Guide for the CA Proposed Scheme of Education and Training 2022

- CA|Exam|

- 6 Min Read

- By Taxmann

- |

- Last Updated on 23 December, 2023

Table of Content

1. Implementation of International Curriculum to build global ready Chartered Accountants

3. Revalidation of Registration

7. Requirement of Certificate of Practice (COP)

As has been rightly said, “We cannot become what we want by remaining what we are”, which means that changes are vital for one’s constant growth and it is equally important to accept such changes for achieving what is desired.

The Institute of Chartered Accountants of India (ICAI), being one of the premier professional accountancy bodies in the world, has spared no efforts to continuously strengthen the system of education and training and with the advent of technology, increased globalisation and development in the teaching and learning approaches, ICAI has proposed necessary changes in the syllabus and overall scheme to keep it globally relevant and hence internationalizing the Chartered Accountancy (CA) course.

The Committee for Review of Education and Training (CRET) has been formed with the objective to review the existing system of imparting education in the CA course, through industry roundtables and academic board comprising of top academicians and subject experts from across India. Accordingly, major changes have been announced in the syllabus/ Papers, registration validity, articleship duration, passing criteria, etc. the details of which are significant to be congnizant of.

Some of the salient features and major changes in the Proposed Scheme of Education and Training 2022 include:

1. Implementation of International Curriculum to build global ready Chartered Accountants

The aim is to develop a contemporary curriculum having course structure and duration that are in line with the global best practices and shall focus on two aspects:

- Common Curriculum for domestic and international students, with the exception of country specific papers and;

- Candidate residing outside India may undergo Practical Training under eligible Members of Accounting Bodies outside India recognized by the International Federation of Accountants (IFAC).

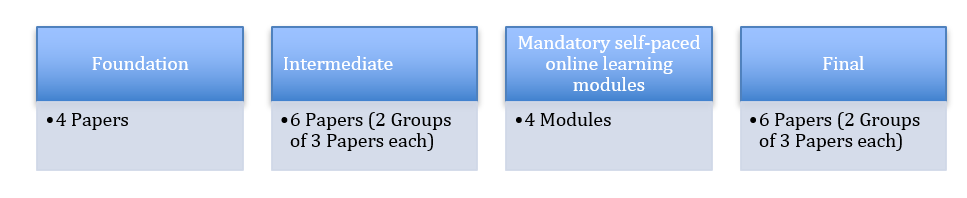

2. Number of Papers

The proposed scheme consists of all the levels as in the present scheme viz. Foundation, CA Intermediate or equivalent level and CA Final or equivalent level; however in the new scheme, following changes have been made in the number of papers where some papers have been merged and some removed.

| CA Level | Proposed Changes in Papers |

| Foundation | From Paper 2 and Paper 4, Business Correspondence and Reporting (BCR) and Business and Commercial knowledge (BCK) respectively have been removed. |

| Intermediate | Paper 1 (Accounting) and Paper 5 (Advanced Accounting) have been merged into one paper i.e. CA Proposed Scheme of Education and Training and from Paper 7 and Paper 8, Enterprise Information Systems (EIS) and Economics for Finance (EFF) respectively have been removed from the syllabus. |

| Final | Paper 4 (Corporate and Economic Laws) and Paper 5 (Strategic Cost Management & Performance Evaluation) have been removed and included in the self-paced modules. |

Further, self-paced online learning modules encompassing different fields have been introduced which students can learn and qualify at their own pace after qualifying Intermediate examination and before writing Final examination.

Accordingly, the change in the number of Papers at different levels of Chartered Accountancy course as presented:

Below are the details of the Papers covered at different levels:

| Sr. No. | Course Level | Papers | Marks Per Paper |

| 1. | Foundation

(4 Papers) |

Paper 1: Accounting

Paper 2: Business Laws Paper 3: Quantitative Aptitude

Paper 4: Business Economics

|

100 Marks

100 Marks 100 Marks

100 Marks Total: 400 marks |

| 2. | Intermediate

(2 Groups of 3 Papers each) |

Group 1

Paper 1: Advanced Accounting Paper 2: Corporate Laws Paper 3: Cost and Management Accounting

Group 2 Paper 4: Taxation

Paper 5: Auditing and Code of Ethics Paper 6A: Financial Management Paper 6B: Strategic Management |

100 Marks 100 Marks 100 Marks Total: 300 marks

100 Marks

100 Marks 50 Marks 50 Marks Total: 300 Marks |

| 3. | Self Paced Online Learning Modules | Set A

Economic Laws Set B Strategic Cost Management and Performance Evaluation Set C Specialisation Elective – Choose Any One

Set D Choose Any One

|

|

| 4. | Final

(2 Groups of 3 Papers each) |

Group 1

Paper 1: Financial Reporting Paper 2: Advanced Financial Management Paper 3: Advanced Auditing & Professional Ethics

Group 2 Paper 4: Direct Tax Laws and International Taxation Paper 5: Indirect Tax Laws Paper 6: Integrated Business Solutions (Multi-disciplinary case study with Strategic Management)

Note: There shall be an additional emphasis on Ethics and Information Technology and will be integrated with curriculum of all subjects at Final level. |

100 Marks

100 Marks 100 Marks Total: 300 Marks

100 Marks 100 Marks 100 Marks

Total: 300 Marks |

3. Revalidation of Registration

The registration at each level of CA Course remains valid for a finite period, after which it lapses. However, it can be validated by paying a renewal/ re-validation fee as specified by ICAI from time to time.

The validity period of initial registration to CA Course at each level as well as the allowability of re-validation is stated below:

| CA Level | Validity of Registration | Revalidation |

| Foundation | 4 years | Not allowed |

| Intermediate | 5 years | Allowed once |

| Final | 10 years | Allowed |

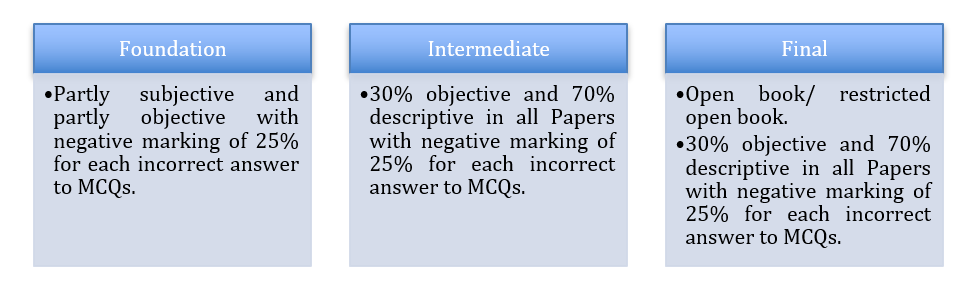

4. Pattern of Examination

It is pertinent for a student to note the changes in subjects of CA Course along with the type of questions asked (whether subjective or objective-type) so that an appropriate study strategy can be prepared.

5. Passing Criteria

| CA Level | Criteria |

| Foundation | 50% in each paper (with 25% negative marking for each wrong answer to MCQs in Paper 3 and 4) |

| Intermediate/ Final | 40% in each paper individually and 50% in aggregate to pass the group (with 25% negative making for wrong answers in MCQ based questions).

Exemption: If a student secures 60% or more in Paper/s in one attempt, he/she may be exempted from that Paper/s and treated as passed in that Paper/s for next 3 attempts. The exemption can be availed further (after 3 attempts) subject to scoring 50% passing marks in the remaining paper/s individually (instead of 40% marks in individual paper and 50% marks in aggregate).

In case the student finds difficult to obtain 50% in each of the remaining paper/s individually, he/she may opt to surrender the exemption after three attempts. |

| Self Paced Online Learning Modules | 50% in each module. |

6. Practical Training

- Seamless and focused Practical Training for 2 years after qualifying both groups of Intermediate and completion of ICITSS.

- Since it will be an examination-free period, 12 leaves in a year shall be allowed.

- 100% increase in the stipend presently paid to Article Assistants.

- Option to undergo Industrial Training for 9 months to 1 year (in the last leg of Practical Training).

- The student can appear in Final examination after completion of 6 months from the end of Practical Training period. (Note: If the student is unable to clear the Final examination, he/she can apply for Business Accounting Associate (BAA) Certificate.)

7. Requirement of Certificate of Practice (COP)

| Category | Eligibility Criteria |

| New Members | Mandatory one-year post qualification work experience in a Chartered Accountancy firm for members applying for COP. |

| Existing Members | Members who are in industry and who desire to shift to practice would also be required to have a one-year experience in a CA firm before they apply for COP.

The requirement would be treated as having complied with if they have one year of post-qualification experience in CA firm at any point of time in the last 5 years. |

The Proposed Scheme of Education and Training has already received an in-principle approval from Ministry of Corporate Affairs as of 2nd June, 2022. Moreover, the institute has also shared a detailed PPT for the new scheme at its official website https://www.icai.org/post/bospset-ppt. The Institute has also invited suggestions from the stakeholders regarding the new scheme which may be sent latest by 1st July, 2022 by visiting the link: https://boscret.icai.org.

Thus, the proposed scheme launched by ICAI emphasizes mainly on building global ready CAs with high ethical standards. Clearly, with the launch of new scheme of education and training, ICAI seems to be stepping towards the achievement of a new paradigm.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA