What are the various Financial Instruments? | Ind AS 32, Ind AS 109 and Ind AS 107

- Blog|Account & Audit|

- 9 Min Read

- By Taxmann

- |

- Last Updated on 18 March, 2023

Table of Contents

1. Introduction

2. What is a Financial Instrument?

3. Financial Asset

4. Financial liability (FL)

5. Equity Instrument

Check out Taxmann's Ind AS Made Easy which is the most updated & amended self-study material providing the subject matter in a simple and lucid language. It incorporates 1,000+ questions & answers and a conceptual understanding of each point with a detailed explanation. This book covers all amendments till December 2021. CA-Final | New Syllabus | May 2022 Exams

1. Introduction

Which Ind AS do you think prescribes accounting treatment for debtors, cash, loans and advances, share capital, debentures, loans taken, trade payables and derivatives?

The answer is Ind AS 109; which is going to cover all the above items. The coverage of this standard is extensive and hence, let us try to understand this standard to the extent required for examination.

As we discussed, this standard covers assets, liabilities and equity in its discussion.

Financial instrument topic is discussed in three standards:

-

- Ind-AS 109 – “Financial instruments” – discusses on

-

-

- Recognition and Derecognition of financial assets and financial liabilities;

- Classification of financial assets and financial liabilities;

- Measurement of financial assets and financial liabilities; and

- Hedge accounting.

-

-

- Ind-AS 32 discusses on “Financial instruments – Presentation”

-

-

- Classification as Liability Vs Equity; and

- Netting/offsetting of financial instruments; and

-

-

- Ind-AS 107 discusses on “Financial instruments – Disclosures”.

2. What is a Financial Instrument?

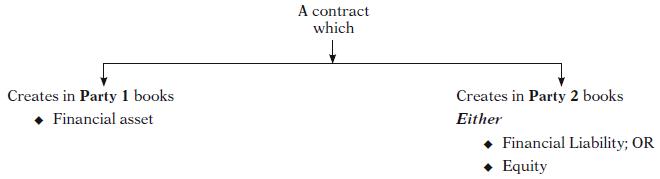

Financial instrument is a contract that gives rise to a financial asset to one entity and a financial liability/equity instrument to another entity.

As you know, there will be minimum two parties to the contract.

‘Contract’ and ‘Contractual’ refer to

-

- An agreement between two or more parties;

- Usually enforceable by law;

- Contracts can be in writing or oral.

Now you need to understand what is financial asset and financial liability. Well, before that let us try to understand the following examples of financial instruments.

| Example 1: A Ltd. sold goods to X Ltd.

In this case, sale of goods is a contract and A Ltd and X Ltd. are parties to this contract. As a result of this contract,

As the contract is creating financial asset in one party’s books and financial liability in other party’s books – it is a financial instrument. Example 2: X Ltd. issued equity shares to Y Ltd. In this case, acquisition of equity shares is a contract between X & Y Ltd.

As the contract is creating financial asset in one party’s books and equity in other party’s books – it is a financial instrument. |

3. Financial Asset

The following definitions are given in Ind AS 32.

A financial asset is any asset that is:

(a) cash;

Analysis: Currency /Cash is a financial instrument because it is a medium of exchange of transactions and is therefore the basis on which all transactions are measured and recognized in the financial statements;

A deposit of cash with a bank or similar financial institution is a financial asset because it represents the contractual right of the depositor to obtains cash from the bank.

(b) an equity instrument of another entity;

Analysis: Investment in equity shares of other entity;

Read the word carefully – It is “Equity” instrument not just ‘equity share capital’. We will be discussing it below

(c) a contractual right:

(i) to receive cash or another financial asset from another entity; or

Examples: Trade receivables, Bills receivables, loan and advance (given).

In these cases, the entity has either a right to receive cash or other financial asset (i.e., equity instrument of any entity);

(ii) to exchange financial assets or financial liabilities with another entity under conditions that are potentially favourable to the entity (Profit making); or

Examples: A Ltd. holds a call option to purchase equity share in listed company X Ltd for ` 50 per share at the end of 60 days period and if value of the share on exercise day is more than 50 Say 75 (This is called “In the money” in financial management terms). As you know, A Ltd. is called “Holder of the option” and X Ltd. is called “Writer of the option”

As it is potentially favourable, it is a financial asset and A Ltd. recognises the same by debiting -Option asset & Crediting – Other income for ` 25.

Try to understand, when it is potentially favourable to A Ltd., obviously it is the other side of the coin for X Ltd, i.e., potentially unfavourable to X Ltd and hence, it is an obligation to settle for X Ltd. Hence, it should recognise the financial liability by debiting – Expense/loss & Crediting – Financial liability for ` 25.

(d) a contract that will or may be settled in the entity’s own equity instruments and is:

(i) a NON-DERIVATIVE for which the entity is or may be obliged to receive a variable number of the entity’s OWN equity instruments; or

(ii) a DERIVATIVE that will or may be settled OTHER THAN by the exchange of a fixed amount of cash or another financial asset for a fixed number of the entity’s own equity instruments. For this purpose, the entity’s own equity instruments DO NOT INCLUDE:

-

-

-

-

- Puttable financial instruments classified as equity instruments,

- Instruments that impose on the entity an obligation to deliver to another party a pro rata share of the net assets of the entity only on liquidation and are classified as equity instruments; or

- Instruments that are contracts for the future receipt or delivery of the entity’s own equity instruments.

-

-

-

Important note:

As per the Companies Act, 2013 – a company cannot hold its own shares; hence Point (d) is not applicable in India. It leads to buy back of shares and it should satisfy the provisions of the Companies Act, 2013.

Outside India, as per the laws of that country, a company can hold its own shares. Such shares are called “Treasury stock” – Accounting of treasury stock is discussed in the later part to this chapter.

|

Concept Capsule 1 Perpetual debt Instrument A Ltd. issues a bond at principal amount of ` 1000 per bond. The terms of bond require annual payments in perpetuity at a stated interest rate of 8% applied to the principal amount of ` 1000. Assuming 8% to be the market rate of interest for the instrument when it was issued, the issuer assumes a contractual obligation to make a stream of future interest payments having a fair value (present value) of ` 1,000 on initial recognition. Evaluate the financial instrument in the hands of both the holder and the issuer. Suggested Answer For the Holder – right to receive cash in future (Interest throughout the period and Principal at the time of liquidation) – classifies to be a financial asset; For the Issuer – Contractual obligation to pay cash in future – classifies to be a financial liability. |

4. Financial liability (FL)

Financial liability is any liability that is:

(a) a contractual obligation:

(i) to deliver cash or another financial asset to another entity; or

Examples: Trade payables, Loan taken wherein the entity should settle by paying either cash or by transferring any other financial asset;

(ii) to exchange financial assets or financial liabilities with another entity under conditions that are potentially unfavourable to the entity(loss making); or

Example: Refer the point in financial asset.

(b) a contract that will or may be settled in the entity’s own equity instruments and is

(i) a NON-DERIVATIVE for which the entity is or may be obliged to deliver a variable number of the entity’s own equity instruments; or

E.g., A convertible debenture, which will be converted into equity shares based on the market value of the shares on the date of conversion. (Variable number of own shares – based on market value) (See below concept capsule)

(ii) A DERIVATIVE that will or may be settled for OTHER THAN

-

-

-

-

- By exchange of a fixed amount of cash (i.e., payable in variable amount is FL); or

- Another financial asset for a fixed number of the entity’s own equity instruments;

-

-

-

Based on the above definition the following are NOT financial liabilities but are equity instruments:

-

-

- For this purpose, rights, options or warrants to acquire a fixed number of the entity’s own equity instruments for a fixed amount of any currency are equity instruments if the entity offers rights, options or warrants pro rata to all of its existing owners of the same class of its own non-derivative equity instruments. (Example: a contract to issue right shares, Share warrants, etc., are not financial liability).

- Apart from the aforesaid, the equity conversion option embedded in a convertible bond denominated in foreign currency to acquire a fixed number of the entity’s own equity instruments is an equity instrument if the exercise price is fixed in any currency.

-

In the above two cases – entity’s own equity instruments do not include Puttable instruments (discussed part of “equity”).

|

Concept Capsule 2 A Ltd. (the ‘Company’) makes purchase of steel for its consumption in normal course of business. The purchase terms provide for payment of goods at 30 days credit and interest payable @ 12% p.a. for any delays beyond the credit period. Analyse the nature of this financial instrument for A Ltd. Suggested Answer As per Ind AS 32, Financial liability is any liability which creates a contractual obligation to deliver cash or another financial asset to another entity. In the given case, in the contract to purchase goods, A Ltd. has got an obligation to deliver fixed amount of cash to another entity. Hence, it is financial liability for the entity. |

|

Concept Capsule 3 A Ltd. (the ‘Company’) makes a borrowing for INR 10 lacs from RBC Bank, with bullet repayment of INR 10 lacs and an annual interest rate of 12% p.a. Now, Company defaults at the end of 5th year and consequently, a rescheduling of the payment schedule is made beginning 6th year onwards. The Company is required to pay INR 13 lakh at the end of 6th year for one time settlement, in lieu of defaults in payments made earlier. (a) Does the above restructured instrument meet definition of financial liability? Please explain. (b) Analyse the differential amount to be exchanged for one-time settlement. Suggested Answer Please note that “bullet repayment” refers to lumpsum payment to be made for the entirety of an outstanding loan amount usually at the end of agreed tenure. That is, in case of a loan with bullet repayment, until the maturity date, only interest will be paid by the borrower to lender at agreed intervals and on maturity, both outstanding principal and interest will be paid. As per Ind AS 32, Financial liability is any liability that is contractual obligation to exchange financial assets or financial liabilities with another entity under conditions that are potentially unfavourable to the entity (loss making). In the given case, Loan principal amount = ` 10,00,000 Amount otherwise payable at the end of 6th year = Principal + two years interest (i.e., 5th and 6th) at compound rate = 10,00,000*1.12*1.12 =` 12,54,400 Cash payable as per understanding = ` 13 lakh; Here, the company is exchanging the loan (settling the loan) by paying cash (cash is a financial asset) and the exchange is potentially unfavourable as it is paying excess amount i.e.,` 45,600 (` 13 lakh – ` 12,54,400); Hence, the rescheduled arrangement meets definition of ‘financial liability’. |

|

Concept Capsule 4 (Settlement in variable number of shares) Target Ltd. took a loan from Z Ltd. for ` 10,00,000. Z Ltd enters into an arrangement with Target Ltd. for settlement of the loan against issue of a certain number of equity shares of Target Ltd. whose value equals ` 10,00,000. For this purpose, fair value per share (to determine total number of equity shares to be issued) shall be determined based on the market price of the shares of Target Ltd. at a future date, upon settlement of the contract. Evaluate this under definition of financial instrument. Suggested Answer As per Ind AS 32, a financial liability a contract that will or may be settled in the entity’s own equity instruments and is a NON-DERIVATIVE for which the entity is or may be obliged to deliver a variable number of the entity’s own equity instruments; In the given case, Target Ltd. has an obligation to settle by issuing variable number of its own equity shares worth of ` 10,00,000. Number of shares will vary based on the market value of share on the date of settlement. This contract is a non-derivative and thus, meets definition of financial liability in books of Target Ltd.(Please note that in a derivative contract, the value (gain / loss) of the contract is often derived from changes in the value of an underlying asset and in this particular case, the contract is to obtain number of shares amounting to ` 10 Lacs and obviously it depends on the market price of the share itself and not any other asset price and hence, it is a non-derivative.) |

5. Equity Instrument

It is defined in two ways:

Definition 1

It is a contract that evidences a residual interest in the assets of an entity after deducting all of its liabilities;

It means equity instrument holder is the owner and who is ready to accept the remaining money after clearing all the liabilities of the entity. Remaining amount may be positive or nil.

Definition 2

Equity instrument is the one which is NOT a financial liability. This is elaborated like this:

An instrument is equity instrument if it satisfies following both of the following conditions-

a. The instrument includes NO contractual obligation to either (i) to deliver cash or another financial asset to another entity; or (ii) to exchange financial assets or financial liabilities with another entity under conditions that are potentially unfavourable to the issuer;

b. If the instrument will or may be settled in the issuer’s own equity instruments, it is:

-

-

-

-

- a non-derivative that includes NO contractual obligation for the issuer to deliver a variable number of its own equity instruments; or

- a derivative that will be settled only by the issuer exchanging a fixed amount of cash or another financial asset for a fixed number of its own equity instruments.

-

-

-

To classify an instrument correctly whether as a liability or equity – One should NOT look at the nomenclature of the instrument BUT to observe the terms and conditions attached to it.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA