Income Tax Returns: What you should know about ITR-1

- Blog|Income Tax|

- 4 Min Read

- By Taxmann

- |

- Last Updated on 10 May, 2021

Introduction to ITR – Filing:

ITR-1(Sahaj) can be filed only by an individual who is ordinarily resident in India. The individual who can file ITR-1 should have a total income up to Rs. 50,00,000 from the following sources: a)Income from Salary/Pension b)Income from only one house property c)Income from other sources excluding income chargeable to tax at special rates. ITR-1 is required to be filed electronically by all the individuals except super senior citizens (i.e., individuals whose age is 80 years or more at any time during the previous year).

Assessees not eligible to file ITR-1:

- Any person is other than an ordinarily resident individual.

- Individual who is a director of a company.

- Individual having income from more than 1 House property or has brought forward or who has carried forward losses under the head “Income from house property”.

- Income from Race horses, Lottery, Gambling, etc.

- Assessee having income or losses under the head “Income from business or profession” or “Capital gains”

- Income from agricultural activities exceeding Rs. 5,000.

- Assessee having dividend income exceeding Rs. 10 lakhs taxable under section 115BBDA.

- Assessee having unexplained income taxable u/s 115BBE.

- The assessee has any brought forward losses or wishes to carry forward losses under any head of income.

- An individual resident in India having:

- Asset outside India

- Signing authority in any account located outside India.

- Individual claiming relief of foreign tax paid or double taxation relief under Sec 90/90A/91.

Changes made in ITR-1 in the Assessment year 2019-20:

a) Four more disqualifications have been added which will debar the person to file this return, where the person,

-

- Has claimed deduction under section 57 except deduction in respect of family pension.

- Is a director in any company.

- Has held any unlisted equity share at any time during the previous year.

- Is assessable for the whole or any part of the income on which tax has been deducted at source in the hands of a person other than the assessee.

b) In the employer category, one more category named “Pensioners” is added.

c) Up to Assessment Year 2018-19, taxpayers were required to disclose the aggregate amount of income taxable under the head of other sources. However, from Assessment Year 2019-20, it is mandatory for an assessee to specify the nature of income taxable under the head income from other sources. ITR 1 and ITR 4 can be filed by an assessee having income from one house property. Thus, while reporting income from house property, an assessee can either mark this house property as ‘self-occupied or ‘let out’ during the year. A new option ‘deemed let out’ under the category of ‘type of property’ is inserted in the new ITR 1 & ITR 4. Now following three options are available to select ‘type of property’:

-

- Self-Occupied

- Let out

- Deemed let out

d) Section 80G allows deduction for donations made to certain notified funds, charitable institutions or other institutions/ funds set-up by the Government of India. The Finance Act, 2017 had reduced the limit of a cash donation from Rs. 10,000 to Rs. 2,000. Thus, with effect from Assessment Year 2018-19, no deduction is allowed for cash donation made in excess of Rs. 2,000. The new ITR forms have incorporated new columns to specify the amount of donation made in cash and in other modes. Cash donation made in excess of Rs. 2,000 shall not be allowed as a deduction from gross total income.

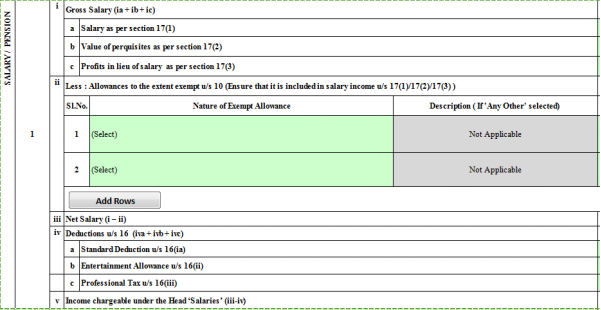

e) The new ITR forms have changed mechanism of reporting of salary income, which is now in sync with the columns of Form 16 (TDS Certificate issued by the employer). Now, from Assessment Year 2019-20, an individual has to mention his gross salary and then the amount of exempt allowances, perquisites and profit in lieu of salary shall be deducted or added to arrive at the taxable figure of salary income. Further, the new ITR forms seek separate reporting of all deductions allowable under Section 16, namely:

-

- Standard deduction

- Entertainment allowance

- Professional tax

Details required to file ITR-1 Online:

1. PAN number

2. Aadhaar Number/ Aadhaar enrolment ID

3. Form-16 issued by the employer

4. Form 26AS

5. Bank accounts information Steps to file ITR-1

-

- Go to website: www.incometaxindiaefiling.gov.in

- On the home page

-

-

- Click on “Login Here”, if you are a registered user, then login.

- Click on “Register Yourself”, if you are not registered, then register yourself and then login.

-

3. After logging in, on your Dashboard: click on the “Income Tax Return” option under the e-file menu.

4. On the “Income Tax Return” page:

-

- Select the Assessment Year

- Select “ITR form Name” as ITR-1.

- Select mode of submission as prepare & submit online.

- Fill up the other information as required in all tabs and under various fields.

5. Save and submit the return filed.

6. Next step is to e-verify the return. It can be done by various modes such as:

-

- Aadhaar OTP- If linked with PAN

- EVC using Pre-validated bank account

- EVC using Pre-validated Demat account

- Digital Signature Certificate

- Already generated EVC through My Account- Generate EVC option or bank ATM. *E-filing of ITR is not complete without verification.

7. Further, if an option, “I don’t want to e-verify my return” is chosen to send the signed ITR-V through normal or speed post to “Centralized Processing Centre, income tax department, Prestige Alpha, No. 48/1 & 48/2, Beratena Agrahara, Hosur Road, Bengaluru- 560500” within 120 days from the date of filing the return.

Author: CA Shivi Agarwal

Related Articles:

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA