CSEET Paper 3 Preparation Guide—Conceptual Clarity with Exam Strategy

- CSEET|CS|Exam|

- 3 Min Read

- By Taxmann

- |

- Last Updated on 7 June, 2025

Preparing for CSEET Paper 3 – Economic & Business Environment – can feel like juggling two subjects at once. While one half dives into economic concepts like GDP, inflation, and national income, the other half demands an understanding of dynamic real-world factors such as entrepreneurship, market ecosystems, and government institutions. This article explores how to strike the perfect balance between comprehensive learning and concise revision. With practical strategies and focused insights, it shows you how to study smarter, not longer, and boost your chances of scoring high in Paper 3.

Table of Contents

- Introduction

- Understanding the Structure of Paper 3

- Why You Need to Balance Comprehensiveness with Conciseness

- Smart Strategies to Achieve This Balance

- Benefits of a Balanced Study Strategy

- Conclusion

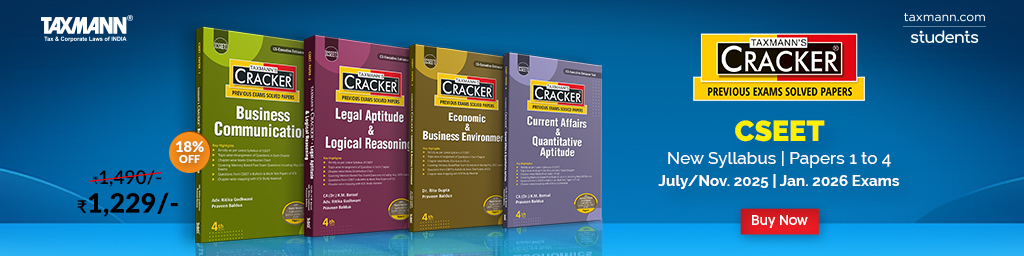

Check out Taxmann's Economic & Business Environment (Paper 3) | CRACKER which is a comprehensive, exam-focused guide for CSEET – Paper 3, covering key topics in Economics (Part A) and Business Environment (Part B). Authored by Dr Ritu Gupta & Praveen Baldua, it strictly aligns with the latest syllabus and features memory-based past exam questions (including May 2025) for realistic practice. The book's structured layout provides topic-wise questions, a chapter-wise marks distribution chart, and references to CSEET e-Bulletins & mock tests for thorough preparation. A dedicated Rapid Reviser aids quick conceptual clarity, and the Solved Paper (May 2025) offers invaluable exam insights. Overall, this 4th Edition ensures a concise yet complete approach, helping students excel in July/Nov. 2025 and Jan. 2026 exams.

1. Introduction

Preparing for Paper 3 – Economic & Business Environment of the CS Executive Entrance Test (CSEET) is often a challenge because of its dual nature. On one side, it involves deep conceptual learning in economics; on the other, it demands real-world awareness of the business environment.

A common mistake many aspirants make is either diving too deep into theory or skipping through chapters with shallow understanding. The ideal approach lies in striking the right balance between depth and brevity—studying enough to master the concepts, yet fast enough to revise within time limits.

2. Understanding the Structure of Paper 3

This paper is divided into two broad parts:

- Part A – Economics: Includes demand and supply, national income, markets, Indian budget, and financial systems

- Part B – Business Environment: Covers entrepreneurship, business ecosystem, and government institutions

With such wide coverage, candidates must carefully allocate study hours based on concept complexity, marks weightage, and past year trends.

3. Why You Need to Balance Comprehensiveness with Conciseness

- Reading lengthy theory may help in classroom learning, but exam prep calls for precise understanding

- Time is limited—both in preparation and during the exam

- Retaining everything becomes harder without summarised revision aids

- Smart prep involves condensing key points while preserving clarity

4. Smart Strategies to Achieve This Balance

4.1 Concept First, Details Later

Always start with a firm grip on the basics. Understand economic indicators like GDP, inflation, and monetary policy before moving to policy-level discussions.

4.2 Summarise and Simplify

Once a chapter is complete, summarise it in your own words. Use flashcards or mind maps for better recall. For business topics, use real-life examples to understand abstract terms.

4.3 Use Chapter-Wise Questions

Solve questions related to one topic at a time. This helps in isolating weak spots and improving accuracy.

4.4 Mock Tests + Memory-Based Questions

Simulate exam conditions with mock tests. Use memory-based past exam questions (especially from May 2025) to understand the pattern and expected question types.

4.5 Set Daily Micro-Goals

Break your syllabus into small targets. For example:

- Day 1 – National Income

- Day 2 – Indian Budget

- Day 3 – Entrepreneurship Models

This helps avoid overwhelm and gives a sense of progress.

5. Benefits of a Balanced Study Strategy

- Better retention due to simplified summaries

- Higher accuracy in MCQs due to strong concept clarity

- Effective time management during revision

- Increased confidence in solving unknown or application-based questions

6. Conclusion

CSEET Paper 3 preparation requires both depth of understanding and smart summarisation. A preparation strategy that balances these two aspects not only saves time but also strengthens performance. Be intentional with your learning—cover what’s important, but revise it in a way that sticks.

With the right approach, CSEET Paper 3 preparation will feel less like a burden and more like an opportunity to showcase your business and economic acumen.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA