Transfer Pricing Documentation and its Importance in Practice

- Blog|Transfer Pricing|

- 15 Min Read

- By Taxmann

- |

- Last Updated on 29 June, 2022

Table of Content

- Background

- Importance of TP Documentation

- What are the documentation requirements as per Indian transfer pricing regulations?

- Approach to Documentation

Check out Taxmann's Transfer Pricing – A Compendium which is a collection of incisive & in-depth 75 articles on transfer pricing, authored by 150 recognised experts, covered in 2800 pages.

1. Background

1.1 Transfer Pricing has evolved as a focus area of tax authorities to garner tax revenue. The tax authorities have always looked at transfer pricing from suspicious lens. This is mainly due to buzz about Multi-National Enterprises (“MNEs”) using transfer pricing as a tool to shift profits to lower tax jurisdiction. Over a period of time, the importance of transfer pricing has garnished attention globally. Similarly, in order to demonstrate the arm’s length nature of transfer prices, preparation and maintenance of required information and details is a must. MNEs need to make reasonable efforts to establish transfer prices in compliance with the arm’s length principle which is also required mandatorily by the tax regulations of the respective countries in which the MNEs operate.

1.2 OECD Guidelines has enumerated three-tiered of documentation approach consisting of the following:

-

- Master file: A document containing standardized information relevant for all members of a multinational enterprise (MNE) group;

- Local file: A document referring specifically to material transactions of the local taxpayer; and

- Country-by-Country (CbC) report: A document containing certain information relating to the MNE group’s income and taxes, together with certain indicators of the location of economic activity within the MNE group.

1.3 Following the footsteps of OECD, various countries have adopted three-tiered documentation approach suggested by OECD. Being one of the active members of the Base Erosion and Profit Shifting (“BEPS”) initiative by OECD, in 2016, India adopted the three-tier transfer pricing documentation structure as prescribed by the OECD under BEPS Action 13.

The relevant Transfer Pricing provisions are contained in Chapter X of the Income-tax Act, 1961 (“the Act”) under section 92 read along with Rules 10A to 10E of the Income-tax Rules, 1962 (“the Rules”) [collectively referred to as the “transfer pricing regulations” or “the Regulations”]1. The TP documentation related provisions are specifically covered under section 92D read along with Rule 10D.

1.4 Objective of transfer pricing documentation (referred to as “the Documentation”) – The intent of transfer pricing regulations is to prevent taxpayer from entering into transaction with associated enterprises which is not at arm’s length. Therefore, the main objective of the regulations is that the taxpayer is required to maintain appropriate documentation at the time of entering into intercompany transactions to show that the transactions undertaken are at arm’s length. Also, upon request, producing such documents in a timely manner to the Transfer Pricing Officer (“TPO”) helps the taxpayer to discharge the burden of proof cast upon him by the law.

1.5 According to the OECD, following are the main objectives of transfer pricing documentation:

-

- To ensure that taxpayers give appropriate considerationto transfer pricing requirements in establishing prices and other conditions for transactions between associated enterprises and in reporting the income derived from such transactions in their tax returns;

- To provide tax administrations with the information necessaryto conduct an informed transfer pricing risk assessment; and

- To provide tax administrations with useful information to employ in conducting an appropriately thorough auditof the transfer pricing practices of entities subject to tax in their jurisdiction, although it may be necessary to supplement the documentation with additional information as the audit progresses.

2. Importance of TP Documentation

2.1 Over the period, since the time Indian transfer pricing regulations came into existence, the documentation has been the most crucial aspect in evaluating the arm’s length nature of the transaction. The Indian tax authorities have given due importance to the documentation prepared and maintained by the taxpayer before concluding the arm’s length nature of the inter-company transaction. The Delhi High Court in case of Maruti Suzuki India Limited2 held that during transfer pricing proceedings, the revenue authority can reject the ALP computed by the taxpayer and determine it only when the revenue authority finds that the taxpayer has not discharged its responsibility of computing ALP in consonance with the relevant provisions of the Act. Therefore, maintaining TP documentation is important from various perspective such as:

-

- Demonstrate at ALP: The ultimate endeavour of the taxpayer is to demonstrate that the intercompany transactions are undertaken in accordance with the arm’s length principle. Hence, in order to demonstrate intercompany transactions to be at ALP, the taxpayer need to document analysis undertaken, assumptions made and detailed and methodological search process to substantiate comparable data.

- Discharge burden of Proof: Prima facie, it provides an assurance to the tax authorities that the taxpayer has maintained required documentation as mandated and duly undertaken required analysis to come to conclusion that the intercompany transaction is at arm’s length.

- Syncing various TP documentation – Another important aspect is to align the information shared through various compliance requirements. The taxpayer needs to ensure that the information presented in Documentation is in sync with Form 3CEB as well as with master file and CbC report. Further, wherever possible a reference of specific clauses of master file or CbC report can be given in the Documentation against relevant information.

- Different regulations pertaining to inter-company trans-actions: The transfer pricing regulations in India co-exist with the provisions under the Excise and Customs Regulations, the Companies Act, 2013 and the SEBI Guidelines. One of the intents of these regulations is to ensure transactions between related parties are at arm’s length. Hence, the importance of preparation and maintenance of appropriate documentation to demonstrate arm’s length nature of such transactions is manifold.

3. What are the documentation requirements as per Indian transfer pricing regulations?

3.1 TP Documentation/Local File: Section 92D(1) provides that every person who has undertaken an international transaction or specified domestic transaction shall keep and maintain such information and documents in respect of such transactions as may be prescribed. This information requirement is in line with the local file recommended by OECD BEPS Action 13.

3.2 Master File and Country by Country Reporting: Further Section 92D was amended to provide for maintaining of the Master File by every constituent entity of an International Group (IG) and filing of CbC report to align with OECD three-tiered documentation approach. Section 92D(2) emphasize on the information and documents to be maintained by the constituent entity3 of an international group4 in respect of an international group.

3.3 The ensuing chapter first discusses the documentation requirements for local file i.e. TP Study Report. The Master file and CbC documentation requirements have been discussed subsequently in this chapter.

- Transfer Pricing Documentation (TP Study/Local File)

3.4 The documentation to be maintained has been prescribed under Rule 10D. Rule 10D(1) enunciated different types of documents and information to be maintained by the taxpayer in respect of its international transactions whereas Rule 10D(3) list down the documents to be maintained in support of the same. In summary, the Rule 10D provides for 13 items of mandatory documentation and an additional 7 items of supporting documentation to be maintained by the taxpayer, which inter alia include:

-

- Ownership structure of the taxpayer;

- Profile of multinational group;

- Broad description of the business/industry profile;

- Nature and terms (including price) of international transactions;

- Description of functions performed, risks assumed, and assets employed;

- Records of economic and market analysis (economic analysis), forecasts, budget etc.;

- A record of uncontrolled transactions for analysing comparability with international transactions;

- A record of analysis performed to evaluate comparability of uncontrolled transactions vis-à-visinternational transaction;

- Description of method considered with reasons of rejection of other methods;

- A record of the actual working carried out to determine arm’s length price, most appropriate method, and adjustments, if any;

- The assumptions, policies, and price negotiations if any;

- Details of assumptions, policies, negotiations, etc. that have affected the determination of arm’s length price;

- Details of adjustment made to transfer prices to align with arm’s length price.

3.5 Diagrammatic Representation: Interdependency between the various aspects of the mandatory documentation requirements noted above is presented by way of the following chart:

3.6 Supporting Documentation: The supporting documentation to be maintained as per Rule 10D(3) includes information regarding official publications, reports, studies, and data bases from the Government of the country of residence of the associated enterprise, reports of market research studies carried out and technical publications, price publications, published accounts and financial statements relating to the business affairs of the associated enterprises, agreements and contracts entered into with associated enterprises or with unrelated enterprises in respect of transactions similar to the international transactions, letters and other correspondence between taxpayer and the associated enterprise, etc.

3.7 Aggregate Value Limit of ` 1 Crore: The Rules [Rule 10D(2)] specify that every person who has entered into an international transaction, the aggregate value of which exceeds ` 1 crore, is required to keep, and maintain information and documents as prescribed. In a case where the aggregate value as recorded in the books of account, of international transactions entered into by the taxpayer does not exceed ` 1 crore, the information, and documents as specified are not required to be maintained. However, the taxpayer shall be required to substantiate, on the basis of material available with him, that income arising from international transactions entered into by him has been computed in accordance with section 92, i.e. it is at arm’s length price.

3.8 Time Limit for Maintenance: The Rules further specify that the information and documents maintained under the Act should be contemporaneous and should exist latest by the specified date referred to in clause (iv) of section 92F i.e. one month before due date for furnishing of return of income under section 139(1) for the relevant assessment year. Further the documentation should be kept and maintained for a period of 8 years as per Rule 10D(5) from the end of the assessment year to which the Documentation relates.

3.9 Obtaining and filing Accountant’s report by the due date: The need to maintain Documentation on a contemporaneous basis is underscored by the requirement under the Regulations to obtain and file an Accountant’s Report in Form 3CEB5. The Form inter alia requires an opinion to be expressed by the signing Accountant as to whether the prescribed Documentation is maintained and whether it is appropriate and complete.

3.10 Accountant: The Accountant shall have the same meaning as in the Explanation below sub-section (2) of Section 288 [Section 92F(i)] and it is not necessary that the Accountant’s Report to be issued under the Act is to be issued by the statutory auditor of the taxpayer. However, Form 3CEB mentions that the report from an accountant to be furnished under section 92E relating international transaction(s) and specified domestic transaction(s) has to be signed by; (i) a chartered accountant; or (ii) any person who, in relation to any State, is, by virtue of the provisions in sub-section (2) of section 226 of the Companies Act, 1956 (1 of 1956), entitled to be appointed to act as an auditor of companies registered in that State.

3.11 Onus to demonstrate ‘arm’s length nature’: The onus is on the taxpayer to determine an arm’s length price in accordance with the Rules, and to substantiate the same with the prescribed documentation. Where such an onus is discharged by the taxpayer and the data used for determining the arm’s length price is reliable and correct, there can normally be no intervention by the TPO. Apart from mandatory requirements, the taxpayer should bear in mind that once the taxpayer has fulfilled its responsibility of maintaining and furnishing the transfer pricing documentation in respect of the international transactions entered into by it, the TPO will then examine the appropriateness of the documentation as well as the determination of the arm’s length price of the international transactions. Therefore, to avoid any difference in opinion by the TPO on the determination of the arm’s length price, the taxpayer should follow adequate record keeping practices and voluntary production of documents. This approach would also increase the persuasiveness of its case before the TPOs. Further, it is important to note that, greater the complexity of the taxpayer’s case, greater is the significance of adequate and robust Documentation.

3.12 During the course of any proceedings under the Act, the TPO may require any person who has undertaken an international transaction to furnish any of the information and documents specified under the said Rule within a period of thirty days from the date of receipt of notice issued in this regard, and such period may be extended by a further period not exceeding thirty days.

3.13 Extent of Documentation: If one is to have a cursory look at the Documentation requirements prescribed under the Indian Transfer Pricing Regulations, one could see that the documents/information required to be maintained by the taxpayer are detailed and same will help the taxpayer in supporting its case that the international transactions are at arm’s length. Further, maintaining adequate documentation also acts as a safeguard against rigorous penalty provisions. The taxpayer while maintaining documentation, and the tax authorities while requiring the production thereof, are therefore required to adopt a pragmatic approach. On more than one occasion the Income-tax Appellate Tribunal (ITAT) has underscored the need to adopt a pragmatic approach in this regard. The ITAT in its ruling in case of Cargill India (P.) Ltd.6 has stated that only documentation which has a bearing on the international transaction are required to be maintained and taxpayer cannot be penalized for not maintaining all the documents stated in Rule 10D of the Rules, if they are not relevant for determining the arm’s length price of the international transactions undertaken by the taxpayer.

3.14 The justification of arm’s length standard includes in its fold a multitude of factors. Even though one may have considered the aforementioned factors, documenting the same assumes prominence from a justification as well as transfer pricing audit perspective. Transfer Pricing Regulations around the world have tried to address the issue of justification of the transfer pricing by requiring detailed documentation and India is no exception to it.

3.15 The OECD Guidelines heavily stresses on the importance of maintaining documentation to support the determined ALP, and that tax administrations should be able to verify, from such documentation maintained, the arm’s length nature of the international transaction in question. To summarize, the following principles are advocated by the OECD Guidelines in connection with documentation to be maintained by the taxpayer:

-

- Documentation should be maintained and be made available by the taxpayer in order to establish the arm’s length nature of the international transaction;

- Tax administrations must be rational and reasonable in their approach while advocating upon the extensiveness of the documentation that should be maintained to justify the arm’s length nature of the international transaction;

- Documentation should be in line with the existing business management principles followed by the taxpayer while evaluating a certain business decision; and

- The requirement to maintain documentation should not result in high cost and an administrative burden for the taxpayer, especially in situations where the requirement results in preparation of documentation that would not have otherwise been prepared by the taxpayer.

3.16 The Documentation requirements prescribed under the Indian Transfer Pricing Regulations touch upon a multitude of factors and issues. This chapter endeavours to touch upon the most basic as well as the most intricate requirements/issues vis-à-vis documentation requirements under the Regulations and its practical importance. Further, at the end of the Chapter, sample Documentation formats relevant for various business models are also provided, which could provide a high level guidance for the manner in which the Documentation could be maintained.

4. Approach to Documentation

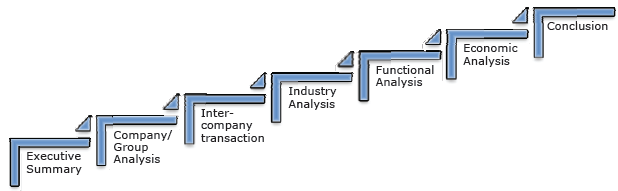

Although the Regulations do not specify any particular format in which the Documentation is to be maintained by the taxpayers, over the years, since the implementation of the Regulations in India, TPOs have favoured an organized and systematic approach to maintenance of Documentation. The most pragmatic approach to Documentation is to collate it in the form of a Report that starts with the most basic and generic information, building a context for the specific international transaction of the taxpayer during the year under review and then delving into the more specific aspects such as functional and risk analysis, the determination of the arm’s length price(s) and concluding finally with the comparability analysis between the arm’s length prices so determined with the transfer prices of the taxpayer. The general flow of transfer pricing documentation has been depicted as below:

4.1 Executive Summary

4.1.1 The objective of transfer pricing analysis is to support the arm’s length nature of international transactions and specified domestic transactions entered into by the taxpayer. Therefore, the essence of the transfer pricing documentation and all major observations and findings has to be summarily discussed at the start of the report.

4.1.2 The executive summary should clearly enumerate the gist of the detailed analysis and information captured in transfer pricing Documentation Report, such as:

-

- The business overview of the group and the taxpayer;

- Relationship between the taxpayer and its associated enterprise;

- Characterization of the entities based on functional and risk analysis;

- List of international transactions or specified domestic transactions along with the value of the transactions and methodology used to benchmark the transactions; and

- Summary of economic analysis undertaken.

4.1.3 Also, it is important to mention the fact that the results obtained in the transfer pricing Documentation, are pertinent to that financial year and the results may need to be updated based on latest financials result, change in functional and risk profile or the level of tangible/intangible asset owned (i.e. the need to review and update the transfer pricing policy/arrangement to reflect change in market conditions).

4.2 Company/Group Overview

4.2.1 Group structure and Ownership linkages: The taxpayer should appropriately document its shareholding structure as well as the overall group structure, to the extent relevant to the Indian taxpayer and its international transactions. The ownership linkages among the group entities should also be mentioned, as the same would enable one to easily identify the entities within the group which would qualify as “associated enterprise” (“AEs”) as specified in section 92A(2), under which the two become associated enterprises. Further, in view of specific requirements of Rule 10D of the Rules, it is imperative to mention the name, address, legal status, and country of tax residence country of tax residence of each of the AEs.

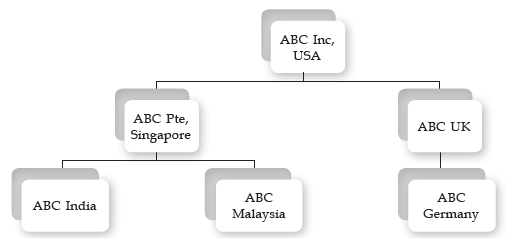

4.2.2 Diagrammatic representation: The aforesaid information, if presented in the form of a chart or a table would provide a better optical view of the group structure and would be easy to comprehend. An illustrative presentation of the group structure of an MNC group is presented below:

4.2.3 Business overview of the Group: The Documentation should contain an overview of the business of the MNE group of which the taxpayer is a member. This section should also include the overview of the business operations of the taxpayer, especially, its activities in relation to which international transactions have been entered into with its AEs, a brief background (date of incorporation, employee base, global presence etc.), short description of the business segments, financial performance of the entity, activities performed/services offered under each segment and the product profile. The information in this regard could be obtained from and linked to the information contained in the Director’s Report, company’s/group website and other publicly available authentic data. This information would give an overall understanding of the business operations of the Indian entity within the overall group structure. This would also form a base for carrying out an analysis of the functions performed, assets employed, and risks assumed (“FAR analysis”) and also the economic analysis.

4.2.4 Business overview of the transacting AEs: Lastly, a brief business description of each of the AEs with whom the taxpayer has international transactions including section reference as per which it becomes an AE, should also be included in the Documentation. This enables an easy understanding of the business activities of the AEs and gives an overview of the relevance of the activity of each of the entities within the group.

4.2.5 Summary: In summary, the group overview section could contain information such as:

-

- the lines of business in which the MNE group is engaged;

- key products dealt-in by the group and its market leadership;

- global positioning in terms of presence in various countries, number of employees in the group;

- major historical events like global mergers or acquisitions, if any;

- a snapshot of the key financial numbers;

- description of transactions entered into with AE; and

- awards and recognitions etc.

4.2.6 Business Overview of the taxpayer: The documentation should also include a brief description of the business of the Indian company with respect to the year under review.

4.2.7 The different aspects which can be included are as under:

-

- the historical background of the company’s operations like date of incorporation, significant events like mergers and acquisitions etc.;

- organization structure –a high level diagrammatic representation would be advisable;

- business activities carried out by the Indian entity i.e., whether it is a manufacturer, trader, or a services provider;

- products and services offered by the taxpayer and the industry in which such products are used;

- the geographical presence of the entity;

- manufacturing facilities;

- number of employees;

- research and development (R&D) activity, if any, carried out by the company;

- key customers;

- any key event during the year under consideration which would have impacted the business as a whole; and

- the industry in which the goods manufactured/distributed, service provided by the taxpayer is consumed, can also be mentioned to establish the dependence of the taxpayer’s business on any particular industry.

4.3 Industry Analysis

4.3.1 Requirement: Rule 10D(1)(c) requires a taxpayer to prepare an overview of the industry in which the entity operates. The industry overview should be drawn from relevant industry associations or other authentic sources and should more specifically discuss conditions prevailing in the market during the year under consideration both from a global as well as domestic perspective.

4.3.2 For instance, recently the outburst of novel corona virus (COVID-19), has not only impacted day to day lives but also led to shutting down business due to nationwide lockdown. Some industries were operating under essential services, therefore were not impacted much by the pandemic. However, for majority of industries, business was shut for few months. The pandemic changed ways of doing business wherein business had to incur various cost to go the digital way. The pandemic impacted top line/bottom line of various businesses whereas the fixed cost remained at Pre-Covid level. In case of some industries, the cost savings due to work from home nullified the impact of Covid on the bottom line.

4.3.3 Such events which are correlated to industry, economic situation in particular, are required to be taken into consideration while documenting the industry overview. Appropriate documentation of industry overview will help to justify the potential impact on the arm’s length analysis.

4.3.4 Objectivity: The industry overview should be objective and should bring out the nuances affecting the players in the taxpayer’s business. The same should also discuss the value drivers of the taxpayer’s industry which enables one to understand the criticality of the functions performed by the taxpayer and the AEs in the scheme of overall business operations.

4.3.5 Details to be covered: Further, certain industries are highly regulated, in which case the relevant regulatory framework and its impact on the pricing of the international transaction, if any, should also be discussed. In case there are certain critical factors which distinguish the taxpayer from the industry at large, the same could form the basis of making appropriate economic adjustments while carrying out the benchmarking analysis and hence, should be highlighted. For example, in case the taxpayer is a new entrant in the industry as compared to other established players operating in the industry, the said fact can be used to demonstrate that the results of the taxpayer would be impacted by such difference and could form the basis for appropriate economic adjustments on account of being a new entrant in the industry. The industry overview may also include a list of the taxpayer’s competitors. Further, a link can also be drawn to the comparables selected while benchmarking the international transactions of the taxpayer.

__________________

Authored by:

Karishma R. Phatarphekar is a CA and lawyer by profession and a Partner with Deloitte Touche Tohmatsu India LLP and leads the Tax Controversy Management team. She has more than two decades of experience in TP with extensive experience on dispute resolution, global compliances and consulting on complex transfer pricing issues.

Shefali Shah (L.L.B, MBA (Finance), M.A. (Economics)) is a Director in Deloitte Touche Tohmatsu India LLP, Transfer Pricing. She has over 15 years of niche Transfer Pricing experience in advising MNCs on end-to-end transfer pricing solutions including transfer pricing planning opportunities, BEPS, TP documentation, APA, TP Litigation etc.

1 All references to Sections are Sections contained in the Income-tax Act, 1961 unless otherwise indicated. Similarly, all references to Rules are to Rules contained in the Income-tax Rules, 1962 unless otherwise indicated.

2 W.P.(C) 6876/2008.

3 “constituent entity” means,—

(i) any separate entity of an international group that is included in the consolidated financial statement of the said group for financial reporting purposes, or may be so included for the said purpose, if the equity share of any entity of the international group were to be listed on a stock exchange;

(ii) any such entity that is excluded from the consolidated financial statement of the international group solely on the basis of size or materiality; or

(iii) any permanent establishment of any separate business entity of the international group included in sub-clause (i) or sub-clause (ii), if such business unit prepares a separate financial statement for such permanent establishment for financial reporting, regulatory, tax reporting or internal management control purposes;

4 “international group” means any group that includes,—

(i) two or more enterprises which are resident of different countries or territories; or

(ii) an enterprise, being a resident of one country or territory, which carries on any business through a permanent establishment in other countries or territories;

5 Rule 10E read with Section 92E

6 300ITR(AT) 223.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA