What is Arm’s Length Price?

- Blog|Transfer Pricing|

- 7 Min Read

- By Taxmann

- |

- Last Updated on 10 December, 2025

Definition:

Section 92A (1) of the Income-tax Act, 1961:

Section 92A (1) of the Income-tax Act, 1961 defines Associated Enterprises as under: “Associated enterprise, in relation to another enterprise, means an enterprise- a) which participates, directly or indirectly, or through one or more intermediaries, in the management or control or capital of the other enterprise;

or

b) in respect of which one or more persons who participate, directly or indirectly, or through one or more intermediaries, in its management or control or capital, are the same persons who participate, directly or indirectly, or through one or more intermediaries, in the management or control or capital of the other enterprise.

Analysis of Definition of Associated Enterprises:

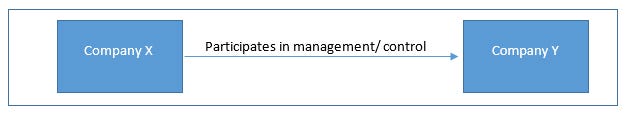

We shall try to understand the definition of Associated Enterprise (‘AE’) by means of below examples. Example 1: Direct participation of one entity in another:

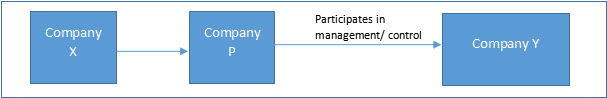

In the above example, both Company X and Company Y are AEs since Company X directly participates in the management and control of Company Y as per section 92A(1)(a). Example 2: Indirect Participation of one entity in another:

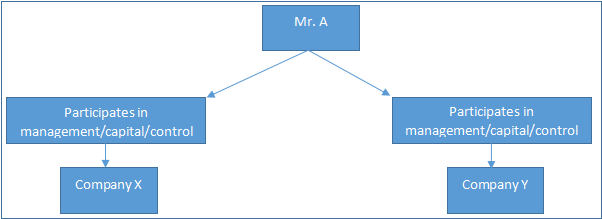

In the above example, Company X does not have a direct control over the management of Company Y. However, Company X exercises an indirect control through Company P. Hence, Companies X, P and Y are Associated Enterprises as section 92A(1)(a). Example 3: A common person participates in management/ control/capital of both the enterprises:

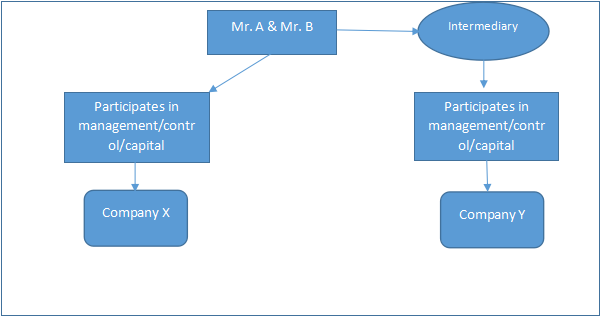

In the above example, both Company X and Company Y are AEs since both the Companies are controlled and managed by Mr. A. Accordingly, by virtue of section 92A(1)(b), Company X and Company Y are Associated Enterprises. Example 4: One or more person participate directly or indirectly through an intermediary in the management/control/capital of both the enterprise:

In the above example, Company X and Company Y are Associated Enterprises (by virtue of section 92A(1)(b)) since Mr. A and Mr. B simultaneously participate in management and control of both Company X and Company Y.

Deemed Associated Enterprise:

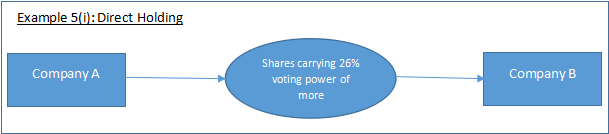

Definition: Apart from the definition of the term in Section 92A(1), Section 92A(2) creates a deeming fiction enlisting thirteen scenarios in which two parties are deemed to be “Associated Enterprises”. Section 92A(2) of the Act reads as under: “Two enterprises shall be deemed to be associated enterprises if, at any time during the previous year,— a) one enterprise holds, directly or indirectly, shares carrying not less than twenty-six per cent of the voting power in the other enterprise; or b) any person or enterprise holds, directly or indirectly, shares carrying not less than twenty-six per cent of the voting power in each of such enterprises; or c) a loan advanced by one enterprise to the other enterprise constitutes not less than fifty-one per cent of the book value of the total assets of the other enterprise; or d)one enterprise guarantees not less than ten per cent of the total borrowings of the other enterprise; or e) more than half of the board of directors or members of the governing board, or one or more executive directors or executive members of the governing board of one enterprise, are appointed by the other enterprise; or f) more than half of the directors or members of the governing board, or one or more of the executive directors or members of the governing board, of each of the two enterprises are appointed by the same person or persons; or g) the manufacture or processing of goods or articles or business carried out by one enterprise is wholly dependent on the use of know-how, patents, copyrights, trade-marks, licences, franchises or any other business or commercial rights of similar nature, or any data, documentation, drawing or specification relating to any patent, invention, model, design, secret formula or process, of which the other enterprise is the owner or in respect of which the other enterprise has exclusive rights; or h) ninety per cent or more of the raw materials and consumables required for the manufacture or processing of goods or articles carried out by one enterprise, are supplied by the other enterprise, or by persons specified by the other enterprise, and the prices and other conditions relating to the supply are influenced by such other enterprise; or i) the goods or articles manufactured or processed by one enterprise, are sold to the other enterprise or to persons specified by the other enterprise, and the prices and other conditions relating thereto are influenced by such other enterprise; or j) where one enterprise is controlled by an individual, the other enterprise is also controlled by such individual or his relative or jointly by such individual and relative of such individual; or k) where one enterprise is controlled by a Hindu undivided family, the other enterprise is controlled by a member of such Hindu undivided family or by a relative of a member of such Hindu undivided family or jointly by such member and his relative; or l) where one enterprise is a firm, association of persons or body of individuals, the other enterprise holds not less than ten per cent interest in such firm, association of persons or body of individuals; or m) there exists between the two enterprises, any relationship of mutual interest, as may be prescribed.” Analysis of Definition: The term Deemed Associated Enterprise has not been defined anywhere in Act. This term is used to refer to the conditions wherein by virtue of application of section 92A(2), two entities shall be deemed to be Associated Enterprises for the purpose of application of Transfer Pricing Provisions. In the below section, we shall try to understand various situations in which two entities shall be deemed to be Associated Enterprises. Example 5: One Enterprise hold directly or indirectly shares carrying more than 26% of voting power in another enterprise:

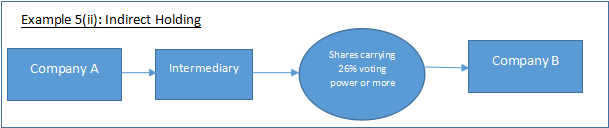

In both the above cases, Company A and Company B are deemed to be AEs as per provisions of section 92A (2)(a). This is because in Example 5(i), Company A holds directly more than 26 per cent voting rights in Company B (Direct Holding) and in Example 5(ii), Company A indirectly holds voting rights of more than 26 per cent in Company B (Indirect Holding). Accordingly transfer pricing provisions shall be applicable. Example 6: Any person or an enterprise holds directly or indirectly shares carrying not less than twenty six percent of voting power in each of the enterprise: Example 6(i): Direct Holding

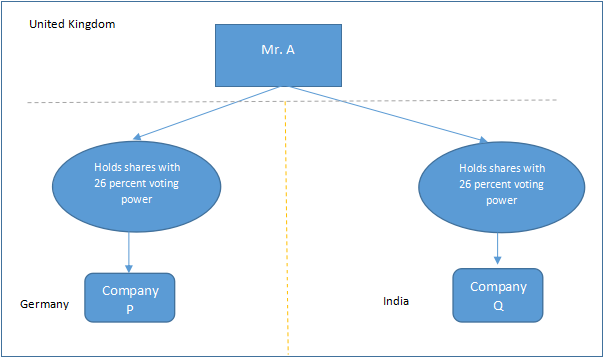

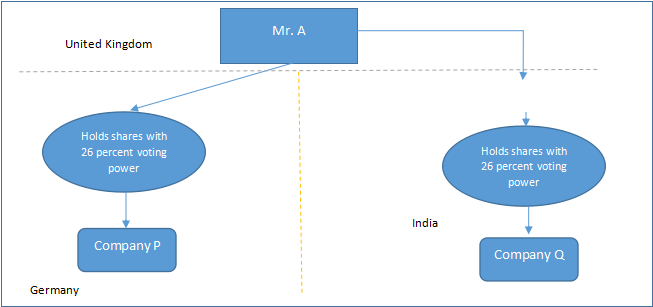

In the above example, Company P and Company Q are deemed AEs by virtue of section 92A(2)(b). Mr. A directly holds more than 26 per cent voting powers in both Company P and Company Q. Example 6(ii): Indirect Holding

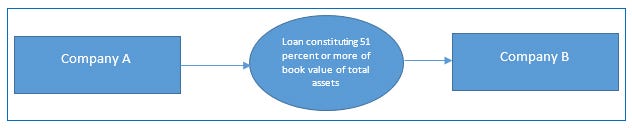

In the above example, Company P and Company Q are deemed AEs by virtue of section 92A(2)(b). Mr. A directly holds more than 26 per cent voting powers in Company P and indirectly holds 26 per cent of voting power in Company Q. Example 7: A loan advanced by one enterprise to another constitute not less than fifty-one percent of the book value of total asset of the other enterprise:

In the above example, since Company A has given loan to Company B the value of which is more than 50 percent of book value of total assets of Company B. Accordingly, as per provisions of Section 92A(2)(c), both the entities are deemed to be Associated Enterprises. Example 8: One enterprise guarantees not less than ten percent of the total borrowings of the other enterprise:

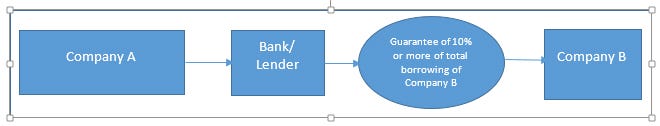

In the above example, Company A and Company B are deemed to be Associated Enterprises as per provisions of section 92A(2)(d) since Company A has provided guarantee for 10% or more of borrowing of Company B to Banks/Lenders. Example

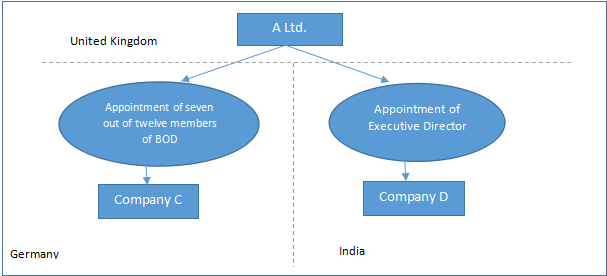

9: More than half of the directors or members of the governing board, or one or more executive directors or members of the governing board, of each of the two enterprises, are appointed by the same person or persons:

In above Example, Company C and Company D are Associated Enterprises as per section 92A(2)(f) since A Ltd. has the power to appoint more than half of Directors of Company C and has appointed the Executive Director of Company D.

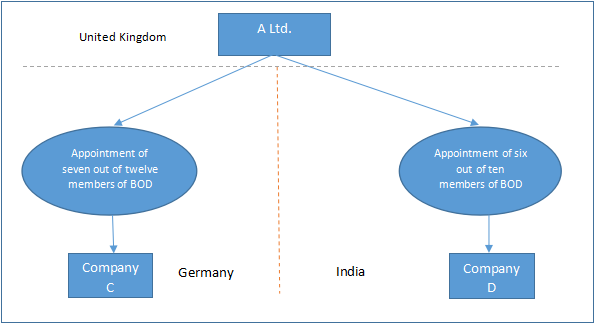

Example 10:

In the above example, A Ltd. has appointed the majority of directors of Board of Directors of Company C. Also, the executive director/majority of directors in the board of Company D has been appointed by A Ltd. Therefore by virtue of application of Section 92A(2)(f), both these entities are deemed to be Associated Enterprises for the purpose of Transfer Pricing Regulation.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

%20Title%202019_L.jpg)

CA | CS | CMA

CA | CS | CMA

Comments are closed.