Understanding the Environmental | Social | Governance (ESG) Framework – Sustainable Business Practices and Ethical Responsibility

- Blog|Company Law|

- 2 Min Read

- By Taxmann

- |

- Last Updated on 28 February, 2024

By Garima Dadhich – Associate Professor & Head and Ravi Raj Atrey – Chief Programme Executive | School of Business Environment – Indian Institute of Corporate Affairs

Table of Contents

- What is the Mystery?

- Components in Demystifying

- Defining ESG

- Understanding the Theory

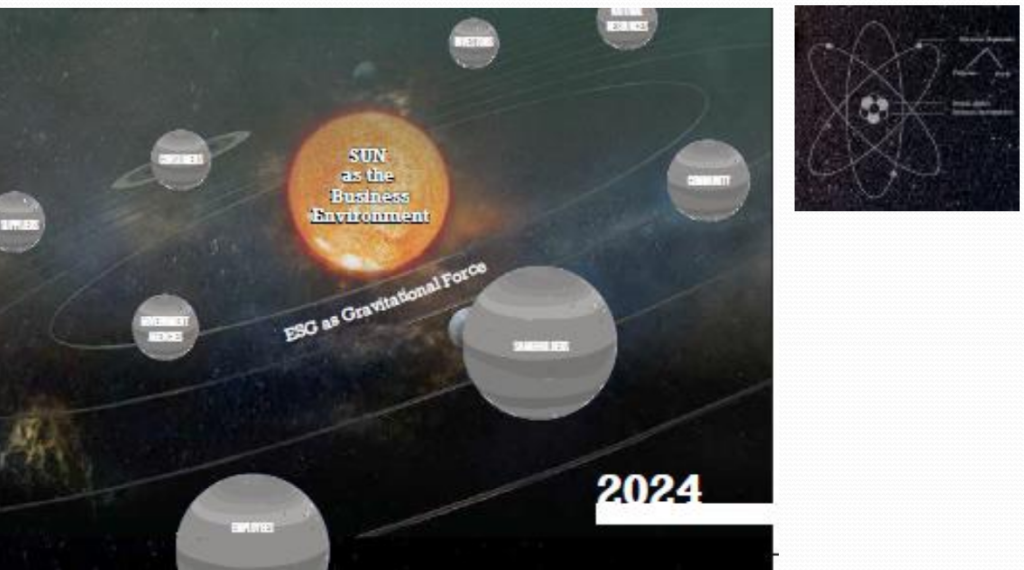

- The Solar System Model

- Indian Context

- Beginning with ESG Journey

1. What is the Mystery?

- Solutions to sustainability

- Life for our upcoming generations

- Extent of climate change

- Limited natural resources

- Increasing inequality

- Role of Businesses

- Framework for Businesses

2. Components in Demystifying

- Defining ESG

- Understanding its Theory

- Model for Integration

- Indian Context

- How to begin ESG journey

- Environmental Dimensions

- Social Dimensions

- Governance Dimensions

- ESG Trends & Challenges

- Way Forward

3. Defining ESG

ESG is a fundamental responsibility of business to adapt, integrate and disclose its commitment towards sustainability. It enables businesses with a yardstick for their commitment towards stakeholders as mentioned in the solar system model. It also helps businesses towards monitor and measure of ESG practices which inter-alia includes actions to combat climate changes, GHG emissions, deforestation, biodiversity preservation, reducing pollution, judicious usages of water, waste management, extended producer responsibility, customer relations, employee relations, labour, human rights, community, supply chains, responsible board, succession planning, compensation, diversity, equity and inclusion, regulatory compliance, corruption, and data hygiene etc.

4. Understanding the Theory

- Ethical Behaviour at the core of individual mindset

- Link between Responsibility and Ethics

- Responsibility as a Mandatory Compulsion

- Individual Responsible Behaviour to Collective Impact

- Organizational Responsibilities v/s Individual Ethics

- The Age of Responsibility

- The Originality Approach

- Integrating Responsible Behaviour

- Responsible Capitalism

5. The Solar System Model

6. Indian Context

- National Guidelines on Responsible Business Conduct

- Business Responsibility and Sustainability Report (BRSR)

7. Beginning with ESG Journey

- Conducting Baseline

- Peer Benchmarking

- Materiality Assessment

- Relevant Policies

- Setting Targets & KPIs

- Implementation

- Measuring the performance

- Audit, Index & Rating

- Communications & Branding

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA