Taxmann’s Analysis | Risk-Based Audit – Enhance Audit Quality with SA 315 & SA 330 Compliance

- Blog|Advisory|Account & Audit|

- 6 Min Read

- By Taxmann

- |

- Last Updated on 26 February, 2025

Risk-based Audit is an approach that focuses on identifying, assessing, and responding to areas of significant risk in financial reporting. It involves evaluating internal controls and tailoring audit procedures to address identified risks, ensuring auditors concentrate on critical areas that could lead to material misstatements. By leveraging standards like SA 315 and SA 330, this method enhances audit quality, improves transparency, and supports effective risk management in financial statements.

Table of Contents

- Introduction

- Identifying Risks Without Proper Documentation

- Overlooking the Role of Internal Controls in Risk Mitigation

- Inadequate Response to Assessed Risks

- Overlooking Fraud Risk and Management Override of Controls

- Weak Documentation Practices and Lack of Cross-Referencing

- Conclusion

1. Introduction

Auditing is not just about reviewing financial statements; it is about ensuring their accuracy, reliability, and compliance with professional standards. Two critical auditing standards, i.e. SA 315 and SA 330, form the foundation of a risk-based audit approach. SA 315 focuses on identifying and assessing risks of material misstatement, while SA 330 requires auditors to respond appropriately to those risks. However, quality reviews have repeatedly highlighted deficiencies in how auditors document risks, assess internal controls and design audit procedures in response to identified risks.

This article integrates key observations of non-compliance from SA 315 and SA 330, clarifies the issues faced by auditors, and provides guidance to improve audit effectiveness. By addressing these gaps, auditors can ensure compliance with the highest professional standards and enhance the overall quality of audits.

2. Identifying Risks Without Proper Documentation

2.1 Relevant SA 315 Provisions

Para 25 – The auditor shall identify and assess the risks of material misstatement at:

- The financial statement level

- The assertion level for classes of transactions, account balances, and disclosures

Para 26 – The auditor shall identify risks throughout the process of obtaining an understanding of the entity and its environment, including relevant controls that relate to those risks.

| Observation |

| A significant issue in audit documentation is the failure to properly record identified risks and link them to the financial statements. In many instances, auditors use generic checklists that provide a broad overview but fail to explain the rationale behind the classification of risks as significant or non-significant. Moreover, the documentation often lacks a connection between risks and the corresponding financial statement areas, making it difficult to determine whether audit procedures are appropriately designed to address the risks. |

| AASB Guidance |

| Risk identification should not be limited to a checklist approach; it requires a thorough analysis explaining why a particular risk is deemed significant. Each identified risk must be explicitly linked to relevant assertions, financial statement items, and the potential for material misstatement. The audit file should provide a narrative discussion, supported by data, about the nature of the risk and how it affects financial reporting. The risk assessment must also be aligned with the audit strategy, ensuring that responses are proportionate to the level of risk identified. Clear documentation should include references to industry-specific risks, historical financial trends, and management discussions, creating a well-supported risk assessment process. |

3. Overlooking the Role of Internal Controls in Risk Mitigation

Relevant SA 315 Provisions

Para 12 – The auditor shall obtain an understanding of internal control relevant to the audit.

Para 18 – The auditor shall obtain an understanding of the information system, including the related business processes relevant to financial reporting.

Para 20 – The auditor shall obtain an understanding of control activities relevant to the audit, which are necessary to assess the risks of material misstatement.

| Observation |

| Internal controls, particularly IT-related controls, are frequently overlooked in audits. Many auditors do not test automated controls or IT-dependent processes, relying instead on manual verification. Additionally, some auditors place excessive reliance on internal auditors without independently evaluating their work. This lack of rigorous control testing weakens the audit’s effectiveness and increases the risk of undetected material misstatements. |

| AASB Guidance |

| Understanding and testing internal controls is fundamental to an effective risk assessment process. Auditors must go beyond assessing manual controls and evaluating IT-related controls, primarily in organizations that rely heavily on automated systems for financial reporting. IT general controls, application controls, and system-generated reports should be tested to ensure the integrity of financial data. If auditors choose to rely on the work of internal auditors, they must independently assess the scope, objectivity, and reliability of that work. All reliance on internal controls should be justified with supporting documentation, including test results and an evaluation of control effectiveness. A well-documented control assessment ensures that the auditor’s risk response is appropriately designed to address potential weaknesses. |

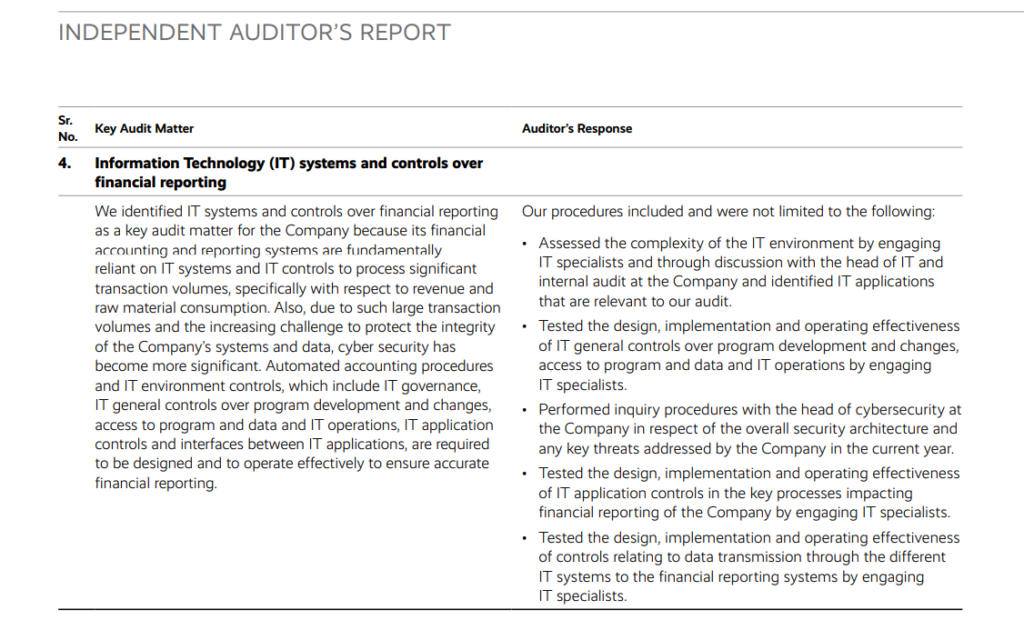

An extract from the Independent Auditor’s Report of Reliance Industries Limited

4. Inadequate Response to Assessed Risks

Relevant SA 330 Provisions

Para 5 – The auditor shall design and implement overall responses to address the assessed risks of material misstatement at the financial statement level.

Para 6 – The auditor shall design and perform further audit procedures whose nature, timing, and extent are based on and are responsive to the assessed risks of material misstatement at the assertion level.

| Observation |

| Even when risks are correctly identified, audit procedures often fail to address them directly. Many auditors apply standard substantive procedures such as vouching, confirmations, and analytical reviews without tailoring these procedures to the specific risks identified. Additionally, control testing is frequently ignored, with auditors defaulting to substantive procedures without determining whether internal controls could be relied upon. This disconnect between risk assessment and audit procedures results in inefficiencies and weakens the overall audit approach. |

| AASB Guidance |

| Audit responses should be designed to address the risks identified during the assessment process. If a particular risk is assessed as high, auditors should implement additional testing procedures, such as detailed walkthroughs, recalculations, and extended sampling. When relying on internal controls, auditors must perform control testing to ensure their effectiveness before reducing substantive procedures. Every audit procedure should be directly linked to a risk, with clear documentation explaining the appropriate approach. This ensures that audit work is targeted and effective in addressing potential misstatements. |

5. Overlooking Fraud Risk and Management Override of Controls

5.1 Relevant SA 240 and SA 330 Provisions

SA 240, Para 27 – The auditor shall treat assessed risks of material misstatement due to fraud as significant risks.

SA 330, Para 21 – When the approach to a significant risk consists only of substantive procedures, those procedures shall include tests of details.

| Observation |

| Many audits fail to consider fraud risk, particularly when management overrides controls adequately. Journal entry testing is often missing, and in cases where it is performed, the selection criteria for testing is unclear. Auditors frequently overlook the potential for biased management estimates, aggressive revenue recognition practices, and unusual transactions that may indicate fraud. This weak approach to fraud risk assessment increases the chances of material misstatements going undetected. |

| AASB Guidance |

| A comprehensive fraud risk assessment should include detailed testing of journal entries, particularly those made at the end of the reporting period. Auditors must evaluate accounting estimates to detect potential bias and scrutinize non-routine transactions for signs of fraud. Discussions with management about fraud risks and any inquiries made to those charged with governance should be documented. By implementing a structured fraud assessment process, auditors can identify and mitigate fraud risks properly. |

6. Weak Documentation Practices and Lack of Cross-Referencing

6.1 Relevant SA 230 and SA 330 Provisions

SA 230, Para 8 – Audit documentation must be sufficient for an experienced auditor to understand the work performed.

SA 330, Para 28 – The auditor shall document the linkage of audit procedures with the assessed risks.

| Observation |

| Many audit files lack structure, making it difficult to track how risks were assessed and addressed. Cross-referencing between risk assessments, audit procedures, and financial statements is often missing, leading to gaps in the audit trail. |

| AASB Guidance |

| Audit files should be well-structured, with clear cross-referencing between risk assessments, audit responses, and supporting evidence. Documentation should provide a logical flow, demonstrating how audit procedures addressed identified risks. By maintaining a comprehensive and organized audit file, auditors improve transparency and facilitate external quality reviews. |

7. Conclusion

Addressing the deficiencies in SA 315 and SA 330 compliance is essential for improving audit quality. Auditors can provide more effective and reliable assurance by enhancing risk documentation, evaluating internal controls, strengthening fraud detection, and ensuring comprehensive audit documentation. Implementing these best practices will reinforce trust in financial reporting and uphold the integrity of the audit profession.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA