Taxmann’s Analysis | Ind AS 16 Compliance – Guidelines for Accurate PPE Reporting

- Blog|Advisory|Account & Audit|

- 8 Min Read

- By Taxmann

- |

- Last Updated on 5 March, 2025

Ind AS 16 Compliance refers to adhering to the Indian Accounting Standard that outlines the proper recognition, measurement, and disclosure of property, plant, and equipment (PPE) in financial statements. It ensures that companies accurately account for tangible fixed assets—covering aspects like capital work-in-progress, depreciation methods, and borrowing costs—thereby enhancing transparency, consistency, and reliability in financial reporting.

Table of Contents

- Non-Disclosure of Capital Work-in-Progress (CWIP) Movements

- Non-Disclosure of Depreciation Methods

- Non-Disclosure of Charges on PPE for Secured Loans

- Non-Disclosure of Useful Lives and Depreciation Rates

- Inconsistencies in Carrying Amounts of PPE

- Non-Disclosure of Borrowing Costs Capitalised

- Incorrect Capitalisation of Borrowing Costs

- Use of Incorrect Terminology for PPE

- Conclusion

Indian Accounting Standard (Ind AS) 16, Property, Plant, and Equipment, provides a comprehensive framework for the recognition, measurement, and disclosure of tangible fixed assets. Compliance with Ind AS 16 is crucial for ensuring transparency and accuracy in financial reporting. However, several companies have been observed to fall short of the standard’s requirements, leading to non-compliance issues. This article examines key observations reported by the Financial Reporting Review Board of ICAI on Ind AS 16 compliance and related standards concerning Property, Plant, and Equipment (PPE), referencing real-world financial statement examples. It also explores the implications of non-compliance and its impact on financial reporting.

1. Non-Disclosure of Capital Work-in-Progress (CWIP) Movements

1.1 Relevant Provisions

Ind AS 16 Para 73(e) – “The financial statements shall disclose, for each class of property, plant and equipment:

…

(e) a reconciliation of the carrying amount at the beginning and end of the period showing:

(i) additions;

…

(v) impairment losses recognised in profit or loss in accordance with Indian Accounting Standard 36;

(vi) impairment losses reversed in profit or loss in accordance with Indian Accounting Standard 36;

…

(ix) other changes.”

Para 74(b) – “The financial statements shall also disclose:

(b) the amount of expenditures recognised in the carrying amount of an item of property, plant and equipment in the course of its construction.”

1.2 Observation

In several cases, companies disclosed Capital Work-in-Progress (CWIP) in their balance sheets but failed to provide detailed movements or reconciliations. For example, a company reported that CWIP was worth Rs. XX million (previous year Rs. YY million) in its balance sheet but did not disclose any reconciliation of the carrying amount at the beginning and end of the period. This omission violates the disclosure requirements of Ind AS 16, as CWIP is considered part of Property, Plant, and Equipment (PPE) and should be treated as such.

It may also be noted that the same view, as to capital-work-in-progress be treated as property, plant and equipment, was taken by the Ind AS Transition and Facilitation Group (ITFG) of ICAI and can be referred from issue number 33 of Compendium of ITFG Clarification Bulletins, December 2018 edition. The relevant extract of the issue number 33 of the compendium is reproduced below:

“…Capital work in progress is in the nature of property, plant and equipment under construction, and accordingly, provisions of Ind AS 16, Property, Plant and Equipment apply to it.”

The company also failed to disclose the amount of expenditures recognised in the carrying amount of PPE during its construction, as required by Para 74(b).

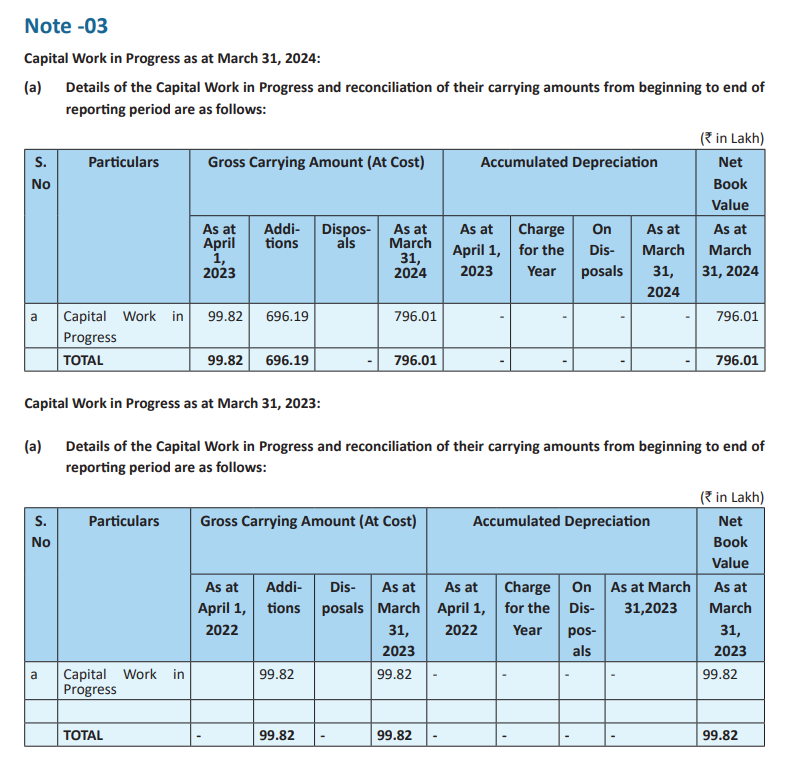

A relevant extract of the notes to the Standalone Financial Statements for the year ended 31st March, 2024 of NBCC Limited reflecting the correct presentation of CWIP is as follows:

1.3 Implication

The non-disclosure of CWIP movements and construction-related expenditures can obscure the true financial position of a company. Stakeholders, including investors and creditors, rely on this information to assess the progress and costs associated with ongoing projects. Without this disclosure, it becomes difficult to evaluate the company’s capital commitments, project timelines, and future cash flows. This lack of transparency can lead to misinterpretation of the company’s asset base and financial health, potentially affecting investment decisions and credit ratings.

2. Non-Disclosure of Depreciation Methods

2.1 Relevant Provision

Ind AS 16 Para 73(b) – “The financial statements shall disclose, for each class of property, plant and equipment:

…

(b) the depreciation methods used.”

Part C of Schedule II to the Companies Act, 2013 – “The following information shall also be disclosed in the accounts, namely:

(i) depreciation methods used; and

…”

2.2 Observation

In one instance, a company provided detailed information on the useful lives of its assets but failed to disclose the depreciation methods applied. For example, the company’s accounting policy stated that depreciation is provided on a pro-rata basis for additions and disposals, but it did not specify whether the straight-line method, written-down value method, or another method was used. This omission was viewed as non-compliance with both Ind AS 16 and the Companies Act, 2013.

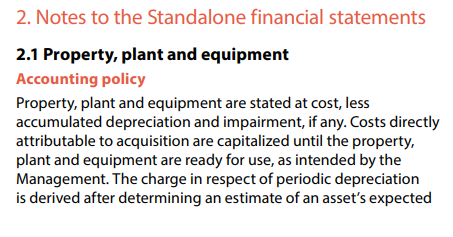

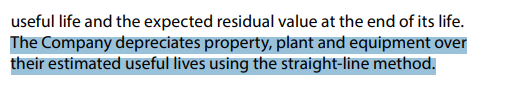

An extract of notes to the Standalone financial statements of Infosys Limited for the year ended 31st March, 2024 reflecting the correct accounting policy related to the depreciation method used is as follows:

2.3 Implication

The depreciation method significantly impacts the carrying amount of assets and the depreciation expense recognised in the profit and loss statement. Without this information, users of financial statements cannot accurately assess the company’s asset utilisation, future capital expenditures, and the pattern of expense recognition. This lack of disclosure can lead to incorrect assumptions about the company’s financial performance and asset management practices, potentially affecting stakeholder decisions.

3. Non-Disclosure of Charges on PPE for Secured Loans

3.1 Relevant Provision

Ind AS 16, Para 74(a) – “The financial statements shall also disclose:

(a) the existence and amounts of restrictions on title, and property, plant and equipment pledged as security for liabilities.”

Note 6E of General Instructions for Preparation of Balance Sheet (Schedule III to the Companies Act, 2013):

“Borrowings shall further be sub-classified as secured and unsecured. Nature of security shall be specified separately in each case.”

3.2 Observation

In one case, a company had availed secured loans from banks and created charges on its PPE as collateral. However, the financial statements did not disclose this information. For example, the company’s notes to accounts mentioned secured loans from HDFC Bank but did not specify that PPE was pledged as security for these loans. This omission was viewed as non-compliance with Ind AS 16 and Schedule III of the Companies Act, 2013.

3.3 Implication

The non-disclosure of charges on PPE can mislead stakeholders about the company’s financial obligations and the extent to which its assets are encumbered. This lack of disclosure can affect the assessment of the company’s liquidity and solvency, as stakeholders may not be aware of the potential risks associated with the secured loans. It can also lead to a loss of trust in the company’s financial reporting, as stakeholders may question the completeness and accuracy of the information provided.

4. Non-Disclosure of Useful Lives and Depreciation Rates

4.1 Relevant Provision

Ind AS 16, Para 73(c) – “The financial statements shall disclose, for each class of property, plant and equipment:

…

(c) the useful lives or the depreciation rates used;

…”

4.2 Observation

In one case, a company disclosed that it depreciates its PPE over their useful lives as per Schedule II of the Companies Act but failed to disclose the specific useful lives or depreciation rates applied. For example, the company’s accounting policy stated that depreciation is provided based on internal assessments and independent technical evaluations, but it did not provide the actual useful lives or rates used for different classes of assets.

An extract of notes to the Standalone financial statements of Infosys Limited for the year ended 31st March, 2024 reflecting the correct presentation of useful life of assets is as follows:

4.3 Implication

The useful life and depreciation rate are critical for understanding the pattern of asset consumption and the timing of future capital expenditures. Non-disclosure of this information can lead to incorrect assumptions about the company’s asset management practices and the timing of asset replacements. This lack of transparency can affect stakeholder decisions, particularly those related to long-term investments and financial planning.

5. Inconsistencies in Carrying Amounts of PPE

5.1 Relevant Provision

Ind AS 16, Para 73(e) – Requires a reconciliation of the carrying amount of PPE at the beginning and end of the period, including additions, disposals, and other changes.

5.2 Observation

In one instance, a company’s financial statements showed inconsistencies in the carrying amounts of PPE at the beginning and end of the period. For example, the gross block at the beginning of the year did not match the gross block at the end of the previous year. Similarly, there were discrepancies in the accumulated depreciation figures. Such inconsistencies raise concerns about the accuracy of the financial statements.

5.3 Implication

Inconsistencies in carrying amounts can undermine the reliability of financial statements. Stakeholders may question the integrity of the financial reporting process, leading to a loss of trust in the company’s management. This can also result in regulatory scrutiny and potential penalties.

6. Non-Disclosure of Borrowing Costs Capitalised

6.1 Relevant Provision

Ind AS 23, Para 26 – “An entity shall disclose:

(a) the amount of borrowing costs capitalised during the period; and

(b) the capitalisation rates used to determine the amount of borrowing costs eligible for capitalisation.”

6.2 Observation

In one case, a company capitalised borrowing costs related to qualifying assets but failed to disclose the amount capitalised or the capitalisation rate used. For example, the company added a significant amount to CWIP, including borrowing costs, but did not provide the required disclosures under Ind AS 23.

6.3 Implication

The capitalisation of borrowing costs affects the carrying amount of PPE and the interest expense recognised in the profit and loss statement. Non-disclosure of this information can lead to an incomplete understanding of the company’s financing activities and their impact on financial performance.

7. Incorrect Capitalisation of Borrowing Costs

7.1 Relevant Provision

Ind AS 23, Para 8 – “An entity shall capitalise borrowing costs that are directly attributable to the acquisition, construction or production of a qualifying asset as part of the cost of that asset. An entity shall recognise other borrowing costs as an expense in the period in which it incurs them.”

7.2 Observation

In one case, a company capitalised borrowing costs for all constructed assets, regardless of whether they met the definition of a qualifying asset. For example, the company’s accounting policy stated that borrowing costs incurred for constructed assets were capitalised up to the date the asset was ready for use without distinguishing between qualifying and non-qualifying assets.

7.3 Implication

Incorrect capitalisation of borrowing costs can overstate the carrying amount of PPE and understate interest expenses, leading to a misrepresentation of the company’s financial position and performance. This can mislead stakeholders and result in regulatory non-compliance.

8. Use of Incorrect Terminology for PPE

8.1 Relevant Provision

Ind AS 16, Para 73 – Requires disclosure of information related to “Property, Plant, and Equipment.”

8.2 Observation

In one case, a company used the term “Tangible Assets” instead of “Property, Plant, and Equipment” in its financial statements. For example, the company’s note on tangible assets did not align with the terminology used in Ind AS 16, which specifically refers to PPE.

8.3 Implication

The use of incorrect terminology can create confusion among stakeholders and may lead to misinterpretation of the financial statements. It also indicates a lack of alignment with the terminology prescribed by Ind AS 16.

9. Conclusion

Compliance with Ind AS 16 is essential for ensuring the accuracy and transparency of financial statements. The observations highlighted in this article underscore the importance of adhering to the disclosure requirements related to PPE, CWIP, depreciation methods, borrowing costs, and other critical aspects. Non-compliance not only violates accounting standards but also undermines the credibility of financial reporting, potentially leading to regulatory scrutiny and loss of investor confidence. By addressing these common non-compliance issues, companies can enhance the quality of their financial reporting and build trust with stakeholders. It is imperative for companies to regularly review their accounting policies and disclosures to ensure full compliance with Ind AS 16 and other relevant standards.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA