Accounting Process – Journal, Ledger and Trial Balance

- Blog|Account & Audit|

- 9 Min Read

- By Taxmann

- |

- Last Updated on 30 August, 2022

Table of Content

2. Steps in Accounting Process

4.3 Nominal Account v. Personal Accounts

6.1 Points to be noted in the ledger

6.2 Distinction between Journal and Ledger

6.4 Balancing of Ledger Accounts

Check out Taxmann's Financial Accounting (Including Lab Work) which is a focused book on Financial Accounting for B.Com. students to possess knowledge of the concepts and practices. It provides a conceptual understanding of accounting, the accounting process and the preparation of final accounts using computers. It also includes exam-oriented problems and solutions.

1. What is Accounting Process?

The primary objective of financial accounting is to record financial transactions to arrive at the results of the operations of the business during a year. This is done by preparing financial statements, i.e. Profit and Loss Account and Balance Sheet at the end of the year. For preparing these financial statements, a business transaction has to pass through a number of stages in the accounting process. This means when a business transaction occurs, the process begins to record the transaction in the account books.

The accounting process is a series of steps that begin with a transaction taking place and ends with closing of the account books at the end of the year. Because the complete sequence of accounting procedure is repeated in the same order during each accounting year, it is also referred to as accounting cycle.

2. Steps in Accounting Process

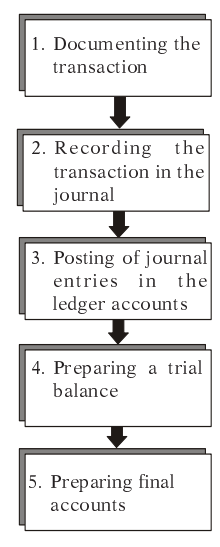

The main steps in the accounting process are described in Fig. 3.1. These steps are:

-

- Source documents

- Journal

- Ledger

- Trial balance

- Final accounts

Of these five steps, first four steps are discussed in this chapter and the last step i.e. final accounts is discussed in a subsequent chapter.

3. Source Documents

The starting point in the accounting process is to record the transaction on the basis of a documentary evidence. This means that the origin of a transaction is the source document. In other words, source document is the voucher or written evidence on the basis of which transactions are recorded in the books of account. Such voucher may be generated within the business or may flow into the business from outside. Examples of vouchers are pay-in-slips of the bank deposit, cash memos, bills, invoices, rent receipts, order received, etc. These documents are the foundation of all accounting records.

|

There should be some documentary evidence (voucher) of each transaction. These documents reveal that transactions have occurred and initiate the accounting process. On the basis of documentary evidences, the accountant makes a record of a transaction in journal in chronological order. Journal is a subsidiary book. Information given in journal is then entered in ledger. This is known as posting. Ledger is a principal book having a set of accounts. The equality of debits and credits in the ledger accounts is verified by preparing a trial balance at the end of the period. Profit and Loss Account and Balance Sheet are the two basic financial statements, also known as final accounts, which are prepared from information given in the trial balance. |

4. Journal in Accounting Process

Journal is a book of first entry. It is a preliminary book to provide a chronological record of transactions in which each transaction is recorded with relevant supplementary information. Journal is known as a book of original entry because the transactions are first recorded in journal and it is from this record that various accounts are posted in the ledger. Journal is also known as subsidiary book or day book. The process of recording transactions in journal is known as journalising.

A standard form of a journal is given below :

Journal

| Date | Particulars | L.F.

(Ledger Folio) |

Amount | |

| Debit

` |

Credit

` |

|||

Journal has the following five columns:

1. Date This column records the date when transaction is entered in journal.

2. Particulars In this column the accounts to be debited and credited are entered. The name of the account to be debited is written first and in the next line, the account to be credited is written preceded by the word ‘To’. A brief explanation of the transaction known as ‘Narration’ is also given below the account to be credited. (see Illustration 3.1)

3. L.F. i.e. Ledger Folio means the page numbers of the ledger in which these accounts appear in the ledger.

4. Debit (Dr) Amount In this column, amount to be debited is entered.

5. Credit (Cr) Amount In this column, amount to be credited is entered.

4.1 Recording in Journal

The transactions in journal are recorded on the basis of rules of debit and credit of double entry system. All financial transactions are classified into three categories:

(i) transactions relating to persons,

(ii) transactions relating to business assets and properties, and

(iii) transactions relating to business expenses and incomes.

On the basis of this classification of transactions, accounts are classified as explained below.

4.2 Types of Accounts

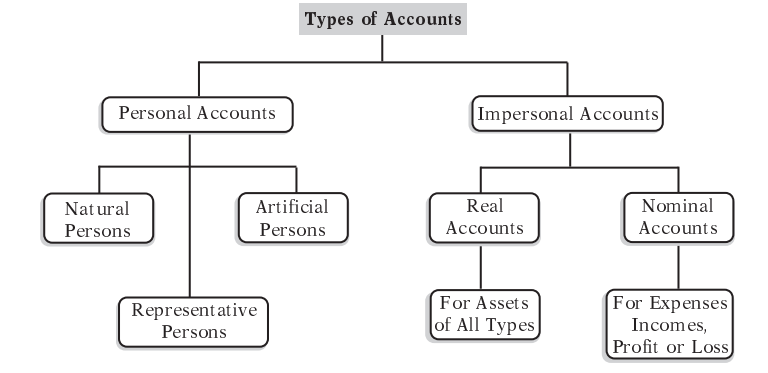

There are three types of accounts, i.e., personal, real and nominal.

Types of Accounts

Note: One should know that short form of account is written as a/c.

(a) Personal Accounts: This includes:

(i) Accounts of natural persons, e.g., debtor’s a/c, creditor’s a/c, Ram’s a/c, etc.

(ii) Accounts of artificial persons and body of persons e.g., partnership firm’s a/c, company’s a/c, bank a/c, club’s a/c, insurance company’s, etc.

(iii) Representative personal accounts When an account represent a certain person, it is called representative personal account. For example, if salary of 10 employees has not been paid, the total amount due to these employees will be added and shown under one common account called ‘salaries outstanding a/c’, but in the books the names of employees will appear. Therefore, salaries outstanding a/c is a personal account because it represents certain persons. Similarly, insurance prepaid a/c, rent outstanding a/c, interest accrued a/c, etc. are personal accounts.

(b) Real Accounts: These are accounts of things tangible or intangible, e.g., furniture a/c, cash a/c, goodwill a/c, patent rights a/c, machinery a/c, land and building a/c, etc.

(c) Nominal Account: These are accounts of expenses (and losses) and incomes (and gains), e.g., interest paid a/c, wages a/c, interest earned a/c, commission a/c, rent a/c, discount a/c, profit on sale of old machine a/c, etc.

4.3 Nominal Account v. Personal Accounts

Generally there is a confusion regarding some of nominal accounts and personal accounts. A simple rule is that when a prefix or suffix is added to a nominal account, it becomes a personal account. For example, wages a/c is a nominal a/c but wages outstanding a/c is a personal a/c. Similarly, rent a/c and insurance a/c are nominal accounts but rent paid in advance a/c and unexpired insurance a/c are personal accounts.

|

Golden Rules of Debit and Credit |

||

| (a) Personal Account: | Debit the receiver. | Credit the giver. |

| (b) Real Account: | Debit what comes in. | Credit what goes out. |

| (c) Nominal Account: | Debit the expenses and losses. | Credit the gains and incomes. |

5. Compound Journal Entries

Sometimes two or more transactions of the same nature take place on the same date. Instead of passing a separate entry for each transaction, a combined entry (known as compound entry) may be passed to record all these transactions. Such compound entries may be of three types:

1. One account to be debited and two or more accounts to be credited.

2. Two or more accounts to be debited and one account to be credited

3. Two or more accounts to be debited and two or more accounts to be credited.

6. Ledger in Accounting Process

The ledger is a set of accounts. In other words, the book which contains various accounts is known as ledger. It may be a bound book or a set of loose leaf pages or punched cards. Each account is opened on a separate page or card in the ledger.

A ledger has the following columns :

| Dr. |

Name of the Account |

Cr. | |||||

| Date | Particulars | Journal Folio (JF) | Amount

` |

Date | Particulars | Journal Folio (JF) | Amount

` |

6.1 Points to be noted in the ledger

1. Every account in the ledger has a name which is written at the top of the account.

2. Ledger account is divided in two equal parts. The left side part is known as debit (Dr.) side and the right side is known as credit (Cr.) side.

3. JF column denotes the page (folio) number on which journal entry of this transaction has been recorded.

6.2 Distinction between Journal and Ledger

The main points of distinction between journal and ledger are as under :

6.2.1 Subsidiary Book and Principal Book

Journal is a subsidiary book. It is also called a book of original entry or first entry. Ledger is the principal book, also known as a book of second entry. In other words, journal an original record while ledger is a derived record.

6.2.2 Chronological and Analytical Record

Journal is a chronological record of day-to-day business transactions while a ledger is an analytical record of these transactions.

6.2.3 Narrations

Journal entries are supported by narrations to help in properly understanding the entries. Ledger entries are not supported by narrations.

6.2.4 Balancing

Journal is not balanced while ledger accounts are balanced.

6.3 Ledger Posting

The process of transferring the debits and credits from the journals to the ledger accounts is called posting. Each amount listed in the debit column of the journal is posted by entering it on the debit side of the account in the ledger and each amount listed in the credit column of the journal is posted to the credit side of the ledger account. The following sequence is used for posting to ledger:

(i) Open (or locate) in the ledger the first account named in the journal entry.

(ii) Enter in the debit column of the ledger account the amount of the debit as shown in the journal. It is customary to write ‘To’ on the debit side with the name of the account and ‘By’ on the credit side with the name of the account.

(iii) Enter the date of the transaction in the date column of the ledger account.

(iv) Enter in journal folio column the number of the journal page from which the entry is being posted.

(v) The recording of the debit in the ledger account is now complete. Return to the journal and enter in the ledger folio column, the number of the ledger page to which the debit was posted.

(vi) Repeat the above five steps for the credit side of the journal entry.

Example. (Data is assumed)

Journal Entry

| Date 2013 | Particulars | L.F. | Dr.

` |

Cr.

` |

| Jan. 1 | Cash Account … Dr.

To Sales Account (Goods sold to R. C. & Co. on cash basis) |

1

14 |

840 |

840 |

The two ledger accounts affected by this entry are:

1. Cash Account

2. Sales Account

These two accounts will appear in the ledger as follows :

| Dr. | Cash Account | Cr. | |||||

| Date

2013 |

Particulars | Journal Folio | Amount

` |

Date | Particulars | Journal Folio | Amount

` |

| Jan. 1 | To Sales | 10 | 840 | ||||

| Dr. | Sales Account | Cr. | |||||

| Date | Particulars | Journal Folio | Amount

` |

Date

2013 |

Particulars | Journal Folio | Amount

` |

| Jan. 1 | By Cash | 10 | 840 | ||||

6.4 Balancing of Ledger Accounts

Balancing is the process of equalising the two sides of an account. After posting has been completed, the difference between the totals of debit and credit sides is ascertained. This is known as balancing of accounts. If the total of the debit side is more than that of credit side, it is said to have a debit balance and vice versa, if credit side total is more than that of debit side, it is a case of credit balance. The difference between the two is placed on the shorter side by writing “To or By Balance c/d” so that the two sides become equal. Thus the total of the bigger side is written on both sides. In the next period, the account will start with the balance as “To or By Balance brought down”. This is written on the side which has a bigger total.

If the totals of the two sides are equal, the account is said to be in balance.

7. Trial Balance in Accounting Process

When all ledger accounts have been prepared and balanced off, a list of all debit balances and credit balances is prepared. In double entry system, the debits must be equal to credits. In other words, the total of the debit balances must be equal to the total of the credit balances. The proof of the equality of debit balances and credit balances is called a ‘Trial Balance’. Thus a trial balance may be defined as ‘a two-column schedule listing the balances of all the accounts as they appear in the ledger. The debit balances are listed in the left hand column and the credit balances in the right hand column’. The total of the two columns should agree. If the debit side and credit side of the trial balance are equal, it is proved that the account books are arithmetically correct. But it is not a conclusive proof that there no errors.

7.1 Objectives

The main objectives of preparing a trial balance are follows:

1. To test the arithmetic accuracy. When a trial balance agrees, it is taken as a proof that double entry of all transactions is complete and arithmetically the books of account are correct. But it should not be taken as a conclusive proof that there no errors because certain errors are not disclosed by trial balance.

2. To detect errors. When the total of the debit balances is not equal to the total of the credit balances, it means that there are certain errors.

3. To provide data for preparing financial statements. Profit and Loss Account and Balance Sheet are prepared on the basis of trial balance data and additional information.

7.2 Solution

Debit and Credit Items in Trial Balance

| Debit Balances | Credit Balances |

| Personal Accounts | Personal Accounts |

| Bank | Capital |

| Sundry debtors | Bank (overdraft) |

| Drawings | Sundry creditors |

| Loan (given) | Loan (taken) |

| Prepaid insurance or other expenses | Outstanding wages or other expenses |

| Real Accounts | Real Accounts |

| Opening stock | Sales |

| Purchases | Purchases returns |

| Sales returns | Nominal Accounts |

| Plant | Discount received |

| Furniture Cash | Dividend received |

| Goodwill | Commission received |

| Investments

Other fixed assets |

Interest received and other incomes received |

| Nominal Accounts | Provisions and reserves |

| Wages, salaries, bad debts and other expenses and losses |

Dive Deeper:

Accounting – Meaning and its Basic Concepts

What are Accounting Standards (AS)?

Introduction to Final Accounts and Accounting Treatment

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA