Understanding Section 28(iv) and Withholding under Section 194R of the Income Tax Act

- Blog|Income Tax|

- 12 Min Read

- By Taxmann

- |

- Last Updated on 25 October, 2023

Table of Contents

- Background – “Profits and Gains from Business and Profession”

- Section 28(iv) – Overview

- Section 28(iv) – Understanding the Term “Benefit”/ “Perquisite”

- Section 28(iv) – Understanding “Arising from” Business and Profession

- Section 28(iv) – Understanding “Whether Convertible into Money or not”

- Section 28(iv) – Understanding the Amendment

- Section 28(iv) – Impact Areas

- Withholding Under Section 194R – Understanding the Section

- Withholding Under Section 194R – Circular 12 of 2022 and Circular 18 of 2022

1. Background – “Profits and Gains from Business and Profession”

- Section 2(13) – defines the term “business” and section 2(36) defines the term “profession”

- Section 2(24) of the Income-tax Act, 1961 (the Act) defines “income” – Inclusive definition

-

- Since inclusive definition – Ambit would be as per word “income” occurring in Entry 82 of List I of 7th Schedule to Constitution; “Taxes on income other than agricultural income”

- Illustrative judicial precedents dealing with Entry 82 of List of 7th schedule to constitution Navinchandra Mafatlal vs. CIT (Civil Appeal No. 194 of 1952, Dated -1/11/1954), Elel Hotels & Investments Ltd. v. Union of India [1989] 44 Taxman 304 (SC) Aero Leather (P.) Ltd. v. Union of India [1993] 67 Taxman 486 (Delhi); Union of India v. A. Sanyasi Rao [1996] 85 Taxman 321 (SC).

- Section 2(24)(vd) includes the value of any benefit or perquisite as taxable under clause (iv) of section 28;

- Section 14 of the Act specifies – heads under which “income” would be liable to tax i.e., Salaries, Income from house property, Profits and gains from business and profession, Capital Gains and Income from Other source.

- Section 28 – Specifies income chargeable under the head PGBP;

- Section 28 – exhaustive list of income chargeable under the head PGBP

-

- Income not falling under any of the clauses of section 28 would not be chargeable under the head PGBP;

2. Section 28(iv) – Overview

- Inserted through Finance Act, 1964 and Circular No. 20D dated 7 July 1964;

- Old section 28(iv):

“the value of any benefit or perquisite, whether convertible into money or not, arising from business or the exercise of a profession”

3. Section 28(iv) – Understanding the Term “Benefit”/ “Perquisite”

Term “benefit” and “perquisite” not defined under the Act – definitions in dictionaries and judicial definitions to be referred.

Meaning of term “Benefit” Black’s Law Dictionary – defines “benefit” – ‘advantage’; profit; fruit; privilege.

- CIT vs. Smt. Kamalini Gautam Sarabhai [1994] 208 ITR 139 (Guj) – rendered in context of 2(24)(iv)

The word “benefit” implies an element of advantage, profit or gain. The word “benefit” occurring in clause (iv) of section 2(24) would mean any advantage, gain or improvement in condition. - Diwan Rahul Nanda vs. Dy CIT [2008] 25 SOT 454 (Mum-Trib) – rendered in context of 2(24)(iv)

For the purpose of these provisions, it is immaterial whether the benefit or perquisite is convertible into money or not. The intention of legislature is to tax any benefit if it is received by a director, etc. irrespective of the fact whether the benefit was in the nature of capital, or whether there is any direct receipt in the transaction or whether there is any detriment to the company (provider of benefit) or not in the transaction.

Meaning of term “Perquisite”

- Section 17(2) of the Act defines “Perquisite” inclusively – however, this applies to salary income and not“PGBP”;

- Ordinary meanings of word “perquisite”should be explored.

Meaning of term “Perquisite” Black’sLaw Dictionary – defines “Perquisite” – A privilege or benefit given in addition to one’s salary or regular wages – often shortened to perk.

4. Section 28(iv) – Understanding “Arising from” Business and Profession

The “benefit” or “perquisite” should have a connection with business or profession of the recipient and not with the business or profession of the person providing the perquisite of benefit.

4.1 CIT vs. Bhavnagar Bone, & Fertiliser Co. Ltd. [1987] 32 Taxman 180 (Guj.)

The amount was not received by the assessee as a result of any business transaction or transaction with the firm. This amount had no connection or nexus with the business of the assessee. It did not represent value of any benefit or perquisite arising from the business of the assessee. This amount, therefore, would not partake of the character of the income.

4.2 Agra Chain Mfg. Co. vs. CIT (IT Reference No. 644 of 1974, Dated-7/04/1978)

For the purposes of attracting of section 28(iv) it is necessary that the benefit should arise from business.

It was not correct, that as assessee was not doing the business of selling and purchasing entitlement, the provisions of section 28(iv) could not be pressed into service. What is necessary for attracting section 28(iv) is that the benefit originates or grows out of the business done and if that aspect is proved, the aforesaid provision would apply.

4.3 ITO vs. Undavalli Constructions [2021] 131 taxmann.com 204/191 ITD 749 (Visakhapatnam – Trib.)

Before sub-section (iv) of section 28 is invoked it is necessary to show and prove the proximate cause or nexus between the alleged benefit or perquisite and the business actually carried on by the assessee. The nexus or the proximate cause must be real, immediateand not illusionary or imaginary. The benefit or perquisite contemplated by sec. 28(iv) must necessarily have a live connection with the business carried on by the assessee and the benefit must accrue or arise in the course of carrying on of such business.

5. Section 28(iv) – Understanding “Whether Convertible into Money or not”

5.1 Commissioner v. Mahindra and Mahindra Ltd. [2018]

93 taxmann.com 32/255 Taxman 305 (SC)

Amount received as cash receipt due to the waiver of loan – Very first condition of Section 28 (iv) of the Act which says any benefit or perquisite arising from the business shall be in the form of benefit or perquisite other than in the shape of money, is not satisfied.

5.2 Gujarat HC – CIT v. Chetan Chemicals (P.), Ltd. [2004] 139 Taxman 301 (Guj.)

It cannot be said that the assessee- company was carrying on business of obtaining loans and that the remission of such loans by the creditors of the company was a benefit arising from such business.

5.3 CIT v. Alchemic (P.) Ltd. [1981] 5 Taxman 55 (Guj.)

The phrase “whether convertible into money or not“ would normally mean something else than money. Section 28(iv) would not apply when the amount received is cash or is considered in terms of money.

5.4 SC – CIT v. T.V. Sundaram Iyengar & Sons Ltd. [1996] 88 Taxman 429 (SC)

- Taxpayer received certain deposits from customers. Such deposits were not claimed by the customers and hence, taxpayer transferred it to P&L a/c.

- Although it was treated as deposit and was of capital nature at the point of time it was received, by influx of time the money had become the assessee’s own money. It became a definite trade surplus.

5.5 Delhi HC – Logitronics (P.) Ltd.

- Where loan was taken for acquiring capital asset, waiver thereof would not be taxable;

- If loan was taken for trading purpose, waiver thereof would result in income, more so when it was transferred to P&L.

5.6 Madras HC – Ramaniyam Homes (P.) Ltd.

Amount representing principal loan waived by bank under one time settlement scheme would constitute income falling under section 28(iv).

6. Section 28(iv) – Understanding the Amendment

| Points | Particulars |

| Comments in Memorandum for the proposed amendment | The intention of legislature while introducing this provision was also to include benefit or perquisite whether in cash or in kind. However, courts have interpreted that if the benefit or perquisite are in cash, it is not covered within the scope of this clause of section 28 of the Act.

In order to align the provision with the intention of legislature, it is proposed to amend clause (iv) of section 28 of the Act to clarify that provisions of the said clause also applies to cases where benefit or perquisite provided is in cash or in kind or partly in cash and partly in kind. |

| Amended provision – clause (iv) of section 28 | “the value of any benefit or perquisite arising from business or the exercise of a profession, whether –

(a) convertible into money or not; or (b) In cash or in kind or partly in cash and partly in kind |

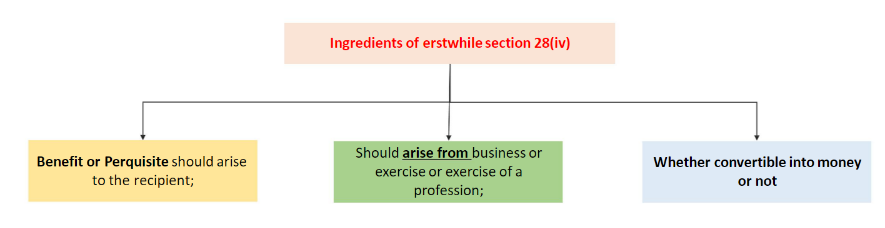

Ingredients of amended section 28(iv)

- Benefit or Perquisite should arise to the recipient;

- Should arise from business or exercise or exercise of a profession;

- Whether convertible into money or not

- In cash or in kind or partly in cash and partly in kind

7. Section 28(iv) – Impact Areas

7.1 Waiver of Loan

The words “in cash or in kind or partly in cash and partly in kind” would rope gains from loan waiver under one-time settlement.

7.2 Discount on redemption of FCCB

Mumbai Tribunal in Pidilite Industries held that discount received on buy-back of FCCB not taxable as receipt was in shape of money and capital receipt.

7.3 Share application money written back

Mumbai Tribunal in Nalwa Chrom Pvt. Ltd. had held that such write back is not taxable u/s 28(iv) and 41(1).

7.4 Benefit from Employer-Employee relationship

Not covered u/s 28(iv) – Can be taxable as Salaries in hands of employees under

section 17.

7.5 Bonus shares/Right shares

- Whether benefit/perquisite at all? – Especially in bonus

- Whether arising in course of business?

7.6 Allocation of common expenditure

Allocation of common expenditure amongst the companies – if less expenditure allocated – whether benefit received by other group company.

7.7 Interest free/Concessional rate loan

Rule 3 prescribes that perquisite for section 17(2) includes interest free loan – no corresponding provision under PGBP

7.8 Free Maintenance Services

Cost is factored and recovered from customers through price of goods at time of sale;

7.9 Zero Cost EMI

Either consumer foregoes discount and pays zero cost or interest is inbuilt in the product price. No benefit in real terms.

Point for consideration ► Whether waiver of such loan can be considered as “arising from” business or exercise of profession? ► Whether discount on redemption of FCCB can be considered as “arising from” business or exercise of profession? ► Whether write back in respect of share application money received is “arising from” business or exercise of profession? ► If benefit provided by Hospital to doctor who is employee – may be taxable u/s 17. However, if benefit provided by Hospital to doctor who is consultant – may be taxable u/s 28(iv) ► Circular issued in context of 194R for Rights / Bonus shares cannot be automatically extrapolated into section 28(iv) ► Whether write back in respect of share application money received is “arising from” business or exercise of profession? ► Interest free loan – Benefit arising to recipient to be demonstrated – i.e., the giver of loan borne interest cost which would have been otherwise payable by the recipient of loan ► Free Maintenance Services - there is difference between “benefit” / “perquisite” vs. “consideration” – Benefit / Perquisite should be over and above the consideration.

8. Withholding Under Section 194R – Understanding the Section

| Particulars | Provisions of section 194R |

| Which payment covered | Benefit or perquisite, whether convertible into money or not, arising from business or exercise of profession, payable to resident |

| Rate of withholding | 10% (not required to be enhanced by surcharge and cess). Nil withholding certificate not possible. |

| TDS to be deducted | Value or aggregate payment > Rs. 20,000 during the FY |

| Person obligated to withhold | Person responsible for providing the benefit or perquisite (i.e., benefit provider)

No withholding obligation on individuals or HUF where sales/gross receipts/turnover < INR 1 crore (business)/INR 50 lakhs (profession) during immediately preceding FY |

| Status of payee | Should be resident |

| Date of applicability | 1 July 2022 |

| Timing of withholding | TDS to be deducted ‘before’ providing benefit or perquisite |

| TDS obligation for in- kind payments | First proviso covers benefit or perquisite

– wholly in kind or – partly in cash an partly in kind but cash component insufficient to meet TDS on whole of benefit/perquisite |

| Power to CBDT to issue guidelines to remove difficulties | CBDT to issue guidelines for purpose of removal of any – binding on both tax authorities and person responsible for providing benefit/perquisite |

9. Withholding Under Section 194R – Circular 12 of 2022 and Circular 18 of 2022

| Clarification | Illustrative issues |

Withholding under section 194R applies on benefit or perquisite provided regardless of:

Comparable to section 196D/PILCOM judgment |

Memorandum provided that section 194R introduced to widen the tax base since recipient of benefit/perquisite are not reporting such benefit/perquisite received in the course of business as taxable income.

The clarification that the recipient is not required to check whether the amount would be taxable in the hands of recipient, or under which section such amount would be taxed appears to be contrary to the intent of introducing section 194R. |

| Section 194R applicable to monetary benefits | Prior to amendment in section 28(iv) – monetary benefits were not covered within the ambit of section 28(iv) –Mahindra and Mahindra (SC)

|

| Section 194R applies to benefit in form of capital asset | What would be cost of acquisition in the hands of recipient?

Circular 18 of 2022 clarified that if tax has been deducted as per section 194R and the recipient has offered such receipt of capital asset as income in the return of income (ROI) – then the amount of benefit included by dealer in ROI shall be deemed as “actual cost” for depreciation purpose |

| Clarification | Illustrative issues |

| Sales discount, Cash discount, Rebates and buy one get one – Are benefit/perquisite – However, tax not deductible to avoid genuine difficulty

Further clarified that the above would not apply to benefits like car, TV, mobile phones, free event ticket, sponsored trips, computers, gold coin, free medicine samples |

Memorandum provided that section 194R introduced to widen the tax base since recipient of benefit/perquisite are not reporting such benefit/perquisite received in the course of business as taxable income.

Following whether benefit or perquisite and subject to section 194R?

|

| Option 1 – withholding in the name of recipient entity if the benefit is “used” by owner/director/employee or relative.

Recipient entity to evaluate withholding under section 194R/192. Option 2 – TDS may be deducted directly in the name of recipient Threshold of 20,000 is qua recipient |

Challenges in dual TDS obligations

|

| Clarification | Illustrative issues |

| Benefit/Perquisite to Government entities not carrying on business/profession – Section 194R not applicable | Whether similar principle can be extended to other entities not carrying on business (e.g., charitable trusts) |

| Guidelines on valuation:

Value = Fair market value except,

GST to be excluded for determination of value |

Fair Market Value has not been defined in circular

Where the manufacturer sells the products to distributors – whether sales price to distributor or sale price of product to ultimate customer to be considered? Whether “purchase” of service would also be covered? |

| Products given to social media influencer for the purpose of advertising not liable for 194R if such products are returned after use

TDS applicable if products is retained |

|

| Clarification | Illustrative issues |

Reimbursement of out-of-pocket expenses:

|

|

Section 194R – Dealer/Business conferences

|

|

| Clarification | Illustrative issues |

| Compliance for benefits provided in kind:

Option 1 – Advance tax payment challan to be obtained from the recipient of such benefit and such challan number to be inserted in Form 26Q by the benefit provider Option 2 – Deduct and pay on “net of tax basis” |

|

Computation of threshold of INR 20,000

|

|

| Whether Embassy/High Commission required to deduct tax at source? | Section 194R not applicable on benefit/perquisite provided by an organization in scope of The UN (Privileges and Immunity Act), 1947, an international organization whose income is exempt under specific Act or parliament, embassy, high commission, legation, commission, consulate and trade representation of foreign state. |

Issuance of bonus shares/right shares:

|

Whether similar principles applicable when bonus/rights issue undertaken by a company which is not 2(18) company. |

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA