Taxmann.com’s Practice | Introduction, Features and Benefits

- Blog|

- 10 Min Read

- By Taxmann

- |

- Last Updated on 26 July, 2023

Introduction

Your virtual legal advisor that helps you understand complex legal concepts and enables you to give instant & best-in-class advice to your clients.

This platform delivers complete, updated, accurate, and authentic content in a simple language that is easy to understand.

Start your search on any concept of the Law using keywords or section no.:

Features of Taxmann.com | Practice

1. Search Engine | Answers are Just a Search Away!

How is Taxmann’s Practice Search Engine different from Google?

-

-

- [Artificial Intelligence] Taxmann’s Practice platform is supported by a powerful search engine, labelled with Artificial Intelligence, to give you the most appropriate and latest record instantly

- [Customised for the Law] The search engine has been built specially to search in the legal database

- [Auto-Complete] This feature helps you access any document directly from the search box & it assists you with the recommendation and link of the matching record(s)

- [Scientifically Indexed Documents] Every document has been prepared and indexed so that the search engine gets you the best result quickly.

- Search a document with a Keyword or Section No., Rule No., Para-heading, etc.

- Know the type of a document even before accessing it

-

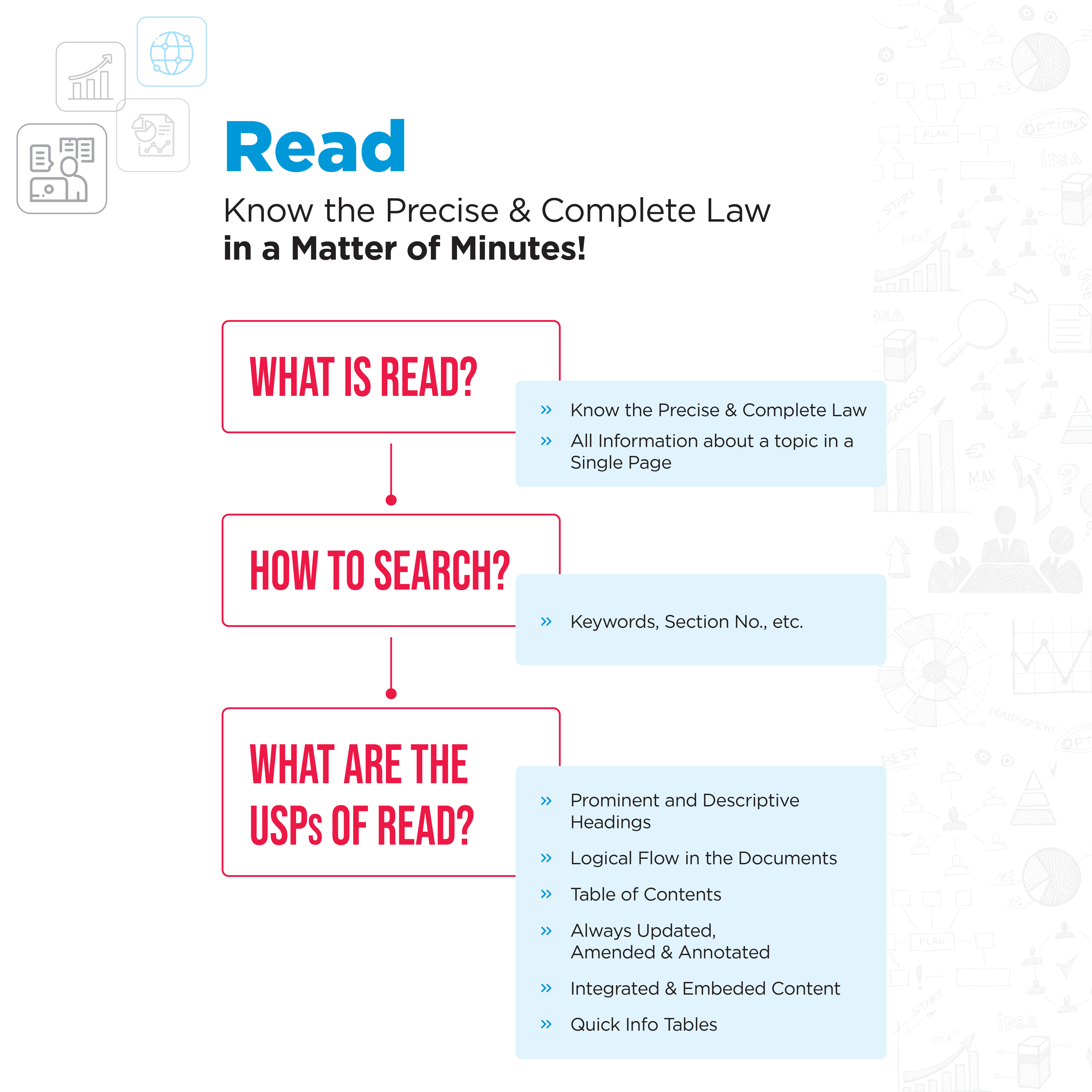

2. Read | Know the Precise & Complete Law, in a Matter of Minutes!

What is Read in Taxmann’s Practice?

-

- [Know the Precise & Complete Law] on every topic, in simple and lucid language

- [Voluminous Information; in a Single Page] All relevant Sections, Rules, Circulars, & Notifications, etc. are covered in the Read documents so that you get complete information, without referring to multiple voluminous sources of information

How to Search in Taxmann’s Practice?

-

- [Keywords, Section No., etc.] Search on any Topic using a keyword or Section or Rule No., etc. The possibilities are endless

What are the USPs of Read in Taxmann’s Practice?

-

- [Prominent and Descriptive Headings] make it easier for you to find the information you are looking for

- [Logical Flow in the Document] makes it easy for you to understand the complex topics

- [Floating Table of Contents] Navigate to the relevant paragraph with a floating ‘Table of Contents’

- [Always Updated, Amended & Annotated]

- [Real-time Basis] All ‘Read’ documents are updated on a real-time basis to give you only the latest and accurate information each time

- [Annotations] of every change in the document with a hyperlink of the source document

- [Integrated & Embedded Content]

- [Multiple Contextual Hyperlinks] are placed across the document to enable you to access the connected documents instantly

- [Reference of all Principles] derived from Case Laws, Circulars & Notifications

- [Quick Info Table] to access the bare Section(s), Rule(s), Form(s), Circulars & Notifications

3. FAQs | Your Queries + Our Expertise = Your Answer

-

- Releasing Shorly

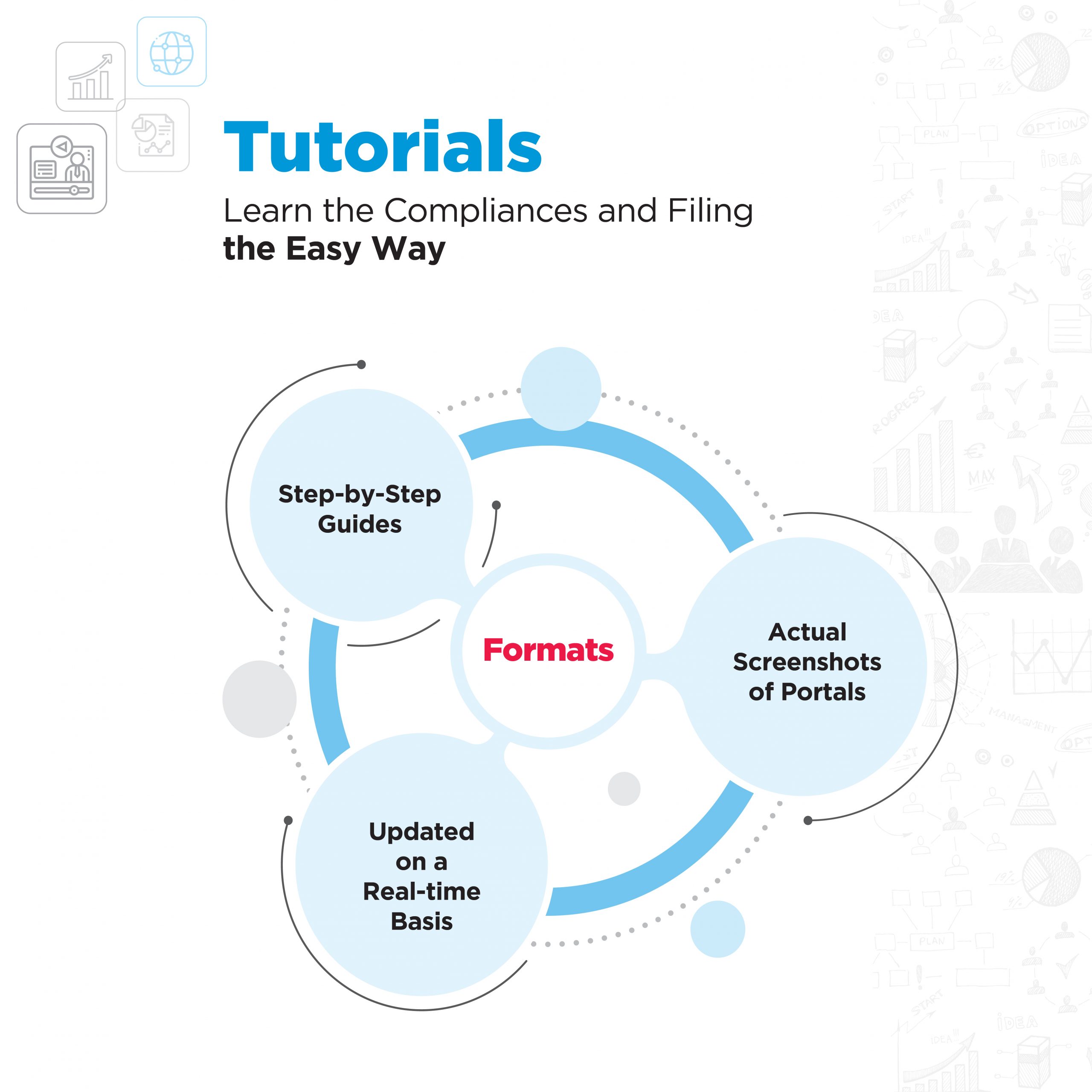

4. Tutorials | Learn the Compliances and Filing, the Easy Way

-

- [Step-by-Step Guides] for all compliances, grievances, filings, registrations, etc.

- [Actual Screenshots of the Portals] Learn the compliance or filing in steps with the help of actual screenshots of the portals

- [Updated on a Real-Time Basis] All tutorials are updated on a real-time basis to give you only the latest and accurate information

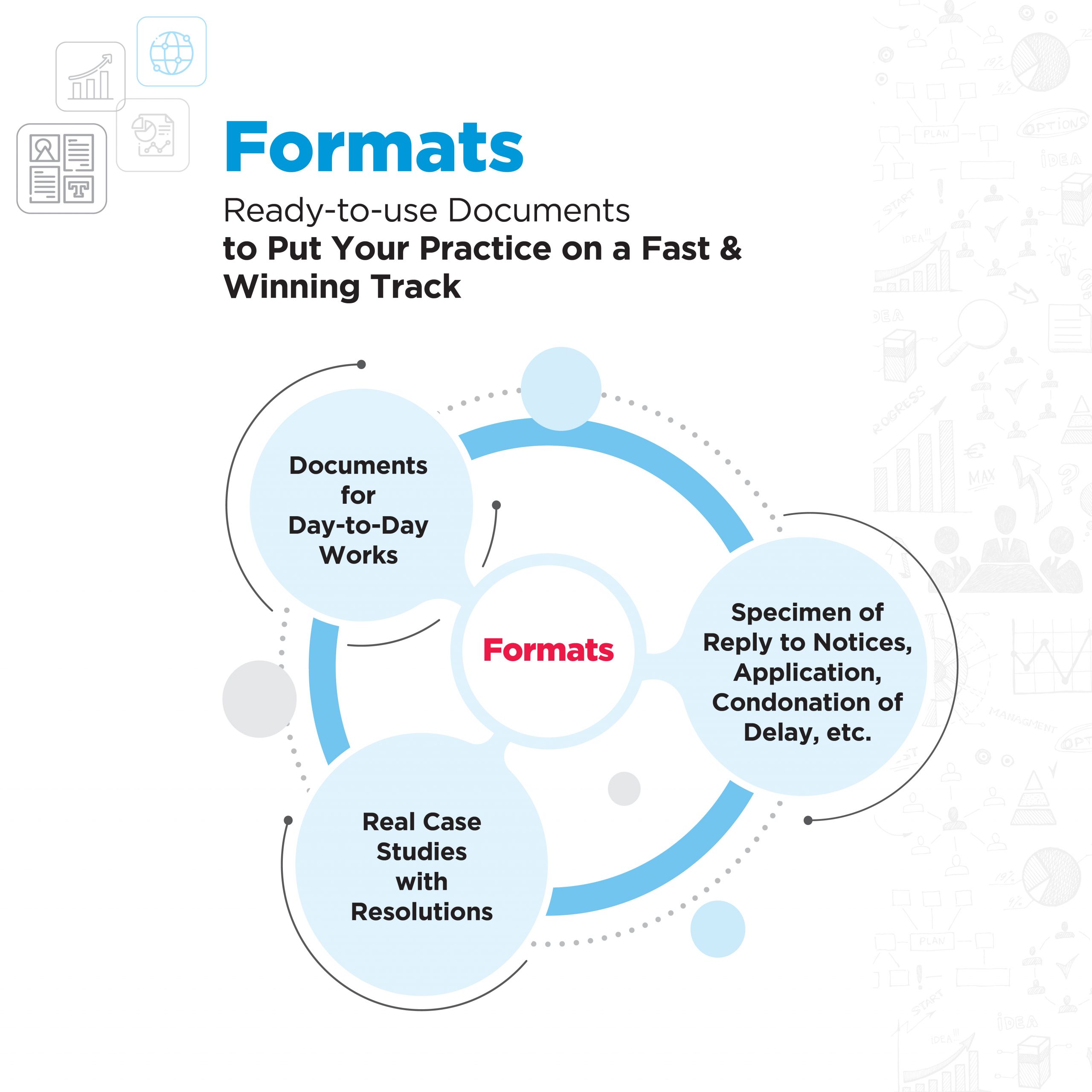

5. Formats | Ready-to-use Documents, to Put Your Practice on a Fast & Winning Track

-

- [Documents for Day-to-Day Works] Formats covers specimens of relevant documents that you need on a routine basis

- Specimen of reply to notices, applications, condonation letters, appeal submissions, deeds, and agreements

- [Real Case Studies] are covered for various grievances, with all possible resolutions

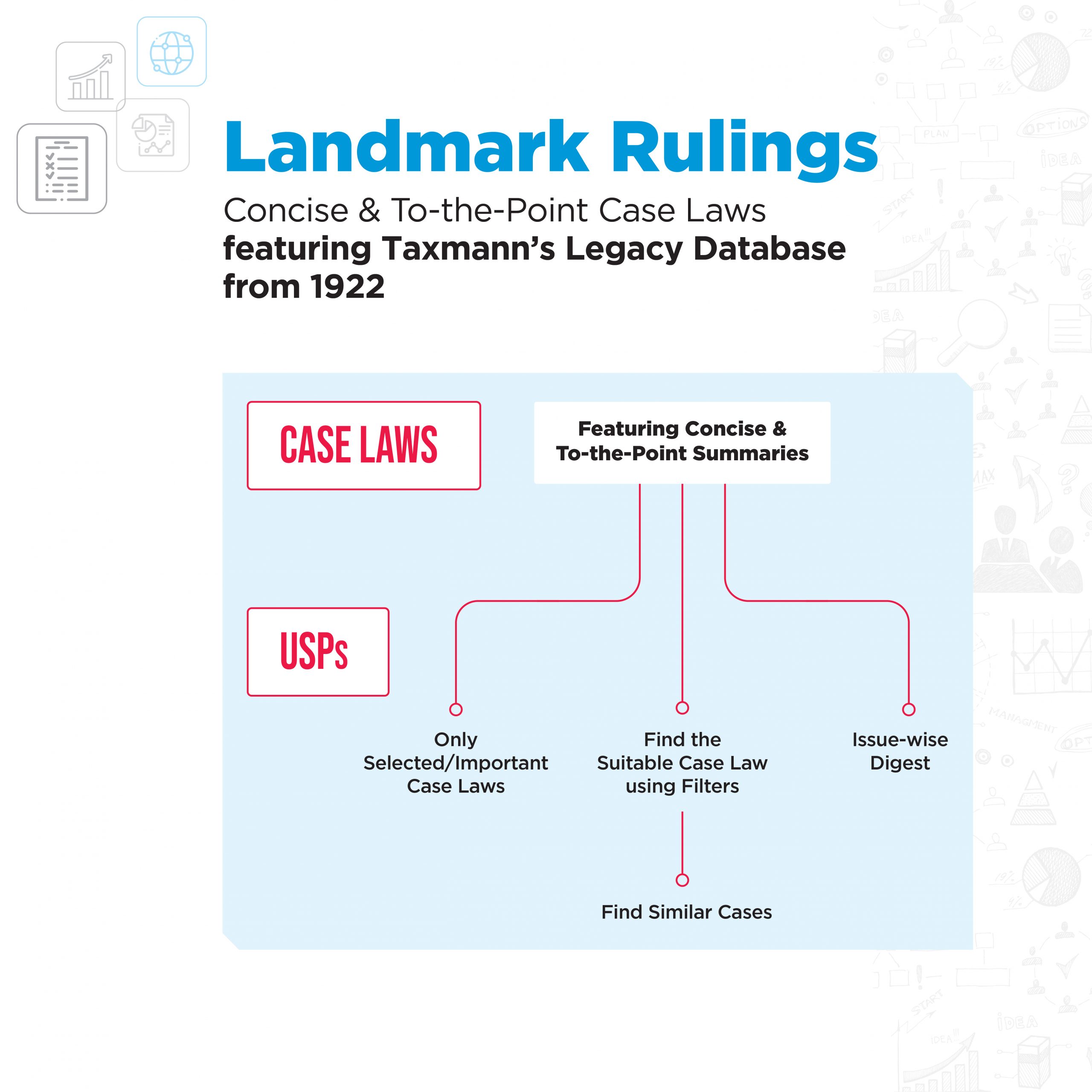

6. Landmark Rulings | Concise & To-the-Point Case Laws, featuring. Taxmann’s Legacy Database since 1922

-

- [Concise & To-the-Point Summaries] with a link to see the entire Order

- [Selected/Important Case Laws] which are sustainable before the authorities

- [Issue-wise Digest] of all landmark rulings

- [Find the Suitable Case Law using Filters] based on court, bench, favour of, date of judgment, etc.

- [Find Similar Cases] under one heading

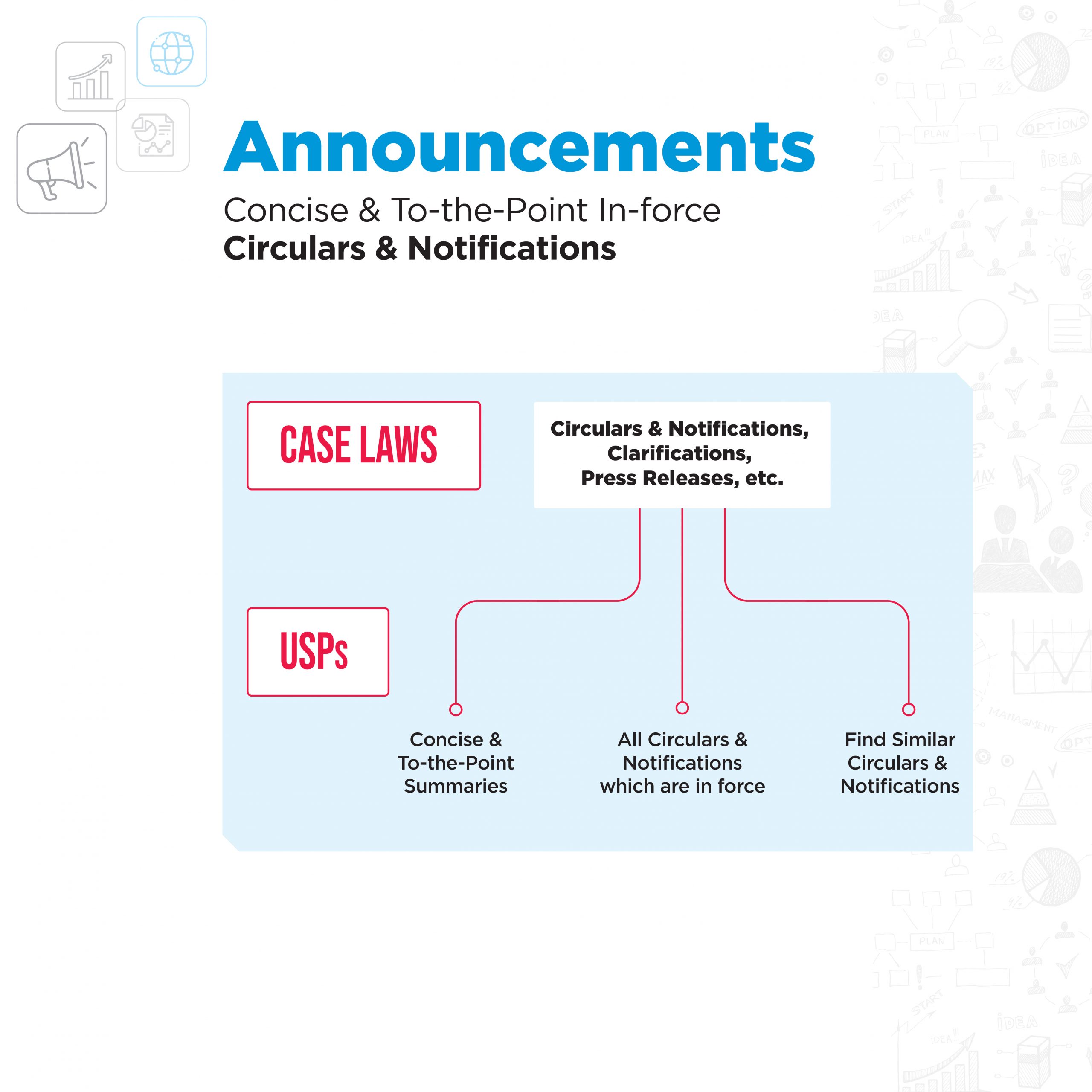

7. Announcements | Concise & To-the-Point In-force Circulars & Notifications

-

- [Concise & To-the-Point Summaries] with a link to see the bare text

- [Selected/Important Circulars & Notifications, etc.] which are still in force

- [Find Similar Circulars & Notifications, etc.] under one heading

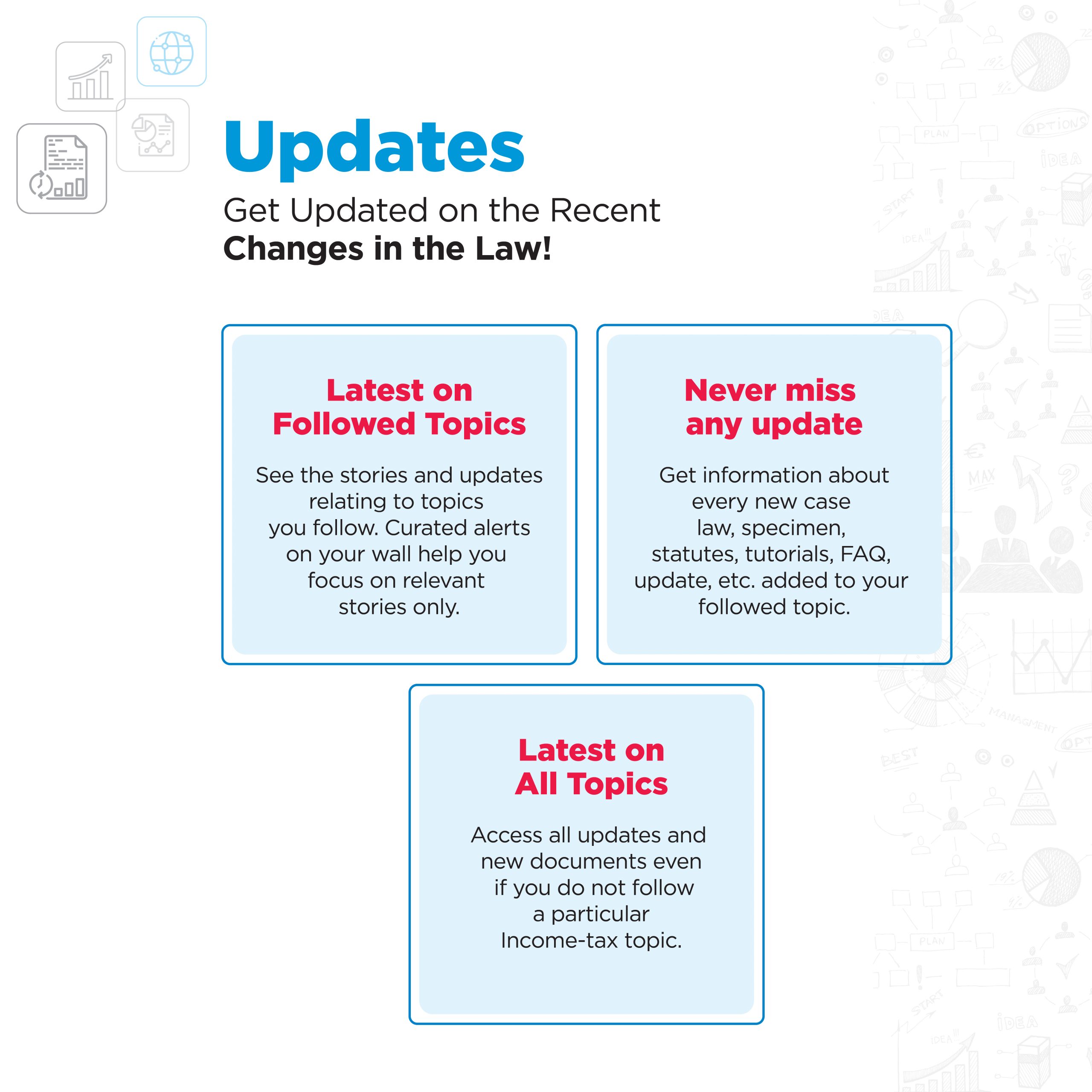

8. Updates | Get Updated on the Recent Changes in the Law

a. My Feeds | Created for You, with Accuracy & Authenticity

What are My Feeds in Taxmann’s Practice?

-

-

- [Personalised for You] ‘My Feeds’ is your page that shows you the stories and updates relating to topics you follow

- [Curated Alerts] on your wall so that you focus on relevant stories only

- [Never Miss an Update] Get information about the number of new updates since your last visit so that you do not miss any update

- [See, Who’s Reading What?] that your peers are reading

- [Instant Alerts] for any update that is creating a buzz

- [Personalised for You] ‘My Feeds’ is your page that shows you the stories and updates relating to topics you follow

-

For Example

Suppose a user follows the topic of the return of income. In that case, he gets instant information for any change in provision (i.e., Section 139, Rule 12, etc.), extension in due date, a new pronouncement on return of income, a new specimen of application, any circular or notification issued by the CBDT, a FAQ uploaded on any complex issue and much more

What information will I get in My Feeds?

-

-

- [Information about Everything New] Get information about every new Case Law, Specimen, Statutes, Tutorials, FAQ, Format, etc., added to your followed topic, etc.

-

What are the USPs of My Feeds?

-

-

- [We Decode the Changes for You] Understand every complex amendment and change in a simple and lucid language

- [By the Professionals, For the Professionals] All stories pushed in your feeds are complete, accurate, and authentic. Every story you read is prepared and reviewed by a team of experienced professionals

- [In Your Mailbox] Get regular alerts in your mailbox on the topics you follow

-

b. All Feeds | Information is the Key!

Why do I need All Feeds when I am following topics in My Feed?

-

-

- Let us suppose you do not follow a particular Income-tax topic. However, there is a new update that impacts your existing client. In this case, you can access this story from All Feeds.

-

What all is included in All Feeds?

-

-

- [Covering Tax & Corporate Laws] All Feeds covers all updates related to Income-tax, GST, FEMA, Accounting Standards and Companies Act

-

9. Discover Topics |Find your Topic, Make your Work Easier

-

- [Exhaustive List of Topics] all in one place

- [Follow/Un-follow Topics] with a single click

- [Create your Feed] by choosing the relevant topics alphabetically or as per the area of your interest.

- [Start your Search on any Concept of the Law] using keywords or section no. Your search will be followed by:

- [Read] which enables you to know the precise and complete law in a matter of minutes

- [FAQs] consists of research papers drafted by Taxmann’s Editorial Board

- [Formats] which consists of ready-to-use documents

- [Tutorials] for learning & filing the compliances, the easy way

- [Landmark Rulings] which consists of concise & to-the-point Case Laws

- Announcements which consists of brief & to-the-point Circulars & Notifications

- [Latest Updates] to enable you to stay updated on the recent changes in the Law

For Example

Search ‘Income-tax refund’ to read the provisions of Section 237 to Section 245 in ‘Read’. In the adjacent tabs, access the FAQs, Formats, Tutorials, Landmark rulings, Announcements, and Updates relating to Income-tax Refund.

10. Related Documents | Exceed the Likely Outcome

-

- [Labellled Artificial Intelligence] Every document opened by the user suggests a list of related documents in an adjacent panel

- [All-in-one Place] These related documents help the users to access the connected document easily

- [Cutting the Clutter] This feature recommends related updates, landmark rulings, tutorials, formats, etc.

11. 360° View of Topics | Everything you need, to deliver advice to your clients

-

[360° Coverage of Various Laws] Covering transactions that might have implications under multiple Acts, and it is not practical for any professional to know about each provision under these Acts

[360° Coverage of Various Laws] Covering transactions that might have implications under multiple Acts, and it is not practical for any professional to know about each provision under these Acts- [Highlighting relevant Provisions & Compliance Requirements] from multiple Acts applicable to a transaction with contextual hyperlinks to read the provision in detail

- [Critical Business Transactions] are covered

- Every ‘360° View of Topics’ page of a transaction covers the following documents:

- Implication under Income-tax Act

- Implication under GST Act

- Implication under Companies Act

- Implication under FEMA Act

- Implication under Accounting Standard and/or Indian Accounting Standards

For Example

Dividend is a multidimensional transaction. The 360° View of Topics feature of the platform provides Dividend (360° View), Dividend under Income-tax Act, Dividend under Companies Act, Dividend under FEMA, Dividend under Accounting Standard, Dividend under GST

12. Frequently Asked Question for Taxmann.com | Practice

What is Taxmann’s Practice?

Taxmann’s Practice is a virtual legal assistant for small and medium practitioners and professionals. This platform has everything to help the professionals to:

-

- Understand complex legal concepts;

- Give instant and best-in-class advice;

- Write extraordinary submissions for assessments and appeals;

- Answer all challenging inquires of clients and management; and

- Learn the process of compliances required under various laws.

What does Taxmann’s Practice do?

This platform delivers complete, updated, accurate, and authentic content in simple language that is easy to understand and use. You can search any concept using keywords or Sections. It provides you with in-depth coverage on every concept from all applicable laws.

What are the unique features of Taxmann’s Practice?

One of the unique features of tax practice is inter-linking between different laws. For example, you wish to know about the implications of selling immovable property. This platform provides guidance from the Income-tax Act, GST, Company law, Accounting Standard, and FEMA relating to the sale of immovable property.

Why are the problems of Small-Medium Practitioners?

Small and medium practitioners and professionals working in the industry often struggle to get the updated, accurate and comprehensive guidance on any transaction or concept. They have no choice but to refer to free blogs and spurious information on social sites or discussion forums. Though many websites provide a summary of the provisions, but these are not updated regularly. Thus, it is distressing for any professional to guide the client or the management relying on such information, which might be outdated, incomplete, or inaccurate. Furthermore, Indian laws are both dynamic and expansive. An Act is not sufficient to understand a concept unless it is read in conjunction with relevant Rules, Circulars, and Notifications prescribed in relation to that. Sometimes it is also essential to know the jurisprudence to conclude a complex problem. The process of researching and understanding takes a considerable amount of time and effort.

Why should I subscribe to Taxmann’s Practice?

Taxmann’s Practice gives you access to everything you need to know about a concept or a transaction in simple language from a single window. It gives you updated, comprehensive, authentic, and accurate guidance on every aspect of tax and corporate laws. A team of professionals has compiled and vetted each document uploaded on the platform. These documents are constantly amended on a real-time basis to ensure that the information you rely on is accurate and tenable before the authorities. It will save your considerable time and effort in legal research and understanding the concepts.

How is it different from Taxmann’s Research?

Taxmann launched a research platform for tax professionals working in litigations, advisory, or assessment. This platform has a database of case laws, statutes, articles, commentaries, and much more. In the last 20+ years, Taxmann’s Research has become the first choice for revenue officers and professionals to access authentic statutory material, case laws, and other research material. It is meant for those who already know the law but are interested in research that helps them in litigation, assessment, and advisory work.

In contrast, professionals working in small and medium-sized firms or entities need a platform to understand the law, to get regular and relevant updates, but they have limited research needs. Taxmann’s Practice is for such professionals. It explains the law relating to every concept in a simple language that is complete, accurate, and constantly updated.

What do I get in Taxmann’s Practice?

When you search for a concept, you first get the ‘Read.’ It explains the fundamentals of that concept in lucid and straightforward language. The Read documents have been prepared considering the relevant Sections, Rules, Circulars, Notifications, and relevant judicial precedents. In the adjacent tabs of Read, you can access everything relating to that concept:

-

- FAQs on Complex Issues;

- Tutorials explaining the Compliances Required;

- Formats of Standard Replies;

- Deeds, or Applications;

- Summary of Landmark Rulings;

- Circulars & Notifications; and

- Recent Updates

All these documents are amended frequently on a real-time basis so that the information you are relying upon remains valid and tenable before the authorities.

How can I search for a document in Taxmann’s Practice?

You can search the guidance material on any concept by searching the keyword, Section, or Rule number. You can also navigate any document through the ‘Discover Topic’ function, which collates and groups all records in a tree-view and list-view. Further, the contextual hyperlinks and list of related documents in every document’s right panel help you find the required material quickly.

Can I download a document from Taxmann’s Practice and use it for my purpose?

Yes, every document can be copied and downloaded from the website. You can use the content to prepare consultancy reports for your client, prepare a submission for appeals or assessments, train your staff, and for any other purpose. However, the content cannot be used commercially or made available to the general public. For instance, you cannot use the content for writing an article or book for any website or publisher except Taxmann.

How can Taxmann’s Practice help me in preparing a submission for the faceless assessment or faceless appeal?

Due to a paradigm shift in the appeal and assessment proceedings, the authorities consider the merits and look for substance over form. Taxmann’s Practice gives you specimen submissions on the various impugned issues you can download and use. Further, the Read, Research Papers, and Guidance Material available on the platform help improve your submissions’ quality. You can also use the landmark rulings given in every topic to give more strength to your submissions.

How many modules Taxmann’s Practice has?

Taxmann’s Practice will have five modules – Income-tax, GST, Company Law, FEMA, and Accounting Standards. Initially, we have launched the Income-tax module, and the remaining modules will be launched shortly

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA

Sound interesting ! What is the price for all of that ? It would be nice to know a reasonable price for small practitioners with an Annual Income of up to 10-15 Lac

“Please see the pricing of Practice from the following link

https://www.taxmann.com/practice-pricing”

Can I clarify any doubt regarding Taxmann’s Practice?