UAE Corporate Tax | Related Parties and Connected Persons

- Blog|International Tax|

- 13 Min Read

- By Taxmann

- |

- Last Updated on 10 November, 2025

UAE Corporate Tax is a federal tax imposed on the taxable profits of businesses and commercial activities conducted within the United Arab Emirates. Introduced through Federal Decree-Law No. 47 of 2022, it applies to juridical persons (companies and legal entities) and certain natural persons engaged in business activities.

Table of Contents

Check out Taxmann's Law & Practice Relating to UAE Transfer Pricing which is the comprehensive treatise on the UAE's TP regime, blending statutory provisions, FTA guidance, OECD methodologies, and compliance tools. It analyses Articles 34–36 and 55 of the Corporate Tax Law, with detailed coverage of Related Party and Connected Person tests, ALP methods, documentation thresholds, and audit processes. The book highlights UAE-specific nuances, such as the deductibility of Connected-Person payments, QFZP implications, and the integration of BEPS Action 13. With practical checklists, worked examples, comparative tables across key jurisdictions, and a complete set of legal sources, it serves as a one-stop reference for professionals navigating the UAE TP framework.

1. Introduction

The UAE Corporate Tax Law establishes specific rules for transactions involving Related Parties and Connected Persons to ensure transparency and proper tax compliance. These provisions, outlined in Articles 35 and 36, are designed to prevent misreporting of income and ensure that taxable entities accurately reflect their economic activities in their financial and tax reporting.

Related Parties include individuals and entities connected through ownership, control, or kinship within defined thresholds, while Connected Persons primarily involve individuals or entities with a significant relationship to a Taxable Person, such as owners, directors, or officers. These definitions are crucial for determining the scope of relationships subject to enhanced disclosure and compliance obligations under UAE tax law.

This article provides:

- Clear Definitions – A comprehensive explanation of Related Parties and Connected Persons, as defined under UAE Corporate Tax Law, including key criteria for identification.

- Ownership and Control Criteria – An overview of the thresholds for ownership and control, focusing on relationships that trigger additional compliance obligations.

- Kinship and Affiliation – Detailed classifications of relationships through kinship, partnership, or association.

- Illustrative Examples – Practical scenarios to demonstrate how these definitions apply to various business and personal relationships.

By outlining these regulations, the UAE ensures fairness and consistency in tax practices while safeguarding its tax base. This chapter equips businesses and stakeholders with the tools to identify applicable relationships, understand their compliance obligations, and align their operations with UAE Corporate Tax requirements.

2. Article 35 – Related Parties and Control

The following is the definition provided in the law under Article 35:

1. “For the purposes of this Decree-Law, “Related Parties” means any of the following:

(a) Two or more natural persons who are related within the fourth degree of kinship or affiliation, including by way of adoption or guardianship.

(b) A natural person and a juridical person where:

i. The natural person or one or more of Related Parties of the natural person are shareholders in the juridical person, and the natural person, Parties, directly or a 50% (fifty per cent) or greater ownership interest in the juridical person; or

ii. the natural person, alone or together with its Related Parties, directly or indirectly controls the juridical person.

(c) Two or more juridical persons where:

i. one juridical person, alone or together with its Related Parties, directly or indirectly owns a 50% (fifty per cent) or greater ownership interest in the other juridical person;

ii. one juridical person, alone or together with its Related Parties, directly or indirectly controls the other juridical person; or

iii. any Person, alone or together with its Related Parties, directly or indirectly owns 50% (fifty per cent) or greater ownership interest in or controls such two or more juridical persons.

(d) A Person and its Permanent Establishment or Foreign Permanent Establishment.

(e) Two or more Persons that are partners in the same Unincorporated Partnership.

(f) A Person who is the trustee, founder, settlor or beneficiary of a trust or foundation, and its Related Parties.

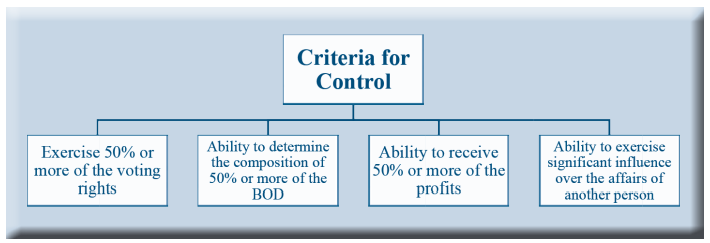

For the purposes of this Decree-Law, “Control” means the ability of a Person, whether in their own right or by agreement or otherwise to influence another Person, including:

(a) The ability to exercise 50% (fifty per cent) or more of the voting rights of another Person.

(b) The ability to determine the composition of 50% (fifty per cent) or more of the board of directors of another Person.

(c) The ability to receive 50% (fifty per cent) or more of the profits of another Person.

(d) The ability to determine, or exercise significant influence over, the conduct of the business and affairs of another Person.”

2.1 Overview

Article 35 of the UAE Corporate Tax Law provides the framework for identifying Related Parties, ensuring that transactions involving such relationships are subject to appropriate scrutiny. The article outlines specific criteria for determining when individuals or entities are classified as Related Parties, with a focus on ownership, control, and kinship connections in UAE Corporate Tax.

Key aspects of the definition include:

- Natural Persons – Individuals related within the fourth degree of kinship or affiliation, including relationships by blood, marriage, adoption, or guardianship, are classified as Related Parties.

- Natural and Juridical Persons – A natural person and a juridical person are considered Related Parties if the individual, alone or along with their Related Parties, directly or indirectly owns 50% or more of the juridical person or exercises control over it.

- Juridical Persons – Two or more juridical persons are classified as Related Parties if one owns or controls 50% or more of the other, or if a third party owns or controls 50% or more of both entities.

- Permanent Establishments – Relationships between a person and their permanent establishment or foreign permanent establishment are automatically considered Related Parties.

- Unincorporated Partnerships – Partners in an unincorporated partnership and their Related Parties are also included under the definition.

These criteria ensure that transactions between Related Parties, whether domestic or cross-border, are appropriately monitored to prevent potential risks such as misallocation of income or tax avoidance. The law emphasises transparency in dealings between Related Parties to protect the integrity of the UAE Corporate Tax.

The following sections provide a detailed breakdown of the specific relationships and examples that illustrate the application of these provisions in various contexts.

2.2 Related Parties (Two Natural Persons)

Two or more individuals are considered related parties if they are connected within the fourth degree of kinship or affiliation.

Kinship includes common blood ties as determined by the ancestors or common ancestors of the individual, where an ancestor or common ancestor may include guardians or adoptive parents, and affiliation covers relationship by marriage, or if one natural person’s spouse is related by kinship to the other Natural Person.

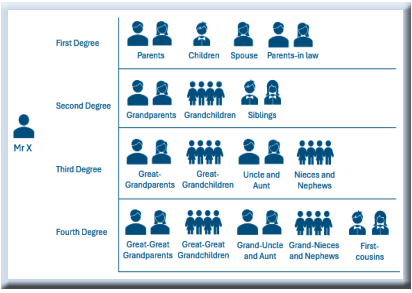

Degrees of kinship are classified as follows:

- First-degree – Parents, children, and the parents and children of a spouse.

- Second-degree – Grandparents, grandchildren, and siblings, including those of a spouse.

- Third-degree – Great-grandparents, great-grandchildren, uncles, aunts,

nieces, and nephews, including those of a spouse. - Fourth degree – Great-great-grandparents, great-great-grandchildren, grand uncles, grand aunts, grandnieces, grandnephews, and first cousins, including those of a spouse.

Examples

- Ali is Omar’s uncle. Under the UAE Corporate Tax Law, Ali and Omar are considered Related Parties because they are family members connected within the third degree of kinship, which includes relationships like uncles, aunts, and nephews.

- Zayed and his first cousin Khalid are related as cousins. Under the UAE Corporate Tax Law, they are classified as Related Parties because first cousins are connected within the fourth degree of kinship, as defined in the law.

- Abdullah and his sister Hiba are siblings. Under the UAE Corporate Tax Law, they are considered Related Parties because siblings are connected within the second degree of kinship.

2.3 Related Parties (Natural and Juridical Persons)

A natural person/juridical person and a juridical person shall be considered ‘related parties’ if they meet either the ownership or control criteria.

2.3.1 Ownership

A. Natural and Juridical Person

A natural person and a juridical person are considered Related Parties through ownership if the individual, either alone or along with their Related Parties, holds a 50% or greater ownership interest—whether directly or indirectly—in the juridical person. This also applies when the individual or their Related Parties are shareholders in the juridical person.

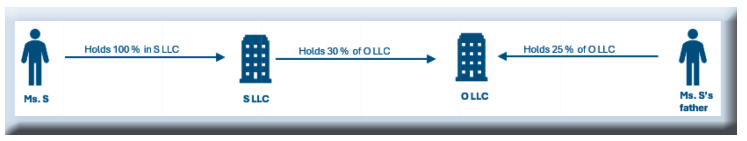

Examples – Ms S and O LLC are related parties through combined ownership

1. If Mr Person owns 85% of ABC LLC, Mr Person and ABC LLC are related parties.

2. If Ms T owns 80% of T LLC and 25% of U LLC, and T LLC owns 45% of U LLC, Ms T and U LLC are related parties due to cumulative ownership exceeding 50%.

3.

Ms S and O LLC are related parties through combined ownership.

4.

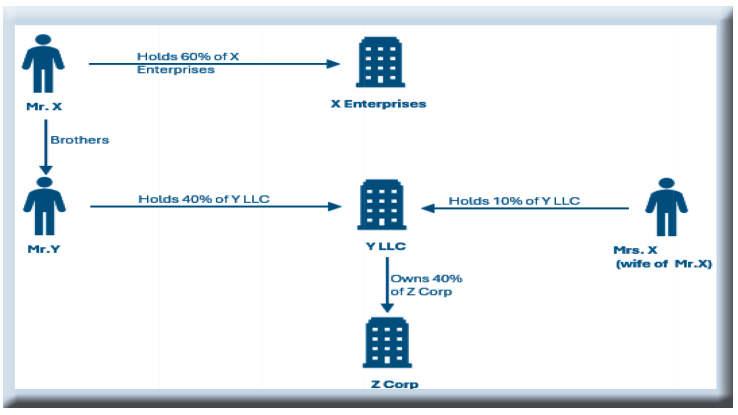

From the above, Mr X is a related party to X Enterprises through his direct 60% ownership. Furthermore, due to the combined ownership interests of Mr. X (60%), Mr. Y (30%), and Mrs. X (10%) in Y LLC, which holds a 40% stake in Z Corp, Mr. X and Z Corp are also considered related parties, as the total ownership exceeds 50% when factoring in indirect ownership through Y LLC. Thus, Mr X, Mr Y, Mrs X, Y LLC, and Z Corp are all related parties under these circumstances.

B. Two or More Juridical Persons

Two or more juridical persons are deemed Related Parties based on ownership if:

- One juridical person, either independently or in conjunction with its Related Parties, holds a direct or indirect ownership interest of 50% or more in the other juridical person; or

- Any person, either individually or together with their Related Parties, directly or indirectly owns 50% or more of the ownership interests in two or more juridical persons.

Examples

1. ABC Corp owns 90% of ABC LLC. Both are related parties.

2. V Inc. owns 55% of U LLC, and W LLC appoints 50% of U LLC’s board. Both V Inc. and W LLC are related parties to U LLC.

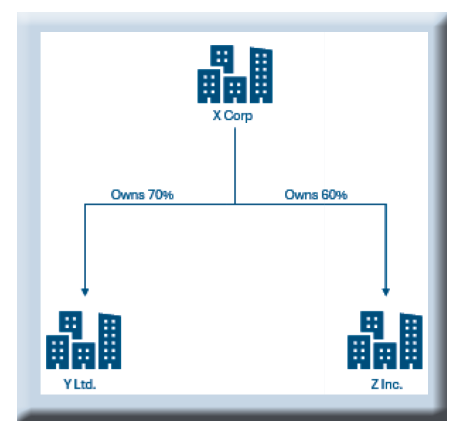

3.

From the above example Y Ltd. and Z Inc. related parties through common ownership. In this scenario, X Corp, with its direct ownership of 70% in Y Ltd. and 60% in Z Inc., establishes a relationship between X Corp, Y Ltd., and Z Inc. as related parties. The ownership interest held by X Corp in both juridical persons exceeds 50%, creating a direct or indirect ownership link between the entities, thereby classifying them as related parties under the ownership criteria.

2.3.2 Control Criteria

Persons can also be regarded as Related Parties through direct or indirect ‘Control.’

Control refers to the ability of one person to direct or influence the actions and decisions of another person. This influence can be exerted through various means, including rights, agreements, or other methods.

If a natural person, either alone or with their related parties, directly or indirectly exercises control over a juridical person, both the natural person and the juridical person will be considered related parties.

The CT Law provides specific criteria to determine whether control exists, as mentioned below:

(a) Voting Rights

A person is considered to exercise control over another if they have the ability to exercise 50% or more of the voting rights of another Person.

For instance, Company P owns 40% of the shares in Company Q, while the remaining 60% is held by various individual shareholders. However, due to a special agreement, Company P has the right to cast 55% of the total votes in the company’s board decisions. Despite owning less than 50% of the shares, Company P has the power to influence the decisions of Company Q by exercising more than 50% of the voting rights. Therefore, Company P is considered to have control over Company Q based on its voting power, and the two companies are regarded as related parties.

(b) Board Composition

A person is considered to have control over another if they have the ability to determine the composition of 50% or more of that person’s Board of Directors (BoD).

For example, Ms B, through her ownership of preferred shares in Company W, has the right to appoint 5 out of 9 members of the company’s Board of Directors, granting her the power to control the board’s composition. Despite holding less than a majority of the shares, her ability to appoint the majority of the board members establishes her control over the company. As a result, Ms B and Company W are considered related parties due to her control over the board.

(c) Profit Entitlement

A person is considered to have control over another,If that person has the ability to receive 50% or more of the profits of the another person.

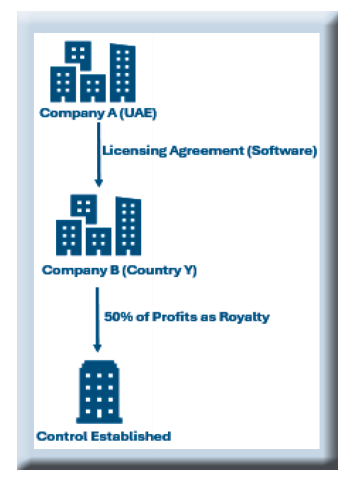

For Example

Company A, a company resident in the UAE, has licensed a software to Company B, resident in country Y, which allows it to operate and run its day-to-day business activities in country Y. Company A and Company B signed a royalty agreement, which entitles Company A to 50% of profits generated by Company B from the use of the software in country Y as remuneration for the use of the software. As per the above, control can be established where a Person is entitled to 50% or more profits of another Person. Thus, Company A is deemed to have Control over Company B as Company A is entitled to 50% of Company B’s profits.

(d) Ability to Exercise Significant Influence

A person is considered to have ‘control’ over the other person if it has the ability to determine or exercise significant influence over the business and affairs of another person. This includes two key aspects:

- The power to determine the actions and operations of the other party; and

- The ability to exercise substantial influence over the other party’s business and decisions.

If a person meets either of these conditions, they are considered to have ‘control’ over the other person.

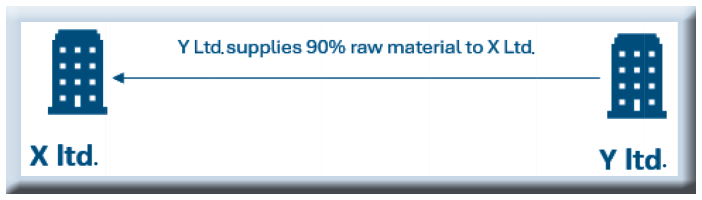

For Example

- High Dependency – Company X relies on Supplier Y for 90% of its raw materials.

- Significant Influence – Supplier Y’s control over pricing, delivery terms, and product quality affects Company X.

- Operational Impact – Any changes by Supplier Y can directly impact Company X’s production and profitability.

- Control – Due to this influence, Supplier Y is considered to have ‘control’ over Company X’s operations.

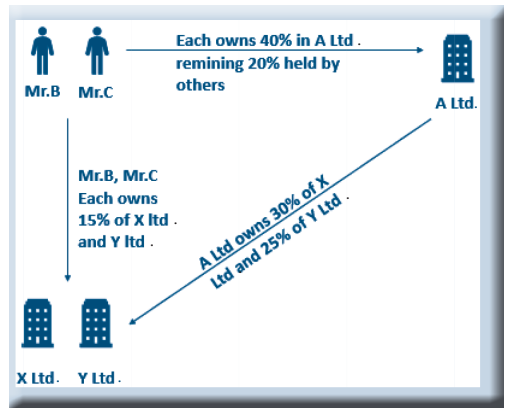

2.3.3 Common Ownership or Control Criteria

When a person, either individually or in conjunction with their related parties, directly or indirectly holds 50% or more of the ownership interest in or has control over two or more juridical persons, those entities will be classified as related parties. This means that sister companies within a corporate group are considered related parties. The connection between the two juridical persons can be formed through common ownership or control, with the controlling party being either a natural person or another juridical entity.

For Example

In this Scenario

- Related Parties – Mr B and Mr C are related parties.

- Control Over Company A – Mr B and Mr C together control Company A.

- Joint Ownership – They have joint ownership interests in Company X and Company Y.

- Shareholding:

-

- 55% of Company X is held by Mr B, Mr C, and Company A.

- 40% of Company Y is held by the same group.

- Related Party Classification – Company X and Company Y are related parties to Mr B, Mr C, and Company A due to their ownership and control.

2.4 Related Parties (Additional Criteria)

2.4.1 Persons and Its Permanent Establishment (PE) or Foreign PE

A person and its permanent establishment shall be regarded as related parties. This means that if a non-resident person operates a permanent establishment in the UAE, the UAE permanent establishment and the non-resident’s other branches or offices outside the UAE Corporate Tax regarded as related parties.

For Example, Company P, a non-resident entity based in the US, has a permanent establishment in Dubai, UAE, to oversee its regional operations. Company P also operates branches in several countries outside the UAE, including the UK and Germany. The Dubai branch of Company P is involved in managing regional sales, while the UK branch handles marketing, and the German branch focuses on distribution.

Because Company P and its UAE permanent establishment are linked as related parties, any transactions between the Dubai branch and the branches in the UK and Germany must adhere to transfer pricing regulations.

2.4.2 Related Parties (Partners in Unincorporated Partnership)

The partners in an unincorporated partnership are considered related parties to each other. An unincorporated partnership can have two or more partners, and each partner will be regarded as a related party to the others. It’s important to note that both natural persons and juridical persons can be partners in an unincorporated partnership.

For Example

Company A and Mr X form an unincorporated partnership to jointly develop a new product line. Company A holds 60% of the partnership, and Mr X holds 40%. As per the rules, both Company A and Mr X are considered related parties to each other due to their partnership. Even though Company A is a juridical person and Mr X is a natural person, their business relationship through the partnership classifies them as related parties.

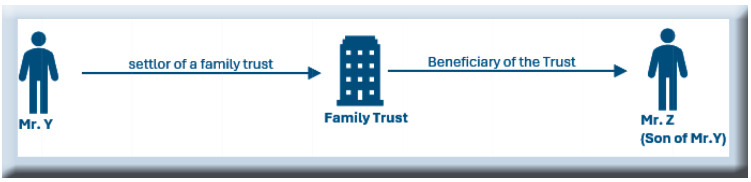

2.4.3 Related Parties (Trustee, Founder, Settlor or Beneficiary of a Trust)

The trustees, founders, settlor, or beneficiaries of a trust or foundation are considered related parties to the trust or foundation. Additionally, the related parties of these trustees, founders, settlor, or beneficiaries are also regarded as related parties of the trust or foundation.

For Example

Mr Y is the settlor of a family trust and also serves as one of its trustees. His son, Mr Z, is a beneficiary of the trust. Since Mr Y, as the settlor and trustee, is a related party of the trust, Mr Z, as a beneficiary, is also considered a related party of the trust. Furthermore, any related parties of Mr Y or Mr Z, such as their spouses or business partners, will also be regarded as related parties to the trust.

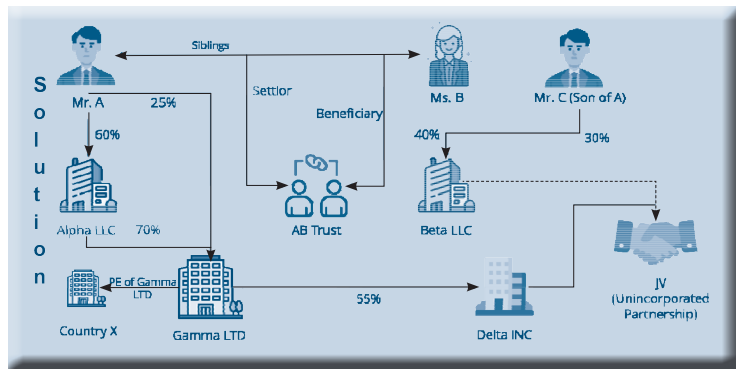

Comprehensive Example

Facts

- Mr A and Ms B are siblings (related within the second degree of kinship).

- Mr C is the son, Mr A.

- Mr A owns 60% of shares in Alpha LLC.

- Ms B owns 40% of shares in Beta LLC. Mr C (Mr A’s son) owns another 30% of Beta LLC.

- Alpha LLC owns 70% of shares in Gamma Ltd.

- Gamma Ltd. owns 55% of shares in Delta Inc.

- Mr A also owns 25% of shares in Gamma Ltd.

- Gamma Ltd operates a Permanent Establishment (PE) in Country X.

- Delta Inc. and Beta LLC are partners in an Unincorporated Partnership called Joint Venture (JV) Partners.

- Mr A is the settlor of the A&B Trust.

- Ms B is a beneficiary of the A&B Trust.

Solution

|

Relationship Type |

Parties Involved |

Reason |

| Related Parties (Kinship) | Mr A and Ms B | They are siblings, related within the second degree of kinship. |

| Related Parties (Kinship) | Mr A and Mr C | They are father and son, related within the first degree of kinship. |

| Related Parties (Ownership) | Mr A and Alpha LLC | Mr. A owns 60% of Alpha LLC, exceeding the 50% ownership threshold. |

| Related Parties (Ownership) | Ms B and Beta LLC | Ms B owns 40%, and Mr C (her nephew) owns 30%, giving Related Parties a total of 70% ownership. |

| Related Parties (Juridical Persons) | Alpha LLC and Gamma Ltd | Alpha LLC owns 70% of Gamma Ltd., exceeding the 50% ownership threshold. |

| Related Parties (Juridical Persons) | Gamma Ltd and Delta Inc. | Gamma Ltd. owns 55% of Delta Inc. |

| Related Parties (Indirect Control) | Alpha LLC and Delta Inc. | Alpha LLC indirectly controls Delta Inc. through its 70% ownership in Gamma Ltd. |

| Related Parties (Permanent Establishment) | Gamma Ltd. and its PE in Country X | A Permanent Establishment is treated as part of the juridical person (Gamma Ltd.). |

| Related Parties (Unincorporated Partnership) | Delta Inc. and Beta LLC | They are partners in the same Unincorporated Partnership (JV Partners). |

| Related Parties (Trust) | Mr A and A&B Trust | Mr A is the settlor of the trust. |

| Related Parties (Trust) | Ms B and A&B Trust | Ms B is a beneficiary of the trust. |

3. Article 36 – Payments to Connected Persons

The following is provided under Article 36 of the law:

- Without prejudice to the provisions of Article 28 of this Decree-Law, a payment or benefit provided by a Taxable Person to its Connected Person shall be deductible only if and to the extent the payment or benefit corresponds with the market value of the service, benefit or otherwise provided by the connected Person and is incurred wholly and exclusively for the purposes of the Taxable Person’s Business.

- For the purposes of this Decree-Law, a Person shall be considered a Connected Person of a Taxable Person if that person is:

-

- An owner of the Taxable Person.

- A director or officer of the Taxable Person.

- A Related Party of any of the Persons referred to in paragraphs (a) and (b) of Clause 2 of this Article.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA