Registration on Social Stock Exchanges – Process and Guidelines

- Blog|Company Law|

- 10 Min Read

- By Taxmann

- |

- Last Updated on 24 October, 2025

Registration on the Social Stock Exchange (SSE) in India refers to the formal process whereby a social enterprise—either a not-for-profit organisation (NPO) or a for-profit social enterprise (FPE)—obtains eligibility and approval to access the SSE platform in order to raise funds, strengthen visibility and comply with disclosure obligations under the regulatory framework. The process demands fulfilment of criteria stipulated by Securities and Exchange Board of India (SEBI) and the host stock exchange (e.g., National Stock Exchange of India or BSE Limited), which include demonstrating a clear social intent, engaging in eligible social activities, meeting financial thresholds (such as minimum operating history, audited accounts, minimum spending or funding levels for NPOs) and committing to enhanced transparency through impact reporting. For an NPO, it is mandatory to register on the SSE before raising funds through the platform, although registration does not invariably mandate listing of securities. Eligible entities that complete the registration process gain access to a broader investor base, improved credibility, and structured mechanisms—such as issuance of Zero-Coupon Zero Principal (ZCZP) instruments in the case of NPOs or equity/debt for FPEs—to channel capital into social missions.

Table of Contents

- Registration Process on Social Stock Exchanges

- Rights, Obligations and Disclosures Document

- Key Listing Guidelines

Check out NISM X Taxmann's Social Impact Assessors is the definitive resource for professionals and students aiming to become certified in Social Impact Assessment, with a special focus on the Social Stock Exchange (SSE) framework. Jointly developed by NISM, ICAI, and industry experts, this workbook delivers comprehensive, exam-focused content covering regulations, best practices, case studies, and reporting standards. With a user-friendly and practical approach, it equips readers with the skills needed to assess, measure, and report social impact effectively. This publication is an indispensable tool for anyone pursuing a career in social finance, ESG, or compliance.

1. Registration Process on Social Stock Exchanges

In the regulatory ambit of SEBI, the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) have established their Social Stock Exchanges wings viz., NSE SSE and BSE SSE respectively. As on February 2025, 115 Non-Governmental Organisations have onboarded the NSE SSE and 51 NPOs have onboarded the BSE SSE.

SSEs direct social enterprises to follow the rules and regulations framed by SEBI.

1.1 Eligibility Requirements1

A social enterprise shall be eligible for fund raising through the Social Stock Exchange mechanism after fulfilment of below mentioned prior conditions:

- Establish the primacy intent of social impact (as per the 17 Social Development Goals (SDG)) for being eligible to qualify for on-boarding the Social Stock Exchange (SSE) and access the SSE for fund-raising. The social enterprise could either engage in the products, services, or programs or work on research, policy analysis and development, awareness building, governance or capacity building.

- The activities as specified for the social enterprises must focus on underserved or underprivileged populations or geographic areas or regions that have recorded lower performance in the development priorities of national/state governments. These activities may include rendering services or delivering products to the members belonging to Scheduled Castes (SC), Scheduled Tribes (ST), Other Backwards Classes (OBC), people with special needs, the elderly, children, at-risk adolescents, migrants, and displaced persons may also fall under this category.

- Social Enterprise shall have at least 67% of its activities qualifying as eligible activities to the target population. This can be ascertained by one or more of the following:

-

- Revenue – At least 67% of the immediately preceding 3-year average revenues should have come from providing the eligible activities to members of the target population;

- Expenditure – At least 67% of the immediately preceding 3-year average of the SE’s expenditure has been incurred for providing the eligible activities to members of the target population;

- Customer base/beneficiaries – Members of the target population to whom the eligible activities have been provided constitute at least 67% of the immediately preceding 3-year average of the SE’s customer base/beneficiaries.

Provided that the corporate foundations, political or religious organizations or activities, professional or trade associations, infrastructure and housing finance Companies, except affordable housing, shall not be eligible to be identified as a Social Enterprise.

1.2 Initial Qualifying Criteria for Onboarding

The eligibility requirements for Social Enterprises to get registered on social stock exchange have been given in point 3.1.1. After fulfilling the qualifying criteria, distinction between FPEs and NPOs has to be ascertained. It is necessary for a not-for-profit organisation (NPO) to qualify the eligibility requirements as mentioned above for the purpose of registration on Social Stock Exchange, and thereafter, it may decide either to list or not for the purpose of raising funds through SSE. The minimum requirements for registration of a not-for-profit organisation on a Social Stock Exchange have been specified by SEBI through its circulars2.

However, a For Profit Enterprise (FPE) shall not seek registration or listing with Social Stock Exchange, unless it is registered as a Company under the provisions of Companies Act, 2013 or erstwhile provisions of Companies Act, 1956 as the case may be and complies with the requirements in terms of SEBI Regulations for issuance and listing of equity or debt securities.

1.2.1 On Boarding Process for NPOs

The NPOs are required to meet certain mandatory criteria in order to register on Social Stock Exchange. The NPOs possess a variety of legal structures and are regulated by a variety of statutory bodies and legislative acts.

The NPO registration shall serve a three-fold purpose:

Firstly, it shall bring interested NPOs onto a common platform of legal requirements for the purposes of accessing the SSE. Secondly, it shall inculcate a cultural shift in NPOs and enable transition towards a disclosure driven fund raising system. Thirdly, it shall provide a means for NPOs (and especially, smaller NPOs) to signal the primacy of social impact and the quality of their governance, transparency even if they wish to not list any security at the present moment. This will enable the NPOs to leverage the reputation value of being registered while raising funds, whether or not they choose to list, and this reputation value will derive from the registered NPOs satisfying the mandatory criteria, which also include annual reporting requirements, as described below.

1.2.2 Mandatory Qualification Criteria

The mandatory criteria for NPO registration is given in Table below. It is to be noted that in addition to the legal requirements, the mandatory qualifying criteria for registration shall include a set of minimum size as indicated by funds received/deployed. This shall ensure that the NPO wishing to register has an adequate track-record of operations.

The NPOs shall ensure compliance with all the qualification requirements, registration requirements, reporting requirements etc. as specified by SEBI from time to time.

Table 3.1: Mandatory Criteria for NPO Registration

[Read with Regulation 292F (1) of SEBI (Issue of Capital and

Disclosure Requirements) Regulations, 2018].3

| Broad Parameter | Indicator | Details |

| Legal Requirements | ||

| Entity is registered as an NPO | Registration certificate valid at least for next 12 months at the time of seeking registration with SSE | Entities must be registered in India as one of the below:

a. a charitable trust registered under the public trust statue of the relevant state; b. a charitable trust registered under the Societies Registration Act, 1860; c. a charitable trust registered under the Indian Trusts Act, 1882; d. a Company incorporated under Section 8 of the Companies Act, 2013. |

| Ownership and control | Governing document (MOA & AOA/Trust Deed/Bye-laws/Constitution) | Disclose if NPO is owned and/or controlled by government or private. |

| Exemption under Income Tax Act | Registration certificate under Section 12A/ 12AA/12AB/10(2 3C)/10(46) under Income Tax Act 1961 | Registration certificate under Section 12A/12AA/12B/10(23C)/10(46) to be valid for at least the next 12 months.

Details regarding pending notices or scrutiny cases from all regulatory and statutory authority shall be disclosed at the time of making the application for the registration. Fines or penalties if imposed shall be disclosed as paid or appealed within 7 days. The Stock Exchanges shall have the right to refuse registration of those applicants, if the notices/scrutiny cases are grave and debilitating enough to endanger the registration of the NPO under the Income-tax Act, 1961 or other relevant laws. |

| Registration with Income Tax as an NPO | IT PAN | Valid IT PAN |

| Age of the NPO | Registration certificate | Minimum 3 years |

| Tax deduction under Income Tax Act, 1961 | Valid 80G registration under Income Tax Act, 1961 for entities registered under section 12A/12AA/12AB of the Income-tax Act, 1961 | Entity to ensure disclosure whether tax deduction is available or not to investors. |

| Eligible to be Social Enterprise | Requirements with regulation 292E of ICDR Regulations | As may be specified by SSE |

| Minimum Fund Flows | ||

| Annual Spending in the past financial year | Receipts or Payments from Audited accounts/Fund Flow Statement | Must be at least Rs. 50 lakhs |

| Funding in the past financial year | Receipts from Audited accounts/Fund Flow Statement | Must be at least Rs. 10 lakhs |

2. Rights, Obligations and Disclosures Document

The SGC Shall lay down the Rights and Obligations of the NPO and FPEs who wish to list with the SSE and also the nuances of the Risk Disclosure Document (RDD). The RDD shall contain important information on risks involved with the trading on the stock exchanges. All social enterprises are required to read this document and understand the nature of the relationship into which they are entering and the extent of their exposure to risk.

Chapter IX-A of the SEBI LODR Regulations describes the disclosure requirements by a FPEs and an NPO.4

2.1 Disclosures by a For Profit Enterprise (FPEs)

A For Profit Enterprise whose designated securities are listed on the Stock Exchange(s) shall comply with the disclosure requirements contained in these regulations with respect to issuers whose specified securities are listed on the Main Board or the SME Exchange or the Innovators Growth Platform, as the case may be.

2.2 Disclosures by a Not for Profit Organisation

- A Not for Profit Organization registered on the Social Stock Exchange(s), including a Not for Profit Organisation whose designated securities are listed on the Social Stock Exchange(s), shall be required to make annual disclosures to the Social Stock Exchange(s) on matters specified by the Board, within 60 days from the end of the financial year or within such period as maybe specified by the Board.

- In addition to the disclosures referred in sub-regulation (1), the Social Stock Exchange(s) may specify matters that shall be disclosed by the Not for Profit Organisation on an annual basis.

3. Key Listing Guidelines

3.1 Listing for FPEs and NPOs

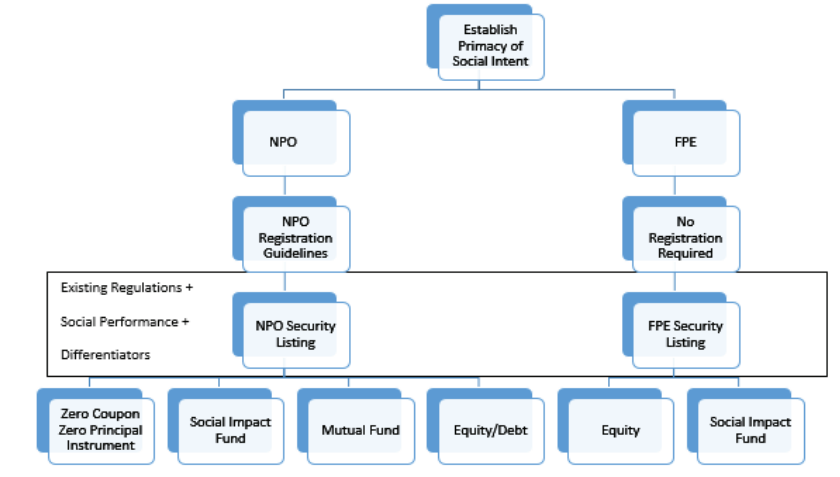

Existing SEBI regulations set the requirements for eligibility and governs the listing of equity and debt securities issued by FPEs. These regulations include SEBI (Issue of Capital and Disclosure Requirements) Regulations and SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015. The process flow for onboarding social enterprises by Social Stock Exchange is depicted below.

Process Flow for Onboarding Social Enterprises by Social Stock Exchange

For Profit Enterprises (FPEs) shall list their securities on their appropriate existing boards of stock exchanges. For example, debt securities shall be listed on the main boards, while equity securities shall either be listed on the main board (NSE/BSE), or on the SME platform (NSE-EMERGE/BSE SME) or Innovators Growth Platform (IGP).

The offer documents of the social enterprises for various modes of fund raising shall require disclosure of aspects called “differentiators”. In case of FPEs, the differentiators mentioned in Table below are additional requirements as mandated in SEBI Regulations in respect of raising funds through equity or debt. The differentiators cover aspects such as vision, target segment, strategy, governance, management, operations, finance, compliance, credibility, social impact and risks. FPEs will also be required to provide information in the offer document under various SEBI regulations.

As part of the pre-listing process, the NPO shall provide audited financial statements for the previous 3 years and social impact statements. Additionally, the offer documents for social enterprises shall provide the details under the following heads, called “differentiators”.

Differentiators for FPEs and NPOs5

| Sr. No. | Differentiator | Details |

| 1 | Vision | Organisation’s activities and programmes are in line with aims and objects stated in its constitution |

| 2 | Target Segment | Organisation has defined its target segment and reach to accomplish its planned activities. Clear identification and understanding of the target segment (those affected by the problem and how they are affected). The SE must disclose how its approach intends to improve inclusion for its customers/recipients |

| 3 | Strategy | Strategy formulation towards accomplishing vision, should take into account capabilities and learning from challenges. |

| 4 | Governance | Organisation has a governing body and details of its highest governing body, composition, dates of board meetings held (key items covered). |

| 5 | Management | Details of key managerial staff such as those in charge of Programmes, Fundraising, Finance, HR. Organisation discloses whether it provides letters to staff and volunteers defining roles and responsibilities, has a periodic performance appraisal process etc. |

| 6 | Operations | The organisation has a physical existence, is operational and shares its address for visits. |

| 7 | Finance | Disclosure of financial statements in accordance with guidelines for NPOs issued by ICAI |

| 8 | Compliance | Organisation makes available, annual accounts duly audited/assessed for the latest three financial years and there are no material qualifications or material irregularities reported by its auditor. Compliances w.r.t. Income Tax, notices received etc. |

| 9 | Credibility | Documents such as Registration, Trust Deed/MoA and AoA, Address Proof, IT PAN, 12A/12AA Certificate, FCRA certificate and returns, remuneration to governing members. |

| 10 | Social Impact | Details of past social impact as per the existing practice of NPOs. The past social impact should highlight trends in key metrics/parameters relevant to the NPO (as may be determined by the Exchanges) for which it seeks to raise funds on SSE, number of beneficiaries, cost per beneficiary and administrative overheads.6 |

| 11 | Risks | Disclose risks that the NPO sees to its work, and how it proposes to mitigate these unintended consequences that the NPO sees from its work, and how it proposes to mitigate these |

The above categories will be used by potential funders/investors to differentiate between the various similar NPOs and securities being listed and to make informed investment decisions.

For program-specific or project-specific listings, the NPO shall have to provide a greater level of detail in the listing document about its track record and impact created in the program target segment. The NPO will also be required to publicly display on its website all the information submitted as part of pre-listing and post-listing requirements.

The Social Stock Exchange lists out various procedures and workflows (e.g., for registration, listing, delisting, accounting, disclosures and other fees etc.), laying out detailed roles and responsibilities for all stakeholders. Annexure 3 is the Application Form for the registration of a social enterprise at NSE SSE. Annexure 4 comprises of the Undertaking from the NPO and Annexure 5 is an illustration of the Undertaking from the Third Party for NPO registration on NSE SSE. (These forms are for the illustration purpose only).7

3.2 Benefits of Registration and Listing on a Social Stock Exchange

As elucidated by the NSE SSE, following are the benefits of Registration and Listing on a Social Stock Exchange:

- Improved Market Access – SSE facilitates a common and a structured meeting ground between Social Enterprises and investors/donors with inbuilt regulation for providing sanctity and accountability of finances.

- Synergy Between Investors and Investee in Social Aims – In view of flexibility of investments and capital that would be available on an SSE, the canvas of choice is much wider allowing investors and investees with similar missions and visions to connect seamlessly.

- Performance Based Philanthropy – Performance of the enterprises listed on an SSE is monitored, thus, it instils a culture of performance (Social return) driven philanthropy.

- Minimal Registration Cost – SSE saves cost for both issuer and investor/donor by charging minimal fees for registration and listing.

- Additional Avenue for Social Enterprises – Central and State governments till date have the biggest onus of achieving sustainable development goals. SSE provides an alternate avenue for raising funds thereby encouraging new and existing social enterprises.

1. https://www.nseindia.com/list-eligibility-criteria and https://www.bsesocialstockexchange.com/static/eligibility.aspx

2. https://www.sebi.gov.in/legal/circulars/dec-2023/framework-on-social-stock-exchange_80233.html

https://www.sebi.gov.in/legal/circulars/sep-2022/framework-on-social-stock-exchange_63053.html

3. The Table above summarises the regulation as of March 2025. https://www.sebi.gov.in/legal/circulars/sep-2022/framework-on-social-stock-exchange_63053.html

https://www.sebi.gov.in/legal/circulars/dec-2023/framework-on-social-stock-exchange_80233.html

Note: The regulations are constantly evolving and candidates are advised to keep track of regulatory developments by visiting SEBI website:

https://www.sebi.gov.in/sebiweb/home/HomeAction.do?doListing=yes&sid=1&ssid=7&smid=0

5. https://www.sebi.gov.in/legal/circulars/sep-2022/framework-on-social-stock-exchange_63053.html

6. https://www.sebi.gov.in/legal/circulars/dec-2023/framework-on-social-stock-exchange_80233.html

7. Candidates shall visit the websites of the respective Social Stock Exchanges for updates on the registration process and requirements.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA