Taxation of Foreign Shipping and Airlines Companies with Case Studies

- Blog|International Tax|

- 31 Min Read

- By Taxmann

- |

- Last Updated on 31 March, 2023

Table of Contents

1. Brief Overview of Shipping & Airline Industry

2. Taxability of Shipping & Airline under Income-tax Act, 1961

3. Taxability of Foreign Shipping & Airline Companies under DTAA

4. Tax Benefits to Shipping and Airline companies set up in IFSC

5. Case Studies

6. Gist of Important CBDT Circulars

8. Article -8 – Comparative Analysis of OECD & UN Model

9. Applicable Domestic Law Provisions

1. Brief Overview of Shipping & Airline Industry

1.1 Foreign Shipping Companies (FSCs)/Foreign Airline Companies (FACs) – Presence in India

1.1.1 Independent Set-up in India

- Liaison/Branch office

- Joint Venture (JV); or Wholly owned subsidiary (WOS)

1.1.2 Agency Set-up

- May be independent or dependent agents

- Solicit customers, assists in cargo handling, deal with customs and port authorities on behalf of the principal

- Earn commission from FSCs/FACs for services rendered

- May or may not constitute PE of FSCs/FACs in India

- Circular No. 723 dt. 19.09.1995 – (Sections covered – S. 194C, 195, 172) Agent of FSC to step into the shoes of the principal

1.2 Key Operators in Shipping Business

1.2.1 Main Line Operators (MLO)

- Own/Charter vessels which carry cargo from the port of origin to the destination-port

- Issue B/L to shippers/NVOCC for the entire voyage

- Earn freight income from shippers

1.2.2 Feeder Vessel Operators (FVO)

- Serve MLOs whose vessels do not call ports of origin/destination

- Own/charter vessels which carry cargo between origin/destination ports and hub ports i.e. “Relay” Cargo

- Issue Service B/L to MLO for voyage between the origin/destination ports and hub ports

- Earn freight from MLO

1.2.3 Non Vessel Owner Common Carrier (NVOCC )

- Do not own, charter or operate any carrying ship

- Undertake transport of goods using container slots booked on the vessels of other operators

- Consolidate small packets/cargo of various shippers into container loads i.e. act as consolidators

- May own or hire containers

- Issue house B/L to shippers

- Earn freight from shippers

1.2.4 Tramp Ship

- A ship which operates without a schedule

- Used mainly for carrying bulk commodities or homogeneous cargoes in shiploads

- Each voyage is separately negotiated between the ship owner and the shipper, usually through a broker

1.3 Types of Charters in Shipping Business

1.3.1 Bareboat Charter

- ‘Bare’ ship is given on hire (i.e. without crew, equipment,)

1.3.2 Bareboat Charter cum demise

- Charter where ownership is intended to be transferred to the charterer after a specified period – Sale transaction as per AS – 19 – “Leases”

1.3.3 Time Charter

- Hire of a fully equipped ship usually along with crew

- Agreement is for a definite period

1.3.4 Voyage Charter

- Hire of a fully equipped ship usually along with crew

- Agreement is for a particular voyage

1.4 Key Operators in Airlines Business

1.4.1 Scheduled Air Transport Service

- Flights operating according to a published timetable

- Each flight open to use by members of the public

1.4.2 Non-Scheduled Air Transport Service

- Other than a scheduled transport service

- Includes Chartered Flights, i.e. Operations where departure time, departure location and arrival locations are negotiated and agreed with the customer and no ticket is usually sold to individual passengers

1.5 Types of Charters in Airline Industry

1.5.1 Dry Lease

- Only aircraft is leased or chartered

- Without insurance, crew, ground staff, supporting equipment, maintenance, etc.

1.5.2 Wet Lease

- Aircraft with operating crews

- Full responsibility of the lessor for the operation and maintenance of the aircraft

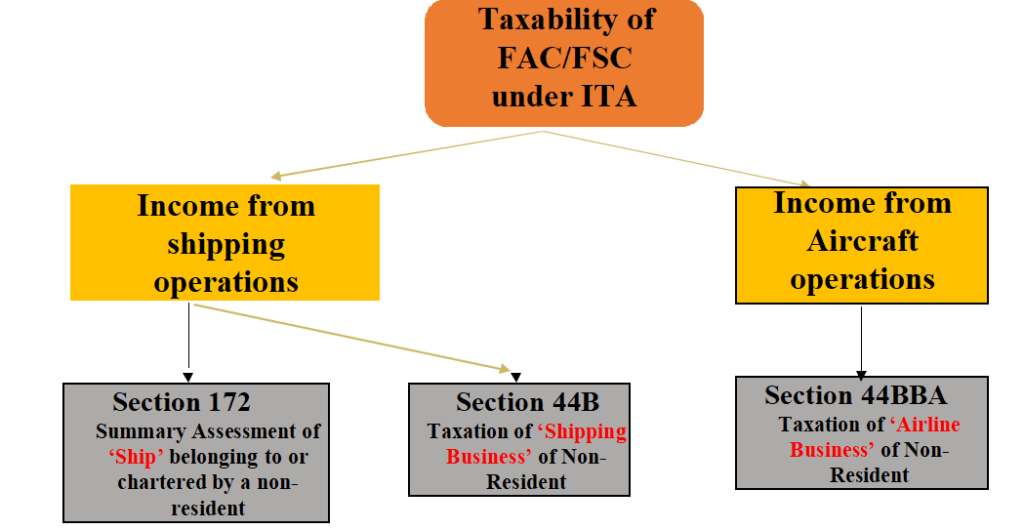

2. Taxability of Shipping & Airline under Income-tax Act, 1961

2.1 Overview of ITA Provisions

- Deal with taxation of profits from “Operations” of Ships/Aircrafts by NRs from Carriage of passengers, livestock, mail or goods

- Income to be computed on presumptive basis as a percentage of gross receipts – Shipping 7.5%/Airlines 5%

- Assessee has option to be governed by other provisions of the Act before expiry of the relevant Assessment Year

2.2 Shipping – Summary Assessment of Ship/Voyage u/s 172

Starts with a non-obstante clause

Overrides all other provisions of the Act – S. 172 is a code by itself

ITO v CMA CGM Agencies (India) Pvt. Ltd. – [2012] 26 taxmann.com 121/[2013 55SOT61] (Rajkot-Trib.)

Applicability

For levy and recovery of tax in case of ships belonging to or chartered by a non-resident

Income deemed @ 7.5% of gross receipts from:

Freight for outbound carriage* of passengers, livestock, mail or goods shipped at a port in India (*Export freight)

Demurrage charges, Handling charges & Other charges similar to demurrage or handling charges

Assessee has an option to be governed by S. 44B of the Act and file regular return of Income

Purpose

To make summary assessment of a ship or voyage and ensure recovery of tax before the ship leaves Indian territory

Procedure

Master of the ship is required to submit Voyage Return to the AO at the port of departure before sailing of the ship or make satisfactory arrangement to file voyage return within 30 days of departure of the ship along with DIT Exemption certificate, if so obtained

Port AO to complete voyage assessment within 9 months from end of the financial year

Issues

Whether Voyage-wise NOC is mandatory for FSCs holding Annual DIT–E?

Refer Circular No 732A dated 12.1995/Circular No 30/2016 dated 26.08.2016.- Port clearance and voyage assessments to be done in routine manner without insisting on documents such as TRC, POEM, Ownership of Vessels, etc.

Payment of commission to shipping agents- Provisions of S. 172 to apply and hence s. 194C will not apply

DCIT Vs. Expeditors International [I] Pvt. Ltd (Delhi ITAT), IT Appeal No. 2128 of 2011, Dt. 17/12/2020. CBDT Circular No. 723 dated 19.09.1995 referred.

2.3 Shipping Taxation u/s 44B

Starts with a non-obstanteclause

Overrides section 28 to 43A. All other provisions of the Act to apply

Applicability

At the option of the non-resident engaged in operation of ships

Non resident has the option to be governed by normal provisions of the Act – DIT vs. Royal Jordanian Airlines [[2015] 64 taxmann.com 93/[2016] 236 Taxman 10/383 ITR 465 (Delhi)]

Income deemed @ 7.5% of gross receipts from:

Export freight (wherever received); Import freight [if received in India by virtue of 5(2)]; Handling charges, demurrage charges and any other charges of the similar nature

Purpose

To make regular assessment of the non-resident assessee under provisions of the Act

Issues

Whether Voyage wise NOC is mandatory for an aseessee who is holding annual DIT-E?

Memorandum to Finance Bill 1975 provides that procedures prescribed u/s 172 for clearance of ships will continue to apply equally for non resident governed u/s 44B

2.4 Section 44B Vs. Section 172

Section 44B

- Deals with assessment of ‘Regular’ shipping business

- Starts with a non-obstante clause

- Overrides sections 28 to 43A

- Income deemed at 7.5% of

- Export freight (wherever received) and import freight (if, received in India)

- Freight to include demurrage, handling charges or other similar charges

- NOC from Port AO for PCC mandatory unless Annual DIT (E) obtained from the jurisdictional AO containing name of the (Cir. 30/2016)

- Filing Voyage Return is mandatory

- Time limit for completion of the assessment procedure is governed by S.153A

Section 172

- Deals with levy and recovery of tax of ship belonging to or chartered by a non-resident

- Starts with a non-obstante clause

- Overrides all other provisions of IT Act

- Income deemed at 7.5% of

- Export freight (wherever received). Includes demurrage, handling charges or any other similar charges – S 172(4)

- Procedure for levy and collection of tax, Voyage return, NOC for obtaining PCC, etc. Benefit of Cir. 30/2016 is available

- Filing Voyage wise return is mandatory

- AO to complete assessment within 9 months from the end of the relevant financial year – S. 172(4A)

2.5 Airlines Section 44BBA

Applicability

- Non-resident engaged in the business of operation of Aircraft

- Non resident has option to be governed by normal provisions of the Act

Starts with a non-obstante clause

Overrides Sections 28 to 43A. All other provisions of the Act to apply

Income deemed @ 5% of gross receipts from:

- Export fare/freight (whether received in or out of India) by or on behalf of the assessee on account of carriage of passengers, livestock, mail or goods from any place in India; and

- Import fare/freight received or deemed to be received in India by or on behalf of the assessee on account of the carriage of passengers, livestock, mail or goods from any place outside India

Purpose

Regular assessment of the non-resident assessee under provisions of the Act

3. Taxability of Foreign Shipping & Airline Companies under DTAA

3.1 Overview

Article -8 OECD 2017 Model Convention (deleted portions were part of 2010 MC)

- Profits of an enterprise of a Contracting State from the operation of ships or aircraft in international traffic shall be taxable only in Contracting State that State in which the place of effective management of the enterprise is situated.

- Profits from the operation of boats engaged in inland waterways transport shall be taxable only in the Contracting State in which the place of effective management of the enterprise is situated.

- If the place of effective management of a shipping enterprise or of an inland waterways transport enterprise is aboard a ship or boat, then it shall be deemed to be situated in the Contracting State in which the home harbour of the ship or boat is situated, or, if there is no.

- The provisions of paragraph 1 shall also apply to profits from the participation in a pool, a joint business or an international operating agency.

Even though Article -8 under Model Convention is amended, bilateral treaties could continue to be based on earlier Model until bilaterally revised.

Article -8 – Special provision for allocation of taxing rights on profits of a non-resident from ‘Operation of Ships or Aircrafts’ in ‘International traffic’.

- Special provision – Prevails over Article 5

- Existence of PE irrelevant – Mitigates burden of profit attribution – MC Para 20 – Art.8

OECD Model 2017 allocates taxing rights to the country of incorporation

Subject to bilateral variations – each treaty needs to be separately examined

Applies to Profits of an enterprise engaged in operation of Ships/Aircraft in international traffic – Article 8(1)

- Profits from Operations of Ships or Aircrafts

- Ship/Aircraft could be owned or leased in ‘International Traffic’

- Activities ‘directly connected with operations’ or ‘incidental or ancillary to operations’

Profits from participation in a pool; a joint business or an international operating agency covered – Article 8(2)

3.2 Article 8(1) – Key Conditions

- Profits

- Operation of ships or aircraft

- International traffic

- Place of Residence/POEM

Each of the condition is subject to judicial interpretation

3.3 Article 8(1) – Profits

OECD commentary

3.3.1 Profits – obtained from Operation

Profits directly obtained by an enterprise from operations that it carries on by its own in the international traffic by ships or aircrafts e.g. freight from transportation of passengers, live stock, cargo, etc.

3.3.2 Profits – directly connected with the operation

Activities closely connected with shipping/air transport business such as:

- Incidental transportation of passengers or cargo onships operated by other enterprises under code-sharing, slot- chartering arrangements or to take advantage of earlier sailing, Hotel used for transit accommodation, On board advertisement, etc.

- Inland haulage charges (IHC)

- Lease of fully equipped & crewed ship/aircraft

- Lease of containers and short-term storage of containers

- Detention Charges for late return of Containers.

3.3.3 Profits – ancillary to operation

- Activities which make minor contribution, relative to the operation of ships/aircrafts

- Cannot be regarded as separate business or source of income.

- E.g. sale of tickets, advertisement in magazines on board a ship/aircraft, etc.

3.3.4 Profits – from pooling arrangements

Profits from pool, joint business or international operating agency

- Lufthansa German Airlines ([2004] 90 ITD 310/83 TTJ 113) (Delhi-Trib.) – Reciprocal arrangement – Article-8 benefit allowed

- British Airways Plc. v. Dy. CIT ([2002] 80 ITD 90/[2001]73 TTJ 519)(Delhi-Trib.) – Absence of reciprocal arrangement – Article – 8 benefit denied

3.3.5 Business or sources to which Article-8 would not apply

- Shipbuilding yard operated in a Country by a shipping enterprises.- Para 15 of OECD MC

- Investment income (e.g. income from stocks, bonds, shares, loans, deposits) from treasury

operations for handling surplus cash – Para 14 of OECD MC.

However income earned from Bonds or Deposits posted as security required under any law in order to carry on the business would fall within the scope of profits from operations – Para 14 of OECD MC.

3.3.6 Some of the Observations/Reservations on the Article

- Greece and Portugal reserve their position as to application of this Article to Income from ancillary activities (Paragraphs 4 to 10.1, 14 & 14.1 of OECD MC)

- Germany, Greece, Maxico and Turkey reserve their position as to the application of the Article to income from inland transportation of passengers or cargo and from container services (paragraphs 4,6,7 and 9 of OECD MC)

- Canada, Hungary, Mexico and New Zealand reserve the rights to tax profits from internal traffic.

- Lativia reserves the right in exceptional cases to apply permanent establishment rule in relation to profits derived from the operation of ships in international traffic.

3.4 Article 8(1) – Operation of Ships or Aircrafts

‘Operation of Ships or Aircrafts’ – Meaning

- The term ‘operation of ships or aircrafts’ has not been defined under any of the MCs.

- However, OECD MC commentary provides that the operation of ships or aircrafts by an enterprise could be either in the capacity of an owner, lessor or in any other capacity. It ship will also include ‘boat’.

Expression when defined/not defined under a bilateral Tax Treaty

- If the term is Defined- Restricted meaning as agreed bilaterally e.g. Singapore, Brazil, Malaysia, UAE

- If Not defined under DTAA – As per commentary on Article -8, subject to observations/reservations by the countries e.g. UK, Australia, France, Denmark, Cyprus

- Other international tax commentaries when MCs do not provide any guidance

Domestic Law Definition – ‘Operation of ships’ defined u/s 115VB of IT Act

- Company regarded as engaged in operations if it operates any ship (owned or chartered) by it and includes arrangement such as slot charter

- Definition under the domestic law is provided under Tonnage Tax Provisions

Leasing a ship or aircraft on a full charter basis (i.e. along with crew)

Wet lease/Time charter – Hire of a vessel fully equipped and crewed – Provision of services –

considered to be a form of ‘Operations’ of ships or aircrafts – Para 5 of OECD MC 2017 on Article-8

CIT v. Poompuhar Shipping Corporation Ltd. [2006] 153 Taxman 486/282 ITR 3 (Mad.)

Ship was held to be ‘Commercial Equipment‘. Payment for ‘time charter’ was on facts held to be for ‘use and hire of vessel’ and hence payment was held to be in the nature of royalty.

Nan Lian Ship Management LLC Vs. ACIT ( Int. Tax) – ITAT Mumbai – ITA No. 1857/Mum/2022 dated 30.12.2022

‘Time Charter Agreement’, is not taxable as ‘royalty’ under Section 9(1) (vi) of the Income Tax Act, 1961, if control and dominance over the ship remained with the owner and not with charterer.

Bareboat charters

- S. 9(1)(vi) – consideration for leasing of Commercial Equipment – hence royalty

- Under DTAA – Does not amount to “operation of ships” except when it is an incidental/ancillary lease by an enterprise primarily engaged in operations – Para 5 of OECD MC 2017 on Article-8

West Asia Maritime Ltd. v. ITO ([2008] 111 ITD 155/[2007]109 TTJ 617)(Chennai- Trib.)

Hire charges paid for a ship taken on BBCD basis (arrangement in substance for BBC) – Payment held to be in the nature of Royalty for use of commercial equipment

Slot Charter arrangements

- Income from leasing one or more slots in a ship belonging to or chartered by a shipping company is in the nature of income from operations –

- Jt. DIT Vs. CMA CGM SA France – [2009] 27 SOT 367 (Mum.-Trib.)

Income from Feeder Vessels

- Services of small vessels deployed to ship cargo from mother vessels located at HUB Ports to the Destination Ports.

- Profits obtained from activities directly connected with the transportation from HUB Ports to Destination Ports of cargo/passengers in international traffic eligible for the benefits of Article-8

- DIT v. Balaji Shipping (UK) Ltd– [[2012] 24 taxmann.com 229/211 Taxman 535/253 CTR 460(Bom.)]

- Hapang –Lloyd AG v. Addll. DIT (International Taxation) [2013] 31 taxmann.com 64/213 Taxman 188 (Bom.) (Mag.)

- ANIL Container Line Pty Ltd 2008-TIOL-625-ITAT(Mum)

- MISC Berhad Vs. Asstt. DIT (IT) [2014] 47 taxmann.com 50/150 ITD 213 (Mum.-Trib.)

- Therefore, linkages with mother ship operating in international traffic should be established to claim the benefit under Article -8.

Inland Haulage Charges (IHC)

- Charges collected from customers mainly towards recovery of cost incurred in inland transportation of cargo from customer locations to the port and vice versa

- Benefit of Article – 8 is available for IHCs which are incidental and ancillary to the ‘Operation of Ships’ in ‘International Traffic’ as defined bilaterally.

- Dy. DIT v. Safmarine Container Lines NV ([2009] 120 ITD 71/[2008] 24 SOT 211) (Mum.-Trib.) – Confirmed by Bombay HC – DIT (International Taxation) v. Safmarine Container Lines NV [2014] 48 taxmann.com 238/225 Taxman 299/367 ITR 209 (Bom.)

- Asstt. CIT vs. Federal Express Corporation ([2010] 125 ITD 1 (Mum.-Trib.)/2010-35- DTR-425-ITAT-Mum)

- Asstt. DIT vs. Federal Express Corporation ([2010] 125 ITD 1 (Mum.-Trib.)/2009 TIOL 179 Mum ITAT)

- Avana Global FZCO Vs Dy. CIT ([2022] 142 taxmann.com 386 (Mum. – Trib.)

- Income from equipment for security screening, maintenance and charter handling – Benefit of Article 8 denied

- ACIT v. Delta Airlines Inc. (2008-TIOL-646-ITAT-Mum)

- Slot arrangement incidental and ancillary to ‘Operation of Ships’ – Covered by Article -8 based on commentary in MC

- Bombay HC in DIT V. Balaji Shipping UK Ltd. ([2012] 24 taxmann.com 229/211 Taxman 535 (Bom.)/315 ITR 62 (Mum))

3.5 Article 8(1) – International Traffic

Defined under Article 3(e) of the OECD MC 2017:

Any transport by a ship or aircraft except when the ship or aircraft is operated solely between places in a contracting state and the enterprise that operates the ship or aircraft is not an enterprise of that state

Illustrations

| Sr. No. | International Traffic | Non-international Traffic |

| Ship owned by a non-resident enterprise which is plying between | ||

| 1. | Colombo-Chennai | Chennai-Mumbai |

| 2. | Colombo-Chennai-Mumbai |

Chennai-Colombo (not stopping) – Mumbai

|

| 3. | Colombo-Chennai-Dubai | |

The above illustration is subject to reservations/observation or bilateral agreements between the countries

For example, Canada, Hungary, Mexico and New Zealand reserve their right to tax profits from internal traffic, even if it is not solely between places within the state.

Transport by boats on rivers, canals and lakes

Boats/ships are to be considered as same – Para 17 of the OECD MC

Inland waterways through canals, rivers, etc.

Whether following transportation can be considered as international traffic?

- Inland waterways transport between two or more contracting countries- Yes – Article 3(e)

of OECD MC subject to reservations/observations by some countries - Inland waterways carried out by an enterprise of one country between two points in another country – Generally No, unless countries bilaterally agree to the benefits

Not relevant in Indian context- Article 8(2) is not present in most Indian treaties

3.6 Article 8(1)- Place of Residence/Effective Management

Place of Residence

- Determined under provisions of domestic tax laws of each country e.g. S. 6 in India, or

- In a case of dual residency under domestic laws of two countries, tax residency determined under DTAA – resolution of dual residency through application of tie-breaking rules. Under MLI- to be resolved by competent authorities bilaterally.

Place of Effective Management (POEM)

- Section 115VC: Place where board of directors or executive directors make decisions; or where BOD routinely approve commercial and strategic decisions made by executives, the place where such executives perform their economic functions

- Section 6(3): The place where key management and commercial decisions that are necessary for the conduct of entity’s business as a whole are in substance made.

- All relevant facts and circumstances must be examined to determine the place of effective management.

POEM Guidelines

- CBDT Circular 8 of 2017 – Concept of substance over form – Separate guiding principles prescribed based on –

- Company engaged in active business outside India

- Company other than company engaged in active business outside India

Article 4 of MLI – Dual residency for entities to be decided by Competent Authorities of both the countries

3.7 Article 8(2) – Profits from joint business, pool, etc.

- Provisions of Article 8(1) shall also apply to profits from participation in pool, joint business or international operating agency

- Terms “pool”, “joint business” or “international operating agency” are not defined under Model Conventions

- Typically, a pooling arrangement involves –

- Pooling of resources by various shipping/airline companies to cut down costs/use expertise of each other.

- Generally covers all forms of mutual cooperation like sharing of infrastructure, manpower, maintenance facilities, code sharing, joint operation of routes, etc.

- Division of the resultant profit amongst each other in agreed ratios

- Services are provided to each other i.e. reciprocity is essential. Profits shall be taxed at the place of residence of each member or otherwise as agreed to bilaterally.

- In case of joint business, assuming entrepreneurial risk of an operator (though in part) where bilateral treaties refer to ‘owners/charterers’ of the ships or aircrafts

Lufthansa German Airlines v. Dy. CIT, [2004] 90 ITD 310 (Delhi-Trib.)

- The taxpayer was in the business of operation of aircraft in international traffic and was a member of the ‘International AirlinesTechnical Pool’ (‘IATP’) rendered/availed certain services in India to/from other members

- ITAT held that the amount received from various IATP members airlines for above services rendered in India was not taxable in India under Article 8

British Airways Ple. v. Dy. CIT [2002] 80 ITD 90/(2001) 73 TTJ 519 (Delhi-Trib.)

- The taxpayer was not a member of the IATP, no reciprocal rendering of services or pooling arrangement or joint business was in place

- Unilaterally rendered services to various airlines without availing of any services in reciprocation

- Standalone activity was not in the nature of operations of ships/aircrafts in the international traffic

- ITAT held that the amount for services rendered could not be treated as having rendered under pooling arrangement and hence cannot be brought under Article 8 of the India-UK Treaty

3.8 Article 8 – Indian Treaty Context

- Place of effective management – Mauritius, Germany, Netherlands

- Place of Residence – USA, UK, Japan, France, UAE, Australia, Cyprus, Singapore, etc.

- UN model (Alternative B) – Netherlands, etc.

- Pooling arrangement – Denmark, US, UK, France, Singapore, etc.

- Alienation of ship/aircraft taxable in the country of residence – UK, Cyprus, USA, etc.

- Interest from investments – USA, Singapore, Japan, France, etc.

- Rental on Bareboat basis incidental to the main activity covered – UK, USA, Singapore etc.

- Income from use, maintenance or rental of containers (including trailers and related equipment for transport of containers) used for the transport of goods or merchandise – UK

- Country specific provisions- Example Article 8 of India- Singapore DTAA

3.9 Taxability of NVOCC under the Act

- 44B applies to income of FSCs engaged in the Business of “Operation of Ships”

- Non Vessel Operating Common Carriers (NVOCCs) do not own, charter or operate any vessel but undertake transport of goods using container slots on vessels owned or chartered by other operators.

- Issue Bill of Lading to shippers in their own name

- Article -8 benefits under most of the treaties are available only to enterprises which are ‘Owners or Charterers’ of the ships engaged in “Operation of Ships or Aircrafts” in international traffic.

- Ship should be owned or chartered by the non-resident enterprise- ITA 2727(Mum) of 2006-Asstt. DIT v. Hoyer Odfjell BV [2010] 40 SOT 25 (Mum.)(URO).

- Provisions of Article 7 read with Article 5 will apply in such cases

- ‘Operation of Ships’ as defined u/s 115VB of IT Act (Tonnage tax Provisions)

- Company regarded as engaged in operations if it operates any ship (owned or chartered) by it and includes arrangement such as slot charter

- Incudes indicates only incidental slot hire arrangements?

- Company regarded as engaged in operations if it operates any ship (owned or chartered) by it and includes arrangement such as slot charter

- Whether benefits of S. 172/S. 44B would be available?

3.10 Payment of Commission and additional charges to Agents of foreign airlines

Singapore Airlines Ltd vs CIT [2022] 144 taxmann.com 221/[2023] 90 Taxman 139 (SC) [KLM Royal Dutch Airlines vs CIT and British Airways PLC vs CIT]

- Agents of airlines collect freight on behalf of their NR principal. S. 182 of the Contract Act

- Remit net surplus to NR principal after deduction of commission/other charges incurred

- Airlines have no control over the actual fare at which the agents sell tickets

- As per the agreement, “all monies” collected by the agents on sale of air tickets is held in a fiduciary capacity. Hence, it is a contract of agency and not a contract of sale

- Apex court held that every action taken by the agents is on behalf of the principal and the services they provide is with express prior authorization

- Therefore, the amounts were incidental to the agency contract. Such incidental benefit must come under principal-agent relationship

- When the contract doesn’t distinguish between various stages of the transaction, the ambit of section 194H is expansive enough to cover indirect payments also. Hence, the contention that payments made by customer to travel agent is not commission, was not accepted

- In a principal-agent relationship, there could be situation where principal has no control over how the end objective of the relationship is achieved. That wouldn’t change the relationship

- Accepted tax neutrality argument – Hindustan Coca-Cola Beverage Pvt. Ltd followed. Recovery of TDS cannot be done

- Interest u/s 201(1A) to be collected. Penalty cannot be levied as the law was not settled

4. Tax Benefits to Shipping and Airline companies set up in IFSC

4.1 Shipping in IFSC

- Income by way of royalty or interest on account of lease of ship paid to foreign entities is fully exempt from tax in India

- No Capital Gains tax on transfer of ship by a IFSC Unit enjoying 100% tax exemption

- The above two exemptions are subject to IFSC Unit commencing its operations by 31st March, 2024

4.2 Airlines in IFSC

- 100% tax exemption to Units Set up in IFSC for any 10 consecutive years out of total of 15 years

- Depreciation on aircrafts and aircraft engines shall be allowed at 40% on written down value basis

- Unabsorbed depreciation can be carried forward without any time limit and can be set- off against future profits

- Income by way of royalty or interest on lease of aircraft paid to foreign entities exempt

from tax in India, subject to Unit commencing its operation by 31st March, 2024.- S. 10(4F) inserted wef 1.4.2022 (AY 2022-2023) - Exemption from Capital Gains Tax on transfer of aircraft/aircraft engines by an IFSC Unit which is enjoying 100% tax exemption, subject to Unit commencing its operation by 31st March, 2024

5. Case Studies

Case Study 1: India-Malaysia Tax Treaty

Article 8 – Shipping and Air Transport

1. Profits derived by an enterprise of a Contracting State from the operation by that enterprise of ships or aircraft in international traffic shall be taxable only in that State.

2. For the purposes of this Article, profits from the operation of ships or aircraft in international traffic shall mean profits derived by an enterprise described in paragraph 1 from the transportation by sea or air respectively of passengers, mail, livestock or goods carried on by the owners or lessees or charterers of ships or aircraft including:

(a) the sale of tickets for such transportation on behalf of other enterprises; and

(b) the rental of ships or aircraft incidental to any activity directly connected with such transportation.

3. The provisions of paragraphs 1 and 3 shall also apply to profits from participation in a pool, a joint business, or an international operating agency.

Income from incidental sale of tickets on behalf of other enterprise and rental of containers of an enterprise engaged in ‘Operation of Ships’ is covered by the Article

India-Ireland Tax Treaty

Article 8 – Shipping and Air Transport

- Profits derived by an enterprise of a Contracting State from the operation or rental of ships or aircraft in international traffic and the rental of containers and related equipment which is incidental to the operation of ships or aircraft in international traffic shall be taxable only in that Contracting State.

- The provisions of paragraph 1 shall also apply to profits from the participation in a pool,

a joint business or an international operating agency. - For the purposes of this Article, interest on funds connected directly with the operation of ships or aircraft in international traffic shall be regarded as profits derived from the operation of such ships or aircraft; and the provisions of Article 11 shall not apply in relation to such interest, provided that such funds are incidental to that operation.

- Notwithstanding the preceding provisions of this Article, profits derived by an enterprise of a Contracting State from the operation of ships between the ports of the other Contracting State and the ports of third countries may be taxed in that other Contracting State, but the tax imposed in that other State shall be reduced by an amount equal to two-thirds thereof.

Income from rental of ships or rental of containers of an enterprise though not engaged in ‘Operation of Ships’ is covered by the Article

Case Study 2: India-UK Tax Treaty

Article 9 – Shipping

1. Income of an enterprise of a Contracting State from the operation of ships in international traffic shall be taxable only in that State.

2. The provisions of paragraph 1 of this Article shall not apply to income from journeys

between places which are situated in a Contracting State……….

…………

…………

……………

3. The provisions of this Article shall apply also to income derived from participation in a pool, a joint business or an international operating agency.

Term profits from ‘operations of ships’ is not defined

Case Study 3: Article 24 of India-Singapore Tax Treaty

- F Co. Pte Ltd is engaged in operation of ships in international water

- It received freight in respect of a Vessel which sailed from Indian port

- Freight money was remitted to F’s UK Account where treasury operations are centralized

- F Co holds TRC issued by the Singapore Tax Authorities

- FCo applies Article 8 of the India-Singapore treaty and claims that freight income is not taxable in India

- F Co could not establish that income of foreign shipping company was taxable on accrual basis

Issue

- Whether benefit under Article 8 can be availed by FCo?

- T.A. No. 392/RJT/2014 – Alabra Shipping Pte Ltd, Singapore v. ITO [2015] 62 taxmann.com 185 (Rajkot – Trib.)

- PACC Container Line (P.) Ltd. vs. ITO (International Taxation), Nellore ITA no. 25/Hyd./2018 [2022] 141 taxmann.com 103 (Hyd.-Trib.)

India-Singapore Tax Treaty

Article 8 of India-Singapore treaty

“1. Profits derived by an enterprise of a Contracting State from the operation of ships or aircraft in international traffic shall be taxable only in that State”

Article 24 of India-Singapore treaty

“1. Where this Agreement provides (with or without other conditions) that income from sources in a Contracting State shall be exempt from tax, or taxed at a reduced rate in that Contracting State and under the laws in force in the other Contracting State the said income is subject to tax by reference to the amount thereof which is remitted to or received in that other Contracting State and not by reference to the full amount thereof, then the exemption or reduction of tax to be allowed under this Agreement in the first-mentioned Contracting State shall apply to so much of the income as is remitted to or received in that other Contracting State.

2. However, this limitation does not apply to income derived by the Government of a Contracting State or any person approved by the competent authority of that State for the purpose of this paragraph. The term “Government” includes its agencies and statutory bodies.”

Section 10 of Singapore Income-tax Act

Charge of income tax

Sec10.—(1) Income tax shall, subject to the provisions of this Act, be payable at the rate or rates specified hereinafter for each year of assessment upon the income of any person accruing in or derived from Singapore or received in Singapore from outside Singapore in respect of —

(a) gains or profits from any trade, business, profession or vocation, for whatever period of time such trade, business, profession or vocation may have been carried on or exercised;

Exemption of shipping income of a foreign shipping company in Singapore- Section 13F(f):-

Subject to restrictions in subsections (1A) & (2) of Section 13F , income from the carriage by any foreign ship of passengers, mail, livestock or goods which are shipped in Singapore, except where such carriage is only within the limits of the port of Singapore;

Conclusion

Alabra Shipping Pte Ltd, Singapore [62 taxmann.com 185]

- The onus was on the taxpayer to show that the amount was remitted to or was received in

Singapore. - However, such an onus was confined to the cases in which income in question was taxable in Singapore on limited receipt basis rather than on comprehensive accrual basis.

- If it could be demonstrated, that the related income was taxable in Singapore on accrual

basis and not on remittance basis, such an onus did not get triggered.

PACC Container Line Pvt Ltd vs. ITO (International Taxation), [2022] 141 taxmann.com 103 (Hyd. – Trib.)

- Article 8 of the India-Singapore tax treaty could not be applied on stand-alone basis and the effect to the other Articles mentioned in the India-Singapore tax treaty more particularly, Article 24 was required to be given.

- Article 24 of the India-Singapore tax treaty limits the relief only to the extent of amount which is ‘remitted to’ or ‘received’ in that other Contracting State and has not referred the full amount. Literal meaning was required to be given to the word “remitted to” or

“received” while applying Article 24. The word “remitted” could not be read as accrued

for the purposes of Article 24

Maersk Tankers Singapore (P) Ltd Vs. Asstt. CIT – [(2022) 145 taxmann.com 260 (Rajkot-Trib.)].

- Issue: The Assessee had remitted freight income to its agent in Denmark. As the amount is not remitted to Singapore, can the benefit under Article 8 of India-Singapore DTAA be denied by invocation of Article 24?

- Held: Benefits under Article -8 cannot be denied to Singapore resident shipping enterprise by invoking Article 24 of DTAA – Held on the basis of clarification by Singapore IRS that shipping income is taxable in Singapore, on an arising basis when the income is earned by the shipping enterprise regardless of whether the shipping income is received in or remitted to Singapore

- Followed Far Shipping (Singapore) Pte. Ltd. v. ITO [2017] 84 taxmann.com 297/166 ITD 321 (Hyd. – Trib.)

Case Study 4: India UK Treaty

- C Ltd., a UK company, is engaged in transportation of goods in International traffic by ships

- It earns income from two sources:

- Freight income for international transport from vessels chartered

- Income from slot chartering with feeder vessels

- It declares Nil income by claiming exemption under article 9 of India UK Treaty as entire income was on account of ‘operation of ship’

- Whether C Ltd. is liable to be taxed in India on any portion of its income earned from India

Article 9

- Income of an enterprise of a Contracting State from the operation of ships in international traffic shall be taxable only in that State.

- The provisions of paragraph (1) of this Article shall not apply to income from journeys between places which are situated in a Contracting State.

- For the purposes of this Article, income from the operation of ships includes income derived from the rental on a bareboat basis of ships if such rental income is incidental to the income described in paragraph (1) of this Article.

- Notwithstanding the provisions of Article 7 (Business profits) of this Convention, the provisions of paragraphs (1) and (2) of this Article shall likewise apply to income of an enterprise of a Contracting State from the use, maintenance or rental of containers (including trailers and related equipment for the transport of containers) used for the transport of goods or merchandise.

- The provisions of this Article shall apply also to income derived from participation in a pool, a joint business or an international operating agency.

- Gains derived by an enterprise of a Contracting State from the alienation of ships or containers owned and operated by the enterprise shall be taxed only in that State if either the income from the operation of the alienated ships or containers was taxed only in that State, or the ships or containers are situated outside the other Contracting State at the time of the alienation.

6. Gist of Important CBDT Circulars

6.1 CBDT Circulars under S. 172

6.1.1 Circular No. 723 (dated September 19, 1995)

Withholding tax on freight charges paid to FSC/Indian shipping agents

- Section 172 overrides all other provisions of IT Act

- Overrides sections 195 and 194C

6.1.2 Circular No. 723 (dated September 19, 1995)

In the matter of Freight Systems (India) the Delhi Tribunal observed that payment of ocean freight and IHC are not subjected to TDS by virtue of provisions of Section 172. The issue is clarified by the CBDT vide Circular no. 723 dated 19/09/1995.

ITO v. Freight Systems (India) (P.) Ltd. (2006) 103 TTJ (Del) 103/(2006) 6 SOT 473 (Del)

6.1.3 Circular No. 730 (dated July 14, 1995)

- CIT v. Norasia Lines (Malta) Ltd. [[2007] 107 ITD 301/109 TTJ 152 (Cochin Trib.) (SB)] – Chargeability of interest is to be determined by statutory provisions and not by CBDT Circulars

- Circular 730 struck down and withdrawn vide Circular No. 9/2001

6.1.4 Circular No. 732 (dated December 20, 1995)

- ‘No objection certificate’ on annual basis

- No requirement to obtain Voyage- wise NOC

- AO competent to issue Annual NOC valid for one year in respect of taxation of shipping profits after being satisfied about applicability of the DTAA benefits

6.1.5 Circular No. 9 (dated July 9, 2001)

- Payment u/s. 172(4) cannot be considered as payment of advance tax

- Assessee who exercises option u/s. 172(7) is not liable to pay interest u/s 234B/234C or entitled to receive interest u/s 244A

6.1.6 Circular No. 30 (dated August 26, 2016)

- Customs authorities to accept Annual NOC for issuance of PCC for FSCs enjoying full DIT Relief. Voyage NOC from port AO is not required

- In other cases, voyage NOC from the AO having jurisdiction over port is necessary

7. Port Clearance Procedure

STEP 1: Obtain DIT Exemption Certificate, wherever FSC is entitled to DTAA benefits, along with Annual NOC containing names of the vessel for which relief is granted from the jurisdictional AO

STEP 2: Where annual NOC is not available, or does not contain the name of the vessel, file undertaking with the AO at the concerned port (guaranteeing to file voyage return and pay/arrange for payment of taxes, if any) before arrival of the ship at the port and obtain Voyage-wise NOC

STEP 3: Obtain PCC from Customs Authorities on the basis of Annual NOC/Voyage-wise NOC

STEP 4: Ship is allowed to leave India on the basis of PCC from Customs Authorities

STEP 5: File Voyage Return u/s 172(3) within 30 days of the departure of the ship along with challans for the taxes paid, or file DIT Relief Certificate, if no tax is payable

STEP 6: Time-limit for passing voyage assessment order u/s 172(4A) – 9 (nine) months from the end of the financial year in which Voyage Return is filed – Inserted vide Finance Act 2007 w.e.f. April 1, 2007 – No form for the return is prescribed.

STEP 7: Option u/s 172(7) – to be taxed under other provisions of the Act- option to be exercised before end of the assessment year.

8. Article -8 – Comparative Analysis of OECD & UN Model

8.1 Revised Article 8

Replace Article 8 by the following:

Article 8

International Shipping and Air Transport

1. Profits of an enterprise of a Contracting State from the operation of ships or

aircraft in international traffic shall be taxable only in that State

2. The provisions of paragraph 1 shall also apply to profits from the participation in a pool, a joint business or an international operating agency

UN Model Convention 2017 (released in May 2018)

Article 8 – Alternative 1 similar to OECD model as reproduced above

Article 8 – Alternative 2 also includes right to taxation of state of source where transactions are more than casual

8.2 Comparison – OECD vs UN Model

| Article | OECD Model | UN Model (Alternative A) |

UN Model (Alternative B) |

| 8(1) | Profits of an enterprise of a Contracting State from the operation of ships or aircraft in international traffic shall be taxable only in that State.

|

Profits of an enterprise of a Contracting State from the operation of ships or aircraft in international traffic shall be taxable only in that State.

|

Profits of an enterprise of a Contracting State from the operation of aircraft in international traffic shall be taxable only in that State.

|

Deleted portions refer to earlier Models. Most of existing treaties are currently based on old Models

| Article | OECD Model | UN Model (Alternative A) |

UN Model (Alternative B) |

| 8(2) |

Profits of an enterprise of a Contracting State from the operation of ships in international traffic shall be taxable only in that State unless the shipping activities arising from such operation in the other Contracting State are more than casual. If such activities are more than casual, such profits may be taxed in that other State. The profits to be taxed in that other State shall be determined on the basis of an appropriate allocation of the overall net profits derived by the enterprise from its shipping operations. The tax computed in accordance with such allocation shall then be reduced by per cent. (The percentage is to be established through bilateral negotiations.)

|

| Article | OECD | UN Model (Alternative A) |

UN Model (Alternative B) |

| 8(3) |

|

||

| 8(4) | The provisions of paragraphs Enlarges the scope |

The provisions of paragraphs Enlarges the scope |

The provisions of paragraphs 1 and 2 shall also apply to profits from the participation in a pool, a joint business or an international operating agency Enlarges the scope |

9. Applicable Domestic Law Provisions

9.1 Section 172 – Shipping Business of Non-Residents

The provisions of this section shall, notwithstanding anything contained in the other provisions of this Act, apply for the purpose of the levy and recovery of tax in the case of any ship, belonging to or chartered by a non-resident, which carries passengers, livestock, mail or goods shipped at a port in India

Where such a ship carries passengers, livestock, mail or goods shipped at a port in India, seven and a half per cent of the amount paid or payable on account of such carriage to the owner or the charterer or to any person on his behalf, whether that amount is paid or payable in or out of India, shall be deemed to be income accruing in India to the owner or charterer on account of such carriage.

Before the departure from any port in India of any such ship, the master of the ship shall prepare and furnish to the [Assessing] Officer a return of the full amount paid or payable to the owner or charterer or any person on his behalf, on account of the carriage of all passengers, livestock, mail or goods shipped at that port since the last arrival of the ship thereat:

Provided that where the [Assessing] Officer is satisfied that it is not possible for the master of the ship to furnish the return required by this sub-section before the departure of the ship from the port and provided the master of the ship has made satisfactory arrangements for the filing of the return and payment of the tax by any other person on his behalf, the [Assessing] Officer may, if the return is filed within thirty days of the departure of the ship, deem the filing of the return by the person so authorised by the master as sufficient compliance with this sub-section.

On receipt of the return, the [Assessing] Officer shall assess the income referred to in sub-section (2) and determine the sum payable as tax thereon at the rate or rates [in force] applicable to the total income of a company which has not made the arrangements referred to in section 194 and such sum shall be payable by the master of the ship.

No order assessing the income and determining the sum of tax payable thereon shall be made under sub-section (4) after the expiry of nine months from the end of the financial year in which the return under sub-section (3) is furnished

Provided that where the return under sub-section (3) has been furnished before the 1st day of April, 2007, such order shall be made on or before the 31st day of December, 2008.]

For the purpose of determining the tax payable under sub-section (4), the [Assessing] Officer may call for such accounts or documents as he may require.

A port clearance shall not be granted to the ship until the Collector of Customs, or other officer duly authorised to grant the same, is satisfied that the tax assessable under this section has been duly paid or that satisfactory arrangements have been made for the payment thereof.

Nothing in this section shall be deemed to prevent the owner or charterer of a ship from claiming before the expiry of the assessment year relevant to the previous year in which the date of departure of the ship from the Indian port falls, that an assessment be made of his total income of the previous year and the tax payable on the basis thereof be determined in accordance with the other provisions of this Act, and if he so claims, any payment made under this section in respect of the passengers, livestock, mail or goods shipped at Indian ports during that previous year shall be treated as a payment in advance of the tax leviable for that assessment year, and the difference between the sum so paid and the amount of tax found payable by him on such assessment shall be paid by him or refunded to him, as the case may be.

For the purposes of this section, the amount referred to in sub-section (2) shall include the amount paid or payable by way of demurrage charge or handling charge or any other amount of similar nature.]

9.2 Section 44B- Special Provisions- Taxation of Profit & Gains of Shipping (Business of Non-residents)

Notwithstanding anything to the contrary contained in sections 28 to 43A, in the case of an assessee, being a non-resident, engaged in the business of operation of ships, a sum equal to seven and a half per cent of the aggregate of the amounts specified in sub-section (2) shall be deemed to be the profits and gains of such business chargeable to tax under the head “Profits and gains of business or profession”.

The amounts referred to in sub-section (1) shall be the following, namely:

(i) the amount paid or payable (whether in or out of India) to the assessee or to any person on his behalf on account of the carriage of passengers, livestock, mail or goods shipped at any port in India; and

(ii) the amount received or deemed to be received in India by or on behalf of the assessee on account of the carriage of passengers, livestock, mail or goods shipped at any port outside India.]

[Explanation.—For the purposes of this sub-section, the amount referred to in clause

(i) or clause (ii) shall include the amount paid or payable or received or deemed to be received, as the case may be, by way of demurrage charges or handling charges or any other amount of similar nature.]

9.3 Section 44BA- Special Provisions- Taxation of Profits from Operation of Aircrafts by Non-residents

Notwithstanding anything to the contrary contained in sections 28 to 43A, in the case of an assessee, being a non-resident, engaged in the business of operation of aircraft, a sum equal to five per cent of the aggregate of the amounts specified in sub-section (2) shall be deemed to be the profits and gains of such business chargeable to tax under the head “Profits and gains of business or profession”.

(2) The amounts referred to in sub-section (1) shall be the following, namely:

(a) the amount paid or payable (whether in or out of India) to the assessee or to any person on his behalf on account of the carriage of passengers, livestock, mail or goods from any place in India; and

(b) the amount received or deemed to be received in India by or on behalf of the assessee on account of the carriage of passengers, livestock, mail or goods from any place outside India.

10. Gist of Select Case Laws

| Citation | Gist |

| ITO v Freight Systems (India) Pvt. Ltd. (2006) 6 SOT 473/103 TTJ 103 (Delhi-Trib.) |

Inland haulage charges, terminal handling charges, container detention charges, etc could be considered in the nature of shipping income

|

| Czechoslovak Ocean Shipping International Joint Stock Company v ITO (1971) 81 ITR 162 (Cal) |

Shipping income from import freight shall be taxable in India on receipt basis u/s 5

|

| Nedlloyd Lines B.V. v Dy. CIT (1992) 43 ITD 433 (Mum.-Trib.)

Poompuhar Shipping Corporation Ltd. v ITO [2007] 109 ITD 226/108 TTJ 970 (Chennai-Trib.) |

Slot charges paid will not be allowed as deduction from shipping income which is taxable on presumptive basis as a percentage of gross receipts

|

| Citation | Gist |

| ONGC v Inspecting Assistant Commissioner (1989) 29 ITD 422 (Del) |

Hire charges for vessels used for movement of materials and personnel to offshore location in E&P – Income not considered from operation of ships- activities not covered by s. 44B

|

| West Asia Maritime v ITO (2006) 297 ITR (AT) 202 (Mad) |

Bareboat hire charges received by NR ship owner which is not incidental to shipping income is taxable as royalty income

|

| CIT v Orient (Goa) Pvt. Ltd. (2009) 185 Taxman 131/227 CTR 109 (Bom.) |

Benefit of Circular no. 723 apply only to foreign shipping companies entitled to benefit of S. 172 carrying on occasional shipping

|

| Citation | Gist |

| Dy. DIT v. Safmarine Container Lines NV (2009) 314 ITR (AT) 15/2008] 24 SOT 211/[2009] 120 ITD 71 (Mum.-Trib) |

Inland haulage charges covered within the scope of Article 8 of “India – Belgium Treaty”

|

| Dy. DIT v. Thoresen Chartering Singapore (Pte) Ltd. [2009] 118 ITD 416/[2008] 24 SOT 433 (Mum.-Trib.) |

Mere commission agent in the chain of agencies involved between cargo owner and the ship owner – not engaged in “Operation of ship”. Benefit of article 8 denied

|

| JDIT v ANL Container Line Pty Ltd. (2008) TIOL 625 (ITAT Mum)/Dy. DIT v Cia De Navegacao Norsul [2009] 27 SOT 316/121 ITD 113 (Mum.-Trib.) |

International Traffic by feeder vessel under slot chartering arrangement would fall under ‘operation of ships’ if linkages are established with the operations of mother ship engaged in the operation in “International traffic”

|

| Citation | Gist |

| Essar Oil Ltd. v Dy. CIT [2007] 13 SOT 691 (Mum.-Trib.) |

If a voyage is in International traffic and incidentally performed between two Indian coastal shores, it will still be International traffic as it is part of a longer voyage

|

| Integrated Container Feeder Service v Jt. DIT [2021] 133 taxmann.com 194/[2022] 192 ITD 286 (Mum.- Trib.) |

Two companies appointed as agents in India. Both companies provided services to various companies and not exclusively working for assesse. Held as agents of independent status- Did not constitute PE under article 5(5).

|

| UASC/CSL Ltd. v. Dy. CIT [2007] 12 SOT 588 (Mum.-Trib.) |

TRC from Mauritian tax authorities was considered as valid documentary evidence for residence purposes and PEM was held in Mauritius.

|

| Citation | Gist |

| Lufthansa German Airlines v Dy. CIT (2004) 83 TTJ 113/90 ITD 310 (Delhi-Trib.) |

Profits earned by extending technical facilities to IATP member airlines not taxable in India as same in the nature of profits from participation in a pool

|

| Union of India v. Gosalia Shipping P. Ltd (1978) 113 ITR 307 (SC) |

If charterers are liable to pay amount irrespective of whether they carry the goods or not, it would be difficult to say that that the amount was payable for carriage of goods

|

| Caribjet Inc v Dy. CIT (2005) 4 SOT 18 (Mum.-Trib.) |

Wet lease & dry lease are same, discharge of additional responsibilities under wet lease by a NRC, inherent in flying of aircrafts, should not be considered as carrying on operation of aircraft business

|

| Singapore Airlines Ltd v. CIT [2022] 144 taxmann.com 221/[2023] 290 Taxman 139 (SC)

[KLM Royal Dutch Airlines v. CIT and British Airways PLC vs CIT] |

Every action is taken by agent on behalf of the principal with prior permission. Contract does not distinguish between various stages of the transaction. Ambit of S. 194H is wide enough to cover indirect payments. Quatar Airways overruled. Accepted tax neutrality following Hindustan Coca-Cola. Interest under S. 201(1A) can be collected. |

| Citation | Gist |

| Royal Jordanian Airlines v Dy. DIT [2008] 25 SOT 270 (Delhi-Trib.) |

Where there is no business income by the airline, section 44BBA cannot be pressed into service

|

| Asstt. CIT V. Norasia Lines (Malta) Ltd. [2007] 109 TTJ 152/ 107 ITD 301 (Cochin- Trib.)(SB) |

If non-resident opts for assessment under section 172(7), he will not be liable to interest under section 234B and 234C of the ITA

|

| Delmas Shipping South Africa (Pty) Ltd. 547 ITAT MUM |

Income from inland haulage charges incidental to the carrying on of the main activity of operation of ships are not taxable.

|

| Dy. DIT v. Balaji Shipping (UK) Ltd. [2009] 315 ITR (AT) 62/121 ITD 61 (Mum.-Trib.), upheld by Bombay HC |

Income from incidental slot charter is treated as income from operation of ships and eligible for Article 9 of Indo-UK treaty.

|

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA

Very good short note about taxation of foreign shipping and airline companies under Indian Tax laws however the article shows nothing more about PE status of these entities’ branch/liaison office in India. In one of the matter Galileo International Inc vs DCIT (2008) 19 SOT 257 ITAT-Delhi partially treated the operations as PE discussing much about Article 5 of DTAA.

In my considered views the fact is that these entities carried on activities through commission based agents for booking baggage or passenger tickets etc at port or airport and considering these type of activities and uncertainty of PE, there is specific presumptive provisions in the Act considering their partial income chargeable to tax India u/s 44B/172 and section 44BBA i.e. 7.5% and 5% of gross receipts respectively.

Further, if these activities are carried out by Government bodies of concern State then these are exempt from tax under specific treaties in this regard if any between the countries .

If there anything much more material with the team members of Taxman please be shared it for the benefit of members.