Analysis of Section 269SS | Clause 31 of Form No. 3CD | Tax Audit

- Blog|Income Tax|

- 23 Min Read

- By Taxmann

- |

- Last Updated on 21 September, 2023

Table of Content

Check out Taxmann's Tax Audit which provides a detailed commentary/clause-by-clause analysis on provisions relating to Tax Audit and clauses of Form 3CA, 3CB and 3CD, along-with Guidance Notes issued by ICAI & Tax Audit Reckoner. This book is amended by the Finance Act, 2022.

1. Applicability of Clause 31(a)

Clause 31(a) is not applicable in respect of the following assessees:

-

-

- any banking company;

- any corporation established by a Central, State or Provincial Act;

- any Government company as defined in section 617 of the Companies Act, 1956 [now section 2(45) of the Companies Act, 2013].

-

Clause 31(a) deals with acceptance of loan or deposit in an amount exceeding the limit specified in section 269SS (i.e. Rs. 20,000).

Clause 31(b) deals with receipt of specified sum i.e. money receivable as advance or otherwise in relation to transfer of immovable property whether or not transfer takes place.

2. Legal provisions – Section 269SS

Section 269SS of the Act provides that no person shall take or accept from any other person (herein referred to as the depositor) the following amounts otherwise than by specified modes,

-

-

- any loan or

- deposit or

- any specified sum,

-

if,—

-

-

- the amount of such loan or deposit or specified sum or the aggregate amount of such loan, deposit and specified sum; or

- on the date of taking or accepting such loan or deposit or specified sum, any loan or deposit or specified sum taken or accepted earlier by such person from the depositor is remaining unpaid (whether repayment has fallen due or not), the amount or the aggregate amount remaining unpaid; or

- the amount or the aggregate amount referred to in clause (a) together with the amount or the aggregate amount referred to in clause (b), is twenty thousand rupees or more:

-

Provided that the provisions of this section shall not apply to any loan or deposit or specified sum taken or accepted from, or any loan or deposit or specified sum taken or accepted by,—

-

-

- the Government;

- any banking company, post office savings bank or co-operative bank;

- any corporation established by a Central, State or Provincial Act;

- any Government company as defined in clause (45) of section 2 of the Companies Act, 2013;

- such other institution, association or body or class of institutions, associations or bodies which the Central Government may, for reasons to be recorded in writing, notify in this behalf in the Official Gazette:

-

Provided further that the provisions of this section shall not apply to any loan or deposit or specified sum, where the person from whom the loan or deposit or specified sum is taken or accepted and the person by whom the loan or deposit or specified sum is taken or accepted, are both having agricultural income and neither of them has any income chargeable to tax under this Act.

2.1 Specified Modes

In terms of section 269SS read with Rule 6ABBA, the specified modes of accepting loan or deposit or specified sums are:

-

-

- by account payee cheque;

- by account payee bank draft;

- by use of electronic clearing system through a bank account; or

- Aadhaar Pay;

- Credit Card;

- Debit Card;

- Net Banking;

- NEFT;

- RTGS;

- IMPS;

- UPI; and

- BHIM.

-

2.2 “Loan or deposit”

“Loan or deposit” means loan or deposit of money;

Definition of a Loan

The term ‘loan’ is not defined in the Act. So, one would have to go by its ordinary meaning as explained in judicial decisions and law dictionaries.

The following judicial definitions of ‘loan’ are relevant:

(a) The term “loan” generally refers to borrowing something, especially a sum of cash that is to be paid back along with interest decided mutually by the parties. In other terms, the debtor is under a liability to pay back the principal amount along with the agreed rate of interest within a stipulated time [CIT v. Mahindra and Mahindra Ltd. [2018] 93 taxmann.com 32/255 Taxman 305 (SC)];

(b) The expression ‘loan’, though not defined under the Act, has a well-settled connotation, i.e., advancing of money by one person to another under an agreement by which the recipient of the money agrees to repay the amount on such agreed terms with regard to the time of repayment and the liability to pay interest. The person advancing the money is generally called a creditor, and the person receiving the money is generally called a borrower. The most simple form of a loan transaction is a contract by which the borrower agrees to repay the amount borrowed on demand by the creditor with such interest as stipulated under the agreement. Such a loan transaction may be attended by any security arrangement, a mortgage or pledge etc., depending upon the agreement of the parties [Keshavlal Khemchand and Sons (P.) Ltd. v. UOI [2015] 53 taxmann.com 470 (SC)/4 SCC 770];

(c) If A pays money to B, who agrees to return not the identical currency in specie but an equivalent sum subsequently, no bailment arises but simply a loan owing by B to A. The fact that it is called a “deposit” can make no difference [K.M.S. Lakshmanier and Sons v. CIT and CEPT [1953] 23 ITR 202 (SC)];

(d) A loan imports a positive act of lending coupled with an acceptance by the other side of the money as a loan. The relationship between borrower and lender cannot ordinarily come about by mere inaction. At the bottom, this is a question of fact. Of course, money so left could, by a proper agreement between the parties, be converted into a loan, but in the absence of an agreement, mere inaction on the part of the managing agents cannot convert the money due to them, and not withdrawn, into a loan [Shree Ram Mills Ltd. v. CEPT [1953] 23 ITR 120 (SC)];

(e) A loan can be with interest or without interest because no condition exists in law of contract that a loan can be with interest only [Chandrakant H. Shah v. ITO [2009] 28 SOT 315/[2010] 3 ITR (Trib.) 398/124 ITD 177 (Mum. – Trib.)].

The following points flow as corollaries from the above judicial decisions:

(a) Two parties: Loan involves two parties – the lender/creditor and borrower;

(b) Money is taken with Obligation to return: Loan involves taking money from another person lender under a contract whereby the person taking the loan (borrower/debtor/loanee) promises to repay the loan;

(c) Unpaid purchase price is not a loan: Where there has been no transaction of taking a loan but purchase of goods or property, the deferring or giving more time for payment by the vendor does not convert the unpaid purchase price into a loan;

(d) Loan may be interest-free: Loan may be interest-bearing or interest-free. If ingredients in (a) and (b) above are there, the loan does not cease to be so merely because it is to be repaid without any interest.

Two parties essential to a loan

The following judicial decisions are noteworthy in this regard:

(a) For a transaction to be considered as a loan, two different persons are required. A contract of loan requires two persons. There cannot be a loan by the same person to himself merely because he functions in two different capacities [Mohan Lal Shyam Lal, In re [1942] 10 ITR 219 (All.), CIT v. Mridu Hari Dalmia [1982] 8 Taxman 138/133 ITR 550/27 CTR 20 (Delhi)].

(b) Amount invested by the proprietor in his proprietorship concern is not a loan. Under no circumstances can a person borrow from himself and transpose as ‘creditor’ and ‘borrower’ at the same time. To this extent, ‘proprietor’ and ‘proprietorship concern’ are not two different entities. Whatever is pumped in by the ‘proprietor’ to his proprietorship, is nothing other than investment. The proprietorship concern could have borrowed any amount to be categorised as a ‘loan’, only if it was procured from some other source, then himself/the proprietor [CIT v. K. V. Mohammed Zakir [2017] 82 taxmann.com 96/396 ITR 180 (Ker.)].

(c) As per the Apex Court, firm and partner are not two different persons. Therefore, credit in the books of the firm in the capital account of partner, it cannot be said that firm has taken loan or deposit from partner [Asstt. CIT v. Vardaan Fashion [2015] 60 taxmann.com 407/38 ITR (Trib.) 247/168 TTJ 561 (Delhi-Trib.)].

(d) The amount paid by a partner to a firm does not partake the character of loan or deposit in general law [Shrepak Enterprises v. Dy. CIT [1998] 64 ITD 300 (Ahd. – Trib.) cited in Asstt. CIT v. Vardaan Fashion [2015] 60 taxmann.com 407/38 ITR (Trib.) 247/168 TTJ 561 (Delhi – Trib.)].

(e) The transactions made between the two sister concerns were under exceptional circumstances to accommodate the emergency needs of the sister concern for a very short and temporary period. As such, it did not amount to a loan or deposit as defined under section 269SS of the Act [Patiram Jain v. UOI [1997] 225 ITR 409/[1996] 85 Taxman 431 (MP) cited in Dillu Cine Enterprises (P.) Ltd. v. Addl. CIT [2002] 80 ITD 484 (Hyd. – Trib.)].

(f) When one single individual is managing the affairs of two concerns and the decision to transfer the funds from one concern to another or to repay the funds could have been said to have been largely influenced by the same individual, it cannot be said that transaction partake the nature of either deposit or loan [Chandra Cement Ltd. v. Dy. CIT [2000] 68 TTJ (JP – Trib.) 35 cited in Dillu Cine Enterprises (P.) Ltd. v. Addl. CIT [2002] 80 ITD 484 (Hyd. – Trib.)].

(g) Where funds have been transferred from and to the sister concerns as and when required and the managing partner is common to all the sister concerns, the decision to transfer the funds from one concern to another concern or to repay the funds could be said to have been largely influenced by the same individual. In other words, the decision to give and the decision to take rested with either the same group of people or with the same individual. In such circumstances of the case, the transaction inter se between the sister concerns and the assessee cannot partake or the nature of either “deposit” or “loan” though interest might have been paid on the same. It only represents the diversion of funds from one concern to another depending upon the exigencies of the business [Muthoot M. George Bankers v. Asstt. CIT [1993] 46 ITD 10 (Cochin – Trib.) cited in Dillu Cine Enterprises (P.) Ltd. v. Addl. CIT [2002] 80 ITD 484 (Hyd. – Trib.)].

Loan must be taken from another with an obligation to return

Loan must be taken with an obligation to return. In a loan, the amount taken is returned or repaid to fulfil the contract. Return or repayment of the loan is the happy ending to the contract desired by both parties at the inception itself. Trade advances taken by the supplier of goods or services or advances taken by the vendor of property or share application money is not a loan. Return/repayment of such advances may happen when the original agreement or contract to supply goods/services/property/allot shares could not be fulfilled. In a loan, the original agreement is to return the money taken with or without interest. In trade advance, the original agreement is to supply goods/services in return. In share application money, the original contract is to allot shares. It is repaid/returned when the original contract cannot be fulfilled. Therefore, trade advances, advances for property and share application money are not loans [See CIT v. Alpex Exports (P.) Ltd. [2014] 49 taxmann.com 389/[2015] 230 Taxman 140 (Delhi), CIT v. I. P. India (P.) Ltd. [2011] 16 taxmann.com 407/[2012] 204 Taxman 368/ 343 ITR 353 (Delhi), Chemmanur Metals and Alloys (P.) Ltd. v. Addl. CIT [ITA No. 934/Bang./2016, dated 31-1-2019].

Unpaid/deferred purchase price is not a ‘loan’

The following judicial decisions are noteworthy:

(a) An agreement to pay the balance of consideration due by the purchaser does not give rise to a loan. A loan of money undoubtedly results in a debt, but every debt does not involve a loan. Liability to pay a debt may arise from diverse sources, and a loan is only one of such sources. Every creditor who is entitled to receive a debt cannot be regarded as a lender [Bombay Steam Navigation Co. (P.) Ltd. v. CIT [1965] 56 ITR 52 (SC)].

(b) A loan is defined by the Oxford English Dictionary as ‘a thing lent; something the use of which is allowed for a time, on the understanding that it shall be returned or an equivalent given; esp., a sum of money lent on these conditions and usually with interest’. The essential requirement of a loan is the advance of money (or of some article) upon the understanding that it shall be returned, and it may or may not carry interest. The debt here arose not out of an advance but out of the sale of the flat by the company to the seventh petitioner. The company gave to the seventh petitioner time to pay a part of the purchase price. The seventh petitioner was, thus, given financial accommodation by the company in the matter of payment of the debt. Such financial accommodation was not and did not amount to a loan [Dr. Fredie Ardeshir Mehta v. Union of India [1991] 70 Comp. Cas. 210 (Bom.)].

(c) The legislative has, for reasons of policy, thought it fit not to define the term “loan” in an inelastic or rigid manner, and in every case, we have got to look to the substance or the essential nature of the transaction for the purpose of determining as to whether or not it is a “loan” within the meaning of the Act. If a vendor of property feeling unable to rely on the personal credit of the purchaser merely takes a bond or security from him in respect of unpaid purchase money the transaction by itself cannot rank as a loan because there is no element of advance involved in it [Kunja Behari Pal v. Satyendra Nath AIR 1941 Cal 689 cited in Radha Kisen Chamria v. Keshardeo Chamria AIR 1954 Cal 105].

(d) The amount of the unpaid price (of plant & machinery supplied by a non-resident) cannot be said to be a loan advanced by the non-resident to the buyer, nor can be the non-resident be said to be a lender to the buyer so far as that amount was concerned [CIT v. Saurashtra Cement & Chemical Industries Ltd. [1975] 101 ITR 502 (Guj.)].

(e) Amount payable to electricity company in respect of electricity charges is not a loan from the electricity company [Ashiana Paper Mills Pvt. Ltd. v. Punjab State Electricity Board, AIR 2008 P&H 119].

(f) Provisions of section 68 are not attracted to amount representing purchases made on credits – Principal CIT v. Kulwinder Singh [2018] 99 taxmann.com 449 (Punj. & Har.). In CIT v. Pancham Dass Jain (2006) 156 Taxman 507 (All. HC) it was held that provisions of section 68 are not attracted to amounts representing purchases made on credit.

Whether renewal of loan is a loan?

Renewal of loan may be taken to be a payment by the debtor with one hand and a fresh borrowing with the other, and, in that view of the matter, a renewal amounted to a fresh loan [Pratap Singh v. Gulzari Lal, 1942 ALJ 3, AIR 1942 All 50 explained in Lachmi Lal v. Babu Narain Das, AIR 1950 All 152].

There is a distinction between ‘loans’ and ‘deposits’. That is why, in section 269SS of the Act, the words ‘take or accept’ has been used with reference to the words ‘loan or deposit’ respectively. The reason is obvious. In the case of a loan, it is the borrower who goes to the lender for obtaining the loan, and in the case of a deposit, it is the depositor who goes to the person with whom he wants to deposit the money. This is the reason that the legislature has used the word ‘take’ with reference to the word ‘loan’ and used the word ‘accept’ with reference to the word ‘deposit’. The legislature has also defined the words ‘loan or deposit’ as ‘loan or deposit of money’. This clearly shows that this section can be applied only where money passes from one person to another by way of ‘loan or deposit’. Therefore, this provision cannot be applied where the money does not pass from one person to another, but the debt is acknowledged by an entry in the books of account, depending upon the facts of the case. Similarly, in the case of dissolution of the firm, the parties may agree that the amount standing to the credit of retiring partner may be treated as a loan with the continuing partners. In such a situation also, only journal entries are made, and no cash is transferred from one person to another [Sunflower Builders (P.) Ltd. v. Dy. CIT [1997] 61 ITD 227 (Pune – Trib.)].

In Chemmanur Metals and Alloys (P.) Ltd. v. Addl. CIT [ITA No. 934/Bang/2016, dated 31-1-2019], it was held that trade advances are not “loans”.

A word of caution is in order here. Genuine advances for the supply of goods or services or advances for sale of property or application money for allotment of securities will not be covered in the ambit of the expression ‘loan or borrowing or any such amount, by whatever name called’ used in the new first proviso to section 68. However, advances in the nature of the loan (i.e., financial accommodation in the guise of advances for the supply of goods or services) will be covered by the new first proviso.

Whether an advance is a genuine advance or an advance in the nature of a loan can be judged by various factors surrounding the transaction including but not limited to the following :

(a) Trade practice would be a helpful guide;

(b) A normal advance against an order, in accordance with the normal trade practice, would not be an advance in nature of a loan;

(c) If the advance far exceeds the value of an order or is for a period that is far in excess of the period for which such advances are usually extended as per the normal trade practice, then such excess advance may be in nature of a loan;

(d) If a trade practice does not exist, then the normal lead time required for a supplier to deliver an order should be considered;

(e) An outstanding advance for a period exceeding the normal lead time would generally be an advance in nature of loan, in the absence of any evidence to the contrary; and

(f) A stipulation regarding interest may indicate that the advance is in nature of a loan. This, however, by itself, is not conclusive. There may be advances that are not in the nature of the loan and which carry interest.

2.3 “Specified sum”

“Specified sum” means any sum of money receivable, whether as advance or otherwise, in relation to transfer of an immovable property, whether or not the transfer takes place.

2.4 “Transfer”

Section 269SS applies to cash received in relation to transfer of an immovable property. It does not matter whether immovable property being transferred is held as capital asset or as stock-in-trade

Section 2(47) of the Act defines “transfer”. The definition is an inclusive definition and expands the scope of the term ‘transfer’. However, the definition in section 2(47) is in relation to capital assets. All definitions in section 2 of the Act are subject to the qualifying phrase “unless the context otherwise requires”. Since section 269SS is not intended to be limited only to cash transactions relating to immovable property held as capital asset, the context appears to rule out the application of definition in section 2(47) to section 269SS.

The expression ‘transfer’ will have to be understood in the same sense as the expression is understood in Transfer of Property Act, 1882.

2.5 “Immovable Property”

Section 56(2)(x) applies to immovable property being land or building or both held as capital asset . Therefore section 56(2)(x) does not apply to rural agricultural land in India as the same is not a capital asset.

Section 194-IA requires seller to deduct TDS on consideration on transfer of immovable properties where transferor is a resident. TDS is to be deducted @1% if the consideration exceeds ` 50 lakhs. Section 194-IA defines ‘immovable property’ to mean any land (other than agricultural land) or any building or part of a building. Agricultural land means agricultural land in India other than urban land covered by section 2(14)(iii)(a)/(b).

Section 269SS does not define ‘immovable property’. There is no exclusion for rural agricultural land. Therefore, section 269SS would apply even to transfer of rural agricultural land in India except where both parties involved are having agricultural income and neither of them has any income chargeable to tax under this Act.

Section 269UA(d) defines ‘immovable property’. However, section 269SS does not expressly say that the said definition will apply. Therefore, the definition cannot be applied to section 269SS.

2.6 How to compute the limit of Rs. 20,000

The limit of Rs. 20,000 will have to be reckoned person-wise by aggregating the transactions with as under:

-

-

- the amount of such loan or deposit or specified sum or the aggregate amount of such loan, deposit and specified sum; or

- on the date of taking or accepting such loan or deposit or specified sum, any loan or deposit or specified sum taken or accepted earlier by such person from the depositor is remaining unpaid (whether repayment has fallen due or not), the amount or the aggregate amount remaining unpaid; or

- the amount or the aggregate amount referred to in clause (a) together with the amount or the aggregate amount referred to in clause (b),

-

The words “such” refer to loan or deposit or specified sum accepted or taken otherwise than by specified modes – e.g. by cash. The word “any” refers to loan or deposit or specified sum accepted or taken by any which mode.

2.7 What if one plot/flat is booked in joint names and another booked in solo name?

It may happen that one plot/flat is booked in solo name of an individual and another by same individual in joint name with others. Suppose cash advance of ` 10,000 is paid in one and cash advance of ` 25,000 is paid in another. It would appear that both are not to be clubbed for the limit of ` 20,000. It would appear that there would be no violation in this case. Where such clubbing is to be done, law says in so many words—a case in point is new clause (c) in section 269T which reads as under:

“(c) the aggregate amount of the specified advances received by such person either in his own name or jointly with any other person on the date of such repayment together with the interest, if any, payable on such specified advances,”;

Since section 269SS is not worded along the lines of clause (c) of section 269T, it can be inferred that clubbing of deposits accepted from a person in his name is not to be clubbed with advances received from him in joint names with any other person.

2.8 “Account Payee” vs. “Crossed” – Whether hairsplitting required?

Question of “account payee” or “crossed” applies only if loan or deposit is accepted by cheque or draft. If accepted by ECS, there is no need for hairsplitting on this issue. If the cheque or bank draft through which loan is received is ‘crossed’ but words ‘account payee’ is not written in the crossing but the transaction is otherwise genuine and the bank confirms that these amounts have been deposited in assessee’s account and are as per the banking norms and there was no flaw in the transaction, penalty under section 271D is not imposable for such a trivial violation. In CIT v. Makhija Construction Co. [2002] 123 Taxman 1003 (MP) the Court observed as under :

“. . . .The Tribunal has rejected appeal of the revenue mainly on the ground that cheques were crossed and were deposited in the account of assessee-firm through banking channel. Consequently and in the result, provisions of section 269SS of the Act could not be attracted. A further finding has been recorded that bank has also issued a certificate in this regard that all the amounts of six creditors have been shown in the account of Makhija Construction Co., i.e., assessee. Bank has further mentioned that all the six transactions in question were as per the banking norms and there was no flaw in the transaction, whereby the aforesaid amount of ` 2,15,000 was transferred in the account of the assessee. The Tribunal has come to the conclusion that for such minor deviation, no penalty could have been imposed on the assessee as otherwise the transaction appears to be genuine, proper and bona fide.”

Although a distinction exists between ‘crossed’ and ‘account payee’, hair-splitting on this is not warranted at least in section 269SS/269T context but is so warranted in section 40A(3) context.

2.9 Transactions between sister concerns

In Muthoot M. George Bankers v. Asstt. CIT [1993] 46 ITD 10 (Coch. – Trib.), the Tribunal held as under :

‘. . . .From the copies of the accounts furnished before us all that can be gathered is that funds have been transferred from and to the sister concerns as and when required and since the managing partner is common to all the sister concerns, the decision to transfer the funds from one concern to another concern or to repay the funds could be said to have been largely influenced by the same individual. In other words, the decision to give and the decision to take rested with either the same group of people or with the same individual. In such circumstances of the case, we hold that the transactions inter se between the sister concerns and the assessee cannot partake of the nature of either “deposit” or “loan”, though interest might have been paid on the same. . . .’

In Shree Durga Distillery v. Addl. CIT (Inv.) [ITA No. 349/Bang/2004, order, dated 30-11-2005], the Tribunal had the occasion to consider whether transactions between sister concerns can constitute a ‘loan or deposit’ for the purposes of sections 269SS and 271D. The Tribunal held that transfer of funds inter se between two sister concerns cannot be termed as a ‘loan’ or ‘deposit’. Deposit is given by the lender for a fixed term while loan is given on the request of the borrower. If decision on behalf of lender or borrower is taken by the same person controlling the financial affairs then it is difficult to term such transactions as loan or deposit as understood in common parlance. Further, the Tribunal also relied upon Asstt. CIT v. G.P. Taparia [2005] 143 Taxman 46 (Jodh. – Trib.) (Mag.) that cash transactions with sister concerns will not attract penalty as default of assessee would only be a technical one.

Whether direct deposit of cash in closely held company’s bank account by the director is ‘loan’ or ‘deposit’ under section 269SS? – In Mangala Builders Pvt. Ltd. v. Addl. CIT [2006] 9 SOT 23 (Bang. – Trib.) (URO), this issue was considered by ITAT. The Tribunal held that although the appellant-company and its Directors are two different legal entities, the appellant is a closely held company whose affairs are managed by the Directors. Since it was short of funds and to see that cheques issued by it are cleared, it had to keep sufficient balance in Bank. At that point of time, the Director out of his personal funds, deposited the sum in the bank account of the appellant company. Though this can be considered as receiving the sum from Director, it cannot be considered as taking a loan or accepting the deposits in its true sense (for the purposes of section 269SS). The appellant, being closely held company and the affairs being managed by the Director, broadly speaking, they are one and the same. At this point of crisis, the appellant can bank upon only its Directors. If the cheques are not cleared, ultimately any liability arising by way of criminal proceedings under section 138 of the Negotiable Instruments Act, will fall on such Director only. Thus the amount was deposited to save the hour of crisis and hence even if it is considered as received in violation of provisions of section 269SS, it amounts to reasonable cause within the meaning of section 273B which applies to section 271D also (under which penalty is imposable for violation of section 269SS).

The Bangalore Bench of ITAT in Sri Renukeswara Rice Mills v. ITO [2005] 93 ITD 263 (Bang. – Trib.) had held in the context of section 40A(3) held that where the payments are made otherwise than by account payee cheque directly in the bank account of the payee, it meets with the intention of the Legislature and no disallowance can be made under section 40A(3). Applying the same principle, it can be opined that when direct deposit of cash is made in (closely held) company’s bank account there would be no contravention of section 269SS.

2.10 Applicability of section 269SS/269T in respect of capital contributions of partners

In Munjal Sales Corpn. v. CIT [2008] 168 Taxman 43 (SC), the Supreme Court held that capital contributions by partners are ‘capital borrowed’ for the purposes of section 36(1)(iii). The Court held ‘It is vehemently urged on behalf of the assessee that partner’s capital is not a loan or borrowing in the hand of a firm. According to the assessee, section 40(b)(iv) applies to partner’s capital whereas section 36(1)(iii) applies to loan/borrowing. Conceptually, the position may be correct but we are concerned with the scheme of Chapter IV-D’. From the Court’s remarks, it appears that the Court’s ruling is only in the context of Chapter IV-D and this definition of borrowings will not apply in other contexts in the Act. So, it appears that capital contributions in money by partners are not hit by section 269SS/269T of the Act. However, to be on a safe side, it makes sense for firms and LLPs to comply with sections 269SS and 269T in the matter of partner’s capital contributions as well.

2.11 Cash against cheque – ‘Exchange

This is a money for money transaction which is called ‘exchange’. It is not a ‘loan’. Giving a cheque means giving money so long as the cheque is not post-dated and it does not get dishonoured subsequently. Hence, if the cheque is current dated and was duly encashed, it appears that the tax auditor need not report this matter under this clause.

2.12 Equity shares issued in satisfaction of loan

The word ‘repay’ in Oxford Dictionary is defined as payback (a loan), payback (money owed to some one). The word ‘repayment’ cannot be equated with ‘settlement/adjustment/square-off’. In fact the words ‘squared up’ is used in clause 31(a)(iii). Words ‘squared up’ is not used in clause 31(c). Hence, it is possible to take a view, clause 31(b) will only cover repayments by cash and repayment by bearer cheque/draft.

2.13 Transfer of newly admitted partner’s loan account balance to capital account as his capital contribution

Based on the Supreme Court’s decision in Munjal Sales Corpn. case (supra), it can be argued that partner’s capital is also nothing but ‘capital borrowed’. Therefore, this transaction can be construed as acceptance/taking of a loan otherwise then by crossed A/c payee cheque/DD and reporting against clause 31(a)/(c) is required.

2.14 ‘Renewal’ of deposits – Whether hit by Clause 31?

The word ‘renew’ has been defined by Oxford English Dictionary as “extend the period of validity of (a license, subscription or contract).” Shroud’s Judicial Dictionary defines if as extension of time for payment. Thus, renewal is neither ‘acceptance’ nor ‘repayment’. ‘Accept’ means to ‘consent to receive (something offered)’. ‘Take’ means to accept or receive. Repay means to ‘pay back’ (loan/money owed). Thus, analyzing all the above words, it appears that renewal is neither acceptance nor repayment. ICAI’s contrary views in its Guidance Note on Tax Audit, it is respectfully submitted, requires reconsideration.

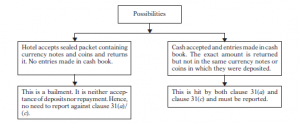

2.15 ‘Loan’, ‘Bailment’ – Hotel accepting cash from guests for safe custody

2.16 Retentions from contractor’s bills as ‘Security deposit’ – Whether ‘deposit’

AS-7 Construction Contracts [Para 39(c)] describes these amounts as ‘retentions’. Thus, it is not really correct to call these security deposits. They are ‘retentions’. Para 40 of (AS) 7 defines retentions as amounts of progress billings which are not paid until the conditions in the contract are satisfied or until defects have been rectified. So, withholding amounts out of contractor’s bills and releasing them after warranty period does not attract clause 31(a) and/or clause 31(c). However, if contractor i.e., deposits money with assessee and this money is refunded by assessee to him on expiry of warranty period – clause 31(a) and/or 31(c) will be attracted.

3. ICAI’s views on Clause 31(a)

The following views of ICAI are relevant in this regard :

-

-

- Sale proceeds collected by the selling agent (on behalf of his principal) is not a loan or deposit.

- The definition of deposit does not exclude a current account. Therefore, if the transactions in a current account exceed the amount of ` 20,000, it will be necessary to give the information against this sub-clause. This is so even if no interest is paid on current account.

- In case, the lender’s account is a mixed account, the transactions relating to loans and deposits (temporary advances) should be segregated from other accounts and the transactions relating to loans/deposits only should be stated under this clause.

- Advance received against sale of goods is not a loan or deposit.

- In case of loan taken in earlier years, opening credit balance is not specifically required to be disclosed. However, while giving figures of maximum amount outstanding at any time during the year or while giving information about repayment of loan/deposit, the opening balances in the loan accounts will have to be taken into consideration.

- Information has to be given in respect of interest-free loans also.

- Security deposits against contracts, etc. are ‘deposits’ and therefore, such information in respect of them should be given. However, if these ‘security deposits’ are in the form of amounts retained/withheld from bills, these are ‘retentions’ as per (AS) 7 and not ‘deposits’. To that extent, above view of ICAI needs reconsideration.

- Loans and deposits taken or accepted by transfer entries constitute acceptance of deposits or loans otherwise than by account payee cheques/drafts or ECS. Hence, such entries have to be reported under this clause.

- The entries that relate to transactions with a supplier and customer are not loans or deposits accepted.

- If the aggregate loans/deposits in a year (from a single party) exceed ` 20,000 but each individual item is less than ` 20,000 the information will still be required to be given in respect of all such entries starting from the entry when the balance reaches ` 20,000 or more and until the balance goes down below ` 20,000. The tax auditor should verify all loans/deposits taken or accepted where balance has reached ` 20,000 or more during the year for the purpose of reporting under this clause.

- In case of loans or deposits taken or accepted through electronic transfers (possible due to technological advances) through internet/mail transfer-these are not through account payee cheque/DD or through ECS. All the same, they are capable of being tracked. These loans and deposits need not be reported. In terms of Rule 6ABBA, loans or deposits may be received by the following ‘other prescribed electronic modes’ for section 269SS purposes: (i) Debit card; (ii) Credit card; (iii) Net Banking; (iv) UPI; (v) BHIM; (vi) RTGS; (vii) NEFT; (viii) IMPS; (ix) Aadhaar Pay. If loan or deposit is received by the modes specified in Rule 6ABBA, no need for reporting even though received otherwise than by account payee cheque/DD or ECS.

- In the absence of conclusive or satisfactory evidence that the loan/deposit was taken/accepted by account payee cheque/DD or use of electronic clearing system through bank, he should make a suitable comment in his report as suggested below : “It is not possible for me/us to verify whether loans or deposits have been taken or accepted otherwise than by an account payee cheque or account payee bank draft, as the necessary evidence is not in the possession of the assessee”.

- Share application money advance supported by appropriate documentation is neither deposit nor loan.

- Subsequent allotment of shares or repayment of application money as a part of allotment process does not alter the character of application money and provision of section 269SS/T are not attracted in such a case. – CIT Rugmini Ram Ragav Spinners (P.) Ltd. [2008] 304 ITR 417 (Mad.) and CIT v. IP India (P.) Ltd. [2011] 16 taxmann.com 407/[2012[204 Taxman 368 (Delhi) and CIT v. Numero Uno Financial Services P. Ltd. [2012] 20 taxmann.com 508/206 Taxman 96 (Delhi) (Mag.). However, contrary view has been taken in Bhalotia Engineering Works (P.) Ltd. v. CIT [2005] 275 ITR 399 (Jhar.).

-

3.1 Certificate from assessee (management representation)

Where loan or deposit is accepted by use of ECS, tax auditor will not be required to verify whether cheque/DD is “account payee” or not. Tax auditor should advice the auditee at the start of the financial year itself to accept/repay loans/deposits/specified sum through ECS rather than by cheque or DD.

Where loan or deposit is accepted by cheque or Bank draft, it may not be practically possible for the tax auditor to verify each payment, reflected in the bank statement as received through cheque or DD, as to whether the payment/acceptance of deposits or loans has been made through account payee cheque, demand draft, pay order or not. Therefore, the 2014 Guidance Note requires the tax auditor to obtain suitable certificate from the assessee to the effect that the payments/receipts referred to in sections 269SS and 269T were made by account payee cheque drawn on a bank or account payee bank draft as the case may be. Where the reporting has been done on the basis of the certificate of the assessee, the same shall be reported as an observation in clause (3) of Form No. 3CA and clause (5) of Form No. 3CB, as the case may be.

[Para 51.5 of the 2014 Guidance Note]

3.2 Verification procedures

There will be practical difficulties in verifying the loan or deposit taken or accepted by account payee cheque or an account payee bank draft. In such cases, the tax auditor should verify the transactions with reference to such evidence which may be available. In the absence of satisfactory evidence, the tax auditor should make a suitable comment in his report as under :

“It is not possible for me/us to verify whether loans or deposits have been taken or accepted otherwise than by an account payee cheque or account payee bank draft, as the necessary evidence is not in the possession of the assessee”.

[Para 49.6 of the Guidance Note]

Dive Deeper:

Detailed Analysis of Clause 9 to 12

Detailed Analysis of Clause 13 and Clause 14

Detailed Analysis of Clause 15 and Clause 16

Detailed Analysis of Clause 17 to Clause 19

Detailed Analysis of Clause 20 and Clause 21

Detailed Analysis of Clause 22 to Clause 25

Detailed Analysis of Clause 26 to Clause 29

Detailed Analysis of Clause 31

Detailed Analysis of Clause 32 to Clause 34

Detailed analysis of Clause 35 to Clause 38

Detailed Analysis of Clause 39 to Clause 41

Detailed Analysis of Clause 42 to Clause 44

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA