What is the Role of Government Policies in Business Growth?

- Other Laws|Blog|

- 12 Min Read

- By Taxmann

- |

- Last Updated on 21 February, 2023

Table of Contents

- Introduction

- Historical Sketch of Policy Framework in India

- Typology of Economic Policies

- Macro Policy Indicators & Business Conduciveness

- Policy Formulation & Impact Transmission

- Types of Government Policies

- Liberalization

- Privatization

- Inward Foreign Direct Investment (IFDI) In India

- Foreign Institutional Investors (FII’s)

- Investment From India Abroad (Outward FDI)

Check out Taxmann's Business & Commercial Knowledge (BCK) | Study Material which provides the subject matter in simple & lucid language with topic-wise coverage. It also covers the practice questions of ICAI & past exam questions & answers. CA Foundation | New Syllabus | June 2023 Exams

With government deregulation and the triumph of financial liberalization, the dangers of systemic risks, the possibility of a financial tsunami, sharply increased.

– Noam Chomsky

1. Introduction

Every nation defines its mode of governance through several policies. These policies are described as public policies. Public policy is an institutionalized proposal to solve relevant and real-world problems, guided by a conception and implemented by programs as a course of action created and/or enacted, typically by a government, in response to social issues1. The government policies in some cases help in facilitating business. In contrast, they are restrictive, controlling and regulating in nature in many other cases. In India, after independence, the mixed policy was followed, and there was a co-existence of the public and private sectors. This chapter elaborates on the importance of government policies on business. The policy changes in 1991 (LPG) have also been discussed in this chapter. The present chapter also briefly describes the types of Government Policies, FDI, FII, etc.

2. Historical Sketch of Policy Framework in India

This para discusses the policy framework adopted in India from ancient times to today.

2.1 Ancient India

-

- During the time of Emperor Chandra Gupta Maurya:

-

-

- Chanyaka outlined the public policy of the state.

- He authored the book “Arthashastra”, a conceptual framework of state craft and public policy.

-

-

- In Greek city states and Roman empire:

-

-

- Public policy was centre of attraction.

- Philosophers like Plato and Aristotle had a number of discourses on public policy.

-

-

- During the time when Ashoka the Great ruled Magadh:

-

-

- He introduced the policy of peace and harmony.

- Chandra Gupta Maurya defined various policies on taxes, trade and warfare.

-

-

- In Delhi Sultanate Alauddin Khilji introduced a stringent tax reform

- During the time of Akbar:

-

-

- land reforms were introduced under the leadership of Todarmal.

-

In all the forms of governance, be it oligarchic, monarchy, aristocracy, tyranny or democracy, public policies were formulated and implemented.

2.2 India Under the British

-

- The British government in India introduced:

-

-

- Zamindari system: to extract maximum revenue from the Indian peasants.

- Managing agency system: through which it was possible for a handful of the wealthy British to build and control vast industrial and business empires in India; sometimes with the assistance from Indian partners.

-

-

- They just fulfilled the duty of the police state that is maintenance of internal order and defence of the Indian border.

The policies of the British Government indirectly curbed the economic freedom of the Indian people, politically we were subjugated anyways. Their policies were so designed as to benefit the foreign rulers.

2.3 India Since Independence

-

- After independence, the most critical considerations included industrial business and economic growth. Accordingly, the first industrial policy was announced in 1948.

- As a part of economic planning, the First Five Year Plan was launched in 1951.

- The Industrial Policy Resolution 1956 emphasized an era of direct ownership of government in business through departmental undertakings, statutory corporations and government companies in the sectors private investment was either not able or willing.

- After Independence and upto the first 3-4 decades, there were:

-

-

- Dominant Public sector (socialistic economic system)

- The setting up of industrial units was brought under the regulation of licenses.

- Several industrial and labour laws were introduced to ensure orderly development.

-

-

- From the year 1991:

New era of economic policies in India (LPG: Liberalization, Privatization and Globalization). It has been discussed in ensuing portion of the blog.

- From the year 1991:

2.4 Comparision of policies of the fifties and nineties

This para discusses the policy framework adopted in India from ancient times to today.

| Basis | Policy regime of mid fifties | Policy regime since 1990s | |

| 1 | Economic System | Socialistic | Mixed |

| 2 | Economic Governance | The dominant instrument was economic planning | Market mechanism |

| 3 | Orientation | Closed economy policies | Open economy policies |

| 4 | Govt. role in business | Acquiring commanding heights through public sector undertakings | State ownership of business as exception; privatisation of public sector undertakings |

| 5 | Govt. role in Private business | Regulation and control | Liberalisation of regulations |

3. Typology of Economic Policies

The typology of economic policy refers to the study and classification of its types. The economic policies have a major role in the growth of any economy. The major economic policies are the following:

(a) Fiscal Policy

(b) Monetary Policy

(c) National Agricultural Policy

(d) Industrial Policy

(e) Trade Policy

(f) International Trade Policy

(g) EXIM Policy

(h) Exchange Rate Management Policy

The first two are for macroeconomic management. The Fiscal policies relate to government expenditure and tax and non-tax revenue. The policies relating to the supply of money, credit and foreign exchange broadly impact the business, and others are sector management are monetary policies. Except for the first two, the abovementioned policies are related to sector management. The sectoral policies pertain to the specific sectors of the economy like agriculture, industries, foreign trade, etc. The government policies like telecon policy, civil aviation policies, etc. are for specific industries.

It is important to note that, apart from the Central government’s policies, there are policies of the State Governments that influence business activities in the respective states.

Life Cycle and Policies

The Government policies and laws pervade the successive stages in a firm’s life cycle.

| Policies and Regulations impacting | Particulars (illustrative) | |

| 1 | Business start-ups and business registration | Registration as a partnership firm or incorporation as a company |

| 2 | Environmental clearances, conduct of business | Policies affecting competition |

| 3 | Dealings with consumers | Consumer laws |

| 4 | Exit | Dissolution, Insolvency and Bankruptcy |

4. Macro Policy Indicators & Business Conduciveness

Macroeconomics2 is a branch of economics that studies how an overall economy—the market or other systems that operate on a large scale—behaves. Macroeconomics studies economy-wide phenomena such as inflation, price levels, rate of economic growth, national income, gross domestic product (GDP), and changes in unemployment.

The five most significant macro policy indicators impact business are the following:

(a) GDP

(b) Inflation

(c) Tax rates

(d) Interest rates

(e) Exchange rates

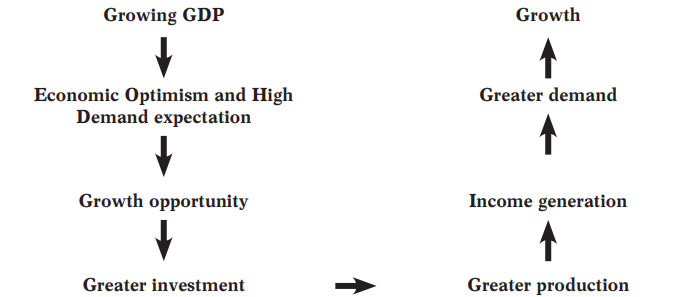

How GDP acts as catalyst for Business Conduciveness?

Comparative statement showing five Macro Variables and Business Conduciveness

| Variable | Direction | Meaning | |

| 1 | GDP | Rising | Economic optimism; high demand expectations |

| 2 | Inflation | Moderate | Demand and profit expectations |

| 3 | Tax | Lower | Incentive for investors in the form of post-tax business income |

| 4 | Interest | Lower | Lower cost of funds |

| 5 | Exchange | Moderate | Protection to domestic production; incentive for exports |

It is important to note that the impact of macro variables on business is contingent upon a host of factors, including a host of non-economic factors such as politico-legal, socio-cultural institutions. There always is a time lag between calibration/ recalibration of a macro-economic variable and its impact.

5. Policy Formulation & Impact Transmission

-

- The government policies are always drawn after high thinking and in a dynamic, open environment considering their impact on the persons or bodies to whom they would be applicable. Thus, these are always framed given the developmental aspirations of the nation.

- The ultimate responsibility for policy formulation lies with the concerned ministry:

- The ministry generally functions through various committees, commissions and institutions.

- Initially the draft is prepared.

- In preparation of such draft policies, all stakeholders are involved through a wider consultative and participative process.

- At first, the comments, critiques and suggestions are invited by putting this draft in the public domain.

- These comments and suggestions, if found suitable, are then incorporated and the policy is given a final shape.

- Then, policies are then implemented.

- The real time and post implementation feedback enables their further calibrations to serve the purpose for which these were envisaged. Thus, evaluation of policy is always made after its implementation.

Steps in Policy formulation

In the public policy process, there are mainly five steps as follows,

-

- Identification of Problem

- Formation of Policy

- Policy Adaption

- Implementation of Policy

- Evaluation of Policy

6. Types of Government Policies

Government policies have a significant impact on business. From this perspective, these may be classified into the following four categories.

6.1 Protective Policies

-

- Protectionism3 refers to government policies that restrict international trade to help domestic industries.

- Protectionist policies are usually implemented with the goal to improve economic activity within a domestic economy but can also be implemented for safety or quality concerns.

- These policies aim to provide protection to the businesses so that these may sustain themselves and grow.

- For example:

The restricted entry of multinational corporations into India provided a protective environment to domestic firms upto the eighties.

6.2 Restrictive Policies

-

- Any business activity should not be detrimental to the interests of the consumers and public at large.

- The restrictive policies are aimed for this purpose.

- For example:

When the economic power is concentrated so that a firm gains monopoly or dominant position, then there are chances of exploitation of consumers in terms of low quality, high price, etc.

At present, the competition commission of India takes care of this aspect. The MRTP Act previously regulated the concentration of economic power in a few hands. But, this Act was repealed when the Competition Commission of India Act was introduced.

6.3 Regulative Policies

-

- The preamble to the Constitution of India adopted in 1950 conferred on people the economic freedom and recognized the right to carryon business and trade as a fundamental right.

- But policies are required to regulate the business activities.

- Regulatory policies are about achieving government’s objectives through the use of regulations, laws, and other instruments to deliver better economic and social outcomes and thus enhance the life of citizens and business.4

- The non-funding regulatory bodies.

6.4 Facilitative or Developmental Policies

-

- The policies facilitate an activity.

- For example:

-

-

- The conducive policies towards the development of MSMEs (Micro- Small-Medium Enterprises)

- The formation of National Skills Development Corporation (NSDC).

-

In a broader sense, the government policy- the business interface is interpreted to ease business and business facilitation. That is how permissive, supportive, promotional and development-oriented are the government’s policies for stimulating, supporting, and sustaining more significant business activity.

7. Liberalization

India faced foreign exchange crises in 1990. The process of economic liberalization in India began primarily in 1991. The economic reforms are being implemented in two stages, namely (i) First Generation Reforms, and (ii) Second Generation Reforms.

7.1 Meaning

-

- Liberalization of an economy means removing or relaxing Government controls and restrictions on economic activities.

- It is the process of liberating the economy from unnecessary controls and restrictions on trade, industry, banking system, etc. of the country.

- It involves abolition of those policies, rules and regulations which impede economic development.

7.2 Liberalization in India

7.2.1 Infrastructural Reforms

(a) Opening up of oil exploration and petroleum to foreign investment.

(b) Power sector reforms.

(c) Private sector participation in infrastructure development.

(d) Decontrol of steel.

(e) Telecom sector reforms.

7.2.2 Industrial Reforms

(a) Delicensing of industry.

(b) Public sector undertakings allowed access to capital market.

(c) Simplification of licensing procedures.

7.2.3 Fiscal Reforms

(a) Reduction in customs duty.

(b) Five year tax holiday to enterprises in specified sectors.

(c) Downsizing of some departments.

(d) Reduction in personal and corporate taxes.

(e) Simplified tax administration.

(f) Introduction of GST.

7.2.4 Capital and Money Market Reforms

(a) Clearing Corporation of India set up.

(b) Introduction of Negotiated Dealing System.

(c) Floating rate Government bonds re-introduced.

(d) Trading in index options, and stock futures introduced.

7.2.5 External Sector Reforms

(a) Removal of import restrictions.

(b) Liberalised Exchange Rate Management System (LERMS)

(c) Liberalisation of NRI remittances.

(d) Encouraging foreign tie-ups.

(e) Automatic approval of foreign investment and foreign technology agreements to specified extent.

7.2.6 Banking Sector Reforms

(a) Reduction in CRR and SLR.

(b) Introduction of capital adequacy norms.

(c) Setting up of Debt Recovery Tribunals.

(d) Issue of guidelines for entry to new private banks.

(e) Setting up of IRDA

7.3 Impact of Liberalization

-

- Liberalization has considerably expanded the scope of private sector in India.

- Private enterprises can now enter most of the industries.

- The competitive strength and industrial efficiency have improved.

- Thus, liberalization has led to radical changes in India’s business environment.

| Positive Effects | Negative Effects |

|

|

8. Privatization

The process of privatization began in India mainly after the Industrial Policy of July 1991. Under this policy the number of industries reserved for the public sector was reduced from 17 to 2 – Railways and Atomic Energy. Shares of several public sector enterprises have been sold to mutual funds, workers and the public.

8.1 Meaning

-

- Privatization means the transfer of ownership and/or management of an enterprise from the public sector to the private sector.

- It refers to the introduction of private control and ownership in public sector undertakings.

- According to the World Bank,

“Privatization is the transfer of State-owned enterprises to the private sector by sale (full or partial) of going concerns or by sale of assets following their liquidation.”

-

- As per Barbara Lee and John Nellis

“Privatization is the general process of involving the private sector in the ownership or operation of a State-owned enterprise.”

8.2 Prominent Types

8.2.1 Delegation

-

- Government keeps hold of responsibility and private enterprise handles fully or partly the delivery of product and services.

- There is active involvement by government.

- Delegation may happen through contract, franchise, grant, etc.

8.2.2 Divestment

-

- Government surrenders partial ownership and responsibility and

- sells the majority stake to one or more private entities in course of time

8.2.3 Displacement

-

- The private enterprise expands and gradually displaces the government entity.

- Deregulation facilitates privatization if it enables private sector to challenge a government monopoly.

- The government monopoly through BSNL and MTNL has been displaced by the private sector players like Airtel, Idea, Jio, etc.

8.2.4 Disinvestment

-

- Selling a portion of ownership (stake) in a public enterprise to private parties.

8.3 Impact of privatization

-

- The main reason for privatization in India has been the poor performance of public sector units which results in wastage of national resources and burden on common man.

| Positive Effects | Negative Effects |

|

|

| Privatization helps in a big way to enhance market potencies by enhancing efficiency, quality and competitiveness. Privatization is an essentially effective tool for rapid restructuring and reforming the public sector enterprises. | Subject to some exceptions, the private sector is perceived to be more self-motivated, prolific and reliable for superior quality of products and services. |

9. Inward Foreign Direct Investment (IFDI) In India

Foreign Direct Investment (FDI) plays a significant role in developing a nation as it fills the gaps between domestic savings and investment. India is always perceived as an attractive FDI destination due to the enormous domestic market prevailing in India. In a liberalized economy, foreign funding is beneficial as it creates employment opportunities together with demand.

9.1 Meaning

-

- Inward Foreign Direct Investment (FDI) means investment in a foreign country where the investor claims control over the investment in terms of actual power of management and effective decision-making.

- FDI typically occurs in the form of setting up a subsidiary, starting a joint venture or acquiring a stake in an existing firm in a foreign country.

- According to the Committee on Compilation of FDI in India,

“FDI is the process whereby residents of one country (the home country) acquire ownership of assets for the purpose of controlling the production, distribution and other activities of a firm in another country (the host country).”

9.2 Categories

There are three main categories of FDI:

-

- Equity capital

- Reinvested earnings

- Lending of funds by a multinational to its affiliate.

9.3 FDI Routes

-

- There are two routes– Government Route and Automatic Route.

- Where there is no approval through Automatic Route, the company concerned has to seek permission from Foreign Investment Facilitation Portal (FIFP).

9.4 FDI Percentage

Permission for Foreign Direct Investment (FDI) is not uniform for all sectors. Some sectors are opened up for 100% and in some sectors, it is allowed only upto 26%, 49% or 51%.

9.5 Prohibited Sectors

In the following sectors, FDI is prohibited under both the Government Route as well as the Automatic Route:

(1) Atomic Energy

(2) Lottery Business

(3) Gambling and Betting

(4) Business of Chit Fund

(5) Nidhi Company

(6) Agricultural (excluding Floriculture, Horticulture, Development of seeds, Animal Husbandry, Pisciculture and cultivation of vegetables, mushrooms, etc. under controlled conditions and services related to agro and allied sectors) and Plantation’s activities (other than Tea Plantations)

(7) Housing and Real Estate business (except development of townships, construction of residential/commercial premises, roads or bridges to the extent specified)

(8) Trading in Transferable Development Rights (TDRs)

(9) Manufacture of cigars, cheroots, cigarillos and cigarettes, of tobacco or of tobacco substitutes

9.6 Countries

- India has been a prominent destination for FDI flows.

- India generally receives FDI from US, Britain, Singapore, Japan and the USA

9.7 FDI in last 7 Years

-

- FDI inflows in the last seven financial years is over $ 440 bn, which is nearly 58 % of the total FDI inflow in the last 21 financial years.

- The top five countries from where FDI Equity Inflows were received during 2014-2021 are:

-

-

- Singapore

- Mauritius

- USA

- Netherland &

- Japan.

-

10. Foreign Institutional Investors (FII’s)

Foreign institutional investors play a very important role in any economy.

10.1 Meaning

-

- A foreign institutional investor (FII) is an investor or investment fund investing in a country outside of the one in which it is registered or

headquartered.5

-

Foreign institutional investors (FIIs) are those institutional investors which invest in the assets belonging to a different country other than that where these organizations are based.

- A foreign institutional investor (FII) is an investor or investment fund investing in a country outside of the one in which it is registered or

10.2 Foreign Groups

-

- FIIs are large foreign groups with substantial investible funds.

10.3 Registration

-

- FIIs are registered abroad with a view to investing in other nations.

- To participate in the market of India, FIIs must register themselves with SEBI.

10.4 Investment

FIIs usually invest in:

-

- Equity market

- Hedge funds

- Pension funds

- Mutual funds

10.5 Research Team of FIIs

-

-

- FIIs have strong research team which speculate to invest in a country with a possibility of strong return in equity market.

- These funds park their funds to fuel a bullish market. Naturally for small period the nation experience inflow of strong foreign currency in its financial system.

-

11. Investment From India Abroad (Outward FDI)

-

- The outward FDI (OFDI) refers to the outflow of investment capital from domestic firms to foreign economies. As per Investopedia, it is a business strategy in which a domestic firm expands its operations to a foreign country.

- The OFDI occurs when a domestic firm expands its operations in foreign country through mergers, acquisitions, expansion, etc.

- OFDI- A new Channel for Development:6

-

-

- There is growing evidence that outward foreign direct investment (OFDI) can increase a country’s investment competitiveness, crucial for long-term, sustainable growth.

- Some countries are thus using OFDI as a channel for new development and a catch-up strategy to acquire knowledge and technology, upgrade production processes, boost competitiveness, augment managerial skills, and access distribution networks.

-

Table showing examples of OFDI

| Indian company | Investment from India Abroad | |

| 1 | Bharti Airtel | In wholly owned subsidiary in Mauritius |

| 2 | Lupin Ltd. | in a JV in the US |

| 3 | SRF Ltd. | in a wholly owned subsidiary (WoS) in the Netherlands. |

| 4 | PVR Cinemas | In property in Sri Lanka |

| 5 | Sun Pharma | licensing agreement with China System Medical Holdings (CMS) |

| 6 | Mahindra & Mahindra | In wholly owned subsidiary in Mauritius |

| 7 | The Indian Hotels Co. Ltd. | In its wholly owned subsidiary in the Netherland |

-

- Wikipedia

- Investopedia

- Investopedia

- www.oecd.ord/gov/regulatorypolicy

- Investopedia

- Blogs.worldbank.org/psd/outward-foreign-direct-investment-new-channel-development

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA