AIBE Exam Questions Strategy – Approach and Techniques

- Exam|

- 8 Min Read

- By Taxmann

- |

- Last Updated on 16 October, 2025

An effective AIBE exam questions strategy involves more than just relying on the open-book format—it requires a smart, structured approach. Candidates should begin by thoroughly understanding the AIBE syllabus and identifying which legal subjects each question pertains to. Practising previous year papers and mock tests helps in recognising question patterns and improving accuracy. Since time management is crucial, aspirants must learn to quickly locate relevant sections or Acts while answering. Prioritising familiar topics, maintaining concise notes, and revising landmark cases and sections can significantly boost speed and confidence.

Table of Contents

- Understanding the Nature of AIBE Questions

- Tackling Objective Questions Effectively

- Techniques for Quick Reference During the Exam

Check out Taxmann's AIBE – All India Bar Examination | CRACKER which is a practice-first, exam-ready guide that shows exactly what to study, how to study, and how to navigate Bare Acts under time pressure. It consolidates the essentials—exam pattern, eligibility, passing criteria, subject-weightage, Bare Act reading—and pairs them with subject-wise high-yield notes, 10 years' solved papers (AIBE X–XIX), and three full-length mock tests. Standout features include an Examination Quick Guide, a Bare Act Mastery module (titles, sections, provisions and explanations/illustrations, schedules), weightage maps for high-mark subjects, and practical strategies (elimination, shortcuts, scenario-based solving). Ideal for first-timers, working graduates, final-year LL.B. students, and re-takers seeking a structured, high-yield plan aligned with the official AIBE pattern.

1. Understanding the Nature of AIBE Questions

The AIBE consists of multiple-choice questions (MCQs) that test both theoretical and practical knowledge. These questions assess a candidate’s understanding of legal concepts, application of laws, and ability to analyse case scenarios. Since the exam is open-book, many aspirants assume that they can simply refer to their materials and answer questions quickly. However, time management and strategic answering play a crucial role in ensuring success.

The key to effectively attempt any exam is to understand the syllabus and art of specifying the subject from which any particular question is been asked. Let’s understand the syllabus prima facie so as to get assistance in order to specify the subject from which the question is asked. It is one of the prominent tricks to attempt AIBE questions more effectively and quickly. Given below is the syllabus and brief overview as to what any particular subject deal with; the brief description of each subject to help you differentiate their scope:

(a) Constitutional Law

Deals with the fundamental framework of governance, including the distribution of powers between the legislature, executive, and judiciary. Covers fundamental rights, directive principles, and the structure of the Constitution.

(b) Indian Penal Code, 1860 (IPC)/Bharatiya Nyaya Sanhita, 2023

Defines criminal offenses, their classification, and prescribed punishments. The Bharatiya Nyaya Sanhita, 2023 replaces IPC with some modifications.

(c) Criminal Procedure Code, 1973 (CrPC)/Bharatiya Nagarik Suraksha Sanhita, 2023

CrPC provides the procedure for investigation, trial, and punishment of criminal offenses. The Bharatiya Nagarik Suraksha Sanhita, 2023 replaces CrPC with updated provisions.

(d) Code of Civil Procedure, 1908 (CPC)

Lays down the procedures for filing, conducting, and adjudicating civil suits, including jurisdiction, pleadings, evidence, and execution of decrees. It is to be kept in mind that this Code is divided into two parts, i.e., Part I, that provides substantive law and provisions are provided in Sections, and Part-II, that provides procedural law and provisions are provided in Orders and Rules.

(e) Indian Evidence Act, 1872/Bharatiya Sakshya Adhiniyam, 2023

Defines rules regarding admissibility, relevancy, and burden of proof in legal proceedings. The Bharatiya Sakshya Adhiniyam, 2023 replaces the Indian Evidence Act with modernized provisions.

(f) Alternative Dispute Redressal (ADR) including Arbitration Act

Covers methods like arbitration, mediation, conciliation, and negotiation for resolving disputes outside traditional courts. Arbitration Act governs arbitration proceedings.

(g) Family Law

Regulates personal matters like marriage, divorce, maintenance, inheritance, and adoption under Hindu, Muslim, Christian, and Parsi laws.

(h) Public Interest Litigation (PIL)

Allows any citizen to approach the courts for legal remedies in matters of public interest, especially in cases of constitutional and legal rights violations.

(i) Administrative Law

Regulates the functioning of government authorities, administrative discretion, and judicial review of administrative actions to ensure fairness.

(j) Professional Ethics & Cases of Professional Misconduct under BCI Rules

Covers ethical responsibilities of advocates, rules of professional conduct, and cases of professional misconduct under the Bar Council of India (BCI) regulations.

(k) Company Law

Regulates the formation, management, and dissolution of companies, including provisions under the Companies Act, 2013, covering corporate governance and compliance.

(l) Environmental Law

Deals with laws related to environmental protection, pollution control, conservation of natural resources, and liabilities for environmental damage.

(m) Cyber Law

Regulates offenses related to digital transactions, cybercrime, data protection, and internet security under the Information Technology Act, 2000.

(n) Labour and Industrial Laws

Covers rights and duties of employers and employees, wages, working conditions, industrial disputes, and trade unions under various labour legislations.

(o) Law of Tort including Motor Vehicle Act & Consumer Protection Law

Tort law covers civil wrongs and liabilities, including negligence and defamation. The Motor Vehicle Act deals with road accidents and liabilities, while Consumer Protection Law safeguards consumer rights.

(p) Law Related to Taxation

Covers direct and indirect tax laws, including Income Tax, Goods and Services Tax (GST), and legal procedures for tax assessments and disputes.

(q) Law of Contract, Specific Relief, Property Law & Negotiable Instruments Act

- Law of Contract – Covers formation, performance, and breach of contracts.

- Specific Relief Act – Deals with remedies like specific performance of contracts.

- Property Law – Covers ownership, transfer, and lease of immovable property.

- Negotiable Instruments Act – Governs instruments like cheques, promissory notes, and their legal enforcement.

(r) Land Acquisition Act

Regulates the process of acquisition of private land by the government for public purposes and provides for compensation to affected landowners.

(s) Intellectual Property Laws

Covers legal protection of creations such as patents, trademarks, copyrights, and trade secrets, ensuring exclusive rights to inventors and creators.

1.1 Types of Questions in AIBE

There are various types of questions asked in the AIBE, like, provision based, chapter based, assertion and reasoning based, case laws based, maxims and doctrine based, etc. However, we have categorised the paper into three categories, i.e., easy, medium and hard.

- Easy – The questions fall under the easy category are those that may be easily attempted by any aspirant with just the help of Bare Act, such questions may easily be attempted by weak students or below average students who have not gone through the law even at the course time.

- Medium – The second category, i.e., medium, is a category under which such questions are considered which may be attempted by average students with simple reasoning and understanding by thoroughly analysing the question and by various tricks.

- Hard – The third category is hard, attempting which will require knowledge of leading cases, legal maxims and doctrines and much more, which are not provided in the Bare Acts. It requires learning of law in little depth. As the syllabus of AIBE is very vast and not thoroughly specified, therefore, it would be a difficult task to achieve. However, based on previous papers, we tried to provide limited and relevant matter for the ease of learning burden.

2. Tackling Objective Questions Effectively

Since AIBE questions are multiple-choice, candidates need to adopt smart answering techniques. As the syllabus of the AIBE is vast, therefore, finding the answers from Bare Act may be feels like finding an iron needle in a haystack. But do not worry, a magnet will make your work easy. Apart from understanding the syllabus, you need to understand some tricks and strategies in order to attempt such questions. Here are some strategies and tricks provided hereinafter to assist you in the exam.

3. Techniques for Quick Reference During the Exam

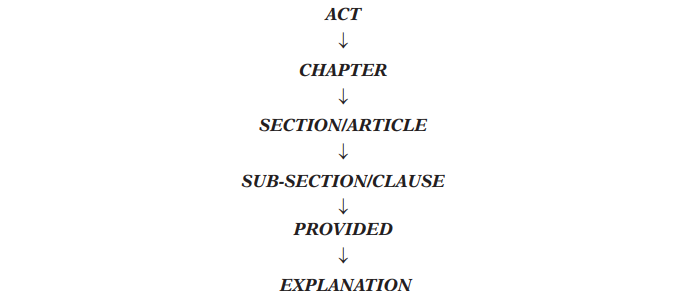

The AIBE is an open-book exam, but merely having Bare Acts won’t help unless you know how to navigate them efficiently. For this, you are required to analyse the question and extract some specific information and arrange them in order to navigate Bare Acts for answer to the question. To implement this, you need to analyse the question and extract the following information in the following mentioned order:

Try to extract as much information you can get from the question and apply such information in descending order in order to find the exact location in the Bare Act where you may have the answer. Keep in mind, such information may not be given directly but you have to figure it out.

Let understand it with the following questions from AIBE XIX paper.

3.1 Easy

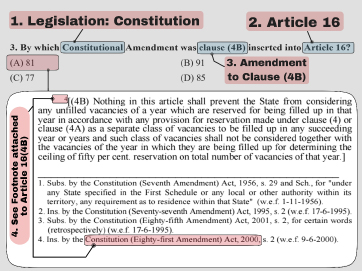

Figure 3.1 – Attempting Questions With the Help of Footnotes

The above question is an example of easy category questions, in which various information are provided in order to locate the required information to attempt the answer. In the above example, they asked for the Constitutional amendment through which clause (4B) of Article 16 of the Constitution was inserted. Now, in order to attempt the question, first we have to gather as much information in sequence mentioned. Thereafter analysing all the information given and information required, the answer to the question may be located by following the below steps:

- First extract out the information given. Here, the information we have from the question are – Constitution, Amendment, Article 16, Clause (4B) and various range of Amendments, i.e., 81, 91, 77 and 85. Therefore, we can clearly observe that the question is from the Constitution. Thus, take the Bare Act of the Constitution of India.

- The information required is by which Constitutional Amendment Article 16(4B) was inserted, therefore, the answer to question lies under Article 16(4B). Open Bare Act of the Constitution and locate Article 16(4B).

- As we have learned from the previous chapter that the information related to enforcement, amendment through which any provision is inserted, substituted or omitted, or any other information which is not a part of provision but associated to the provision are provided through the footnotes, therefore; search for the footnote(s) associated with the said provision.

- After analysing we can easily observe that the answer is (A) 81 [See Figure 3.1].

*Note – While attempting such question, kindly verify the information carefully as there may be multiple amendments in a provision. Understand the question whether it is asking for the amendment by which a provision is inserted or amendment substituting words therein or omitting as the case may be [See Article 16(4A)].

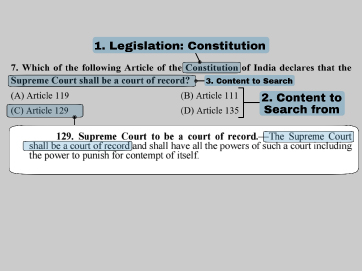

Figure 3.2 – Attempting Questions With the Help of Options Given

Similarly to the previous example, in this question, the information given are – Constitution, statement – Supreme Court shall be a court of record and range of Articles, i.e., Article 119, Article 111, Article 129 and Article 135. Now, to find out the answer to the above question, we may follow the following steps:

- As we can clearly observe from the information extracted from the question that the question is asked from the Constitution of India, therefore, take the Bare Act of the Constitution of India.

- Now searching the statement from whole of the Bare Act will be so time consuming, therefore, we have to limit our search by going through the provisions mentioned in the options.

- Thus, going through just 4 provisions of the Constitution, we got the answer to the question [See Figure 3.2]

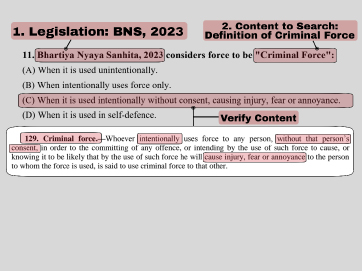

Figure 3.3 – Attempt Question with General Understanding

Figure 3.3 – Attempt Question with General Understanding

Here in the above question, it seems to be a difficult task to find the answer, however, it is just a tricky question to attempt. In the above question the information we extract is the Act name and other information given is “Criminal Force”. Therefore, we can clearly see that the question is from the definition of Criminal Force; now, we just have to locate the definition of Criminal Force in the Bharatiya Nyaya Sanhita, 2023. As we know that Section 2 of the Sanhita provides for the definition, therefore, we will look for the definition in the Section; after a look we could not find the definition, therefore, the definition could possibly be found under different Section or Explanation to a Section.

Now, focus on term Criminal Force and go through the Index of BNS analysing the possible chapter in which this definition may fall. By going through the Chapter’s name with general understanding, we can easily conclude that this definition may falls under Chapter VI – “Of Offences Affecting the Human Body”, and further in Sub-Chapter – “Of Criminal Force and Assault”.

Now, we can easily find Section 129 that provides for Criminal Force. Then comparing the options of the above question with the definition, we can easily figure out the correct answer [as shown in Figure 3.3].

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA