Overview of Foreign Trade Policy (FTP) 2023 & Its Key Features

- Blog|GST & Customs|

- 7 Min Read

- By Taxmann

- |

- Last Updated on 18 September, 2023

Table of Contents

1. Introduction

4. Conclusion

1. Introduction

Before the introduction of Foreign Trade Policy (FTP) 2023, FTP 2015-20 was functional. The tenure of FTP 2015-20 had been completed on 31st March, 2020, but owing to the COVID-19 scenario, FTP 2015-20 had been extended up to 31st March, 2023. Thus, new Foreign Trade Policy 2023 was announced on 31st March, 2023 by the respected Union Minster of Commerce and Industry, Consumer Affairs, Food and Public Distribution and Textiles, Shri Piyush Goyal.

2. Highlights of FTP 2023

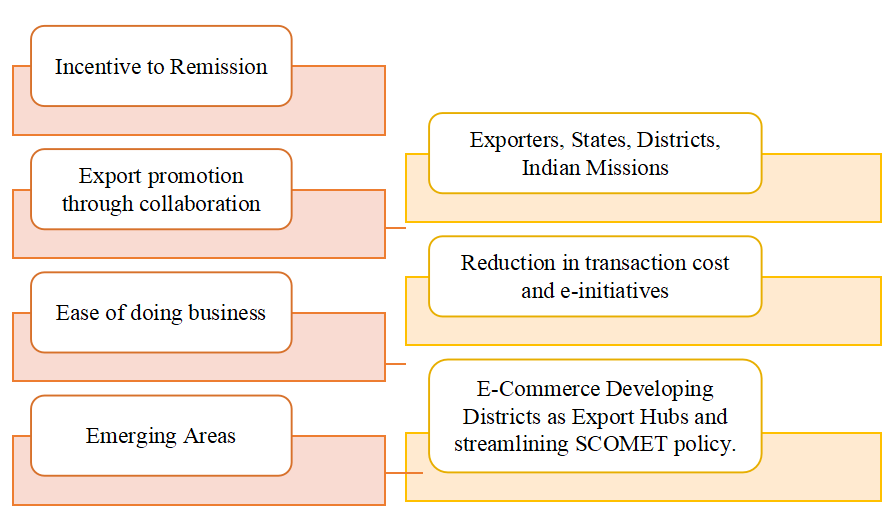

2.1 Four Pillars of Foreign Trade Policy (FTP) 2023

(1)

(2)

(3)

(4)

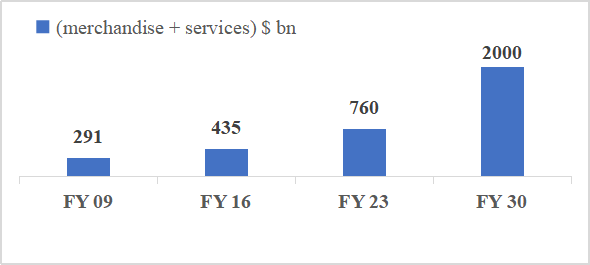

(5) Total Exports

| Compound Annual Growth Rate (CAGR) (%) | ||

| FY 16 | FY 23 | FY 30 |

| 5.9 | 8.3 | 14.8 |

(6) Internationalisation of Rupee

FTP benefits extended for rupee realizations through special Vostro Accounts setup as per RBI circular issued on 11th July, 2022.

3. Major Features of FTP 2023

3.1 Process Re-Engineering and Automation

- Greater faith through automated IT System.

- Ongoing schemes like Advance Authorization, Export Promotion Capital Goods (EPCG), etc. to continue with substantial process re-engineering.

- FTP 2023 – Mechanism in a paperless environment – ease of doing business.

- Reduction in fees structure and IT based system will make it easier for MSME and others to access export benefits.

- Duty exemption – through a rule-based IT system.

- Cases identified under risk management framework will be scrutinized manually, but covered under automatic route initially.

| Faster Online Processing under FTP 2023 | ||

| Permission Type | Current Processing Time | Automatic Route Processing Time |

| Advance authorization issuance | 3 to 7 days | 1 day |

| EPCG issuance | 3 to 7 days | 1 day |

| Revalidation of authorizations | 3 days to 1 month | 1 day |

| Reduced User Charges for MSMEs under Advance Authorization and EPCG Schemes | ||

| License value (Rupees) | User charges for non-MSMEs (Rupees) | Reduced user charges for MSMEs (Rupees) |

| Up to 10 million | 1 per 1000 | 100 |

| 10 million to 100 million | 1 per 1000 | 5000 |

| Above 100 million | Cap at 100000 | 5000 |

3.2 Towns of Export Excellence

- Four new towns, namely Faridabad, Mirzapur, Moradabad and Varanasi have been designated as Towns of Export Excellence (TEE) in addition to the existing 39 towns.

| Town of Export Excellence | Product Category |

| Faridabad | Apparel |

| Mirzapur | Handmade Carpet and Dari |

| Moradabad | Handicraft |

| Varanasi | Handloom and Handicraft |

- The TEEs will have priority access to export promotion funds under the Market Access Initiative (MAI) scheme and will be able to avail Common Service Provider (CSP) benefits for export fulfilment under the EPCG Scheme.

- This addition is expected to boost the exports of handlooms, handicrafts and carpets.

3.3 Recognition of Exporters

- Exporter firms recognized with ‘status’ based on export performance will now be partners in capacity-building initiatives on a best-endeavour basis.

- Similar to the ‘each one teach one’ initiative, 2-star and above status holders would be encouraged to provide trade-related training based on a model curriculum to interested individuals.

- This will help India build a skilled manpower pool capable of servicing a $5 Trillion economy before 2030.

- Status recognition norms have been re-calibrated to enable more exporting firms to achieve 4 and 5-star ratings, leading to better branding opportunities in export markets.

| Status Recognition Norms | ||

| Status House Category | Existing Export Performance Threshold (in US$ million) | Revised Export Performance Threshold (in US$ million) |

| One star | 3 | 3 |

| Two star | 25 | 15 |

| Three star | 100 | 50 |

| Four star | 500 | 200 |

| Five star | 2000 | 800 |

3.4 Promoting export from the districts

- The FTP aims at building partnerships with State governments and taking forward the Districts as Export Hubs (DEH) initiative to promote exports at the district level and accelerate the development of grassroots trade ecosystem.

- Efforts to identify export worthy products and services and resolve concerns at the district level will be made through an institutional mechanism – State Export Promotion Committee and District Export Promotion Committee at the State and District level, respectively.

- District specific export action plans to be prepared for each district outlining the district specific strategy to promote export of identified products and services.

5. Streamlining SCOMET Policy

- India is placing more emphasis on the “export control” regime as its integration with export control regime countries strengthens.

- There is a wider outreach and understanding of SCOMET (Special Chemicals, Organisms, Materials, Equipment and Technologies) among stakeholders, and the policy regime is being made more robust to implement international treaties and agreements entered into by India.

- A robust export control system in India would provide access of dual-use High end goods and technologies to Indian exporters while facilitating exports of controlled items/technologies under SCOMET from India.

6. Facilitating E-Commerce Exports

- E-Commerce exports are a promising category that requires distinct policy interventions from traditional offline trade. Various estimates suggest e-commerce export potential in the range of $200 to $300 billion by 2030.

- FTP 2023 outlines the intent and roadmap for establishing e-commerce hubs and related elements such as payment reconciliation, book-keeping, returns policy and export entitlements.

- As a starting point, the consignment wise cap on E-Commerce exports through courier has been raised from Rs. 5 Lakhs to Rs. 10 Lakhs in the FTP 2023.

- This cap will be further revised or eventually removed, depending on the feedback of the exporters. Integration of Courier and Postal exports with ICEGATE will enable exporters to claim benefits under FTP.

- Dak Niryat Facilitation: Dak Ghar Niryat Kendras shall be operationalised throughout the country to work in a hub-and spoke model with Foreign Post Offices (FPOs) to facilitate cross-border e-commerce and to enable artisans, weavers, craftsmen, MSMEs in the hinterland and land-locked regions to reach international markets.

7. Facilitation under the Export Promotion of Capital Goods (EPCG) Scheme

- The EPCG Scheme, which allows import of capital goods at zero Customs duty for export production, is being further rationalized. Some stepsto boost manufacturing are:

-

- Prime Minister Mega Integrated Textile Region and Apparel Parks (PM MITRA) scheme has been added as an additional scheme eligible to claim benefits under CSP (Common Service Provider) Scheme of Export Promotion Capital Goods (EPCG).

- Dairy sector to be exempted from maintaining Average Export Obligation – to support dairy sector to upgrade the technology.

- Battery Electric Vehicles (BEV) of all types, Vertical Farming equipment, Wastewater Treatment and Recycling, Rainwater harvesting system and Rainwater Filters and Green Hydrogen are added to Green Technology products – will now be eligible for reduced Export Obligation requirement under EPCG Scheme.

8. Facilitation under the Advance Authorization Scheme (AAS)

- Advance Authorization Scheme accessed by DTA units provides duty-free import of raw materials for manufacturing export items and is placed at a similar footing to EOU and SEZ Scheme.

- However, the DTA unit has the flexibility to work both for domestic as well as export production. Based on interactions with industry and Export Promotion councils, certain facilitation provisions have been added in the present FTP such as:

-

- Special Advance Authorization Scheme extended to export of Apparel and Clothing sector under para 4.07 of HBP on self-declaration basis to facilitate prompt execution of export orders – Norms would be fixed within fixed timeframe.

- Benefits of Self-Ratification Scheme for fixation of Input-Output Norms extended to 2 star and above status holders in addition to Authorised Economic Operators at present.

9. Merchanting trade

- To develop India into a merchanting trade hub, the FTP 2023 has introduced for merchanting trade.

- Merchanting trade of restricted and prohibited items under export policy would now be possible.

- Merchanting trade involves shipment of goods from one foreign country to another foreign country without touching Indian ports, involving an Indian intermediary.

- This will be subject to compliance with RBI guidelines, and won’t be applicable for goods/items classified in the CITES and SCOMET list. In course of time, this will allow Indian entrepreneurs to convert certain places like GIFT city etc. into major merchanting hubs as seen in places like Dubai, Singapore and Hong Kong.

10. Amnesty Scheme

- Finally, the government is strongly committed to reducing litigation and fostering trust-based relationships to help alleviate the issues faced by exporters.

- In line with “Vivaad se Vishwaas” initiative, which sought to settle tax disputes amicably, the government is introducing a special one-time Amnesty Scheme under the FTP 2023 to address default on Export Obligations.

- This scheme is intended to provide relief to exporters who have been unable to meet their obligations under EPCG and Advance Authorizations, and who are burdened by high duty and interest costs associated with pending cases.

- All pending cases of the default in meeting Export Obligation (EO) of authorizations mentioned can be regularized on payment of all customs duties that were exempted in proportion to unfulfilled Export Obligation.

- The interest payable is capped at 100% of these exempted duties under this scheme. However, no interest is payable on the portion of Additional Customs Duty and Special Additional Customs Duty and this is likely to provide relief to exporters as interest burden will come down substantially.

- It is hoped that this amnesty will give these exporters a fresh start and an opportunity to come into compliance.

4. Conclusion

India’s new Foreign Trade Policy 2023 focuses mainly on the internationalization of trade in Rupees, with no set end date for the policy, leaving the scope for the policy to be continuously updated as per the demand of the export industry. It aims to boost exports to $2 trillion by 2030, using E-commerce as its major tool for achieving the said target, and also developing districts as export hubs along with streamlining the SCOMET policy. Thus, FTP 2023 would enhance the competitiveness of Indian exports in the global market.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA