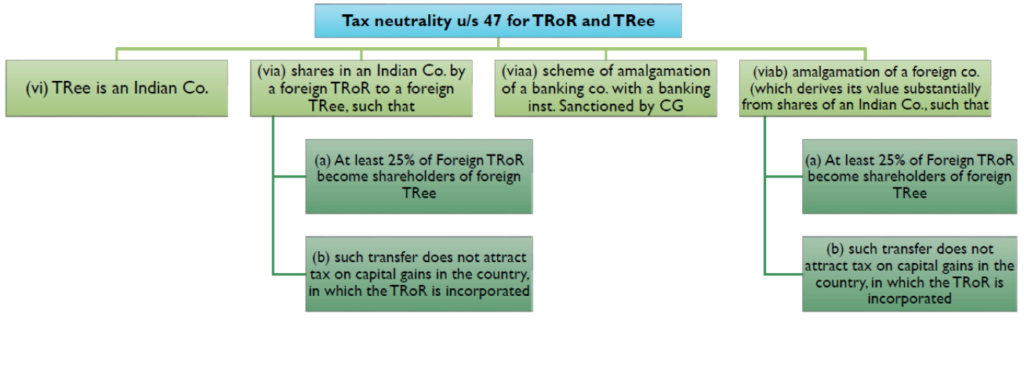

4.4 Tax Neutrality in case of Amalgamation

Transfer of any capital asset is subject to capital gains tax in India; However, amalgamation enjoys tax-neutrality with respect to tax on transfer.

Taxability in the hands of shareholder – Sec 47 (vii) – not regarded as transfer

any transfer by a shareholder, in a scheme of amalgamation, of a capital asset being a share or shares held by him in the amalgamating company, if—

- The transfer is made in consideration of the allotment to him of any share or shares in the amalgamated company except where the shareholder itself is the amalgamated company, an

- the amalgamated company is an Indian company

4.5 Carry Forward of Losses and Unabsorbed Depreciation

Where there has been an amalgamation of—

- a company owning an industrial undertaking or a ship or a hotel with another company; or

- a banking company referred to in clause (c) of section 5 of the Banking Regulation Act, 1949 (10 of 1949) with a specified bank; or

- 38[(c) one or more public sector company or companies with one or more public sector company or companies; or

Industrial undertaking means any undertaking which is engaged in—

- the manufacture or processing of goods; or

- the manufacture of computer software; or

- the business of generation or distribution of electricity or any other form of power; or

- the business of providing telecommunication services, whether basic or cellular, including

radio paging, domestic satellite service, network of trunking, broadband network and internet services; or - mining; or

- the construction of ships, aircrafts or rail systems;

Nature of loss

- Accumulated business loss & unabsorbed depreciation

Conditions for Transferor

- Amalgamation of company owning industrial undertaking

- Company engaged in business for 3 or more years

- At least 75% of BV of fixed assets held continuously for 2 years prior to the date of amalgamation

Conditions for Transferee

- Continue to hold at least 75% of BV of fixed assets of transferor for a minimum 5 years

- Continue the business for a minimum period of 5 years

- Achieve at least 50% of installed capacity before end of 4 years and continue to maintain the same till year 5

Conditions for set-off, under Rule 9C [pursuant to sec 72A (2) (b) (iii)]

- The TRee (owning an industrial co.) shall: achieve >= 50% of the installed capacity before the end of 4 years; and maintain till end of 5 years

- The TRee shall: furnish to the Assessing Officer a certificate in Form No. 62, duly verified by an accountant, to establish that production levels have been achieved

Points to note-

- All conditions (u/s 72A (2)(a) and (b)) must be fulfilled.

- Where such conditions are fulfilled,

- Accumulated loss of the TRoR will be allowed to carried forward for a fresh period of 8 years;

- Supreme Industries Ltd. v. Dy. CIT [2007] 17 SOT 476/[2008] 115 ITD 225 (Mum.-Trib.)

- Accumulated loss of the TRoR will be allowed to carried forward for a fresh period of 8 years;

- Unabsorbed depreciation an be carried forward indefinitely

- If the conditions mentioned in the previous slide are not fulfilled- [Sec. 72A (3)]

- The set off of loss or allowance of depreciation made in any previous year in the hands of the TRee Co.

- Shall be deemed to be the income of the TRee Co. chargeable to tax

- For the year in which such conditions are not complied with.

- Accumulated loss means loss of the TRoR under the head “Profit and Gains of business or profession” (not being a loss due to speculation business)

- Accumulated losses b/f under the head “house property” or “capital gain” will get lost, and neither co. will be able to avail c/f benefit

4.6 Apportionment of Depreciation

For apportionment of depreciation b/w the TRoR and TRee, following steps should be followed [proviso to S.32(5)]

- Assume that there has been no amalgamation;and compute depreciation for the TRoR;

- Once computed, the depreciation amount shall be:

-

- Apportioned b/w the TRoR and TRee

- In the ratio of the number of days for which the assets were used by them

4.7 Amalgamation Expenses and Bad Debts

Amortisation of amalgamation expenses [sec. 35DD]

- Where an Indian Co.;

- Incurs any expenditure wholly or exclusively for the purpose of amalgamation;

- Deduction = 1/5th of such expenditure

-

- For each of the 5 successive years

- Beginning in the prev. year in which amalgamation was done

- Shall be given to the TRee

Treatment of Bad-debts [sec. 36 (1) (vii)

- Where the debts of the TRoR, transferred to the TRee becomes bad;

- Such bad debts will be allowed as a deduction to the TRee [CIT v. T.Veerabhadra Rao, K. Koteswara Roa & Co. [1985] 22 Taxman 45 (SC)/(1985) 155 ITR 152 (SC)]

4.8 Other tax aspects in merger

- As per Section 2(42A) of the Act, Period of Holding of the shareholders for the amalgamated company shall include period for which the shares were held in the amalgamating company.

- As per section 49(1) of the Act, the cost of acquisition of the said asset to the amalgamated company shall be cost for which the amalgamating company acquired it

- As per Section 49(2) of the Act, the cost of acquisition of the shares for the shareholders in the amalgamated company shall be the cost of acquisition of the shares in the amalgamating company.

- If capital asset was acquired by the amalgamating company before 01.04.2001 then COA may be taken as the cost or F.M.V. as on 01.04.2001, whichever is higher – sec 55 (2)

- The cost of improvement incurred by the amalgamating company shall be deemed to be the cost of improvement incurred by the amalgamated company.

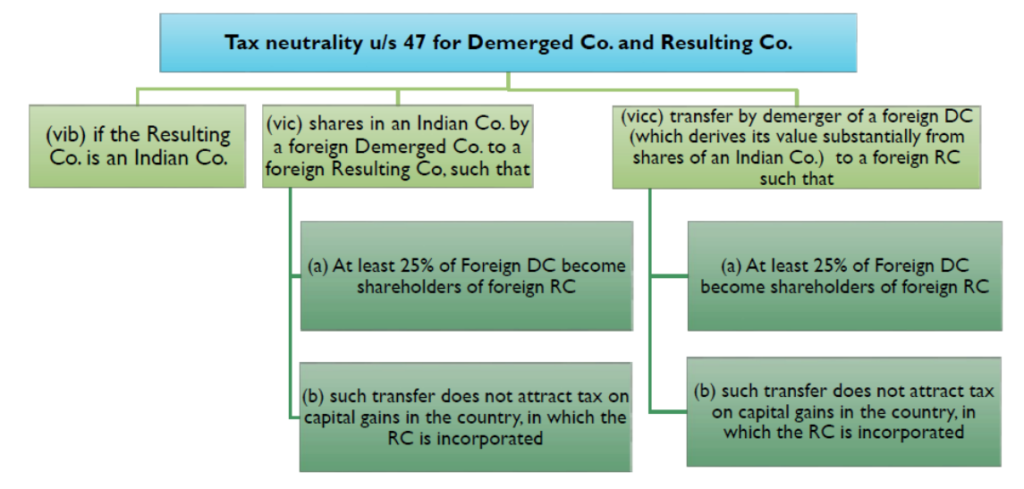

5. Demerger – Tax Landscape

5.1 Demerger – Definition

- As per Section 2(19AA) of the Income Tax Act, 1961 “demerger”, in relation to companies, means the transfer by a demerged company of its one or more undertakings to any resulting company

- Demerger in such a manner that

- All property of the undertaking being transferred is transferred to the Resulting Co.

- All the liabilities relatable to the Undertaking is transferred to the Resulting Co.

- All properties and liabilities of the Undertaking are transferred at Book Value

- Resulting co. issues shares to the shareholders of the Demerged Company

- Shareholders >= 3/4th of the Demerged Co. become shareholders of the Resulting Co.

- Transfer of undertaking is on Going concern basis

- Demerged Co. [Sec. 2(19AAA)] – company whose undertaking is transferred, pursuant to a demerger, to a resulting company

- Resulting Co. [Sec. 2(41A)] – company (including a WoS) to which the undertaking of the Demerged Co. is transferred in a demerger and, the Resulting Co. in consideration of such transfer of undertaking, issues shares to the shareholders of the demerged company

Points to note-

- The definition is only applicable in case of demerger of companies;

- Revaluation, if any, of the properties and liabilities being transferred, shall be ignored;

- Shares to be allotted to the shareholders of the Demerged Co., must be on proportional basis;

- W.r.t. the shareholding condition – Shares already held by the Resulting Co. or its nominees, in the Demerged Co. shall not be included;

- The shares allotted to shareholders of Demerged Co. is not subject to any lock-in;

A share-swap agreement either pursuant to the Scheme, or otherwise is a common transaction; - It is not mandatory that the shareholders of Demerged Co. constitute the same % of holding in the Resulting Co.

- For eg: if shareholders holding 80% in Demerged Co. become shareholders of Resulting Co.- it is not mandatory that they constitute 80% in Resulting Co. also.

- Conditions u/s 2(19AA) are only to ascertain tax neutrality

- Non-compliance of the same does not in any manner result in the arrangement not being regarded as a ‘demerger’ under Cos. Act.

5.2 Meaning of “Undertaking”

Explanation 1- Meaning of “Undertaking”- It includes

- any part of an undertaking; or

- a unit or division of an undertaking; or

- a business activity taken as a whole

- But does not include

-

- Individual assets or liabilities

- Or any combination thereof

- Not constituting a business activity

Key Considerations

- Can assets and liabilities be cherry picked?

- What does “going-concern” mean?

- What is business activity?

Cherry-picking of Assets & Liabilities

The Hon’ble Delhi High Court vide its judgement in Indo Rama Textile Ltd, In re [2012] 23 taxmann.com 390/[2013] 212 Taxman 462 (Delhi), held that-

“in a demerger, transfer of all common assets and/or liabilities relatable to undertaking being demerged is not required so long as the assets and liabilities transferred, by themselves, constitutes a running business and the business can be carried on uninterruptedly with such assets and liabilities alone”

The Delhi High Court further held that-

To ensure that the undertaking has been transferred as a going concern or not, while sanctioning a scheme of arrangement, the Court can examine whether essential and integral assets like plant, machinery and manpower without which it would not be able to run as an independent unit have been transferred to the resulting company.

5.3 Meaning of “Liabilities”

Explanation 2- Meaning of Liabilities – it shall include-

- the liabilities which arise out of the activities or operations of the undertaking (identifiable to an Undertaking)

- the specific loans or borrowings (including debentures)- w.r.t.the Undertaking

- Other than above, general liabilities & borrowings in the same proportion to assets being transferred.

5.4 Decoding – Demerger tax landscape

- Tax Neutrality – No capital gain implications for the company [sec 47(vib)] or shareholder and 47 (vic and vid)]

- Cost of acquisition of shares of demerged co, for shareholders proportionate to the net book values [49 (2C)/(2D)]

- Carry forward of losses and accumulated depreciation [sec 72A (4) and (5)]

- Demerger Expenses [35DD] and Bad debts

- Apportionment of Depreciation [sec 32(I), 43 (I), 43(6)]

- Other Aspects

5.6 Tax Neutrality in case of Demerger

Transfer of any capital asset is subject to capital gains tax in India; However, demerger enjoys tax-neutrality with respect to tax on transfer.

Taxability in the hands of shareholder – Sec 47 (vid)

- any transfer or issue of shares by RC, to the shareholders of the DC if the transfer or issue is made in consideration of demerger of the undertaking

- In case of a demerger, the existing shareholders of the DC will hold:

-

- Shares in the resulting Co.; and

- Shares in the demerged co.

Cost of acquisition will be computed as under

By virtue of Section 49(2D) the COA of shares in the Demerged Company shall be:

- COA of original shares in the demerged company

Less: COA of shares in the resulting company as calculated in section 49(2C) - Cost u/s 49 (2C) = CoA of the shares held, in the same proportion as the

Net Book Value: Net Worth of the DC

5.7 Carry Forward of Losses and Unabsorbed Depreciation – Sec 72 (A)(4)

- Losses and unabsorbed depreciation of the Demerged Co, shall be carried forward –

- where such loss or unabsorbed depreciation

- is directly relatable to the undertakings transferred to the resulting company, for the remaining period only

- be allowed to be carried forward and set off in the hands of the resulting company

- where such loss or unabsorbed depreciation

- where such loss or unabsorbed depreciation

- is not directly relatable to the undertakings transferred to the resulting company,

- be apportioned between the demerged company and the resulting company in the same proportion in which the assets of the undertakings have been retained by the demerged company and transferred to the resulting company,

- and be allowed to be carried forward and set off in the hands of the demerged company or the resulting company, as the case may be

5.8 Apportionment of Depreciation

For apportionment of depreciation b/w the Demerged Co. and Resulting Co., following steps should be followed [proviso to S. 32(5)]

- Assume that there has been no amalgamation; and compute depreciation for the Demerged Co.

- Once computed, the depreciation amount shall be:

- Apportioned b/w the Demerged Co. and Resulting Co.

- In the ratio of the number of days for which the assets were used by them

5.9 Demerger Expenses and Bad Debts

Amortisation of demerger expenses [sec. 35DD]

- Where an Indian Co.;

- Incurs any expenditure wholly or exclusively for the purpose of amalgamation;

- Deduction = 1/5th of such expenditure

- For each of the 5 successive years

- Beginning in the prev. year in which amalgamation was done

- Shall be given to the Resulting Co.

- If any proportion of such expense has been considered by the Demerged Co.; the Resulting Co. shall amortize the remaining portion only.

Treatment of Bad-debts [sec. 36 (1) (vii)

- Where the debts of the Demerged Co. transferred to the Resulting Co. becomes

bad; - Such bad debts will be allowed as a deduction to the Resulting Co. [CIT v. T. Veerabhadra Rao, K. Koteswara Roa & Co. [1985] 22 Taxman 45 (SC)/(1985) 155 ITR 152 (SC)]]

5.10 Other Aspects

- By virtue of Section 2(22)(v) there will be no dividend in the hands of shareholders on distribution of shares pursuant to a demerger by the resulting company to the shareholders of the demerged company.

- By virtue of amendment in section 2(42A), for calculating the period for which the shares are received upon demerger are held, the period for which shares were held in the demerged company shall also be considered.

- The Resulting Company must record the cost of assets transferred pursuant to the demerger, as equal to the cost that would have been recorded in the books of the Demerged Co., i.e. the actual cost:

- However, exception made for companies which have adopted IndAS

6. Few Other Restructuring

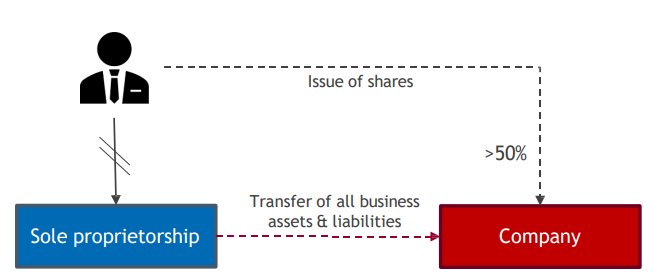

6.1 Succession of Sole Proprietorship by Company

Tax neutral subject to conditions:

- All assets and liabilities of the sole proprietary concern become the assets and liabilities of the company

- Sole proprietor to hold 50% or more of voting power in the company and such holding to continue for a period of 5 years

- Consideration in the form of shares only

Other Aspects:

- Cost & period of holding of proprietorship concern available in the hands of Company

- Carry forward of accumulated loss & unabsorbed depreciation available in the hands of Co

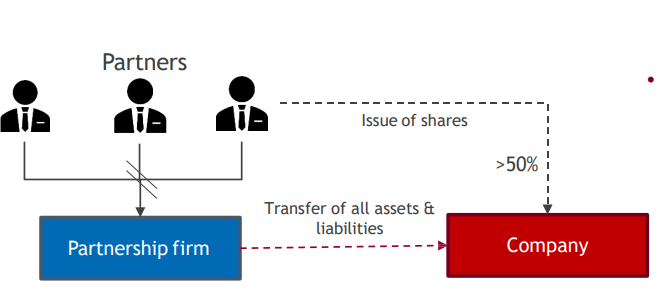

6.2 Succession of Partnership Firm by Company

Prescribed process under Companies Act

- Requires consent of all the creditors

- Requires DIN of proposed directors & name approval

- Draft AOA & MOA

- File conversion form (URC-1)

- Post approval, obtain certificate of incorporation

Tax neutral subject to conditions:

- All assets and liabilities of the firm concern become the assets and liabilities of the company

- All partners becomes shareholders in proportion of capital accounts of firm on the date of the succession

- Aggregate shareholding of partners: 50% or more of voting power in the company and such holding to continue for a period of 5 years

- Consideration in the form of shares only

Other Aspects:

- Cost & period of holding of proprietorship concern available in the hands of Company

- Carry forward of accumulated loss & unabsorbed depreciation available in the hands of Co-Fresh life

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA