All-about Liaison Office (LO), Branch Office (BO) & Project Office (PO)

- Blog|FEMA & Banking|

- 12 Min Read

- By Taxmann

- |

- Last Updated on 22 September, 2022

Table of Contents:

2. Regulation of LO, BO and PO

2.1 Regulation under the Companies Act, 2013

3.1 Routes for opening of LO/BO/PO

3.4 Prohibited/Restricted Activities

3.6 Application for Additional Offices and Activities

Checkout Taxmann's FEMA Practice Manual which is a comprehensive day to day commentary on FEMA for professionals presented in a simple, exhaustive & practically useful manner with examples. The coverage of this book includes a wide range of complex cross-border transactions. It will be helpful for professionals, CFOs, AD Banks, etc.

1. Introduction

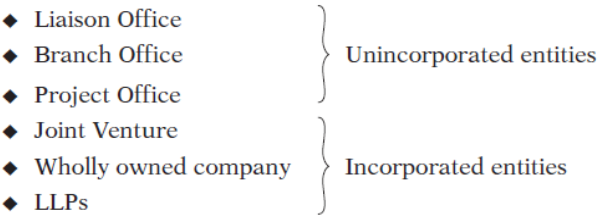

A foreign entity before entering into new territory would like to check the business environment, available market and acceptability of its product, social and economic influencer of any new country. In India, a foreign company can enter by way of:

Liaison Office (LO) and Branch Office (BO) provide window to foreign investors to have the initial understanding of the business environment in India. The activities that can be undertaken by BO and LO them are specified and they cannot undertake any other activity which is not specified.

Project office (PO) is opened for a limited purpose of execution of project and life of project office is limited to the tenure of project.

2. Regulation of LO, BO and PO

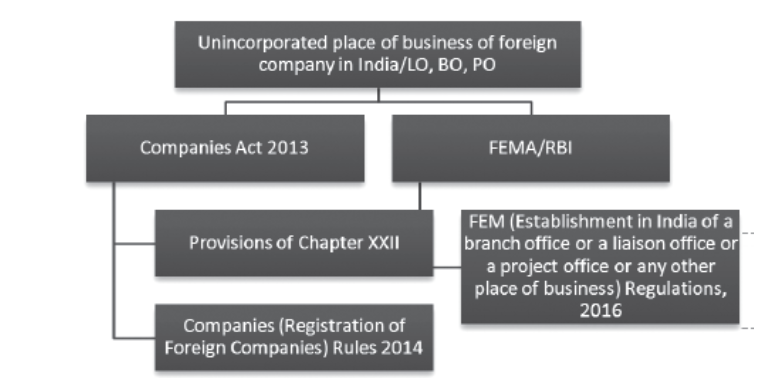

LO, BO and PO are unincorporated place of business of foreign company in India and is regulated by the Companies Act as well under FEMA.

We have briefly discussed the provisions of the Companies Act, 2013 below in relation to LO, BO and PO for better understanding. Under the Companies Act, all the unincorporated entities being LO, BO and PO are regulated in the same fashion as the Act does not differentiate on the basis of purpose for which it is established. Unlike FEMA where different provisions for each of the entity being LO, BO and PO are specified on the basis of activity for which it is established in India.

2.1 Regulation under the Companies Act, 2013

Provisions under the Companies Act, 1956: Sections 591 to 602 of the Companies Act, 1956 dealt with foreign companies having a place of business in India. Corresponding to these sections Chapter XXII was introduced in Companies Act, 2013 with additional sections and requirements read with the Companies (Registration of Foreign Companies) Rules, 2014.

Registration under Companies Act, 2013: A foreign company (through LO/BO or PO) shall, within a period of 30 days of the establishment of its place of business in India, file with the registrar Form FC-1 with such fee as provided in Companies (Registration Offices and Fees) Rules, 2014 and with the documents required to be delivered for registration by a foreign company in accordance with the provisions of sub-section (1) of s 380.

Application for registration to be supported by approval from RBI: The above application shall be supported with an attested copy of approval from the Reserve Bank of India under Foreign Exchange Management Act or Regulations, and also from other regulators, if any, approval is required by such foreign company to establish a place of business in India or a declaration from the authorised representative of such foreign company that no such approval is required.

Alteration in the information: Where any alteration is made or occurs in the document delivered to the Registrar for registration under sub-section (1) of section 380, the foreign company shall file with the Registrar, a return in Form FC2 containing the particulars of the alteration, within a period of 30 days from the date on which the alteration was made or occurred.

Accounts and Audit: Every foreign company (present through LO/BO or PO in India) shall prepare financial statement of its Indian business operations in accordance with Schedule III or as near thereto as may be possible for each financial year and get them audited by a practising Chartered Accountant in India.

Filing of financial statement and list of place of business: Every foreign company (present through LO/BO or PO in India) shall file with the Registrar, along with the financial statement, in Form FC.3 a list of all the places of business established by the foreign company in India as on the date of balance sheet.

2.2 Regulation under FEMA

Governing Regulation: As per sub-section (6) of section 6 of the Foreign Exchange Management Act, 1999, the Reserve Bank may, by regulation, prohibit, restrict, or regulate establishment in India of a branch, office or other place of business by a person resident outside India, for carrying on any activity relating to such branch, office or other place of business. In exercise of the powers given under sub-section (6) of section 6 of the Foreign Exchange Management Act, 1999, the RBI has framed the regulation by way of notification to regulate the provisions relating the LO in India. These regulations are Foreign Exchange Management (Establishment in India of a branch office or a liaison office or a project office or any other place of business) Regulations, 2016 issued by way of Notification No. FEMA 22(R)/RB-2016 dated March 31, 20161 (referred as ‘FEMA 22R’ as well).

In the following paragraphs, we have discussed about the various provisions under FEMA governing these unincorporated foreign entities in India in detail.

3. Liaison Office

An LO is a representative office set up primarily to explore and understand the business and investment climate. Such office is not permitted to undertake any commercial/trading/industrial activity, directly or indirectly, and is required to maintain itself out of inward remittances received from parent company through normal banking channels.

As defined under clause 2(e) of FEMA 22R:

‘Liaison Office’ means a place of business to act as a channel of communication between the principal place of business or Head Office or by whatever name called and entities in India but which does not undertake any commercial/trading/industrial activity, directly or indirectly, and maintains itself out of inward remittances received from abroad through normal banking channel.

In the definition following is relevant

-

- a place of business;

- to act as a channel of communication;

- between the principal place of business or Head Office or by whatever name called and entities in India;

- but which does not undertake any commercial/trading/industrial activity, directly or indirectly; and

- maintains itself out of inward remittances received from abroad through normal banking channel.

Thus, an LO is opened to act like a medium of communication by way of promoting the business of its parent company in India, promoting collaboration in India, etc. An LO is not allowed to earn profit in India. It cannot undertake any commercial, trading, industrial activity either through itself or through any other entity. It has to meet its expenses by way receiving money from its parent company.

Expenses of LO are to be met entirely through inward remittances of foreign exchange from the Head Office outside India. The role of such offices is, therefore, limited to collecting information about possible market opportunities and providing information about the company and its products to the prospective Indian customers.

No person resident outside India shall, without prior approval of the Reserve Bank, establish in India a Branch or an LO or a PO or any other place of business by whatever name called. The power of RBI has been delegated to AD Banker in certain cases.

3.1 Routes for opening of LO/BO/PO

(a) For opening an LO in India, a foreign company needs to obtain registration with the Reserve Bank of India. The route is dependent on the sector of operations. Based on the sector of operations, an LO can come either under Automatic or Government Route.

(1) Automatic Route—Where principal business of the foreign entity falls under sectors where 100% Foreign Direct Investment (FDI) is permissible the application for opening LO can be made to AD category I Bank under the automatic route. The AD Category-I bank may consider such application under delegated powers.

(2) Approval Route—Where principal business of the foreign entity falls under the sectors where 100% FDI is not permissible under the automatic route the application for opening LO shall be under approval route only.

Prior approval of RBI: Prior approval of the Reserve Bank of India is required in the following cases:

a. The applicant is a citizen of or is registered/incorporated in Pakistan;

b. The applicant is a citizen of or is registered/incorporated in Bangladesh, Sri Lanka, Afghanistan, Iran, China, Hong Kong or Macau and the application is for opening a BO/LO/PO in Jammu and Kashmir, North East region and Andaman and Nicobar Islands;

c. The principal business of the applicant falls in the four sectors namely Defence, Telecom, Private Security and Information and Broadcasting.1However, prior approval of Reserve Bank of India shall not be required in cases where Government approval or license/permission by the concerned Ministry/Regulator has already been granted. In the case of proposal for opening a PO relating to defence sector, no separate reference or approval of Government of India shall be required if the said non-resident applicant has been awarded a contract by/entered into an agreement with Ministry of Defence or Service Headquarters or Defence Public Sector Undertakings. The term “permission” used in the Government of India Notification dated January 21, 2019 does not include general permission, if any, available under Foreign Direct Investment in the automatic route, in respect of the above four sectors.

d. The applicant is a Non-Government Organisation (NGO), Non-Profit Organisation, Body/ Agency/ Department of a foreign government. However, if such entity is engaged, partly or wholly, in any of the activities covered under Foreign Contribution (Regulation) Act, 2010 (FCRA), they shall obtain a certificate of registration under the said Act and shall not seek permission under FEMA 22(R).2

Such applications may be forwarded by the AD Category-I bank to the General Manager, Reserve Bank of India, Central Office Cell, Foreign Exchange Department, 6, Sansad Marg, New Delhi-110 001 who shall process the applications in consultation with the Government of India.

(3) No approval required in following cases:

a. A banking company resident outside India shall not require any approval under these Regulations for establishing any office in India if such company has obtained necessary approval under the provisions of the Banking Regulation Act, 1949.

b. An insurance company resident outside India shall not require any approval under these Regulations for establishing any office in India if such company has obtained approval from the Insurance Regulatory and Development Authority established under section 3 of the Insurance Regulatory and Development Authority Act, 1999.

3.2 Eligibility Criteria

For registration of LO, a foreign entity should have profit making track record during the immediately preceding three financial years in the home country and the Net Worth of not less than US$ 50,000 or its equivalent.

Net Worth is defined to be total of paid-up capital and free reserves, less intangible assets as per the latest Audited Balance Sheet or Account Statement certified by a Certified Public Accountant or any Registered Accounts Practitioner by whatever name.

Where eligibility criteria is not satisfied

Applicants who do not satisfy the eligibility criteria and are subsidiaries of other companies can submit a Letter of Comfort from their parent company as per Annexure I.

“I, subject to the condition that the parent company satisfies the eligibility criteria for net worth and profit”.

The RBI gives due consideration to applicant’s background, antecedents of the promoter, nature and location of activity, sources of funds, etc, while giving the permission for establishment of LO.

3.3 Permitted Activities

An LO is not allowed to undertake any business activity in India and cannot earn any income in India. Expenses of such offices are to be met entirely through inward remittances of foreign exchange from the Head Office outside India. The role of such offices is, therefore, limited to collecting information about possible market opportunities and providing information about the company and its products to the prospective Indian customers.

An LO can undertake the following activities in India:

-

- Representing in India the parent company/group companies in India

- Promoting export/import from/to India

- Promoting technical/financial collaborations between parent/group companies and companies in India

- Acting as a communication channel between the parent company and Indian companies

An entity undertaking any activity beyond the activity mentioned above shall be considered to be in contravention of FEMA.

3.4 Prohibited/Restricted Activities

-

- The LO in India is not allowed to carry on any business activity in India. It shall not take any trading, commercial or industrial activity. There shall be no generation of revenue by LO in India.

- It shall not enter into any contracts with Indian residents on its own behalf.

- No commission/fees shall be charged or any other remuneration received/income earned by the office in India for the LO activities/services rendered by it or otherwise in India.

- All the expenses for the set-up, operation and maintenance of the LO have to be met out of foreign exchange remittances from the foreign company through normal banking channels.

- It shall not acquire any immovable property in India except on lease for period not exceeding five years.

3.5 Procedure of Registration

(a) Application to be submitted

Form FNC

A person resident outside India desiring to establish an LO, BO or a PO or any other place of business in India shall submit an application in Form FNC (Annex B) to an Authorised Dealer Category-I bank.

Other documents to be submitted with an application:

(a) Copy of the Certificate of Incorporation/Registration; Memorandum of Association and Articles of Association attested by the Notary Public in the country of registration. [If the original Certificate is in a language other than in English, the same may be translated into English and notarized as above and cross verified/attested by the Indian Embassy/ Consulate in the home country].

(b) Audited Balance sheet of the applicant company for the last three/five years in case of branch office/liaison office respectively. [If the applicants’ home country laws/regulations do not insist on auditing of accounts, an Account Statement certified by a Certified Public Accountant (CPA) or any Registered Accounts Practitioner by any name, clearly showing the net worth may be submitted].

(c) Bankers’ Report from the applicant’s banker in the host country/country of registration showing the number of years the applicant has had banking relations with that bank.

(d) Power of Attorney in favour of signatory of Form FNC in case the Head of the overseas entity is not signing the Form FNC.

(e) Declaration by the applicant company.

(f) Letter of comfort, where applicable, stating that the parent company undertakes to provide the necessary financial support for its subsidiary/group company’s operations as a branch/liaison office in India and that any liability that may arise due to the functioning of the branch/liaison office in India will be met by the parent company/group company, in case of inability on part of the branch/liaison office to do so.

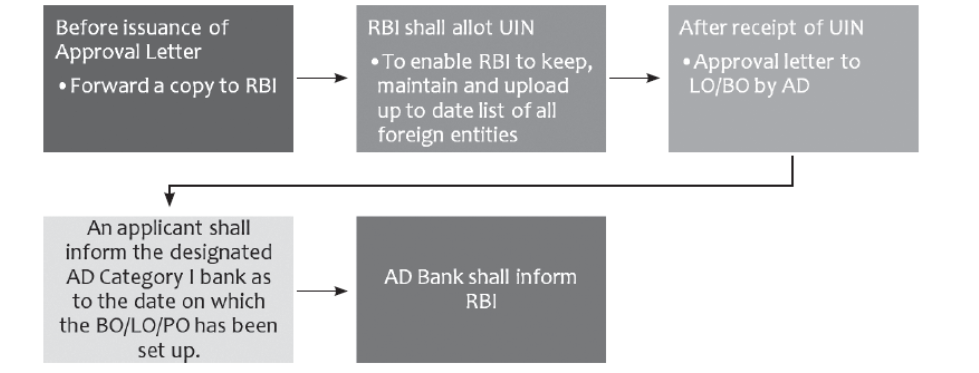

(b) Onward submission of Form FNC to RBI by AD Bank: In case of automatic route, the approval may be given by AD Bank and in case of approval route, the approval is given by the RBI. An application under approval route is forwarded to RBI seeking for grant of approval.

Although in automatic route the approval is given by AD bank yet a copy of the Form FNC along with the other details of the approval proposed to be granted is also submitted by AD Category–I bank to RBI for allotment of Unique Identification Number (UIN) to each LO. The UIN allotted by RBI can be accessed at the following link http://rbidocs.rbi.org.in/rdocs/Content/docs/UIN100001.xls

(c) Approval Letter:

After receipt of the UIN from the Reserve Bank, the AD Category-I bank shall issue the approval letter to the non-resident entity for establishing LO/BO in India.

Due diligence to be exercised by AD Bank: The AD Category-I bank shall after exercising due diligence in respect of the applicant’s background, and satisfying itself as regards adherence to the eligibility criteria for establishing LO/BO, antecedents of the promoter, nature and location of activity of the applicant, sources of funds, etc. and compliance with the extant KYC norms grant approval to the foreign entity for establishing LO in India.

Activity to start within six months of the approval: The approval granted by the AD Category I bank should include a proviso to the effect that in case the BO/LO/PO for which approval has been granted is not opened within six months from the date of the approval letter, the approval shall lapse.

Extension of time: In cases where the non-resident entity is not able to open the office within the stipulated time frame due to reasons beyond its control, the AD Category-I bank may consider granting extension of time for a further period of six months for setting up the office. Any further extension of time shall require the prior approval of the Reserve Bank of India in this regard.

3.6 Application for Additional Offices and Activities

Requests for establishing additional LOs/BOs may be submitted to the AD Category-I bank in a fresh FNC form. However, the documents mentioned in form FNC need not be resubmitted, if there are no changes to the documents already submitted earlier.

a. Number of offices: If the number of offices exceeds 4 (ie, one LO/BO in each zone, viz, East, West, North and South), the applicant has to justify the need for additional office/s and it shall require prior approval of RBI.

b. Nodal office to be identified: The applicant may identify one of its offices in India as the Nodal Office, which will coordinate the activities of all of its offices in India.

c. Additional Activities: Requests for undertaking activities in addition to what has been permitted initially by the Reserve Bank of India/ AD Category-I bank may be submitted by the applicant to the Reserve Bank through the designated AD Category-I bank justifying the need.

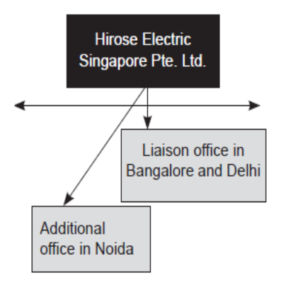

Compounding order on additional office

Hirose Electric Singapore Pte. Ltd. was granted permission to establish a Liaison Office in India at Bangalore (Nodal Office) and New Delhi as an additional Liaison Office) vide Reserve Bank approval letter No. FE.CO.FID/14278/10.97.440/2010-11 dated December 15, 2010.

-

- In terms of RBI approval, the offices were opened in Bangalore and New Delhi.

-

- Permission for the first extension of Liaison Office (LO) valid up to December 14, 2016 was granted by Standard Chartered Bank vide their letter dated December 05, 2013 and further extension up to December 14, 2017 was given by Sumitomo Banking Corporation vide their letter dated January 02, 2017.

- Subsequently, the company also opened a Liaison Office at Noida, Uttar Pradesh in May 2014 without obtaining prior approval from Reserve Bank of India.

- thereby, contravening terms and conditions (para 3) of RBI approval letter dated December 15, 2010 which is construed as contravention of Regulation 3 & 5(i) of Notification No. FEMA 22/2000-RB dated May 3, 2000. All the operations were routed through the Noida Office (which was in operation without RBI permission) instead of New Delhi office, which was also maintained in terms of RBI approval.

- Issued in supersession of Notification No. FEMA 22/2000-RB dated May 3, 2000.

- Notification No. FEMA 22(R)(2) dated January 21, 2019 and AP (DIR Series) Circular No. 27 dated March 28, 2019.

- Notification No. FEMA 22(R)(1)/2018-RB dated August 31, 2018 and AP (DIR Series) Circular No 20 dated February 27, 2019.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA