Retirement Planning Concepts – Process | Goal | Financial Security

- Other Laws|Blog|

- 14 Min Read

- By Taxmann

- |

- Last Updated on 28 March, 2024

Retirement Planning is the process of putting in place the road map for retirement. A big part of the retirement plan is the financial aspect of how the retirement will be funded. The life style envisaged will define the expenses and income required in retirement, which in turn will set the goal for retirement savings. Planning for retirement is about linking the current financial situation with the expectations for the future and having a strategy in place to secure the financial future.

Table of Contents

Check out NISM X Taxmann's Retirement Adviser which covers fundamental concepts about retirement planning, retirement planning products, retirement planning process & strategies, National Pension System. This book has been accredited by Pension Fund Regulatory and Development (PFRDA).

1. Evaluate Client’s Current Situation

Understanding the current financial situation of the individual is vital in framing a viable retirement plan. This includes personal factors such as age, dependents, health history; financial details such as the level of income and expenses, assets and liabilities, other financial goals, retirement benefits that are available, risk tolerance levels and investment horizon.

All this information is evaluated to understand the elements that are central to planning for retirement savings including the ability to save, the investment horizon available to accumulate the savings, the risk tolerance levels that will determine the types of investments that can be used and the accumulated wealth available that can be apportioned to the retirement goal.

The retirement plan will seek to fuse the expectations for retirement with what is realistically possible given the personal and financial situation of the individual.

1.1 Lifecycles and its Impact on Saving and Investing for Retirement

Financial needs and financial compulsions vary not only across individuals but also across time periods for each individual. They vary depending upon the financial circumstances at the age and stage in life. The income and expenses, debt levels, ability to take risks and goal priorities are all dynamic. For example, debt repayment may take a large portion of the income in the early and mid-earning years, but are not so significant later in life. The availability of an emergency fund to tide over unexpected short-falls in income is critical for the young earner with a dependent family, but not so important for a retired investor. One way to be able to incorporate the demographic and economic factors specific to each stage of life into the planning process is to consider the life cycle of the individual. This takes into consideration the financial and personal circumstances at that stage. For effective financial planning it is important to incorporate the lifecycle into the planning framework. Despite the uniqueness of each individual’s situation there are some commonalities of the typical situations that individuals go through in each stage of the lifecycle and which affects the income, expenses and savings. The common stages are:

- Young Earner: At this stage income is not very high and just about adequate to meet expenses. Creating an emergency or reserve fund to manage any possible loss or reduction in income should have first claim on savings. Any mandatory savings, such as provident fund deductions from income, should be assigned to long-term goals such as retirement. While long-term goals like retirement exist, at this stage priority is given to short and medium-term consumption goals like buying a motor vehicle and lifestyle goods. There is a risk of falling into debt to meet consumption demands or even essential expenses in case of loss of income. Repayment of debt, such as educational loans and consumption loans, becomes a strain on income for a long time. Flexibility in making investments to align to income conditions is important for investors at this stage. Being tied to a long-term commitment, such as a home loan EMI, when income stability is not there can be risky to the investor. A suitable portfolio allocation will have to consider holding an emergency fund in safe and liquid short-term investments. Savings assigned to long term goals should be invested in growth assets like equity. The allocation to growth assets should move up as there is greater stability to income.

- Young Family: At this stage household income is likely to be stable, though still not very high relative to the expenses that have to be met. Expenses are mainly discretionary expenses for a lifestyle they aspire to live. Debt may still be a concern and taking a big portion of income to service, especially if the family has bought a home. At this stage the young family will have protection as a priority. This will be primarily in the form of insurance and emergency fund. The amount of savings available after meeting all these essential claims will be limited, but whatever is available can be invested in asset classes capable of earning higher returns albeit with higher risk. Plan ahead for changes, such as moving from a double income to single income family or moving to being self-employed, that may disrupt income flows. Thus, at this stage it is essential to ensure that the rear eadequate savings to tide over the needs till income and expenses stabilize. An allocation of 60 percent to 70 percent in growth assets such as equity to meet long term goals is advisable at this stage.

- Middle Earning Years: This is typically the peak earning years and income levels at this stage are high and stable. Expenses are likely to have stabilized too leading to higher savings. Debt levels are likely to be steady and easily serviced out of available income. Some goals, such as the education of children, may be close and require moving funds to less volatile investments. Other goals, like retirement, may still be 15-20 years away and still eligible for growth-oriented investments. This stage is a good time to catch up on all the short fall in retirement savings by apportioning larger portions of available savings to it. There is greater clarity on life style preferences, interests and health issues, all of which are important for firming up the retirement plans. Portfolios at this stage can see 50 percent to 60 percent in growth assets with a plan to systematically reduce exposure as goals come closer.

- Pre-retirement: Preservation of assets is critical at this stage as earning years are coming to an end soon. While contribution to retirement will continue, this is the stage to move accumulated investments to less risky investments. Paying off any remaining debt and refraining from taking on any long-term obligations is important at this point. This is the stage when the distribution or income strategy for retirement should be finalized and there is likely to be more clarity on the length of retirement period. The portfolio should be in lower risk income-oriented assets such as income funds and deposits, with some exposure to growth. Around 60 to 70 percent of the portfolio should be allocated in lower risk products at this stage.

- Retirement: At this stage the level of expenses in retirement is known and the decision on how to fund them has to be decided. This will be from any employer-linked pension, the income generated from the corpus accumulated, part-time employment or a combination of the different sources. While deciding on investing for income, the tax implications, need for assurance and risk levels have to be considered. Care should also be taken to invest some portion of the corpus in growth assets to beat inflation. The portfolio should be predominantly income-oriented, with not more than 25 percent to 30 percent in growth assets.

1.2 Budget to Realize Savings

The age and stage of life gives an understanding of the ability to save and the risk profile of the individual. Budgeting is an effective way to realize the potential to save. The steps in budgeting are the following:

- List the regular income that is expected in the month. This is the income available to meet current and future needs.

- List the mandatory expenses that have to be met like taxes, loan repayments. These have to be first met out of the available income. What remains is the disposable income.

- The essential living expenses have to be met out of disposable income next. These include housing, food, transportation, health and other necessary expenses. While this category of expenses cannot be eliminated, it is possible to reduce the cost incurred on them.

- Discretionary expenses are the last category of expenses and includes expenses on entertainment and recreation.

Savings is what remains from the income after meeting all these expenses. There should be a target to generate a pre-defined amount of savings each period. The savings required will depend upon the identified goals of each individual. Ad hoc or irregular savings does not serve the purpose of creating the corpus required to meet the goals. One way to reach the targeted savings is to expand income by taking on additional income earning opportunities. But the extent to which income can be increase dislimited by skills and availability of time to take up additional employment. Controlling expenses is a more effective way to generate savings. It is possible to rationalize essential living expenses by choosing a less expensive place to live or a cheaper mode of transport and so on. The discretionary expenses is in the category of expenses that can be cut back or even eliminated to reach the savings required.

A budget helps put income and expenses in perspective. But to be workable, a budget needs to be realistic. Very narrow allocations to expenses or eliminating all expenses related to an individual’s interests or hobbies can be stressful and likely to fail.

The savings ratio, or the savings relative to income, should ideally rise over time as an individual moves from one stage in the life cycle to the next and as the level of income and expenses change. Similarly, expense ratio should ideally move down to indicate that the house hold is saving more. The debt to income ratio measures the extent of income that goes towards servicing debt. This will peak when a large loan such as the home loan is taken and then moved own as income goes up over time. These ratios give an indication of whether the household is managing income and expenses as they should to reach their goals. If not, changes need to be made in the budget to get savings back on track.

2. Learn the Process of Setting the Retirement Goal

The retirement goal has certain features that are unique to it. It is the goal with the longest accumulation and distribution periods and requires the largest corpus1. Though the income required to meet expenses in retirement can be defined with certainty only close to the time of transition to retirement, the accumulation of the corpus has to be done from the beginning of an individual’s working years. There are many variables in estimating the goal and these variables are likely to change multiple times given the long periods associated with the goal. It becomes important therefore for there to be an adequate rigour in determining the variables that affect the retirement goal and periodic monitoring to incorporate changes, if any, into the goal.

The process of determining the retirement goal is about defining the income that will be required to meet living expenses in the period when there is no income being earned from employment. Once this is done, then the planning process deals with how to accumulate the corpus required, and use this corpus to generate the income.

2.1 Expenses in Retirement

The first step in retirement planning process is to determine the expenses that have to be met in retirement. The expense in retirement is unlikely to be the same as prior to retirement. The level of expense may go down in some categories like transportation and personal upkeep, while it may go up in other categories such as leisure and health. Even in the retirement period the expense profile is likely to undergo change over time. The categories of expense heads during the retirement phase includes housing (including utilities, maintenance cost, taxes), living expenses (food and personal upkeep), medical care, transportation, recreational expenses and insurance (life, health, disability) and taxes. A retirement expense list may have all or some of these expenses (see Table 1).

Table 1: Retirement Expenses List

| Expense Head | Amount (Rs.) |

| Housing | |

| Mortgage/Rent | |

| Property tax | |

| Home insurance | |

| Electricity | |

| Water | |

| Telephone & Communication | |

| Maintenance costs | |

| Miscellaneous | |

| Total | |

| Living Expenses | |

| Food | |

| Clothing | |

| Personal expenses | |

| Miscellaneous | |

| Total | |

| Medical Expenses | |

| Health insurance | |

| Long-term care | |

| Medical costs | |

| Miscellaneous | |

| Total | |

| Transportation | |

| Auto loan | |

| Fuel | |

| Maintenance costs | |

| Motor insurance | |

| Total | |

| Recreational Expenses | |

| Interests & Hobbies | |

| Entertainment | |

| Travelling | |

| Social activities | |

| Miscellaneous | |

| Total | |

| Total Expenses |

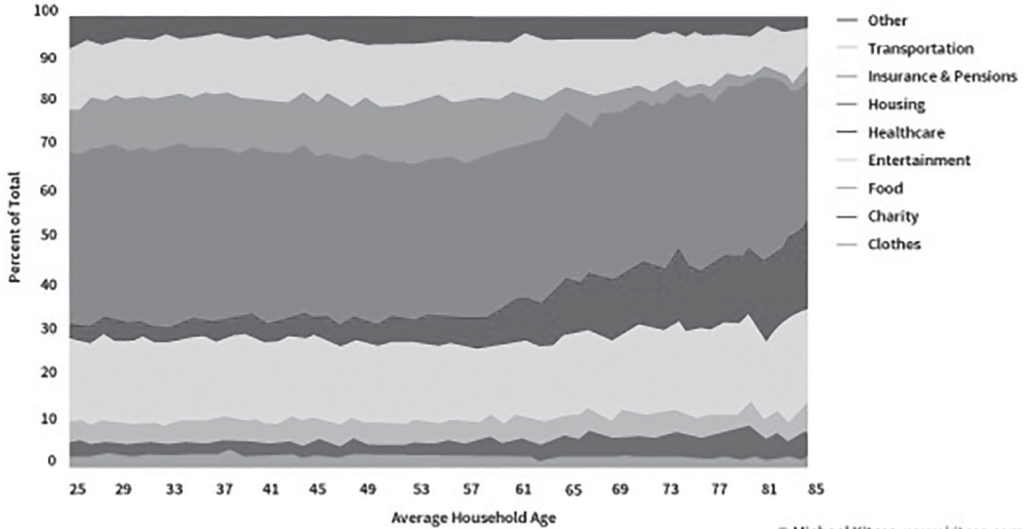

Ideally, mortgages and other large debt obligations should be paid off before retirement. Renting is an option instead of buying a home and may provide greater flexibility in deciding on where to live in retirement. However, it may bring in an element of uncertainty on housing costs and availability, which may be difficult to deal with later on in retirement. The expense profile of an individual against their age is graphically represented below (see Chart 1).

Chart 1: Changing Expenditures Over Time

2.2 Determine Income Requirement in Retirement

Income Replacement Method

Income replacement ratio is calculated as gross income after retirement/gross income before retirement.

The income replacement ratio is the percentage of the income just before retirement that will be required by an individual to maintain the desired standard of living in retirement. While the categories of expenses may remain the same in retirement, the contribution to total expenses may be different from working years. For example, medical and health care expenses is likely to be a big component in later years of retirement as compared to working years and even the initial years of retirement. Transportation and tax outgo is likely to be lower in retirement years while recreational expenses may be higher in retirement years. Expenses incurred towards children’s education is typically not there in retirement. The portion of income that was going towards necessary savings in the pre-retirement stage will now no longer be required.

Usually 70 percent to 90 percent of the income before retirement is required to maintain the lifestyle of the individual after retirement. However, this number may be lower if a large part of the pre-retirement income was going into savings. This is very likely the case with many individuals who hit a phase of high income in their early 50s, and with much of the large-ticket expenses already taken care of a large portion of the income may go into savings. In such a case, the income replacement ratio is likely to be much lower since the saving and probably tax component would account for a large part of the pre-retirement income.

In the initial years of planning, when there is less clarity on the future income, it is more convenient to go with thumb rules to determine the needs in retirement. But as the income and expense situation becomes clearer, especially in the last 5-10 years before retirement, it is best to consider the particular situation of each individual while determining the income replacement ratio. The income replacement method is simple to follow and useful to set a target for savings when retirement is some time away. But like all rules of thumb it does not take individual circumstances into consideration. For example, assuming that expenses in retirement will automatically go down may be erroneous.

The steps for estimating the income required in retirement under this method are:

- Calculate the current income.

- Estimate the rate at which the income is expected to grow over the years to retirement.

- Calculate the years to retirement.

- Calculate the income at the time of retirement as Current value x (1+ rate of growth) ^ (Years to retirement).

- Apply the income replacement ratio to this income to arrive at the income required in retirement.

Example

Pradeep has a current annual income of Rs. 10,00,000. He is 30 years of age and expects to retire at the age of 55. He also expects his income to grow at a rate of 10 percent and estimates that he will require an income replacement of 75 percent. What is the income required by Pradeep in retirement?

| Current Annual Income (Rs.) | 1000000 | Formula |

| Age | 30 | |

| Retirement age | 55 | |

| Years to Retirement | 25 | 55-30 |

| Annual Rate of Growth in Income | 10 percent | |

| Income at the time of Retirement | 1,08,34,706 | 1000000 ×(1+10 percent)^25 |

| Income Replacement Ratio | 75 percent | |

| Annual Income required in Retirement | 81,26,029 | 10834706 × 75 percent |

Expense Protection Method

In the expense protection method, the focus is on identifying and estimating the expenses likely to be incurred in the retirement years and providing for it. Typically, the expenses required by the person in retirement is taken as a percentage of the expenses of that person just before retirement – the assumption being that one’s post retirement expenses will not include certain expenses such as transport, home loan EMI. On the other hand, the expenses incurred on other heads such as health, is likely to be higher.

Expense Protection is a slightly cumbersome method due to the detailed listing required of expenses incurred post-retirement. Estimating this wrongly may make the determination of retirement corpus in accurate. The process involves preparing a list of pre and post-retirement expenses, and arriving at the total expense list. The expense so calculated has to be adjusted for inflation over the period of time left to retirement to arrive at the expense in retirement.

If expenses are overlooked or underestimated there is a risk of overspending in retirement since the income required would be calculated lower than what is actually required.

Example

Pradeep has a monthly expense of Rs. 50,000 of which 60 percent is for household expenses. He is 30 years old and expects to retire at the age of 55. He expects to incur additional expenses of Rs. 10,000 pm at current prices for discretionary expenses in retirement. If inflation is seen at 6 percent, what is the expense that has to be met by retirement income?

| Expenses | Formula | |

| Current monthly expense (Rs.) | 50000 | |

| Proportion of household expenses | 60 percent | |

| Current household expenses (Rs.) | 30000 | 60 percent of Rs.50000 |

| Additional discretionary expense in retirement (Rs.) | 10000 | |

| Total retirement expenses at current prices (Rs.) | 40000 | |

| Time to retirement (years) | 25 | Retirement age (55) – Current age (30) |

| Expected rate of inflation | 6 percent | |

| Expense at the time of retirement (Rs.) | 171675 | 40000 x (1+6 percent)^25 |

2.3 Time Horizon

Time plays an important role in retirement planning. The time periods that are central to calculating the retirement corpus are:

- Years to retirement: This is the period from the current point in time to the year of retirement. Another way to calculate it is as the period between current age and retirement age. With every passing year this period will reduce as long as the year/age of retirement has not changed. They ears to retirement is important to be able to determine the cost of expenses that have to be met in retirement. The effects of inflation on cost will depend on the years to retirement. Lower this number, lower will be the effect of inflation. This number is also important in the calculation of the periodic savings required to accumulate the corpus required to fund the expenses in retirement. Longer the period, greater will be compounding effects, and lower will be the allocation from savings required for the retirement.

- Years in/during retirement: The years in/during retirement are the number of years from the beginning of retirement to the end of life for which an income has to be secured. This period cannot be defined precisely. However, life expectancy can be broadly estimated based on factors such as average life expectancy in the country for the specific gender, health conditions, genetic factors, lifestyle habits and so on. The years for which funding has to be provided will determine the corpus required. Underestimating the years, or longevity risk, will mean that there may not be enough money to last the retirement years.

2.4 Determining the Retirement Corpus

The income required in retirement can be estimated using either of the two methods described earlier. Once this has been done, the next step in retirement planning is to calculate the corpus that will generate the income required in retirement. The variables in this calculation are:

- The periodic income required

- The expected rate of inflation

- The rate of return expected to be generated by the corpus

- The period of retirement, i.e. the period for which income has to be provided by the corpus

Impact of Inflation

Inflation is a general rise in prices of goods and services over a period of time. Over time, as the cost of goods and services increase, the value of one unit of money will go down and the same amount of money will not be able to purchase as much as it could have earlier i.e. last month or last year. Inflation eats away the purchasing power of money over time.

Inflation impacts retirement planning in two ways:

- At the time of calculating the income required, the value of the current expenses has to be adjusted for inflation to arrive at the cost of the expense at the time of retirement. For instance, if consumer goods prices rise 6 percent a year over the next 30 years, items that cost Rs. 100 today would cost Rs. 179 in 10 years, Rs. 321 in 20 years and Rs. 574 in 30 years.

- This figure is true for the beginning of the retirement period. Over the retirement years, the income required to meet the same level of expenses would not be constant but would go up due to inflation. The corpus created to fund income during retirement will have to consider the escalation in cost of living during the period in which pension is drawn. In the previous example Rs. 1,71,675 is the monthly expense at the time of retirement. However, this will not remain the same throughout the retirement period but will increase over time, depending upon inflation. The increase in expenses has to be considered while calculating the retirement corpus else there is a risk of the retirement being under-funded. If you’re planning to live on Rs. 60,000 a month at the start of retirement, a 6 percent inflation rate means that in 10 years you would actually need Rs. 1,07,451 a month, and in 20 years you’d need Rs. 1,92,428 a month to cover the same expenses.

- While the standard rate of inflation may be appropriate to calculate the future cost of living expenses, other expenses, such as health costs and travel, typically increase at a higher rate.

- The accumulation stage is the stage in which the saving and investment for the retirement corpus is made. The distribution stage of retirement is when the corpus created in the accumulation stage is employed to generate the income required to meet expenses in retirement.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA