What are the Different Forms of Business Organisation?

- Blog|Company Law|

- 12 Min Read

- By Taxmann

- |

- Last Updated on 1 June, 2025

A business organisation refers to the legal and structural framework within which a business operates. It defines how the business is owned, managed, and controlled, and has implications on liability, taxation, and regulatory compliance. The main forms of business organisation include sole proprietorship, partnership, limited liability partnership (LLP), company, co-operative society, joint Hindu family business, and one person company (OPC).

Table of Contents

- Ownership Forms

- Sole Proprietorship

- Partnership

- Limited Liability Partnership (LLP)

- Limited Liability Company (LLC)

- Private Limited Company

- Public Limited Company

Check out Taxmann's Business Organisation & Management which is a comprehensive resource that bridges foundational management principles with modern trends, fully aligned with NEP guidelines. Authored by Prof. CA. Abha Mathur, it adopts a clear, engaging style enriched by case studies, to-do exercises, and strategic revision tools. The book covers various topics—from entrepreneurship and diverse business environments to planning, directing, and controlling—while integrating Indian ethos and subaltern success stories for holistic insight. Designed for students, educators, and professionals, it ensures conceptual clarity and exam readiness through its reader-friendly layout and past exam references.

1. Ownership Forms

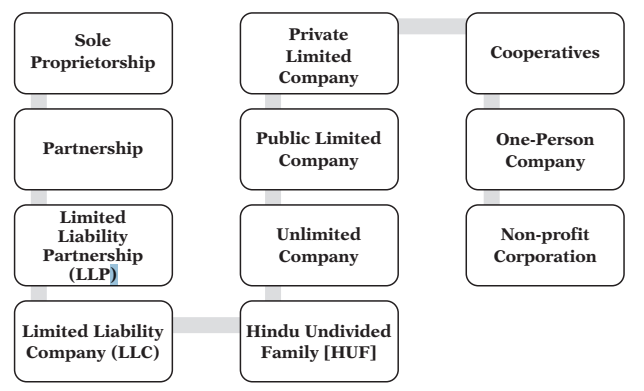

Starting a business in India requires the entrepreneur to choose a specific business structure. There are many legitimate Business ownerships in India, to choose from. There are Sole Proprietorship, Partnership Firm, Limited Liability Partnership, Private Limited Company, and Public Limited Company. The decision of the business element is subject to different factors. They are tax collection, proprietor obligation compliance burden, investment and funding, and exit strategy. These are being discussed one by one below:

Glimpse of Ownership Forms

Every business structure poses different benefits and limitations. To find the best option, one needs to answer following questions about business, such as:

| Vision for starting the business | Business development plans |

Tax laws relating to corporate and personal tax rates |

| Kind of funding required | Perceived Bottom-line |

Sources of funding |

2. Sole Proprietorship

A sole proprietorship is an unincorporated business that one person owns and manages. As the business and the owner are not legally separate, it is the simplest form of business structure. It is also known as individual entrepreneurship, sole trader, or simply proprietorship. Sole proprietorship form of business is the default structure of a business, which does not require any paperwork to create a legal entity. Here, there is no requirement for a Permanent Account Number (PAN), in the name of business. For a sole proprietorship, the PAN of the Proprietor is suffice to vouch for the Proprietorship firm. It is not possible to transfer a proprietorship to another person. Owners of such firms have endless business obligations. In a sole proprietorship, proprietor’s personal assets and resources can be at stake due to liability risks. Apart from being the simplest form of business ownership, it is also the structure of choice for small business owners, who can initially run the business even without employees. The business owner, conducts business using their legal name. They may also choose to do business using another name by registering a trade name with their local authority. This type of business is the cheapest form to start. For this reason, it is common among small businesses, freelancers, and other self-employed individuals. A sole proprietorship begins and ends, when the business owner decides, or upon their death. A sole proprietorship may transform into another, more complex business structure if the business grows substantially.

2.1 Advantages of a Sole Proprietorship

- Simplicity – In most cases, sole proprietors operating under their own names, can easily start work, without having to fulfil any legal requirements.

- Exemptions –Sole proprietorships may be exempt from certain licensing and registration requirements such as obtaining a business license to sell online.

- Least Expensive – Sole proprietorship the simplest and least expensive among the different types of business ownership.

- Control Over the Business – A sole proprietorship is owned by a single person. There is no need to get consensus, before making decisions about the business.

- Easy Taxation – Profits from a sole proprietorship are taxed as the income of the sole-proprietor, simplifying taxes significantly.

2.2 Disadvantages of a Sole Proprietorship

- Legal Liability – Legally, the owner and the business are inseparable. That means any lawsuits or other claims against the business, are launched personally against the owner.

- Financial Risk – In addition to legal risks, sole proprietors take on all financial risk of the business personally.

- Difficulty in Funding – Because of their informal structures, sole proprietorships generally have a difficulty in procuring loans and investment capital than other business ownership types.

3. Partnership

A partnership business, consists of two or more people, who combine their resources to form a business and agree to share risks, profits and losses. Partnerships are popular amongst professional firms. A partnership firm in India, is governed under the Partnership Act, 1932. At least two individuals can start a Partnership firm subject to a limit of a maximum of 20 partners. For legal validity, partnership deeds are made and each partner decides upon their capital contribution to the firm. It is also decided on how much profit or loss each partner will share. The working partners of the firm are permitted to attract a compensation and are also permitted to buy resources in their name. In such cases, these resources belong to the firm. In case of the sudden death of a partner, the partnership may or may not be dissolved. For a partnership, a different Permanent Account Number (PAN) is created for the firm. The partners of the firm have boundless business liabilities, which means their own benefits can be taken away, in order to meet business obligations. In case the firm faces any loss due to one partner, all the other partners have to equally share the loss.

3.1 Features of Partnership

- Agreement Between Partners – It is an association of two or more individuals, and a partnership arises from an agreement or a contract.

- Two or More Persons – In order to start a partnership, there should be at least two persons possessing a common goal.

- Sharing of Profit – Another significant component of the partnership is, the agreement between partners has to share gains and losses of a trading concern.

- Business Motive – It is important for a firm to carry some kind of business and should have a profit gaining motive.

- Mutual Business – The partners are the owners as well as the agent of their firm. Any act performed by one partner can affect other partners and the firm. It can be concluded that this point acts as a test of partnership for all the partners.

- Unlimited Liability – Every partner in a partnership has unlimited liability.

3.2 Types of Partnerships

- General Partnership – A general partnership comprises two or more owners to run a business. In this partnership, each partner represents the firm with equal right. All partners can participate in management activities, decision-making, and have the right to control the business. Similarly, profits, debts, and liabilities are equally shared and divided equally.

- Limited Partnership – This partnership, includes both the general and limited partners. The general partner has unlimited liability, manages the business and the other limited partners. Limited partners have limited control over the business. They are not associated with the everyday operations of the firm.

- Limited Liability Partnership – In Limited Liability Partnership (LLP), all the partners have limited liability. Each partner is guarded against other partner’s legal and financial mistakes. A limited liability partnership is almost similar to a Limited Liability Company (LLC) but different from a limited partnership or a general partnership.

- Partnership at Will – Partnership at Will can be defined as when there is no clause mentioned about the expiration of a partnership firm. Under section 7 of the Indian Partnership Act, 1932, the two conditions that have to be fulfilled by a firm to become a Partnership at Will are:

-

- The partnership agreement should not have any fixed expiration date.

- No particular determination of the partnership should be mentioned.

3.3 Advantages of a Partnership

- Easy Formation – An agreement can be made oral or printed as an agreement to enter as a partner and establish a firm.

- Large Resources – Unlike sole proprietor where every contribution is made by one person, in partnership, partners of the firm can contribute more capital and other resources as required.

- Simplicity – Partnership is a relatively simple structure since it does not require formation paperwork. Depending on the number of partners and the terms of agreement, it is also simple to run.

- Control Over the Business – Partnerships allow their owners to participate in the business directly and allocate profits and control according to their own wishes.

- Flexibility – The partners can initiate any changes if they think it is required to meet the desired result or change circumstances.

- Sharing Risk – All loss incurred by the firm is equally distributed amongst each partner.

- Combination of Different Skills – The partnership firm has the advantage of knowledge, skill, experience and talents of different partners.

- Simple Taxation – Partnerships profit is distributed amongst the partners, in profit sharing ratio. Then each partner is assessed to tax as an individual assessee.

3.4 Disadvantages of a Partnership

- Legal Liability – Like sole proprietorships, partnerships often have unlimited liability, unless, agreed upon to have limited liability.

- Financial Risk – Partners also take on financial liability for the business, putting their personal assets at risk, in case of financial hardship or bankruptcy.

4. Limited Liability Partnership (LLP)

Limited liability partnership is an alternative corporate business form, which offers the benefits of limited liability to the partners, at low compliance costs. It also allows the partners to organise their internal structure like a traditional partnership. A limited liability partnership is a legal body, liable for the full extent of its assets. The liability of the partners, however, is limited. Hence, LLP is a hybrid between a company and a partnership. It is not the same as limited liability Company. They are a popular type of business entity with professionals such as doctors, lawyers, accountants, architects, and engineers.

4.1 Advantages of Limited Liability Partnership (LLP)

- No Limit on Owners of the Business – An LLP requires a minimum of 2 partners while there is no limit on the maximum number of partners. This is in contrast to a private limited company wherein there is a restriction of not having more than 200 members.

- Lower Registration Cost – The cost of registering LLP is low as compared to the cost of incorporating a private limited or a public limited company. However, the difference in the cost of registering an LLP vs Private Limited Company has come down in recent days.

- No Requirement of Minimum Contribution – There is no minimum capital requirement in LLP. An LLP can be formed with the least possible capital. Moreover, the contribution of a partner can consist of tangible, movable or immovable or intangible property or other benefits to the LLP.

- No Requirement of Compulsory Audit – All companies, whether private or public, irrespective of their share capital, are required to get their accounts audited. But in case of LLP, there is no such mandatory requirement. This is perceived to be a significant compliance benefit. A Limited Liability Partnership is required to get the tax audit done only in the case that—

-

- The contributions of the LLP exceeds ` 25 Lakhs, or

- The annual turnover of the LLP exceeds ` 40 Lakhs

- Taxation Aspect on LLP – For income tax purpose, LLP is treated on a par with partnership firms. Thus, LLP is liable for payment of income tax and share of its partners in LLP is not liable to tax.

- Dividend Distribution Tax (DDT) Not Applicable – In the case of a company, if the owners to withdraw profits from the company, additional tax liability in the form of DDT is payable by the company. However, no such tax is payable in the case of LLP and profits of an LLP can be easily withdrawn by the partners.

4.2 Disadvantages of Limited Liability Partnership (LLP)

- Penalty for Non-compliance – Even if an LLP does not have any activity, it is required to file an income tax return and MCA annual return each year. In case an LLP fails to file Form 8 or Form 11 (LLP Annual Filing), a penalty of Rs. 100 per day, per form is applicable.

- Inability to Have Equity Investment – LLP does not have the concept of equity or shareholding like a company. Hence, angel investors, HNIs, venture capital and private equity funds cannot invest in an LLP as shareholders. Thus, most LLPs would have to rely on funding from promoters and debt funding.

- Higher Income Tax Rate – The income tax rate for a company with a turnover of up to Rs. 250 crores is 25%. However, LLPs are taxed at a 30% rate, irrespective of the turnover.

- Increased Complexity – Because LLPs are treated differently in different states, partners will need to research their state requirements and tax laws thoroughly before choosing this structure.

- Limited Availability – LLPs are not available in every state, and they may only be available to certain types of businesses.

5. Limited Liability Company (LLC)

Company is an association of persons or an artificial person formed under the Indian Companies Act in order to carry out a certain business. Limited Liability Company is another category of company registered under the New Companies Act, 2013. Limited Liability Company is a latest new concept in the list of different types of companies. Its nature of business is quite similar with partnership firm and sole trade business. Under the act, in a Limited Liability Company, liability of members or partners is limited and no one is responsible for other member’s misconduct and responsibilities in any case. Limited liability company registration has been growing extensively due to its many advantages over other forms of business enterprises. LLCs allow business owners to retain some of the advantages of sole proprietorship while limiting legal and financial liability, making them a popular business ownership structure for small businesses.

5.1 Advantages of an LLC

- Simplicity – Limited liability companies are relatively easy to set up and run, as compared to corporations. Incorporation of a company is a hectic and costly process, whereas, the law requires an LLP to file an Articles of Association and the draft an Operating Agreement. Also, whereas a corporation requires regular shareholders’ meetings, etc., a limited liability company does not require to observe such formalities.

| Operating agreement defines the company’s policies and procedures such as accounting methods to be used, rights and responsibilities of the members, etc. |

- Limited Liability – A Limited Liability Company has the same advantage as that of corporations. The company exists as a separate legal entity that protects its members from being personally liable for business obligations.

- Flexibility of Income Distribution – A Limited Liability Company has flexibility regarding distribution of profits of the business. Accordingly, earnings of the business, under this form, do not necessarily have to be distributed equally or in the ratio of the partners’ capital contribution.

- Tax Advantage – Law treats the income of a Limited Liability Company as the income of its members/owners. This means that the members of a limited liability company can avoid double taxation on business income, which is the case in a corporation.

5.2 Disadvantages of an LLC

- Complexity – LLCs involve filing of articles of formation with the state. There is also an ongoing regulatory paperwork, including maintaining a registered agent to receive legal documents and filing periodic reports.

- Administrative Costs – An LLC costs more to create and maintain than a sole proprietorship.

| Advantages of LLC | Disadvantages of LLC |

| Limited liability Avoids double taxation Distribution Flexibility Simplicity Member Controlled |

Difficulty in raising capital

Confusion across states Lack of perpetual existence Complexity in paperwork Higher Administrative costs |

6. Private Limited Company

A Private Limited Company is a company which is privately held for small businesses. It is the simplest and a very popular form of Business in India. It can be registered with a minimum of two people. Section 2(68) of Companies Act, 2013 defines private companies as being those companies, whose articles of association restrict the transferability of shares and prevent the public at large from subscribing to them. The liability of the members of a Private Limited Company is limited to the number of shares respectively held by them. Shares of Private Limited Company cannot be publicly traded. Limited liability protection to shareholders, ability to raise equity funds, separate legal entity status make it the most recommended type of business entity for small and medium-sized businesses, which are family-owned or professionally managed. This type of business ownership, enables proprietors to buy its own shares. On buying shares, the proprietors/individuals become investors in the organisation. A private restricted organisation can be framed by registering the company name, with the Registrar of Companies (ROC). Drafts of Memorandum of Association and Article of Association are signed by the promoters and filed with the ROC. Directors are named by the Shareholders for day to day running of the business activities. At least two directors must be named for this purpose. A Private Limited Company in India is like a C-Corporation in the US.

6.1 Advantages of Private Limited Company

- No Minimum Capital – No minimum capital is required to form a Private Limited Company. A Private Limited Company can be registered with a mere sum of ` 10,000, as total Authorised Share capital.

- Separate Legal Entity – A Private Limited Company is a separate legal identity in the court of the law. A Private Limited Company separates Management and Ownership and thus, managers are responsible for the company’s success and are also answerable for the company’s loss.

- Limited Liability – If the company undergoes financial difficulties, the personal assets of members will not be used to pay the debts of the Company as the liability of the person is limited.

- Free & Easy Transfer of Shares – Shares of a company limited by shares are transferable by a shareholder to any other person. The transfer is easy as compared to the transfer of an interest in a business run as a proprietary concern or a partnership. Filing and signing a share transfer form and handing over the buyer of the shares along with a share certificate can easily transfer shares.

- Uninterrupted Existence – A Private Limited Company has ‘Perpetual Succession’, which is continued or uninterrupted existence, until it is legally dissolved. A company, being a separate legal person, is unaffected by the death or other departure of any member but continues to be in existence irrespective of the changes in membership.

- Foreign Direct Investment Permitted – In a Private Limited Company, 100% Foreign Direct Investment is allowed, that means any foreign entity or foreign person can directly invest in a Private Limited Company.

- Fund Raising – A Private Limited Company in India is the only form of business, apart from Public Limited Companies, that can raise funds from Venture Capitalists or Angel investors.

- Builds Prestige and Credibility – The particulars of the company are available on a public database. This improves the credibility of the company as it makes it easy to authenticate the details.

6.2 Disadvantages of a Private Limited Company

- Shares cannot be quoted in the stock exchange.

- Another disadvantage of a Private Limited Company is that it cannot issue prospectus to the public.

- In a Private Limited Company the number of shareholders, cannot exceed 50.

- One of the main disadvantages of a Private Limited Company is that, it restricts the transferability of shares by its articles.

7. Public Limited Company

A public limited company is a voluntary association of members that are incorporated and, therefore, has a separate legal existence and the liability of whose members is limited. It is listed on the stock exchange where its share/stocks are traded publicly. It requires time, cost and efforts to set up a public limited company. A Public Limited Company can be either recorded in a stock trade or stay unlisted. A Listed Public Limited Company enables investors of the organisation to exchange its offers uninhibitedly on the stock exchange.

7.1 Features of Public Limited Company

- Public Limited Company must have a minimum of seven members but there is no limit as regards the maximum number.

- The company has separate legal existence apart from its members who compose it.

- Its formation, working and it’s winding up all its activities, are strictly governed by rules, laws, and regulations.

- The company collects its capital by issue of shares and those who buy the shares are called the members. The amount so collected is called the share capital.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA

One thought on “What are the Different Forms of Business Organisation?”