Securities Trade Life Cycle – Key Steps | Front Office Operations

- Blog|Company Law|

- 14 Min Read

- By Taxmann

- |

- Last Updated on 12 December, 2025

The Securities Trade Life Cycle refers to the complete end-to-end process that a securities transaction (such as buying or selling shares, bonds, derivatives or other financial instruments) goes through—from the moment an order is placed until the trade is fully settled and ownership is transferred. It covers all operational, technological and regulatory steps involved across the front office, middle office and back office, ensuring that the trade is executed correctly, risks are managed, records are maintained and settlement is completed. In simple terms, it is the entire journey of a trade – Order → Execution → Confirmation → Clearing → Settlement → Reporting & Reconciliation

Table of Contents

Check out NISM X Taxmann's Securities Operations and Risk Management which is NISM's official workbook, setting the essential knowledge benchmark for professionals involved in broking, clearing, compliance, and operational risk functions. It provides a clear understanding of how India's securities market operates—covering the regulatory framework, trade life cycle, broker operations, risk management systems, and investor protection mechanisms. The June 2025 Edition offers comprehensive, regulation-aligned coverage of products, market infrastructure, T+1 settlement, interoperability, cyber-security, and grievance redressal. With learning objectives, practical illustrations, and chapter-end assessments, the workbook provides a structured, exam-focused preparation pathway for the NISM Series VII certification.

1. Introduction to the Securities Trade Life Cycle

In financial market, “trade” means to buy and/or sell securities/financial products. To explain it further,

a trade is the conversion of an order placed on the Exchange into a pay-in and pay-out of funds and securities. Trade ends with the settlement of the order placed.

Every trade placed on the stock market has a cycle which can be broken down into pre-trade and post-trade events. Trading of securities involves multiple participants like the investors, brokers, Exchanges, Clearing agency/corporation, Clearing banks, Depository Participants, Custodians etc.

The following steps are involved in a trade’s life cycle:

- Placing of an Order by the investor/client/broker

- Risk management and routing of order through the trading platform

- Matching of order and its conversion into trade

- Confirmation of trades

- Clearing and Settlement of trades

The above mentioned steps in a trade’s life cycle can easily be categorized into front office, middle office and back office operations of broking firms wherein the placing of an order by the investor/client/broker, matching of order and its conversion into trade and routing of order through the trading platform are generally the front office functions; Risk management is the middle office function; Confirmation of trades and Clearing and Settlement of trades are the back office functions.

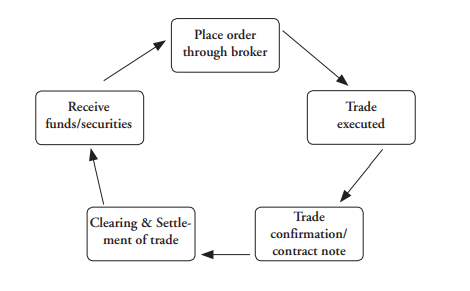

In this article we discuss these various steps involved in a trade life cycle. Figure 1 gives a pictorial representation of the typical trade life cycle for cash/equity/capital segment.

Figure 1 – A Typical Securities Trade Life Cycle

1.1 Placing of Order

1.1.1 Trader Workstation

The trader workstation (TWS) is the terminal from which the member accesses the trading system of Exchange. From TWS member entered order into the Exchange trading system. Exchange provides own trading platforms to its member. Each trader has a unique identification by way of Trading Member ID and User ID through which they are able to log on to the system for trading or inquiry purposes.

TWS provides mainly two kinds of information which are:

Trading member’s own transaction Information:

- Order entered

- Order Modified

- Outstanding Order

- Order Log

- Trade details

Market Information:

- Order book

- Securities/contract price information

- Securities/contract trade information

- Additional information

Exchanges have allowed members to develop their customised trading workstation as per their requirements and connect to Exchange trading system. Under this facility, the Exchanges has made available product such as Computer to Computer Link (CTCL)/Internet based trading (IBT)/Direct Market Access (DMA)/Security trading thought wireless technology facility (STWT)/Automated/Algorithm Trading (ALGO)/Smart order router (SOR) to the Trading Members. Trading member can connect to the system by various mode such as lease line, VSAT, co-location1 etc.

1.1.2 Placing of Client Orders

The Broker accepts orders from the client and sends the same to the Exchange after performing the risk management checks. Clients have the option of placing their orders through various channels like internet, phone, direct market access (DMA) (for institutional clients), Securities trading using wireless technology facility (STWT)/Automated/Algorithm Trading (ALGO)/Smart order router (SOR) etc. To strengthen the regulatory provisions against un-authorized trades and to harmonise the requirements across equity & derivative market, all brokers shall execute trades of clients only after keeping evidence of the client placing such order, it could be, inter alia, in the form of:

(a) Physical record written & signed by client,

(b) Telephone recording,

(c) Email from authorised email id,

(d) Log for internet transactions,

(e) Record of SMS messages,

(f) Any other legally verifiable record.

When a dispute arises, the broker shall produce the above mentioned records for the disputed trades. However, for exceptional cases such as technical failure etc. where broker fails to produce order placing evidences, the broker shall justify with reasons for the same and depending upon merit of the case, other appropriate evidences like post trade confirmation by client, receipt/payment of funds/securities by client in respect of disputed trade, etc. shall also be considered. The Brokers are required to maintain the records for a minimum period for which the arbitration accepts investors’ complaints as notified from time to time (which is currently three years). However, in cases where dispute has been raised, such records shall be kept till final resolution of the dispute. If SEBI desires that specific records be preserved, then such records shall be kept till further intimation by SEBI.

Placing of orders through the internet/phone means the facility provided by stock brokers, whereby the client can place order(s) over the phone/internet for transactions in securities, to be executed on behalf of clients by the broker.

Here, the dealer shall refer to the Dealing Desk Executive appointed by the call centre(s) for the purpose of providing this facility.

- For the purpose of availing of this service, the Client is required to call on the specific numbers intimated or notified from time to time by the stock broker for the said purpose by means of an email and/or by putting up such numbers on the website or otherwise.

- In case the Client opts for this service, he may be required to provide accurate answers to the questions asked by the Dealing Desk Executive, including the Client’s user id and TPIN, for ascertaining the genuineness of the caller. Once this is done, the order can be placed and will be processed in the normal course.

SEBI further instructed that wherever the order instructions were received from clients through the telephone, the stock broker shall mandatorily use telephone recording system to record the instructions and maintain telephone recordings as part of its records.2

Internet trading can take place through order routing systems, which will route client orders to exchange trading systems for execution. Thus, a client sitting in any part of the country would be able to trade using the Internet as a medium through brokers’ Internet trading systems. SEBI-registered brokers can introduce internet based trading after obtaining permission from respective Stock Exchanges. SEBI has stipulated the minimum conditions to be fulfilled by trading members to start internet based trading and services. Broker can provide Securities Trading through Wireless medium on Wireless Application Protocol (WAP) platform. Some additional requirements are to be met by the broker for providing securities transaction through WAP.

Direct Market Access (DMA) is a facility which allows brokers to offer clients direct access to the exchange trading system through the broker’s infrastructure without manual intervention by the broker. Some of the advantages offered by DMA are direct control of clients over orders, faster execution of client orders, reduced risk of errors associated with manual order entry, greater transparency, increased liquidity, lower impact costs for large orders, better audit trails and better use of hedging and arbitrage opportunities through the use of decision support tools/algorithms for trading. SEBI in 2008, introduced Direct Market Access (DMA) and permitted institutional investors to use DMA facility. The facility of the DMA provided by the stock broker shall be used by the client or an investment manager of the client. A SEBI registered entity is permitted to act as an investment manager on behalf of institutional clients. In case the facility of DMA is used by the client through an investment manager, the investment manager is required to execute the necessary documents on behalf of the client(s). Exchange can also specify the categories of investors to whom the DMA facility can be extended. SEBI-registered brokers can introduce DMA facility to their clients after obtaining permission from respective Stock Exchanges. Brokers must specifically authorize clients or investment managers acting on behalf of clients for providing DMA facility, after fulfilling KYC requirements, documentation and carrying out necessary due diligence, records of which should be properly maintained.

Another feature which has been introduced in the Indian securities market is Algorithmic Trading and High Frequency Trading. Algorithmic Trading – Any order that is generated using automated execution logic shall be known as algorithmic trading3. “Automated Trading” shall mean and include any software or facility by the use of which, upon the fulfilment of certain specified parameters, without the necessity of manual entry of orders, buy/sell orders are automatically generated and pushed into the trading system of the Exchange for the purpose of matching.

SEBI has advised the stock exchanges to ensure that all algorithmic orders are necessarily routed through broker servers located in India and the stock exchange has appropriate risk controls mechanism to address the risk emanating from algorithmic orders and trades. The minimum order-level risk controls shall include price check, quantity limit check, order value check etc. Stock exchange shall ensure that the stock broker shall provide the facility of algorithmic trading only upon the prior permission of the stock exchange. SEBI also advised stock exchanges to ensure fair and equitable access to their co-location facility. The stock broker, desirous of placing orders generated using algos, shall satisfy the stock exchange with regard to the implementation of the minimum levels of risk controls at its end as specified by SEBI and Exchanges from time to time. The stock brokers that provide the facility of algorithmic trading shall subject their algorithmic trading system to a system audit every six months in order to ensure that the requirements prescribed by SEBI/stock exchanges with regard to algorithmic trading are effectively implemented.4 Such system audit of algorithmic trading system shall be undertaken by a certified system auditor.

High frequency trading (HFT) is a type of algorithmic trading which is latency sensitive and is characterized by a high daily portfolio turnover and high order-to trade ratio (OTR).

Once the orders are received by the broker, it is confirmed with the client and then entered into the trading system of the Exchange. The Exchange gives confirmation of the order and time stamps it. An order generally comes with certain conditions which determine whether it is a market order, limit order etc. These specify the terms and conditions at which the client wants his/her order to get executed.

1.2 Risk Management and Order Routing

An efficient risk management system is integral to an efficient settlement system. The goal of a risk management system is to measure and manage a trading firm’s exposure to various risks identified as central to its operations. The implementation of strong and effective risk management and controls within stock brokers promotes stability throughout the entire financial system. Specifically, internal risk management controls provide four important functions:

- to protect the firm against market, credit, liquidity, operational, and legal risks;

- to protect the financial industry from systemic risk;

- to protect the firm’s customers from large non-market related losses (e.g., firm failure, misappropriation, fraud, etc.); and

- to protect the firm and its franchise from suffering adversely from reputational risk.

The broker should have online risk management system (including upfront real-time risk management) in place for all orders placed on exchange trading system. The system should have pre-defined limits/checks such as Order Quantity and Value Limits, Symbol wise User Order/Quantity limit, User/Branch Order Limit, Order Price limit, etc. are in place and only such orders which are within the parameters specified by the RMS are allowed to be pushed into exchange trading engines.

1.3 Order Matching and Conversion into Trade

All orders which are entered into the trading system of the Exchange are matched with similar counter orders and are executed. The order matching in an Exchange is done on a price time priority basis. The best price orders are matched first. If more than one order is available at the same price, then they are arranged in ascending time order. Best buy price is the highest buy price amongst all orders and the best sell price is the lowest price of all sell orders.

Once the order is matched, it results into a trade. As soon as the trade is executed, a trade confirmation message is sent to the broker who had entered the order. The broker in turn lets the client know about the trade confirmation through a contract note and messages.

All orders which have not been executed, partly or fully can be modified or cancelled during the trading hours. Trades done during the day can also be cancelled by mutual consent of both the parties subject to approval of the Exchange and as per the trade annulment policy prescribed by SEBI and Exchanges from time to time. These generally occur due to order entry errors and are not a common practice.

1.4 Affirmation and Confirmation (For Institutional Clients)

Institutional clients trading in the Indian securities market use the services of a custodian to assist them in the clearing and settlement of executed trades in cash/equity segment. Custodians are clearing members of the Exchange. On behalf of their clients, they settle the trades that have been executed through brokers. A broker assigns a particular trade to a custodian for settlement by entering custodian participant code at the time of order entry. Upon confirmation by the custodian whether he would settle the trade, the clearing corporations assigns the obligation to the custodian. The overall risk that the custodian is bearing by accepting the trade is constantly measured against the collateral that the institution (who trades) submits to the custodian for providing this service. While confirming the trade Custodian verifies security details, side of the trade, price range etc. as specified by the institutional client.

In 2004, SEBI had mandated that all the institutional trades executed on the Stock Exchanges should be processed through the Straight through Processing (STP) system.5 STP is a mechanism that automates the end-to-end processing of transactions of the financial instruments. It involves use of a single system to process or control all elements of the work-flow of a financial transaction, including what is commonly known as the Front, Middle, and Back office, and General Ledger. In other words, STP can be defined as electronically capturing and processing transactions in one pass, from the point of first ‘deal’ to final settlement. STP thus streamlines the process of trade execution and settlement and avoids manual entry and re-entry of the details of the same trade by different market intermediaries and participants. Usage of STP enables orders to be processed, confirmed, settled in a shorter time period and in a more cost effective manner with fewer errors. Apart from compressing the clearing and settlement time, STP also provides a flexible, cost effective infrastructure, which enables e-business expansion through online processing and access to enterprise data.

|

What is a Contract Note? Contract note is the legal record of any transaction carried out on a stock exchange through a stockbroker. It serves as the confirmation of trade done on a day on behalf of a client on a stock exchange. Every stock broker shall issue a contract note to its clients for trades executed in such format as specified by the Exchanges. It establishes a legally enforceable relationship between the stock broker and the client in respect of settlement of trades executed on the Exchange as stated in the contract note. Every trade executed by a stock broker on behalf of his client should be supported by a contract note. Contract note should be issued within 24 hours of execution of contract and in the format prescribed by Exchanges/SEBI. These should be issued in physical form or electronic form depending on the mode chosen by client. The contract notes should be acknowledged by the clients along with date in case of personal delivery. Stock-brokers are required to maintain proof of dispatch of contract notes in the case of delivery of physical contract notes through post/courier. The digitally signed Electronic Contract Notes (ECNs) may be sent only to those clients who have opted to receive the contract notes in an electronic form, either in the account opening kit or by a separate letter. The usual mode of delivery of ECNs to the clients shall be through e-mail. For this purpose, the client shall provide an appropriate e-mail account to the member which shall be made available at all times for such receipts of ECNs. The acknowledgement of the e-mail shall be retained by the member in a soft and non-tamperable form. The proof of delivery i.e., log report generated by the system at the time of sending the contract notes shall be maintained by the member Stock-Broker should also maintain a bounce mail log showing details of the contract notes that were not delivered to the clients/e mails rejected or bounced back. Whenever ECNs have not been delivered or has bounced, Member should send the physical copy of the contract note to such clients within the stipulated time under the extant regulations of SEBI/stock exchanges and maintain the proof of delivery. All ECNs sent through the e-mail shall be digitally signed, encrypted, non-tamperable and shall comply with the provisions of the IT Act, 2000. In case the ECN is sent through e-mail as an attachment, the attached file shall also be secured with the digital signature, encrypted and non-tamperable. In addition to the e-mail communication of the ECNs in the manner stated above, in order to further strengthen the electronic communication channel, the member shall simultaneously publish the ECN on his designated web-site in a secured way and enable relevant access to the clients. In addition, through e-mail ECN can be send through SMS/electronic instant messaging services only on registered mobile number as uploaded by the member on Exchange portal. The contract notes should be unique running serially numbered starting from the beginning of the financial year. They should be issued with the client’s name, PAN and client’s code written on them. It should also contain the exact order number, order entry time, trade number, trade time, quantity of securities transacted, rates/price, etc. Contract notes with weighted average price of trade should contain an annexure with the details thereon. Stock brokers are required to maintain duplicate copy or counter foil of the contract notes. The contract notes should be signed by stock broker or by an authorized signatory of the stock broker as per the guideline specified by SEBI/Exchanges from time to time. A contract note without consideration is null and void under Indian Contracts Act and hence all contracts should mention the consideration separately. Contract should also mention all statutory charges (like Securities Transaction Tax (STT), Goods and Service Tax (GST), stamp duty etc.), Regulatory levies/charges (e.g., SEBI turnover fees, Exchange transaction charges, etc.), Brokerage etc. Contract notes should be affixed with the brokers note stamps, as a percentage of the total value of the contract, as per the government stamp acts/rules. Contracts note also should clearly specify the complete address, phone number, e-mail IDs, fax numbers, the name of the compliance officer, his telephone number and e-mail address etc. of the broker along with the PAN. |

1.5 Clearing and Settlement

Once the trade is executed on the Exchange, the details are passed on to the clearing corporation, to initiate the clearing and settlement of those executed trades. Based on the trade details from the Exchange, the Clearing Corporation determines the obligations of the members. In case of cash segment, institutional trades are sent to custodian and in derivatives custodian participant code trade send to clearing member for confirmation. Based on the affirmation, the clearing corporation applies multilateral netting and determines obligations. The settlement process begins as soon as member’s obligations are determined through the clearing process.

The settlement process is carried out by the clearing corporation with the help of clearing banks and the depositories. The clearing corporation provides a major link between the clearing banks and the depositories. This link ensures actual movement of funds as well as securities on the prescribed pay-in and pay-out day.

Instructions are given to the depositories and the clearing banks for pay-in of securities and funds and pay-out of securities and funds. The clearing members have to ensure that they make available the securities/funds to the clearing corporation before pay-in day and time. Once the pay-in activities are carried out the clearing corporation carries out the pay-out of funds and securities.

SEBI vide circular dated September 07, 2021, provided guideline for Introduction of T+1 rolling settlement on an optional basis. T+1 rolling settlement was completely implemented in the Indian securities market w.e.f. January 27, 2023. Currently for all securities traded in equity segment Exchanges and clearing corporation follows the T+1 rolling settlement. In case of T+1 rolling settlement, the trades executed on Wednesday, has to be settled on Thursday (provided Thursday is working day) with pay-in and pay-out of funds and securities being completed on that day. SEBI vide Circular No. SEBI/HO/MRD/MRD-PoD-3/P/CIR/2024/20 dated March 21, 2024 introduced the beta version of T+0 rolling settlement cycle on optional basis in addition to the existing T+1 settlement cycle in Equity Cash Markets, for a limited set of 25 scrips and with a limited number of brokers. Further in December 2024, SEBI increased the number of scrips under optional T+0 settlement and also all stock brokers were allowed to participate in optional T+0 settlement.

2. Front Office Operations

The front office is responsible for order capture and execution. This is where the order/trade originates, and the client relationship is maintained. The front office makes/takes orders and executes them. Dealers and sales staff are considered front office staff.

- The facility of co-location or proximity hosting (or by whatever name called) is offered by the stock exchanges to stock brokers and data vendors whereby their trading or data-vending systems are allowed to be located within or at close proximity to the premises of the stock exchanges, and are allowed to connect to the trading platform of stock exchanges through direct and private network.

- SEBI Circular Ref No.: SEBI/HO/MIRSD/DOP1/CIR/P/2018/54, Dated March 22, 2018.

- SEBI Circular Ref. No. CIR/MRD/DP/09/2012 Dated March 30, 2012.

- SEBI Master Circular dated December 30, 2024, “Master Circular for Stock Exchanges and Clearing Corporations, Chapter 2 – Trading Software and Technology”.

- SEBI Circular Ref. No. DNPD/Cir-22/2004 dated April 1, 2004, DNPD/Cir-25/04 dated June 10, 2004.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA