Taxation in Securities Markets – Capital Gains, Equity Shares, Mutual Funds, and Futures & Options

- Blog|Company Law|

- 8 Min Read

- By Taxmann

- |

- Last Updated on 29 November, 2023

Table of Contents

- Common Factors for the Computation of Capital Gains

- Taxation of Equity Shares

- Taxation of Mutual Funds

- Taxation of Futures & Options

- NISM-Series-XX: Taxation in Securities Markets Certification Examination

1. Common Factors for the Computation of Capital Gains

| Particulars | Amount |

| Full Value of Consideration

Less: Expenses incurred wholly and exclusively in connection with the transfer Less: Cost of Acquisition/Indexed Cost of Acquisition Less: Exemption under Sections 54F |

***

(***) (***) (***) |

| Short-term or Long-term Capital Gains | *** |

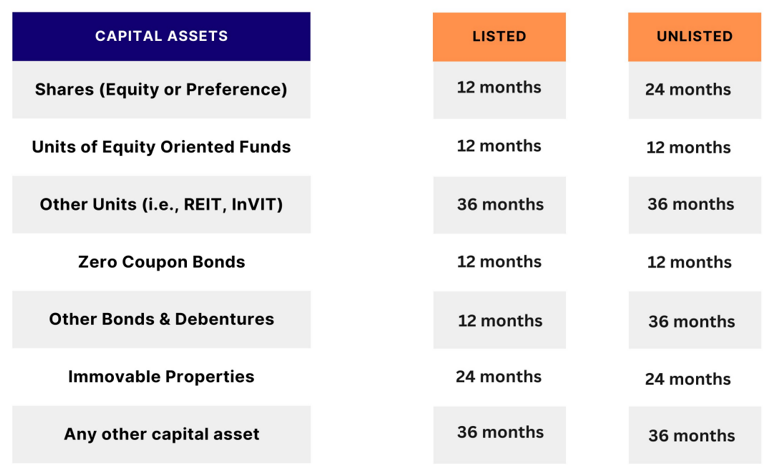

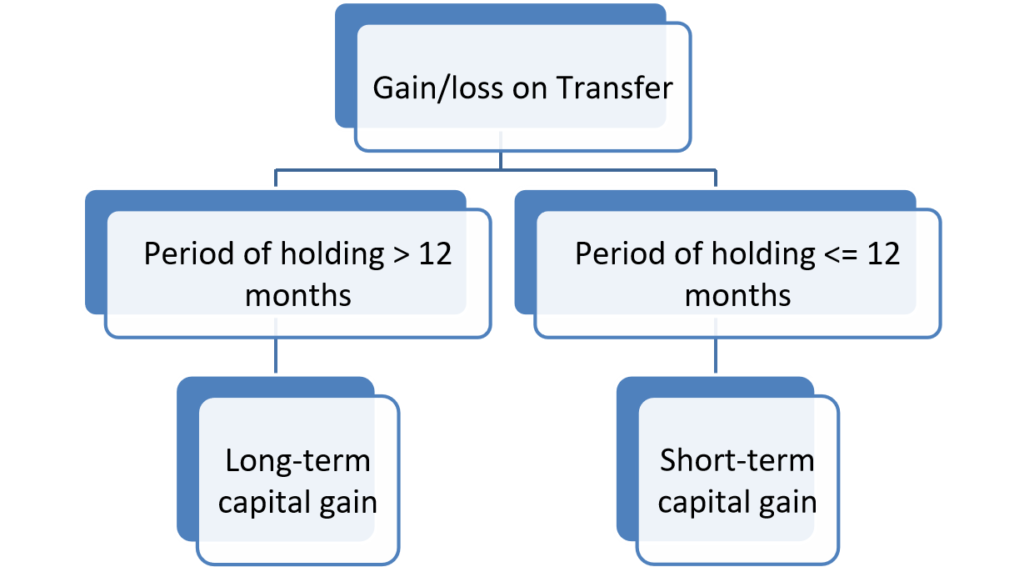

1.1 Period of holding to become long-term capital asset

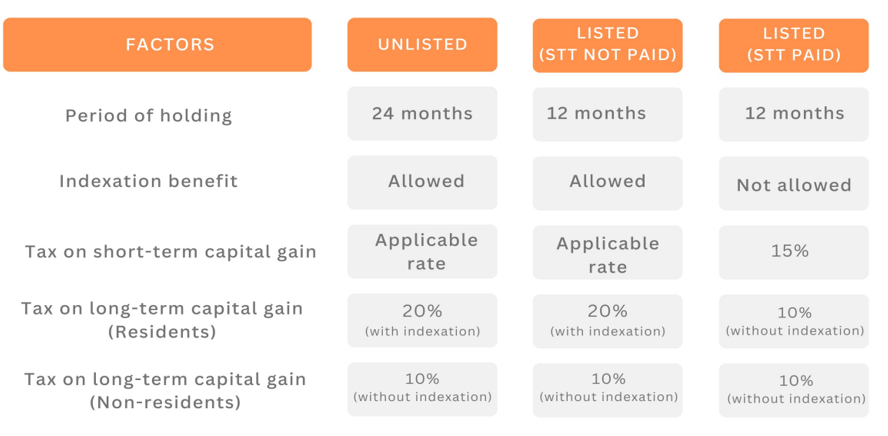

1.2 Indexation Benefit Allowed & Not Allowed

Allowed

- Capital Indexed Bonds

- Sovereign Gold Bond

- Unlisted Equity Shares

- Preference Shares

- Immovable Property

- Physical Gold

- Other Capital Assets (except specified in ‘Not Allowed’)

Not Allowed

- Listed Equity Shares

- Shares purchased by a non-resident

- ReIT & InVIT Units

- Debentures

- Other Bonds

- Units of Equity-oriented MFs

- Non-equity Mutual Funds

- Purchase of:

-

- Unlisted securities by non-resident

- Securities by an FPI

- Units in foreign currency by offshore fund

- GDRs in foreign currency

2. Taxation of Equity Shares

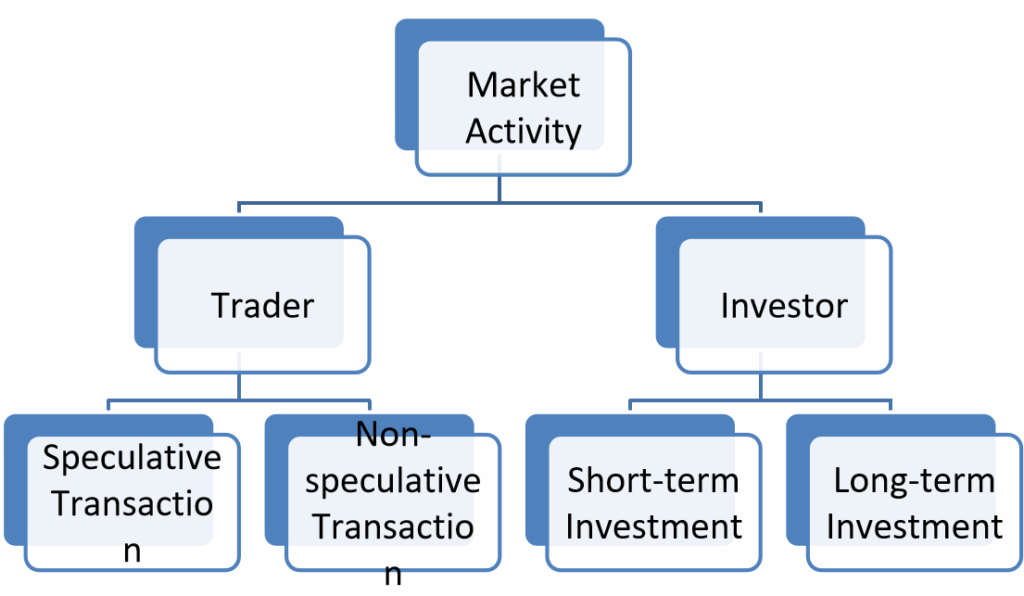

2.1 Are you a trader or an investor?

2.2 How to classify yourself as a Trader or Investor?

| Period of Holding | Classification by Taxpayer | Department’s stand on classification | Reference |

| Less than or equal to 12 months | Stock-in-trade | Business Income | Circular No. 6, dated 29-02-2016 |

| More than 12 Months | Stock-in-trade | Business Income | Circular No. 6, dated 29-02-2016 |

| More than 12 Months | Investment | Long-term capital gain | Circular No. 6, dated 29-02-2016 |

| Less than or equal to 12 months | Investment | Determinative Factors

|

Circular No. 4, dated 15-06-2007 |

2.3 Taxation for Investor in Equity Shares

2.4 Tax on Long-term capital gain

| Particulars | Transaction through stock exchange | Off-Market Transaction |

| Computation | FVC – Cost – Transfer Expense | FVC – Cost – Transfer Expense |

| Period of Holding | FIFO Method | Broker’s/Contract Note |

| Indexation Benefit | Not available | Available |

| Tax Rate | 10% on capital gain exceeding Rs. 1,00,000 | 20% with indexation benefit or 10% without indexation benefit |

| Surcharge capped to 15% | Yes | Yes |

| Grandfathering for shares acquired on or before 31-01-2018 | Applicable | Not Applicable |

| Tax Rebate u/s 87A | Not available | Available |

| Set-off of losses | Set-off allowed only against long-term capital gain | Set-off allowed only against long-term capital gain |

| Carry forward of losses | 8 years | 8 years |

| Advance Tax | No interest if advance tax paid after accrual of income | No interest if advance tax paid after accrual of income |

2.5 Tax on Short-term capital gain

| Particulars | Transaction through stock exchange | Off-Market Transaction |

| Computation | FVC – Cost – Transfer Expense | FVC – Cost – Transfer Expense |

| Period of Holding | FIFO Method | Broker’s/Contract Note |

| Tax Rate | 15% | Normal Tax Rate |

| Surcharge rate capped to 15% | Yes | No |

| Set-off of losses | Set-off allowed only against long-term/short-term capital gain | Set-off allowed only against long-term/short-term capital gain |

| Carry forward of losses | 8 years | 8 years |

| Advance Tax | No interest if advance tax paid after accrual of income | No interest if advance tax paid after accrual of income |

2.6 Tax Rates on Equity Shares

2.7 Taxation for Trader in Equity Shares

2.8 Tax on Business Income

| Particulars | Treatment |

| Maintenance of Books of Accounts | Mandatory if total income or gross turnover in any of the 3 years immediately preceding the previous year exceeds Rs. 1,20,000 (Rs. 2,50,000 in case of Individual or HUF) or Rs. 10,00,000 (Rs. 25,00,000 in case of Individual or HUF), respectively. |

| Tax Audit | Mandatory if turnover during the previous year exceeds Rs. 1 crore (Rs. 10 crores if at least 95% of the transactions are done through banking channels) |

| Availability of presumptive taxation scheme | Law doesn’t restrict assessee to opt for presumptive taxation scheme. However, department may not accept the assessee’s claim as all transactions details are readily made available by the Brokers. |

| Computation of Turnover | The total value of sale shall be considered as the turnover in case of delivery based transactions. There are different rules for computation of turnover in case of speculative and derivative transactions. |

| Computation of Business Income | The advantage of showing trading in shares as business is that a person can claim a deduction of all the expenses incurred in connection with the sale or purchase of securities. Some of such expenses are security transaction tax, internet or telephone charges, depreciation on computer/other electronics, office rent, staff salary etc. |

| Marked-to-market loss/gain | Marked-to-market loss allowed as deduction under Section 36(1)(xviii) if computed as per ICDS-VIII. Whereas, gain is treated as income under Section 28. |

| Tax & Surcharge Rate | Normal Rate as applicable |

| Set-off of losses | Set-off is allowed against any income except salary, gambling, online games, VDA and unexplained income. |

| Carry forward of losses | Carry forward allowed for 8 years. However, in subsequent years, the set-off of losses is allowed only against business income. |

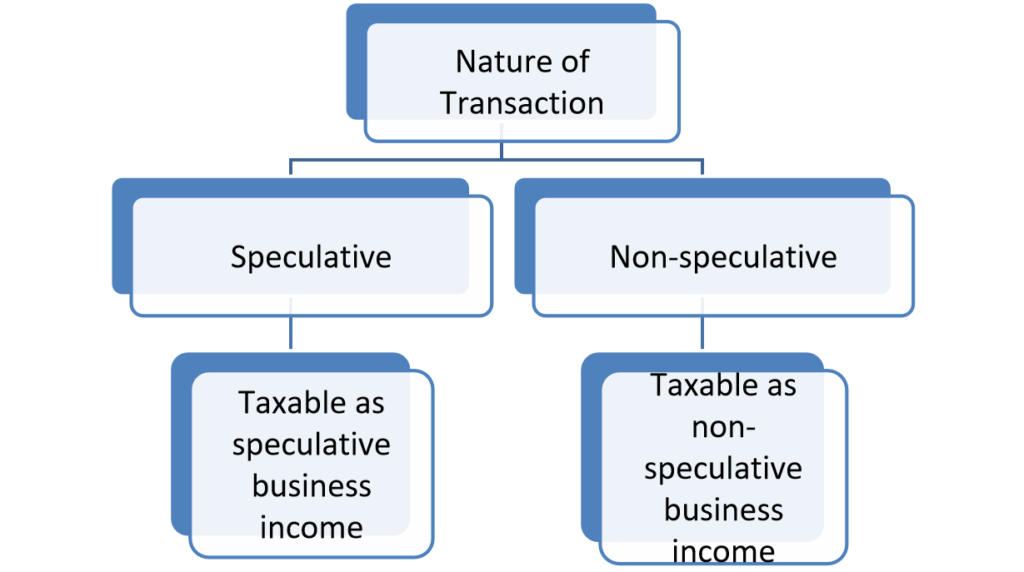

2.9 Tax on Speculative Business Income

The tax treatment of speculative and non-speculative business is same except the following:

| Particulars | Treatment in case of speculative transactions |

| Computation of Turnover | Aggregate of both positive and negative differences arising from the settlement of contracts is to be considered as the turnover. |

| Set-off of losses | Set-off is allowed only against speculative income. |

| Carry forward of losses | Carry forward allowed for 4 years. |

3. Taxation of Mutual Funds

3.1 About Mutual Funds

Mutual funds are the funds which collect money from the investor and invest the same in the capital market for their benefit. Mutual funds invest in a variety of instruments such as equity, debt, bonds, etc. Investments of a mutual fund are managed by the Asset

Management Company through fund managers. All the mutual funds are registered with the SEBI and they function within the provisions of strict regulation created to protect the interests of the investor.

3.2 Types of Mutual Funds

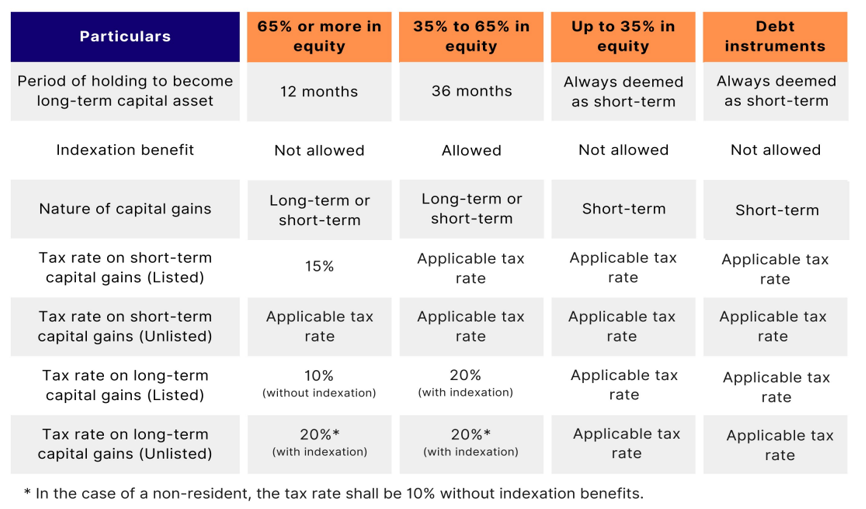

Until Assessment Year 2023-24, mutual funds were categorized into two types for taxation purposes:

- Equity-oriented Mutual Funds and

- Other Funds. However, with effect from Assessment Year 2024-25, mutual funds are now classified into three types for taxation purposes:

-

- Equity-oriented Mutual Funds,

- Hybrid Mutual Funds, and

- Debt/Specified Mutual Funds.

3.3 Tax on different Mutual Funds

| Particulars | Equity-oriented Mutual Funds | Hybrid Mutual Funds | Debt/Specified Mutual Funds |

| Investment percentage in equity | 65% or more (or 90% in case of fund of funds) | More than 35% but less than 65% | 35% or less |

| Period of holding to qualify as long-term capital asset | 12 Months | 36 Months | NA |

| Nature of Capital Gain | Long-term/Short-term | Long-term/Short-term | Always Short-term |

| Indexation Benefit on Long-term capital gain | Not Available | Available | NA |

| Tax rate on Long-term capital gain | 10% on capital gain exceeding Rs. 1,00,000 | 20% with Indexation | Applicable Tax Rate |

| Tax on short-term capital gain | 15% | Applicable Tax Rate | Applicable Tax Rate |

3.4 Taxation of Mutual Funds

3.5 Tax on Dividend from Shares or Mutual Funds

| Particulars | Treatment |

| Method of Accounting | Deemed to be the income of the previous year in which dividend is declared, distributed or paid, as the case may be. |

| Relevant Head of Income | Other Sources |

| Allowability of expenses | Only interest expenditure allowed to the extent of 20% of total dividend income. |

| Tax Rate | Applicable Tax Rates |

| Surcharge capped to 15% | Yes |

| Advance Tax | No interest if advance tax paid after accrual of income |

4. Taxation of Futures & Options

4.1 What is Futures and Options?

Derivatives, popularly known as Futures and Options (F&O), is quite popular among investors who invest in the stock market.

Derivatives are financial products whose value is derived from the real asset. An equity derivative is a class of derivatives whose value is derived from one or more underlying equity securities.

A ‘futures’ is a contract for buying or selling underlying security or index on a future date, at a price specified today.

An ‘option’ is a contract that gives the right, but not an obligation, to buy or sell the underlying security or index on or before a specified date, at a stated price. Options are categorized into 2 categories – Call Options and Put Options. Option, which gives the buyer a right to buy the underlying asset, is called ‘Call option’ and the option which gives the buyer a right to sell the underlying asset, is called ‘Put option’.

4.2 Tax on Futures and Options

The transactions in Futures and Options are treated as normal business transactions.

Thus, the tax treatment is same as in case of a normal business.

However, there are different rules for computation of turnover from F & O transactions.

4.3 Computation of Turnover from F&O

Turnover is calculated as under:

- In case of squared off transactions, total of favourable and unfavourable differences is taken as turnover;

- Premium received on sale of options is also to be included in turnover;

- In respect of any reverse trades, the difference thereon should also form part of the turnover.

- In case of an open position as at the end of the financial year, the turnover arising from the said transaction should be considered in the financial year when the transaction has been actually squared off.

- In case of delivery based settlement in a derivatives transaction, the difference between the trade price and the settlement price shall be considered as turnover.

4.4 Example (For Illustration purpose only)

| Security name | Type | Qty | Option Premium Paid | Option Premium Received | Strike price | Spot/Settlement price | Profit/ (Loss) | Remarks |

| Cipla | Futures | 500 | 1,495 | 1610 | 57,500 | Squared off | ||

| BHEL | Futures | 200 | 208 | 104 | -20,800 | Squared off | ||

| IOC | Put (Sell) | 100 | 5 | 50 | – | Open | ||

| ITC | Put (Sell) | 100 | 40 | 10 | -3,000 | Squared off | ||

| Axis Bank | Futures | 200 | 1229 | – | Open | |||

| TCS | Call (Buy) | 100 | 20 | 1500 | 1600 | 8,000 | Delivery Settlement | |

| Infosys | Call (Buy) | 100 | 10 | 1000 | 950 | (1000) | Expired | |

| GAIL | Put (Buy) | 50 | 4 | 100 | 90 | 300 | Delivery Settlement |

Answer

| Security Name | Profit/(Loss) |

| Cipla | 57,500 |

| BHEL | 20,800 |

| IOC** | – |

| ITC* | 3,000 |

| Axis Bank** | – |

| TCS | 10,000 |

| Infosys | 1,000 |

| GAIL | 500 |

| Total Turnover | 92,800 |

| * As the amount of premium received is already considered for computing the profit or loss from the transaction, it is not included again while computing the turnover.

** Mr. A has open position in underlying shares as on 31st March 2023. Hence, the turnover from such options shall be computed in the financial year in which transaction is squared off or settled for delivery.. |

|

5. NISM-Series-XX: Taxation in Securities Markets Certification Examination

An examination for professionals who want to understand various aspects of taxation applicable to Securities Markets and the diverse securities traded in these markets.

5.1 Who can take Series XX: Taxation in Securities Markets Certification Examination?

- All those Individuals who want to know about the different taxation aspects in the Securities Markets.

- Interested Students/ Professionals

- Any other individuals interested in gaining knowledge of taxation.

5.2 What will you learn in NISM-Series-XX: Taxation in Securities Markets Certification Examination?

- Basics of the Indian Securities Market-Structure, Participants, Products and Features.

- Basic concepts in Taxation, Capital Gains, Sources of Income etc.

- Taxation of products available in the market viz., Equity, Debt, ESOPS, Exchange Traded Funds, Alternate Investment Funds, Real Estate Investment Trusts, Infrastructure Investment Trust and Derivative products.

- Taxation in the hands of the Intermediaries, Foreign Portfolio Investors, IFSC etc.

5.3 Assessment Structure

- Computer-based examination with multiple choice questions.

- Test duration: 2 hours

- There shall be negative marking of 25% of the marks assigned to a question.

- Passing score: 60%

- Certificate Validity : 3 years

- Fees: Rs. 1770

- No. of questions: Total 75 questions of (50 questions of 1-mark each and 25 questions of 2-marks each, adding to a total of 100 marks)

5.4 Function-wise NISM Certifications

Securities Market Foundation (Basic Certification Common for all)

Product Sales

- Currency Derivatives

- Interest Rate Derivatives

- Equity Derivatives

- Commodity Derivatives

- Common Derivatives

MF/PMS/AIF

- Mutual Fund Distributors

- Mutual Fund Foundation

- AIF (Cat I & II) Distributors

- AIF (Cat III) Distributors

- PMS Distributors

- Portfolio Managers

Advisory

- Investment Advisers (Level 1)

- Investment Advisers (Level 2)

- Research Analyst

- Retirement Adviser (mandated by PFRDA)

Operations

- RTA – Corporate

- RTA – MF

- Depository Operations

- Securities Operations & Risk Management

- Merchant Banking

Compliance & Audit

- Securities Intermediaries Compliance (Non-Fund Activities)

- Taxation in Securities Markets

- Social Auditors

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA