Taxmann.AI New Features – Improve Prompt | Rewrite | Concise Style

- Other Laws|Blog|

- 4 Min Read

- By Taxmann

- |

- Last Updated on 20 February, 2026

Taxmann.AI New Features are designed to make legal and tax research faster, clearer, and more precise. With Improve Prompt, Rewrite, and Concise Style, professionals can now frame better queries, refine AI-generated responses, and get quick, to-the-point answers when time is critical. These upgrades significantly enhance workflow efficiency, ensuring every interaction delivers sharper insights and higher research accuracy.

Table of Contents

- Three Smart Enhancements for Faster | Sharper | More Accurate Legal Research

- Improve Prompt

- Rewrite

- Concise Style

1. Three Smart Enhancements for Faster | Sharper | More Accurate Legal Research

Taxmann.AI now introduces three intelligent smart feature enhancements—Improve Prompt, Rewrite, and Concise Style.

They eliminate the most common AI challenges:

- Unclear queries

- Lengthy or unfocused outputs

- Need for contextually precise restructuring

Together, they deliver more clarity, more control, and more speed across every query, response and drafting task.

2. Improve Prompt

Transform Unclear Queries into Professional, Legally Structured Questions

2.1 What It Is

Improve Prompt is an intelligent assistant that automatically rewrites user queries into well-structured, complete, legally relevant research questions.

Even when users know what they want to ask, they often struggle with how to frame it so the AI understands the legal context. This feature bridges that gap instantly.

It solves challenges like:

- Vague or incomplete queries

- Missing legal context

- Unclear terminology

- Poorly structured research questions

2.2 How It Works

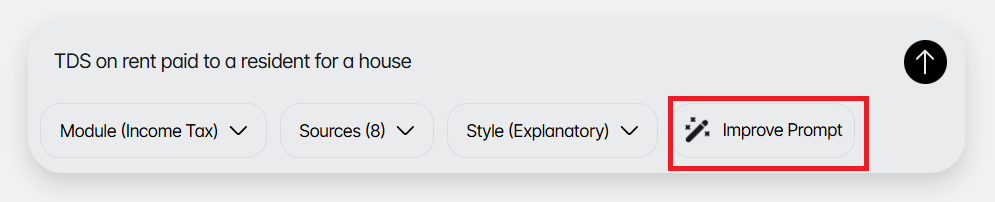

- Type your query in the Ask-Bot window.

- The Improve Prompt button activates.

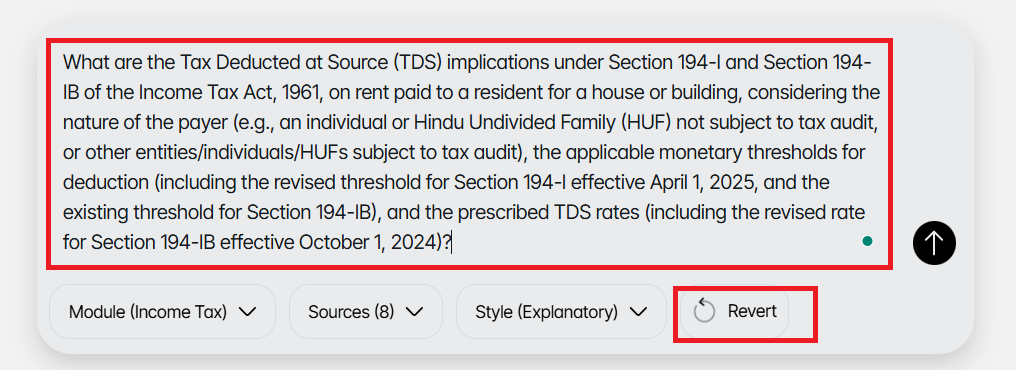

- Once clicked, the system analyses your query and resolves ambiguity or missing context.

- It generates a refined, clearer, legally contextualised version of the prompt.

- The improved prompt appears in editable mode.

- A Revert option allows users to revert to the original query anytime.

2.3 What You Can Achieve

- Convert unclear questions into precise research prompts

- Get more accurate answers on the first attempt

- Save time otherwise spent rewriting or refining questions

- Learn how to ask better questions by observing improvements

- Receive legally aligned, comprehensive prompts without needing prompt engineering skills

2.4 Example

Original Query:

“TDS on rent paid to a resident for a house.”

Improved Prompt (Generated):

“What are the Tax Deducted at Source (TDS) implications under Section 194-I and Section 194-IB of the Income Tax Act, 1961, on rent paid to a resident for a house (land or building), considering the applicable thresholds and rates, including the revised annual threshold of Rs. 50,000 per month for Section 194-I effective April 1, 2025, and the revised rate of 2% for Section 194-IB effective October 1, 2024?”

3. Rewrite

Refine, Expand, or Redirect the AI’s Response to Match Your Exact Needs

3.1 What It Is

Rewrite gives users complete control over the output generated by the AI.

Instead of treating responses as final, users can instruct Taxmann.AI to:

- Refocus the answer

- Include/exclude sections

- Add case laws or citations

- Expand or shorten

- Shift focus to a jurisdiction, topic, or time period

- Update with latest judgments

This makes Taxmann.AI an active research partner, not just an answer generator.

3.2 How It Works

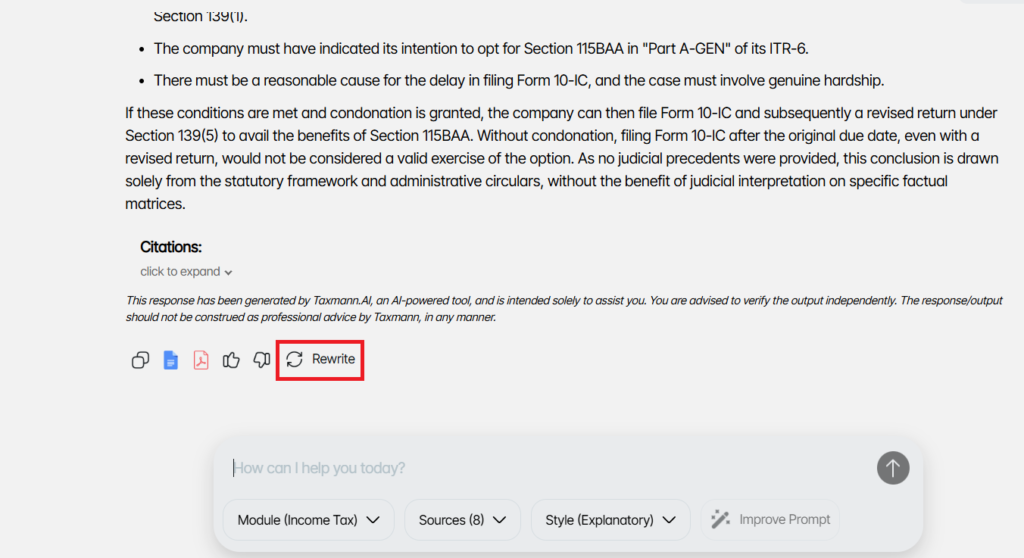

- Ask your question and wait for the AI’s first response.

- Click the Rewrite button.

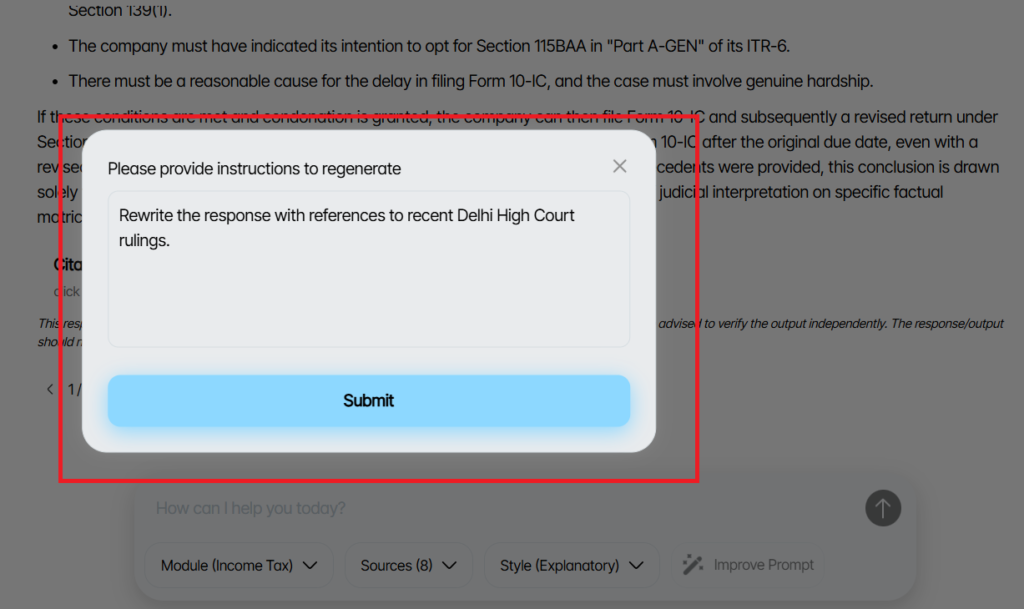

- A window opens where you can define what changes you want.

- Enter your instruction (e.g., “Rewrite with recent Delhi High Court decisions”).

- Taxmann.AI generates a completely new version.

- You can toggle between Previous Version and Rewritten Version anytime.

3.3 What You Can Achieve

- Customise responses exactly to your requirements

- Add depth, include case laws or focus on any particular provision

- Refine the research within the same conversation thread

- Improve accuracy by instructing the system to include specific focus areas

- Save time and avoid rewriting manually

3.4 Example Instruction

“Rewrite the response with references to recent Delhi High Court rulings.”

4. Concise Style

Get Quick, Sharp Responses When You Don’t Need Detailed Analysis

4.1 What It Is

Concise Style is designed for fast, to-the-point answers.

It is ideal for:

- Quick definitions

- Compliance checks

- Verifying dates, rates, thresholds

- Client call lookups

- Initial scoping before deep research

It prioritises brevity and speed, offering responses up to 80% faster than detailed mode.

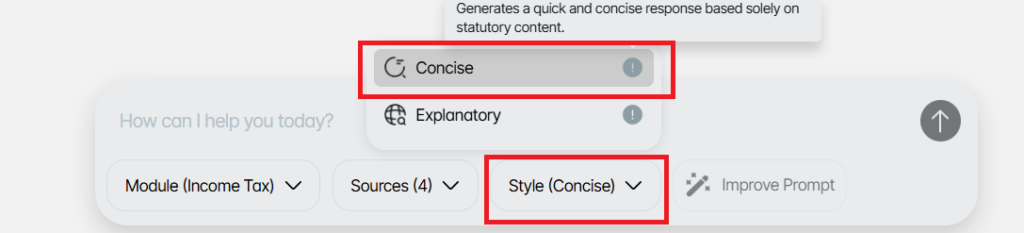

4.2 How It Works

- Choose Concise Style before submitting your query.

- Taxmann.AI new features provide a short, focused response based on statutory content.

- If more detail is required, simply ask – “Explain in detail.”

4.3 What You Can Achieve

- Instant answers when time is critical

- Quick validation of facts, rules, timelines

- Ability to scan multiple legal topics quickly

- High-level insights before starting deep research

- Faster client interactions during calls or meetings

4.4 Limitation

Because it draws from a smaller set of content, responses may not be exhaustive. For detailed explanations, deeper analysis, or full citations—switch back to Explanatory mode.

The addition of Improve Prompt, Rewrite, and Concise Style makes Taxmann.AI more intelligent, adaptable, and aligned with the real needs of legal and tax professionals. Whether users want clearer questions, refined answers, or faster responses, these features combine to create a more efficient, research-oriented workflow.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA